Forex.com

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, eSignal, TradingView, AutoChartist, TradingCentral

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.0 -

# Assets80+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

Our Opinion On Forex.com

Forex.com is a trustworthy broker with strong regulatory oversight and an excellent reputation. We rate the 80+ forex pairs available with very tight spreads and low to zero commissions.

Based on our evaluation, Forex.com is suitable for both beginners and experienced traders with its user-friendly WebTrader, MetaTrader 4 and suite of third-party tools. We especially rate the education center and fee rebates for high-volume forex traders.

Summary

- Instruments – 82 forex pairs, plus stocks, indices, commodities

- Live Accounts – Standard, DMA, MT4, Corporate

- Platforms & Apps – WebTrader, MT4, Forex.com App. Additional tools include NinjaTrader, Trading Central, TradingView, Capitalise.ai

- Deposit Options – Credit/debit cards, bank wire transfer, PayPal

- Demo Account – Yes

Pros & Cons

- Heavily regulated with authorization from the NFA, CFTC, IIROC, FCA, CySEC & CIMA

- Competitive fees with spreads starting from 0.7 pips on the EUR/USD

- Excellent selection of proprietary platforms and third-party trading tools

- Widely respected brand with over 1 million traders globally

- The broker's parent company, StoneX Group Inc. is listed on the NASDAQ

- High-quality education for beginner, intermediate and advanced traders

- Easy account opening which takes less than 5 minutes

- Fast average order execution speed of 50 ms

- 24/5 multilingual customer support

- Rebates for high-volume traders

- Negative balance protection not provided in the US

- Limited choice of e-wallets for account funding

- Cannot directly buy stocks

- Low-quality chatbot

Is Forex.com Regulated?

Our team has no concerns about the legitimacy of Forex.com – the broker is regulated in all major trading jurisdictions, including the US, Europe and Asia.

You can be confident trading with this broker, as it segregates clients’ funds from business money and implements negative balance protection, ensuring that your account balance cannot fall below zero. And, since our Forex.com review did not uncover any historical scams or major security breaches, we are assured about this broker’s track record.

Forex.com is registered under nine entities:

- USA – Registered with the the National Futures Association (NFA), and the Commodities Futures Trading Commission (CFTC), ID 0339826

- Canada – Regulated by the Investment Industry Regulatory Organization of Canada (IIROC)

- Cyprus – Regulated by the Cyprus Securities & Exchange Commission (CySEC), license number 400/21

- Australia – Regulated by the Australian Securities and Investments Commission (ASIC), license number ABN 50 141 774 727

- UK – Regulated by the Financial Conduct Authority (FCA), license number 446717

- Cayman Islands – Regulated by the Cayman Islands Monetary Authority (CIMA), license number 25033

- Hong Kong – Registered with the Securities and Futures Commission (SFC), registration ARS812

- Japan – Regulated by the Financial Services Agency (FSA)

- Singapore – Regulated by the Monetary Authority of Singapore (MAS)

These are all reputable financial agencies, so we are confident the forex broker is safe, though traders should note that the Cayman Islands Monetary Authority has laxer membership requirements than the other organizations and the Hong Kong license appears to have lapsed.

Traders may also be entitled to compensation in the event of business failure depending on their jurisdiction; this includes access to the Investors’ Compensation Scheme (ICF) for European traders and access to the Financial Services Compensation Scheme (FSCS) in the UK.

Forex Accounts

Forex.com offers retail investors three account types – Standard, MT4, or DMA. We are pleased to report that a halal account is also available to Muslim traders.

These cater to a range of forex trading styles, with accessible account minimums set at $100 for all profiles. This rivals other top forex brokers like AvaTrade, which also has a $100 minimum deposit.

We think the Standard profile is the most suitable for beginners, with tight spreads and access to the proprietary web terminal, which facilitates trading on all instruments. The MT4 account, on the other hand, is specifically for forex trading on the MetaTrader 4 platform. Aside from this, we found the pricing structure relatively similar between the MT4 and Standard accounts; the main difference is the platforms you can trade on.

The Direct Market Access (DMA) account requires a much higher trading volume for the benefits to become apparent, but it will tick many boxes for experienced forex traders. There are no spreads, and pricing is obtained from top-tier financial institutions with a low commission. You get greater control over execution pricing with this account, and trades are passed directly through to liquidity providers without any intervention.

Forex.com’s US entity also offers a choice between a Commission account or an STP Pro profile. Commission account holders can access raw, tight spreads including from 0.2 pips on the EUR/USD. In return for these low spreads, you will pay a competitive $5 commission per 100,000 traded. The STP Pro account is the equivalent of the DMA profile, with direct exposure to market liquidity.

How To Open A Live Account

I found it quick and easy to sign up for a Forex.com account by following these steps:

- Open the application form and complete the ‘Account Information’ section including your country of residence, name, phone number, and date of birth

- Click ‘Save And Continue’

- Complete the ‘About You’ section including your address and tax details

- Select ‘Continue’

- Complete the ‘Trading Experience’ section including your current employment status and estimated trading frequency

- Click ‘Continue’

- Review the details and submit your application

- Login credentials will be sent to your registered email address

Trading Fees

Our experts are impressed by the competitive spreads on offer, starting as low as 0.7 pips on major currency pairs. The brand competes with other top-rated brokers when it comes to trading fees.

When we used Forex.com, we were offered spreads of 0.8 pips on the EUR/USD pair and 1 pip on the USD/GBP. Alternative instruments such as oil were offered at 1.5 points and the FTSE 100 index from 1 point. These stack up well against other leading forex brokers.

Commission fees apply for shares only. This fee is also low at just 0.08% for UK, EU, and Asian stocks, however, we did find a minimum commission rate of $10. US shares have a fee of $0.18 per share.

We do feel that direct market access (DMA) pricing, which provides no spreads with commissions, is the better option for high-volume traders. The only downside is that you need to trade more than $100 million per month to receive the minimum commission reduction, which will put it out of reach for most forex traders.

Canadian traders can also get Raw FX pricing with spreads from 0.0 pips on major forex pairs with a $7 commission per $100k traded. These rates are very competitive vs other local brokers.

Non-Trading Fees

We are glad to see that non-trading fees are transparent, so you shouldn’t get caught out with hidden costs. A $12 inactivity fee does apply, though these rates are not applicable until after 12 months of no trading. This is also a standard charge found at other popular brokers.

We also like that there are no fees or minimum deposit requirements needed to use the third-party tools including Capitalise.ai and Trading Central, which are offered to Forex.com customers for free as a perk. These are great additions that really improve the trading experience for us.

Payment Methods

The broker imposes a $100 initial deposit requirement to sign up which is competitive, though more expensive than some competitors such as XTB ($0) and OANDA ($0).

You can deposit to your Forex.com account via credit/debit card, bank wire transfer, or PayPal. We are disappointed by the lack of alternative e-wallet solutions such as Neteller or Skrill or crypto payments such as Bitcoin. These are used by many global traders and are also increasingly supported by the best forex brokers.

Having said that, we are happy to see that Forex.com does not impose any funding fees and processing times are fast. This includes immediate fund clearance for credit/debit cards and PayPal, and up to two working days for bank wire transfers.

Another bonus is that you can deposit in the following base currencies for credit/debit cards and wire transfers, making the brand accessible to traders from popular trading regions: USD, EUR, CAD, JPY, CHF, AUD, and GBP.

How To Fund A Forex.com Account

I have no issues navigating the deposit process – there are a few simple steps to follow:

- Log in to the members area

- Select the ‘My Account’ page

- Choose ‘funding’ and then ‘deposit’

- Select the payment method from the options

- Add a value to the deposit and complete the required payment details

- Select ‘Deposit’

Withdrawals

Importantly, you must request a withdrawal via the same method used to fund your Forex.com account.

We do feel the $100 minimum withdrawal that applies to all payment methods is a little high. However, we are glad to see the broker does not charge any withdrawal fees, which is competitive compared to alternatives like eToro with its $5 fee.

For quick withdrawals, PayPal and credit/debit cards will be your best option. For any problems, reach out to the customer support team.

Forex Assets

With a substantial list of 82 currency pairs, including major, minor, and exotic currencies, the suite of forex assets is one area where Forex.com stands out. The broker trumps rivals like Plus500 (60 currency pairs) and AvaTrade (50 currency pairs).

Alongside an excellent offering of forex pairs, we appreciate that the brand provides a useful currency converter and a leverage/margin/pip calculator to aid trading decisions.

Note that the minimum lot size is 1000 units and forex can be traded via contracts for difference (CFDs), so you can bet on rising and falling prices with leverage.

Non-Forex Assets

Although we are pleased to see that Forex.com also has some non-forex instruments, the list is missing some major markets.

Alongside forex, you can trade a small selection of indices, shares, and commodities only. This list is further limited in the US with only gold, silver, futures, and options available. There is no cryptocurrency, bonds, or ETFs, so traders interested in these instruments will need to look elsewhere.

Supported asset classes include:

- Shares – 65+ company stocks such as Adidas, Coca-Cola, Meta, and VISA

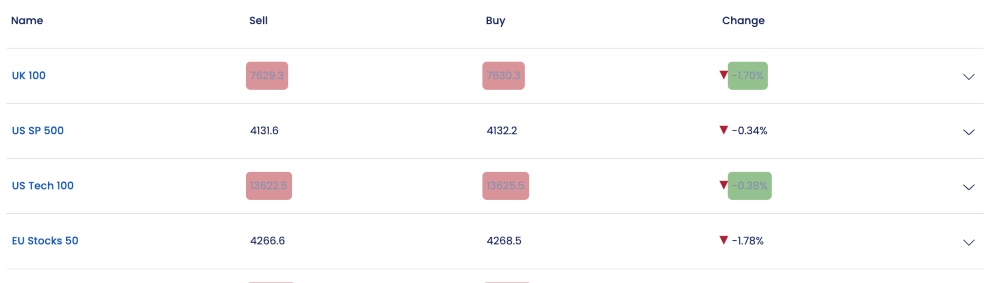

- Indices – 17 index funds including the S&P 500, Dax 40, Japan 225, and FTSE 100

- Commodities – 10 commodities and two precious metals including gold, silver, US Crude oil, natural gas, and coffee

Forex.com Execution

Forex.com offers Straight Through Processing/Market Marker order execution. FX pricing is derived from top-tier global banks.

We particularly rate Forex.com’s impressive execution speeds, with 99.83% of trades executed in less than one second at an average speed of 0.05 seconds.

Leverage

Forex.com offers leverage to increase position sizes, with the maximum level available depending on local regulations; so for example, a maximum 1:50 leverage ratio is available for US and Canadian clients and 1:30 for UK and EU customers.

On the downside, no amendments can be made to the default margin settings. You can, however, change the leverage on the MetaTrader 4 platform down to 1:20 or 1:10 if desired.

We advise beginners to approach leveraged trading with caution until they are comfortable using the platform and have spent time sharpening their skills, as losses can build up quickly while margin trading.

Platforms & Apps

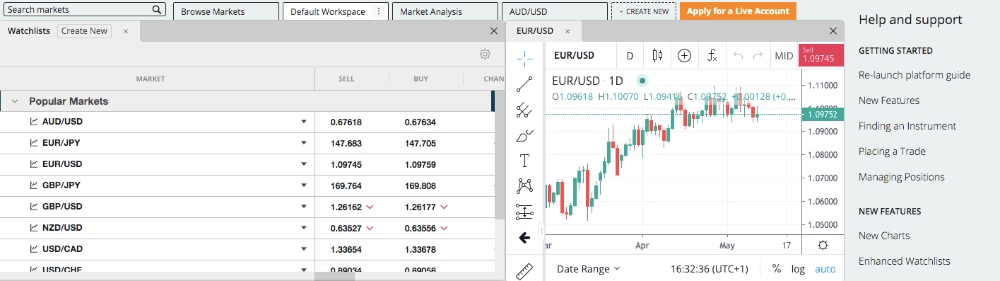

I appreciate having the choice between the proprietary Forex.com WebTrader or MetaTrader 4 (MT4). MetaTrader 5 (MT5) is also available in some countries. The platforms are available on desktop devices and mobiles (iOS and Android).

Both are powerful systems with unique benefits that can be used from beginner level but the Forex.com terminal just clinches it for me when comparing the platforms head-to-head. The interface feels sleeker with fully customizable workspaces and TradingView integration. It ultimately provides a cleaner and more intuitive forex trading experience, even if it lacks some of the advanced trading functionality available on MT4.

WebTrader is the best for beginners while I would stick with MT4 if you are already familiar with MetaTrader or experienced and want to deploy automated forex trading strategies.

I highlight the key differences and features between the platforms:

- Forex.com WebTrader – 80+ technical indicators, 10 chart types, TradingView charts, one-click trading, customizable watchlists and alerts, Trading Central integration, performance analytics, and an economic calendar.

- MetaTrader 4 – 30 in-built indicators, 24 analytical objects, nine timeframes, one-click trading, custom watchlists, access to expert advisors, and four pending order types.

How To Open A Trade On WebTrader

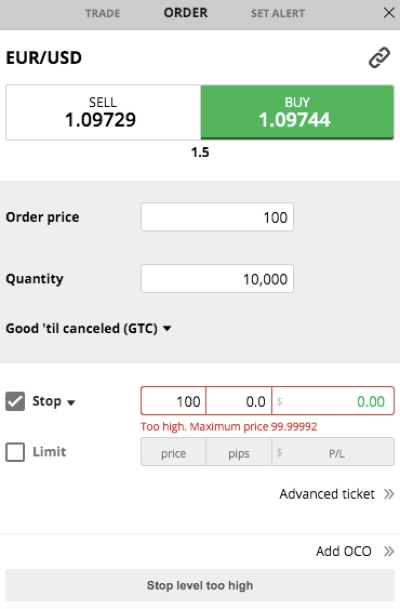

There are several ways to open new positions on the Forex.com platform, but I think the simplest way is through the market watch window:

- Log in to the trading platform

- Choose an instrument to trade from the market watch window

- Click ‘Buy’ or ‘Sell’ next to the instrument symbol to open the new trade window

- Add the quantity to trade and slippage limit

- Input stop out or limit price (optional)

- Select ‘Place Trade’

Forex Tools

Forex.com really excels when it comes to the suite of additional trading tools, with a wider selection of solutions than many competitors.

The brand provides several third-party tools to improve the forex trading experience, including access to NinjaTrader, TradingView, Capitalise.ai, and Trading Central.

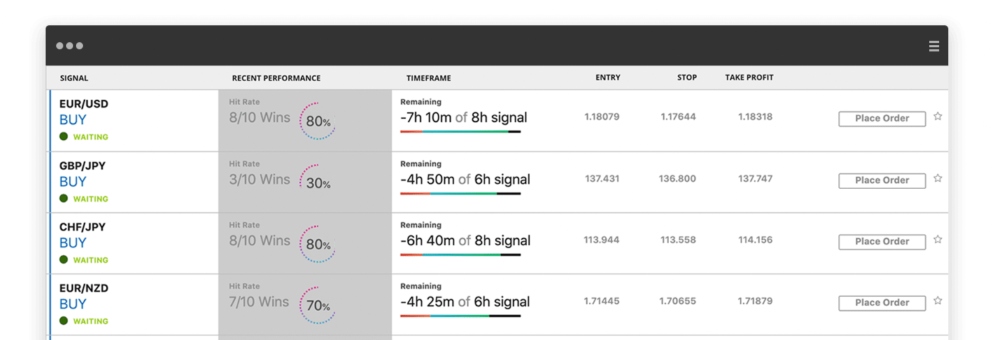

Trading Central

The research tool scans the FX market 24/7, highlighting potential trading opportunities and ideas.

Our favorite features include the Market Buzz sentiment tool, recommended stops/limits, and trend line charts. We especially rate the ‘What If’ function, which can be used to scrutinize potential positions before you risk your money.

You can also access technical, economic, and fundamental analysis via indicators, signals, and strategy builders.

Capitalise.ai

Capitalise.ai offers automated trading strategies with backtesting functionality. The tool essentially provides easy-to-create strategies using ‘if then’ English coding.

We think this makes it more suitable for beginners, but if it is not something you feel comfortable with, Capitalise.ai also provides a large trade ideas library and risk-free simulation.

NinjaTrader

The NinjaTrader platform is a powerful solution available to Forex.com customers. Features include automated trading functions, customizable forex watchlists, and advanced trading strategies.

My tip is to spend some time reviewing tutorials and video guidance to create the best dashboard interface as the platform is not the most user-friendly out of the box.

The only thing missing that we would like to see is copy trading, which can be a great feature for beginners. With that said, the SMART Signals engine does provide actionable insights.

Forex Education & Research

We are impressed with Forex.com’s educational content and learning resources, including an online ‘Academy’ with a wealth of information spanning platform tutorials, articles, webinars, and a glossary of key terms.

We like that courses are grouped into beginner, intermediate, and advanced experience levels, and highly rate the range of topics including charting, applying historical data to trading decisions, and maximum lot size suggestions for beginners.

The broker also provides expert analysis and trading ideas which we find easy to filter by category. Multiple articles are posted daily so you won’t feel short of support.

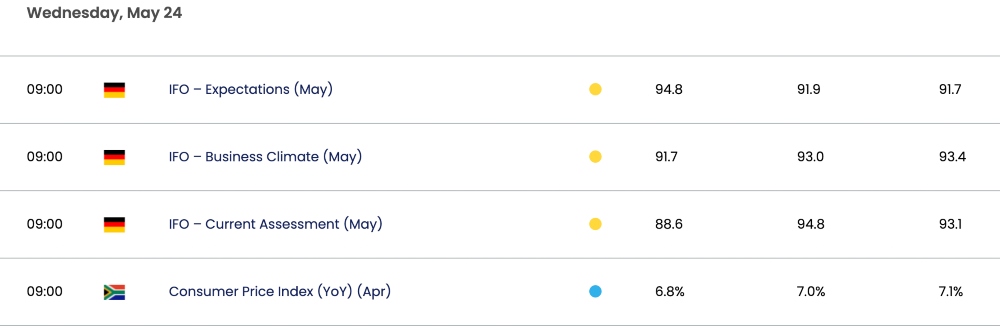

Other information sources available that are worth highlighting include an economic calendar, weekly FX updates, and financial market insights.

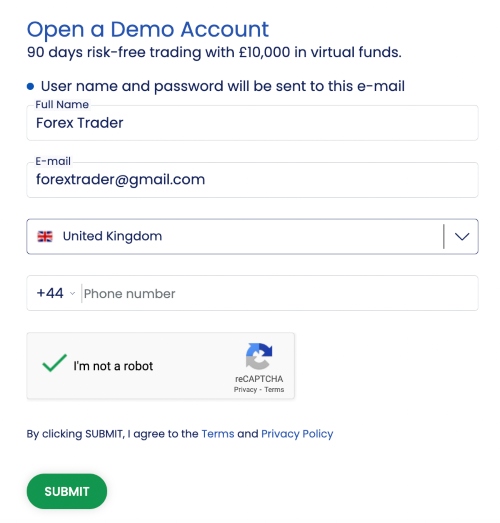

Demo Account

We are happy to see Forex.com offering a free MT4 and WebTrader demo account with $50,000 in virtual funds that works using real-time trading conditions including live pricing and access to all forex pairs.

We do feel, though, that the paper profile’s 90-day limit is a disadvantage, as it means you cannot use the simulator account alongside a live profile to test strategies.

How To Open A Demo Account

I was able to open a demo account quickly and easily, and without any comprehensive sign-up requirements or lengthy registration forms holding me up.

- Choose ‘Try A Demo Account’ from the broker’s homepage

- Enter your name, email address, and phone number in the online application form

- Click ‘Submit’

- Login credentials will be displayed on the following screen and sent to the registered email address

- Click ‘Log Into Web Platform’

- Add your username and password to the login screen and click ‘Login’

- Start trading in demo mode

Forex.com Bonus

A huge perk of signing up with Forex.com for me is the $5000 welcome bonus. This is a competitive sign-up offer, even if it is calculated at just 20% of your total deposit (starting from a minimum of $250). On the downside, this promotion is not available to clients in the UK, US, or China due to regulatory restrictions.

Cash rebates are also available to customers with ‘Active Trader’ status. Rewards vary based on trading volumes, but rebates range between $3 and $10 per million traded. We found a minimum account balance of $10,000 or $50 million monthly trading volume is required to qualify. This will be steep for many retail traders but it is a great perk for high-volume, active forex traders.

Trading Restrictions

Forex.com is a good pick if you want to use sometimes prohibited strategies. Scalping, hedging and automated trading are all permitted with no restrictions. This is a benefit over many alternatives.

Customer Service

There is room for improvement in terms of customer support at Forex.com. On the plus side, 24/5 support is available via email, regional telephone numbers with multilingual support, an online ticket request system, and live chat. Alternatively, there is a decent amount of information that can be sourced from the FAQ section.

On the downside, the live chat is not the best and I often struggle to reach a human advisor, with all interactions via a chat robot. Although there are plenty of menu options, I usually find it is much quicker to speak to someone directly.

Contact details:

- Email – global.support@forex.com

- Live Chat – Bottom right of the broker’s website

- HQ Address – Forex.com, 30 Independence Blvd, Suite 300 (3rd Floor), Warren, New Jersey, 07059, US

- Phone Number – 1.908.315.0653 (International), +44 207 429 7900 (UK) or 0800 032 1948 (Freephone)

Company Details

Forex.com was established in 2001 and is part of the StoneX Group, which is listed on the NASDAQ stock exchange and boasts an impressive valuation of around $10.9 billion.

The US-based brokerage was initially launched from its headquarters in New Jersey, though services now span internationally, including the launch of products in Europe in 2021.

Today, Forex.com has 200,000+ registered customers. The broker has also been recognized with many industry awards including the Best CFD FX Provider and Best Trading Analysis Provider at the Online Personal Wealth Awards and the Best Mobile Platform/App at the Investment Trends UK Leverage Trading Report Awards.

Trading Hours

Forex.com offers standard trading hours which vary by market. Forex, for example, is available 24/5 from 9 PM (GMT) Sunday to 9 PM (GMT) Friday.

However it is worth noting that markets tend to be particularly volatile at the beginning of the trading week and the opening and closing of the four major global FX sessions (London, New York, Sydney, and Tokyo).

Helpfully, you can find opening hours including holiday closures on the broker’s website.

Who Is Forex.com Best For?

Forex.com is suitable for both beginners and seasoned traders. The extensive range of currency pairs, tight spreads, advanced tools, and rebates for high-volume traders will appeal to experienced investors. Beginners can also benefit from a user-friendly web platform, education center, and free demo account.

On the negative side, we would like to see Forex.com widen its selection of payment methods. The addition of a copy trading platform would also be a welcome bonus. Still, Forex.com remains an excellent pick for forex traders of all experience levels and strategies.

FAQ

Is Forex.com A Legit Broker Or A Scam?

Forex.com is a legitimate broker with 20+ years in the online trading industry. The brand is globally regulated, with a transparent pricing model. Other customer reviews and ratings are also generally positive, praising the selection of powerful forex trading tools and market research.

Can I Trust Forex.com?

Yes, Forex.com is an established brand, renowned for its pricing transparency and top-tier trading services. We are confident that Forex.com is a relatively secure brokerage, with top-tier regulatory oversight and no reports of scams or malpractice.

Can You Make Money Trading Forex With Forex.com?

There are opportunities to make money trading with Forex.com. However, most retail traders lose money so you will need to take a sensible approach to risk and money management. Make use of the risk management tools available on the WebTrader and MT4 platforms.

Does Forex.com Offer Low Forex Trading Fees?

Yes, forex trading fees are competitive. There are no commission charges and spreads start from 0.7 pips on popular pairs like the EUR/USD. DMA pricing is also available, though high minimum volumes are required to receive lower commission fees.

Is Forex.com A Regulated Forex Broker?

Yes, Forex.com is heavily regulated, with oversight from nine financial authorities, including in the US, UK and Europe. As a result, the brokerage has a high trust score.

Is Forex.com A Good Forex Broker For Beginners?

Forex.com is a good broker for beginners. The online learning academy is comprehensive, with integrated videos, trading ideas, and step-by-step user guides. A demo account is also available to practice trading forex on all platforms.

Does Forex.com Have An App?

Yes, Forex.com has a proprietary platform with mobile compatibility, available to download as an iPhone/iPad or Android app. You can access all the powerful features of the web-based terminal including full account management and trade execution. Alternatively, MT4 is available as a mobile app.

How Long Do Withdrawals Take At Forex.com?

Withdrawal times from a Forex.com account vary by payment method but are generally fast. Credit/debit cards and PayPal transactions are the quickest, typically with instant processing times. Bank wire transfers can take up to two working days to clear, though this is standard.