AvaTrade

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD

-

🛠 PlatformsMT4, MT5, AlgoTrader, TradingCentral, DupliTrade

-

⇔ Spread

GBPUSD: 1.5 EURUSD: 0.9 GBPEUR: 1.5 -

# Assets50+

-

🪙 Minimum Deposit$100

-

🫴 Bonus OfferWelcome bonus 20% up to 10.000$

Our Opinion On AvaTrade

AvaTrade is an award-winning forex and CFD broker with a high trust score. We like the low deposit, demo account and copy trading, making the brand a good pick for beginners. Our team also rate the excellent research tools and powerful trading platforms, including MT4, MT5 and proprietary software, ensuring AvaTrade is a contender for experienced forex traders.

Summary

- Instruments: 1250+ including 53 forex pairs, stocks, indices, commodities, options, cryptos, bonds, treasuries, and ETFs

- Live Accounts: Standard

- Platforms & Apps: MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, AvaOptions, AvaTradeGO, AvaSocial, DupliTrade, ZuluTrade, and Capitalise.ai

- Deposit Options: Bank cards, wire transfers, and e-wallets

- Demo Account: Yes

Pros & Cons

- Regulatory oversight including CySEC, ASIC and FSCA

- Sophisticated trading tools including copy trading and AvaProtect

- Straightforward account opening process

- Beginner-friendly education center

- High leverage up to 1:400

- Negative balance protection

- 24/5 customer service

- PayPal supported

- $50 inactivity fee after 3 months

- Average spreads and fees

- Not available in the US

Is AvaTrade Regulated?

We are satisfied with AvaTrade’s regulatory status. The broker holds licenses with multiple financial agencies in the various territories where it operates. The level of customer protection and oversight will vary between watchdogs, but overall, AvaTrade is a legitimate broker with no reports of scams or financial malpractice.

AvaTrade subsidiaries and their respective regulatory authorizations:

- AVA Trade EU Ltd – Central Bank of Ireland, registration number C53877

- Ava Trade Markets Ltd – British Virgin Islands Financial Services Commission, registration number SIBA/L/13/1049

- Ava Capital Markets Australia Pty Ltd – Australian Securities and Investments Commission, registration number 406684

- Ava Capital Markets Pty – South African Financial Sector Conduct Authority, registration number 45984

- Ava Trade Japan K.K. – Japanese Financial Services Agency, registration number 1662, and the Financial Futures Association, registration number 1574

- Ava Trade Middle East Ltd – Abu Dubai Global Markets Financial Regulatory Services Authority, registration number 190018

- DT Direct Investment Hub Ltd – Cyprus Securities and Exchange Commission, registration number 347/17

- ATrade Ltd – Israel Securities Authority, registration number 514666577

We like that the brokerage offers negative balance protection, meaning we cannot lose more than our account balance. AvaTrade also segregates client money from business funds, which is a reassuring sign.

In addition, our team finds that the company processes all transmissions with 256-bit encryption and implements McAfee Secure to protect against fraud during payment handling. This helps give the forex broker a good security rating.

Forex Accounts

On the downside, we think it’s a shame that AvaTrade doesn’t offer a choice of account types, with a single solution available.

The minimum deposit is $100 or equivalent currency, which is comparable with the likes of Plus500. The broker accepts four base currencies; USD, GBP, EUR, and CHF. Both of these factors make it easy for global traders on a budget to start trading forex with AvaTrade.

Yet while the single account offering simplifies the joining process for new traders, we know experienced traders may be disappointed by the lack of premium account tiers that often come with fee rebates and priority customer service, amongst other perks. Fortunately, a professional account is available for those with a financial portfolio of $500,000. Benefits of the pro account include higher leverage up to 1:400 on major forex pairs.

Our team also finds that an Islamic account is available, complying with Sharia law. Positions can be held open for five days without incurring overnight rollover charges.

In addition, the broker provides multi-account manager (MAM) and percentage allocation management module (PAMM) accounts for experienced money managers operating multiple investment profiles. This is a notable advantage over alternatives.

How To Open An AvaTrade Account

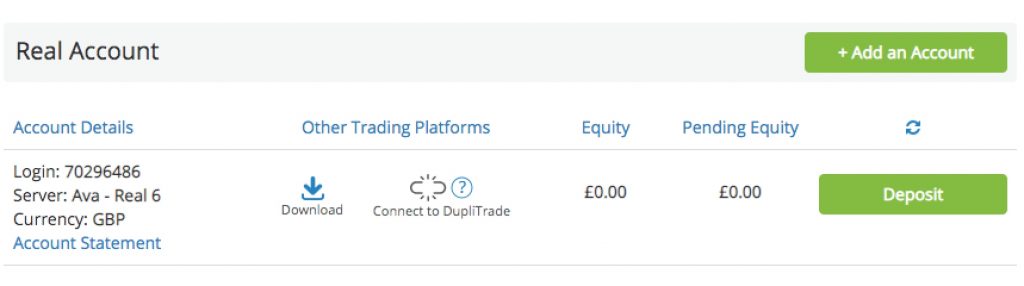

I was able to sign up for a live account in around five minutes and found the joining process straightforward.

- Sign up with an email address and create a password

- Select ‘Create My Account’

- Complete the online registration form

- Submit financial details including employment status

- Provide information about your trading experience and market knowledge

- Choose a base currency and trading platform

- Review the terms and conditions and select ‘Complete Registration’

Trading Fees

Our team think there is room for improvement in terms of pricing. AvaTrade offers average spreads and trading fees. The broker does not charge commission fees on products. Instead, floating spreads apply.

While using AvaTrade, we were offered spreads of 1.5 pips on the GBP/USD and 1 pip on the EUR/USD. This is relatively competitive vs alternative brokers such as FxPro, which offers 1.8 pips on the GBP/USD. We were also offered a gold spread of $0.29 over market and to trade the US 30 index, 2.00 over market. Again, these are reasonable compared to some alternatives, but they aren’t the tightest around.

Non-Trading Fees

Unfortunately, a $50 inactivity fee applies after three months of no trading activity as well as a $100 administration charge after 12 months of inactivity. This is high vs alternative brands, such as HotForex ($5 after six months) and Tickmill (no inactivity fee).

On a lighter note, most of the broker’s trading tools are provided at no extra charge:

- MT4 VPS – No fee

- Trading Central – No fee

- MT4 Guardian Angel Add-On – No fee

- DupliTrade – No fee but a $2,000 minimum deposit

Other costs to bear in mind include swap fees applied to positions held overnight.

Payment Methods

We like that AvaTrade offers a long list of deposit and withdrawal methods, making the forex broker accessible to traders worldwide. Supported funding options include credit/debit cards, bank wire transfers, and e-wallets like PayPal, Skrill, Neteller, and WebMoney. On the downside, cryptocurrency deposits, including Bitcoin (BTC) and Ethereum (ETH), are not accepted.

Processing times vary between deposit methods. We recommend card payments for instant funding, while e-wallets can take up to 24 hours, and wire transfers normally take the longest at up to seven working days.

Our team also appreciate that AvaTrade does not charge fees to deposit or withdraw from a live account. This means the key costs to take into account are spreads and swap fees.

How To Make A Deposit

I found the account funding process hassle-free. To make a deposit:

- Sign in to your AvaTrade account

- Select the orange ‘Deposit’ icon from the top menu or select ‘My Accounts’ from the side menu and then ‘Deposit’

- Choose a payment method

- Select the trading account to fund

- Enter the amount to deposit and select ‘Confirm’

Note, account verification is required before you can make deposits and withdrawals.

You can withdraw funds via the same methods as deposits, which is normal at established forex brokers.

It is good to see fast processing times. Funds are typically cleared back to the original payment method within 24-48 hours, which is comparable vs competitors, such as FXCM. We also like that there are no minimum or maximum withdrawal limits.

For withdrawal or payment problems, reach out to the broker’s customer support team.

Forex Assets

We like that AvaTrade offers a decent selection of forex instruments, with 53 assets available. This includes major, minor, and exotic currency pairs. Ultimately, this provides trading opportunities on all leading currencies.

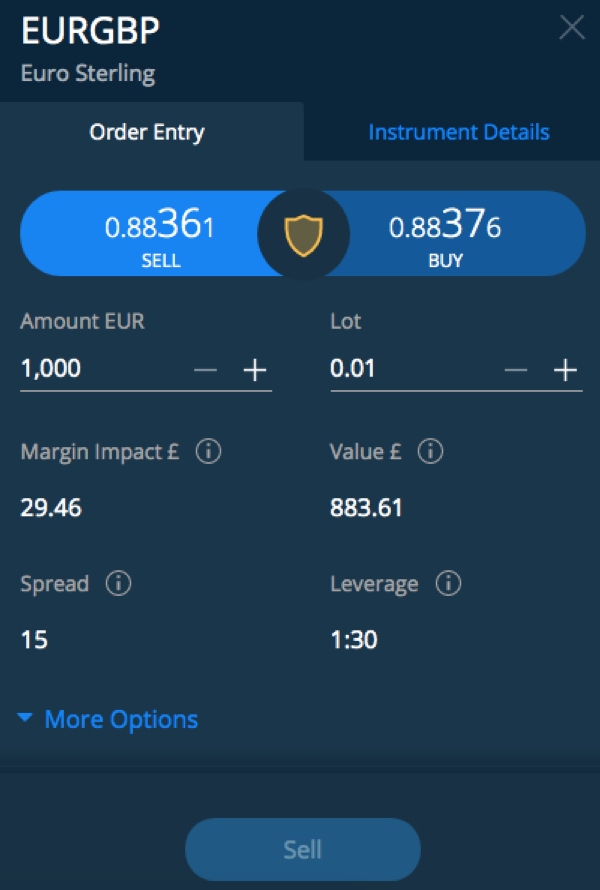

Importantly, forex can be traded via contracts for difference (CFDs) or spread betting (location dependent). A CFD is a derivative whereby the trader and broker exchange the difference in the price of an asset between the contract open and close. Forex CFDs can be traded with leverage, increasing potential returns (and losses). They can also be used to go long or short on an asset. Spread bets are similar, however, they typically have a fixed expiry and profits are generally tax-free.

Our team finds that you can trade forex with a minimum lot size of 0.01 lots.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

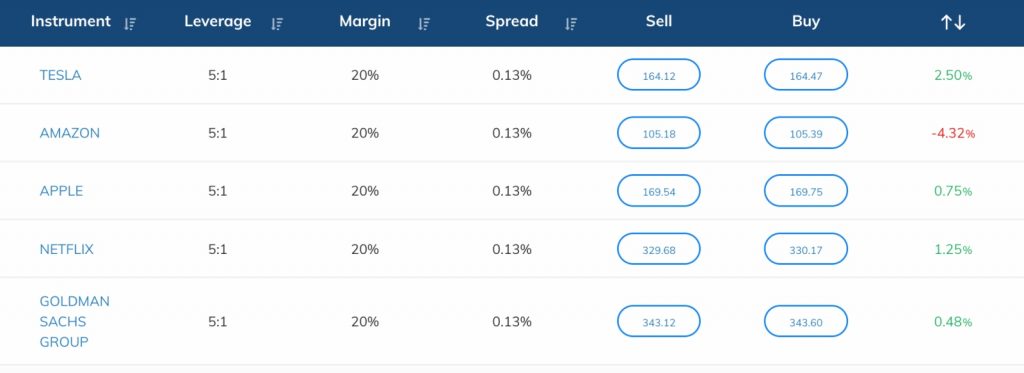

Non-Forex Assets

AvaTrade also offers a good selection of additional instruments. The broker offers stocks, indices, commodities, options, ETFs, cryptocurrencies, and bonds. The list of indices, in particular, is considerably larger than most online brokers, providing opportunities in popular global markets.

Supported assets (varies between countries):

- Stocks – Trade 50+ company stocks, including Amazon, JP Morgan Chase, Coca Cola and Apple

- Indices – Speculate on 22 of the world’s leading US, European, and Asian index funds, including the S&P 500, FTSE 100, and Dow Jones

- Commodities – Trade 18 soft and hard commodities, including gold, silver, crude oil, and sugar

- Bonds – A range of European, US, and Asian government bonds are available, including the US 10-Year-T-Note

- Cryptocurrencies – Speculate on the price of 10+ popular digital currencies, including Bitcoin, Litecoin, Ripple, and Dogecoin

- ETFs – Trade 10+ exchange-traded funds, including the Dow Jones US Real Estate Index Fund, MSCI Singapore Index Fund, and S&P 500 VIX Short-Term Futures ETN

- Vanilla Options – Invest in call and put options on a selection of asset classes including commodities, indices, forex, and crypto

AvaTrade Execution

AvaTrade is a market maker. Orders are executed ’in-house’ through the broker’s dealing desk. Essentially, AvaTrade makes the market and takes the other side of its customers’ trades.

In our opinion, the benefit of this approach is that clients may benefit from tight spreads and low latency due to server locations, including New York and London. However, it does also raise a conflict of interest in that AvaTrade effectively trades against its clients. We also note that there is no guarantee that fees will be more competitive than at ECN brokers, for instance.

Leverage

AvaTrade offers leveraged trading opportunities. However, our team finds that access to margin trading varies by asset and registered entity.

In the EU and UK, for example, 1:30 leverage is available. Customers classified as ‘professionals’ can access leverage up to 1:400.

From our experience, trading on margin can be a good way to boost revenue, but the risk of higher losses should also be considered. With that in mind, make sure you employ risk management tools.

AvaTrade has a 50% margin requirement on MT4 and AvaOptions. A margin call will be issued if you fail to maintain sufficient equity.

Platforms & Apps

AvaTrade stands out for its suite of advanced trading tools. We have access to third-party platforms, such as MetaTrader 4 and MetaTrader 5, plus proprietary software like WebTrader and the AvaTradeGo mobile app. We also rate that the brand offers a selection of automated platforms and copy trading solutions. The latter, in particular, is good news for beginners that are looking to learn from experienced forex traders.

The MT4 and MT5 desktop platforms are available for free download to desktop devices (Mac, Windows, Linux etc) whilst WebTrader can be accessed through major web browsers.

My favorite features of the different platforms include:

MetaTrader 4

- 24 graphical objects

- 30+ technical indicators

- Instant and pending orders

- 9 timeframes; 1 minute to 1 month

- Autotrader through EAs

- Signals for mirror trading

- Secure login and interface

- Single-thread strategy testing

MetaTrader 5

- 44 graphical objects

- 38+ technical indicators

- Instant and pending orders

- 21 timeframes; 1 minute to 1 month

- Automated trading tools and robots

- Multi-thread strategy testing

- Built-in economic calendar

- Community chat

AvaTrade WebTrader

- No download

- Full trading history

- 10 timeframes; 1 minute to 1 month

- 3 chart types; candlestick, bar and line

- Real-time trends including popular instruments

- 50+ in-built technical indicators including MACD, Bollinger Bands, and RSI

- 12 drawing tools including Fibonacci Retracements, Pitchfork, and Trend Channel

- Integrated economic calendar, Trading Central news, market sentiment data, and analyst insights

AvaTradeGo App

- Custom watchlists

- Live pricing and charts

- Zoom and scroll charting features

- Switch between live and demo mode

- Market trend data including the trading behavior of other investors

- Available on Apple (iPhone, iPad etc) plus Android

Ava Social App

- Follow and copy the trades of other investors

- Manual or automated trading strategies supported

- Learn and receive strategy insights in mentor groups

- Communicate with like-minded traders and share ideas

- View and compare ‘professional’ traders’ performance

- Available on Apple (iPhone, iPad etc) plus Android

AvaOptions

- Implied volatility

- Risk and reward profit/loss chart

- Set entry and closing limits directly in charts

- Trade spot, call, put, and combination orders

- Interactive sliders to set limit, stop, and entry orders

- Historical price charts with ’confidence’ forecast for trends

Importantly, our team finds that the bespoke software is more user-friendly than the MT4/MT5 platforms. The AvaTradeGo app, for example, is reliable with simple navigation, technical analysis, trailing stops, and live spreads. It also has a solid rating of 4.1/5 on Google Play with positive feedback and testimonials.

Additionally, the WebTrader solution is easier to use than the third-party platforms. It is straightforward to search for symbols, amend charts, and source additional data from the same interface. This makes it a good tool to start with for new forex traders.

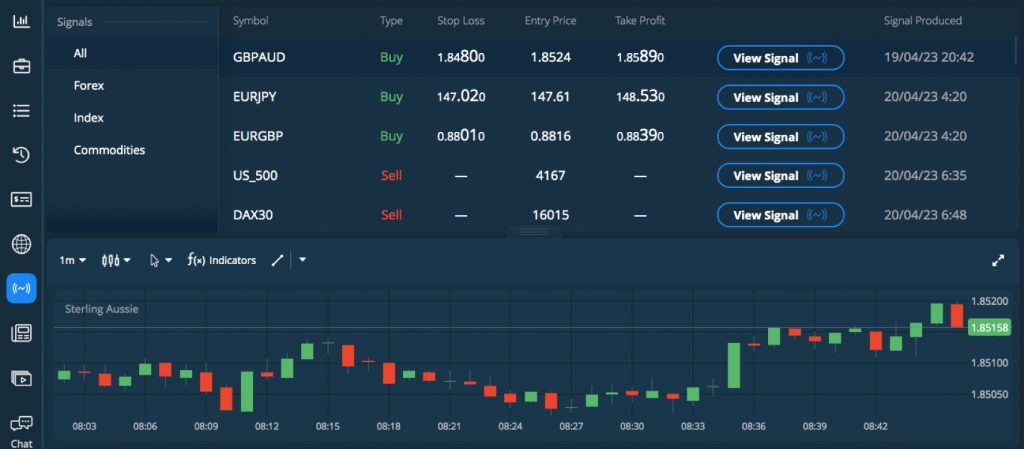

How To Make A Forex Trade

It is easy to place a forex market order on AvaTrade WebTrader, requiring a few simple steps:

- Log in to your account and launch the web platform

- Search for a forex symbol or source through the favorites or trending lists

- Click ‘Buy’ or ‘Sell’ from the icons next to the instrument name

- An order detail screen will pop up on the right of the page

- Use the toggles to amend the investment amount or number of lots

- View the market conditions including the current spread

- Add any risk management parameters such as stop loss or take profit

- Select ‘Buy’ or ‘Sell’ from the bottom of the window to confirm the order

Forex Tools

We don’t feel let down when it comes to the useful forex trading tools available. Our team appreciate that AvaTrade offers various in-house solutions and third-party tools. Our favorites include:

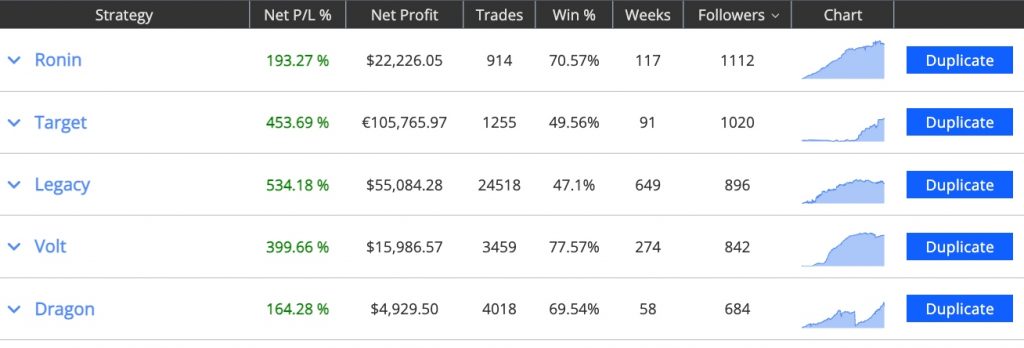

DupliTrade

In addition to AvaTrade’s social trading app, customers can access the DupliTrade automated investing solution. I can copy the actions of traders in real-time. The server will also continue to trade even when I am offline or if I have no connection to the platform.

On the downside, a minimum deposit of $2,000 is required to gain access to the tool. To get started:

- Register for a DupliTrade account

- Sign up and login to your AvaTrade profile

- Link your AvaTrade account with your DupliTrade account using your registered credentials

- Review and select a strategy provider to follow and copy

- Enter your risk tolerance and investment value and confirm you want to start copy trading

- Track the performance of copied positions through the dashboard

ZuluTrade

Another helpful copy trading function available to AvaTrade customers is ZuluTrade, which can be integrated into the MT4/MT5 platform via API. ZuluTrade allows users to follow and copy experienced traders while accessing a community of like-minded investors.

I like that I can source investors with a strong track record of profits using a detailed filtering system, such as those opening regular positions on the FTSE 100 index or those that trade with their personal capital.

I also appreciate the lower investment requirement of $200 or equivalent currency to access the platform.

Capitalise.ai

Capitalise.ai allows retail investors to automate trading strategies. These can be custom-built or accessed from a published library. I like that coding is not required and that I can benefit from real-time alerts, hands-off market data tracking, and strategy backtesting.

Automated strategies available include ‘Trailing Take Profit’ or ‘Trade At A Specific Time’. This means I can create positions that are only triggered when a specific event happens.

AvaTrade customers can sign up for free and integrate Capitalise.ai into an existing MT4 account.

Trading Central

Insights and data on Trading Central are available to AvaTrade traders using the proprietary AvaTradeGo and WebTrader terminals.

My favorite features include market buzz sentiment, pattern recognition ideas, daily strategy newsletter, analyst views, integration with charts, and economic event publications. I also like that the industry-recognized tool provides 24-hour market coverage.

Another bonus is that there is no fee or minimum deposit required.

AvaProtect

We particularly like AvaProtect, a risk reduction tool that protects forex trades against significant losses. Essentially, a refund will be provided if my position falls into the red. Costs apply depending on the level of risk involved. To use AvaProtect:

- Log in to the AvaTradeGo app or open the proprietary WebTrader

- Choose an instrument to trade, such as GBP/USD

- Click the ‘AvaProtect’ logo and select a timeframe/expiry date

- Complete the trade parameters and open a position

Forex Research

Our team like that there is plenty of market data available to aid with forex trading decisions. This includes technical and fundamental analysis, access to earnings releases, an integrated economic calendar, and analyst insights. The market insights in particular we think are of good quality compared to other forex brokers.

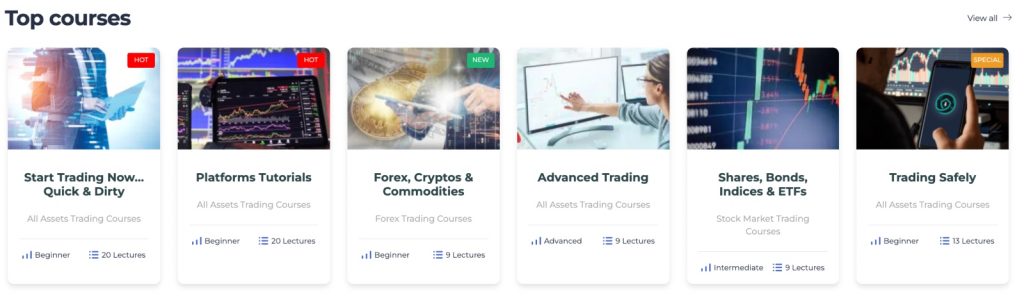

Forex Education

The broker offers an excellent education hub through the AvaTrade Academy. The platform provides 20+ online trading courses, with over 100 lessons and 50+ interactive quizzes.

We can sign up and enroll in any course of interest. We can also specify courses by asset class or experience level. Training materials include video tutorials, articles, and blog-style forums.

Although it is not as vast as the eToro learning hub, AvaTrade’s resources are ideal for building a basic understanding of the financial markets.

For more experienced investors, we recommend the ‘Advanced Trading’ course which covers complex strategy implementation.

Demo Account

We are pleased to see that AvaTrade offers a free demo account. This is a great place to start for those new to forex trading or AvaTrade.

The paper trading account is available to prospective clients or can be accessed by existing customers. There is no maximum time limit and users have access to $10,000 in virtual funds.

Retail traders can log in to test the features and functions of MT4, MT5, and the proprietary web platform under real market conditions. Traders can also use the forex broker’s selection of educational materials alongside the simulator profile.

How To Open An AvaTrade Demo Account

- From the AvaTrade homepage, select the ‘Free Demo’ icon

- Enter your name, email address, and phone number in the window pop-out

- Select ‘Create Account’

- Login to the simulator account with your login credentials

Alternatively, from the live account dashboard, select the main menu icon and choose ‘Switch to Demo’ under the accounts section.

Bonus Offers

On the downside, AvaTrade doesn’t offer much to shout about when it comes to bonus deals.

With that said, we did note that AvaTrade occasionally offers a welcome deposit bonus for new traders. Other financial incentives and promotions are also sometimes available. For example, there is a refer-a-friend scheme with up to $250 for successful referrals.

Importantly, bonus eligibility will vary between jurisdictions due to regulatory rules. This includes restrictions imposed by ESMA, meaning EU clients may not be able to access offers. It is also worth bearing in mind that bonus credit cannot always be withdrawn. With this in mind, check terms and conditions before opting in.

Customer Service

We are impressed with the AvaTrade customer support, which is available 24/5. Contact methods include live chat, telephone numbers with local language support, an online email form, and WhatsApp. Upon testing, we found the live chat service offers the quickest response, with replies received in less than two minutes.

The broker also provides a comprehensive FAQ section and a help centre with a wealth of information. This is a good place to start if you have a basic query. We can use the search bar to find useful content on how to close or delete an account, change leverage, update a username, withdraw funds, and download annual financial statements and reports.

Contact details:

- WhatsApp – +447520644093

- Online Chat – Bottom right of the broker’s webpages

- Email – Online contact form on the ‘Contact Us’ section of the website

- Phone Number – +(44) 203 307 4336 or visit the ‘Contact Us’ section of the website for local contact numbers

Our team also get some useful information on AvaTrade’s social media channels, including Twitter, LinkedIn, and Facebook. In particular, new services, product upgrades and bonus deals are announced here.

Company Details

AvaTrade was established in 2006 as one of the first forex trading platforms for retail investors. Today, the company has over 400,000 registered customers, a global presence, and a range of platforms and mobile apps. This is a reassuring sign that the brand is legitimate, so it’s also unsurprising that AvaTrade executes an average of 2 million trades per month with a volume of $60 billion.

The organization has headquarters in Dublin, Ireland, with additional offices in Japan, Mongolia, South Africa, France, Malaysia, and Australia. The CEO is Dáire Ferguson.

It is also good to see that AvaTrade has been recognized with various industry awards, including the Best Overall Broker 2022, Most Trusted Broker 2023 and the Best Online Broker 2022. This helps bolster the firm’s safety rating.

Trading Hours

Trading hours vary depending on market opening times. The broker’s platform is available from Sunday at 9:00 pm (GMT) to Friday at 9:00 pm (GMT), though crypto trading is available 24/7.

Holiday trading hours and market closures are published on the broker’s website and reflected in the trading platforms. We also appreciate that the financial instruments page is up to date with opening hours by asset. For example, you can trade Apple shares between 1:30 pm and 7:59 pm (GMT).

Who Is AvaTrade Best For?

AvaTrade is a good all-round forex broker. We particularly like the low minimum deposit, rich education centre, and copy trading solutions, which make the brand accessible to beginners. Equally, the large suite of platforms, apps and tools, alongside the zero restrictions on scalping, hedging and automated trading, mean our experts are comfortable recommending AvaTrade to experienced traders.

On the downside, we are aware the broker isn’t the cheapest around and the single trading account may disappoint active forex traders looking for discounts and perks in return for high volumes. Overall though, AvaTrade is one of the best forex brokers.

FAQ

Is AvaTrade Legit Or A Scam?

Our team is confident that AvaTrade is not a scam. The broker operates in line with top-tier security standards, offering negative balance protection and segregating client funds from company capital. AvaTrade is also highly regulated with authorization from respected financial watchdogs, including the CySEC and ASIC.

Can I Trust AvaTrade?

AvaTrade is trustworthy with a good reputation. It has been operating since 2006 and is used by over 400,000 traders globally. Our experts note that there haven’t been reports of security breaches or scams and the company holds licenses with multiple agencies and follows relevant regulations in the various countries that it operates in. The broker also doesn’t have many bad customer reviews vs alternatives.

Is AvaTrade A Regulated Forex Broker?

Yes, AvaTrade is regulated by nine financial authorities. This includes oversight from the Central Bank of Ireland, the Cyprus Securities and Exchange Commission, the Australian Securities & Investments Commission, and the South African Financial Sector Conduct Authority.

Is AvaTrade A Good Or Bad Forex Broker?

AvaTrade is a highly rated forex broker. Traders can speculate on 53 currency pairs with floating spreads and user-friendly platforms. Novice traders can make use of the training academy, demo account, and copy trading service, while experienced traders can automate forex strategies and receive market insights through integration with Trading Central.

Is AvaTrade Good For Beginners?

Yes, we are comfortable that AvaTrade is a good broker for beginners. There is a wealth of educational content and training materials available to those new to forex trading. The low minimum deposit and demo account also make it easy to get started. In addition, we like the copy trading tools like DupliTrade that mean you can follow and learn from experienced traders.

Does AvaTrade Offer Low Forex Trading Fees?

Our team finds that AvaTrade’s forex trading fees are in line with the industry. There are no commission charges and spreads are relatively tight thanks to the low latency server times and co-location. Spreads on the EUR/USD, for example, come in at 1 pip, while on the GBP/USD, spreads are 1.5 pips.

Does AvaTrade Have A Forex App?

AvaTrade offers its in-house AvaTradeGo app. This can be downloaded for free on iOS and Android (APK) devices. Alternatively, MT4 and MT5 have mobile-compatible apps that can be used to trade forex online.

I find the broker’s bespoke software more user-friendly than MT4 and MT5, but it will ultimately come down to personal preference. My useful tip is to test them out on a demo account first.

How Long Do Withdrawals Take At AvaTrade?

AvaTrade aims to process withdrawals within 24-48 hours of receiving the withdrawal form. In my experience of forex broker reviews, this is pretty standard. However, it is worth noting that the time for funds to appear in accounts will vary depending on the payment solution, but returns are usually available within a few working days.

Can You Make Money Trading Forex With AvaTrade?

Our team appreciate that AvaTrade offers leading trading tools and transparent fees. However, there is no guarantee you will make money trading forex online, regardless of the broker. In fact, many retail traders lose money. With that in mind, we always recommend taking a pragmatic approach to risk management.

Is AvaTrade A Market Marker Or ECN Broker?

AvaTrade is a market maker broker with an in-house dealing desk. This means it takes the opposing side of its clients’ trades using its own liquidity channels. Retail traders benefit from low spreads and fast execution speeds due to server locations, including London and New York.

Article Sources

AvaTrade Central Bank of Ireland License

AvaTrade Australian Securities & Investments Commission License

AvaTrade Abu Dubai Global Markets Financial Regulatory Services Authority License