Best Forex Brokers in Australia

The best forex brokers in Australia offer trading on currency pairs with oversight from the Australian Securities & Investments Commission (ASIC). To list the top brokers for Aussie forex traders, we considered:

Whether the forex broker is regulated by the ASIC

The minimum deposit for Australian currency traders

Whether the forex trading account is available in AUD

The quality of the trading platform, app and tools

Average forex spreads and trading fees

List of Best Forex Brokers in Australia 2026

These are the top 5 forex brokers for Australian traders:

- Vantage: Best Overall Forex Broker

- AvaTrade: Best Forex Trading Software

- Eightcap: Best Forex Broker For Day Trading

- ThinkMarkets: Best MetaTrader Forex Broker

- FXCC: Best Forex Coverage

| Vantage | AvaTrade | Eightcap | ThinkMarkets | FXCC | |

|---|---|---|---|---|---|

| Currency Pairs | 40+ | 50+ | 50+ | 40+ | 70+ |

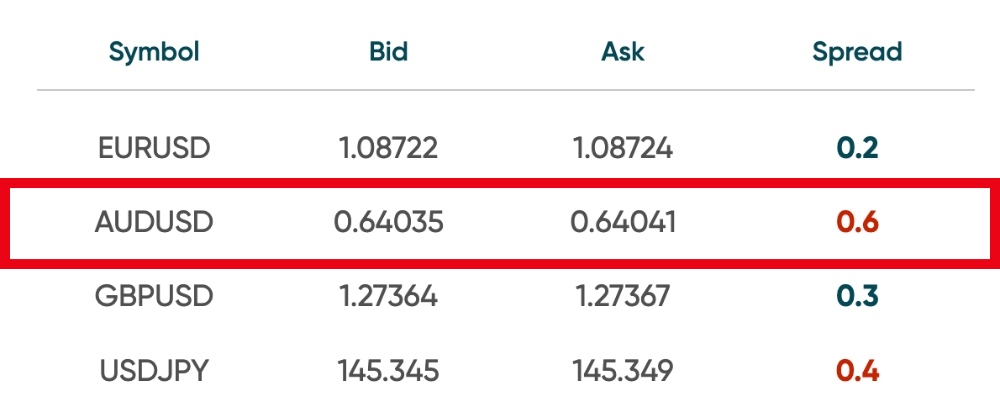

| AUD/USD Spread | 1.4 | 1.1 | 0.2 | 0.2 | 0.6 |

| Minimum Deposit | $50 | $100 | $100 | $0 | $0 |

| AUD Account | Yes | Yes | Yes | Yes | No |

| Regulated | Yes | Yes | Yes | Yes | Yes |

Vantage: Best Overall Forex Broker

Why We Recommend Vantage

We recommend Vantage because it is an Australian-headquartered and regulated forex broker with excellent trading conditions on dozens of currency pairs.

Below we explain why Vantage tops our list of forex brokers in Australia.

Pros/Cons Of Vantage

Pros

A trusted Australian forex broker with 900,000+ clients

Vantage is a Sydney-based forex broker with over a decade of serving Aussie currency traders.

The brand has an excellent reputation locally with dozens of awards and authorization from the ASIC, reassuring us that it is a legitimate and trustworthy forex broker.

Tight forex spreads on key currency pairs from 0.0 pips

Vantage offers competitive trading fees on currency assets. Based on our tests, the average spread on the AUD/USD comes in at 0.6 pips. Alternatively, the Raw account offers the same pair with 0.3 pips plus a $2 commission.

Paired with an accessible $50 minimum deposit, Vantage is one of the lowest-cost Australian forex brokers that we have evaluated.

Local payment methods are available to Australian traders

Vantage offers a good selection of accessible payment methods, making it easy to fund your forex trading account.

The brokerage accepts Domestic Fast Wire Transfers, credit/debit cards, and popular e-wallets. The added bonus for us is the zero transfer fees and near-instant deposits.

As a result, we could sign up with Vantage, fund our account, and start trading currencies in a matter of minutes – quicker than most alternatives.

Industry-leading trading software with MT4, MT5 and TradingView charts

Vantage offers a choice of top-rated third-party trading platforms – MetaTrader 4 (MT4), MetaTrader 5 (MT5) and TradingView.

MT4, in particular, is the gold standard for forex trading with advanced analysis tools and rich customization.

We also rate the broker’s in-house app which has a modern look, 1000+ instruments and straightforward account management. This will appeal to forex traders looking to manage positions on the go.

Cons

The range of currency pairs trails some forex brokers

Vantage offers fewer forex pairs than some rivals with 44 currency assets.

With that said, we don’t consider this a major drawback as there is still enough coverage for most aspiring traders who will likely focus on a handful of pairs, such as the AUD/USD, AUD/NZD, AUD/CHF, and AUD/JPY, all of which are supported.

Why Is Vantage Better Than The Competition?

Vantage offers a superb all-round package for forex traders in Australia.

The brokerage is regulated by the ASIC, provides an AUD account, supports local payment methods, and offers competitive trading conditions on key currency pairs.

Our experts also found the fully digital and fast account opening process smoother than most alternatives.

Who Should Choose Vantage?

Beginners looking for a reputable forex broker that caters to Aussie currency traders should consider Vantage. The firm’s 24/5, award-winning customer support team are also on-hand to assist new clients.

Experienced traders looking for tight forex spreads and powerful trading software will also be well served by Vantage, especially through its Raw Account.

Who Should Avoid Vantage?

Vantage isn’t the best option if you want extensive coverage of the forex market – it offers fewer currency pairs than other brokers on our list.

AvaTrade: Best Forex Trading Software

Why We Recommend AvaTrade

We recommend AvaTrade because it is an ASIC-regulated forex broker that offers powerful trading software, best-in-class education, and local support for Australian traders.

Our team explain why AvaTrade is one of the top forex brokers in Australia below.

Pros/Cons Of AvaTrade

Pros

Desktop, mobile and web forex trading with a choice of software

AvaTrade stands out for its wide selection of in-house and third-party trading platforms, ensuring there is a terminal to suit different trading styles and forex strategies.

As well as MT4 and MT5, the broker offers its own AvaTradeGo App, plus forex copy trading software from DupliTrade and ZuluTrade.

50+ currency pairs with very low fees

AvaTrade offers excellent coverage of the foreign exchange market with over 50 currency pairs.

Spreads are also tighter than many rival brokers we tested, coming in at 1.1 pips on the AUD/USD. And with zero commissions, this straightforward pricing model will appeal to forex traders that just want to pay through variable spreads.

Excellent education and courses for new currency traders

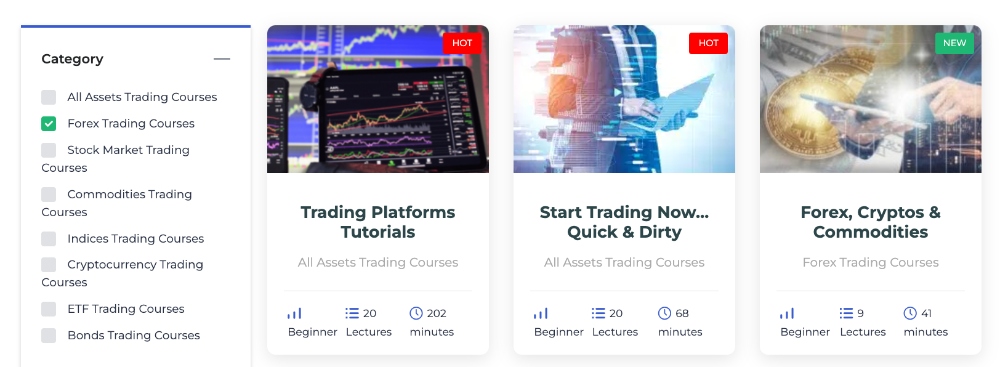

AvaTrade offers some of the best educational materials that we have seen for new forex traders.

Through its education hub and academy, we can access 400+ videos and articles, plus 150+ lessons and quizzes. Topics cover everything from the basics of forex trading to building an advanced strategy, ideal for beginners.

Cons

Limited local payment methods for Aussie traders

AvaTrade trails some forex brokers in Australia when it comes to funding options. POLi is not supported and withdrawals are on the slow side, taking up to five working days to process.

Whilst not major issues in our opinion, it is worth noting before you open an account.

Why Is AvaTrade Better Than The Competition?

AvaTrade offers a greater choice of forex trading platforms than almost every other broker we tested.

The educational materials for new currency traders also surpass most alternatives, while the brand is well-regarded in Australia.

Who Should Choose AvaTrade?

Forex traders familiar with popular third-party trading software like MT4, MT5, DupliTrade and ZuluTrade should consider AvaTrade.

Aspiring currency traders should also choose AvaTrade for its high-quality learning resources and award-winning customer support.

Who Should Avoid AvaTrade?

We don’t recommend AvaTrade if you want to fund your forex trading account with local payment solutions POLi or BPAY, as the brokerage does not support these.

Eightcap: Best Forex Broker For Day Trading

Why We Recommend Eightcap

We recommend Eightcap because it offers excellent trading conditions for day traders, with an ECN account, forex VPS and algorithmic trading tools.

The forex brokerage is also regulated by the ASIC with an office and support team in Melbourne.

Pros/Cons Of Eightcap

Pros

ECN pricing with forex spreads from 0.0 pips and a 0.01 minimum trade size

Eightcap excels for its Raw account with low forex spreads of 0.0 pips plus a $3.50 commission.

This will serve active forex traders, in particular, with scalping permitted and support for Expert Advisors (EAs).

Australian payment methods accepted including POLi

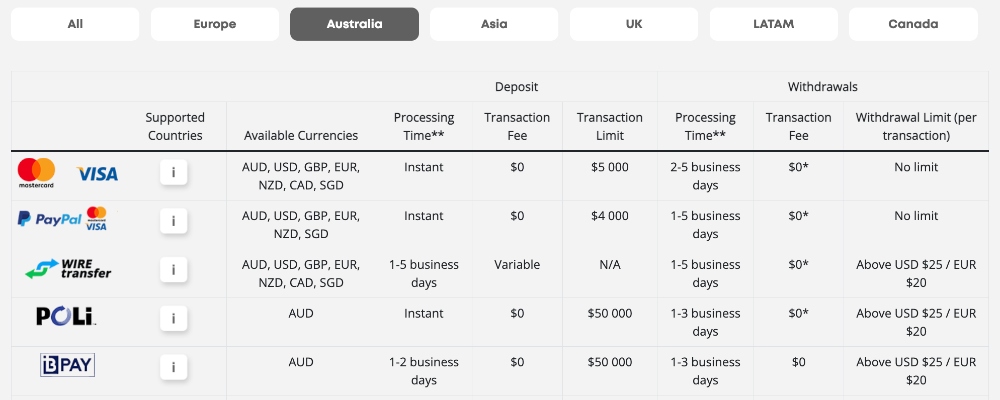

Eightcap is one of the few forex brokers in Australia to support local deposit options like BPAY and POLi.

With instant funding and no fees, this makes Eightcap one of the most convenient brokerages for Australian currency traders.

Code-free automated forex trading through Capitalise.ai

Eightcap offers the Capitalise.ai platform, which provides automated trading solutions and analytics in an easy-to-understand interface.

The bonus for me is that you can develop algorithmic trading strategies with no coding abilities. I can choose from a library of pre-existing setups or base systems on technical indicators using English.

Cons

Average forex education and market research

Eightcap trails some of the top forex brokers in Australia when it comes to education.

The broker’s Labs contain some useful long-form content but it lacks the engaging learning materials available at alternatives, which we consider important for new forex traders.

Why Is Eightcap Better Than The Competition?

Eightcap is one of the most trustworthy forex brokers in Australia. It offers more attractive pricing and tools for FX day traders than most alternatives.

The brokerage also does a particularly good job of catering to Australian residents with fee-free, near-instant and local payment methods.

Who Should Choose Eightcap?

Eightcap is a great option for day traders interested in forex CFDs with ECN pricing, VPS hosting and automated trading.

It will also appeal to Aussie currency traders looking to quickly fund their accounts in local transfer solutions like BPAY and POLi.

Who Should Avoid Eightcap?

Eightcap won’t appeal to newer forex traders looking for hands-on support with the best educational materials and learning resources.

ThinkMarkets: Best MetaTrader Forex Broker

Why We Recommend ThinkMarkets

We recommend ThinkMarkets because the ASIC-regulated forex broker offers excellent trading software in MetaTrader 4 and MetaTrader 5.

The brokerage also has an office and strong presence in Australia, catering to local currency traders.

Our experts unpack the benefits of forex trading with ThinkMarkets below.

Pros/Cons Of ThinkMarkets

Pros

Trade 40+ currency pairs on MetaTrader 4 and MetaTrader 5

As well as its own in-house software, ThinkMarkets offers forex trading on both of MetaQuotes platforms – MT4 and MT5.

These are two of the best third-party platforms for forex traders based on our tests, with dozens of technical indicators and drawing tools, one-click trading, plus bots.

I would recommend MetaTrader 4 for newer traders while MetaTrader 5 will appeal to seasoned traders looking for faster processing, more pending orders and timeframes, plus multiple backtesting.

Forex trading ideas from Signal Centre

Our team have evaluated over 100 Australian forex brokers and ThinkMarkets offers one of the best signals services.

Signal Centre offers human-based and AI-powered signals on forex, alongside other markets. You can get up to 40 ideas daily, which really helps me plan out forex strategies for the day ahead.

Low forex spreads on the Standard and ThinkZero accounts

ThinkMarkets offers competitive pricing on popular forex assets, including AUD/USD, AUD/NZD and AUD/JPY.

In particular, we found that the ThinkZero account provides average FX spreads of 0.1 pips with a $3.50 commission.

The Standard account offers spread-only pricing with typical FX spreads of 1.2, which is also decent compared to other forex brokers in Australia.

Cons

A $500 minimum deposit is required to access ThinkZero

You need to fund your ThinkMarkets account with $500 to access the best pricing on ThinkZero.

This is a drawback to alternatives like Eightcap which offers access to its raw-spread account with $100. We don’t consider this a dealbreaker, but it may deter some forex traders on a budget.

Why Are ThinkMarkets Better Than The Competition?

ThinkMarkets offers very competitive forex pricing on the MetaTrader 4 and MetaTrader 5 platforms, especially on the ThinkZero account.

The brand is also heavily regulated, including in Australia, and has 450,000+ clients globally with a string of forex trading awards under its belt.

Who Should Choose ThinkMarkets?

Australian forex traders familiar with the MetaQuotes software will appreciate the desktop, web and mobile trading opportunities at ThinkMarkets.

The brokerage will also appeal to forex traders willing to deposit $500 to access ultra-low pricing on popular currency assets.

Who Should Avoid ThinkMarkets?

ThinkMarkets doesn’t offer the highest-quality educational materials, so newer traders may prefer an alternative Australian forex broker on our list.

FXCC: Best Forex Coverage

Why We Recommend FXCC

We recommend FXCC because it offers more currency pairs than most forex brokers in Australia with no minimum deposit and high leverage up to 1:500.

Our team unpack the key reasons to trade forex at FXCC below.

Pros/Cons Of FXCC

Pros

70+ currency pairs including AUD/USD, AUD/CAD, and AUD/GBP

FXCC offers more forex assets than every other broker on our list. This includes access to majors, minors and exotics, with support for eight pairs with the AUD.

Ultimately, greater exposure to the foreign exchange market provides more opportunities for serious forex traders.

Trade forex with spreads from 0.1 pips and zero commission

While not the cheapest forex broker in Australia, FXCC offers fairly competitive pricing on popular currency assets.

Upon testing, the AUD/USD was available from 0.6 pips with no commission, which is comparable to other top currency brokers in Australia.

High leverage up to 1:500 on major currencies

FXCC offers very high leverage up to 1:500 on key forex assets like the AUD/USD and EUR/USD. This is more than every other forex broker on this list and means a $100 outlay affords you $50,000 in buying power.

With that said, we always recommend employing suitable risk management parameters when trading forex with high leverage as losses are amplified alongside returns.

Cons

Weak regulatory oversight for Australian traders

Unlike the other forex brokers in our list, FXCC is not regulated by the Australian Securities and Investments Commission (ASIC).

The brokerage is licensed by a tier-two regulator, the Cyprus Securities & Exchange Commission (CySEC), which is a reassuring sign. However, Aussie residents will trade through the offshore entity, incorporated in Nevis, where there are fewer regulatory safeguards.

No AUD base currency for Australian forex traders

FXCC does not provide a trading account denominated in AUD. Instead, USD, EUR and GBP are supported.

We prefer brokers that offer AUD accounts because it makes managing our trading activity in a local currency easier, while also avoiding conversion fees.

Why Are FXCC Better Than The Competition?

FXCC offers better forex coverage than many alternatives, plus higher leverage than most forex brokers in Australia.

The $0 minimum deposit also makes it very accessible for those on a budget.

Who Should Choose FXCC?

FXCC will serve forex traders looking to get started with a low deposit and access to a large range of currency assets.

Aussie investors looking for highly leveraged forex trading in return for fewer regulatory safeguards may also want to consider FXCC.

Who Should Avoid FXCC?

FXCC is not a sensible option if you want an ASIC-regulated forex broker. Consider alternatives on the list.

If you want an Australian forex broker with an AUD trading account, FXCC also isn’t the best firm.

What To Look For In An Australian Forex Broker

To compile a list of the best forex brokers in Australia, our team considered several factors:

ASIC Regulation

Authorization from the Australian Securities & Investments Commission (ASIC) is a key consideration when we compare forex brokers.

As one of the toughest regulators globally, the ASIC ensures retail traders are provided with several important safeguards.

These include limiting leverage to 1:30 on forex trading, prohibiting bonuses and promotions, and ensuring you can’t become indebted to your broker if your account drops below zero, known as negative balance protection.

Minimum Deposit

The best forex brokers in Australia have an accessible minimum deposit of between $0 and $500.

While a high starting deposit won’t deter seasoned traders, it can act as a barrier to new currency traders.

We also look for access to local payment methods, such as POLi and BPAY. In our experience, these offer faster processing times and more convenient account funding for Aussie traders.

AUD Account

The top forex brokers for Australian traders offer a live account denominated in the Australian Dollar.

This is important because it makes it easier to load your account and manage your forex trading activity in your local currency.

We have found that it can also help avoid the currency conversion charges sometimes levied if you need to move AUD into a USD account, for example.

Platforms Features

The quality of the forex trading platform, app and any additional tools is a key factor. This is where you will spend a significant portion of your time, so having a reliable and powerful terminal is a must.

While testing forex trading software, we compare the analysis tools, charting features, order functionality, one-click trading capabilities, and degree of customization, amongst others.

But most importantly, we check that trading tools are user-friendly and well-designed with forex traders in mind.

Trading Fees

An important part of ranking the best forex brokers in Australia is comparing fees.

We look at both the minimum and average spreads on popular forex assets like the AUD/USD, AUD/NZD and AUD/JPY, plus any commissions.

Our team also consider any non-trading costs. These typically come in the form of deposit and withdrawal fees, inactivity charges, and swap fees.

Put together, this allows us to identify the cheapest forex brokers for Australian traders.

FAQ

Is Forex Trading Legal In Australia?

Yes – forex trading is legal in Australia. The industry is regulated by the Australian Securities and Investments Commission (ASIC), which authorizes brokers to provide currency trading to Australian residents.

Opening an account with an ASIC-regulated forex broker will help protect you from scams and malpractice.

Which Is The Best Forex Broker In Australia?

The best forex broker in Australia is Vantage. The ASIC-regulated firm offers 40+ currency pairs with tight spreads from 0.0 pips and an accessible $50 minimum deposit.

AvaTrade, Eightcap, ThinkMarkets and FXCC are also top-rated Australian forex brokers.