Pepperstone

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

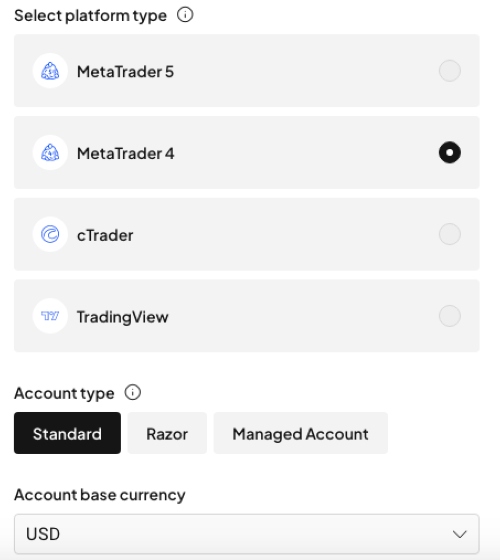

🛠 PlatformsMT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.2 -

# Assets60+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Our Opinion On Pepperstone

Pepperstone is a leading forex broker thanks to its large suite of powerful tools, reliable customer service and low fees. The ultra-tight forex spreads from 0.0 pips are amongst the lowest we have seen. Pepperstone doesn’t match some competitors when it comes to deposit options and account opening, but it remains an excellent choice for both beginners and experienced forex traders.

Summary

- Instruments: 1200+ including 90+ forex pairs, stocks, indices, ETFs, commodities, and spread bets (UK clients only)

- Live Accounts: Razor, Standard

- Platform & Apps: MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView

- Deposit Options: Credit/debit cards, wire transfer, and PayPal

- Demo Account: Yes

Pros & Cons

- Trustworthy forex broker with licenses from 7 regulators including FCA, ASIC and CySEC

- Excellent range of 90+ forex assets including majors, minors, exotics, plus currency indices

- Capitalise.ai can be used to automate strategies with no coding knowledge

- Responsive 24/7 customer support via telephone, live chat and email

- Access to industry-leading software including MT4 and MT5

- Very tight spreads from 0.0 pips in the Razor account

- Award-winning brand with over 400,000 clients

- Forex fee discounts for high-volume traders

- Fast execution speeds from 30ms

- Slow registration process which takes around half an hour

- Limited support for popular e-wallets like Skrill and Neteller

- Withdrawal timeframes slower than some alternatives

- Demo accounts expire after 30 days

- US traders not accepted

Is Pepperstone Regulated?

Pepperstone is one of the most heavily regulated forex brokers that we have evaluated.

The company holds licenses with tier-one regulators, including the UK Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

It is also regulated by other reputable agencies, including the Cyprus Securities and Exchange Commission (CySEC), the Dubai Financial Services Authority (DFSA), the Securities Commission of the Bahamas (SCB), the Capital Markets Authority (CMA) in Kenya, and the Federal Financial Supervisory Authority (BaFin) in Germany.

We always recommend signing up with regulated forex brokers as it brings greater account and fund security. For example, Pepperstone must segregate client funds from business money, protecting your capital in the event of business failure. It must also provide negative balance protection to retail traders, meaning you cannot lose more than your account balance.

On the negative side, our experts did uncover a concerning security event in 2020, where a data leak left customers’ personal data exposed. Fortunately, the broker was quick to respond and transparent about the threat. We are also reassured that no financial losses were suffered by the firm’s clients.

Forex Accounts

Pepperstone stands out for its simple account structure with two profiles; Razor and Standard.

Both accounts offer access to all instruments, a choice of popular base currencies (USD, EUR, GBP, CAD, AUD, JPY, CHF), and an accessible minimum trading volume of 0.01 lots.

The main differences between the accounts are the pricing conditions and the platforms available. Like many forex brokers, Pepperstone’s Standard account offers zero commissions with a higher, variable spread. I recommend this account for beginners and casual traders looking for straightforward pricing.

For active, high-volume traders, I would opt for the Razor account. This comes with industry-low spreads from 0 pips and a competitive $6 round-turn commission. It also has the added benefit of access to TradingView charts and analytics. It is particularly well suited to short-term forex strategies like scalping.

Our team have pulled out the key differences between the forex accounts:

Razor

- Raw spreads from 0 pips

- Commissions from $3 per lot per side

- MT4, MT5, cTrader, and TradingView access

Standard

- Floating spreads averaging 1 pip

- Zero commissions

- MT4, MT5, and cTrader access

Muslim traders will be pleased to learn that Pepperstone also offers a swap-free account. However, we were disappointed to find a relatively expensive admin fee of $100 per standard lot which applies to all trades held for five days.

It is also worth being aware that swap-free accounts are only available in certain countries by default including Indonesia, Turkey, Oman, Morocco, and Egypt. This is a noticeable drawback vs popular alternatives like AvaTrade and Plus500 that cater to Muslim traders in most countries where they accept clients.

How To Open A Live Trading Account

We have tested hundreds of forex brokers and Pepperstone’s registration process is on the slow side. It took us the best part of half an hour with 10 steps to complete before we could start trading forex:

- Sign up with an existing account (e.g. Facebook or Google) or select ‘Continue With Email’

- Find your country of residency from the dropdown menu

- Select ‘Individual’ in the account type option

- Add your name, date of birth, phone number, and email address, and create a password

- Click ‘Set Up A Live Account’

- Select a trading platform, account type, base currency and create a password (applicable for MT4 and MT5 accounts only)

- Complete your employment, income, and trading experience details

- When you are redirected to the client area, complete the appropriateness test, personal details, and account declaration

- Upload identity documents and proof of address

- Submit the application

Trading Fees

Pepperstone offers some of the lowest forex trading fees in the industry.

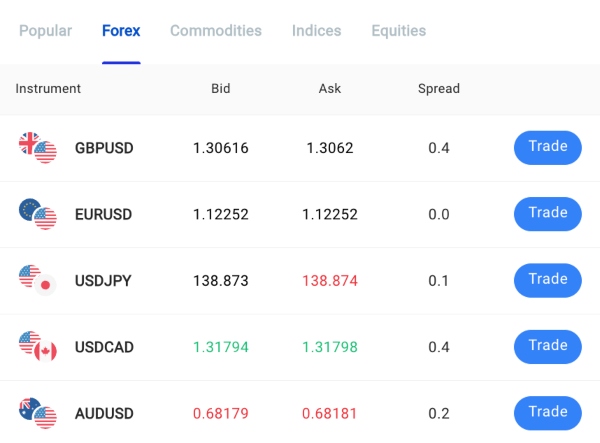

The Razor account offers some of the best spreads we have seen, starting from 0 pips alongside a low commission of $3.50 per lot, per side on MetaTrader. When we used the forex broker, we got an average spread on EUR/USD of just 0.12 pips. The GBP/USD was also competitive at 0.69 pips.

Interestingly, we found cTrader ($3) and TradingView ($3) commissions came in slightly cheaper vs MT4/MT5 ($3.50), which is worth keeping in mind if you want to keep costs to a minimum and are familiar with these platforms.

The Standard account offers floating spreads averaging around 1 pip on most majors, which is excellent value if not quite as low as competitors like CMC Markets. Upon testing, we got an average spread of 1.12 pips on the EUR/USD and 1.69 pips on the GBP/USD.

It is worth noting a commission fee applies when trading forex on the Razor profile and on all stock trades regardless of account type. Share CFD commissions vary by region, but we found these charges competitive, especially on US stocks:

- US Shares – $0.02 commission, USD 0.02 minimum

- AU Shares – 0.07% commission, AUD 5 minimum

- DE Shares – 0.10% commission, EUR 7 minimum

- HK Shares – 0.20% commission, HKD 45 minimum

- UK Shares – 0.10% commission, GBP 7 minimum

Overnight swap charges apply to all accounts, except swap-free profiles, which is standard at forex brokers.

Non-Trading Fees

Bolstering its position as a low-cost forex broker is the low to zero additional charges. Unlike alternatives such as AvaTrade and Plus500, Pepperstone does not charge an inactivity fee, which will appeal to casual traders.

We are also pleased to find no deposit or withdrawal charges. Whilst this is pretty standard at leading forex brokers, some firms do levy a fee to fund or withdraw from accounts, cutting into profit margins.

On the negative side, there are some fees for additional tools like Virtual Private Server (VPS) access. We unpack these in more detail below and explain how active traders can get discounted rates.

Payment Methods

Our team have evaluated dozens of leading forex brokers and Pepperstone could improve its funding options. The broker supports credit/debit cards, PayPal, and bank transfers. However, it lacks popular e-wallets like Skrill and Neteller which are available at other leading forex brokers, including eToro and IC Markets.

On the plus side, while using Pepperstone we found that credit/debit cards and PayPal offer near-instant account funding.

Another bonus for us is that Pepperstone has no minimum deposit. This is good news for beginners and forex traders on a budget.

Based on our tests – withdrawals are around the industry norm, taking between one and three working days. This puts them in line with other regulated forex brokers that have checks to complete before releasing funds.

How To Make A Deposit

I didn’t run into any issues navigating the cashier portal at Pepperstone. You can quickly and easily make a deposit into your live trading account:

- Sign in to the client area

- Choose ‘Funds’ from the menu on the left and click ‘Add Funds’

- Select a payment method from the list of options (wire transfer, bank cards, PayPal)

- Input the value to transfer and click ‘Deposit’

Forex Assets

Pepperstone offers access to popular forex pairs with over 90 major, minor and exotic currencies available. This is a competitive selection that will serve most active currency traders.

Importantly, clients can trade forex through contracts for difference (CFDs). These popular derivatives allow traders to speculate on rising and falling prices while using leverage to magnify their purchasing power and potential returns (or losses).

A key bonus for us is the availability of currency indices, such as the US Dollar Index and Euro Currency Index. Not offered by many alternatives, these products offer diversified exposure to leading currencies by measuring their value against a basket of other related currencies, for example, those of key trading partners.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

Pepperstone is also a good choice for traders interested in asset classes beyond forex. More than 1200 instruments are available spanning precious metals, energies, stocks, indices, and ETFs.

Access to products may vary between jurisdictions, but with this breadth on offer, we are confident most traders will find opportunities to suit their trading strategy and style.

- Trade metals, energies, and soft commodities including cocoa, coffee, crude oil, silver, and gold

- Speculate on the price of popular cryptocurrencies vs the US Dollar including Bitcoin, Ethereum, Dash, and Ripple (location dependent)

- Take positions on the price of North American, European, Asian, and African stock indices such as the S&P 500, FTSE 100, and AUS 200

- Trade US, UK, AU, HK, and GE company shares including Airbnb, AT&T, Unilever, Newcrest Mining, and National Australia Bank

- Trade country-specific or industry-established exchange-traded funds (ETFs) such as the iShares China 25, SPDR S&P Bank, iShares 1-3 Year Treasury Bond, and iShares MSCI Emerging Markets ETF

Execution

Pepperstone is an ECN/STP broker, with no dealing desk intervention. The brokerage uses tier-one liquidity providers and banks to offer raw spreads and incredibly fast execution speeds of 30ms (anything below 100ms is good).

This model ultimately makes the firm an excellent pick for active day traders looking to profit from relatively small, short-term price movements with reliable execution and low fees.

Leverage

Pepperstone offers leverage in line with relevant regulatory restrictions. EU and UK traders, for example, can access 1:30 leverage on major forex pairs, while traders registered with the DFSA-regulated entity can trade with 1:200 leverage.

Professional retail investors can trade with even higher leverage up to 1:500 if they meet certain criteria and are willing to forego protections afforded retail traders, such as negative balance protection.

We are pleased to see flexibility when it comes to trading on margin. We can change the leverage available in our account by following a simple process:

- Log in to the client area

- Select the ‘Account’ icon from the menu on the left and tick ‘Live’ to ensure your real accounts are listed

- Use the pen logo to open the ‘Account Settings’ menu

- Click ‘Change Leverage’ and choose a new ratio from the dropdown menu

- Select ‘Submit’

Note the MT4 and MT5 platforms have a 90% margin call and a 50% stop-out level.

Platforms & Apps

Although Pepperstone does not offer any proprietary software, it does provide four of the best third-party trading terminals; MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, and cTrader.

These four leading platforms and the long list of additional tools to use with them were very positive factors for us during our review of Pepperstone.

All the solutions offer a wealth of technical analysis features including customizable charts, flexible interface views, and simple position opening and closing.

Each platform can also be downloaded to desktop devices, used as a web trader, or accessed via iOS and Android mobile apps.

Another plus for us is that there are no limits to the instruments available on any of the solutions. While often overlooked – it is not uncommon for brokers to limit access to instruments in favor of certain terminals, such as in-house software.

We recommend TradingView for beginners thanks to its modern interface and focus on intuitive charts with data interpretation tools, while the ever-popular MT4 and MT5 are excellent choices for traders who use automated strategies and cTrader is an equally powerful choice for day trading and algorithmic forex trading.

We have pulled out some of our favorite features from each platform below:

TradingView

- 100+ integrated technical indicators, 90+ drawing tools, and over 100,000 downloadable analysis tools

- Strategy forward and backtesting and bespoke indicator creation with Pine Script programming language

- 15+ chart types including Renko, Point & Figure, and Kagi with one-click trading

- Alerts and notifications can be set up for all devices with 12 different conditions

- Historical price data replays with four speeds available

MetaTrader 4

- 3 chart types with 9 timeframe views from 1 minute to 1 month

- 30+ integrated technical indicators and drawing tools including lines, shapes, and waves

- Access to Expert Advisors (EAs) for automated trading using the MQL4 programming language

MetaTrader 5

- Multi-thread and multi-currency strategy backtesting

- 3 chart types with 21 timeframe views from 1 minute to 1 month

- 38+ integrated technical indicators and drawing tools plus access to depth of market data

- Automated trading opportunities using Expert Advisors (EAs) and MQL5 programming language

cTrader

- cTrader Automate algorithmic solution to create custom robots and indicators

- Customize your cTrader interface with single-chart, multi-chart, and free-chart modes

- Simultaneous order processing means no queued positions and faster execution speeds

- 4 chart types including candlesticks, lines, and dots with full flexibility to view and remove influences such as tick volumes, market sentiment, and bid/ask price lines

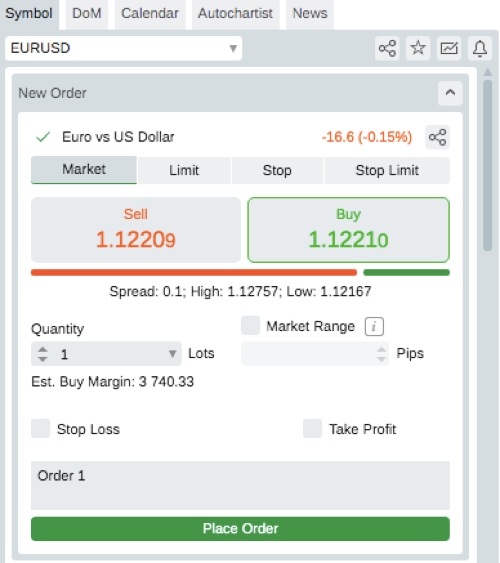

How To Place A Forex Trade On The cTrader Platform

While down to personal preference, I appreciate the speed and ease at which you can place a forex trade on cTrader:

- Right-click on the symbol name and select ‘Create New Order’ from the pop-out menu

- Ensure the instrument is displayed in the top left box or choose a new product from the dropdown

- Input the trade direction by selecting ‘Buy’ or ‘Sell’

- Add the order volume in lots using the toggle symbols or by manually inputting the number

- Use the ‘Market Range’ function to source a suitable price range for the order to be filled

- Tick the ‘Stop Loss’ or ‘Take Profit’ boxes to add a risk parameter and input the price

- Add a comment (optional)

- Click ‘Place Order’ to confirm the position

Forex Tools

Pepperstone impressed us with its choice of excellent trading tools. Access may vary depending on your jurisdiction, but there is plenty available for forex traders of all experience levels in our view.

Automated Trading

Automated forex trading is well catered for. As well as the reliable trading platforms reviewed above, Pepperstone offers Capitalise.ai, facilitating automated trading with no coding requirements. This is a great option for beginner to intermediate forex traders.

We also like that it is provided at no further charge, and can be connected seamlessly with your MetaTrader 4 account.

To get started with Capitalise.ai, simply follow the link on the broker’s website and log in with your existing MT4 credentials. Conveniently, there are no additional registration requirements to use the service.

For more experienced traders with technical know-how, we would opt for the cTrader Automate API, which can be used to develop custom indicators and bots. This solution offers more customizability and configurability.

Copy Trading

Pepperstone is one of the best forex brokers for copy trading.

Our experts are pleased to see that the broker supports Myfxbook, DupliTrade, and MetaTrader Signals. These are ideal for beginners or those with limited time, as they allow you to copy the positions of more experienced forex traders in real time.

Importantly, all solutions offer strategy provider statistics and data, meaning you can review past performance metrics and make informed decisions on how to allocate funds.

We find the MetaTrader Signals solution the easiest to use, with trading taking place directly via the MetaTrader software. We especially appreciate that the tool offers full account control, meaning you can close positions, amend investment allocations and add risk management parameters as you see fit.

VPS

Pepperstone offers two Virtual Private Server (VPS) hosting services, providing 24/7 market connectivity and enhanced speeds – extremely useful for algorithmic trading.

It is a shame the brand does not offer these for free to registered customers (except for eligible clients under the Active Trader program), however, there is an upside in the form of a 25% discount. It is also pretty standard for forex brokers to require a large balance or monthly trading volume before you get low-cost or free access to a VPS.

You can sign up with either ForexVPS or New York City Servers for low-latency solutions.

Autochartist

Access to Autochartist is another advantage of trading forex with Pepperstone. It can essentially help you identify patterns and market trends.

We especially like the deep filtering tools, with probability factors, historical events and future outlooks among the list of options.

Another useful feature is the technical indicator notifications, which can be set up to alert you to developing patterns such as Wedges and Triangles.

Forex Research

Pepperstone has a team of expert analysts, who publish daily forex articles and investment ideation for customers. The research includes commentary on key market movers, economic events and technical price analysis.

This is a hugely useful resource for traders with enough up-to-date data to be a real boost while navigating financial markets.

Forex Education

Our experts rank Pepperstone’s educational resources highly. There is a choice of online webinars, videos, and trading guides for retail investors of all experience levels, and we are happy to find the content labelled appropriately for ‘Beginner’, ‘Intermediate’, and ‘Advanced’ topics.

With that said, we do think some alternatives offer more engaging content, especially for newer forex traders. A broker like eToro is a good option here, with a beginner-friendly trading academy and training courses.

Demo Account

Pepperstone offers a demo account – a key consideration for aspiring forex traders.

Our team rates that you can practice opening and closing positions on all platforms with $50,000 in virtual funds. Access to real-time pricing is another advantage, as it helps traders test out the firm’s trading terms before risking real money.

Our only criticism is that the practice profile has a 30-day time restriction as standard. This limits its use – we favor brokers with unrestricted demo accounts so we can continue to test forex strategies even after we have opened a real account.

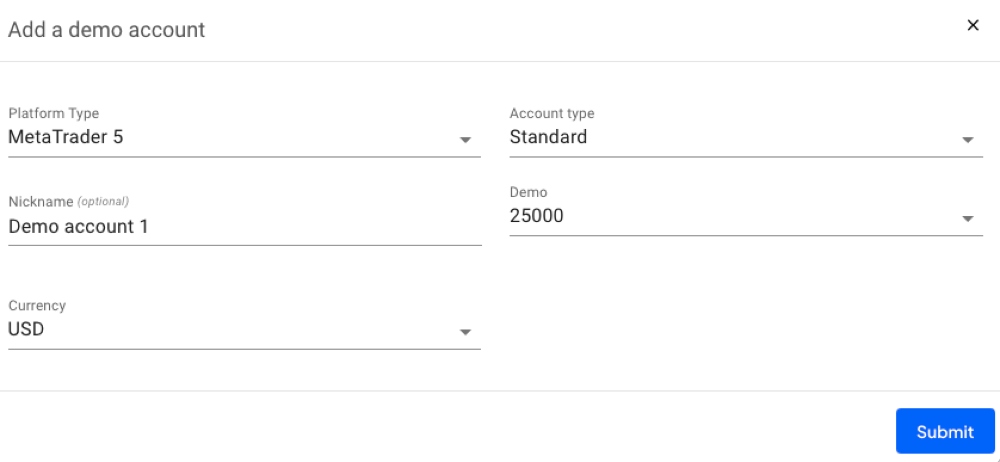

How To Open A Demo Account

I didn’t run into any problems registering for a demo account. I was signed up and trading forex with paper funds in less than 5 minutes.

To get started:

- Click ‘Try Demo’ from the broker’s homepage

- Choose whether you want to sign up with an existing account (e.g. Google or Facebook) or select ‘Continue with email’

- Choose your country of residence from the dropdown menu

- Select ‘Individual’ in the account type option

- Add your name, date of birth, phone number, email address, and create a password

- Click ‘Start Trading With Demo’

- In the new window, choose your platform, account type, base currency, and virtual balance, then click ‘Submit’

- Login credentials will be displayed on the following screen and sent to your registered email address

- Launch the relevant platform and start trading forex

Bonus Offers

Like most forex brokers that are overseen by top-tier regulators, Pepperstone does not offer a welcome bonus. We don’t consider this a disadvantage as sign-up bonuses often encourage over-trading and come with challenging withdrawal stipulations.

There is a refer-a-friend scheme, with 20 commission-free trades available for both the referee and the referral for forex and stock CFD positions. This is fairly enticing, though the initial deposit made by the referral must be $1000 or more, which is fairly steep.

An alternative and more attractive promotion is Pepperstone’s Active Trader program. This is a great way for high-volume traders to pick up fee rebates. The highest tier rewards offer a $3 discount per lot, with a 30% spread reduction. To be eligible you must trade a total volume of 1501+ FX lots.

We like that as well as the fee discounts, you also receive access to premium customer support with a dedicated account manager, complimentary VPS hosting, and advanced market insights.

Trading Restrictions

Pepperstone permits hedging, scalping and netting. Our experts found no trading restrictions, making the broker suitable for all trading strategies and styles.

This is good news, especially for forex scalpers owing to the razor spreads and lightning-fast execution speeds.

Customer Service

Having spoken to dozens of customer support teams at forex brokers, Pepperstone scores fairly highly. It is one of the few brokers to offer 24/7 telephone assistance with multilingual support also available via email or live chat. Additionally, the online help centre provides plenty of FAQs and user guides for important queries.

On the downside, and as is increasingly the case, the live chat function initially connects you to an automated chatbot which often cannot deal with my queries. Fortunately, it is very easy to switch to a live assistant through the ‘request an agent’ function. I usually get through to a customer service representative within a few minutes.

To contact the broker:

- Email – support@pepperstone.com

- Live Chat – Icon bottom right of the broker’s website

- Telephone – 0035725030573 (EU), 08000465473 (UK), +44(800)0465473 (international)

Company Details

Pepperstone was established in 2010 by a group of experienced investors.

The brokerage has an office presence in London, Cyprus, Dubai, and Melbourne.

The Pepperstone Group operates several global subsidiaries, with regulatory oversight from some of the most reputable financial bodies, including the FCA, CySEC, and ASIC.

The brand has been recognized with several accolades, including the Best Spread Betting and CFD Educational Tools at the 2023 ADVFN International Financial Awards, and the Best MT4 Broker at the 2023 Good Money Guide Awards.

Today, Pepperstone has over 400,000 registered customers and processes an average $12.55 billion trading volume per day.

Trading Hours

Pepperstone is transparent about its trading hours, which vary by instrument but are easy to check via useful sections on the broker’s website including a monthly market holiday calendar and maintenance schedule.

Importantly, the broker follows standard market opening times. For instance, the majority of forex pairs can be traded from 00:01 to 23:59 (GMT +3) Monday to Friday.

The broker adopts a GMT +3 server time (US daylight savings).

Who Is Pepperstone Best For?

Both beginner and experienced forex traders will be well served by Pepperstone.

With no minimum deposit, a demo account, copy trading, and responsive support, beginners can start trading forex in a secure environment.

There is also plenty for active traders, from ultra-low spreads and excellent execution to powerful trading software, VPS support and rebates for high-volume traders.

Altogether, this makes Pepperstone a top-rated forex broker that we feel provides some of the best value on the market for online traders.

FAQ

Is Pepperstone Legit Or A Scam?

Pepperstone is a legitimate broker with over a decade in the online trading industry. The brokerage is regulated by some of the most reputable watchdogs including the FCA, ASIC and CySEC.

More than 400,000 traders have also signed up with the broker, a good sign that the brand is credible.

Can I Trust Pepperstone?

Pepperstone is a trustworthy, regulated brand that offers negative balance protection, segregated client funds, and access to compensation schemes in relevant countries should the firm encounter financial difficulties.

Our experts are comfortable recommending Pepperstone to forex traders.

Can You Make Money Trading Forex With Pepperstone?

Forex traders can make money at Pepperstone, supported by the low fees and market-leading tools.

However, many retail traders lose money and a robust approach to risk and money management is required. Most importantly, never risk more than you can afford to lose.

Does Pepperstone Offer Low Forex Trading Fees?

Pepperstone offers some of the tightest spreads and lowest commissions that we have seen.

You can trade commission-free on the Standard account and benefit from tight floating spreads averaging around 1 pip on majors.

The broker also offers a raw-spread Razor account, with commissions from $3.50 per lot per side (MetaTrader) or $3 per lot per side (cTrader/TradingView).

Is Pepperstone A Regulated Forex Broker?

Yes, Pepperstone is heavily regulated in various jurisdictions where it operates. This includes regulation from the FCA, CySEC, ASIC, and the DFSA.

It is important to note the level of regulatory oversight you receive will depend on your location and the entity you sign up with.

Is Pepperstone A Good Or Bad Forex Broker For Beginners?

Pepperstone is an excellent forex broker for beginners. The brand offers a comprehensive educational academy, with content tailored to novice investors.

The firm has also partnered with popular copy trading brands such as ZuluTrade and Myfxbook, offers a $0 minimum deposit and a free demo account.

Does Pepperstone Have A Forex App?

Pepperstone does not offer a proprietary mobile app, however MT4, MT5, TradingView, and cTrader all offer mobile-compatible applications. This provides plenty of opportunities and capabilities to manage your account and forex positions while on the go. All you need is a stable internet connection.

How Long Do Withdrawals Take At Pepperstone?

Withdrawals at Pepperstone take an average of between one and three working days. This puts the broker in line with most leading brands based on our tests and experience.