Best Forex Brokers in the UK

The best forex brokers in the UK offer competitive trading conditions and are regulated by the Financial Conduct Authority (FCA). We have ranked the top brokers for UK forex traders, taking into account:

Access to currency pairs

Forex trading fees

Account conditions

Platforms and tools

FCA authorisation

List of Best Forex Brokers in the UK 2026

These are the top 5 currency brokers that accept UK traders:

- XTB: Best Overall Forex Broker

- CMC Markets: Best Forex Broker For Active Traders

- Vantage: Best Forex Trading Software

- FXCC: Best MetaTrader 4 Forex Broker

- IC Markets: Best Forex Broker For Copy Trading

XTB: Best Overall Forex Broker

Why We Recommend XTB

We recommend XTB because it is a hugely respected, FCA-regulated forex broker. UK traders benefit from low forex fees, powerful trading software and accessible account conditions.

Below we explain why XTB is our best overall forex broker in the UK.

Pros/Cons of XTB

Pros

Trustworthy forex broker authorised by the FCA

XTB is a top-rated forex broker with more than 1 million registered clients.

With 15+ years of experience in the online trading industry and a license from the UK’s Financial Conduct Authority (FCA), we consider XTB a legitimate, trustworthy forex broker.

Excellent market access including 70+ currency pairs

Our team have tested dozens of UK forex brokers and XTB has one of the best product lineups, with 5300+ instruments including 71 currency pairs.

UK traders can also build a diverse portfolio with access to 250+ stocks listed on the London Stock Exchange (LSE).

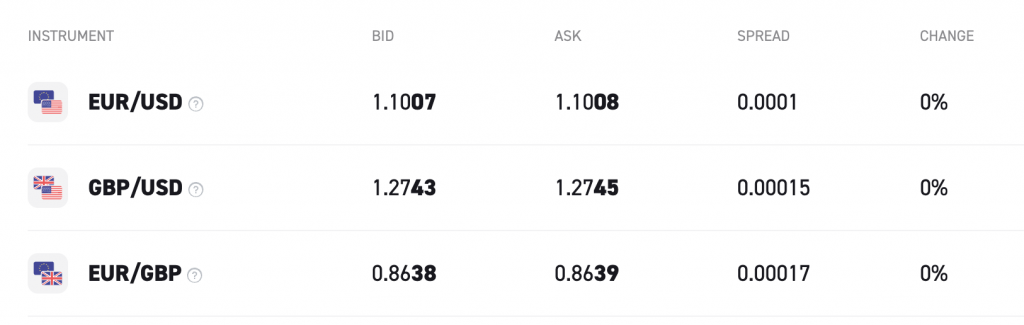

Tight spreads from 0.1 pips on major forex pairs

XTB offers very low forex trading fees. Based on our tests, spreads start from 0.1 pips on popular currency assets like the EUR/USD and EUR/GBP.

We also rate the zero-commission trading model with no hidden charges, including fee-free account funding and support for GBP deposits.

Easy-to-use award-winning web and mobile platform – xStation

The proprietary xStation platform is user-friendly and feature-rich.

Alongside the customisable charts and in-built risk management tools, our team particularly rate the market audio commentary, which often comes with a fee at competitors. The free video tutorials also make it easy to get up to speed with the forex trading platform.

Cons

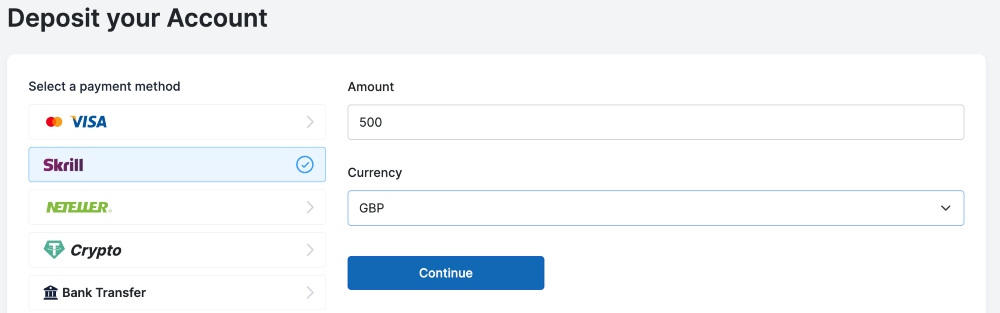

A narrow range of payment methods for UK forex traders

XTB supports fewer deposit options than some UK forex brokers we have reviewed.

You can only fund your forex account with wire transfers, credit/debit cards, or Skrill. EU traders, on the other hand, can use PayPal whilst non-UK/EU clients are also offered Neteller.

We don’t consider this a major drawback, but it is worth noting. The GBP base currency, near-instant processing and no deposit fees also make up for this minor inconvenience in our opinion.

MetaTrader 4 is not supported for forex trading

XTB does not offer the most popular third-party forex trading platform – MetaTrader 4 (MT4).

Whilst xStation is an excellent alternative based on our experience, this may deter some currency traders who are already familiar with MT4.

Why Is XTB Better Than The Competition?

XTB offers the complete package for UK forex traders, from FCA authorisation and powerful tools to nearly 50 currency pairs with tight spreads. The UK-based customer support available 24/5 is also reassuring.

Ultimately, XTB will serve British traders of all stripes looking for a reliable and trustworthy forex broker.

Who Should Choose XTB?

Newer traders seeking a user-friendly platform to learn forex trading with no minimum deposit and a free demo account should consider XTB.

Experienced traders looking for a wide range of currency assets, below average spreads and leverage up to 1:30 should also choose XTB.

Who Should Avoid XTB?

We don’t recommend XTB if you want to trade forex on MetaTrader 4, as the broker does not integrate this platform.

You should also avoid XTB if you want to fund your forex trading account with PayPal, as XTB does not support this payment method.

CMC Markets: Best Forex Broker For Active Traders

Why We Recommend CMC Markets

We recommend CMC Markets because it is an FCA-regulated and FTSE 250-registered forex broker that accepts UK traders. The firm also has a London headquarters, as well as UK-based customer support available 24/5.

With 30+ years of experience and 300,000+ registered customers, it is widely respected. The award-winning brokerage also offers more forex assets than every other firm we tested, as well as very low fees and powerful trading software.

Our team will explain why CMC Markets makes our list of the best forex brokers in the UK.

Pros/Cons of CMC Markets

Pros

FX Active account for high-volume traders with spread discounts

CMC Markets is one of the only currency brokers in the UK to offer a dedicated account for high-volume forex traders.

FX Active offers spreads from 0.0 pips on six major pairs, including EUR/USD, GBP/USD, and AUD/USD. Traders also get a 25% spread discount on all other currency assets, making it an excellent option for active forex traders looking to keep fees down.

FX Active is compatible with both MetaTrader 4 and the broker’s Next Generation platform.

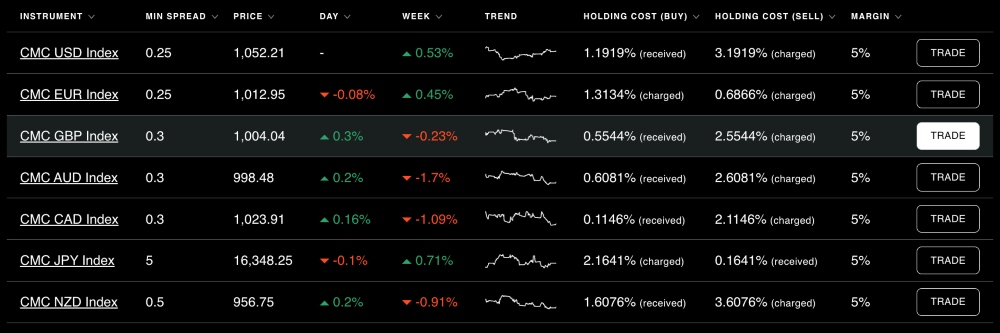

Access to over 330 forex instruments including currency indices

CMC Markets stands out for its huge list of forex assets, covering major, minor and exotic pairs.

The CMC GBP Index will be particularly attractive for UK traders, offering wider market exposure to a basket of currencies where GBP is the base currency. This reduces the risk exposure of trading on a single forex pair, such as the GBP/USD.

UK investors can also access spread betting opportunities on 12,000+ instruments, including forex. Profits from spread bets are tax-free and trading is available around the clock.

UK-based customer support is available 24/5

CMC Markets offers reliable customer service with English-speaking agents based in the UK. You can contact the team via email, phone, and online chat.

We got through to the team on live chat within two minutes during our tests, which puts it on par with the best forex brokers in the UK for customer service.

Cons

No forex copy trading for beginners

CMC Markets falls short when it comes to copy trading for newer forex traders.

Whilst the brand’s Next Generation platform offers social investing features, where traders are encouraged to share insights, users cannot mirror forex strategies in their own accounts.

There is a $10 monthly inactivity fee

While not a major criticism, CMC Markets charges a $10 monthly inactivity fee after 12 months.

This won’t affect active forex traders, but casual investors should bear this in mind.

Why Are CMC Markets Better Than The Competition?

CMC Markets is one of the best forex brokers in the UK thanks to its extensive range of forex instruments, very tight spreads, and trading account geared towards active currency traders.

It is also a massively respected forex broker based and regulated in the UK.

Who Should Choose CMC Markets?

CMC Markets is an excellent option for high-volume forex traders. The FX Active account offers ultra-low fees including a 25% spread discount, plus fast execution speeds below 10 ms.

UK traders interested in broader exposure to currency markets through forex indices should also consider CMC Markets. Seven currency indices are available, including a GBP Index, USD Index, and EUR Index.

British investors who want to trade spread bets on forex with tax-free profits will also be well served by CMC Markets.

Who Should Avoid CMC Markets?

We don’t recommend CMC Markets for traders interested in forex copy trading, as the brokerage does not support this.

IC Markets is a better option here.

Vantage: Best Forex Trading Software

Why We Recommend Vantage

Vantage is an FCA-regulated forex broker with excellent trading conditions, including over 50 currency pairs with tight spreads from 0.0 pips.

The forex broker also offers both the MetaTrader 4 and MetaTrader 5 platforms and has no restrictions on trading strategies, including forex scalping.

Our experts will explain why we consider Vantage a top forex broker for UK traders.

Pros/Cons of Vantage

Pros

UK-regulated forex broker with 900,000+ clients and multiple awards

Vantage is an FCA-authorised forex broker with a good reputation and high trust score. Hundreds of thousands of traders have opened an account with the firm, which has a strong client base in the UK.

Our team also found no evidence of scams or security breaches in their research.

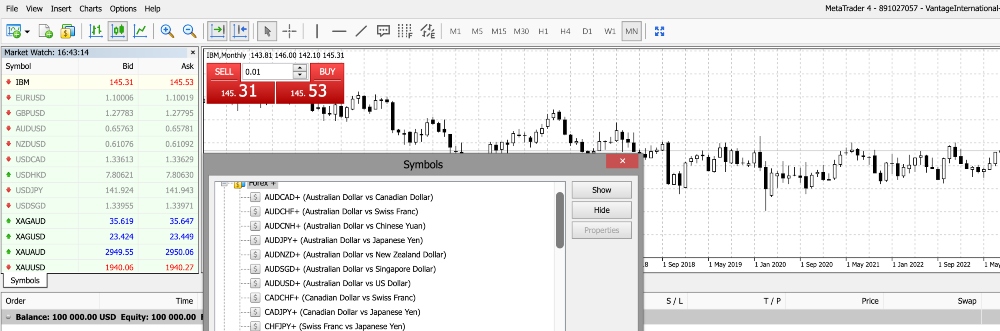

Excellent forex trading software including MT4 and MT5

Vantage stands out for its wide selection of market-leading trading tools. It is one of the few forex brokers in the UK to offer both MetaTrader 4 and MetaTrader 5.

It also offers its own app, a TradingView-powered solution, plus copy trading tools. The forex VPS is another great option for active traders.

57 forex pairs with spreads from 0.0 pips and a $3 commission

Vantage offers access to 57 forex pairs, including majors, minors and exotics. This is more than most UK forex brokers.

We also found lower-than-average fees, especially on the Pro ECN account, which offers spreads from 0.0 pips with a $3 commission per round lot turn.

Accessible £50 minimum deposit and GBP trading account

We appreciate the GBP trading account at Vantage, making it easier to manage your forex trading activity in your native currency, while also saving on conversion fees.

Vantage also offers a lower minimum deposit than many UK forex brokers at £50 – we consider anything below £500 reasonable. This makes the brand accessible to newer currency traders.

Cons

The Pro ECN account requires a $10,000 minimum deposit

The best forex trading conditions are available on the Pro ECN account, which has a $10,000 minimum deposit, putting it out of the reach of many beginners.

The Standard account trails the lowest-cost forex brokers in the UK with spreads from 1.0 pip, though there is no commission.

Slower withdrawals than some UK forex brokers

We found that withdrawals at Vantage can take five working days, which is slower than some of the top forex brokers in the UK.

We don’t consider this a dealbreaker but it is worth being aware of. To avoid this, we recommend e-wallets as these offer the fastest processing times.

Why Is Vantage Better Than The Competition?

Vantage is one of only a handful of FCA-regulated forex brokers that offers both MetaTrader 4 and MetaTrader 5.

It also offers tighter forex spreads than many alternatives on its Pro ECN account, though this requires a hefty starting deposit.

Who Should Choose Vantage?

Vantage will serve UK traders looking to speculate on forex through either the MT4 or MT5 platforms with no restrictions on scalping or automated trading.

It will also meet the needs of active forex traders looking for very low fees in return for a large minimum deposit through the Pro ECN account.

Who Should Avoid Vantage?

Vantage isn’t the best option if you want low fees but can only afford a small starting deposit – other forex brokers offer better pricing on their basic account.

We also don’t recommend Vantage if you want to trade currency indices, as these are not available. CMC Markets is a better option here.

FXCC: Best MetaTrader 4 Forex Broker

Why We Recommend FXCC

We recommend FXCC to UK forex traders because it offers the industry-leading MetaTrader 4 platform with competitive trading conditions.

Over 70 forex pairs are available spanning major, minor and exotic currency pairs alongside low fees through the ECN/STP model.

Below we explain why FXCC makes our list of the best forex brokers in the UK.

Pros/Cons of FXCC

Pros

Access to the MetaTrader 4 desktop, web and mobile platform

FXCC offers the world’s leading retail forex trading platform – MetaTrader 4 (MT4).

The software stands out for its technical analysis capabilities, with interactive charts, 9 timeframes, 23 analytical objects, and 30 integrated indicators.

Its support for automated trading through Expert Advisors (EAs) also makes it a great pick for algorithmic forex traders.

FXCC is also one of only a handful of UK forex brokers that we tested to offer MT4 Multi Terminal, an add-on that allows money managers and pro traders to manage multiple forex accounts at once.

More than 70 currency pairs are available with raw spreads from 0.0 pips

FXCC offers more currency assets than most forex brokers that accept UK traders.

Over 70 currency pairs are available spanning majors, minors, and exotics, including EUR/USD, GBP/USD and EUR/GBP.

Forex trading fees also come in lower than most alternatives. During our tests, spreads on the EUR/USD averaged 0.1 pips, while on the GBP/USD, they averaged 0.7 pips. There is also no commission.

GBP-funding methods with fast processing and no fees

You can fund your FXCC account using popular payment methods, including wire transfer, credit/debit card, Neteller, and Skrill. It is also one of the few UK forex brokers to accept crypto deposits.

Our only minor complaint is that wire transfers can take up to 7 working days to process, so we recommend bank cards, e-wallets or cryptos for faster account funding – these take up to an hour based on our experience.

Cons

FXCC is not regulated by the FCA

FXCC is not authorised by the FCA. This means UK forex traders won’t have access to up to £85,000 in compensation from the Financial Services Compensation Scheme (FSCS) in the case of business insolvency.

Having said this, FXCC is authorised by the Cyprus Securities and Exchange Commission (CySEC) – a well-regarded tier-two regulator.

We are also reassured to see the brand offers negative balance protection and uses segregated accounts, which we consider important client safeguards.

Forex education and research trail alternatives

FXCC does not stand up to rivals when it comes to educational resources.

Aspiring forex traders will have to make do with basic guides and no video resources, webinars or courses, which are all available at alternatives like CMC Markets.

There is also no copy trading which is becoming increasingly popular with beginners and casual forex traders.

Why Is FXCC Better Than The Competition?

FXCC offers access to a huge range of currency pairs and the most popular FX trading platform – MetaTrader 4.

With no minimum deposit and straightforward funding solutions, UK clients can also open an account and start trading forex quickly.

Who Should Choose FXCC?

Forex traders familiar with MetaTrader 4 should consider FXCC. The platform is available on desktop, web and mobile devices, along with support for MT4 Multi Terminal for pro traders and money managers.

UK traders looking for highly leveraged forex trading should also consider FXCC, with up to 1:500 leverage available and a 50% stop-out level.

Who Should Avoid FXCC?

We don’t recommend FXCC if you want best-in-class educational resources or market research. XTB or IC Markets are better options here.

FXCC also won’t serve UK forex traders that want the latest software from MetaQuotes – MetaTrader 5 (MT5), as the broker does not offer this platform.

IC Markets: Best Forex Broker For Copy Trading

Why We Recommend IC Markets

We recommend IC Markets because it is an award-winning forex broker with an excellent reputation and a fantastic selection of trading tools, including copy trading.

The UK-friendly payment methods and competitive forex trading fees make this an excellent option for British traders.

Below we explain why IC Markets makes our ranking of the best forex brokers in the UK.

Pros/Cons of IC Markets

Pros

IC Social app to connect aspiring forex traders with experienced investors

IC Markets offers one of the best forex copy trading tools based on our tests.

IC Social lets you interact with other forex traders and copy their positions into your own account. We particularly rate that you can copy over risk management parameters.

Alternatively, users can access several other popular copy trading platforms, including ZuluTrade and Myfxbook AutoTrade.

60+ currency pairs are available with competitive pricing and execution

IC Markets offers a strong selection of forex pairs with over 60 assets, more than most rivals.

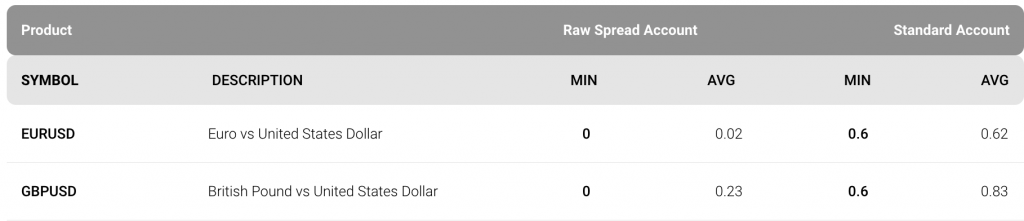

Trading fees are also competitive, coming in at 0.2 pips on the GBP/USD plus a $3.50 commission per side with the Raw Spread account, and 0.8 pips on the Standard account.

Additionally, IC Markets posts impressive execution speeds at around 40 ms. This helps to prevent slippage and will serve active forex traders, in particular.

Excellent range of GBP-supported payment methods

IC Markets offers more convenient account funding for UK traders than most forex brokers we tested.

We can fund our account in GBP via various payment methods, including PayPal, Klarna, Neteller, credit/debit card, and wire transfer. Most of these solutions offer instant processing and zero fees.

Cons

Not regulated by the FCA in the UK

IC Markets does not hold a license with the FCA.

While this is a drawback for British clients, the firm makes our list of best UK forex brokers because it is still a trustworthy brand, with oversight from the ASIC in Australia and the CySEC in Europe.

More than 180,000 clients from 200 countries have opened a trading account with the forex broker, a reassuring sign.

Average customer support with slow response times via live chat

IC Markets doesn’t match the best UK forex brokers when it comes to customer service.

The automated chatbot makes getting answers to some queries challenging. It often takes several minutes of jumping through hoops before being connected to a customer service agent, which is slower than many alternatives.

Why Are IC Markets Better Than The Competition?

IC Markets offer more forex copy trading tools than most UK brokers we evaluated.

It also outperforms most rivals when it comes to hassle-free account funding for British traders, with multiple deposit options and a GBP trading account.

The 60+ forex assets with tight spreads and fast execution speeds are also key bonuses for us.

Who Should Choose IC Markets?

IC Markets will appeal to traders that want to mirror the forex strategies of seasoned traders.

It will also serve traders that want to be able to quickly, cheaply and securely fund their GBP forex account with a convenient payment method, such as PayPal.

Who Should Avoid IC Markets?

We don’t recommend IC Markets if you want a UK forex broker regulated by the FCA, as the brand is not authorised.

The lack of fast and responsive assistance via live chat also means it trails UK forex brokers with the best customer support.

What To Look For In A UK Forex Broker

To find the best forex brokers in the UK, our experts test, compare and rank brands in several areas:

FCA Regulation

The Financial Conduct Authority (FCA) is the body responsible for regulating forex brokers that offer services to British traders. One of its key aims is to protect retail traders from unfair trading practices, such as forex scams.

As a result, we generally recommend choosing a firm that holds a license with the FCA. Ultimately, these firms offer the strongest safeguards for UK traders, including:

- Negative balance protection so your balance doesn’t fall below zero when trading forex on margin.

- Limiting leverage to 1:30 on major forex pairs to prevent you from accumulating substantial losses if the market moves against you.

- Segregated client accounts so your funds are kept separate from the forex broker’s operating capital.

- Access to compensation up to £85,000 from the Financial Services Compensation Scheme (FSCS) should your forex broker go bankrupt.

You can check if a forex broker is regulated by the FCA by running their company name or license number through the Financial Services Register.

GBP Trading Account

In our experience, the best forex brokers in the UK will cater to British traders by offering a trading account denominated in GBP.

Not only does this make it easier to manage your forex trading activity, but it also avoids the conversion fees sometimes charged if you open an account in USD, for example.

We also favour UK forex brokers with near-immediate account funding and no fees at the deposit or withdrawal stage.

Access To Currency Pairs

The best forex brokers in the UK offer access to popular currency pairs, including EUR/USD, EUR/GBP and GBP/USD.

And whilst a larger range of currency assets means more opportunities, the majority of retail traders will find strong enough coverage in a forex broker that offers 30+ assets.

Forex Trading Fees

We also assess the forex trading fees. We look at the minimum spread and/or commission but also use forex brokers to find average spreads over a given period, as these paint a more accurate picture.

In addition, we check for any non-trading charges, from deposit and withdrawal fees to inactivity charges and swap fees for positions held overnight.

Platforms And Tools

The forex trading platform available is another key consideration for us. We rate powerful and reliable third-party solutions like MetaTrader 4 and MetaTrader 5, which are industry frontrunners.

With that said, we also use and test proprietary platforms offered by forex brokers in the UK. These sometimes provide a more user-friendly and modern feel with straightforward access through popular web browsers.

During testing, we pay particular attention to the suite of technical analysis tools, order types, degree of customisability and general usability.

FAQ

Is Forex Trading Legal In The UK?

Forex trading is legal in the UK and is overseen by the Financial Conduct Authority (FCA). Forex brokers should obtain a license from the financial regulator to offer trading services to British traders.

By choosing an FCA-regulated broker, you will reduce the likelihood of encountering forex scams and unfair trading practices.

Which Is The Best Forex Broker In The UK?

Based on our experts’ tests and comparisons, XTB is the best overall forex broker in the UK. The FCA-authorised brokerage offers 45+ forex pairs, tight spreads from 0.1 pips, and access to a powerful trading platform – xStation.

CMC Markets, Vantage, IC Markets, and FXCC also make our list of the top UK forex brokers. They all offer competitive forex trading conditions and accessible accounts for British traders.