Forex Brokers & Trading Platforms

Retail forex traders cannot access the interbank market directly, but STP and ECN forex brokers provide a bridge, connecting individuals to liquidity providers through trading platforms. In addition to providing price feeds and order execution, brokers manage account infrastructure, offer leverage, and usually also give you access to trading tools and educational material. Deposits and withdrawals to and from your trading account are processed by your broker, and your broker is also the one safeguarding the money and assets in your trading account.

In addition to the STP and ECN forex brokers, there are brokers who will be your counterpart in the trade instead of connecting you to liquidity providers. These brokers are known as dealing desk brokers (DD brokers) and they are very popular among beginner forex traders. Compared to an STP broker or ECN broker, a DD broker is more likely to cater to the needs of novice traders by accepting very low deposits (e.g. $10), allow small trade-sizes (micro-trading or nano-trading), providing a lot of free educational material suited for beginners and intermediate forex traders. The downside is that you are trading against your broker, which creates a conflict of interest.

DD brokers are more likely to offer fixed spreads and commission-free trading, while ECN brokers and STP brokers usually provide tighter, variable spreads and make the bulk of their money from commissions rather than spreads. Just like STP and ECN brokers, a DD broker will provide price feeds, order execution, account management infrastructure, leverage, trading tools, and educational resources, as well as processing your deposits and withdrawals, and safeguard the money and assets in your trading account.

Choosing Between Brokers

As a prospective forex trader, you need to first chose which type of broker you want, and then evaluate which specific broker within that category that is the best choice for your trading strategy and personal needs and preferences.

The type of broker most suitable largely depends on trading style and goals. Market makers may suit beginners who want fixed spreads and simple platforms. ECN brokers are better for experienced traders who require speed, transparency, and very tight pricing. STP brokers strike a balance between the two, while hybrid brokers provide flexibility but require careful scrutiny of execution policies.

Your choice of forex broker is a very important one, as it will shape your trading experience and can make the difference between becoming a long-term profitable trader and losing your money. It is therefore a choice that you should put some effort into, rather than pick whatever broker is running the most flashy marketing campaign right now. The way a broker handles orders, sets prices, and manages risk has a direct impact on your trading experience. Understanding the types of forex brokers is therefore critical before opening an account, since each structure carries its own advantages, disadvantages, and limitations.

As a forex trader, regardless of strategy, you will be putting a lot of trust in your broker. Even the most carefully designed trading system cannot perform well if the broker executes trades poorly or manipulates prices. Issues such as unexplained requotes, slippage, withdrawal delays, and account restrictions are frequently reported by traders, and it becomes especially problematic when a broker is not regulated by a strict financial authority that can and will enforce trader protection rules. Our dependence on a broker being reputable and proving a high-quality service underscores the importance of due diligence before you part with any money and personal data. Researching a broker’s regulation, reputation, and trading conditions before you make a decision is not optional but necessary for survival in the market. You should also be ready to cut ties and move on if your current broker drops in quality, moves to a lax jurisdiction, or makes changes that result in them now being less ideal for your trading strategy.

Forex trading is accessible and potentially rewarding, but its success depends as much on the broker relationship as on the trader’s own decisions. Brokers provide the platform, pricing, and infrastructure that make retail forex possible. A well-regulated broker with transparent policies and reliable technology enables traders to focus on market analysis and strategy. A poorly chosen broker, by contrast, introduces risks that no amount of skill can overcome. For anyone entering the forex market, careful broker selection is imperative.

Choosing Between Broker Types

As mentioned above, most retail brokers are DD brokers, STP brokers, or ECN brokers. DD brokers quote their own prices and take the other side of client trades, while straight-through processing (STP) brokers and electronic communication network (ECN) brokers pass trades directly to liquidity providers and will not be your counterpart in the trades.

Below, we will take a closer look at these different types and how they work.

Dealing Desk brokers (DD brokers), also known as Market Maker Brokers (MM brokers)

Dealing desk brokers, also known as market maker brokers, create their own market by quoting both the bid and ask prices to clients. In this model, the broker takes the opposite side of client trades. For example, if a trader goes long in EUR/USD, the broker takes the opposite position.

Market makers provide in-house liquidity, which usually ensures that orders can be executed quickly even in thin markets. It is also common for them to offer fixed spreads, which some traders prefer because they provide cost certainty during volatile conditions.

However, the potential conflict of interest is clear: if a client loses, the broker will profit, creating doubts about execution transparency. Reputable DD brokers mitigate this by hedging client exposure with larger liquidity providers, but not all do so consistently. Regulation becomes especially important, as you want a strict financial authority to keep an eye on the broker and be ready to step in if traders begin reporting suspected price manipulation on the platform.

ECN Brokers

Electronic Communication Network (ECN) brokers operate by connecting traders directly to a pool of liquidity providers, such as banks, hedge funds, and other traders. Rather than taking the other side of a trade, the ECN broker matches buy and sell orders in the electronic network.

This model is considered highly transparent. Spreads are variable and can be extremely tight, sometimes close to zero under the right market conditions. The broker earns income through commissions charged per trade. ECN brokers are particularly favored by experience traders (including high-frequency traders) who rely on fast execution and accurate market pricing. The downside is that spreads can widen significantly during volatile events, and commissions add costs.

ECN brokers will typically not aim to attract inexperienced traders, and will therefore also not offer things such as low deposit limits, small trade-sizes, and a lot of hand-holding when it comes to basic trading issues.

STP Brokers

Straight-Through Processing (STP) brokers are similar to ECN brokers, but with some differences in how orders are routed. Rather than matching orders within a network, STP brokers pass client trades directly to a pool of liquidity providers. The quality of execution depends on the broker’s liquidity partners.

STP brokers may add a small markup to spreads as compensation, instead of charging commissions, or they may use a mixed model that combines both. It is important to read the fine print to make sure you understand how costs are calculated and what it would mean for your particular trading strategy.

STP brokers offer transparency and fast execution, and does not take the opposite side of trades. They appeal to traders who want to stay away from the DD brokers, but without dealing with the complexity of ECN brokers.

Hybrid Brokers

Some brokers adopt a hybrid model, combining elements of market making (DD), ECN, and/or STP. For example, they might process smaller trades internally as a market maker while routing larger trades directly to liquidity providers. This can allow them to manage risk more efficiently while still offering clients tight spreads and fast execution. The hybrid model can be effective, but it also requires trust. Traders must rely on the broker’s honesty in handling orders fairly and transparently, since the broker has discretion over whether a trade is internalized or passed through.

What Are Proprietary Trading Brokers (Prop Brokers)?

A smaller category of brokers operates under a proprietary trading model. These brokers focus primarily on funding traders who demonstrate profitability and consistency, providing capital in exchange for a share of profits. While not traditional retail brokers, they have become more visible with the rise of prop trading firms.

Regrettably, there are quite a lot of scams active in this field, so traders need to be extra cautious. A prop broker can for instance require a trader to make deposits and trade for a while to prove their capacity before they gain access to capital from the firm, and this model can easily be used by outright scammers and semi-sketchy brokers who will keep the terms and conditions deliberately opaque or have unreasonable success requirements. Their main business model is to milk deposits from hopeful traders. There are also prop firms that place such high profit demands on their traders that traders are pressured to take outsized risks in their effort to achieve the unreasonable goals.

Trading Platforms

The trading platforms are the software traders use to place orders. Using a high-quality trading platform that is suitable for your trading strategy is really important, because it will have such as huge impact on your trading experience and your chances of becoming a profitable forex trader. The platform impacts how orders are placed and executed, how prices are displayed, how strategies can be developed, and how traders interact with their brokers. The relationship between broker and platform is inseparable, because a trader’s choice of broker determines which trading platform (or platforms) that will be available to them. Understanding the strengths and weaknesses of different platforms is critical for anyone considering forex trading seriously.

For traders, platform decision should be approached alongside the broker decision, not after it. You need both a broker and a trading platform that fits your trading strategy well. A strategy that requires automation might fit best on platform A or B, while one that requires advanced charting may be more effective on platform C, and so on. For beginners, a proprietary platform tied to only one broker may be sufficient, but the trade-off is reduced portability if they want switch brokers later. If you learn how to trade on a proprietary platform, you need to get used to another platform later if you ever want to switch broker.

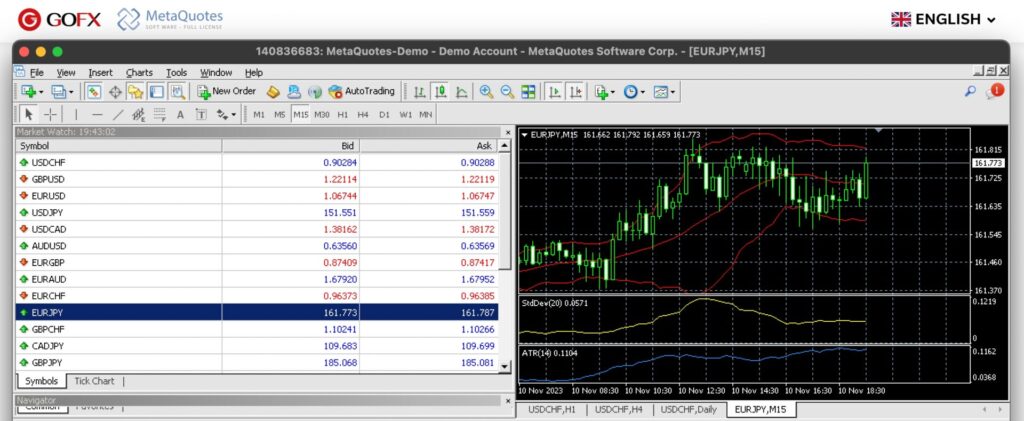

MetaTrader 4

MetaTrader 4 (MT4) remains the most widely adopted trading platform in the retail forex market. Released in 2005, it became popular because of its reliability and ability to run on modest hardware. Even today, many brokers continue to give access to the MT4, despite all the newer alternatives that are available.

Core features of the MT4 include real-time charting, a wide selection of built-in indicators, and the ability to execute trades quickly across multiple timeframes. What has made the MT4 especially popular is its support for Expert Advisors (EAs), a type of automated trading scripts written in the MQL4 programming language. Over the years, a large community has developed within the MT4 ecosystem and countless EAs, indicators, and scripts have been built and shared, making MT4 a hub for customization.

The downside is that MT4 is limited in terms of asset classes. While some brokers extend it to CFDs on commodities or indices, the platform was designed primarily for forex and does not natively handle exchange-traded assets such as stocks. It is also becoming dated compared to modern platforms with smoother interfaces and more advanced order handling. MetaQuotes, the company who developed and owns MT4, is still maintaining the platform, but is not doing any big overhauls to modernize it, since they are focusing more on the MetaTrader 5 (MT5) platform. According to unconfirmed rumors, MetaQuotes has also become reluctant to grant new MT4 licenses to brokers, instead encouraging them to sing on for the newer MT5 platform.

MetaTrader4 is by many considered the best forex trading platform for beginners but other platforms such as NinjaTrader and Algotrader are also popular.

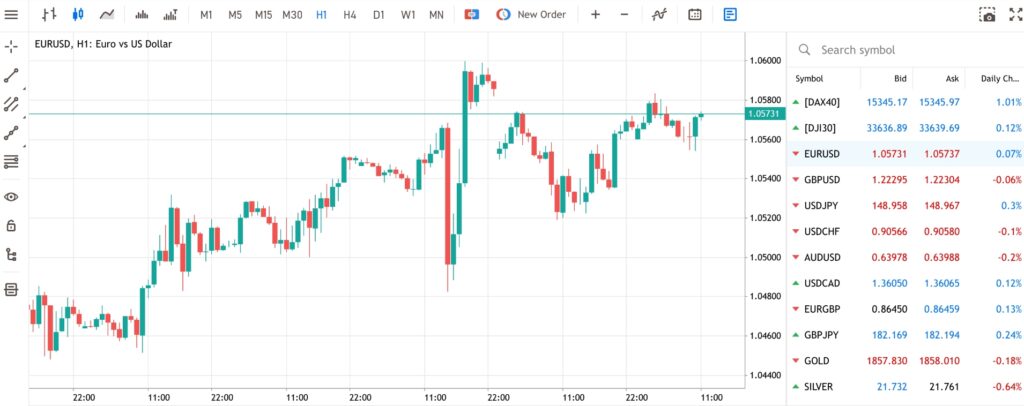

MetaTrader 5

MetaTrader 5 (MT5) was developed as a successor to MT4 and was originally planned to replace it. When forex traders proved reluctant to switch over from the MT4 to the MT5, MetaQuotes (the owner and developer of both) decided to keep offering both platforms.

The MT5 builds on the familiarity of MT4, while adding support for a broader range of asset classes, including stocks, futures, and commodities. MT5 also have more order types, allowing for more flexibility in managing trades, and includes a more powerful strategy tester for multi-threaded backtesting across different timeframes and markets.

The tool box for technical analysis is larger, with more timeframes and indicators.

The programming language, MQL5, is more advanced than MQL4, and allows developers to create more complex EAs and indicators. However, this also means that MT4 scripts are not directly compatible with MT5, creating friction for traders with existing libraries of MT4 tools.

Brokers that offer multi-asset access often prefer the MT5, while brokers focusing solely on forex are more likely to still provide access to the MT4. Traders deciding between the two often base their choice on whether they require multi-asset trading or not.

cTrader

The trading platform cTrader appeals to traders who want a modern, intuitive interface and advanced order execution options. Unlike MT4 and MT5, which are often tied to DD brokers, cTrader is commonly paired with electronic communication network (ECN) brokers offering direct market access.

The platform supports depth-of-market (DOM) functionality, allowing traders to see available liquidity levels. It also supports one-click trading, advanced order types, and automated trading through its cAlgo environment, which uses C#. Unlike MQL4 and MQL5 which are programming languages specifically for the MetaTrader ecosystem, C# is a widely used mainstream programming language. This makes cAlgo particularly attractive to traders who already work with mainstream programming languages, and C# also gives more flexibility than the proprietary MQL environment of MetaTrader.

Compared to MT4/MT5, the cTrader platform is supported by fewer brokers, which limits trader choice. While highly regarded by those who use it, cTrader has not achieved the same widespread community adoption as MetaTrader. The traders who do use cTrader tend to be more experienced, although it is absolutely possible to start trading with cTrader as a beginner.

NinjaTrader

NinjaTrader is a platform more commonly associated with futures, but is also used for forex by certain brokers. Its comes with advanced charting, detailed market analytics, and custom strategy development capabilities. Traders can create and backtest strategies extensively, making it a strong choice for those who want in-depth technical tools.

However, NinjaTrader requires a steeper learning curve and appeals to advanced traders rather than beginners. It is also less available among mainstream forex brokers, which limits accessibility. The NinjaTrader company provides its own brokerage service that you can sign up for if you want to, but third-party brokers are also available.

In 2025, NinjaTrader was acquired by the cryptocurrency trading company Kraken, and increased ability to use NinjaTrader for cryptocurrency speculation is expected to become a reality in the near future.

Proprietary Platforms

Some brokers develop their own platforms, often as a way to differentiate themselves or offer a minimalist platform especially suited for beginners. Sometimes, these proprietary systems integrate special features like social trading, copy trading, or embedded research feeds.

From the trader´s perspective, the disadvantage with proprietary platforms is that they tie traders exclusively to that broker, with no portability. Proprietary platforms lock the trader into a single broker, and if you want to switch broker, you also need to learn a new platform. Proprietary platforms also lack the large third-party ecosystems that have developed around the major third-party platforms.

Still, for beginners it can be a relief to pick a broker with a very simple proprietary trading software and learn the basics without any distractions. Proprietary platforms can also give access to highly specialized features that some traders seek, such as a certain type of copy trading.

Broker Regulation and Oversight

The Role of Regulation

Around the world, many countries have comprehensive laws and regulations in place to protect traders from malpractice, fraud, and systemic risk. Brokers regulated in such countries are typically required to meet minimum capital standards, segregate client funds from company operating accounts, and operate under fair dealing rules that prevent manipulation of spreads or prices. Without regulation, there is little to prevent brokers from misusing client deposits, randomly refusing withdrawals, or altering trading conditions without notice, and when something goes wrong, it can be difficult for the trader to find recourse. Strict trader protection regulation provides assurance that brokers are operating within a framework that emphasizes transparency and accountability. While it does not guarantee profitability for traders, it reduces the chance of losing funds due to broker misconduct.

For a trader, the downside of strict trader protection rules is that they can come off as overly restrictive. Countries with strong trader protection rules will for instance normally limit how much leverage a broker is permitted to give a non-professional trader, and bans against welcome bonuses and deposit bonuses are also common. There can also be rules in place that require retail traders to pass certain tests and requirements before they can gain access to complex products such as structured notes and composites.

Strict Jurisdictions

Here are a few examples of financial authorities that enforce strict trader protection laws and regulations, and also have the legal and practical resources required to actually supervise brokers and take action when brokers misbehave.

- The Financial Conduct Authority (FCA) in the United Kingdom, known for strict standards on client fund protection and conduct rules.

- Cyprus Securities and Exchange Commission (CySEC) in Europe, popular with brokers that want access to the European Union market. When a broker is licensed by one of the membership countries, it is considered licensed throughout the whole union. This also means that a broker licensed by CySEC must adhere to both CySEC rules and EU rules, including the Markets in Financial Instruments Directive (MiFID), a regulatory framework created by the European Union to increase transparency, improve investor protection, and harmonize financial markets across member states.

- The Australian Securities and Investments Commission (ASIC), which enforces capital requirements and strict reporting standards.

- The Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) in the United States, known for their rigorous enforcement of rules.

Lax Jurisdictions

Some jurisdictions have a more laissez-faire approach to trader protection and place a higher responsibility on individual traders to pick good brokers and leave the bad ones. There are also jurisdictions that may have strong trader protection rules in theory, but lack the resources and/or the political will to actually enforce them.

Here are a few examples of jurisdictions that have become popular among brokers who want to operate in a more relaxed legal environment:

- The Seychelles

- Vanuatu

- Saint Vincent and the Grenadines (SVG)

- Mauritius

- British Virgin Islands (BVI)

The risks associated with trading with a broker registered in these regions are larger than choosing a broker regulated in a strong jurisdiction.

Using Unregulated and Poorly Regulated Brokers

Despite the advantages of strictly regulated brokers, many traders are drawn to unregulated broker and brokers based in more lax jurisdictions. Since these brokers have more freedom, they can for instance offer very high leverage on retail forex trading (1:500 or 1:1000 is not uncommon) and hand out big welcome bonuses and deposit bonuses. They can also be less likely to report profits and trading activity back to the relevant authorities in the trader´s home country.

The problem with the more laissez-faire jurisdictions is that there is not much the trader can do if the broker behaves poorly, e.g. engaging in price manipulation on the trading platform or suddenly refusing withdrawals. Execution quality is another problem, with trades being delayed, slipped, or manipulated to the broker’s advantage. When brokers are outside the jurisdiction of strict financial authorities, traders have little recourse in case of disputes. Complaints or legal action are nearly impossible when dealing with companies incorporated in remote jurisdictions with minimal oversight.

For traders, this creates a trade-off. Strictly regulated brokers will not give you access to 1:1000 leverage or a big welcome bonus, but they provide a safer trading environment, and if something goes wrong, you can complain to a financial authority that have a proper escalation route in place.

It can be tempting to focus on elements such as advertised super-tight spreads, 1:1000 leverage, and deposit bonuses when selecting a broker. However, these features are meaningless if the broker itself cannot be trusted. Regulation is the foundation of safe forex trading. Even if conditions appear less attractive, the protection of client funds and the ability to resolve disputes through recognized authorities outweighs the lure of high leverage or quick incentives.

Costs and Trading Conditions in Forex Trading

The success or failure of a forex trader is not determined only by strategy or discipline. Broker conditions play an equally decisive role. Trading costs, execution quality, and leverage policies can tilt the balance between profitability and loss, particularly for traders who operate frequently. A broker’s conditions form the environment in which all strategies must function, and even minor differences can accumulate into major outcomes over time.

The importance of each cost factor depends on the trading style. Daytraders, including scalpers, require really tight spreads and fast execution to make frequent trades viable. Daytraders typically exploit small price movements and make a small profit on each profitable trade, so they will not be profitable with a broker where commissions are calculated and charged in a way that would take hefty chunk out of each tiny profit.

Swing traders and position traders will open fewer positions and keep them for much longer, and are therefore less affected by spreads. Paying fairly large fixed open and close commissions on each trade might not be a bad idea if your positions are big enough and you keep them open for a long time. For anyone that is not a day trader, understanding the overnight costs (swap fees) is very important.

Always calculate what the costs would be for your particular trading strategy. A broker and account type that is great for one strategy might be completely wrong for another.

What Are Spreads?

Spreads and commissions are the most direct costs in forex trading. In forex, the spread is the difference between the bid and ask price of a currency pair, measured in pips. Brokers either include their compensation within the spread or charge an additional commission per trade. This is why it is important to look at both the spreads and the commissions when you are evaluating a broker. A broker offering commission-free trading might have wider spreads, and vice versa. Make sure you understand the effects for your particular trading strategy. You also need to know the difference between fixed spreads and variable spreads, what your broker is offering, and what it means for your trading.

For example, a broker offering EUR/USD at a spread of 0.5 pips is significantly cheaper for the trader than one offering 2 pips, if we look only at the spread. The difference may appear small, but these costs compound quickly. Scalpers and other daytraders are particularly sensitive to spreads because they rely on capturing small moves.

What Are Commissions?

A broker can charge a commission each time you open a trade and each time you close a trade. With this model, you pay two commissions per complete trade. Commissions can be fixed, percentage-based, or a combination (e.g. a percentage, but never below a certain fixed threshold per trade).

Commission-based models are especially common among ECN brokers. ECN brokers typically offer really tight spreads, and will instead make their money from traders who pay commissions. This structure can be more transparent and often results in lower overall costs for active traders.

Swap Fees

Overnight swaps apply when positions are held beyond the trading day, reflecting the interest rate differential between currencies. You can pay a swap fee to your broker or get money back, depending on the circumstances. Daytraders do not need to worry about swap fees, since they always close all open positions before the trading day is over. If you plan on keeping positions open over night, e.g. because you will employ a swing trading strategy, it is really important to not get stuck with a broker where swap fees turn to your profits into losses. These charges accumulate and can easily turn otherwise profitable trades into break-even positions or even a loss.

Some brokers offer swap-free or Islamic accounts, structured to comply with Shariah principles by removing interest charges. These accounts often replace swaps with fixed administrative fees. While necessary for Sharia compliance, they can alter the economics of long-term strategies.

Other costs

Non-trading costs such as deposit and withdrawal fees, inactivity charges, platform fees, and currency conversion costs also affect overall profitability. It is important to pick a broker that is transparent about these fees. Calculate what the fees mean to you. Big fixed withdrawal processing fees are a bigger issue for someone who plans to make frequent withdrawals than someone who plans on growing their trading account, and so on.

Execution Speed and Slippage

The speed and reliability of order execution is another major factor that needs to be taken into account when picking a broker. Speed is especially true for daytraders, but other traders can also find themselves caught up in fast-moving markets where every moment counts, e.g. during economic announcements or unexpected geopolitical events.

Execution delays of even a second can result in slippage; the difference between the expected entry or exit price and the actual execution price. For traders, particularly those engaged in short-term strategies, slippage can erode profits as surely as wide spreads.

Leverage and Margin

In essence, leverage means that you borrow money from your broker to open a position. You use a small portion of money from your trading account and then borrow money for the rest. Example: You use $10 from your trading account and borrow $90 to open a $100 position.

Leverage amplifies both losses and gains. It allows traders to control positions much larger than their capital would otherwise permit, and it is very common for forex traders to use leverage. While it is really appealing, leverage is also commonly involved when inexperienced traders suddenly wipe out their trading account. Inexperienced traders often accept leverage without fully understanding what it is and how it works, and they fail to adjust their risk-management routines to account for leverage. Then the market suddenly moves against them and they are left wondering what happened.

Around the world, the financial authorities that are strict about trader protection are typically also the ones who have imposed leverage caps on trades carried out by retail traders (non-professional traders). Typically, this is combined with mandatory Negative Account Balance Protection for retail traders, which means that a retail trader can not fall below zero in their account and end up owing the broker money.

The European Union, the UK, and Australia, are all examples of places where brokers are not allow to give their retail clients more than 1:30 leverage. That is the general cap, but even lower caps are in place for assets considered extra risky, such as minor currency pairs, exotic currency pairs, and any trade that involves cryptocurrency.

By contrast, brokers in lax jurisdictions often advertise leverage as high as 1:500 or even 1:1000 for retail forex traders. While these levels offer the potential for large gains with small capital outlays, they expose traders to enormous risk, and a small adverse move in the market can wipe out a fortune within minutes.

Typically, the leverage cap rules imposed by strict financial authorities target the broker, and not the trader. It is the broker that is not permitted to give a retail trader leverage above the cap. This legal distinction is important, because if retail traders were breaking a law by accepting higher leverage, they would be less likely to report a misbehaving broker to the authorities, fearing that the investigation would unveil their own rule violation.

Note: It is important to know if your account has Negative Account Balance Protection. Of course, brokers do not want to foot the bill for money you borrowed and lost in the financial markets, so they safeguard themselves by imposing automatic stop-loss orders on your leveraged positions, in accordance with applicable laws and regulations. If the market moves against you beyond a certain point, one or more of your leveraged positions will be closed. This can be a horrible experience in a situation where the market is going through turbulence that you believe will be short lived, and you would have preferred to just keep all positions open and ride out the hiccups. If your account has Negative Account Balance Protection, make sure you understand exactly how it works with your particular broker before you use any leverage.

Customer Support

The quality of the customer support matters a lot. It is easy to overlook when you evaluate brokers, but as soon as there is a problem, you are in the hands of your broker´s customer support team. A responsive support team that can actually get things done can make all the difference when dealing with account issues or technical difficulties.

Here are a few examples of things to look for:

- Does the support have a generally good reputation among traders online? All brokers have some disgruntled traders who are posting angry reviews, but what does the overall sentiment look like? Are the same customer service issues popping up over and over again with this particular broker?

- How can you contact the customer support? Live chat, email, and phone call are common routes. If the broker only offers email, you can not get step-by-step guiding in real time, e.g. to get through a verification process on the platform.

- Is the customer support staffed when you are likely to be trading? If you are hobby forex trader active outside office hours, you do not want to wait until 9 am the next day to get help. The forex market is open 24/5 so the customer support should ideally also be 24/5 or more.

- Is the customer support actually staffed with humans during the announced hours, or will you end up with a clunky chat bot?

- Is customer support available in a language you are comfortable with?

- If phone support is important to you, will you be required to make an expensive phone call to another country? Or can you use a local number, toll free number, call over the internet, or use a call-back service?

Education

Many brokers provide their clients with educational material, such as webinars, tutorials, e-books, and instructions videos, e.g. for general market knowledge, strategy development, and risk management. This can be a great way to learn more. With that said, we do not recommend you get all your information from a single source. It is always a good idea to be critical consumer of information and education, and compare what several sources has to say about important issues. Obtaining different perspectives can help you become a more well-rounded trader who is less likely to fall for the latest hype or buzz word in the world of finance.

Free Demo Account

Many brokers will let you open a free demo account and they will fill it with play-money for you. This way, you can explore the trading platform and get a feeling for what it would be like to use this broker and trading platform for your strategy. A free demo account is also a great way to learn how the platform works and do all the beginner mistakes using free play-money instead of your own hard-earned cash.

If you have not traded forex before, or if you are venturing into a new currency pair, demo account trading can help you become more accustomed to how the markets move. Be careful though, because some platforms are a bit too perfect in demo mode, e.g. without any risk of slippage.

A demo account that uses real price-feeds can help you test run your trading strategy and risk management plan, to see how it all stacks up against real world price data, and under different market conditions. You can find tune your setup in demo mode to improve it before you start putting real money on the line. We recommend you read about the risk of overfitting before you get started, to avoid the common pitfalls. Overfitting is when a trader adjusts a strategy to perform so perfectly with historical price data that it becomes ill equipped to handle live trading.

Using a demo account is a great way to practice forex trading, but will not give you a feel for how it is to actually have real money on the line. When you move from play-money trading to real-money trading, it is advisable to start with very small positions, to gradually get used to how to handle emotional impulses rooted in fear, greed, etc. Many traders throw their risk management routines away when exposed to strong emotions and this is a common reason behind beginner accounts getting wiped out.

When you practice in your demo account, do not go crazy. Yes, it is free play-money, but if you treat it as such, you can develop poor trading habits which can be difficult to unlearn. Use the play-money to trade in accordance with your trading strategy and risk manage routines. Do not build strategies that rely on taking on exceedingly big risks.

If a broker does not offer any demo account, or if they require you to make a deposit to get access to the demo account, consider that a warning sign. Some brokers are reluctant to provide demo accounts because they know that their platform is not great, and they do not want you to find out before you have sent them a first deposit. There is also a reason to be suspicious about brokers who are very stingy with the demo account, e.g. only allowing you to use it for 24 hours. Evaluating a trading platform takes time and serious brokers will allow you to do this without stress.

If a broker that is not properly licensed refuses to give you free access to a demo account, it can (in the worst case scenario) be a scam. The fraudster is simply posing as a broker, but there is no trading platform. These scams are typically short-lived. They pop up, do heavy marketing, collect as many first deposits as possible, and then vanish when people start reporting them to the authorities and post warning messages in trading forums online. Soon, the fraudsters pop up again, but under a new name and with a new marketing pitch.