Best Forex Brokers With Bonuses & Trading Promotions

Forex brokers use welcome bonuses to entice new traders, providing extra credit for trading. This guide lists the best broker bonus offers in January 2026, taking into account:

The type of bonus

Joining requirements

Terms and conditions

Regulatory oversight

Forex Brokers With The Best Trading Bonuses

These are the five best forex broker bonus offers available today:

- Vantage– 50% Welcome Deposit Bonus

- FXCC – 100% First Deposit Bonus Up To $2000

- SuperForex – $88 No Deposit Bonus

- Webull– Up to 12 free fractional shares when you deposit $100

- FXChoice – 50% or 65% Welcome Deposit Bonus

We do not recommend choosing a brokerage based on their bonuses alone. Above all, pick a trustworthy broker that offers the account conditions and trading tools you need to execute your forex strategy.

Vantage

Why We Recommend Vantage

We recommend Vantage because it is a trustworthy forex and CFD broker that offers attractive bonus deals with transparent terms and conditions.

As well as a welcome bonus, traders can benefit from a tier-based reward scheme and access to useful add-ons, including daily forex signals and advanced charting from TradingView.

Pros/Cons of Vantage

Pros

Vantage offers an ongoing welcome bonus with recurring deposit bonuses

Vantage stands out for its attractive sign-up bonus of 50% on first deposits up to $500 and 10% on recurring deposits up to $19,500, meaning $20,000 in free trading credit is available.

This is one of the largest cumulative bonuses offered by any of the dozens of brokers we tested.

The Vantage Points rewards scheme is available to all traders

Vantage offers one of the best tier-based reward schemes of any forex broker. And whilst many firms only offer loyalty programs to high-volume traders, Vantage makes theirs available to all clients.

Traders collect points, known as V-Points, for each trade executed, which can then be redeemed for various rewards, from profit-boosting and trade loss protection vouchers to cash redemption and deposit rebates.

Transparent bonus terms and conditions including withdrawals

Every trading promotion available at Vantage comes with clear terms and conditions that can be viewed before you opt in. This includes a straightforward breakdown of eligibility requirements.

Also, while many brokers attach tough withdrawal stipulations to trading promotions, profits generated from Vantage bonus funds can normally be withdrawn at any time, though the bonus credit itself cannot.

Cons

Trading bonuses are available through the broker’s offshore entity with limited regulatory scrutiny

The majority of trading promotions are available through Vantage Global Limited, which is registered with the Vanuatu Financial Services Commission (VFSC) – a weak regulator.

It is normal for reputable brokers to have both heavily regulated entities and offshore branches that operate with little to no regulatory oversight, however, prospective traders should be aware they will not receive the same level of legal protections as clients signed up with Vantage Markets (Pty) Ltd, which is authorized by a tier-one regulator – the Australian Securities & Investments Commission (ASIC).

A high minimum deposit is needed to qualify for some promotions

Vantage requires a $1,000 deposit and trading volume of $1 million to access the free Virtual Private Server (VPS). Also, a $500 deposit is needed for free daily signals from Trading Central.

Whilst we don’t consider these major drawbacks as many brokers have balance and volume requirements to access additional trading tools, it is worth noting before you sign up.

Why Is Vantage Better Than The Competition?

Vantage is one of the most trustworthy forex brokers with bonuses. With over a decade in the online trading industry, more than 900,000 clients and multiple awards, it is a respected brand.

The firm also offers excellent variety in its promotions, from welcome deposit bonuses for new clients to a loyalty scheme and free VPS for active traders.

The straightforward sign-up process, which took us less than two minutes, also makes it quick and easy to get started with Vantage.

Who Should Choose Vantage?

Beginners looking to boost their starting capital with a welcome deposit bonus from a reputable broker should consider Vantage.

Experienced traders that want rewards for trading in high volumes should also consider Vantage’s three-tier loyalty program.

Who Should Avoid Vantage?

Vantage is not a good option if you want a no deposit bonus as they do not offer these.

We also don’t recommend the broker for traders in countries where Vantage does not generally offer bonuses, including Australia, Turkey and Thailand. Traders from these countries should consider other brands in this list.

FXCC

Why We Recommend FXCC

We recommend FXCC because it frequently offers welcome bonuses.

With no minimum deposit or transfer fees, it is also straightforward to claim a joining bonus and get started.

Pros/Cons of FXCC

Pros

The broker will double your buying power on popular instruments

FXCC offers a 100% deposit bonus up to $2,000 which is significantly more than most forex brokers. Traders can effectively double their purchasing power when they sign up and fund their account.

The broker’s bonus credit can also be used to speculate on a full suite of popular asset classes, including forex, indices, commodities and crypto.

Traders can make a qualifying deposit with multiple fee-free payment methods

FXCC will pay out bonus funds within 24 hours of receiving a qualifying deposit, which can be made via multiple zero-free payment methods.

The broker supports wire transfers, Mastercard and Visa bank cards, popular cryptocurrencies, plus a selection of e-wallets, including Skrill and Neteller.

Cons

Limited choice of trading promotions

Compared to other brokers with bonuses that we reviewed, FXCC offers a limited selection of trading promotions.

Whilst it has an ongoing sign-up bonus, traders will find little in terms of loyalty schemes and trading competitions.

There is a VPS offer, but it requires an account balance of $2,500 and a minimum monthly trading volume of 30 lots, which is higher than many alternatives.

Weak regulatory oversight and account safeguards

FXCC has been operating since 2010, however it is not authorized by a tier-one regulator.

The group does hold a license with a tier-two regulator, the Cyprus Securities & Exchange Commission (CySEC), but EU clients cannot take part in the sign-up deal and the promotion is available through its offshore entity.

Why Is FXCC Better Than The Competition?

FXCC offers a larger welcome bonus than most of the forex brokers we reviewed.

With a $0 minimum deposit, no funding fees, and the automatic distribution of credit funds, it is also straightforward to sign up and receive the joining bonus.

Who Should Choose FXCC?

FXCC will serve beginners looking for an initial boost to their account with a 100% matching deposit bonus up to $2,000.

Investors looking for highly leveraged forex trading up to 1:500 on the popular MetaTrader 4 platform will also find a good bonus broker in FXCC.

Who Should Avoid FXCC?

We don’t recommend FXCC for experienced traders looking for loyalty rewards and cash rebates – this broker does not offer them.

FXCC is also not the most heavily regulated firm on this list, so consider alternative brokers with bonuses if you want a better-known brand.

SuperForex

Why We Recommend SuperForex

SuperForex stands out for its wide selection of trading promotions.

Rewards are not restricted to just new clients either, with multiple bonuses for existing traders.

Pros/Cons of SuperForex

Pros

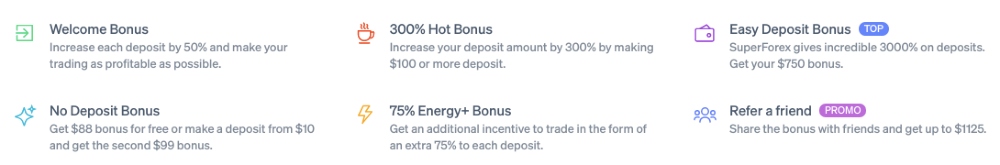

Excellent range of welcome bonuses and trading promotions

As well as a welcome deposit bonus, the firm offers a no-deposit bonus, bonuses on recurring deposits, and a refer-a-friend scheme.

SuperForex offers the greatest choice and frequency of promotions out of every forex broker we evaluated.

A clear bonus chart to help you compare trading offers

SuperForex offers a helpful comparison chart that breaks down the different trading bonuses available, including the size of the deposit boost, funding requirements, and compatibility with other promotions.

This is a useful feature that we did not find at any other forex broker with bonuses that we tested.

There is no bonus cap applied to some promotions

SuperForex is one of the few brokers not to cap the amount of bonus credit available in some of its promotions. This means that, in theory, bonus funds can stretch into the thousands.

Having said that, we note that bonus funds cannot be withdrawn – they can mostly only be used to practice trading on the broker’s 400+ instruments, including 100+ forex assets.

Cons

Weak regulatory position with oversight from the IFSC

SuperForex is not as well regulated as alternative bonus brokers on this list. The company holds a license with the International Financial Services Commission (IFSC) – which we do not consider a leading financial watchdog.

This means clients will not receive the same legal protections and registered brokers may not follow the same standards as firms overseen by bodies like the Australian Securities & Investments Commission (ASIC) or the UK Financial Conduct Authority (FCA).

Strict withdrawal terms apply to trading bonuses

Stringent terms make withdrawing bonus funds either difficult or impossible. For example, only $1 of profit can be withdrawn for each lot traded using the standard welcome bonus.

So, while the size of the bonuses might be high, withdrawing them or associated profits may be hard, especially for beginners.

Why Is SuperForex Better Than The Competition?

SuperForex offers more trading bonuses than most forex brokers based on our experience testing hundreds of firms.

It is also one of the few brokers we have reviewed that provides a comparison chart to help traders find the best bonus for their circumstances.

Who Should Choose SuperForex?

SuperForex will serve traders looking for regular bonuses and account top-ups. With a low starting deposit of just $1, it will also meet the needs of beginners and traders on a budget.

Traders looking for a no deposit bonus will also appreciate SuperForex, which offers $88 to those that register for an account and claim the offer in the Client Cabinet.

Who Should Avoid SuperForex?

We don’t recommend SuperForex for experienced traders who will find little in terms of additional tools and software – only MetaTrader 4 is provided.

SuperForex also isn’t the best option if you want a heavily regulated forex broker – we do not consider the IFSC a top-tier financial body.

Webull

Why We Recommend Webull

Webull is a US-regulated broker that offers generous welcome bonuses with free shares. We also like that you can earn interest on uninvested cash.

As well as forex trading, Webull offers stocks, options, ETFs, and ADRs.

Pros/Cons of Webull

Pros

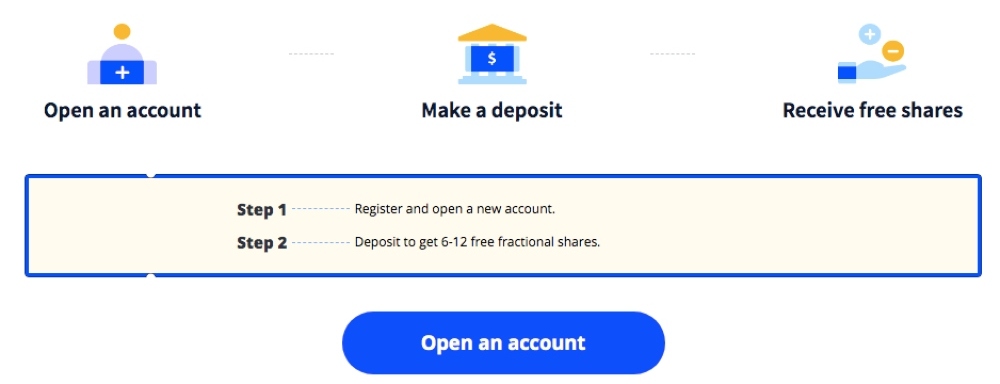

Regular promotions with free shares worth up to $3,000

Webull has a track record of offering free shares to new clients. These can range from 6 to 16+ fractional shares depending on the promotion.

We also appreciate that they are usually in NYSE or NASDAQ-listed companies, and can range in value from a modest $3 to an impressive $3000.

Earn up to 5% on uninvested cash

Webull also offers competitive interest on uninvested cash held in its brokerage accounts up to 5%+ APY. These rates are higher than most of the brands we evaluated.

Even more reassuring, Webull is registered with the Securities and Exchange Commission (SEC) and a member of SIPC, with fund protection up to $500,000.

Cons

Limitations associated with fractional shares

In our experience, fractional shares come with several limitations. For example, you may not be able to transfer shares to another broker should you choose to move to Webull.

You are also not always entitled to shareholder rights and the broker does not support all order types on fractional shares.

Your chances of receiving high-value shares are low

Whilst to be expected, it is worth being aware that the chances of getting a share worth a considerable sum are low.

At the time of writing, your odds of getting shares valued at between $1,000 and $3,000 are around 1:10000. In contrast, your odds of receiving shares worth between $3 and $10 are around 1:1.02.

Why Is Webull Better Than The Competition?

Webull is a US-regulated and trustworthy broker that offers more free stock bonuses than most rivals.

The high interest rate on uninvested funds is also a draw.

Who Should Choose Webull?

Webull is a good option for traders interested in receiving free fractional shares upon sign-up.

The individual brokerage accounts and retirement accounts also make the firm a sensible pick for longer-term traders.

Who Should Avoid Webull?

We don’t recommend Webull for short-term forex traders looking for standard deposit bonuses as the firm does not offer these.

Webull only accepts traders from a few countries alongside the US, so clients from most other countries should consider alternatives, including those based in the EU.

FXChoice

Why We Recommend FXChoice

We recommend FXChoice because it offers a competitive trading environment for active forex traders with an attractive welcome bonus.

Our team explains why FXChoice makes our list of the best forex broker bonuses below.

Pros/Cons of FXChoice

Pros

You can claim a welcome bonus in three straightforward steps

FXChoice stands out for its quick sign-up process and immediate access to bonus funds.

It takes less than two minutes to register for an account, then you just need to verify your profile and deposit funds to receive a welcome bonus that can top 50% of your initial funding.

Up to $10,000 in monthly bonuses are available

You can accumulate several bonus rewards by making multiple deposits in a period. This is because the forex broker may offer an initial joining bonus, plus extra funds for depositing with certain payment methods, such as crypto.

Together, these bonus funds can build to up to $10,000 per month, subject to the current trading promotions and terms and conditions.

Cons

You only have 90 days to meet the volume requirements to withdraw the bonus

You only have three months to meet the volume requirements (number of turnover units = bonus sum [USD] / 2) to withdraw bonus funds. After this period, the bonus will no longer be available.

While we often see such stipulations attached to bonuses at forex brokers, it will still prove challenging for some newer traders to meet.

Weak regulatory oversight from the FSC

FXChoice does not boast the strong regulatory credentials enjoyed by some other forex brokers. The company is regulated by the Financial Services Commission (FSC) of Belize.

We don’t consider this a reputable regulator so traders should be aware they may receive little in terms of legal protections should the firm run into financial difficulties, for example.

Why Is FXChoice Better Than The Competition?

Alongside a generous welcome bonus, the brokerage offers great perks for high-volume forex traders. This includes a fiver-tier loyalty scheme where commissions can fall to $1.50 per side.

Currency traders can also access very high leverage up to 1:1000 with spreads from 0.0 pips.

Who Should Choose FXChoice?

Active forex traders who can make use of the Pips+ Loyalty Program should consider FXChoice if they are looking for a big welcome bonus.

The brand will also appeal to currency traders familiar with MetaQuotes software, as both MetaTrader 4 and MetaTrader 5 are available.

Who Should Avoid FXChoice?

Traders looking for a heavily regulated forex broker should not sign up with FXChoice – the brokerage does not have an entity that is licensed by a trusted financial body like the UK’s FCA, Australia’s ASIC or the EU’s CySEC.

How To Compare Brokers With Bonuses

In evaluating the bonuses and trading promotions offered by brokers, our team concentrate on several factors:

Type Of Bonus

Most trading promotions come in the form of a deposit bonus, whereby you fund your account with X amount and the broker will top it up with extra credit.

The key considerations here are the amount the broker will add to your deposit, generally displayed as a percentage, for example 100%. The other is the total amount of bonus funds available, for example up to $2,000.

Other popular promotions include no deposit bonuses, which require no initial payment. These are attractive but in our experience, you can rarely withdraw this money, even profits generated from it.

Trading promotions we do rate are loyalty schemes whereby active forex traders are rewarded with fee rebates, bonus credits, access to advanced tools, and other perks. These can be of great use to high-volume traders.

Joining Requirements

Our team also consider how quick and easy it is to qualify for a bonus.

Brokers that automatically credit your account with bonus funds when you make an eligible deposit are preferable, but sometimes you may need to enter a promo code in the client cabinet or even email the customer support team.

Another worthwhile consideration is the minimum qualifying deposit. Some brokers only require a $10 to $50 starting deposit to receive a bonus, which will appeal to newer traders and those on a budget.

Terms & Conditions

We always recommend you read bonus terms and conditions carefully.

It is important you know what is and isn’t included in the offer. The key traps we look for are restrictions on withdrawing bonus funds or profits generated from it.

Regulatory Oversight

Our team always consider the reputation and regulatory oversight of a forex broker.

Many forex brokers with bonuses are based offshore. From here, they can offer financial incentives that are not permitted by respected regulators in jurisdictions like Europe, Australia and the UK.

Importantly, by turning to offshore brokers with bonuses, traders may forego legal and account protections, including access to investor compensation schemes, negative balance protection and adequate complaints procedures.

As a result, we always recommend caution when considering unregulated or weakly regulated brokers. Ask yourself – is the welcome bonus worth it?

Wider Trading Conditions

Choosing a broker based solely on their bonus deals and trading promotions is a bad idea.

We recommend forex traders consider the whole package, from regulation and trust to spreads and fees, access to trading tools, customer support and more.

Ultimately, a welcome bonus should only be part of the decision-making process.