Best CySEC-Regulated Forex Brokers

Discover our pick of the best forex brokers regulated by the Cyprus Securities & Exchange Commission (CySEC). We’ve ranked the top platforms for different trading styles.

List of Best CySEC Forex Brokers

Following our hands-on analysis, we recommend these 5 forex brokers that hold CySEC licenses:

- Skilling: Best Overall CySEC Forex Broker

- eToro: Best For Beginners

- Pepperstone: Best For Advanced Traders

- IC Markets: Best MetaTrader Broker

- Eightcap: Best For Automated Trading

| Skilling | eToro | Pepperstone | IC Markets | Eightcap | |

|---|---|---|---|---|---|

| CySEC-Regulated | Yes | Yes | Yes | Yes | Yes |

| License Number | 357/18 | 109/10 | 388/20 | 362/18 | 246/14 |

| Minimum Deposit | $100 | $50 | $0 | $200 | $100 |

Skilling: Best Overall CySEC Forex Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, SEK, NOK

-

🛠 PlatformsMT4, cTrader, TradingView, AutoChartist

-

⇔ Spread

GBPUSD: 0.1 EURUSD: 0.1 GBPEUR: 0.1 -

# Assets70+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

Why We Recommend Skilling

We recommend Skilling, because after comparing a long row of CySEC-regulated forex brokers, it emerged as a top choice, offering an experience that stands out.

Skilling offers very competitive trading conditions with flexible tools and top-rate platforms. Pair this with a great range of 70+ currency pairs, and this makes it an attractive broker for traders of all stripes.

Pros/Cons Of Skilling

Pros

High-quality software for beginners to seasoned traders

Our tests show that Skilling offers three dependable platforms. For beginners, Skilling Trader’s user-friendly design is a standout, while cTrader’s charting package and MT4’s familiarity excel for seasoned traders.

We particularly rate the practicality of the built-in Trade Assistant, a fairly unique tool that simplifies the basics and helps new investors navigate their first forex trades on the in-house platform.

Flexible accounts with competitive forex fees

Examining the account options, our analysis points to the Standard account as optimal for beginners seeking spread-only pricing, while the Premium solution with tight spreads caters to experienced traders.

Importantly, the spreads on the commission-free account also start from 0.7, making this one of the more affordable CySEC forex brokers that we evaluated.

Excellent investment offering with 70+ currency pairs

With 73 major, minor and exotic currency pairs to trade, Skilling has one of the best forex offerings of all the CySEC-regulated FX brokers we reviewed, and at least 20 more pairs than the average.

As a result, clients have many trading opportunities with assets of varying liquidity and volatility, including a strong range of exotics, such as the EUR/SEK and GBP/SGD.

Cons

A high deposit requirement of €5000 for the raw spread account

Our evaluation shows that Skilling’s €5000 minimum deposit for the Premium account is more expensive than most competitors. This may price out some experienced traders who would enjoy its features and spreads from 0.1 pips.

Time-limited demo account that expires after 90 days

The forex demo account is only available for 90 days. While three months is a good amount of time to test the platform, we find it useful to have an unrestricted demo so traders can keep coming back for more testing as they develop strategies.

Why Is Skilling Better Than The Competition?

Skilling sets itself apart among CySEC-regulated forex brokers. Our evaluation revealed a convenience that makes it a standout choice, from varied account types and reliable platforms to quick, fee-free deposits.

Who Should Choose Skilling?

Reflecting on our experience, Skilling caters to a broad spectrum of forex traders.

The competitive trading terms and accessible $100 minimum deposit make it welcoming for beginners. Simultaneously, support for cTrader and MT4, along with raw spreads and fast execution speeds, positions Skilling as a robust choice for experienced traders.

Who Should Avoid Skilling?

Our analysis found that MetaTrader users will get a narrower range of currency pairs (53) compared to Skilling Trader and cTrader (73), meaning it doesn’t offer the most complete experience for MT4 investors.

Additionally, the high funding demands for the Premium account (€5000) will steer traders with less capital towards alternative raw-spread options.

eToro: Best For Beginners

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD

-

🛠 PlatformsTradingCentral

-

⇔ Spread

GBPUSD: 2 pips EURUSD: 1.5 pips GBPEUR: 1.5 pips -

# Assets49

-

🪙 Minimum Deposit$10

-

🫴 Bonus Offer-

Why We Recommend eToro

We recommend eToro because it is an ideal choice for investors looking to get started with forex trading. It houses an extensive library of educational resources as well as a market-leading social trading network.

Pros/Cons Of eToro

Pros

Excellent academy with high-quality education

eToro’s educational content is a strong point and we rank it as one of the best among the hundreds of firms we have reviewed – not only CySEC-regulated forex brokers.

We particularly enjoyed the Forex Course. It consists of 6 lessons, takes around 40 minutes and offers an excellent introduction to the foreign exchange market for new investors.

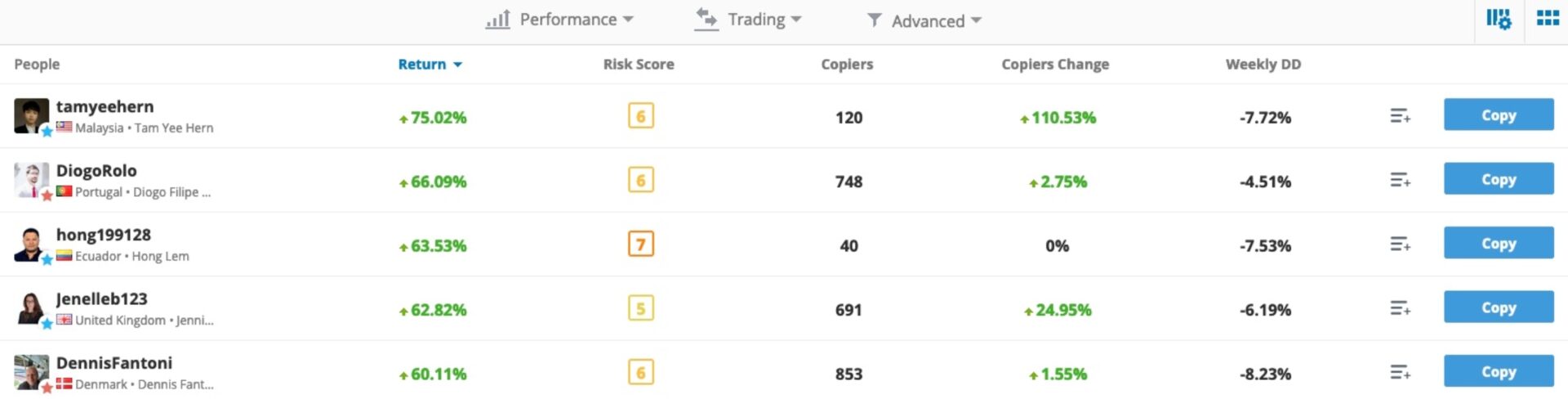

Best-in-class social trading network with copy trading features

eToro made its name as a social and copy trading platform, and we rate these tools as some of the broker’s best features.

CopyTrader provides access to hundreds of experienced investors in a slick interface. You can follow up to 100 traders simultaneously while the minimum investment is accessible at $200.

Unlimited forex demo account

Traders can register for a free demo that has no expiry, meaning users can practice forex trading for as long as they like with $100,000 in virtual funds.

What we really like about eToro’s demo account is that you can easily switch between it and the live account with one click, making for a smooth user experience.

Cons

Average forex trading fees from 1 pip

Our tests show that eToro trails the cheapest forex brokers. The firm uses a floating spread model with fees coming in at 1.5 pips on the EUR/GBP and 2 pips on the GBP/USD.

As a comparison, IC Markets offers the EUR/GBP from 1.3 pips and the GBP/USD from 0.8 pips.

Account denominated in USD only

eToro only supports USD as a base account currency, meaning clients wishing to deposit funds in EUR or other fiat currencies will need to pay conversion fees.

This also makes for a less convenient trading experience in our view, especially when many forex brokers allow you to deposit, withdraw and manage forex trades in your local currency.

Why Is eToro Better Than The Competition?

eToro outguns every forex broker we reviewed when it comes to social trading and education. The firm has also simplified the copy trading process with a ranked leaderboard showing all the strategy providers with filtering options such as returns, risk and number of copiers.

Who Should Choose eToro?

eToro is an excellent choice for beginners. With many tools to help investors get started with forex, including a proprietary platform with an intuitive design, it is straightforward to start trading.

Who Should Avoid eToro?

Traders looking for the lowest fees should avoid eToro. Our evaluation shows it lags behind the cheapest forex brokers.

Also, if you plan on using popular third-party platforms such as MetaTrader, you will need to consider an alternative broker in our list.

Pepperstone: Best For Advanced Traders

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.2 -

# Assets60+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend Pepperstone

We recommend Pepperstone, because as well as being a CySEC-regulated forex broker with a stellar reputation, it offers very low trading and non-trading fees, especially for active traders.

Pros/Cons Of Pepperstone

Pros

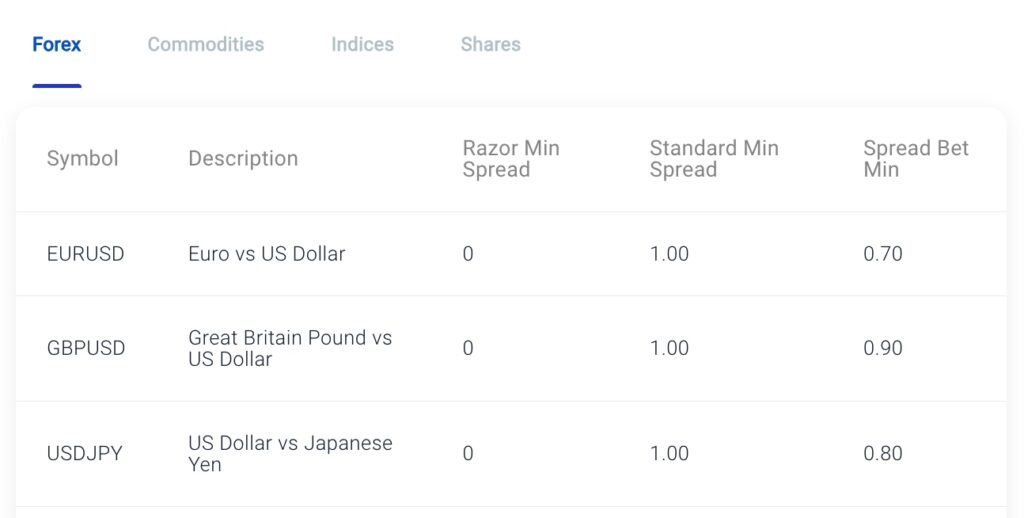

The Razor account offers ultra-tight spreads with low commissions

Our analysis shows that Pepperstone offers industry low forex fees, particularly in its Razor account. During testing, we got spreads from 0.0 pips with a $3.50 commission on MT4, including a 0.1-pip spread on the EUR/USD.

Tip: we found that you can get lower commissions at $3 by trading currencies on cTrader or TradingView.

Low non-trading fees with no inactivity penalty

We also consider Pepperstone a low-cost forex broker because of its non-trading fees. Our research shows that there is no inactivity penalty nor deposit and withdrawal charges, keeping costs down.

As a comparison, eToro charges a $10 monthly inactivity fee and $5 for withdrawals.

Active Trader program with fee rebates

Pepperstone also excels in its Active Trader program, which offers up to a $3 rebate per lot with a 30% reduction in spreads. This is an excellent perk for serious traders, and isn’t available at most CySEC forex brokers.

Cons

Slow sign-up process that takes around 30 minutes

Pepperstone has a relatively cumbersome registration process. We had to complete 10 steps which took us nearly half an hour. In contrast, it only took us a few minutes to get started with IC Markets.

Education materials are good but trail other forex brokers

After reviewing Pepperstone’s various educational tools, including trading guides and videos, we found they were useful, but they don’t rival the courses at alternatives like eToro.

They don’t go into the same level of detail or offer many useful illustrations to help beginners understand key topics, such as risk management.

Why Is Pepperstone Better Than The Competition?

Pepperstone stands out for its low trading and non-trading fees. Our analysis shows that it is one of the lowest-cost forex brokers for active traders.

Who Should Choose Pepperstone?

High-volume forex traders should choose Pepperstone. The Razor account offers ultra-tight spreads while you can get up to a 30% spread reduction and a $3 rebate per lot if you trade upwards of 1500 lots.

Who Should Avoid Pepperstone?

We don’t recommend Pepperstone for traders seeking a comprehensive education. Its training tools are reasonable, but you can find better materials at other forex brokers in this guide.

IC Markets: Best MetaTrader Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, cTrader, DupliTrade

-

⇔ Spread

GBPUSD: 0.5 EURUSD: 0.1 GBPEUR: 0.5 -

# Assets55+

-

🪙 Minimum Deposit$200

-

🫴 Bonus Offer-

Why We Recommend IC Markets

We recommend IC Markets because it is a reputable CySEC forex broker with a clean track record and no significan regulatory fines or security breaches. It also offers excellent integration with MetaTrader 4 and MetaTrader 5.

Pros/Cons Of IC Markets

Pros

Access to MetaTrader 4 with fast execution and zero restrictions

IC Markets supports the most popular forex platform – MetaTrader 4, with reliable execution, low fees and no restrictions.

We found the broker’s MT4 platform offers below-average execution speeds of under 40 milliseconds, low fees with an average spread on the EUR/USD of 0.1 pips, and support for expert advisors, hedging and other strategies.

Access to MetaTrader 5 with enhanced features for serious traders

IC Markets also supports MetaTrader 5, which based on our first-hand experience, is the better option for experienced traders. Compared to its predecessor, it offers 2 additional order types, 8 more integrated indicators, 12 more charting timeframes, plus an integrated news feed.

IC Markets’ MT5 integration also excels for its competitive trading conditions, with 25 pricing providers ensuring raw spreads that suit serious investors, algo traders and scalpers.

Above-average investment offering including 60+ currency pairs

As well as providing more than 60 currency pairs, IC Markets stands out for its wide selection of additional assets, helping traders build a diverse portfolio.

IC Markets supports trading on 2100+ stocks, 20+ indices, 20+ commodities, 20+ cryptos, 9 bonds and 4 futures – second only to eToro in our shortlist when it comes to the size of investment offering.

Cons

The $200 funding requirement may deter budget traders

IC Markets has one of the higher minimum deposit requirements of the CySEC-regulated forex brokers we have reviewed.

While we still consider the $200 minimum investment accessible for most traders, it may put off some low capital traders.

No two-factor authentication for added security

We noted while testing IC Markets that you can’t add two-factor authentication to bolster your account security. We consider this a basic safety feature, and one we see at most forex brokers.

Why Is IC Markets Better Than The Competition?

IC Markets is another top-rate forex broker that ticks many boxes. Its strong points for us are the excellent integration with MetaTrader with competitive trading conditions, and the large suite of tradeable assets, which are well ahead of most forex brokers we have reviewed.

Who Should Choose IC Markets?

IC Markets is a great option for traders familiar with the MetaTrader package. Its reliable execution, low fees and powerful software also make it good for serious traders, scalpers and algo traders.

Who Should Avoid IC Markets?

IC Markets isn’t best if you want a low-deposit forex broker – every other option in our shortlist accepts traders with a smaller initial investment.

IC Markets also isn’t suitable if you want a beginner-friendly proprietary platform – the broker only offers sophisticated, third-party solutions.

Eightcap: Best For Automated Trading

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, NZD, SGD

-

🛠 PlatformsMT4, MT5, TradingView

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.0 -

# Assets50+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

Why We Recommend Eightcap

We recommend Eightcap because it is another CySEC-regulated forex broker with an exemplary platform offering, including TradingView and Capitalise.ai for code-free algo trading. It also backs these up with useful tools like VPS hosting and AI-enabled calendars.

Pros/Cons Of Eightcap

Pros

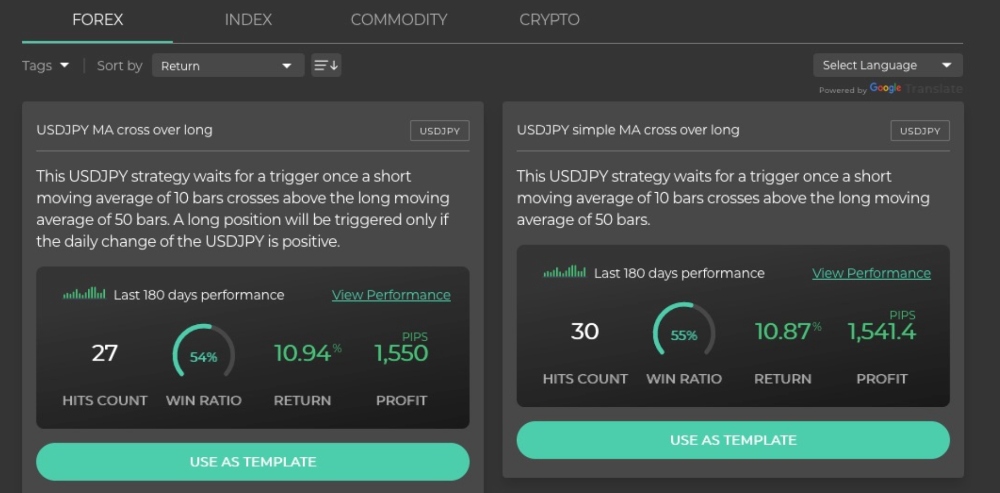

Capitalise.ai offers code-free automated trading solutions

We have found that Capitalise.ai can be used to construct sophisticated algorithmic trading strategies, all with a user-friendly interface and straightforward setup.

What we really like is that you don’t need any coding knowledge – you can build forex strategies in plain English. For example, we could set up a strategy for placing a buy order on EUR/GBP if the price change is negative for 60 minutes.

Forex VPS with 24/7 connectivity

Eightcap also offers virtual private server (VPS) hosting, with reliable execution and low latency. This is a great tool to support algo trading and is available at no charge with a $1000 minimum deposit and a monthly trading volume of 5 lots.

ECN execution with tight spreads

We are impressed by Eightcap’s execution for its ECN account, which offers very competitive spreads from 0.0 pips on the EUR/USD pair.

This, coupled with ultra-fast 30–50ms execution speeds, works well with the broker’s algo trading platforms.

Cons

Average forex spreads in the Standard account

Our assessment shows that the minimum spread of 1 pip in the Standard and TradingView accounts is not much better than average. We think forex traders looking for low-cost no-commission trading will be better served by Skilling.

Average education for beginners

We think new traders will find a more comprehensive education at other forex brokers on our list. We found that Eightcap’s Labs is home to some eBooks and useful guides on specific forex pairs, but it lacks the interactive element and engaging materials offered by alternatives like eToro.

Why Is Eightcap Better Than The Competition?

Eightcap is one of the few CySEC-regulated forex brokers to support the Capitalise.ai platform, which offers one of the best introductions to algo trading in our experience.

Who Should Choose Eightcap?

Investors interested in algorithmic forex trading should choose Eightcap. With Capitalise.ai, TradingView and a VPS, we think this broker takes the lead on this front.

Who Should Avoid Eightcap?

Eightcap does not offer a copy trading solution, so it’s a bad choice for hands-off investors. Combined with average educational content, we think this forex broker is a mediocre choice for rookies.

Why EU Traders Should Choose a CySEC-Regulated Forex Broker

Dispute Resolution and Compensation

Choosing a CySEC-regulated forex broker protects your funds through client fund segregation and the Cyprus Investor Compensation Fund (ICF), which remunerates traders up to €20,000.

In case of a broker’s insolvency or financial difficulties, these measures can help safeguard your investments.

Fair Trading Practices

CySEC-regulated forex brokers must adhere to strict guidelines that promote fair trading practices, including accurate pricing, reliable execution and transparent trading conditions.

They also follow European Securities and Markets Authority (ESMA) rules by banning misleading promotions, ensuring brokers limit leverage on forex to 1:30 to curtail losses, and providing negative balance protection so you can’t lose more than your balance.

Access to EU Markets

As a member of the European Union, Cyprus follows the MiFID II regulatory framework. CySEC-regulated forex brokers can offer their services to traders across the European Economic Area (EEA).

As a result, choosing a CySEC forex broker allows you to access a wide range of markets and trading opportunities within the EU.

Review Methodology

To identify the top CySEC-regulated forex brokers, we first confirmed their licenses were valid on the register of investment firms.

We then assessed shortlisted brokers across key categories:

- Fees – weighing low costs with platform and product quality

- Market offering – preferring firms with a diverse range of currency pairs

- Accounts – comparing entry requirements and account availability for various strategies

- Trading tools – evaluating platforms for design and functionality

This enabled us to find the 5 best CySEC-regulated forex brokers and determine the optimal type of trader for each.

FAQ

Can I Trust Forex Brokers Regulated By The CySEC?

Yes, the CySEC is a trusted regulator that works to prevent fraud and misconduct. It investigates complaints and takes enforcement actions against brokers found to be engaging in fraudulent or unethical practices.

That said, some CySEC forex brokers are more trustworthy than others, depending on their years of experience, industry reputation, and the quality of other regulatory licenses that they hold.

How Can I Check A Forex Broker Is Regulated By The CySEC?

Most forex brokers publish their license number and registration name in the footer of the homepage. You can then verify this license on the CySEC’s register by going to the regulator’s website and performing a search.

How Much Forex Leverage Can CySEC Brokers Offer?

CySEC-regulated forex brokers should follow restrictions that mean you can trade major currency pairs with 1:30 leverage and minor, exotic and cross pairs with 1:20 leverage.

Do All Forex Brokers Fall Under CySEC Regulation?

CySEC’s jurisdiction covers forex brokers based in Cyprus. As Cyprus is a member of the European Union, firms regulated by CySEC can offer their services to traders throughout the European Economic Area (EEA) under MiFID II.

Article Sources

Etoro (Europe) Ltd – CySEC License

Pepperstone EU Limited – CySEC License

IC Markets (EU) Ltd – CySEC License

Eightcap EU Ltd – CySEC License

Cyprus Securities & Exchange Commission (CySEC)

CySEC’s Register of Investment Firms