IC Markets

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, cTrader, DupliTrade

-

⇔ Spread

GBPUSD: 0.5 EURUSD: 0.1 GBPEUR: 0.5 -

# Assets55+

-

🪙 Minimum Deposit$200

-

🫴 Bonus Offer-

Our Opinion On IC Markets

IC Markets is an excellent forex broker for traders of all experience levels. Raw spreads, fast order execution and feature-rich trading platforms stack up well against competitors. We particularly rate the breadth of copy trading tools, including the easy-to-use IC Social App and ZuluTrade.

Summary

- Instruments: 2250+ including 60+ currency pairs, commodities, stocks, indices, bonds, futures, crypto

- Live Accounts: Standard, Raw Spread, Islamic

- Platforms & Apps: MT4, MT5, cTrader, IC Social, ZuluTrade, Myfxbook AutoTrade

- Deposit Options: 15+ including bank cards, wire transfers, Neteller, Skrill, PayPal, Bpay

- Demo Account: Yes

Pros & Cons

- Trustworthy broker authorized by the CySEC & ASIC

- Excellent range of payment methods with 10+ base currencies

- Beginner-friendly education centre with video tutorials and podcasts

- Competitive fees with 0.1 pip average spread on EUR/USD

- User-friendly copy trading tools including an in-house social app

- Straightforward account opening with instant deposits

- Respected global brand with 180,000+ customers

- Low execution speeds with an average of < 40 ms

- High-quality market commentary through Web TV

- Live chat support is unreliable

- Limited bonuses & promotions

- No two-factor authentication

Is IC Markets Regulated?

We are comfortable that IC Markets is a legitimate and trustworthy broker, holding licenses with several top-tier regulators.

This should reassure traders that the company follows industry-standard security measures. For example, client funds are held in segregated tier-one banks while the Australian and European branches provide negative balance protection, meaning you cannot lose more than your account balance.

The brokerage operates through three subsidiaries:

- IC Markets (EU) Ltd – Regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 362/18. Compliant with the European Markets in Financial Instruments Directive (MiFID).

- International Capital Markets Pty Ltd – Regulated by the Australian Securities and Investments Commission (ASIC), license number 335692.

- IC Market Global – Regulated by the Financial Services Authority of Seychelles (FSA), license number SD018.

Our team did not find any reports of major scams or security breaches, which is a promising sign. However, we couldn’t add two-factor authentication to our accounts for peace of mind and would like to see IC Markets introduce this in the future.

Forex Accounts

A big bonus for me is the flexible account options, which means I can trade with the right tools and conditions for my strategy and budget.

You can choose between Raw Spread (cTrader), Raw Spread (MetaTrader), and Standard (MetaTrader). As the names suggest, the key differences are the platforms available and the pricing model, though each profile offers low fees compared to other forex brokers.

I also like that there are no restrictions in terms of the instruments available or base currencies, with 10 popular currencies supported, including USD, EUR, AUD and GBP. Another advantage for Muslim traders is that an Islamic account is available with each profile.

I break down the key differences between the accounts below:

Raw Spread cTrader

Good for day trading and scalping

- Spreads from 0 pips

- $3 commission per side

- Maximum 2000 orders open

- London server location

Raw Spread MetaTrader

Good for Expert Advisors (EAs) and scalping

- Spreads from 0 pips

- $3.50 commission per side

- Maximum 200 orders open

- New York server location

Standard

Good for discretionary trading

- Spreads from 0.6 pips

- No commission

- Maximum 200 orders open

- New York server location

How To Open A Live Account

I found the registration process at IC Markets noticeably faster than many alternatives. I was signed up and ready to trade in a matter of minutes.

- Fill out the application form including the four key sections (personal details, about yourself, account configuration, and T&Cs declaration)

- Add a security question and review the account details

- Click ‘Submit’ to send the sign-up form to the accounts team

- Login credentials will be sent to the registered email address

Trading Fees

The low-cost trading environment at IC Markets is one of the brand’s strongest points. The broker stands out for its raw spreads from 0.0 pips and competitive trading commissions.

Forex spreads are particularly impressive, with a 0.1 average spread on EUR/USD with the Raw Spread account and 0.6 on the Standard profile. While using IC Markets, we also get tight spreads on other popular FX assets, including an average spread of around 0.2 pips on GBP/USD with the Raw Spread account and 0.8 pips on the Standard profile.

Non-forex traders will also appreciate the competitive fees on other assets, with gold available from 1 pip on the Raw Spread account and 2 pips on the Standard profile.

Of course, it is worth noting that a commission applies on the Raw Spread accounts in return for the tightest spreads:

- Raw Spread Account (MetaTrader) – $3.50 per lot, per side

- Raw Spread Account (cTrader) – $3.00 per $100,000 traded

Non-Trading Fees

IC Markets also compares well to rivals when it comes to non-trading fees. In particular, I appreciate that there is no inactivity fee applied to dormant accounts.

Swap fees apply on positions held overnight (except for the Islamic profile), though again, these are lower than many competitors. Another bonus for me is that the broker’s additional tools, including the subscription for a Virtual Private Server (VPS), are available at no charge if you trade 15 lots per month – a great perk for active forex traders.

It is worth calling out, however, that it is your responsibility to meet local tax requirements.

Payment Methods

IC Markets is a mixed bag when it comes to deposits and withdrawals. Our team rate the wide selection of payment methods, but the minimum deposit of $200 is higher than some competitors. There is no minimum deposit at OANDA, for example, while XM accepts traders with a $5 investment.

Fortunately, IC Markets caters to forex traders from around the world with its long list of funding options, which includes credit/debit cards, wire transfers, and local payment solutions like Bpay (Australia).

Another perk that caught our attention is that the broker does not charges deposit fees. In addition, we like that all transactions are fully encrypted using Secure Socket Layer (SSL) technology.

Funding options along with processing times and accepted currencies:

- POLi – Instant processing, accepted currencies AUD

- UnionPay – Instant processing, accepted currencies RMB

- Bpay – 12 to 24-hour processing, accepted currencies AUD

- Vietnamese Internet Banking – Instant processing, accepted currencies USD

- Klarna – Up to two working days processing time, accepted currencies EUR and GBP

- Rapidpay – Up to two working days processing time, accepted currencies EUR and GBP

- Thailand Internet Banking – 15 to 30 minute processing time, accepted currencies USD

- Skrill – Instant processing, accepted currencies AUD, USD, JPY, EUR, SGD, and GBP

- Neteller – Instant processing, accepted currencies AUD, USD, JPY, EUR, SGD, GBP, and CAD

- PayPal – Instant processing, accepted currencies AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, and CHF

- Bank Wire Transfer – Two-to-five-day processing time, accepted currencies AUD, USD, JPY, EUR, NZD, SGD, CAD, CHF, and GBP

- Credit/Debit Card (VISA & MasterCard) – Instant processing, accepted currencies AUD, USD, JPY, EUR, NZD, SGD, GBP, and CAD

- Brokers To Broker Transfer – Two-to-five-day processing time, accepted currencies AUD, USD, JPY, EUR, NZD, SGD, CAD, CHF, HKD, and GBP

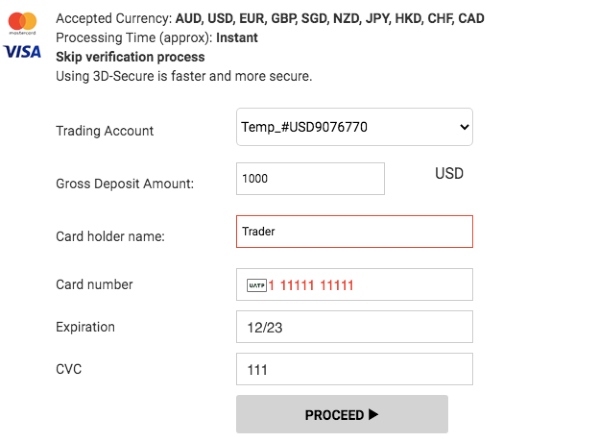

How To Make A Deposit

I found the account funding process straightforward, meaning I could start speculating on popular instruments almost immediately.

- Log in to the secure client area

- Select ’Deposit’ from the side menu and then choose a payment method from the list

- Complete the relevant payment details such as your card number

- Enter the value to deposit

- Select ’Proceed’

- Review the payment details and select ’Confirm’

Withdrawals

I also can’t fault IC Markets’ withdrawal process, which is fast and, importantly, free, a notable advantage over competitors like eToro with its $5 withdrawal fee.

Processing times vary by method, however IC Markets processes withdrawal requests the same day if requested before 12 PM.

It is also worth noting that you need to complete a withdrawal request form via the client area before you will get paid. Fortunately, I found this quick and easy – you just need to choose a withdrawal method, confirm the trading account to remove funds from, and enter the value to withdraw.

Forex Assets

IC Markets offers trading on a decent selection of forex assets. You can trade 60+ currency pairs including majors, minors, and crosses, and this stands up well against competitors like XM (60+), even if it is slightly behind FxPro (70+).

Importantly, the minimum trade size starts from one micro lot and forex can be traded via contracts for difference (CFDs). This means you can speculate on rising and falling prices while using leverage to increase your purchasing power.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

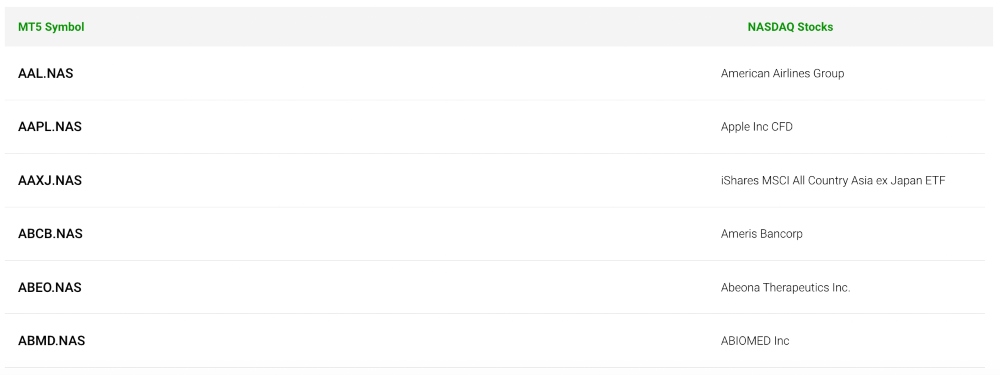

IC Markets is also a great pick for non-forex traders. With over 2000 CFD instruments available spanning popular asset classes and major countries, there are plenty of opportunities. The only notable products missing are binary options and spread betting.

We highlight the main asset classes and popular instruments below:

- Stocks – 2100+ company shares including Westpac Banking Corp, Deutsche Bank, GameStop, and Shell

- Indices – 25 index funds including the ASX 200, FTSE 100, S&P 500, and Italy 40

- Cryptocurrency – 23 digital currencies including Bitcoin, Ethereum, Litecoin, and Ripple

- Futures – Four global futures; Brent Crude oil, WTI Crude oil, CBOE VIX Index, and the ICE Dollar

- Commodities – 22 metal, agriculture, and energy commodities including Crude oil, coffee, gold, and silver

- Bonds – Nine government bonds such as US Treasury 5-year bonds and the UK Gilt

Note that the asset list may vary slightly between entities due to local regulatory requirements.

IC Markets Execution

Our team rate the fast and efficient market execution system, which offers ECN pricing from external liquidity providers. All positions are filled using live-streamed pricing, and you can be assured of fast execution speeds thanks to the brand’s no-dealing desk intervention model from server locations in London and New York.

Upon testing, we saw an average order execution speed of 35 milliseconds on popular forex assets. We consider anything under 100 milliseconds good so this is competitive and will help traders get the best price. We find that fast execution speeds are particularly beneficial for active day traders using forex scalping strategies.

Leverage

As is standard at global forex brokers, the maximum leverage available depends on your location and regulatory requirements.

The highest leverage is available to account holders registered under the global entity, at 1:500. However given the risk of large losses associated with such high leverage, we recommend using suitable risk management tools such as stop losses.

The maximum leverage available to traders with the EU and ASIC branches is 1:30, which is the limit for retail traders imposed by the CySEC and ASIC. Importantly, the margin call level is 100% and the stop-out level is 50% on all accounts.

I found the free margin calculator on the broker’s website a helpful addition. It helps show you the margin required and your potential purchasing power.

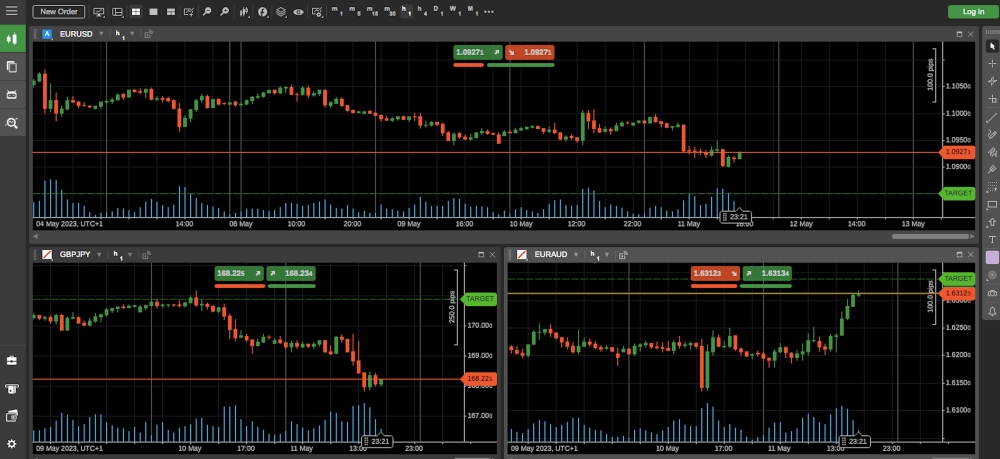

Platforms & Apps

The selection of high-quality trading platforms and apps is a standout feature of IC Markets for me. There is a generous choice of three platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. And while some traders may prefer to see a proprietary platform, there are ample tools available in these leading third-party solutions.

I particularly like the high degree of customizability available with each platform. I found cTrader the most challenging to navigate at first, but the modern interface is flexible, and once I moved around some widgets I found it easy to use. Given the extensive list of indicators, drawing tools and timeframes, I also think it is the best option for active day traders.

For beginners, I would recommend MetaTrader 4 as it offers a good balance between powerful trading tools and usability. MetaTrader 5 will suit seasoned traders with more options in terms of order types and analysis tools,

I have pulled out my favorite features of each platform:

- cTrader – One- or two-click trading, advanced order protection, level II pricing data, 8 chart types, 54 timeframes, and 70 installed technical indicators.

- MetaTrader 4 – One-click trading, access to Expert Advisors (EAs), 30 in-built technical indicators, three chart types, four pending order types, and nine timeframes.

- MetaTrader 5 – Integrated economic calendar, depth of market data, access to Expert Advisors (EAs), multi-thread strategy testing, 21 timeframes, 38 in-built technical indicators, MQL5 programming language, and six pending order types.

All terminals are available for download to desktop devices as well as being available as mobile apps and browser-based solutions.

How To Place A Trade On cTrader

I like the variety of ways you can open a new order on cTrader, including clicking the ‘Buy’ or ‘Sell’ icons at the top of a chart, selecting the ‘New Order’ icon in the ‘QuickLinks’ tab, or right-clicking on an instrument and selecting ‘Create New Order’ from the menu.

To create a market order:

- Choose an instrument, such as EUR/USD

- Select the ‘Buy’ or ‘Sell’ icons

- In the ‘New Order’ screen, stipulate the trade volume/lots by using the toggles or typing in the number

- Apply a Stop Loss or Take Profit risk parameter (optional)

- Amend the ‘Market Range’ details to set the price your order will be filled

- Add a comment (optional)

- Select ‘Place Order’

Forex Tools

Another reason our team rates IC Markets is the suite of additional forex tools. There are 20 features that can be integrated into the platform interface, including a correlation matrix, sentiment trader, and mini terminal.

However, there are several solutions that we consider particularly useful:

IC Social

My favorite tool is the IC Social App. The application has a modern interface with seamless copy trading features. It essentially gives users to access an active trading community, entry and exit signals, plus risk management tools, all from one app.

I particularly rate the chat function and sharing capabilities, alongside the option to create small investment groups. This means I can engage with like-minded traders and get tips from engaged subgroups interested in a particular instrument or market, for example.

As a bonus, the IC Social app is really easy to use and can be downloaded to both iOS and Android devices.

VPS

A useful feature for high-volume traders is the Virtual Private Server (VPS) with 24/7 connectivity. This means you can run forex strategies throughout the night or while away from your computer. Importantly, it protects against technical interruptions and computer failure.

The broker provides third-party connections to Forex VPS, Beeks FX, or NYCServers. These are all dependable providers and it’s a bonus that IC Markets will cover the subscription if you meet volume requirements (15 round turn lots per month).

ZuluTrade

IC Markets also offers ZuluTrade, a leading social and copy trading platform that enables users to follow and duplicate the positions of more experienced traders. This is particularly useful for beginners or time-challenged traders with a slick interface.

My only challenge with ZuluTrade is that there are limited requirements for ’pro’ traders to act as signal providers, which can sometimes make it challenging to source the best traders to follow.

Forex Education & Research

The IC Markets education offering is one of the best in its class, with a range of learning styles available from webinars, videos and blogs to online tutorials and even podcasts.

I sometimes find it difficult to determine the suitability of content as there is no option to filter the information by beginner, intermediate or advanced, but this is a minor complaint.

Other tools that bolstered the trading experience for me are the free trading calculators including a pip calculator. The forex glossary of key terms is also useful for new traders.

The broker has also teamed up with a reputable third-party provider, Bloomberg, to provide overviews of market events and financial activities. On the downside, this is a bit hit-and-miss in terms of keeping content up to date.

Demo Account

We are pleased to find a comprehensive demo profile at IC Markets with all account types, platforms, and products available. With $5 million in virtual funds, leverage up to 1:500, and unlimited simulator access, the demo offering ticks most of our boxes.

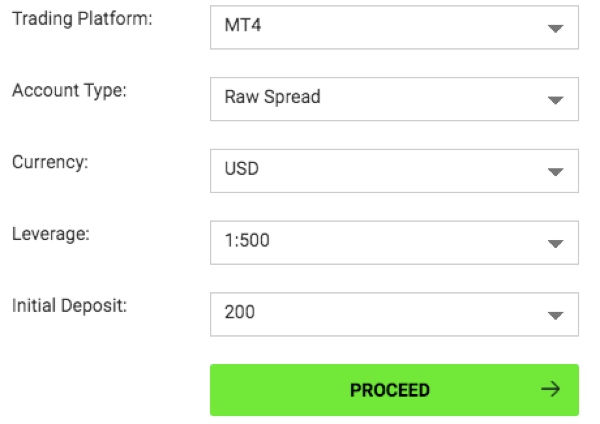

How To Open A Demo Account

You can get started with a paper trading profile in a few minutes you only need to enter basic personal details to sign up.

- Select ‘Try A Free Demo’ from the header of the broker’s website

- Enter your personal details; country of residency, name, email, and mobile number

- Choose ‘Submit’ and automatic login to the client area will be activated

- From the interface, add the demo account requirements including the trading platform, account type, currency, leverage, and amount of virtual funds

- Select ‘Proceed’

- Login credentials will be sent to the registered email address

- Download the relevant platform and sign in to start trading

IC Markets Bonus

It is a shame that IC Markets’ global branch does not offer any welcome deposit bonuses or other promotions. Since the CySEC and ASIC prohibit most financial incentives, these branches also lack bonuses.

With that said, we do like that commission rebates are available with the ‘Raw Trader Plus’ program. This is aimed at high-volume clients with a minimum trade volume of 100 lots for the basic discount ($1.50 per lot). Members also get useful extras like free VPS hosting and dedicated customer support.

Trading Restrictions

IC Markets is a great option for a range of traders with no restrictions on strategies. This means you can trade forex using scalping and high-frequency setups. Netting and hedging are also permitted, plus there are no margin payments on hedged trades.

Another perk for us is that there are no limitations when it comes to minimum or maximum trade sizes. You can open positions from 0.01 lots (micro).

Customer Service

A strong point for me is the reliable customer support team, available 24/7. This compares well to competitors like OANDA and XM which only offer 24/5 help.

You can get in touch with IC Markets through live chat, email, or telephone. A callback request service is also available.

Yet despite the variety of contact methods, I find the live chat service a bit frustrating. You get stuck with an automated bot for a while before you can get through to an actual customer service representative. And ultimately the chatbot lacks the account and product knowledge to answer many questions.

Instead, I recommend starting in the FAQ hub where questions are organized into key topics including trading forex, MetaTrader 4 problems, and account application queries.

Contact details:

- Telephone – +248 467 19 76

- Email – support@icmarkets.com

- Office Address (Global) – Eden Plaza, Office 222, Eden Island, Mahe, Seychelles

Company Details

IC Markets was founded in 2007 as International Capital Markets. The broker aims to bridge the gap between institutional and retail investors by providing low latency connections, superior technology, and top-tier liquidity to the financial markets.

The broker’s offices service clients in 200+ countries, with 180,000+ registered customers and 500,000+ orders processed per day. The total volume traded through the firm has also surpassed an impressive $1.1 trillion – a strong indication that the broker is reliable.

The company has a head office presence in Limassol, Sydney, and Mahe.

Trading Hours

The IC Markets server operates in a GMT +2 timezone. Trading hours vary by market opening times, with forex available between 00:01 and 23:59 Monday to Friday, with an earlier close on Fridays at 23:57.

You can also find opening hours by product on the official website. Alternatively, we found that trading hours are reflected in the MT4 terminal. Simply right-click on an instrument via the ’Market Watch’ list and select ’Specification’.

Who Is IC Markets Best For?

IC Markets is a great broker that will tick most boxes for the majority of traders. With a wide choice of payment methods, powerful trading platforms, multiple account types, and a selection of copy trading tools, the brand has plenty to offer both beginners and seasoned traders. That said, the industry-low fees and fast order execution will be particularly useful for high-volume traders and scalpers.

FAQ

Is IC Markets Legit Or A Scam?

IC Markets is a legitimate broker, offering online trading services since 2007. The brokerage operates via three global entities, all with regulatory oversight. The fact that over 180,000 traders have opened an account with the firm, logging more than 500,000 trades a day, is also a good sign that the firm is reputable.

Can I Trust IC Markets?

Yes, we consider IC Markets trustworthy. The broker is heavily regulated and widely respected in the trading industry. There are also limited reports of scams or security breaches.

Can You Make Money Trading Forex With IC Markets?

Forex trading with any online broker is risky and IC Markets is no exception. You may lose money trading with IC Markets. With that said, IC Markets does offer a competitive trading environment including ultra-tight spreads, low to zero commissions and no hidden fees, helping to protect profit margins.

Does IC Markets Offer Low Forex Trading Fees?

Yes, IC Markets charges low forex trading fees. You can trade commission-free on the Standard account and still benefit from tight floating spreads. For example, we were offered the GBP/USD with a 0.83 pip spread. The broker also offers a Raw Spread account, with spreads from 0.0 pips and commission charges of either $3 per $100,000 traded (cTrader) or $3.50 per lot (MetaTrader). Again, this is lower than many rivals.

Is IC Markets A Regulated Forex Broker?

Yes, IC Markets is a regulated forex broker. The brokerage operates three subsidiaries, overseen by the CySEC in Europe, the ASIC in Australia and the FSA in the rest of the world. As a result, retail investors benefit from various account safety measures, including the segregation of client and company capital, plus negative balance protection.

Is IC Markets A Good Forex Broker For Beginners?

IC Markets is a great forex broker for beginners. We rate the easy-to-follow educational resources and demo account with no time constraints. However, our favorite tools are the IC Social app and ZuluTrade copy trading platform, both of which allow novice traders to learn from experienced and profitable forex traders.

Does IC Markets Have A Forex App?

IC Markets offers a proprietary social trading platform, IC Social. The in-house app hosts an active community chat alongside trading signals and copy trading, allowing users to mirror the strategies of proven forex traders.

Alternatively, MT4, MT5, and cTrader are all available as mobile-compatible applications and facilitate forex trading.

How Long Do Withdrawals Take At IC Markets?

We appreciate the fast withdrawals at IC Markets. The broker processes all requests the same day if received before 12 PM. Withdrawal times will then vary between payment methods with credit/debit cards and e-wallets the best pick if you want near-instant payments.

What Timezone Is The IC Markets Platform?

The IC Markets server operates in a GMT +2 time zone. This is reflected in the broker’s trading platforms, including MetaTrader 4, MetaTrader 5 and cTrader.