OANDA

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD

-

🛠 PlatformsMT4, MT5, TradingView, AutoChartist

-

⇔ Spread

GBPUSD: 1.4 EURUSD: 0.8 GBPEUR: 0.9 -

# Assets68

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Our Opinion On OANDA

OANDA is a trustworthy forex broker with an excellent reputation. Our team particularly like the intuitive web platform and suite of market research tools. To improve its rating further, we would like to see lower spreads on popular assets and a wider range of instruments. Overall though, OANDA is a leading online broker, particularly for experienced forex traders.

Summary

- Instruments: 68 currency pairs, plus a small selection of commodities, indices, bonds and cryptos

- Live Accounts: Standard, Pro, Joint, Islamic

- Platforms & Apps: OANDA Trade, MetaTrader 4, TradingView

- Deposit Options: Bank cards, wire transfers, and e-wallets

- Demo Account: Yes

Pros & Cons

- Safe broker regulated by multiple financial authorities including IIROC, FCA & ASIC

- Powerful proprietary software plus top-rated third-party platforms like MetaTrader 4 and TradingView

- User-friendly fxTrade app with intuitive charting, market research and account management

- Good risk management tools including guaranteed stop-loss orders (GSLOs)

- Automated trading capabilities through API offering

- No minimum deposit reducing entry requirements for beginners

- Reliable and responsive customer support available 24/5

- An award-winning brand with a high trust rating

- Withdrawal fees for some payment methods

- Narrow range of non-forex instruments

- Higher than average trading fees

- No social trading capabilities

Is OANDA Regulated?

We are comfortable that OANDA is heavily regulated and secure. The brand holds licenses with multiple regulators and provides various account safety measures. This includes segregating client money from company capital and providing negative balance protection so that I cannot lose more than I deposit into my trading account.

The brokerage is regulated through several entities:

- OANDA TMS Brokers S.A. – regulated by the Polish Financial Supervision Authority (KNF), license number 0000204776

- OANDA Corporation – a registered Retail Foreign Exchange Dealer (RFED). Regulated by the US Commodity Futures Trading Commission (CFTC) and a registered Forex Dealer Member (FDM) of the National Futures Association (NFA), license number 0325821

- OANDA Asia Pacific Pte Ltd – regulated by the Monetary Authority of Singapore (MAS), license number 100122-4 and a registered commodity CFD dealer by the International Enterprise Singapore, license number OAP/CBL/2012

- OANDA Canada Corporation ULC – regulated by the Investment Industry Regulatory Organization of Canada (IIROC)

- OANDA Europe Limited – regulated by the UK Financial Conduct Authority (FCA), registration number 542574

- OANDA Japan Inc – membership with the Financial Futures Association of Japan (FFAJ), license number 1571. Additional Type 1 Financial Instruments license from the Japanese Financial Services Agency (FSA), Kanto Local Finance Bureau registration number 2137

- OANDA Australia Pty Ltd – regulated by the Australian Securities and Investments Commission (ASIC), AFSL number 412981

Importantly, our experts did not find reports of the broker operating scams. We did find a hacking incident dating back to 2012, in which 0.2% of OANDA accounts were accessed through a compromised employee server, however the brand has since worked hard to review its security protocols.

Forex Accounts

OANDA keeps it simple with just one live account with no minimum deposit. This will appeal to beginners looking to start trading forex quickly.

For seasoned traders, the broker offers a professional account plus an Advanced Trader Program (US only), which provides fee rebates and reduced commissions. We also like that joint accounts and Islamic profiles are available, making the brokerage accessible to a range of traders.

How To Open An OANDA Account

I found it easy to open a live account. In fact, the registration process took less than 5 minutes following 3 straightforward steps:

- Fill out the registration form, including personal details like your name, email, phone number and trading experience

- Verify your identity and address by uploading a scan of your ID, plus a PDF of a recent utility bill or bank statement

- Fund your account by clicking ‘Deposit’ and following the payment instructions

Trading Fees

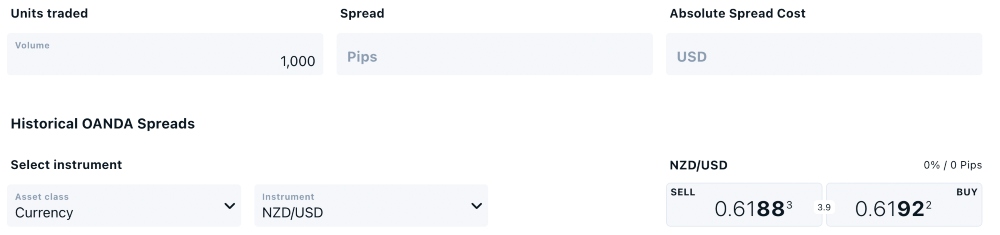

Trading fees are built into the spreads. Minimum spreads start from 0.8 pips on major pairs like EUR/USD, which is reasonable compared to brands like Plus500. With that said, it doesn’t match the ultra-tight spreads available at some discount brokers. We also got a higher spread of 1.2 pips on EUR/USD while using OANDA.

We like that there is the option to trade on OANDA’s ‘commission plus core spread’ pricing model. Here, spreads start from 0.1 on the EUR/USD with a $40 commission per million USD traded.

Our team appreciates that the forex broker is clear about price sourcing, with FX rates derived from top liquidity providers. Recent and historical currency pair quotes are also available on the broker’s website, which is a bonus for me.

Non-Trading Fees

It is good to see OANDA does not charge deposit fees. However, we are less impressed by the withdrawal charges. You get one free withdrawal per month on credit/debit card withdrawals, but there is a $15 charge per request thereafter.

We found bank wire transfers are the most expensive withdrawal option, with a $20 fee for the first withdrawal, followed by $15 for any additional withdrawals in the same month. This is a notable disadvantage vs alternatives, though some popular brands like FXCM take a similar approach.

Other financing charges include swap or rollover rates which apply for positions held overnight. We also risk having to pay a $10 inactivity fee if we do not trade for 12 months. Fortunately, rebates can be requested if you reactivate your profile.

Finally, a 0.5% currency conversion fee will apply if you trade an instrument in a different currency to your account base.

Payment Methods

Our team are satisfied with the selection of deposits and withdrawal options, though these do vary depending on your location. Standard funding options include bank transfers, credit/debit cards, and popular e-wallets like PayPal and Trustly.

Deposits

I find bank cards the best option for immediate, free deposits. In comparison, wire transfers can take 1 – 3 business days for faster payments, BACS and CHAPS, whilst SWIFT and SEPA transfers take 1 – 5 business days.

How To Make A Deposit

I don’t encounter any problems when it comes to funding my OANDA account. The process is straightforward:

- Log in to the OANDA Hub using your account ID and password

- Click on ‘Deposit’ from the dashboard

- Select the trading account to deposit into and press ‘Continue’

- Select the payment method and deposit amount

- Input your bank or card details and confirm the deposit

Withdrawals

Withdrawals are accepted via bank cards and wire transfers, plus popular e-wallets. Again, the list of supported payment solutions will vary depending on your location.

We are reassured that OANDA pays out profits reasonably quickly. Wire transfers, for example, can take up to 2 business days to process in Europe, and up to 5 days internationally. For free withdrawals though, we recommend bank cards which are usually processed within 3 days, or e-wallets, which are generally processed within 1 day.

Forex Assets

The forex broker offers 68 currency pairs, spanning majors, minors and exotics. This is a decent lineup, with plenty of popular currencies available.

Forex pairs can be traded via contracts for difference (CFDs), meaning you can speculate on price changes with leverage, increasing potential gains and losses with a small initial deposit.

Spread betting is also available to traders in some jurisdictions including the UK. Spread betting is particularly popular due to its tax-free status.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

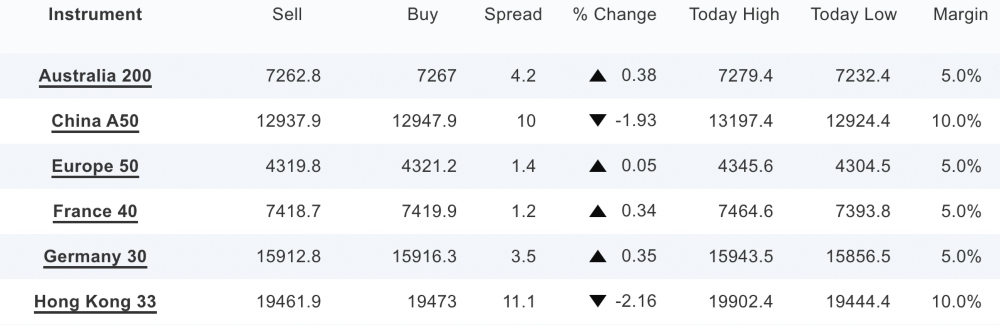

Non-Forex Assets

Our team are disappointed with OANDA’s limited range of products beyond forex in this review. The broker is missing major markets such as stocks while cryptocurrency, including Bitcoin (BTC) and Ethereum (ETH), is also only available in some countries. Ultimately, the broker does not compare to many alternatives when it comes to the list of instruments available.

Available assets include:

- Indices – Trade 15 indices including the S&P 500, NASDAQ, DAX 30 and AUS 200

- Commodities – Speculate on the price of 12 commodities including Gold, Silver, Wheat, Natural Gas and Brent Crude Oil

- Bonds – Invest in 6 US, EU and UK government bonds including the US 2-year T-note and UK 10 Year Gilt

Execution

OANDA is a market maker. This means orders are processed through an in-house dealing desk whereby the broker takes the other side of your trade.

The benefit of this system is fast execution speeds, however, the spreads offered tend to be less competitive than ECN brokers, for instance. OANDA essentially charges higher ask prices (selling) vs bid prices (buying).

Leverage

Our team finds that OANDA is in line with competitors when it comes to leveraged trading opportunities. The level of leverage available varies between entities due to local regulations. For example, major forex pairs are available up to 1:30 for retail traders in the EU and UK. US traders, on the other hand, can trade forex with leverage up to 1:50.

Note that a margin call will be triggered if your account balance approaches the 50% margin stop-out level.

Platforms & Apps

We are particularly impressed with the quality of the trading software available. There is something for all experience levels and trading strategies, from the broker’s in-house web terminal to industry favorites like MetaTrader 4 and TradingView.

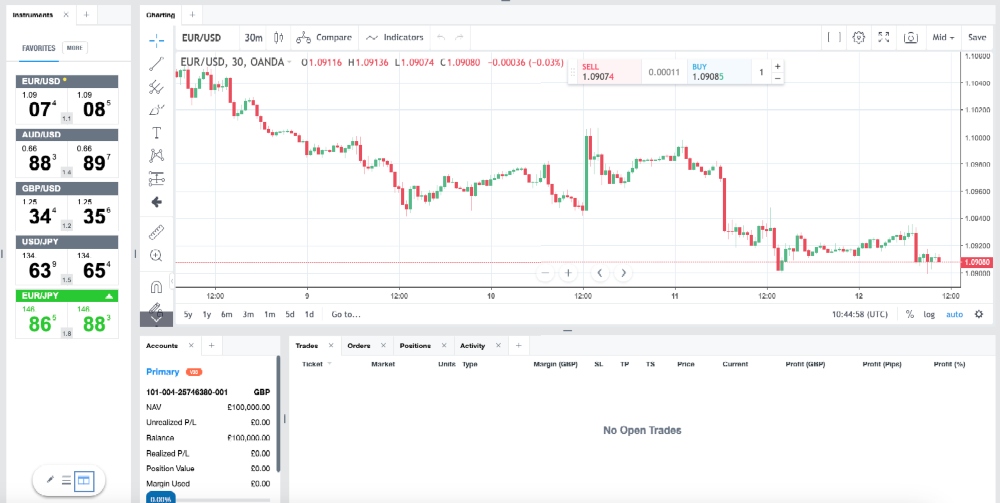

OANDA Trade Platform

The proprietary web platform is available as a web-based terminal only. Yet while I was slightly skeptical at first, I was reassured by the functionality, speed and stability of the platform. I also like that I can personalize the layout and drag and drop windows to suit my preferences.

There are over 65 technical indicators, 11 customizable chart types, plus a range of drawing tools, comparable with top platforms such as MetaTrader 5 (MT5).

I also find the intuitive economic overlay useful, which accompanies the Depth of Market (DoM) pricing and advanced charting insights from TradingView. Another bonus for me is the performance analytics tool which summarizes the profit and loss on trades, helpful for managing risk.

Market data is supplied by leading providers including Dow Jones FX Select, 4CAST and OANDA. I also recommend downloading the mobile app so you can stay up to date with market events and trading positions while on the go.

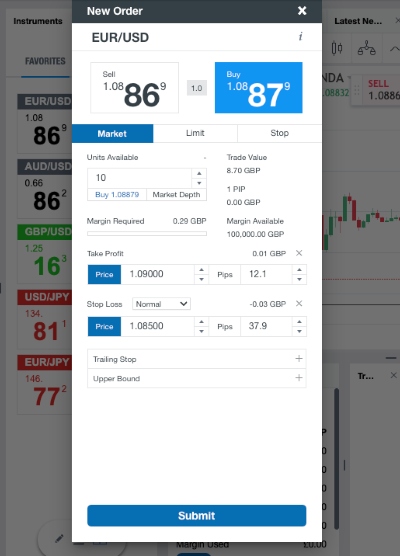

How To Make A Trade

Placing a trade in the OANDA Trade platform is easy:

- Double-click on an instrument from the left-hand instrument window

- In the ‘New Order’ window, choose ‘Buy’ or ‘Sell’

- Use the up or down arrows to change the position size

- Input your ‘Take Profit’ and ‘Stop Loss’ parameters

- Review the margin requirement

- Click ‘Submit’ to confirm the order

MetaTrader 4

The MetaTrader 4 (MT4) platform is among the most popular third-party solutions available to retail traders. I rate that you can customize the interface and trading views with 9 timeframes and 3 chart types. You also get access to 30+ technical indicators, 4 pending order types and a good range of drawing tools.

In my opinion, MetaTrader 4 is not quite as sleek as the web platform, with some features feeling a little outdated. Nonetheless, I cannot fault MT4’s powerful features including access to a vast marketplace of automated tools and Expert Advisors (EAs). In addition, I find the process of creating order books, watchlists and alerts easy.

Forex Tools

Our team is impressed with the range of analysis tools available at OANDA, including advanced technical indicators powered by Autochartist. Traders can essentially access tools with continuous market scanning capabilities.

I found the spread calculator particularly useful. The calculator can be used to estimate how much the entry cost of a trade would be, by analyzing OANDA’s spread history. I also like that you can toggle the results by ‘average spread’ or ‘minimum and maximum spread’ and zoom in or out depending on which time interval you wish to view.

Extra features that I would like to see added are margin and profit calculators, platform tutorials and app guides. This could better help traders assess risk and plan and manage trades.

Forex Education

Our experts find the education offering at OANDA decent, but not as substantial as competitors like eToro. The learning resources are provided in chapters, ranging from trading basics to risk management. The chapters are also accompanied by short but informative videos.

I particularly like the ‘Classroom’, which features live and recorded webinars covering a range of topics including live market analysis and strategy tips. The integrated Dow Jones feed and expert-led analysis by OANDA’s team of analysts are also worth mentioning.

One criticism I do have is that navigating the resources can feel a little clunky with room for improvement in terms of the user experience. It would also be nice to see additional materials such as podcasts and trading ebooks.

OANDA Demo Account

We are pleased to see a free demo account available, with a generous $100,000 in virtual funds and no time limit. Live market conditions and prices are available in the practice profile, with all instruments available to trade.

My experience of using the demo account has been positive overall. I like that you can view the Market Pulse portal which includes an economic calendar and a currency heat map. You don’t get access to the Autochartist technical analysis add-on, but demo traders should still have everything they need to test forex trading strategies.

How To Open A Demo Account

I was able to open a demo account within 1 minute at OANDA. The process is easy, only requiring your name, email and phone number.

- Select ‘Open A Demo Account’ from the broker’s homepage

- Enter your name, email address and phone number

- Set a password and submit

- On the next page, choose whether to begin trading via mobile app, web platform or download MT4

I like that the brand gives you the option to launch the web platform or download the desktop, mobile app or MT4 directly from the demo confirmation page.

If you select ‘Launch OANDA web’, you will be taken directly to the broker’s trading interface without the need to log in again. Otherwise, follow the instructions on your PC to install the software.

Bonus Offers

OANDA offers a good selection of bonuses and promotions. However, these do vary depending between jurisdictions due to regulatory restrictions. For example, Singapore traders can get a SGD 508 welcome bonus with a minimum deposit of SGD 15,000.

Our experts also rate the Advanced Trader Program for high volume/net worth investors (US only). Members benefit from fee rebates of between USD 5 and USD 15 per million. On the downside, qualification requirements are punchy, with a minimum deposit requirement of $10,000 and a monthly volume requirement of $10+ million.

With all trading promotions, make sure you review the terms and conditions before you sign up.

Trading Restrictions

We were pleased to see that OANDA does not impose any restrictions on forex trading strategies. The broker permits scalping and hedging. Additionally, automated trading via expert advisors (EAs) is allowed.

Customer Service

OANDA offers reliable customer support, with multilingual help available 24/5. This includes international telephone hotlines, email and live chat.

We find the chat function especially responsive, with a choice of six languages including English, Spanish and German. However, one drawback is that you have to submit various information before being connected to a representative, including country of residency, account type and email address. This isn’t as efficient as some alternative brands.

A help portal with FAQs is also available on the website, which offers sufficient information. Topics include how to open new positions, understanding historical average exchange rates and how to close an account.

Contact details:

- Email – frontdesk@oanda.com

- Live Chat – Via the ‘Contact Us’ webpage

- Phone numbers – +1(877)6263239 (North America), +44(20)71011600 (Europe), +6565798289 (Asia Pacific), +61280466258 (Australia) or +0120923213 (Japan)

Company Details

OANDA was established in 1997 as a currency exchange data provider. The brand still provides foreign exchange (FX) data feeds and money transfer services to thousands of organizations via API, including AirBnb, Deloitte and Expedia.

Together with technology advancements, the concept developed in 2001 with the launch of an online trading platform for retail investors that could trade from just $1. OANDA was then acquired by CVC Capital Partners in 2018.

Today, the company spans several global offices including the UK headquarters in London plus New York, Toronto and more. Trading services are available internationally, with the broker regulated across six major subsidiaries including the US and Singapore.

The broker has also picked up various awards, including the Best Forex and CFD Broker 2021 and the Best Trading Tools Broker 2021.

Trading Hours

OANDA’s trading platform is available from Sunday at 10:00 pm to Friday at 10:00 pm (GMT time zone), which is aligned with the financial markets. However, as standard, specific trading hours will vary by instrument. All forex products, for example, are available to trade from 5:03 pm (EST) to 4:58 pm (EST), Sunday to Friday.

We are pleased to see the broker publishes global holiday hours and market closures on its website. Trading times are also reflected in the trading platforms.

Who Is OANDA Best For?

OANDA is a good option for traders of all experience levels, though it is a particularly good fit for seasoned forex traders. We rate the clean web platform and catalog of third-party tools, including TradingView and Autochartist. It is also secure with an excellent reputation, robust regulatory oversight, and various industry accolades.

Our only major criticisms are the limited selection of non-forex assets and the wider than average spreads. Overall though, OANDA will meet the needs of most active forex traders.

FAQ

Is OANDA A Reliable Broker Or A Scam?

OANDA is a legitimate broker, regulated in multiple jurisdictions, including by the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). The forex broker also segregates client funds in top-tier banks and offers negative balance protection in some countries.

Can I Trust OANDA?

We are confident that OANDA is trustworthy. The company has been established for over 25 years as a currency conversion platform and online broker. The brand has collected various awards for its trading services and client satisfaction. Other user ratings are also generally positive, with limited negative reviews reporting scams.

Can You Make Money Trading Forex With OANDA?

OANDA offers high-quality trading tools and excellent research. However, profits are not guaranteed and many retail traders lose money. The forex broker also offers fairly high fees on some instruments. Our experts recommend taking advantage of OANDA’s guaranteed stop-loss orders to protect funds.

Does OANDA Offer Low Forex Trading Fees?

Trading fees are reasonable, though not as competitive as some other forex brokers. When we used OANDA, we were offered a spread of 1.2 pips on EUR/USD and 1 pip on GBP/USD, which is higher than some alternatives.

Is OANDA A Regulated Forex Broker?

Yes, OANDA is regulated and licensed in multiple jurisdictions, including by the Monetary Authority of Singapore (MAS), the Investment Industry Regulatory Organization of Canada (IIROC), the Financial Conduct Authority (FCA) in the UK, the Japanese Financial Services Agency, and the Australian Securities and Investments Commission (ASIC).

Is OANDA A Good Forex Broker For Beginners?

OANDA will appeal to some beginners. With no minimum deposit, a free demo account and a comprehensive selection of tutorials, new forex traders should be well-equipped. With that said, we would like to see 24/7 customer support and social trading features for novice traders.

Does OANDA Have A Forex App?

Yes, the OANDA trading platform is optimized for iOS and Android devices, including mobile phones and tablets. Our fxTrade Mobile review uncovered over 50 technical indicators, including 32 overlays, plus 11 drawing tools and 8 chart types. We also like that you can fully configure the interface and toggle easily between charts and market news.

How Long Do Withdrawals Take At OANDA?

Withdrawals at OANDA are fairly fast, taking up to 1 business day for e-wallets, 3 business days for bank cards, and up to 5 days for international wire transfers. We have no complaints or issues about withdrawal times in our review, though more payment methods could be offered.

Is OANDA A Market Maker Or ECN Broker?

OANDA is a market maker, meaning orders are processed through the broker’s dealing desk. As such, the broker takes the opposite side of forex trades, creating liquidity in the market. This system helps the firm execute positions quickly, though it could also be why spreads aren’t as tight as alternatives.