XM

-

💵 CurrenciesUSD, EUR, GBP, AUD, JPY, ZAR, CHF, SGD, PLN, HUF

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: 1.9 EURUSD: 1.6 GBPEUR: 1.8 -

# Assets55+

-

🪙 Minimum Deposit$5

-

🫴 Bonus Offer$50 No Deposit Bonus When You Register A Real Account, Deposit Bonus Up To $5000, Free VPN Service

Our Opinion On XM

XM is a top-rated forex broker with a range of account types to suit both beginners and experienced traders. We like that the brokerage offers 50+ currency pairs with feature-rich trading software in MetaTrader 4 and MetaTrader 5. Our team also appreciate the low spreads, fast execution speeds and excellent research, which makes XM a good forex broker for online traders.

Summary

- Instruments: 1000+ spanning forex majors, crosses and exotics, plus stocks, indices, energies, metals, and cryptos

- Live Accounts: Ultra Low Micro, Ultra Low Standard, and Zero

- Platforms & Apps: MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Deposit Options: Bank cards, wire transfers, and e-wallets

- Demo Account: Yes

Pros & Cons

- Strong regulatory oversight including FCA, CySEC & ASIC

- Full MetaTrader suite with forex signals & EAs

- Market research including daily videos & ideas

- 24/5 customer support in 30+ languages

- Tight forex spreads from 0.0 pips

- Scalping & hedging permitted

- Low minimum deposit of $5

- High leverage up to 1:1000

- Negative balance protection

- Good education centre

- 30+ awards & accolades

- $5 inactivity fee after 90 days

- No crypto in some countries

- No copy trade platform

- PayPal not supported

- Limited bonus deals

- No clients from USA

Is XM Regulated?

Our team are comfortable that XM is a highly regulated forex broker. Through a network of local entities, the brokerage holds licenses in various countries, with oversight from leading agencies:

- UK Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Germany’s Federal Financial Supervisory Authority (BaFin)

- Australian Securities and Investments Commission (ASIC)

- International Financial Services Commission (IFSC)

- Financial Services Commission of Belize (FSC)

- Dubai Financial Services Authority (DFSA)

We do note, however, that access to compensation schemes varies by entity. EU traders, for example, can access up to €20,000 in the case of business insolvency. In contrast, UK traders can access up to £85,000 through the FSCS.

Our experts also appreciate that client funds are segregated from company money in tier-one financial institutions. In addition, it is good to see that XM provides negative balance protection, preventing customers from losing more than the money in their account.

Forex Accounts

XM offers three live accounts with a choice of fee structures and contract sizes. This is useful as it means there is a profile to suit different traders and forex strategies.

We rate that each account benefits from a low minimum deposit of just $5, which is competitive vs AvaTrade ($100) and IC Markets ($200). It also makes XM a good option for beginners.

Our experts also find that Islamic solutions are available for Muslim traders, though we would like to see PAMM accounts added.

In our opinion, the Micro account is the best pick for beginners while the Zero profile is a good option for high-volume forex traders looking for the lowest spreads. We highlight the key trading conditions and differences between the accounts below.

Ultra Low Micro Account

- Commission – Zero

- Spreads – From 0.6 pips

- Base Currencies – USD, EUR, GBP

- Maximum Open Orders – 300 positions

- Contract Size – 1 lot = 1000 units, minimum trade volume 0.1 lots

Ultra Low Standard Account

- Commission – Zero

- Spreads – From 0.6 pips

- Base Currencies – USD, EUR, GBP

- Maximum Open Orders – 300 positions

- Contract Size – 1 lot = 100,000 units, minimum trade volume 0.01 lots

Zero Account

- Commission – $3.50/lot

- Spreads – From 0 pips

- Base Currencies – USD, EUR, JPY

- Maximum Open Orders – 200 positions

- Contract Size – 1 lot = 100,000 units, minimum trade volume 0.1 lots

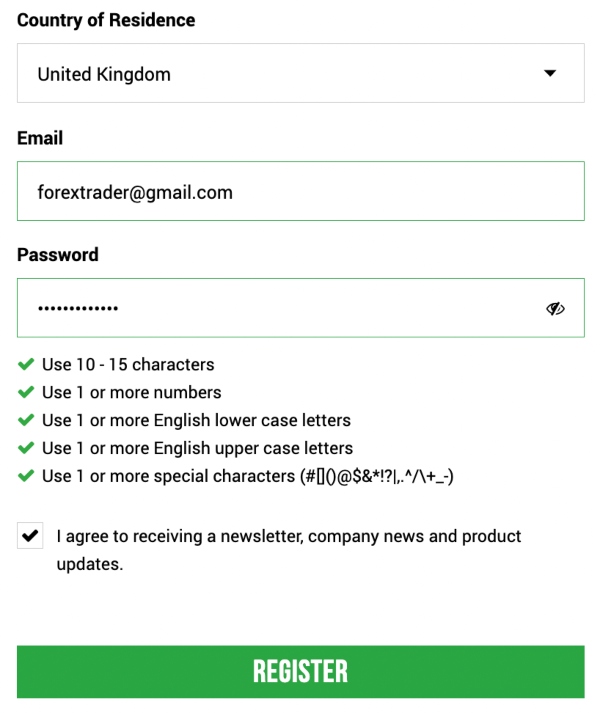

How To Open An XM Account

I found it quick and easy to register for an XM account. In fact, it took me less than five minutes to sign up for a live profile. To get started:

- Complete the online application form with your name, email, and country of residence

- Verify your email using the link sent to the registered email address

- Sign in to the secure client area

- Select ‘Open A Real Account’

- Enter the outstanding personal details

- Fill in your investor profile

- Choose a platform, account, leverage and base currency

- Finalize the account trading setup

Spreads & Commissions

Pricing varies between XM accounts but is competitive.

Ultra Low Micro Account and Ultra Low Standard Account holders benefit from commission-free trading alongside low, floating spreads. The Zero Account offers the tightest spreads, though a $3.50 commission applies per $100,000 traded.

While using XM, we got spreads of 0.6 pips on GBP/USD and EUR/USD and 1 pip on EUR/JPY. This is good compared to other major forex brands.

We also appreciate that the broker offers fractional pip pricing, with five digits vs the four typically offered by forex brokers. This allows traders to take advantage of smaller price movements.

Non-Trading Fees

On the downside, our team note that a $5 inactivity fee applies after 90 days of account dormancy, though this is waived if there is no balance held.

An inactivity penalty is common in the online forex industry, though some competitors such as Admiral Markets and IG Index, do not impose a charge until 24 months of inactivity.

Other fees to be aware of include swap fees applied to positions held overnight, except for Islamic profiles.

On a lighter note, we like that XM do not charge deposit or withdrawal fees and will cover third-party international bank charges for payments over $200. This makes it a low-cost broker to get started with with.

For active traders looking to deploy automated strategies, it is worth keeping in mind that the VPS tool is available for $28 a month.

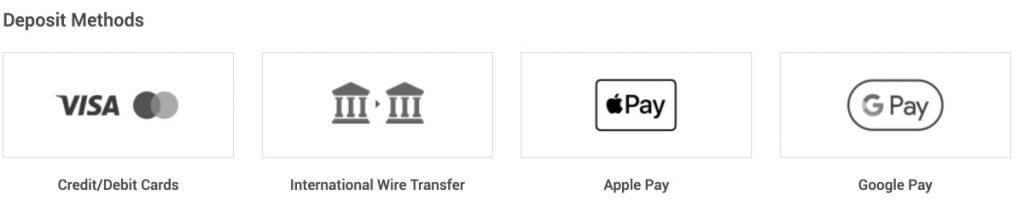

XM Payment Methods

XM offers a good range of global payment methods, including credit/debit cards, bank wire transfers, Google Pay, Apple Pay, plus e-wallets like Sticpay, Skrill, and Neteller. This made it easy for me to fund my account and start trading forex quickly.

On the downside, PayPal and cryptocurrency, including Bitcoin deposits, are not currently supported. Minimum and maximum transfer limits also apply depending on your country of residency.

It is good to see that deposits are accepted in all major currencies and converted to the base currency (including USD, EUR and GBP). This will meet the needs of most global forex traders.

Our team finds that the time taken for funds to be available in your forex trading account will depend on the payment method, but many are near-instant.

Internal transfers between live accounts can also be requested in the client portal.

How To Make A Deposit

- Login to the XM members area

- Select ‘Account’ from the top menu and then ‘Accounts’ in the submenu

- Ensure the ‘Real’ account button is selected and click the green ‘Deposit’ icon

- Choose from the available payment methods

- Follow the on-screen instructions to complete the deposit

Note, account verification must be completed to deposit or withdraw to/from a live account.

Withdrawals must be made back to the same method as deposits in line with regulatory requirements. While this may seem frustrating, in our experience of forex broker reviews, it’s pretty standard.

We did note that withdrawals are typically processed within 24 hours. This is reasonably fast, though some forex brokers process withdrawal requests within a few hours (if submitted during working hours).

We like that there are no minimum or maximum withdrawal limits. We encounter this at other firms and it can make getting your hands on profits frustrating.

Forex Assets

XM stands out for its wide range of products. In particular we like the long list of currencies, spanning majors, minors, and exotics. With more than 50 forex pairs available, there are instruments to suit various trading strategies and setups.

Importantly, forex can be traded via contracts for difference (CFDs). These leveraged derivatives allow traders to go long or short on currencies with a small cash outlay.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

XM also offers a modest selection of other instruments, including precious metals, energies, indices, and stocks.

Whilst not as extensive as the range of assets at some competitors, the broker offers access to popular global markets, providing opportunities to build a diverse portfolio.

Supported assets include:

- Precious Metals – Trade spot gold and silver or palladium and platinum as futures CFDs

- Soft Commodities – Speculate on the price of eight soft commodity futures CFDs including cocoa, sugar and wheat

- Energies – Speculate on the price of brent crude oil, natural gas, and WTI oil cash CFDs or oil and gas futures CFDs

- Indices – Trade 21 cash index CFDs or invest in 11 future index CFDs including the Dax 40, Nasdaq 100 and FTSE 100

- Stocks – Trade 1000+ global company shares, including US, UK, and EU firms such as Goldman Sachs, McDonald’s, Mastercard and BP

Execution

XM is a market maker meaning all forex trades are executed through an online dealing desk, whereby the company matches orders with its own liquidity sources.

Fortunately, the broker guarantees a 100% order execution policy and 99.35% are executed in less than one second. I particularly like that the firm has a no re-quotes or rejection policy. This is a notable advantage vs some competitors.

XM Leverage

Access to leverage varies depending on your location and the corresponding XM entity and regulatory requirements.

EU clients can trade with 1:30 leverage, as stipulated by ESMA restrictions. Non-EU clients, on the other hand, can access higher leverage up to 1:1000. Whilst lower than the 1:2000 leverage provided by the likes of FXTM, this will still provide ample purchasing power for most retail traders.

It is worth calling out that XM will issue a margin call when your account equity drops below 100%. The stop-out level is triggered when the equity in your account falls below 50% of the required margin.

It is also worth noting that leveraged trading can amplify losses as well as gains.

Platforms & Apps

XM offers excellent trading software with the MetaTrader suite. You can download the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms to desktop devices. Alternatively, MT4 and MT5 can be accessed through popular internet browsers or iOS and Android-compatible mobile apps.

Both MT4 and MT5 support online forex trading. And whilst neither platform offers the sleekest of designs, we appreciate the breadth of technical indicators, drawing tools, customizable graphs/charts, expert advisors (EAs), and forex signals. We think this makes the MetaTrader software and servers suitable for a range of forex trading strategies.

Our team finds that MT4 is the best pick for beginners while experienced traders will likely prefer MT5. The latter offers more advanced trading tools and a greater selection of features, including 21 timeframes (9 on MT4), 44 graphical objects (31 on MT4), 38 integrated indicators (30 on MT4), 6 pending order types (4 on MT4), plus multi-thread strategy testing (single-thread on MT4). We also like that MT5 houses a built-in economic calendar that isn’t available on its predecessor. It is good to see that this is even available in the WebTrader solution.

Importantly, we find that the XM app offers a smooth transition from the fully-featured desktop software. The mobile trading solution supports all 1000+ instruments with live price quotes, custom charts, and in-built indicators. Additionally, news streams and market insights can be accessed from the interface.

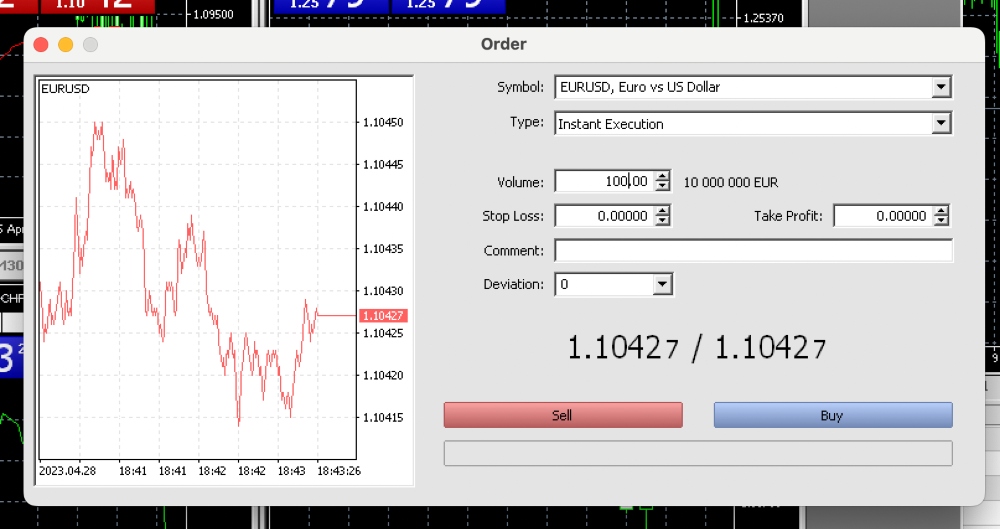

How To Make A Forex Trade

Making a trade on the XM MetaTrader platforms is straightforward:

- Sign in to the MT4 or MT5 platform

- Select the ‘New Order’ icon in the toolbar at the top of the screen

- Use the search function to find an asset, such as the EUR/USD

- Input the trade volume

- Enter any stop loss or take profit levels

- Add any comments (optional)

- Press ‘Sell’ or ‘Buy’

Note, one-click trading can also be activated.

Forex Tools

In this XM review, our experts find that the broker ranks highly for its selection of forex trading tools.

We like that pip value calculators, margin calculators, and economic calendars are available for free from the official website. Useful additional technical indicators are also available to XM clients subscribed to the VIP education package. This includes Ichimoku, Bollinger Bands, and River indicators.

The broker also offers a Virtual Private Server (VPS), providing unlimited server connectivity, with 1.3 GB RAM and 25 GB hard drive capacity. This is good news for users looking to implement automated forex trading strategies. With a reliable VPS, our team aren’t worried about technical interruptions and downtime. To connect to your forex account:

- From your desktop homepage, search ‘Remote Desktop Connection’

- Enter the XM VPS IP address

- Click ‘Connect’

- Enter your member login credentials in the following screen and select ‘Ok’

- Review the security terms and conditions

- Select ‘Connect’ to confirm

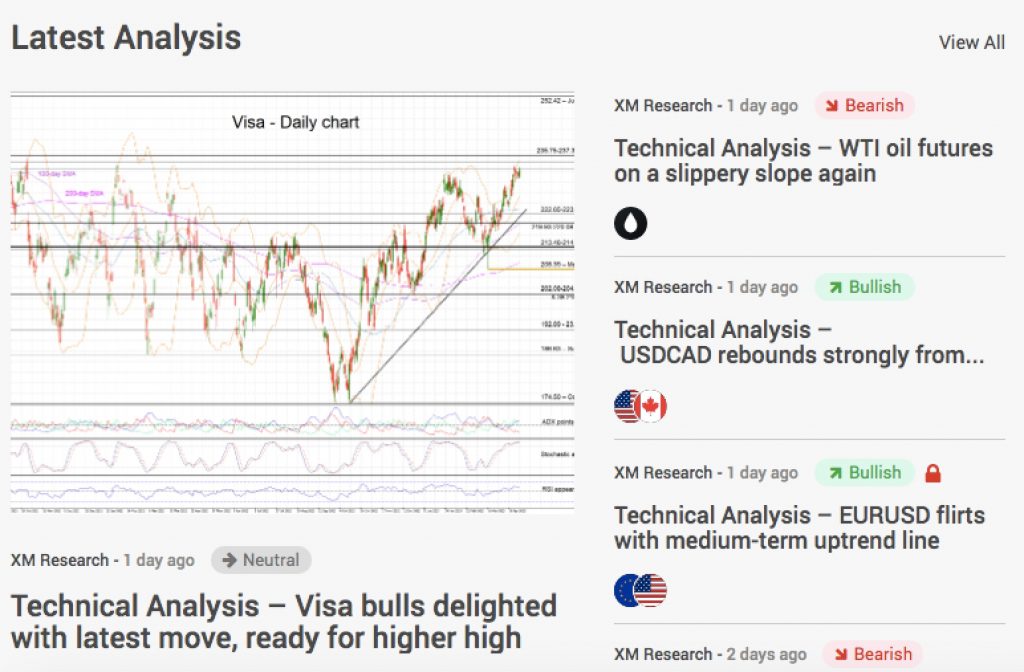

Forex Research

From my experience, I think the XM education and market research offering is strong.

The research hub provides daily updates on the latest financial news and analyst insights discussing market events, trade ideas, and strategy building. I also like that there is plenty of information that can be filtered by instrument, including forex.

Another bonus in my mind is that content is posted throughout the day, providing real-time market updates. We particularly like the Market Pulse tool, which sorts assets by online mentions and sentiment data.

Forex Education

We are comfortable that XM is a great pick for beginners with an online learning center full of live tutorials, blog posts, educational videos, plus webinars and seminars.

Content is suitable for both forex traders of all experience levels, though, for established traders, we recommend skipping past the first few series.

The broker’s TV and podcast channels are also great additions, and not typically provided by forex brokers.

Demo Account

Another advantage of XM for our experts is the free demo account where users can practice trading with a $100,000 virtual balance. You can experience live trading conditions and learn all the functions available on the MT4 and MT5 terminals.

A major benefit of the XM demo account is that you can use the paper profile alongside a live trading account to test strategies or practice opening and closing positions. Simply login to the client area and use the arrow symbols along the top to switch between live and demo modes.

How To Open A Demo Account

I found it quick and hassle-free to sign up for a simulator account. To get started:

- Select the ‘Open A Demo Account’ button on the broker’s website to register

- Complete the online application form and verify your registered email address

- Log in to the client area

- A demo account will be automatically opened, available to access from the homepage dashboard

- Select ‘Platforms’ from the top menu and choose a terminal to practice trading

XM Bonus Offers

Our team think XM could improve in terms of promotions for new and loyal traders. We cannot see any offers or contests available, including free no-deposit bonuses.

With that said, the forex broker does sometimes offer financial incentives, with a 30$ welcome bonus available at the start of 2023, for example.

Importantly, make sure you review bonus terms and conditions before opting in. We often see tough withdrawal restrictions which makes it hard to get your hands on profits. EU traders should also note that access to bonuses may be limited due to regulatory restrictions.

Customer Service

XM is a good pick for forex traders looking for a reliable customer service team. Support is available 24/5 while contact methods include live chat, telephone contact numbers, and an email address.

It is good to see local contact details and support in 25+ languages, ideal for global clients. This includes English, Chinese, and Arabic.

When our experts tested the live chat, we received a response in less than one minute. We also found the online help center useful, providing FAQs and detailed information by category. Topics include live account registration, account validation guidance, and withdrawal issues.

Contact details:

- Email – support@xm.com

- Live Chat – Bottom right of the broker’s webpage

- Telephone – +357 25029933 (Cyprus), +612 8607 8385 (Australia) or +30 211 7700022 (Greece)

XM is also active on social media channels including Facebook, Twitter, and LinkedIn.

Company Details

XM was established in 2009 and is a well-known forex and CFD brokerage.

The company has over 10 million registered clients from over 190 countries worldwide. The group also boasts an impressive 2 billion orders executed with no rejections or requotes. For me, this is a good sign that the brokerage is legitimate and trustworthy.

In addition, XM has received multiple industry awards, including the Top 10 Popular Brokers Award 2022 and the Best CFD Provider 2023.

The firm operates from a headquarters location in Limassol, Cyprus.

Trading Hours

XM trading sessions are open between Sunday at 10:05 pm and Friday at 9:50 pm, GMT. Trading hours within this will vary by instrument. The forex market, for instance, is open 24 hours a day, due to international trading hubs.

Upcoming holidays and market closure schedules can be viewed on the broker’s website (via the company news section). We also appreciate that they are reflected in the trading terminal (GMT time zone).

Who Is XM Best For?

Our team finds that XM has a lot to offer both beginners and experienced forex traders. The reliability of the MetaTrader platforms provides a stable trading environment, alongside competitive spreads and access to excellent market research.

We did note that the list of tradable assets is not as extensive as some other brands, though, for forex trading, there is no reason XM shouldn’t be a contender in your shortlist.

FAQ

Is XM A Scam Or Legit?

We are confident that XM is a legitimate and genuine forex broker. The global brokerage holds licenses with multiple respected regulators, including the UK Financial Conduct Authority (FCA) and Cyprus Securities & Exchange Commission (CySEC). We also like that the brand provides negative balance protection and uses segregated client accounts.

Can I Trust XM?

Our team is comfortable that XM is a trustworthy forex broker. User reviews and ratings are generally positive and there aren’t reports that the brokerage is running scams. The company also follows industry-standard security protocols, from using encryption technology to facilitating access to investor compensation schemes in the event the firm should go bankrupt.

Is XM A Regulated Forex Broker?

Yes, we found that XM is regulated by various financial bodies. The forex broker holds licenses with the Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investment Commission (ASIC), UK Financial Conduct Authority (FCA), and Germany’s Federal Financial Supervisory Authority (BaFin). XM also abides by regulations in the various other countries that it operates.

Is XM A Good Or Bad Broker?

Overall, I think that XM is a good forex broker, with 50+ forex pairs and hundreds of additional assets, including indices, stocks, and commodities. Retail investors can trade on the popular MT4 and MT5 platforms and run automated strategies 24/7 using the VPS. Trading fees are also competitive, with spreads from 0.6 pips on the Ultra Low Micro Account and the Ultra Low Standard Account.

Is XM Good For Beginners?

Our team believe that XM is an excellent broker for beginners. There is a rich education center where novice traders can build their knowledge of the financial markets. We like that the demo account has no time limit and comes with a $100,000 virtual bankroll. We also think the $5 starting deposit reduces the entry barrier for beginners.

Is XM A Market Maker?

XM is a market maker broker, processing orders through an in-house dealing desk. With this, XM has a 100% order execution policy with no rejections or re-quotes.

Does XM Offer Low Forex Trading Fees?

XM offers low fees for online forex trading. You can either trade commission-free with tight spreads from 0.6 pips or access raw spreads from 0 pips with a $3.5 commission per $100,000 traded. We also rate that are no deposit or withdrawal fees.

Does XM Have A Forex App?

XM offers a mobile trading app with MT4 and MT5 access. The application can be downloaded for free to iOS and Android (APK) devices. I can analyze the forex market, view quotes, and execute trades in a few taps from the downloadable app.

How Long Do Withdrawals Take At XM?

In my experience, withdrawal requests from an XM account are typically processed within 24 hours. The time it takes for funds to be received varies between payment methods. With that said, most withdrawals are paid within several working days.

Can You Make Money Trading Forex With XM?

XM offers competitive forex trading conditions with fast execution speeds and low fees. However, profits are not guaranteed. An effective trading system and sensible risk management strategy will be required.