XTB

-

💵 CurrenciesUSD, EUR, GBP

-

🛠 PlatformsProprietary

-

⇔ Spread

GBPUSD: 0.1 EURUSD: 0.2 GBPEUR: 0.1 -

# Assets45+

-

🪙 Minimum Deposit$0

-

🫴 Bonus OfferNo

Our Opinion On XTB

XTB stands out as one of the best forex and CFD brokers in 2024. We find the xStation platform easy to use with a modern design and excellent analytical tools. Forex spreads are also lower than most competitors based on our tests, starting from 0.1 pips. In addition, the $0 minimum deposit makes XTB accessible to beginners.

Looking at the drawbacks, there is a withdrawal fee which can be avoided at other forex brokers. The absence of copy trading may also deter some users. However these are minor complaints for us, and overall, XTB impresses for its excellent trading conditions for forex investors.

Summary

- Instruments: 5,800+ including 71 currency pairs, stocks, indices, ETFs, commodities, cryptos

- Live Accounts: Standard, Professional

- Platforms & Apps: xStation

- Deposit Options: Bank cards, wire transfers, e-wallets

- Demo Account: Yes

Pros & Cons

- The xStation platform is well-designed with dynamic charting and a user-friendly interface

- Respected forex broker listed on the Warsaw Stock Exchange with 780,000+ clients

- Excellent education for beginners with free e-books when you sign up

- Authorized by trusted regulators including the FCA and CySEC

- Transparent pricing with tight forex spreads from 0.1 pips

- No minimum deposit to get started

- Free demo account with $100,000

- Slow customer support with a 10-minute wait during testing

- No forex copy trading for hands-off investors

- Withdrawal fee for small transfers

- MT4 and MT5 not supported

- US clients not accepted

Is XTB Regulated?

XTB is a tightly regulated broker, authorized by several reputable agencies and listed on the Warsaw Stock Exchange. As a result, we are confident that the brokerage follows various measures designed to protect traders’ funds.

For example, client money is segregated from the broker’s capital to ensure it is not used for business operations. XTB also offers negative balance protection to EU and UK clients, though it is not available to those registered with the international branch.

On the negative side, our team did find that the broker was fined PLN 9.9 million by the FSA in Poland for asymmetric price slippage that occurred between 2014 and 2015. XTB benefitted from price slippage when the market moved in its favor, while its clients did not. And although there have been no reported incidents since, this breach did impact retail traders.

Below are details of XTB’s regulatory credentials:

- XTB S.A. – Regulated by the Komisja Nadzoru Finansowego in Poland

- XTB Sucursal – Regulated by the National Securities Market Commission in Spain

- XTB Ltd (UK) – Regulated by the Financial Conduct Authority in the UK (FRN 522157)

- XTB Ltd (CY) – Regulated by the Cyprus Securities and Exchange Commission in Cyprus (LN 169/12)

- XTB International Limited – Regulated by the Financial Services Commission in Belize (LN 000302/438)

- XTB MENA Ltd – Regulated by the Dubai Financial Services Authority in the Middle East and North Africa (RN F006316)

Forex Accounts

I like that XTB keeps things simple by offering one account for retail traders. There is no minimum deposit, making it straightforward to get started and EU customers can choose from multiple base currencies, including USD, EUR, GBP and HUF, while international customers can open an account in USD.

I am also reassured to see that an Islamic account is available, allowing Muslim investors to avoid swap fees. Rather than paying interest on overnight positions, there is a $10 commission per lot.

Eligible traders in the UK and Europe who want to trade with higher leverage can also apply to be elected professionals. To do so, you need to satisfy two of the following requirements:

- At least 10 significantly sized trades per quarter over the previous four quarters.

- Hold a current portfolio of at least €500,000. This includes investments and cash deposits.

- Have spent at least one year in the financial sector in a role that required you to have trading knowledge.

How To Open An Account

I found the registration process fairly straightforward, however you do need quite a lot of personal information to hand before you start the application form.

- Enter your email address and country of residence, and set a password

- Provide personal details, including your name, date of birth and nationality

- Enter your home address, base currency and language

- Complete financial information including annual income and source of funds for trading

- Complete the questions about your trading experience

- Activate your account by uploading proof of ID and residency

- Wait for the customer support team to verify your account

Trading Fees

XTB offers lower fees than most brokers we test. The pricing model is also transparent, with the firm taking its cut via floating spreads and commissions on stocks and ETFs.

The minimum spread for the EUR/USD is 0.8, while the target spread during good market conditions is 0.9. Spreads are also tight for other popular currency pairs, at 0.9 on the GBP/USD and 1.0 on the EUR/GBP, which is lower than competitors like eToro.

We also rate the tight spreads on other assets with indices seeing a minimum of 0.4 on the US500 and 1.4 on the UK100. For stock CFDs, there is a 0.3% markup added to the spread.

Non-Trading Fees

There is an inactivity fee of $10 per month. Yet while this is twice what XM charges, it only comes into effect if there has been no trading activity for 365 days and no deposits for 90 days, which is reasonable.

As expected, there are also fees for positions that are held overnight. The exact amount you pay depends on the asset you are trading and the size (long vs short). For the EUR/USD pair, long and short swap fees are -0.008736% and 0.003182%, respectively, which is competitive.

Payment Methods

Deposits

I am satisfied with the range of deposit methods available, including debit and credit cards, wire transfers and electronic wallets like Skrill.

In addition, there are no fees for bank transfers or payments using credit cards, though XTB will not cover any fees your bank charges.

On the downside, deposits via Neteller, SafetyPay and Skrill come with a charge, ranging from 1% to 2%. This is a shame since competitors, such as IC Markets, offer free deposits via these methods.

Deposits using credit cards and e-wallets are processed instantly, which is ideal if you want to start trading quickly. I would recommend these over bank transfers, which can take a few days to process.

Overall, it is inexpensive and easy to start trading with XTB.

How To Make A Deposit

I appreciate that I can fund my XTB account in a few easy steps:

- Sign in to your account through the xStation platform or the Client Office on the website

- Navigate to the ‘Deposit’ section

- Select the account to deposit funds to and the chosen method

- Follow the on-screen instructions to confirm the details

- Wait for the funds to appear in your live account

Withdrawals

I am less impressed with the withdrawal process at XTB. Only bank transfers are accepted, and to request a withdrawal, you need to first provide a bank statement to verify that your bank account is genuine.

There is also a fee of $20/€16/£12/3,000 HUF if you withdraw less than the free limit. For UK and EU clients of XTB Ltd, this is $100/€80/£60/12,000HUF. For international clients, the free limit is only $50 and anything under this minimum comes with a $30 charge, which is on the high side.

If you request a withdrawal before 1:00 pm on a business day, XTB aims to complete the transfer that same day. If you make the request after this, you can expect the funds to be processed the following working day, which is similar to other brokers.

Forex Assets

XTB offers a strong selection of 71 major, minor and exotic currency pairs. This provides plenty of trading opportunities for beginners through to seasoned forex traders, and rivals the range of instruments available at alternatives like Plus500.

All forex assets can be traded via contracts for difference (CFDs), offering long and short opportunities and leverage to increase trading power.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

XTB excels in its selection of non-forex assets, with thousands of instruments available spanning stocks, indices, commodities, ETFs and cryptocurrencies.

EU clients have the greatest offering, with more than 5,800 assets, including shares in over 3,200 companies. UK clients have access to more than 2,150 assets, the majority of which are CFDs on stocks and fractional shares. International clients can also trade 46 cryptocurrencies, including Bitcoin and Ethereum.

Altogether, XTB offers one of the widest selections of CFDs, especially when it comes to stocks, offering exposure to major economies, industries and sectors.

Execution

The broker’s execution model varies depending on the branch you register with. The subsidiaries XTB Limited and XTB International Limited are not market makers, although both branches use the parent company XTB, based in Poland, as their liquidity provider.

This does call into question conflicts of interest and transparency. We also found that execution speeds trail the fastest brokers – on average, orders are completed in 201 ms.

Leverage

XTB offers high leverage up to 1:500 for non-EU/UK customers. This means that with just $50, a client can get buying power of $25,000.

As we expect, traders based in the UK and EU are restricted to a maximum leverage of 1:30. Note that this 1:30 leverage is only available on major forex pairs such as EUR/USD. Minor and exotic forex pairs are limited to 1:20.

While using XTB, I have found that a margin call is issued when your margin level drops below 100%. To avoid your positions being automatically closed, you will need to deposit funds to increase the margin level. A stop-out will occur if your margin level falls below 50%.

Platforms & Apps

I was a little apprehensive to find that the brokerage does not offer popular third-party platforms such as MetaTrader 4 and MetaTrader 5 – the only platform available is the broker’s proprietary xStation. Fortunately, I enjoy using this feature-rich platform which has a simple, clean layout. It is also easy to access via a desktop client, web browser and mobile app.

All the functions are easy to navigate and highly customizable, with more than 45 technical indicators and patterns such as Bollinger Bands, Stochastic Oscillators and Moving Averages. Moreover, there are multiple time frames, ranging from 1 minute up to 1 month, supporting both short-term and long-term strategies.

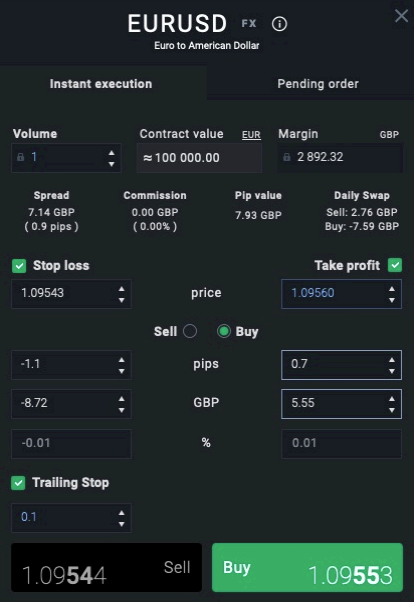

When it comes to making a trade, I can choose between instant execution or pending order, with four order types including buy and sell stop and buy and sell limit. There are also effective risk management tools, including take profit and stop loss, with a trailing stop loss variant available.

How To Make A Forex Trade

New investors won’t have any problems placing a trade on the xStation platform. Simply follow these steps:

- Sign in to the xStation platform

- Select your chosen forex pair from the drop-down or search bar

- Drag and drop the pair to move it onto the chart

- Click the forex pair and open the order box

- Select either ‘Instant Execution’ or ‘Pending Order’

- Enter the order details such as volume, take profit and stop loss

- Confirm the trade and wait for it to complete

- To close the trade, click the red ‘X’ button

Forex Tools

XTB offers a couple of good forex trading tools. I find the forex screener useful – a heat map showing price trends for every forex pair over the past day, week and month. In the example below, you can see how the USD/ZAR pair dropped by 1.3% in the proceeding 24 hours while the USD/MXN rose by 0.7%.

I also like the price alerts, which notify me when certain market conditions are met. To use the system, click the price alerts button above the chart, select your desired asset, whether you are interested in the bid or ask price and specify the strike price. You can also type in any comments that you want to appear when you receive the alert.

Looking at the negatives, XTB doesn’t support Expert Advisors (EAs) or Virtual Private Servers (VPSs), both of which serve active forex traders deploying automated strategies. These services can be found at alternatives like XM.

To improve its rating further, we would also like to see the broker introduce forex copy trading. This can appeal to newer traders and hands-off investors, and is available at firms like AvaTrade.

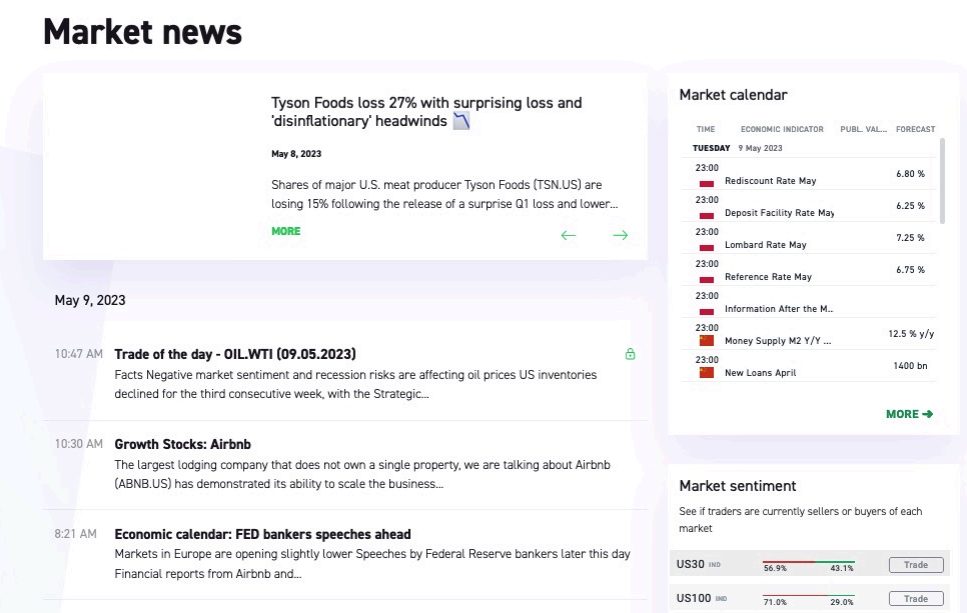

Forex Research

XTB offers comprehensive market analysis and news, accessible through the official website and the xStation platform. Major news and recent headlines are provided daily, and offer a good level of detail on forex and other markets.

The economic calendar also highlights noteworthy events and announcements, so you can prepare for potential price action. I particularly like that you can filter events by ‘light’, ‘medium’ or ‘high impact’.

The market sentiment tool is also useful, and allows me to see what the general buy or sell views are towards key assets such as EUR/USD and NASDAQ.

Forex Education

We rate the forex education on offer. There is an extensive ‘Knowledge Base’ full of excellent guides to help beginners get started with trading online. These include brief introductions to what forex is, how to prepare yourself for trading and how to complete technical analysis.

When I signed up, I was also impressed that XTB sent 2 free e-books on technical analysis and fundamental analysis. Together, these provide 45 pages of information on how to interpret market signals and news and then capitalize on subsequent price action.

To strengthen its offering further, I would like to see XTB offer a wider range of learning materials, including video tutorials and podcasts.

Demo Account

XTB’s free demo account is a great place to start for beginners. Each account comes with $100,000 of virtual funds but you can request more via email.

When you first sign up, the demo account is only valid for 30 days, however, I found that you can request to have this extended or even not expire at all. This makes it a great tool for testing and developing strategies in a risk-free mode.

How To Open A Demo Account

The process to open a demo account is quick and easy:

- Go to the XTB website and click on the ‘Demo’ button

- Select your country of residence, input your email and click ‘Confirm’

- Type in your phone number, name and password

- Go to the xStation platform and begin trading

Bonus Offers

As promotional schemes are not permitted by UK, EU and MENA regulators, customers of XTB Ltd and XTB MENA are not offered a welcome bonus.

However, clients of XTB International, which is regulated by the FSC of Belize can claim a welcome bonus equal to 50% of the first deposit. To claim the bonus, you need to make a trade equal to 15% of your first deposit within 60 days of opening the account. Additionally, the initial deposit must be at least $100.

Trading Restrictions

XTB does not impose any restrictions on trading strategies such as forex scalping. This means the brokerage is a good option for serious traders and active investors.

Customer Service

I think customer support at XTB is good but could be improved in some areas. The service desk is contactable 24/5, meaning you can seek help at any time when the forex market is open. I am also impressed that support is available in 14 languages including English, French, German, Chinese, Arabic and Italian.

However, on the negative side, there is a typical wait time of around 10 minutes to speak to a person on live chat, which is slower than many alternatives. You also must go through a chatbot before being connected to a human agent, which can be frustrating.

If you need immediate assistance, I recommend calling the hotline and avoiding email, as it took over a day to receive a response during testing.

Every new client is assigned an account manager, though they are limited to assisting with setting up accounts, rather than supporting with trading or investing questions.

You can contact the broker using the following details:

- Live Chat: Located in the bottom right-hand corner of the website

- Email: uksales@xtb.com (UK office); accountsupport.cy@xtb.com (EU office); sales_int@xtb.com (International office)

- Telephone: +44 203 695 3085 (UK office); +357 2572 5352 (EU Office); +48 222 739 976 (International office)

XTB is also active on social media including Facebook, Twitter and YouTube. There is also an FAQ section on the website, covering key queries including how to open an account and how to make a deposit.

Overall, it would be nice to see 24/7 support and faster live chat response times to compete with award-winning brokers such as Plus500.

Company Details

XTB initially launched as X-Trade in 2002 before changing its name to XTB in 2004. The broker has grown rapidly and now has offices in 14 countries including France, Germany, the UAE and the UK. The brokerage has its headquarters in Warsaw, Poland where it is listed on the local stock exchange.

Reassuring for us is the firm’s large client base. In 2021, it had over 400,000 accounts, while by 2023 that number had climbed to over 780,000.

Adding to its credibility are various accolades, including the Best Forex Broker and Best CFD Broker at the 2022 Rankia Awards.

Trading Hours

XTB’s trading hours are aligned with market opening times and most other brokers. Currency pairs can be traded 24 hours a day from 11:00 pm on Sunday until 10:00 pm CET the following Friday.

Other markets depend on the specific asset or exchange. For example, most stock CFDs are available Monday to Friday from 9:00 am to 5:30 pm CET.

Who Is XTB Best For?

XTB is best for beginner traders. There is no minimum deposit, an intuitive trading platform available on web and mobile, plus excellent education and research. The range of fast, low-cost and secure deposit options also makes it quick and easy to start trading forex with XTB.

FAQ

Is XTB Legit Or A Scam?

XTB is a legitimate broker. The company is listed on the Warsaw Stock Exchange, has hundreds of thousands of clients, and has a good reputation in the online trading industry.

Can I Trust XTB?

We consider XTB a trustworthy forex broker. The award-winning broker is authorized by respected regulators, has a large client base and offers important safeguards like negative balance protection.

Is XTB A Regulated Forex Broker?

Yes, XTB is regulated by several financial agencies. These include top-tier regulators, the FCA and CySEC overseeing XTB Ltd, the DFSA authorizing the XTB MENA branch, and the FSC of Belize regulating XTB International.

Is XTB A Good Or Bad Forex Broker?

XTB is a good forex broker with straightforward joining requirements, a reliable trading platform and low fees. It is also widely respected and offers a suite of extra tools to bolster the trading environment, including a forex screener and price alerts.

Is XTB Good For Beginners?

XTB is an excellent choice for forex beginners. There is no minimum deposit, a free demo account, high-quality education, and a transparent pricing model with no hidden fees.

Does XTB Offer Low Forex Trading Fees?

Forex trading fees at XTB are low. The broker charges a variable spread which was competitive during testing, coming in at 0.8 pips on the EUR/USD. This is similar to comparable brokers like Plus500 and lower than alternatives like eToro.

Does XTB Have A Forex App?

Yes, xStation is available as a downloadable app from the Apple App Store and the Google Play Store for iPhones and Android mobiles. Mobile traders don’t sacrifice functionality with the ability to analyze markets, place trades and manage positions in a few clicks.

How Long Do Withdrawals Take At XTB?

Withdrawals from XTB must be made using a bank transfer, which typically takes around 1 working day to complete. If you are registered with XTB Ltd as an EU or UK resident, the broker aims to complete any withdrawal requests sent before 1:00 pm on the same day.

Can You Make Money Trading Forex With XTB?

XTB offers attractive spreads with zero commission on forex assets, but there remains a high risk that you will lose money. We recommend taking advantage of the broker’s risk management tools, including take profit and stop loss orders.

Does XTB Offer Futures Trading?

No, XTB does not offer futures trading. Trading is limited to CFDs on forex, commodities, stocks, ETFs, indices and cryptos.

Article Sources

XTB MENA Limited – DFSA License