eToro

-

💵 CurrenciesUSD

-

🛠 PlatformsTradingCentral

-

⇔ Spread

GBPUSD: 2 pips EURUSD: 1.5 pips GBPEUR: 1.5 pips -

# Assets49

-

🪙 Minimum Deposit$10

-

🫴 Bonus Offer-

Our Opinion On eToro

eToro is a good choice for beginners with a top-rated investing app and copy trading. We also like the comprehensive market access with over 3000 instruments spanning forex, stocks, commodities, and cryptos. Looking at the negatives, our team would like to see eToro lower its forex and CFD fees, which trail the cheapest brokers. Overall though, eToro is a trustworthy broker with more than 30 million users and an award-winning social trading platform.

Summary

- Instruments: 3000+ including 50+ currencies, stocks, indices, commodities, cryptos, ETFs, NFTs

- Live Accounts: Standard, Islamic, Professional

- Platforms & Apps: WebTrader, app

- Deposit Options: eToro Money Wallet, credit/debit cards, bank wire transfer, PayPal, Neteller, Skrill, iDeal, POLi, Przelewy 24, Rapid Transfer, Klarna

- Demo Account: Yes

Pros & Cons

- Multi-regulated broker with licenses from FCA, CySEC, ASIC, and FSA

- Great for beginner traders and casual investors with a user-friendly app

- Industry-leading social investing network with real-time copy trading

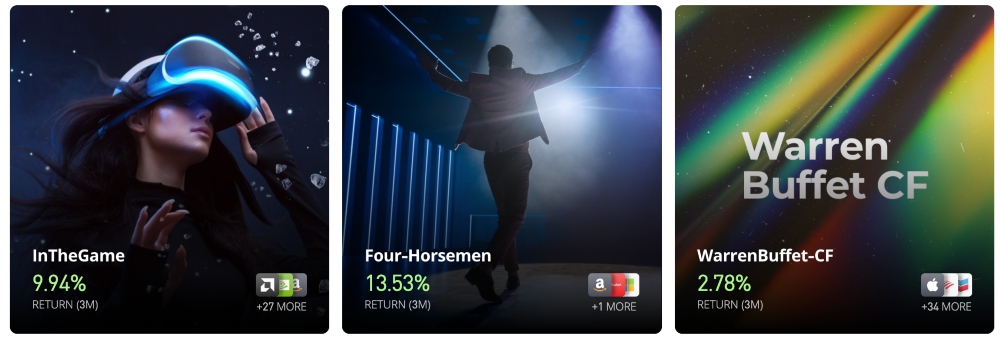

- Smart Portfolios with pre-built thematic investment strategies

- Fractional shares to access high-value stocks

- Excellent education centre and market research

- 80+ digital currencies and crypto staking

- Commission-free stock trading

- High trading fees on forex and CFD instruments

- No crypto deposits and withdrawals

- Slow account verification

- $10 inactivity fee

- $5 withdrawal fee

Is eToro Regulated?

We are impressed with eToro’s regulatory coverage. The company is registered with well-regarded regulators and provides various customer safeguarding initiatives. We particularly like that there is negative balance protection, preventing users from losing more than their account balance. eToro also holds insurance with Lloyd’s of London with protection of up to €1 million in the case of insolvency.

Yet whilst our team is reassured to see the firm has no history of scams, historical reports of security breaches and compromised data are notable drawbacks. As a result, we recommend that traders add two-factor authentication (2FA) at the login stage.

The brokerage is registered under several key entities:

- eToro (Europe) Ltd – Regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 109/10

- eToro (UK) Ltd – Regulated by the Financial Conduct Authority (FCA), license number 583263

- eToro AUS Capital Limited – Regulated by the Australian Securities & Investment Commission (ASIC), license number 491139

- eToro (Seychelles) Ltd – Regulated by the Financial Services Authority of Seychelles (FSA), license number SD076

Forex Accounts

I like that eToro makes it easy to get started by offering one standard account. This means all users get access to the broker’s full suite of assets, tools and trading products.

With that said, the introduction of account currencies beyond USD would be a welcome addition. This would make it easier for clients in different countries to manage their accounts and investing activities in their local currency.

Note that an Islamic-friendly account is also available to Muslim clients.

How To Open An eToro Account

I found the account registration process straightforward. To get started:

- Navigate to the ‘Sign Up’ form

- Add your email address and create a username and password

- Alternatively, sign up with an existing Google or Facebook account

- Review and agree to the terms & conditions and privacy agreement

- Select ‘Create Account’

- Verify your account using the link sent to the email address provided

Note that account verification must be completed to access all features. You will need to upload proof of residency and identity documentation. Unfortunately, it can take a few days for eToro to complete the verification checks, which is slower than some competitors.

eToro Club

Active traders should also consider the availability of the eToro Club. Benefits of being a member include lower fees and discounts, access to exclusive insights and market summaries, plus VIP events.

We also like that traders are automatically enrolled in the scheme when they meet the minimum threshold for the respective tier (Bronze: $0, Silver: $5000, Gold: $10,000, Platinum: $25,000, Platinum+: $50,000, Diamond: $250,000).

We break down the key benefits of the Silver tier below, which is the first upgrade after progressing from the Bronze account that all traders start on.

Silver perks:

- 85% crypto staking

- Dedicated account manager

- eToro Money Visa debit card

- Exclusive access to smart portfolios

- Tax report and 5% tax return discount

Trading Fees

The pricing is a mixed bag. We appreciate that the broker offers stock trading with zero commissions. This is good news for casual investors looking to buy and hold dividend-paying stocks for example. Crypto trading fees are also reasonable at 1%, while ETFs are available with a 0.15% charge.

However, the drawback is that spreads on the broker’s forex assets are wider than some alternatives. While using eToro, we are seeing floating spreads from 1 pip on forex CFDs, including on EUR/USD and USD/JPY. Spreads on other popular assets are higher at 1.5 pips on EUR/GBP and 2 pips on GBP/USD, which is less favorable than some top forex brokers.

Ultimately, eToro isn’t the lowest-cost broker for online forex trading, but we can appreciate that the trade-off is easy-to-use trading tools from a trustworthy and reputable brand.

Non-Trading Fees

We are pleased to see that the majority of the additional services are available for free, including CopyTrader and Smart Portfolios. These are excellent – arguably market-leading features and we are sure they will attract many traders.

eToro does, however, charge $5 for withdrawals, regardless of value. We feel that this is expensive, particularly for beginners or those with smaller account balances.

Additionally, a $10 inactivity fee applies after 12 months of account dormancy. This is not too costly, and some brands start charging after three months, but we still prefer not to see this kind of charge at all.

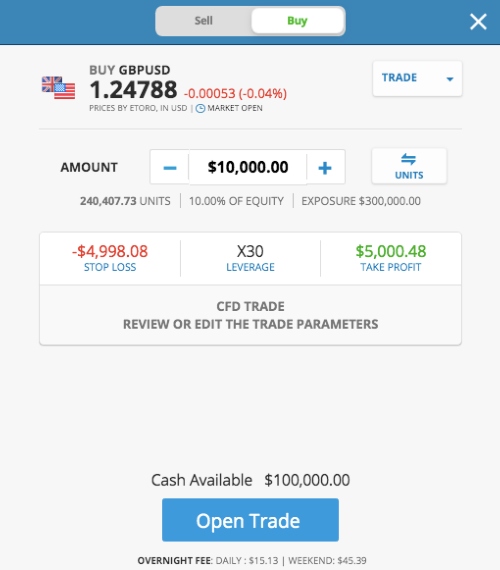

It is also worth calling out that overnight rollover and weekend fees apply. These charges are displayed at the bottom of the new order window. Refunds may also be available for assets that incur drastic price changes between sessions.

Note that taxes based on earnings are the trader’s responsibility.

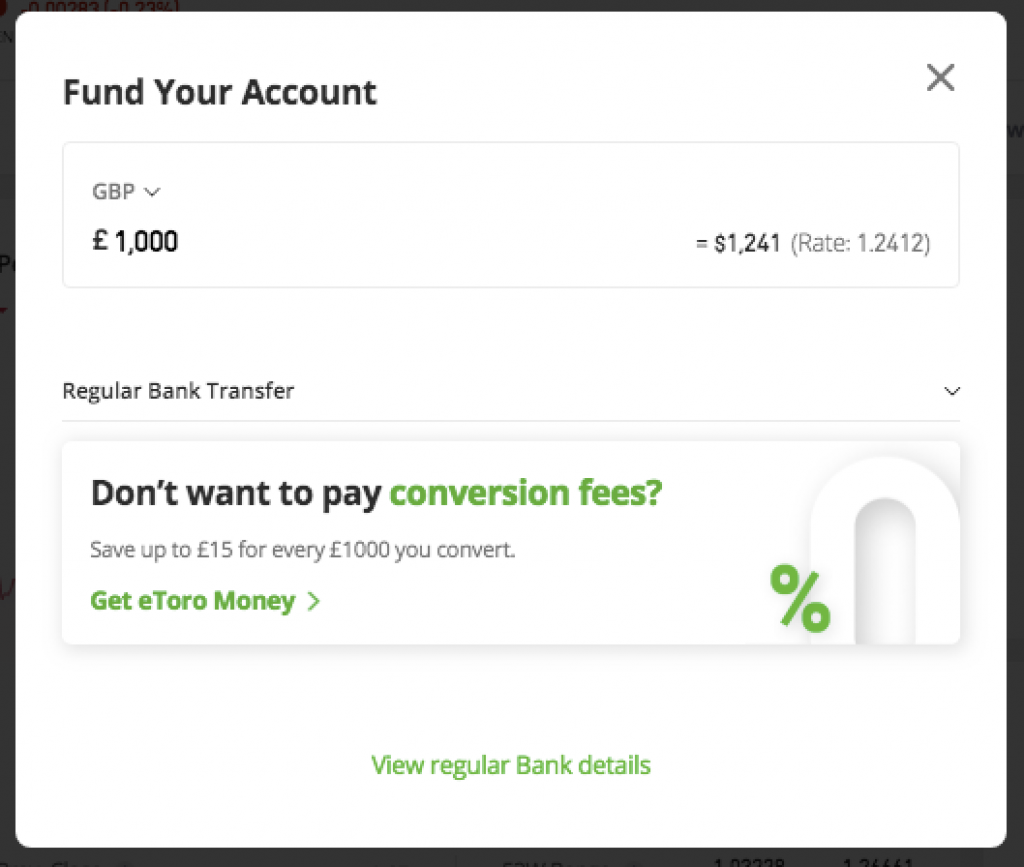

Payment Methods

Our team rates the large list of accepted deposit and withdrawal options, including e-wallets, credit/debit cards, and bank wire transfers. This makes it easy for traders in different countries to fund their accounts with a convenient and low-cost payment method. The only notable omission is Bitcoin (BTC) funding and other crypto solutions.

However, as we highlight elsewhere in this eToro review, we feel that trading accounts only being denominated in USD is a notable drawback. Payments made in an alternative currency will be converted at the current market rate, and fees will apply. This understandably frustrates some users, including me.

Fortunately, we appreciate that these charges can be avoided by using eToro Money. This free digital wallet, available in the EU and UK, can be used to deposit funds to your trading account instantly, with no fees or conversion charges.

Minimum deposit requirements vary by country, the lowest being $10 with an ongoing minimum of $50 thereafter. We are comfortable that this is broadly aligned with other leading brokers, though we are less thrilled to see a minimum bank transfer of $500, which is steep.

| Deposit Method | Processing Time | Supported Currency | Maximum Deposit |

| Credit/Debit Cards | Instant | USD, EUR, GBP, AUD | $40,000 |

| PayPal | Instant | USD, EUR, GBP, AUD | $10,000 |

| Wire Transfer | 4 – 7 days | USD, EUR, GBP | No maximum |

| Rapid Transfer | Instant | USD, EUR, GBP | $5,500 |

| Skrill | Instant | USD, EUR, GBP | $10,000 |

| Neteller | Instant | USD, EUR, GBP | $10,000 |

| POLi | Instant | AUD | $10,000 |

| iDEAL | Instant | EUR | $50,000 |

| Przelewy 24 | Instant | PLN | $11,500 |

| Klarna/Sofort | Instant | EUR | $30,000 |

| eToro Money | Instant | GBP | £250,000 |

How To Make A Deposit

We find that adding money to an eToro trading account is fast and straightforward. All payments are also transmitted using Secure Socket Layer (SSL) technology.

- Log into the platform

- Select the ‘Deposit’ icon from the bottom of the menu on the left

- Choose a currency from the top drop-down

- Choose a payment method from the second drop-down

- Enter the payment details

- Click ‘Deposit’ to approve the transfer

We also like the Automatic Recurring Deposits function, which enables regular transactions from a registered credit/debit card. This can be set up after your first successful card payment. To do so:

- Select ‘Settings’ from the side menu and then choose ‘Recurring Deposits’

- Click ‘Let’s Go’

- Input the value of the frequent payment and the details of your chosen payment card

- Select ‘Next’

- Choose the frequency of deposit (monthly, every two weeks, or weekly)

- Choose the repeat date

- Review and accept the terms and conditions

- Select ‘Activate’

Withdrawals

One area where we would like to see eToro improve its offering is its withdrawal fee. Users are charged $5 each time they want to withdraw profits, which is a disadvantage vs competitors like AvaTrade (no fee) and OANDA (one free withdrawal per month).

Conversion fees also apply when you withdraw funds in a currency other than USD. On a more positive note, eToro Money provides instant withdrawals. The majority of other payment methods, including withdrawals to PayPal, have a two-day processing time, except for wire transfers and cards which can take up to ten working days. These timelines while not the fastest are similar to other top-rated brokers.

Forex Assets

Our experts are satisfied with the suite of forex instruments available. With over 50 assets available spanning majors, minors, and exotics, eToro compares well with rival brokers.

Importantly, forex can be traded via contracts for difference (CFDs). This allows users to bet on rising or falling prices. Leverage can also be used to increase position sizes and requires just a small cash outlay.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

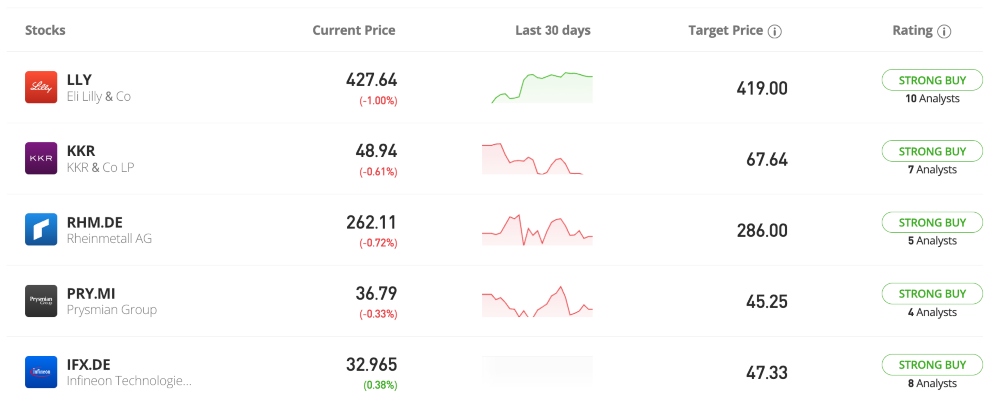

Non-Forex Assets

It is eToro’s extensive selection of non-forex assets which helps it stand out. We are confident that there is plenty of opportunity to build a diverse portfolio, especially when it comes to the stock offering, which really impressed me with the selection of companies and exchanges covered. With a wide range of cryptocurrencies, indices, ETFs and even NFTs also available, we are comfortable that there is something to satisfy most traders and investors.

Our useful tip for beginners is to consider fractional shares, which allow users to invest in a portion of a full share, for example, a half or a third. This can be a good way to speculate on expensive stocks with less upfront cost.

Tradable assets include:

- Stocks – 3000+ company stocks listed on 18+ exchanges including Apple, Tesla, Netflix, JP Morgan, and BlackRock. New stocks and IPO listings are also available

- Indices – 20 index funds such as S&P 500, NASDAQ 100, FTSE 100, and Dow Jones 30

- ETFs – 300 exchange-traded funds such as SPDR S&P 500 ETF, iShares 20+ Year Treasury Bond ETF and Invesco QQQ

- Commodities – 32 soft and hard commodities including gold, platinum, oil, wheat, and sugar

- NFTs – Explore and trade non-fungible tokens from a MetaMask wallet through the NFT marketplace

- Cryptocurrency – 80 popular cryptos including Bitcoin Cash, Monero, Ripple, Ethereum, Dash, and Litecoin

The broker does not offer penny stocks or binary options.

eToro Execution

eToro is classified as a Straight Through Processing (STP) broker. This means all orders are processed instantly via internal liquidity providers.

The benefits of this approach include fast execution speeds and, in theory, competitive spreads. eToro essentially acts as a silent partner connecting customers’ orders with their liquidity providers, applying a markup on the spread.

Note that if the market is closed, orders will be processed at the best price available when the market reopens.

Leverage

Like most competitors, eToro offers leverage. We like that leverage trading is flexible, with traders selecting their preferred level when they open a trade.

The new order window displays leverage as ’x’. For example, ‘x10’ leverage means a ratio of 1:10. Simply explained, for every $10 invested, you can get $100 in purchasing power.

Note that margin limits vary between entities due to local regulations:

eToro (Europe) Ltd, eToro (UK) Ltd & eToro AUS Capital Limited

- Major Forex Pairs – 1:30

- Minor Forex Pairs, Indices and Gold – 1:20

- Commodities – 1:10

- Stocks & ETFs – 1:5

- Cryptocurrency – 1:2

eToro (Seychelles) Ltd

- Major Forex Pairs – 1:400

- Commodities and Indices – 1:100

- Minor Forex Pairs – 1:50

- Stocks & ETFs – 1:10

- Cryptocurrency – 1:5

Platforms & Apps

eToro’s in-house trading software is a great option for beginners. The platform can be accessed through popular internet browsers. It is also available as a mobile app for Apple and Android devices. And while there is no Mac or Windows desktop download, our team is comfortable that the platform is fast, stable and reliable through major browsers.

I rate how intuitive and clutter-free the dashboard is with simple navigation. The process of executing, monitoring and closing trades is also straightforward. And, while this is an easy-to-use platform, there is also plenty going on under the bonnet. I particularly like the watchlist creation, portfolio performance dashboard, integrated economic calendar, and market sentiment data.

One of my favorite features is the way the platform incorporates news stories and market analysis for each asset in a straightforward layout. Clicking an asset’s ‘News’ tab will bring up a list of links to the latest relevant news stories, as well as an evaluation of whether the news is positive, negative or neutral. The same page displays a graph of market sentiment, and for companies’ stocks, you can also find analysis and price targets from industry experts. These are less common features that I think can really help the research process and encourage good habits in rookie traders.

eToro also incorporates TradingView charts, which can be customized with nine timeframe views (60 seconds to one week), five chart types, 13 drawing tools, and 60+ technical indicators including volume and trend indicators.

Our team finds that the mobile trader app supports the same graph functionality, though with smaller screen compatibility. Traders can set price alerts, view the latest financial news, and use the widgets to analyze various financial markets.

Importantly, I like that the app allows me to buy, sell and monitor trades at the click of a button while on the go. I can also view personal financial statements and portfolio performance including deposit history, badge status, and current leverage costs.

How To Make A Forex Trade

We found it easy to open a forex trade on the eToro web platform:

- Search for an instrument (use the search bar at the top, select from your watchlist, or explore the movers on the dashboard homepage)

- Click on the relevant currency pair and select ‘Invest’

- Choose ‘Buy’ or ‘Sell’ from the toggles at the top

- Amend the value to trade or switch to ‘Units’ to enter a specific trade size

- Select the ‘Stop Loss’, ‘Leverage’, and ‘Take Profit’ icons to make amendments

- Click ‘Open Trade’ to confirm the order

Forex Tools

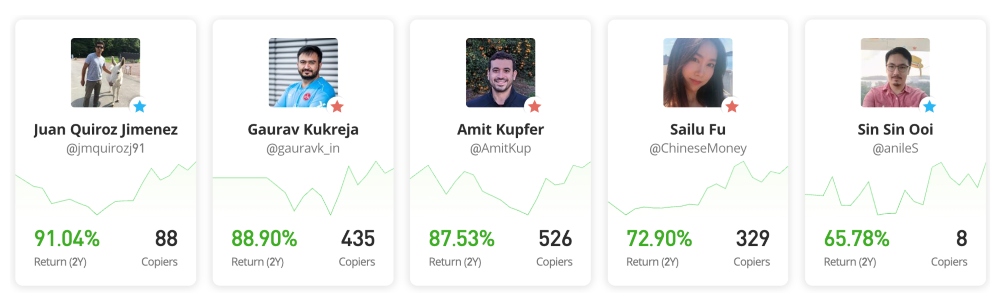

CopyTrader

The shining light in eToro’s offering is the CopyTrader. This easy-to-use tool allows you to easily compare professional traders’ portfolios and past performance and, when you find one you feel is suitable, mirror their positions in real-time.

Our experts find the number of filters available to find who to copy especially impressive. This includes being able to follow and monitor the top 10 or top 100 traders’ performance in real-time.

The minimum investment amount required to copy a trader is $200 with a minimum trade size of $1, though we are happy that the copy trading service also works on the demo trading account.

How to get started:

- Select ‘Discover’ from the dashboard menu

- Scroll down to the CopyTrader section

- Select ‘View All’ and use the filters along the top to find top traders

- Click ‘Copy’

- Use the icons to select the amount of funds to invest

We also like that the Popular Investor Program offers annual rewards for leading traders with a public profile. Eligibility requirements include a minimum $1000 unrealized equity, a minimum two-month trading history, and a low-risk score.

Smart Portfolios

A bespoke product offered by eToro that we are big fans of is Smart Portfolios, curated by the brand’s team of analysts. These are ready-built investment portfolios with collections of assets split into various categories, ideal for beginners or those with limited market knowledge.

With diverse portfolios including sector-specific baskets for everything from cannabis to tech or portfolios that aim to maximize dividend yields, we are confident beginners and experienced traders can make use of them.

On the downside, there is a $500 minimum investment value, which is reasonably high for some new investors.

Crypto Staking

Another interesting feature at eToro that catches our interest is the crypto staking rewards for individuals holding digital currencies in their internal wallets. This essentially works like bank interest, with rewards paid monthly in the respective cryptocurrency. Our team particularly like that the payout process is automatic.

Forex Education

Education is where we rank eToro above many competitors. The Academy is one of the best learning platforms we see available. We rate the simplicity of the filtering system so you can navigate between information. You can filter by experience level, learning style, and topic.

There are comprehensive courses designed to guide you from basic forex trading keywords to implementing complex strategies. There is also content on how to trade with leverage, understanding company revenue and dividends, long-term automated trading strategies, and investment tips for cryptocurrency.

We also like that you can learn by video, webinars, community forums, tutorials, step-by-step guides, and even podcasts.

Overall, we are happy that there is a decent range of content for all skill levels, with a particular focus on beginner traders and casual investors.

Forex Research

Aside from the Academy, eToro offers high-quality market research including weekly analysis articles by asset class.

The ‘Digest & Invest’ section also publishes video interviews with guest speakers discussing the latest market trends and price shifts. We find these simple to understand, with plenty of information to aid trading decisions.

Taken as a whole, we feel eToro is one of the best brokers for education and trading research.

eToro Demo Account

We are pleased to see a demo account is available to all users. Traders can access a virtual bankroll with $100,000.

The demo account is a great place to start if you want to test the firm’s tools, such as CopyTrader, and get up to speed with the platform and app. We also like the straightforward switch function between real and virtual portfolios, which can be used at any time.

How To Open A Demo Account

- Select the ‘Sign Up’ logo from the top right of the eToro website

- Create a username and password and add an email address. Alternatively, sign up with your existing Google or Facebook account

- Agree to the T&Cs

- Select ‘Create Account’

- Click ‘Switch to Virtual’ from the bottom of the left menu

- Start trading in demo mode

Bonus Offers

I don’t think the bonuses at eToro are anything special. The firm offers occasional incentives for new clients. For example, I can claim a $10 welcome bonus when I deposit $100, which is enticing but not game-changing.

The broker also promotes an Invite Friends referral scheme with a $50 bonus for every successful new sign-up. Note, the referred customer must open at least one trade of $100+.

I find that eToro does a much better job of rewarding loyal customers. The eToro Club, details of which can be found in the ‘Accounts’ section above, is a great way to get a range of perks as you deposit and trade.

Customer Service

The level of customer support will depend on your location. While in countries such as Australia telephone and email support is provided, in countries like the UK contact methods are limited to an inquiry form, along with a live chat function that is open 24/7 for registered clients.

Fortunately, response times are quick based on tests. We get a reply almost immediately when we use the live chat which is reassuring.

Additionally, there is an FAQ section with ample information and user guides. Questions include how to open and close an account, how to withdraw funds, how to set or remove risk parameters such as a trailing stop loss and take profit, and guidance on login problems.

Company Details

eToro is a globally recognized social investment network and online broker, and we were happy with the company’s transparency.

eToro was established in 2007 by three founders; Ronen Assia, Yoni Assia, and David Ring. The first design of the platform was released in September 2007 before being upgraded in May 2009 to a more sleek WebTrader solution. The brand launched the world’s first social trading platform in 2010, which was promptly awarded the Finovate Europe Best of Show prize in 2011.

eToro has seen significant growth over the years, with a community of more than 30 million registered users and services available in 100+ countries.

The group has headquarters in Israel, with additional offices across the world including in the UK, USA, Cyprus, and Australia.

Trading Hours

Trading times at eToro vary between instruments due to specific market timings, though the platform is available 24/7.

The forex market opens on Sunday at 11:05 PM (GMT +1) and closes on Friday at 10:30 PM (GMT +1), while gold market hours are between Sunday at 23:00 (GMT +1) and Friday at 9:30 PM (GMT +1).

The ‘Market Hours’ page on the broker’s website provides a useful guide to different assets’ trading hours, allowing you to filter market opening hours by local time zone and view upcoming events and closures.

Who Is eToro Best For?

eToro is a top-rated broker, especially for novice traders and casual investors. The low deposit, demo account, CopyTrader, and straightforward app will appeal to beginners. We also rate the education academy and access to fractional shares.

We would like to see tighter spreads on forex instruments and no withdrawal fee, but these are fairly minor blemishes on an otherwise excellent offering.

FAQ

Is eToro Legit Or A Scam?

eToro is a legitimate broker with a good reputation and authorization from several respected regulators. Other user reviews are also generally positive ranking the brand for top-tier education, social investing, and trading resources.

Can I Trust eToro?

Yes, eToro is a trustworthy, well-regarded brokerage that provides a secure trading environment. Negative balance protection is provided, along with two-factor authentication to secure client accounts. The broker is also regulated by respected financial agencies, including the FCA and CySEC.

Can You Make Money Trading Forex With eToro?

eToro provides opportunities to make money trading 3000+ assets, including forex, stocks, commodities, and cryptos. The broker also offers leverage of up to 1:30 for UK, EU and Australian investors or 1:400 for traders with its offshore branch. Leverage trading can be used to boost potential returns, though losses are also amplified.

Importantly however, there is no guarantee you will make money trading online. Many retail investors lose money so make sure you weigh up the risks.

Does eToro Offer Low Forex Trading Fees?

eToro’s forex trading fees are reasonable but not the cheapest. There are no commission charges and spreads start from 1 pip on major currency pairs. On the downside, we see alternative forex brokers with tighter spreads.

Is eToro A Regulated Forex Broker?

Yes, eToro is regulated by several financial authorities, including the FSA, ASIC, FCA, and CySEC. All retail investors benefit from negative balance protection and segregated funds. The broker also has taken out additional insurance to protect traders in the case of business insolvency.

Is eToro A Good Broker For Beginners?

eToro is a good broker for beginners. Users can benefit from a demo account, a low minimum deposit, and a copy trading service. And whether you are interested in learning the basics of day trading forex, including how to short positions, the free training academy is a great place to start. There are also plenty of user guides on how to sell stock on the app, learn the main functions of the 2.0 WebTrader, and deposit funds.

Does eToro Have A Forex App?

Yes, eToro offers a proprietary mobile app, available for download to iOS and Android devices. You can manage your account, view your portfolio performance, analyze the forex market, and trade in a few clicks. The mobile application also links with the web-based platform.

How Long Do Withdrawals Take At eToro?

Withdrawals sent to an eToro Money wallet are normally available instantly. All other payment methods are processed within two working days, though wire transfers and cards can take up to ten working days. In our experience, this is in line with other major brokers.

What Is The Difference Between ‘Order’ And ‘Trade’ On The eToro Platform?

The difference between eToro’s order vs trade function is that a trade is placed under current market conditions and an order is a request to open a position at a later date/time to the current market price.