Best CIRO-Regulated Forex Brokers

Canadian traders will get the best protection by choosing a forex broker regulated by the Canadian Investment Regulatory Organization (CIRO). In this guide, we share our pick of the best CIRO-regulated forex brokers, reviewed by our experts.

Note, the CIRO is the successor to the Investment Industry Regulatory Organization of Canada (IIROC).

List of Best CIRO Forex Brokers

Following our exhaustive tests, we recommend these 5 forex brokers authorized by the CIRO:

- Forex.com: Excellent platforms. Low fees for active traders. Wide range of currency pairs.

- OANDA: Beginner-friendly platform. Fast account opening. Top-rate research.

- AvaTrade: FX CFDs and FX options. Excellent Academy for education. Fixed spreads.

- Interactive Brokers: Outstanding record. Deep liquidity. Professional-grade platforms.

- CMC Markets: Massive investment offering. Great mobile app. Low trading fees.

| Forex.com | OANDA | AvaTrade | Interactive Brokers | CMC Markets | |

|---|---|---|---|---|---|

| CIRO-Regulated | Yes | Yes | Yes | Yes | Yes |

| CAD Account | Yes | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $300 | $0 | $0 |

1. Forex.com

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, eSignal, TradingView, AutoChartist, TradingCentral

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.0 -

# Assets80+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

Why We Recommend Forex.com

Forex.com maintains its position as our preferred choice for active forex traders, offering excellent charting platforms, a huge range of currency pairs and low fees with cash rebates.

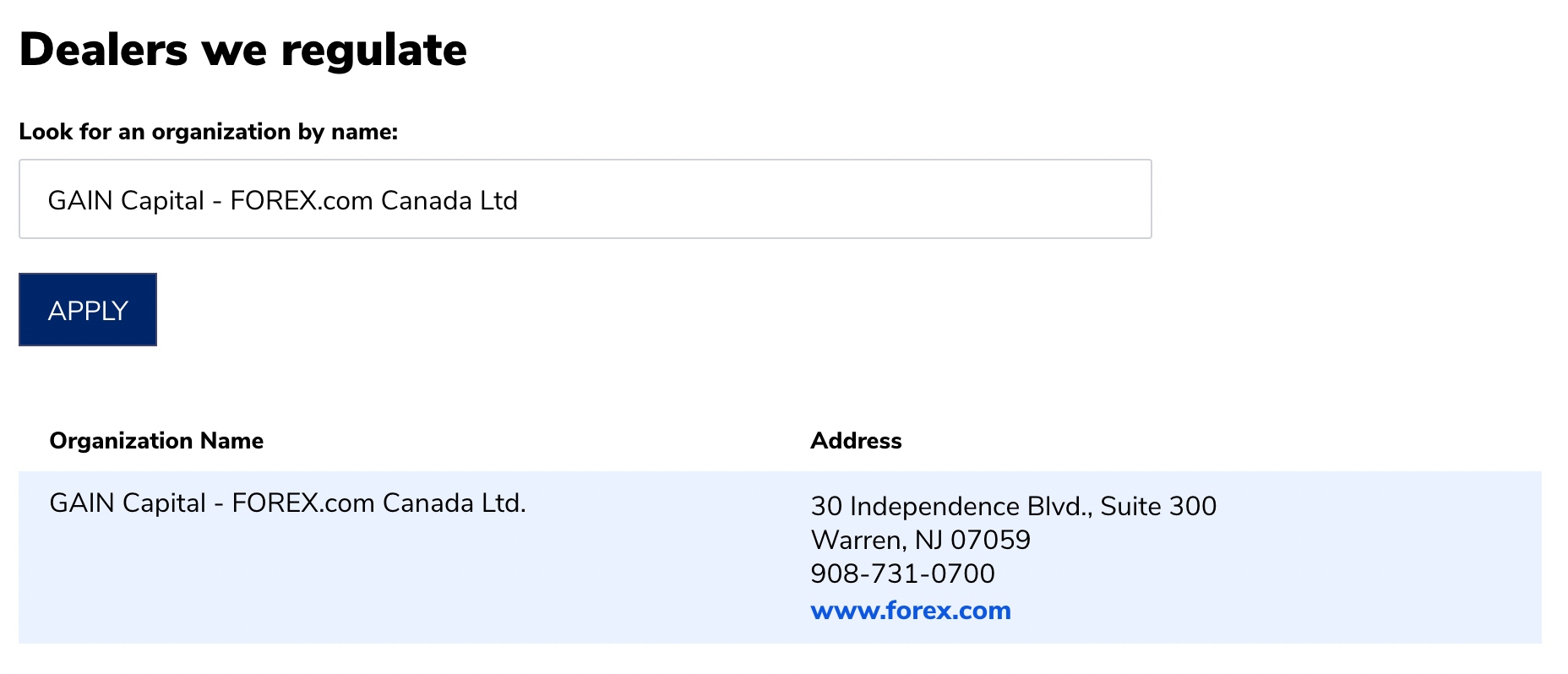

The forex broker is regulated by the CIRO through FOREX.com Canada Ltd.

Pros/Cons Of Forex.com

Pros

Excellent platform line-up including TradingView and MetaTrader

Web Trader delivers a fantastic user experience with an intuitive design and a comprehensive charting package powered by TradingView, providing 80+ indicators and 50+ drawing tools.

Alternatively, MetaTrader is great for algo traders, offering FX Blue Expert Advisors and access to the MetaTrader Market, where you can download 950+ trading bots.

Trade 2500+ instruments including 80+ currency pairs

Forex.com outshines most competitors with an extensive selection of currency pairs, offering trading opportunities on major, minor, and exotic pairs, including USD/CAD, CAD/JPY, and AUD/CAD.

Transparent fees from 0.0 pips in the Raw account

You get optimal trading conditions on the USD/CAD with 0.0 pip spreads and a low $5 commission per $100k in the Raw account.

Beginners also benefit from commission-free, variable spread trading in the Standard account, while high-volume traders enjoy fee reductions of 5-15% through the Active Trader program.

Cons

Narrow range of currencies on MetaTrader

While Forex.com’s platform boasts 2500+ markets, MetaTrader only offers around 500 instruments, with a limited range of currency pairs.

$15 monthly inactivity fee

The inactivity penalty kicks in after 12 months and is higher than alternatives like OANDA with its $10 charge.

Why Is Forex.com Better Than The Competition?

Forex.com shines for its massive selection of currency pairs, choice of competitive pricing models, and platforms that cater to a range of trading styles.

Who Should Choose Forex.com?

Active traders should choose Forex.com. Fees are especially low if you qualify for the Active Trader program while MetaTrader 5 offers a powerful suite of analysis tools and expert advisors.

Who Should Avoid Forex.com?

Casual traders should avoid Forex.com. Its tools and pricing models are geared towards active traders and there is no copy trading service.

2. OANDA

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD

-

🛠 PlatformsMT4, MT5, TradingView, AutoChartist

-

⇔ Spread

GBPUSD: 1.4 EURUSD: 0.8 GBPEUR: 0.9 -

# Assets68

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend OANDA

We recommend OANDA because it continues to offer a great entry point for new forex traders with straightforward account opening, exceptional research tools, and platforms tailored for beginners.

The forex broker is regulated by the CIRO through OANDA (Canada) Corporation ULC.

Pros/Cons Of OANDA

Pros

Intuitive web platform with sophsticated analysis and risk management tools

We found OANDA’s web platform easy to pick up. It features an intuitive design that makes it straightforward to select currency pairs and conduct analysis in the central charting widget. Easy access to stop-loss orders and user guides also helps with managing risk, especially for new traders.

Premium research and analysis through MarketPulse

Expert commentary and technical summaries cover the forex market comprehensively, including insights into events impacting the value of the Canadian Dollar (CAD).

Signing up takes 5 minutes with no minimum deposit

OANDA ensures a swift sign-up process through a user-friendly dashboard. The process requires personal details, citizenship information, address details, employment status, trading experience, and ID verification.

Cons

Education trails best-in-class forex brokers

While the guides on leverage trading and risk management, alongside webinars with live market analysis, provide a solid starting point, they fall short of the comprehensive resources found with alternatives.

We also find navigating the learning resources frustrating with no option to filter by experience level.

Forex spreads are wider than the cheapest brokers

During testing, the USD/CAD came in at 1.5 pips while the EUR/USD stood at 1.4 pips, wider than brokers with sub-1 pip spreads.

That said, the commission-free trading model caters to newer traders seeking traditional spread-only pricing.

Why Is OANDA Better Than The Competition?

OANDA stands out with a fast, hassle-free start, no minimum deposit requirement, and the convenience of a CAD-denominated account.

The platform also provides an excellent user experience for newer traders, offering web accessibility and a customizable workspace.

Who Should Choose OANDA?

OANDA is ideal for beginners. While the education center could improve, the user-friendly web platform, low entry requirements, and supportive research tools make it a suitable choice for new traders.

Who Should Avoid OANDA?

Traders looking for comprehensive educational materials will be better served by AvaTrade.

3. AvaTrade

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD

-

🛠 PlatformsMT4, MT5, AlgoTrader, TradingCentral, DupliTrade

-

⇔ Spread

GBPUSD: 1.5 EURUSD: 0.9 GBPEUR: 1.5 -

# Assets50+

-

🪙 Minimum Deposit$100

-

🫴 Bonus OfferWelcome bonus 20% up to 10.000$

Why We Recommend AvaTrade

We recommend AvaTrade because it offers diverse ways to trade forex, including CFDs and options, alongside fixed over-the-market spreads, and top-notch educational resources.

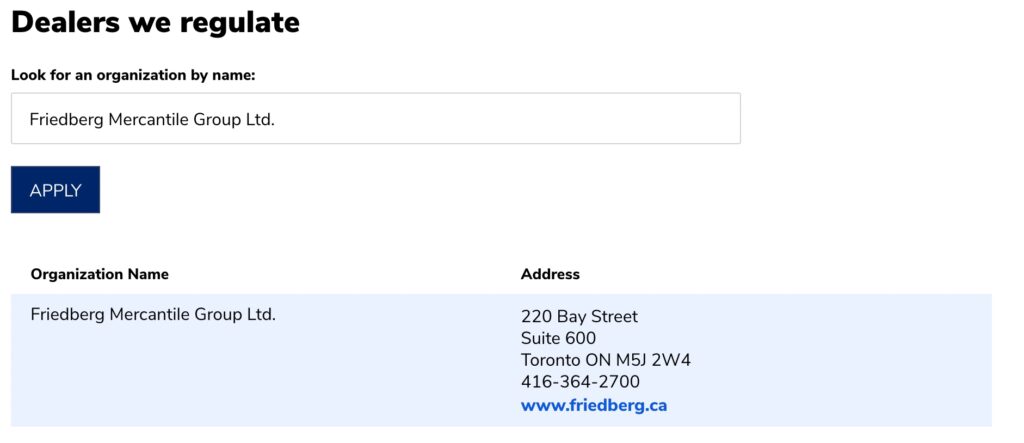

The forex broker is regulated by the CIRO through Friedberg Direct, a division of Friedberg Mercantile Group Ltd.

Pros/Cons Of AvaTrade

Pros

Trade 40+ currency pairs using CFDs and options

Forex CFDs allow you to speculate on price changes without owning the underlying asset, while FX options provide the right (without obligation) to buy or sell a forex contract at a specific price on a set date.

Profits and losses in both hinge on position size and price movement between entry and exit points.

The Academy offers a comprehensive education for beginners

There are more than 20 courses, 150 lessons and 50 quizzes, with materials aimed at different experience levels, from beginners to advanced traders. The risk management course is a particularly good resource for new traders.

Fixed over-the-market spreads provide more price certainty

AvaTrade emerges as one of the most cost-effective fixed spread forex brokers in our analysis, boasting fees of 1.5 pips on USD/CAD and 0.6 pips on EUR/USD.

However, it’s important to note that AvaTrade’s over-the-market spreads may fluctuate during highly volatile periods.

Cons

Above-average minimum deposit of $300

Though we find minimum investments under $500 generally accessible for most traders, it’s worth noting that AvaTrade Canada imposes the highest requirement in our shortlist, set at C$300.

Slim product portfolio with 250+ instruments and around 40 currency pairs

The range of currency pairs trails every alternative in our shortlist while diversification options beyond forex are limited. CMC Markets performs much better with 12,000+ instruments.

Why Is AvaTrade Better Than The Competition?

AvaTrade’s Academy remains among the top we’ve encountered, providing a comprehensive learning environment for new traders. The fixed over-the-market spreads are also lower than many competitors.

Who Should Choose AvaTrade?

Beginners should choose AvaTrade. Despite the relatively high minimum deposit, the training materials are a great resource for aspiring traders, while the pricing model provides a level of certainty.

Who Should Avoid AvaTrade?

Casual investors should steer clear of AvaTrade to avoid the $50 inactivity fee that kicks in after three months.

4. Interactive Brokers

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, HUF

-

🛠 PlatformseSignal, AlgoTrader, TradingCentral

-

⇔ Spread

GBPUSD: Commission (.20 pts x trade value) EURUSD: Commission (.20 pts x trade value) GBPEUR: Commission (.20 pts x trade value) -

# Assets70+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend Interactive Brokers

We recommend Interactive Brokers because it is one of the longest-standing, most trusted forex brokers. Interactive Brokers also offers 100+ currency pairs with deep liquidity and tight spreads.

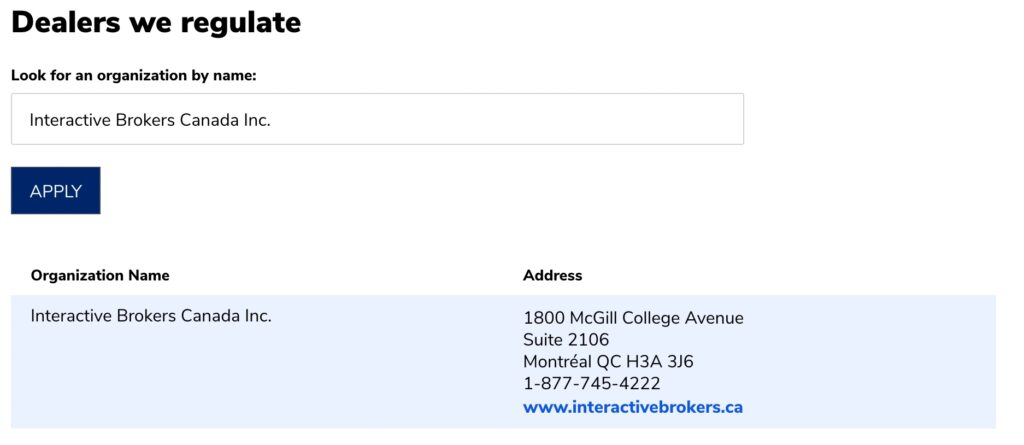

The forex broker is regulated by the CIRO through Interactive Brokers Canada Inc.

Pros/Cons Of Interactive Brokers

Pros

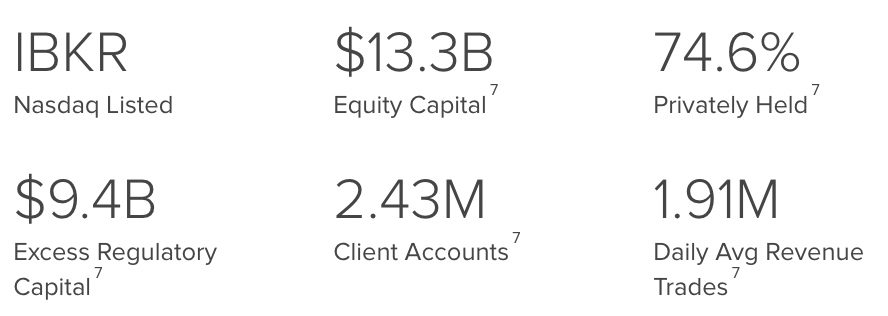

Multi-regulated forex broker listed on the NASDAQ

Interactive Brokers has over 40 years of experience in the industry, more than 2.5 million clients and a daily average trading volume of 1.91 million, underscoring its reliability.

Trader Workstation (TWS) delivers a professional trading environment

TWS stands out for forex trading with its intuitive Mosaic workspace, providing convenient access to comprehensive tools, including 100+ order types, 200+ research and news providers, and customizable charts. The platform’s efficient order management and position tracking also elevate the trading experience.

Low fees with deep liquidity from 17 of the biggest forex dealers

Forex traders get tight spreads from 0.1 pips with a low commission that gets increasingly competitive the more you trade.

Interactive Brokers is also one of the few CIRO-regulated forex brokers to offer interest on uninvested cash balances up to 4.83%.

Cons

Complicated trading platform with no MetaTrader alternative

While using Interactive Brokers, we were struck that the Trader Workstation platform has clearly been designed for experienced traders, making the extensive range of features, charts, and customization options potentially overwhelming for those who are new to trading.

Fortunately, the web-based client portal offers a more streamlined platform for new forex traders.

Customer support trails the best forex brokers

Despite support via phone, email and chat, wait times were long during testing. In fact, we were unable to get through to customer service agents on live chat on multiple occasions.

Why Is Interactive Brokers Better Than The Competition?

Interactive Brokers outshines the competition with its cost-effective structure, advanced tools like Trader Workstation, and global market access.

The broker’s extensive industry experience further contributes to its reputation as a top choice for Canadian forex traders.

Who Should Choose Interactive Brokers?

Interactive Brokers is best suited to experienced and active forex traders who are looking for software with premium analysis tools and competitive pricing, especially the more you trade.

Who Should Avoid Interactive Brokers?

Due to its complex account structure, pricing and trading software, Interactive Brokers should be avoided by beginners. AvaTrade is our preferred choice for beginners.

Visit Interactive Brokers5. CMC Markets

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, AUD, SEK, PLN

-

🛠 PlatformsMT4

-

⇔ Spread

GBPUSD: 0.9 EURUSD: 0.7 GBPEUR: 1.1 -

# Assets330+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend CMC Markets

We recommend CMC Markets because of its unmatched variety of forex products, boasting 330+ currency pairs. The broker’s ongoing improvements to its mobile app also ensure a comprehensive trading experience on the go.

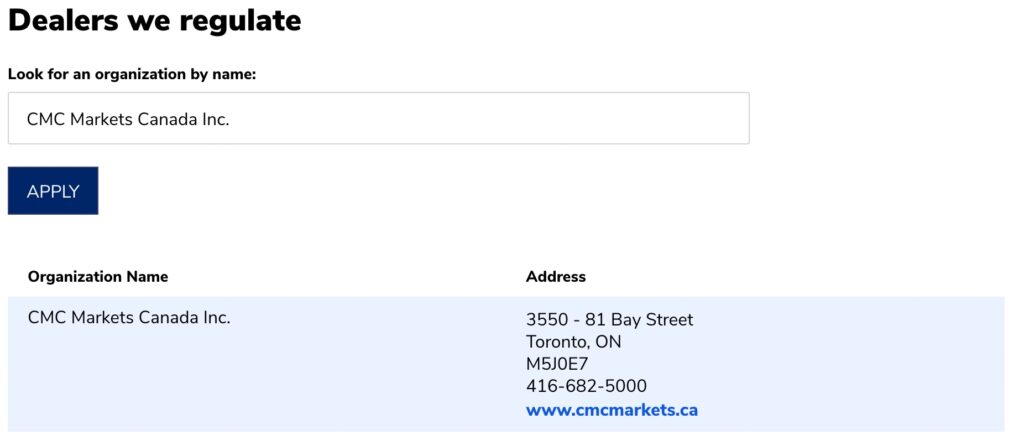

The forex broker is regulated by the CIRO through CMC Markets Canada Inc.

Pros/Cons Of CMC Markets

Pros

12,000+ instruments including 330+ currency pairs

You can also trade forex indices for broader exposure to currencies; for example, the CMC CAD Index assesses the CAD against 8 relevant currencies, including the USD.

Tight forex spreads from 1.3 on the USD/CAD

High-volume traders can also save between 5% and 20% through the cash rebate scheme, with a minimum monthly trading volume of $10M.

Trade forex anywhere, anytime with the CMC Markets app

The CMC Markets app offers an intuitive mobile interface for opening, closing, and modifying trades. There are also instant notifications via push, SMS, or email, so you stay in control of forex trades on the move.

Cons

Limited deposit options will disappoint Canadian traders

Only Online Bill Payment and wire transfer options are accessible, usually processed in 1-2 days, but wire transfers incur a substantial $14 fee.

Limited range of assets on MetaTrader 4

The broker’s MetaTrader 4 platform only supports around half of the broker’s 330+ currency pairs and a more limited selection of non-forex assets.

Why Is CMC Markets Better Than The Competition?

CMC Markets can’t be beaten for its range of forex products, from the huge selection of 330+ currency pairs to its 8 forex indices.

Who Should Choose CMC Markets?

Forex traders looking for an alternative way to speculate on the forex market should consider CMC Markets, thanks to its selection of currency indices, which can’t be found at many alternatives.

Additionally, experienced forex traders can benefit from the vast suite of currency pairs, low fees, and high-quality trading apps.

Who Should Avoid CMC Markets?

Avoid CMC Markets if you’re a hands-off trader seeking a forex copy trading platform, as there is not one available.

Why Canadian Traders Should Choose a CIRO-Regulated Forex Broker

Fund Protection

The CIRO offers protection up to $1 million through the Canadian Investor Protection Fund (CIPF), which can help return your capital to you in the event your broker becomes insolvent.

Note, that crypto assets are not covered under the CIPF.

Fair Trading Conditions

The CIRO establishes and upholds rules that ensure transparency and fairness in the operations of registered forex brokers.

This includes being upfront about fees and limiting leverage to 1:50 on currency pairs like the USD/CAD, helping to protect retail investors from accumulating excessive losses.

Confidence

Like other top-tier regulators, the CIRO provides rigorous oversight of brokers. The body can issue fines and even ban financial firms that do not follow its rules.

The regulator’s focus on market integrity and customer safety ultimately helps create a secure trading environment, making CIRO forex brokers a trustworthy choice for retail investors in Canada.

Review Methodology

We began by confirming forex brokers were authorized on the regulator’s database. Next, we assessed firms in several areas:

- Fees – striking a balance between affordability and trading conditions.

- Investment Offering – preferring brokers with a wide range of currency products.

- Forex Accounts – comparing entry requirements and suitability for different trading styles.

- Tool Evaluation – testing platforms, apps, research features and educational tools for their design and quality.

FAQ

How Do I Check Whether A Forex Broker Is Regulated By The CIRO?

You can check whether a forex broker is regulated on the official database. Input the name of the broker’s Canadian entity, normally found in the footer of the broker’s website, into the search bar on the regulator’s site.

Do Forex Brokers In Canada Have To Be Regulated By The CIRO?

Forex brokers operating in Canada should be regulated by the CIRO. While Canadian traders may be able to sign up with forex brokers regulated elsewhere, they may not receive the same protections afforded by the Canadian regulator.

How Much Forex Leverage Is Allowed Under CIRO Rules?

The maximum leverage available at CIRO-regulated forex brokers is 1:50.

What Is The Difference Between The CIRO And IIROC?

In 2023, the CIRO combined the roles of the Investment Industry Regulatory Organization of Canada (IIROC) and the Mutual Fund Dealers Association of Canada (MFDA). In effect, the CIRO has replaced the IIROC.

Article Sources

Canadian Investment Regulatory Organization (CIRO)