Best Forex Copy Trading Brokers

Copy trading brokers allow users to automatically mirror the strategies of proven traders. Our experts have tested, compared and ranked the best forex brokers with copy trading platforms, taking into account:

The assets and markets you can copy

The quality of the copy trading platform

The metrics for comparing strategy providers

The minimum investment

The commissions and fees

List of Best Forex Brokers With Copy Trading 2026

These are the 5 top forex copy trading platforms based on our tests:

- eToro: Best Overall Broker for Copy Trading

- AvaTrade: Best Copy Trading Platform for Social Features

- Pepperstone: Best Copy Trading on MetaTrader

- Vantage: Best Choice of Copy Trading Platforms

- RoboForex: Best Forex Copy Trading Broker

Note, copy trading does not constitute financial advice – your capital is still at risk.

| eToro | AvaTrade | Pepperstone | Vantage | RoboForex | |

|---|---|---|---|---|---|

| Copy Trading Platforms | CopyTrader | AvaSocial, DupliTrade, ZuluTrade | DupliTrade, Myfxbook, MetaTrader | Vantage App, DupliTrade, Myfxbook, ZuluTrade | CopyFX |

| Minimum Investment | $200 | $100 | $200 | $200 | $100 |

| Regulated | Yes | Yes | Yes | Yes | Yes |

eToro: Best Overall Broker For Copy Trading

Minimum Investment: $200

Why We Recommend eToro

We recommend eToro because it offers an industry-leading social investment network.

You can start copying traders in three easy steps with zero management fees and full control over your portfolio. The broker is also heavily regulated and trustworthy.

Below we explain why eToro tops our list of copy trading brokers.

Pros/Cons of eToro

Pros

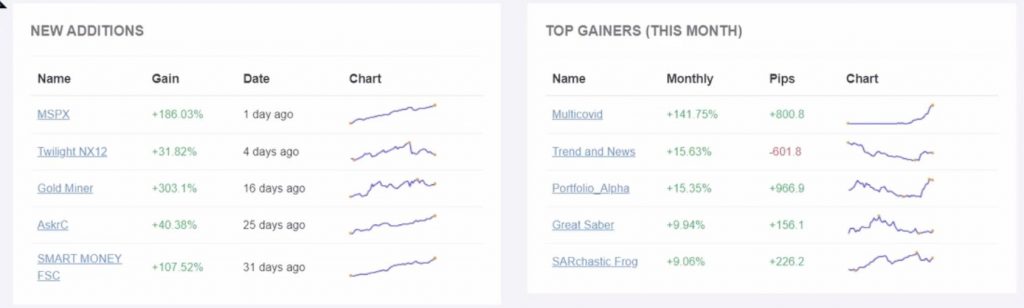

Straightforward search function to find a trader to copy

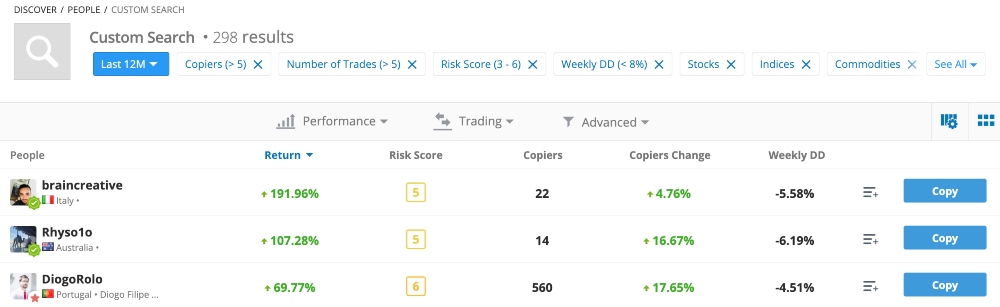

eToro offers the most user-friendly copy trading platform out of the dozens of brokers we tested.

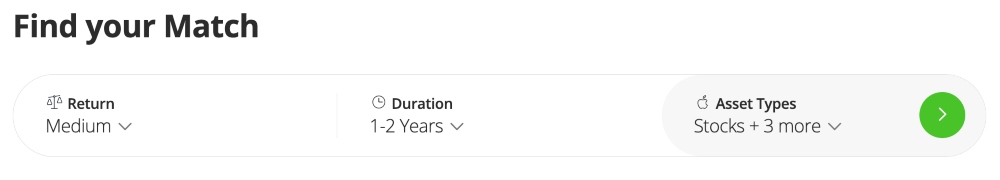

Alongside an intuitive dashboard, eToro matches you with potential traders based on several clear criteria: risk appetite, investment timeframe, and the type of assets you want to trade.

You can then find the right match based on various metrics, including their returns, risk score, and number of followers.

I particularly rate the various filters, which allow me to find suitable traders in a matter of minutes. Then all I have to do is decide how much to invest and press ‘copy’.

You keep full control over your copy trading portfolio with start, pause and stop functionality

Unlike other copy trading brokers we used, eToro lets you pause copy trading, add funds, or remove capital at any time. This will appeal to beginners and those that want access to their funds in real-time.

eToro also lets you follow more traders than many alternatives – you can copy between 1 and 100 traders simultaneously.

You can copy trades in forex, stocks, indices, commodities, cryptos and ETFs

eToro offers copy trading on more assets and markets than most alternatives. This is really important for me as it means I can build a diverse portfolio which can help to lower risk.

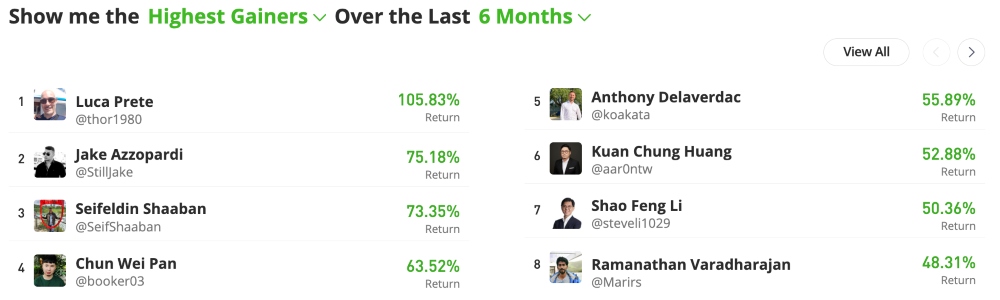

With that said, users that want to strategically copy trades in one asset class can still do this. eToro ranks the highest-performing copy traders by asset, sector and theme, such as stocks, energy, or technology.

There are zero management fees to copy traders

eToro offers one of the most straightforward pricing structures.

Unlike many copy trading brokers, there are no management fees. Instead, you pay through the spread which doesn’t change between copy trading and normal trading.

We rate this approach – it keeps the pricing transparent and eToro offers competitive spreads on popular asset classes.

Cons

eToro CopyTrader requires a $200 minimum investment

You need to invest at least $200 to copy a trader on the eToro platform, which is higher than other copy trading brokers in our list. While this isn’t a dealbreaker for us – it may deter some traders on a budget.

The flip side is that the maximum investment is higher than most competitors – you can deposit up to $500,000 per master trader, which will appeal to investors with a large bankroll.

You need to filter out the low-performing traders

The downside of eToro’s copy trading platform becoming so popular is that it has attracted thousands of traders looking to sell their strategies, and not all post strong returns.

This ultimately means you need to do your research to find the best traders to copy. My tip is to filter by performance or stick to the broker’s copy trading leaderboards.

Why Is eToro Better Than The Competition?

eToro offers a best-in-class copy trading platform which makes it easy to find and follow master traders spanning popular asset types.

There are also no management fees and you retain full control over your copy trading portfolio.

In addition, eToro is overseen multiple by tier-one regulators and has an excellent reputation in the industry.

Who Should Choose eToro?

eToro is perfect for beginners looking for an easy-to-use copy trading platform where you can find, follow and copy traders in a few straightforward steps.

The community forum with chat capabilities also means it will suit traders looking for social investing where you can interact with and learn from experienced traders.

Who Should Avoid eToro?

eToro won’t suit traders looking for third-party copy trading platforms like ZuluTrade or DupliTrade, as the broker does not support these.

eToro CopyTrader also won’t appeal to those looking to invest less than $200 per master trader.

AvaTrade: Best Copy Trading Platform for Social Features

Minimum Investment: $100

Why We Recommend AvaTrade

We recommend AvaTrade because it offers access to a range of copy trading platforms, including ZuluTrade and DupliTrade, plus its own social trading app with excellent social investing features – AvaSocial.

AvaTrade is also an award-winning copy trading broker with strong regulatory oversight and more than 400,000 users.

Our experts explain why AvaTrade makes our list of the best brokers for copy trading below.

Pros/Cons of AvaTrade

Pros

You can interact with seasoned traders in AvaSocial and copy trades in one tap

The AvaSocial app offers social trading functionality not available at many copy trading brokers.

We especially rate that you can ask questions to experienced traders one-on-one or in a group. This makes it ideal for finding a mentor or proven traders.

We also like how straightforward it is to start copying trades – you can either manually copy each trade or click the ‘Copy’ button to automatically mirror the position.

A choice of third-party copy trading platforms

AvaTrade is one of the few brokers to offer a choice of copy trading tools. This makes it easier to find a platform that meets your needs.

DupliTrade has a strict audit process so only proven traders can sell their strategies, while ZuluTrade has a ZuluGuard feature that protects your funds should the strategy change significantly or the signal provider starts placing losing trades. They are both hugely popular copy trading platforms.

You can copy trade on hundreds of popular markets

AvaTrade offers copy trading on a wide range of asset classes, including forex, stocks, indices, commodities and cryptocurrencies.

With hundreds of instruments available between the three platforms, it offers more choice than most copy trading brokers. And similar to eToro, having broad market access is important for me, as it provides portfolio diversification opportunities.

Cons

There is a $2000 minimum deposit to access DupliTrade

DupliTrade requires a $2000 initial investment which will be out of reach for many beginners.

With this in mind, I would recommend AvaSocial or ZuluTrade for beginners, which offer a more accessible starting deposit of $100.

Copy trading is not available to EU clients

AvaTrade’s suite of copy trading tools and social investing community is not available to EU traders.

If this affects you, our experts suggest alternatives like eToro or Pepperstone, which both offer copy trading platforms to EU clients.

Why Is AvaTrade Better Than The Competition?

AvaTrade offers an excellent choice of copy trading platforms, catering to different experience levels and budgets.

With 24/5 support and excellent regulatory credentials, AvaTrade is also one of the most trustworthy copy trading brokers.

Who Should Choose AvaTrade?

Beginners and those on a budget should consider AvaSocial or ZuluTrade due to the modern copy trading tools and $100 minimum investment.

Traders who can afford the $2000 deposit to access DupliTrade should also consider AvaTrade, which offers heavily vetted strategy providers.

Who Should Avoid AvaTrade?

We don’t recommend AvaTrade for copy traders in the EU, as its services won’t be available.

If you want fast withdrawal times, AvaTrade isn’t the best option either – it can take up to 10 days to receive copy trading profits by bank transfer.

Pepperstone: Best Copy Trading On MetaTrader

Minimum Investment: $200

Why We Recommend Pepperstone

We recommend Pepperstone because it offers multiple copy trading tools with easy integration. Our team especially rate the MetaTrader signals available in both MT4 and MT5.

The broker also stands out for its 24/7 customer support and low fees for copy traders.

Our team explain why Pepperstone ranks as one of the top brokers for copy trading below.

Pros/Cons of Pepperstone

Pros

Access to three third-party copy trading tools including MetaTrader signals

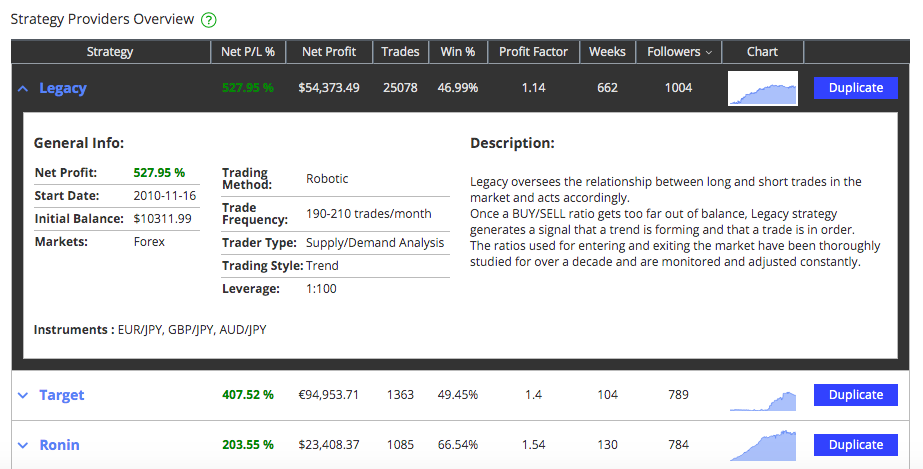

Whether you are looking for full automation through Myfxbook and DupliTrade or integration with MetaTrader, Pepperstone offers a copy trading solution for various needs.

The MetaTrader signals are a particularly attractive option, with thousands of providers and the ability to copy their setups in both your demo and real Pepperstone account.

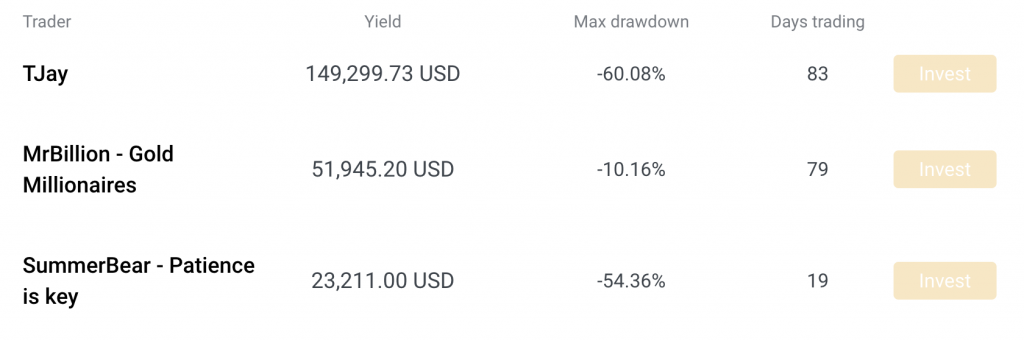

Myfxbook traders commit their own funds and share detailed performance statistics

I rate Pepperstone’s Myfxbook platform because master traders can only operate live accounts – not demo profiles. Knowing any traders I copy must also have their own capital on the line is reassuring for me.

The straightforward performance metrics also make it easy to compare and find suitable traders to follow. And while I rate the customizable search function at eToro, Myfxbook keeps things simple by focusing on the information that matters the most for the majority of users – returns.

No management charges to use the copy trading platforms

There are no additional fees to copy trade at Pepperstone. Like other top brokers with copy trading platforms – clients pay through the standard spread and/or commission.

Importantly, Pepperstone is one of the lowest-cost copy trading brokers with spreads from 0.0 pips on forex with a competitive commission of $3.50. Our team got very tight spreads of 0.12 pips on the EUR/USD during testing.

Cons

No proprietary copy trading app

Unlike eToro and AvaTrade, Pepperstone does not offer an in-house copy trading platform.

Whilst this isn’t a major drawback in our opinion – proprietary apps are sometimes easier to learn for beginners.

A very high minimum deposit of $5000 to access DupliTrade

To unlock the full suite of copy trading tools at DupliTrade through Pepperstone, you need to invest $5000.

This is a high entry barrier for many traders, especially when AvaTrade provides access to DupliTrade for $2000.

Why Is Pepperstone Better Than The Competition?

Pepperstone offers a good selection of third-party copy trading tools, including thousands of MetaTrader signals.

This, alongside best-in-class customer support and no additional commissions to use the firm’s copy trading solutions, makes it an attractive option.

Who Should Choose Pepperstone?

Pepperstone is a good choice if you want to receive signals and copy trade setups in the MetaTrader 4 or MetaTrader 5 platforms.

It is also a sensible pick if you want to try multiple copy trading tools to find the right solution for your goals, with three high-quality solutions available.

Who Should Avoid Pepperstone?

We don’t recommend Pepperstone if you want access to a beginner-friendly, in-house copy trading app, as the broker doesn’t offer one. eToro is a better option.

If you want to access DupliTrade but don’t have $5000 to get started, I would also avoid Pepperstone. AvaTrade is more accessible.

Vantage: Best Choice Of Copy Trading Platforms

Why We Recommend Vantage

We recommend Vantage because it offers excellent third-party copy trading integration with DupliTrade, ZuluTrade, and Myfxbook. The in-house app is also great for copy trading on the go.

Below we outline why Vantage is one of the best copy trading brokers.

Pros/Cons of Vantage

Pros

Proprietary copy trading software with MetaTrader integration

Similar to eToro and AvaTrade, Vantage offers its own app for copy trading.

We tested the application and found the interface simple, yet packed with helpful analysis features and research tools. You can easily switch between multiple accounts and browse portfolio statistics directly from one screen.

We also like that it can be integrated with an MT4 or MT5 account.

Better commission rates through League Trader

One of the key advantages of copy trading with Vantage is their ‘League Trader’, which makes it straightforward to find a master trader that aligns with your target asset, risk tolerance and trading style.

Signal providers can also benefit from improved commission rates, weekly payouts and modify the profit-sharing rate.

Popular third-party copy trading tools are available

Another reason Vantage makes our list of the best brokers for copy trading is the choice of tools. For users that don’t like the in-house app or are familiar with third-party platforms, there is ZuluTrade, Myfxbook, and DupliTrade.

For me, the bonus of third-party platforms is that you can continue using them even if you decide to switch brokers for whatever reason.

Cons

Copy trading accounts are available in USD only

Copy trading accounts are only available in the US Dollar (USD).

This isn’t a serious drawback in our opinion, but it may make managing your account and trading activity harder for investors that normally trade in EUR, AUD or GBP, for example.

Why Is Vantage Better Than The Competition?

Vantage stands above the competition due to its wide selection of copy trading tools and high-quality in-house apps.

We also rate the League Trader perks for signal providers who can earn better rates and get enhanced visibility.

Who Should Choose Vantage?

We recommend Vantage if you want a user-friendly copy trading app where you can mirror the strategies of proven investors on the go.

It is also a good option if you want access to the best third-party copy trading tools, including DupliTrade, ZuluTrade, and Myfxbook.

Who Should Avoid Vantage?

Investors who want to copy trade in a currency other than USD should not sign up with Vantage.

Also, if you want copy trading brokers with the lowest minimum balance requirements then it doesn’t match AvaTrade, which lets users get started with $100.

RoboForex: Best Forex Copy Trading Platform

Minimum Investment: $100

Why We Recommend RoboForex

We recommend RoboForex for its straightforward FX copy trading offering, plus community networking.

It is also a popular global broker with 12,000+ trading products and flexible accounts.

Our experts discuss why RoboForex is one of the top copy trading brokers below.

Pros/Cons of RoboForex

Pros

Maintain full control over your investments with CopyFX

One of the main advantages of RoboForex CopyFX is the full control you keep over your funds. We found that you can easily manage each stage of the investment and stop copy trading at any time.

This is a notable advantage over some forex copy trading platforms where your capital is locked away for a set period.

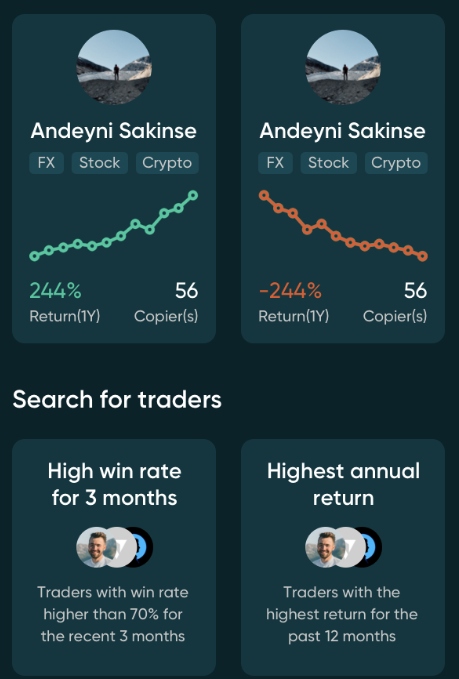

Clear analysis with detailed profiles of master traders

The CopyFX interface is straightforward to navigate with offers easy-to-follow statistics about the forex traders you can follow.

You can view total profitability, maximum drawdown, subscribers, and number of active trading days. We also rate that the information is available in graph format with convenient time filters.

You can fund your copy trading account with 20+ payment methods

RoboForex is one of the easiest FX copy trading brokers to sign up and start trading with.

It is the only firm we tested to offer upwards of 20 deposit options, from bank cards and wire transfers to popular e-wallets like Skrill, Fasapay and Alipay.

The $100 minimum investment to start copy trading also makes the platform accessible for newer traders.

Cons

Traders only have access to one copy trading platform

RoboForex trails other copy trading brokers in our rankings when it comes to choice.

The CopyFX platform is the only solution available, with no support for popular tools like ZuluTrade or DupliTrade.

Weaker regulatory credentials than some alternatives

RoboForex is regulated by an offshore body – the International Financial Services Commission (IFSC) of Belize.

This is not a top-tier regulator like the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities & Exchange Commission (CySEC) in Europe. Whilst this won’t deter some traders, it is worth being aware that you may receive fewer regulatory safeguards.

Why Is RoboForex Better Than The Competition?

The RoboForex CopyFX platform stands out for its fast joining process and account management features.

Traders can also choose from more deposit options than are available at most copy trading brokers.

Who Should Choose RoboForex?

RoboForex is a good choice for forex traders looking for a no-frills copy trading experience.

It will also serve aspiring copy traders on a budget, with just a $100 starting investment required.

Who Should Avoid RoboForex?

We don’t recommend RoboForex for users looking for third-party copy trading platforms, as the broker does not offer these.

It also isn’t a good choice if you want a heavily regulated copy trading broker, as it falls short in this area compared to other firms on our list.

How To Compare Copy Trading Brokers

To find the best copy trading brokers, our experts test, compare and rank firms based on several criteria:

The assets and markets you can copy

We look at the range of asset types available, from forex and stocks to commodities and cryptos.

Our team favor copy trading platforms with multiple asset classes – these allow for portfolio diversification which can help lower risk.

With that said, we also appreciate that some users want to focus on one asset type, so we consider whether a brokerage provides a particularly strong forex copy trading offering, for example.

The quality of the copy trading platform

In our experience, the best copy trading platforms offer simple navigation with user-friendly tutorials and customizable widgets.

Another important consideration is the ease with which you can start copy trading. The top copy trading apps consolidate the process into three straightforward steps:

- Choose a master trader based on performance metrics

- Decide how much you want to invest

- Select ‘Copy’ to start mirroring their strategy

The metrics for comparing strategy providers

The level of insight into prospective signal providers is a key consideration.

Our team looks at the range of metrics you can judge providers on, plus how far back that data goes, for example, two years of history into the top copy traders.

We particularly rate copy trading apps that allow us to customize our search based on relevant filters, such as the number of followers, risk level and trading style.

The minimum investment

The best copy trading brokers for beginners offer an accessible starting deposit, typically between $100 and $200.

With that said, traders that can afford a higher minimum investment of $2000 may prefer the depth and experience strategy providers on third-party platforms like DupliTrade can offer.

Ultimately, it will depend on your budget.

The commissions and fees

Copy trading brokers adopt different pricing structures. The most popular are:

- Zero management fees with the markup applied through the standard spread and/or commission. We like this because you don’t have to pay an additional fee. However, it is important to check that the copy trading broker offers competitive fees as standard.

- Performance fees in the form of a profit split or commission based on the volume traded or account balance. This can provide more transparency, especially in terms of fixed fees paid per trade. However to keep things simple, many traders prefer the idea of no additional fees described above.

As well as evaluating the competitiveness of these fees, we also consider any additional charges, from deposit and withdrawal fees to inactivity penalties. This paints a full picture of the costs involved with copy trading.

Note, copy trading does not constitute financial advice – your capital is still at risk.

FAQ

Which Is The Best Copy Trading Broker?

eToro is the best broker for copy trading in 2026. The social trading app is best in class with an excellent user experience, a low minimum investment of $200, plus access to a wide range of asset types, including forex, stocks, indices, commodities, cryptos and ETFs.

Other top copy trading platforms based on our tests are AvaTrade, Pepperstone, Vantage and RoboForex.