RoboForex

-

💵 CurrenciesUSD, EUR

-

🛠 PlatformsMT4, MT5

-

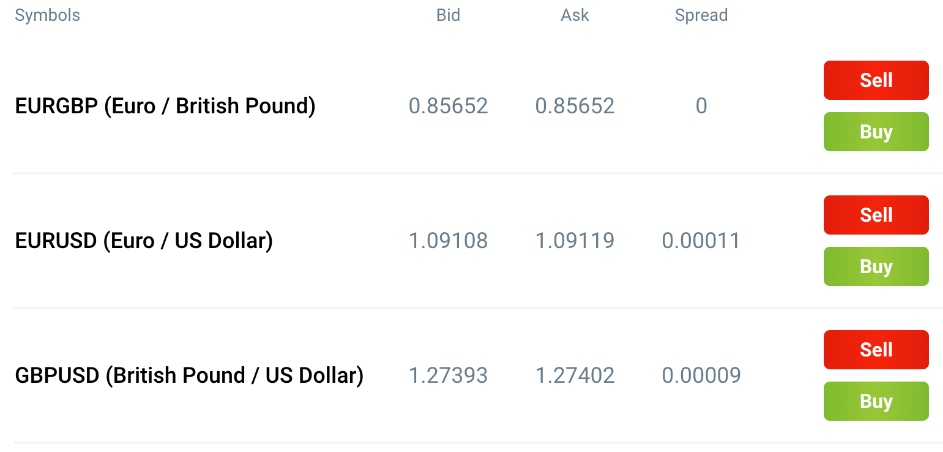

⇔ Spread

GBPUSD: 2 EURUSD: 1.4 GBPEUR: 1.6 -

# Assets30+

-

🪙 Minimum Deposit$10

-

🫴 Bonus Offer$30 No Deposit Bonus

Our Opinion On RoboForex

RoboForex is an award-winning forex and CFD broker. Standout features for us are the flexible STP and ECN accounts, 12,000+ instruments and one-day withdrawals. RoboForex does trail some brokers when it comes to the range of currency pairs and regulatory oversight, but we still rate the competitive trading conditions for traders of all stripes.

Summary

- Instruments: 12,000+ including 30+ forex pairs, 8000+ stocks, indices, commodities, cryptos, futures, ETFs

- Live Accounts: Prime, ECN, R Stocks Trader, ProCent, Pro

- Platforms & Apps: MetaTrader 4, MetaTrader 5, R Mobile Trader, R Stocks Trader, R Web Trader

- Deposit Options: Bank cards, wire transfer, e-wallets, QR, vouchers

- Demo Account: Yes

Pros & Cons

- Huge range of markets with 12,000+ instruments spanning 9 asset classes

- Faster withdrawals than most forex brokers with automatic system

- Popular forex broker with multiple industry awards and accolades

- Accessible accounts for beginners and experienced traders

- $10 minimum deposit with micro lot trading

- MetaTrader 4 and MetaTrader 5 integration

- Welcome bonuses and trading promotions

- CopyFX platform for forex copy trading

- You have to provide ID and pass security checks to open a demo account

- Narrow range of forex assets compared to alternatives

- Average customer support with slow response times

- Weak regulatory oversight from the FSC

Is RoboForex Regulated?

RoboForex is regulated by the Financial Services Commission (FSC) in Belize, license number: 000138/437.

The FSC requires license holders to self-report to ensure they comply with regulations, which include anti-money laundering and anti-fraud requirements, alongside consumer protections.

This offers some assurances to traders, although our experts do not consider the FSC a top-tier regulator and the level of protection it provides is below those guaranteed by a body like the Financial Conduct Authority (FCA) in the UK.

Having said that, we note that the forex broker does implement some reassuring measures to protect clients. These include negative balance protection, know-your-customer verification, and up to €2.5 million of Civil Liability Insurance if risks or actions caused by RoboForex lead to financial loss.

This places this forex broker ahead of most of the 100+ offshore brokers that we have reviewed.

Forex Accounts

RoboForex’s five accounts cater to different trading styles by offering a selection of trading terms including commission-free and raw-spread ECN solutions, as well as an account for traders who want to directly deal in stocks.

This model means that traders from beginners to experienced will find a suitable account, and we think the cashback promotion available is an especially good touch.

It is also good to see a low deposit requirement of 10 USD/EUR for all accounts except the stock trading profile, which requires 100 USD/EUR.

On the negative side, we do feel that the varying trading terms and instruments available between the different account types can make it complicated to get started, but this is a minor complaint.

Our team outline the key differences between the accounts below.

Prime

Best for serious traders building a diverse portfolio

- Minimum deposit: 10 USD/10 EUR

- Trading instruments: 28 currency pairs, metals, cryptocurrencies, and CFDs on US stocks, indices, oil, and futures

- Trading platforms: MT4, MT5, R Web Trader including the mobile app

- Spreads: Floating from 0 pips

- Commission per million USD: 10 for metals, currencies, and futures, 4 for indices and energies, 1000 for cryptocurrencies, and 150 for US stocks

- Maximum leverage: 1:300

- Cashback (rebates): Up to 10% of commission

- Swap-Free account: No

ECN

Best for active forex traders looking for high leverage

- Minimum deposit: 10 USD/10 EUR

- Trading instruments: 26 currency pairs, metals, cryptocurrencies, and CFDs on US stocks, indices, oil, and futures

- Trading platforms: MT4, MT5, R Web Trader including the mobile app

- Spreads: Floating from 0 pips

- Commission per million USD: 20 for metals, currencies, and futures, 5 for indices and energies, 2000 for cryptocurrencies, and 200 for US stocks

- Maximum leverage: 1:500

- Cashback (rebates): Up to 15% of commission

- Swap-free account: No

R StocksTrader

Best for stock traders

- Minimum deposit: 100 USD/100 EUR

- Trading instruments: Indices, real stocks, currencies, ETFs, cryptocurrencies, and CFDs on stocks, oil, metals, and futures

- Trading platforms: R StockTrader

- Spreads: Floating from 0.5 pips for US stocks (all types), 0 for EU stocks and forex, and 0.5 for indices

- Commission: 0.009 USD per share with a minimum of 0.5 USD for US stocks (deposit from 10,000 USD), 0.025 USD per share with a minimum of 2 USD for US stocks, 0.02 USD per share with a minimum of 2.8 EUR/GBP for CFDs on US stocks, 0.07% for CFDs on EU stocks, 15 USD per 1 million base currency for forex, and indices have a variable commission with a minimum of 1 USD

- Maximum leverage: 1:2 for US stocks, 1.20 for CFDs on US stocks and US stocks (deposit from 10,000 USD), 1:5 for CFDs on EU stocks, 1:100 for indices, and 1:500 for currencies

- Swap-free account: Yes

ProCent

Best for algorithmic traders and strategy testing

- Minimum deposit: 10 USD/10 EUR

- Trading instruments: 26 currency pairs, metals, and cryptocurrencies

- Trading platforms: MT4, MT5, R Web Trader including the mobile app

- Spreads: Floating from 1.3 pips

- Commission: Zero

- Maximum leverage: 1:2000

- Cashback(Rebates): Up to 1.5% of the firm’s revenue

- Swap-free account: Yes

Pro

Best for beginners interested in forex and CFDs

- Minimum deposit: 10 USD/10 EUR

- Trading instruments: 36 currency pairs, metals, cryptocurrencies, and CFDs on US stocks, indices, oil, and futures

- Trading platforms: MT4, MT5, R Web Trader including the mobile app

- Spreads: Floating from 1.3 pips

- Commission: Zero

- Maximum leverage: 1:2000

- Cashback(Rebates): Up to 15% of the firm’s revenue

- Swap-free account: Yes

How To Open A Live Account

We found RoboForex’s sign-up process to be straightforward, with only a few steps to complete and everything laid out in an easy-to-use interface. You should be able to complete the process in less than half an hour.

- Enter your email address, full name, and phone number in the sign-up form

- Click the verification link sent to your email address

- Complete the full verification process that the link leads to by uploading proof of ID and address documents

- Once this is done, you will be able to choose the type of account you wish to open

Trading Fees

RoboForex is not the cheapest forex broker, with floating spreads on the Pro and ProCent accounts coming in higher than other forex brokers we test. The commissions on the Prime and ECN accounts are also higher than some alternatives.

Spreads on the Pro and ProCent accounts start from 1.3 pips. These aren’t the tightest spreads, but they will appeal to traders looking for commission-free trading.

Spreads on the Prime and ECN accounts are tighter, starting from 0.0 pips on major currency pairs like the EUR/USD. We think this is the best option for active, short-term traders, especially since you can claim a 15% rebate on commissions.

Non-Trading Fees

RoboForex is a mixed bag when it comes to non-trading fees.

On the plus side, we rate that there is no inactivity fee – a penalty we see at most forex brokers. Account funding is also fee-free, except for Perfect Money deposits which come with a 0.5% charge.

On the negative side, there are withdrawal fees. There is a 4% charge on local bank transfers, while the 2.3% + $1.60 charge on debit/credit cards makes one of the most common payment methods expensive.

The platform also charges for its CopyFX platform, though this comes in the form of a ‘Performance Fee’ on profitable trades. This fee varies between different copy traders, but we rate this pricing model as the absence of up-front fees means you won’t pay for losing trades.

Payment Methods

RoboForex supports a good variety of payment methods, including enough well-known e-wallets to suit most global traders, such as Skrill, Neteller, AdvCash and Perfect Money. Bank cards, wire transfers, Western Union, plus QR codes and vouchers are also supported.

We like the fee-free deposits and the fast withdrawal times on local bank transfers and e-wallets, and we think the deposit and withdrawal limits are generous enough to suit traders of most budgets.

As noted above, the withdrawal fees are frustrating, but they are our only serious complaint about an otherwise good selection of payment methods.

How To Make A Deposit

We find RoboForex’s deposit system intuitive, and enjoy the streamlined interface and ability to fund accounts instantly in a few easy steps:

- Log in to the client portal

- Click ‘My Account’ or ‘My Wallet’ (depositing is available from both menus)

- Click ‘Deposit’ and choose your funding method by pressing on the logo or choosing from the drop-down menu

- Enter the currency and amount you wish to deposit

- For certain electronic payment methods, you will be directed to a new window to sign in to these accounts

- Follow the on-screen instructions to complete the transfer

Forex Assets

Although ‘forex’ is in the name, RoboForex only offers up to 36 forex pairs, with less than 30 pairs available on some account types.

Although it isn’t necessary to have a huge selection of currency pairs, since many investors only trade the currencies that they are familiar with, having a limited selection does restrict your options.

To put this in perspective, CMC Markets offers more than 300 currency pairs, Forex.com offers more than 80, and AvaTrade offers more than 50.

Fortunately, most popular forex pairs are available:

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

RoboForex’s non-forex asset list is extensive and somewhat makes up for the lack of forex pairs.

There are dozens of crypto CFDs available, with more tokens than most similar brokers. There are also 1000+ ETFs, thousands of US stock CFDs and 3000+ direct US stocks on the specialized stock-trading account.

This makes RoboForex a good, flexible broker for forex traders who want to also access stock markets, though it is a shame that traders will need to open a second account to access the full list of shares, unlike with brokers such as eToro.

You can trade:

- Stocks: More than 8000 US stock CFDs and 3000 directly traded US stocks on the stock-trading account; 50+ stock CFDs on the other accounts

- Indices: A few indices are available, such as JP225, US500, and DE40. This isn’t a great range of indices, Nasdaq100, Dow30 and FTSE100 are common indices not supported

- Commodities: Metals (XAU/USD, XAG/USD), Brent Oil and WTI Oil, plus soft commodities such as cocoa, corn, soybeans, and wheat

- Cryptocurrencies: 33 crypto CFDs in pairs against USD and EUR, including Bitcoin

Execution

All accounts except the ECN account use STP market execution; the ECN account uses ECN market execution.

STP execution involves routing client orders to liquidity providers or other market participants without any interference or dealing desk intervention. The orders are executed at the best available market prices.

ECN execution connects traders directly to a network of liquidity providers, including banks, institutions, and other traders. Traders can see the best bid and ask prices from multiple participants in the network and can place orders that are visible to others.

ECN accounts do have higher commissions, but also provide access to tighter spreads, and are often the choice for the more experienced, high-frequency day traders as a result.

Altogether, we are fairly satisfied with the pricing offered by RoboForex’s execution model, which we consider fair since both STP and ECN methods are no-dealing-desk solutions that help prevent conflicts of interest with the brokerage.

However, we are disappointed by the 1–3 seconds quoted by the broker to fill an order. We consider anything below 100ms second to be fast, making RoboForex slower than some alternatives.

This puts traders at more risk of slippage than brokers like FXCM, with its lightning-quick, sub-20ms execution speeds.

Leverage

RoboForex offers very high leverage up to 1:2000, though this varies by account.

This is more than most EU, UK and Australian-regulated and allows traders to gain buying power up to $200,000 with a $100 outlay.

We recommend caution when trading with this level of leverage – both profits and losses are amplified. With that said, our team appreciates that negative balance protection is available as standard, meaning your account balance cannot fall below zero.

Platforms & Apps

RoboForex’s platform support is very good, with MetaTrader 4, MetaTrader 5 and a proprietary web platform providing excellent options for online traders.

The two MetaTrader platforms are well-regarded software that provide fantastic charting and analytical tools as well as powerful automated trading via Expert Advisors (EAs).

We also like the proprietary R WebTrader platform, which allows streamlined access to MT4 via browsers or a mobile app.

MetaTrader 4

MetaTrader 4 (MT4) was made with forex trading in mind and is compatible with desktops (Windows and Mac), iOS and Android mobile devices and web browsers.

The platform offers a wide range of features, including advanced charting capabilities, customizable indicators, drawing tools, multiple timeframes, and support for algorithmic trading. It also provides real-time quotes, market news, and economic calendar integration.

However, the real benefit for us is the large library of built-in technical indicators and the ability to install custom indicators.

It also supports market orders, limit orders, stop orders, and trailing stops, which enables flexible trade execution.

MetaTrader 5

MetaTrader 5 (MT5) offers some advanced features compared to MT4, including more charting tools, additional timeframes, and an improved strategy tester. It also supports trading in various asset classes, such as stocks, futures, and commodities.

In addition, MT5 provides a wider range of built-in technical indicators and drawing tools, as well as custom indicator installation. The faster processing speeds and integrated news feed will also serve serious traders.

MT5 supports various order types, Expert Advisors and risk management features similar to MT4.

R WebTrader

The broker’s proprietary R WebTrader platform, available via browsers and mobile apps, offers a streamlined way to access markets via the MT4 platform.

R WebTrader is similar to other popular browser-based terminals, with multiple chart types, a user-friendly interface, and customizable indicators to tailor your trading experience.

It is nothing groundbreaking, but it is intuitive to use and we think it makes a good first step into the financial markets for new traders.

Forex Tools

We are impressed with RoboForex’s suite of additional tools, which we think add great value to the broker and cover many bases for both new and experienced traders.

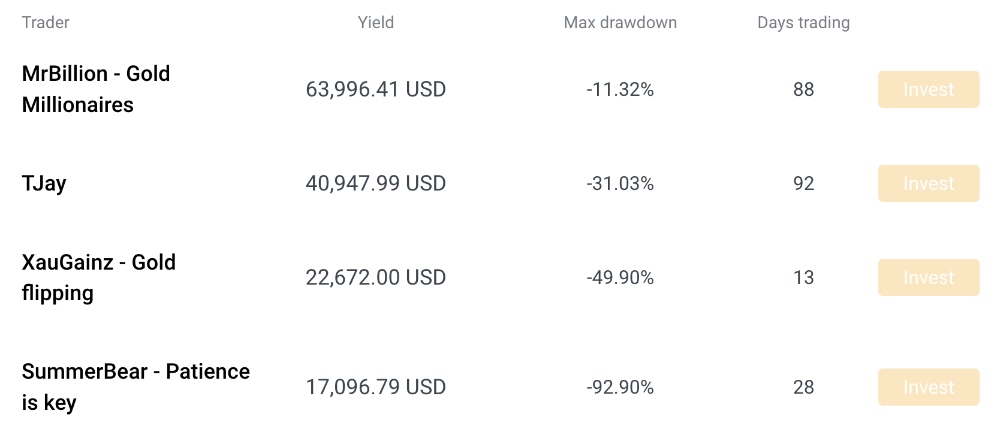

CopyFX

RoboForex’s solution to copy trading allows clients to choose from a list of traders to copy their positions.

There is a minimum investment of $100 before you are allowed to use the service, which we see as reasonable for a feature that will be most useful to new and casual traders.

After registering and opening an account, you can choose the amount you want to invest and deposit funds using various payment methods. You can then decide whether to copy trades from successful traders or offer your own strategies for others to copy.

On testing the service, we found it intuitive and easy to use for both functions, and we see this as an excellent addition to RoboForex’s roster that stands up well to the copy trading offerings from rivals.

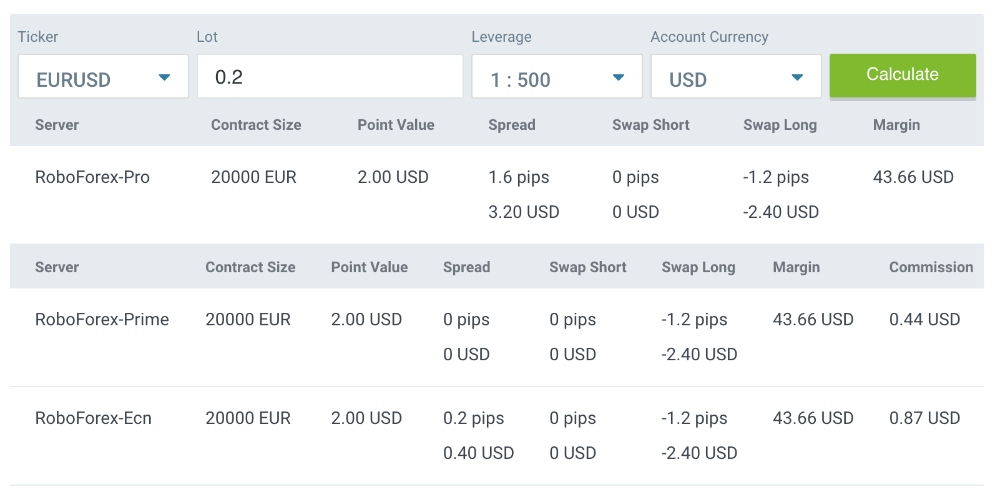

Trading Calculator

The calculator requires you to input the ticker symbol of the instrument being traded, the number of lots, the leverage, and the preferred currency to provide you with important information about your trade, including the contract size, spread, swaps, and margin.

I find this useful for planning trades, as it allows me to anticipate all of the expenses and work out how much ground a position will need to cover to get past the spread and into profit.

I particularly like the simple, attractive interface and functionality of the calculator.

VPS Server

A free VPS server is available for all traders whose account’s equity exceeds $300 (excluding active bonuses) or its equivalent in another currency.

If you don’t meet the trading volume requirement, you can still use the VPS server by paying a monthly fee of $5.

It is a useful tool that allows uninterrupted access to markets with the lowest possible latency. It will serve dedicated day traders, in particular, and complement Expert Advisors, allowing you to implement strategies as long as the markets are open, and without any manual input necessary.

To enable the VPS server service, follow these steps:

- Register with RoboForex and verify your account

- Ensure your trading account has at least 300 USD (or its equivalent in another currency)

- Submit an application in your Members Area’s ‘VPS 2.0 server’ section

- Receive an email with the VPS server IP address, login, and password

- Connect to the VPS server using Remote Desktop Protocol (RDP)

- Trade and invest any time, anywhere using the VPS server

Forex Research

RoboForex provides a decent selection of research tools in the form of market analysis, forecasts and a blog, all available for free on the broker’s website.

I find the market analysis, which is updated on a regular basis with multiple articles every weekday, to be especially valuable. I like that these frequent posts are split between headline analysis and more technical topics such as Japanese candlesticks or Ichimoku clouds.

The blog is similar but is mainly used to highlight important updates that could impact different instruments, leaving you to do the analysis yourself in your own way.

All in all, I think there is a lot of value in the research materials which will prove useful and convenient to traders, thanks to the depth of content and simple navigation via the broker’s homepage.

Forex Education

The firm provides an education tab with step-by-step instructions on how to open an account and how to start trading with RoboForex, as well as links to basic educational videos on its YouTube account.

There is also an FAQ section where questions about the platform and certain definitions are listed.

We see this as a very slim offering compared to rivals such as CMC Markets and XTB, which provide comprehensive educational content in their academies.

There is enough for a beginner to get started, and we are glad to see that the information can be easily navigated. However, with nothing beyond the basics, there isn’t enough there to recommend RoboForex’s educational materials.

Demo Account

Before signing up for a real account, some traders start with a demo account to test the platform and features. However, with RoboForex, you will need to complete full KYC verification – which involves your passport being verified, as well as some sort of address verification.

This is a long process as many brokers such as eToro and XM allow you to use a demo account with just your email address, full name, and phone number.

Demo accounts are also only available for Prime, R Stocks Trader, and Pro accounts.

As a result, we feel that the demo account offering is a mixed bag – we are glad to have the option but don’t like the comprehensive registration or limitations.

Bonus Offers

There is a selection of bonuses and incentives at RoboForex, including a restriction-free $30 welcome bonus for any trader who deposits at least $10 when they open their account.

Other incentives include a scaled bonus up to 120% for deposits up to $50,000, as well as a ‘profit share bonus’ that can be withdrawn when trading requirements are met.

An additional ‘profit share’ bonus of up to 60% of deposit values allows traders to increase their trading volume and reduce drawdown losses.

Finally, a cashback scheme for traders whose volume reaches at least 10 lots per month is a useful addition for active traders, with monthly rebates of up to 15% of the amount the company makes from the trader’s positions.

Altogether, we think the bonus schemes from RoboForex are better than most forex brokers we have reviewed. However, our experts have reservations about trading promotions – they can encourage over-trading and we believe there are more important considerations when choosing a forex broker, including account options, trading fees, and reliability.

Customer Service

Customer support at RoboForex is available via multiple channels. Live chat is available 24/7, you can also request a callback, fill out an online form, or call the team on +593 964 256 286.

On the downside, RoboForex’s live chat service is fairly slow. The brand responded to our queries within 20 minutes in each of the three tests we carried out, while some forex brokers we use respond to questions in less than 5 minutes.

Company Details

RoboForex is a global brokerage with headquarters located in Belize.

It was established in 2012 and has since won more than 20 awards, including Best Stocks Broker 2022 by the London Trader Show Awards.

The company offers its services to clients from various countries, including the UK, Nigeria, Malaysia, Indonesia, and New Zealand.

Trading Hours

RoboForex’s trading hours vary by instrument, with forex trading available 24/5. Trading holidays are also published on the website including bank holidays and the affected instruments or exchanges.

Who Is RoboForex Best For?

RoboForex is a good all-round broker thanks to its range of STP and ECN trading accounts, the possibility to directly trade stocks on a specialized account, and the support for various platforms including an easy-to-use web version of the popular MT4.

Having said that, the forex broker is skewed slightly towards beginners, who will benefit from the low minimum deposit, flexible accounts and copy trading service.

FAQ

Is RoboForex Legit Or A Scam?

RoboForex is a legitimate broker with many years in the business and multiple awards. The company also has thousands of trusted clients from around the world who have provided many positive reviews.

Can I Trust RoboForex?

RoboForex has a good track record, and if it meets your needs as a trader – with the variety of assets, payment methods, and trading platform options – then it is a strong candidate to be your go-to forex broker.

Is RoboForex A Regulated Forex Broker?

RoboForex is regulated by the Financial Services Commission (FSC) in Belize, which is where the broker is based.

However, this is not a top-tier regulator, and will not provide the same degree of protection as an organization like the UK’s Financial Conduct Authority (FCA).

Is RoboForex A Good Or Bad Forex Broker?

RoboForex has a good reputation, excellent trading platforms, a variety of accounts, and a welcome bonus.

It does have a few weak points such as the small variety of forex pairs and difficulty in accessing the demo accounts, but it remains a sensible option for aspiring traders.

Is RoboForex Good For Beginners?

Yes, RoboForex is a good choice for beginners, with a commission-free trading account, a $10 minimum deposit and copy trading. Our only minor complaint is that the education section could be stronger.

Does RoboForex Offer Low Forex Trading Fees?

RoboForex offers average trading fees. Spreads start from 0.0 on the Prime and ECN accounts, but commissions come in higher than some forex brokers.

You can also choose to not pay commission with the Pro or ProCent accounts, though spreads will be higher, starting from 1.3 pips.

Does RoboForex Have A Forex App?

Yes, RoboForex has mobile apps for its R WebTrader and R StockTrader accounts, and traders can also use the MetaTrader apps. The applications are compatible with Apple and Android devices and offer a stable trading environment.

How Long Do Withdrawals Take At RoboForex?

Withdrawal processing times vary between the different withdrawal methods but are faster than many forex brokers. Most e-wallets and bank transfers offer withdrawals in one working day.

Can You Make Money Trading Forex With RoboForex?

It is possible to make money trading forex on RoboForex. However, to maximize your chance of making profitable trades, ensure you have adequate risk management parameters in place and practise strategies with a demo account.

It is also worth remembering that many retail investors lose money trading forex.