Forex Brokers With Demo Accounts

Demo accounts are one of the most useful features offered by online brokers. A good forex demo account allows traders to test a firm or platform and practice new strategies without putting real funds at risk.

The best forex brokers with demo accounts have straightforward registration requirements, zero time constraints, and the opportunity to trade under real market conditions.

Best Forex Brokers With Demo Accounts

Our team have tested, compared and ranked the top five forex demo trading accounts:

- XM: Best Overall Forex Demo Account

- Plus500: Best Demo Account For Fast Sign-Up

- Pepperstone: Best Demo Account For Beginners

- CMC Markets: Best Demo Account For Serious Traders

- OANDA: Best Demo Account For US Traders

XM: Best Overall Forex Demo Account

Virtual Funds: $5,000,000. Time Limit: None

Why We Recommend XM

We recommend XM because it offers an excellent all-round demo trading account with a fast sign-up process, no expiration and access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Below we explain why XM tops our list of demo trading accounts.

Pros/Cons of XM

Pros

The demo account has no time limit

The XM forex demo account has no expiry. We prefer simulator accounts with no time limit because they allow you to continue testing and refining strategies alongside a live account.

Most of the brokers with demo accounts we evaluated stop providing access after 30 – 90 days, so no expiration is a major benefit.

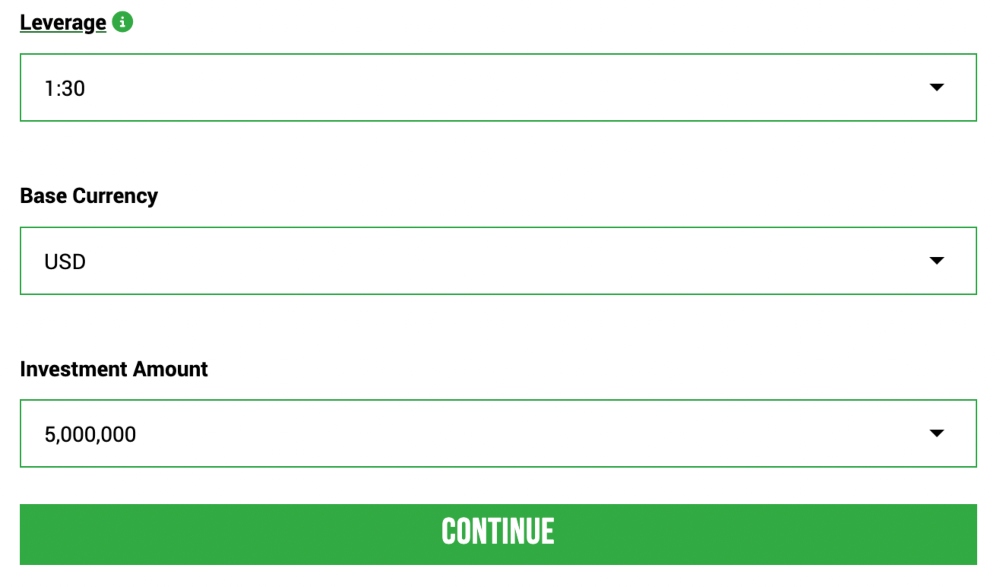

Up to $5,000,000 in virtual funding is available

XM provides the largest virtual bankroll out of the brokers we tested. Traders can select the amount of virtual money when they open a simulator account, ranging from 1,000 to 5,000,000.

This provides plenty of opportunities and practice funds to trial different forex strategies.

The simulator mode closely mirrors live account conditions

XM’s paper trading profile mimics trading conditions in the real account. This is a factor often overlooked when choosing between free demo accounts, but it allows you to practice trading in the most realistic way.

Another bonus for us is that you can enter demo mode for each of the broker’s accounts; Ultra Low Micro, Ultra Low Standard, and Zero. This means you can test the different pricing models and permitted trade sizes to find the profile that best aligns with your forex strategy.

You can sign up for a demo account and start trading in a few minutes

We have opened dozens of forex demo accounts and XM offers one of the fastest and most straightforward joining processes.

The online application form is easy to get through, requiring an email address, password and country of residency. After verifying your email via the link sent to the registered email address, you can sign into the members area to receive MetaTrader login details.

Cons

The default demo trading platform is MetaTrader 5

The standard demo account available upon registration only provides access to MetaTrader 5 (MT5). We found that you need to open an additional profile in the client area to get access to MetaTrader 4 (MT4).

Whilst this won’t be a major drawback for everyone, it does lengthen the joining process for forex traders looking to try MT4, which is more popular with beginners than its successor, MT5.

XM is not available in some popular trading jurisdictions

Traders in some major regions, including the US and Canada, cannot open a demo account at XM.

This is a shame as it is certainly one of the best brokers – with or without a demo account – of the hundreds we have tested.

Why Is XM Better Than The Competition?

The XM demo trading account stands out for its fast joining process, zero expiry and access to the industry-leading forex platforms – MetaTrader 4 and MetaTrader 5.

This, alongside best-in-class education, makes XM a great place to practice trading forex with no risk.

Who Should Choose XM?

XM is a good option for traders that want to retain access to a demo profile alongside a real-money account.

The broker also offers one of the best MT4 demo accounts that don’t expire, as well as access to MT5 in simulator mode.

Who Should Avoid XM?

XM is not a good option if you want access to a platform or app that isn’t MT4 or MT5. There are no other third-party trading terminals, such as cTrader, or proprietary software.

The forex broker is also not suitable for hands-off traders that want access to copy trading tools.

Plus500: Best Demo Account For Fast Sign-Up

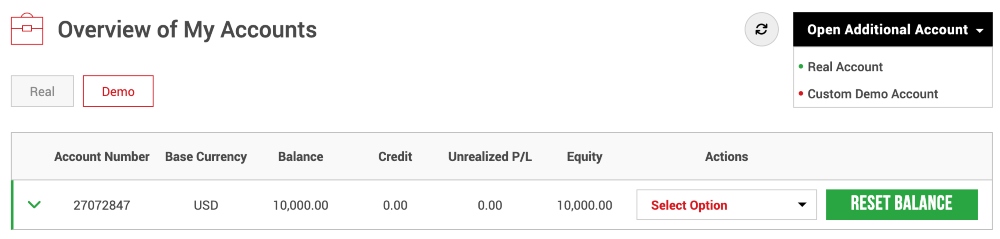

Virtual Funds: $40,000. Time Limit: None

Why We Recommend Plus500

Our experts recommend Plus500 because it is a reputable forex broker with an easy-access demo account that automatically tops up when your balance drops below $200.

The brokers also offers over 60 currency pairs in demo mode, which is more than most forex brokers we have reviewed.

Below we explain why Plus500 is one of our top-rated brokers with demo accounts.

Pros/Cons of Plus500

Pros

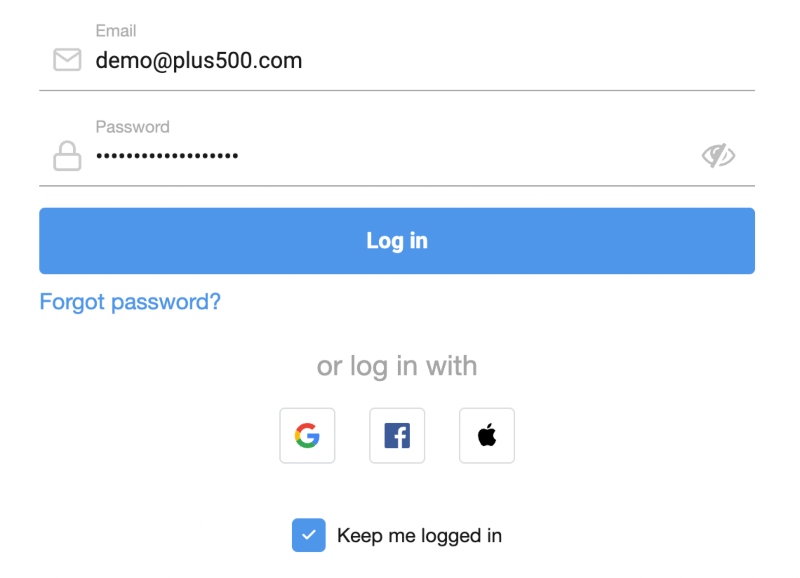

You can sign up for a demo account with a few basic contact details

The registration process for a Plus500 demo account is faster and easier than most alternatives we tested.

An email address and password are all that is required to get started. Alternatively, you can quickly sign up with a Google, Facebook or Apple account.

You can also access the platform directly through popular web browsers and trade forex in a few clicks. This means no time-consuming software download is required.

The demo account automatically tops up your balance and does not expire

The Plus500 paper trading account has no time limit. Similar to XM, this means you can continue developing and refining forex strategies alongside a live account.

We also found that Plus500 automatically resets your demo account when your balance falls below $200 or equivalent currency. This makes maintaining your simulator account hassle-free, though it is needed given that the 40,000 starting balance is lower than many alternatives.

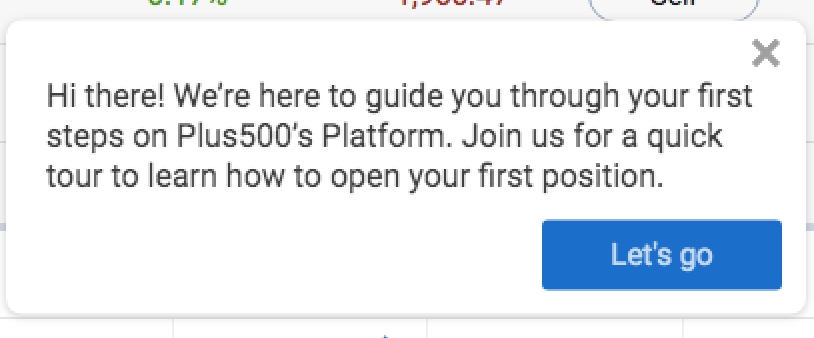

You can test the user-friendly proprietary trading platform

Our team think Plus500’s in-house trading platform is one of the easiest to learn, making it a great pick for beginners.

We particularly like the streamlined interface, with all the main functions placed logically in prominent positions.

We also appreciate the handy tutorial that kicks in when you begin trading in the demo account, guiding you through the process of executing a trade.

Paper trading is available on 2800 instruments

The Plus500 demo account offers access to a larger suite of assets than almost every competitor we have tested.

Alongside more than 60 forex pairs, you can speculate on over 1000 shares, dozens of indices, hard and soft commodity assets, cryptocurrency tokens, options, and ETFs.

This makes Plus500 a good option if you want to build a diverse trading portfolio.

Cons

You cannot choose demo account conditions

Out of the brokers with demo accounts we used, Plus500 offers limited flexibility when it comes to deciding the virtual bankroll, leverage available, or base currencies.

This is a downside when we compare it to XM, which has dropdown menus for all of these when you register for a paper trading profile.

There is no access to popular third-party trading platforms like MT4 or MT5

The Plus500 demo account is only available on the broker’s web-based platform and mobile app (iOS and Android app stores). While these are good quality, some experienced forex traders will prefer the familiar MetaTrader 4 and MetaTrader 5 platforms.

In particular, we think the in-house software lacks the advanced charting tools, technical indicators and automated trading solutions available with some third-party options.

Why Is Plus500 Better Than The Competition?

Plus500 offers a wider selection of trading instruments than most forex brokers with demo accounts.

The firm’s simulator also has no time limit and automatically replenishes accounts, meaning no human intervention.

Access to beginner-friendly proprietary software is also not available at many alternatives.

Who Should Choose Plus500?

The Plus500 demo account is suitable for beginners looking to learn how to trade forex on a user-friendly web platform.

It is also a good option if you want to retain access to a demo account to keep testing forex strategies after switching to a live account.

Who Should Avoid Plus500?

We do not recommend Plus500 if you want to practice forex trading on MetaTrader 4 or MetaTrader 5. XM is a better option here.

It is also not a sensible pick if you want to tailor your demo trading account in terms of leverage and denominated currency.

Pepperstone: Best Demo Account For Beginners

Virtual Funds: $50,000. Time Limit: 30 Days

Why We Recommend Pepperstone

We recommend Pepperstone because it offers demo trading on four excellent third-party platforms.

We also consider the customer support among the best in the industry, which will support beginners alongside the demo account provision.

Our experts explain why we consider Pepperstone one of the best full demo accounts without a deposit below.

Pros/Cons of Pepperstone

Pros

You can practice trading on a range of award-winning platforms

With a choice between four great platforms – MetaTrader 4, MetaTrader 5, cTrader and TradingView – plus the automated trading tool Capitalise.ai, Pepperstone has one of the best ranges of trading software on the market.

And with demo trading available on each terminal, aspiring forex traders can find the platform that works best for their strategy.

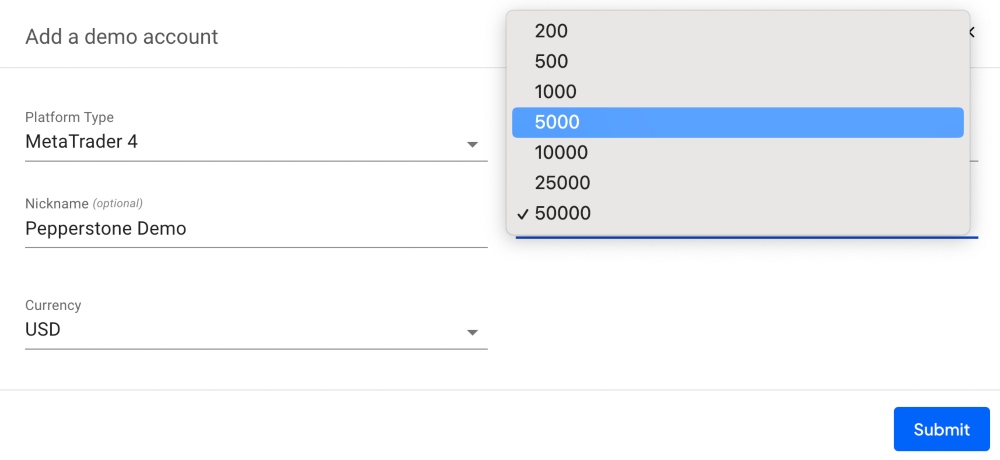

You can easily customize your demo account

Our team was able to set up a demo account for each of the trading platforms with a few mouse clicks. Similarly, you can choose between the standard and razor accounts when you set up your practice profile, as well as choose the currency you want to trade with and select a demo account balance from 200 to 50,000 units of your chosen currency.

These options allow traders to fine-tune their demo account experience, and best of all, the quick and simple registration process can be completed in just two clicks for traders with an active Google, Apple or Facebook profile.

24/7 customer service is available to support the set-up of new demo accounts

Pepperstone is one of the few demo brokerage accounts that we tested with 24/7 customer support.

We found the live chat particularly helpful for our demo account login questions and received a response from a representative within two minutes. We especially like that you can skip the automated bot function, and request human support as required, an advantage over many alternatives.

Cons

The MetaTrader demo account automatically expires after 30 days

Pepperstone traders are restricted to a 30-day time limit on the MT4/MT5 demo account. Fortunately, you can keep access to these profiles if you open a live trading account, but you will need to send a request in order to do this.

On a lighter note, our cTrader demo account at Pepperstone does not expire as long as we log into the account at least once every 30 days.

The paper trading account offers limited access to some assets and tools

In our tests, Pepperstone restricted access to some instruments and features. For instance, in TradingView, the live news stream for company stocks is ‘only available to registered users’.

Moreover, while using the MT4 Razor demo account, we can only access a handful of forex pairs, and not the full list of products available with a live account. This is a big disadvantage as it limits the usefulness of the demo trading account as a tool to test new forex strategies.

Why Is Pepperstone Better Than The Competition?

Pepperstone excels due to its platform offerings. You can try demo trading on more top-rated platforms than most alternatives, with access to MetaTrader 4, MetaTrader 5, cTrader and TradingView.

Pair this with real-market conditions and 24/7 customer support, and you have a top broker for demo trading.

Who Should Choose Pepperstone?

Pepperstone is one of the better brokers with demo accounts for new retail traders that want to put several platforms to the test.

With one registration you can open practice profiles on four third-party platforms and trial the features alongside around-the-clock customer support.

Who Should Avoid Pepperstone?

We don’t recommend Pepperstone if you want unrestricted access to a demo account. Other brokers in this list provide forex demo accounts without a time limit, including XM.

CMC Markets: Best Demo Account For Serious Forex Traders

Virtual Funds: $10,000. Time Limit: None (30 days on stocks)

Why We Recommend CMC Markets

CMC Markets is a hugely respected forex, CFD and spread betting broker that offers a flexible demo account with access to MetaTrader 4 and the bespoke Next Generation platform.

As well as an accessible simulator, the broker provides daily and weekly market outlooks, advanced trading tools, and a secure investing environment. It also offers more forex instruments than most alternatives.

Our team unpack why CMC Markets offers one of the best demo trading accounts below.

Pros/Cons of CMC Markets

Pros

Demo trading is available on over 12,000 instruments including more than 330 forex pairs

CMC Markets offers demo trading on more forex assets than every other broker we tested. With over 300 currency pairs, including majors, minors and exotics, both beginners and experienced traders can practice forex strategies.

The thousands of additional instruments spanning popular asset classes like equities, commodities and cryptos also beats most rivals.

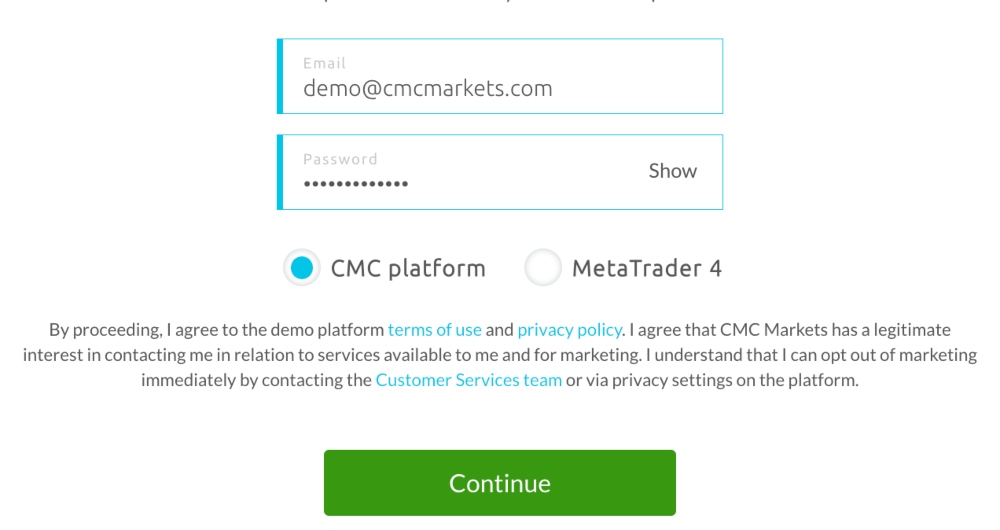

You can sign up for the simulator account and start trading in less than two minutes

CMC Markets is another forex broker with a fast and straightforward sign-up process for demo traders.

All you need to do is provide an email address, password and choose between MetaTrader 4 or the CMC platform. Once complete, you will be automatically redirected to your platform of choice.

We particularly rate the virtual tour that walks you through the key features of the CMC platform, which we were then able to test for ourselves.

The demo account allows you to test different fee models

Prospective traders can test the broker’s different account conditions and pricing structures before risking real funds.

This includes access to a raw spread option, which will appeal to active traders deploying fast-paced strategies like forex scalping.

We also like that seasoned traders get additional tools when they open a real-money account, including support for Virtual Private Servers (VPS).

Cons

Only $10,000 in paper funds is available as default

CMC Markets offers a lower starting balance in its demo account than most forex brokers we assessed.

Traders only get up to $10,000 or equivalent currency, which is significantly lower than the $100,000 available at XM or Plus500.

You can only practice trading stocks for 30 days

Whilst the forex demo account is available for an unlimited period, you can only trade stock CFDs for one month.

As a result, CMC Markets does not offer the best demo account for stock traders.

The MetaTrader 4 web trader is not available in demo mode

CMC Markets does not offer access to the MT4 web terminal in the forex demo account. We had to download the desktop software, which added around 10 minutes to the setup process.

If you don’t want to download the software to your computer, we recommend the Next Generation platform, which we could access almost instantly.

Why Is CMC Markets Better Than The Competition?

CMC Markets offers more currencies than most forex brokers with demo accounts, with over 300 assets.

The broker also stands out for its two-minute sign-up process, access to multiple pricing models and high-quality Next Generation platform.

Who Should Choose CMC Markets?

CMC Markets is an excellent option for experienced traders that want a large suite of forex assets and a hassle-free demo account opening process.

The broker will also serve traders that need access to the MetaTrader 4 platform in demo mode.

Who Should Avoid CMC Markets?

We do not recommend CMC Markets if you want a large initial bankroll – the $10,000 starting balance is lower than many alternatives.

It is also not suitable if you want to practice trading stock CFDs for an unlimited period as the simulator mode expires after 30 days.

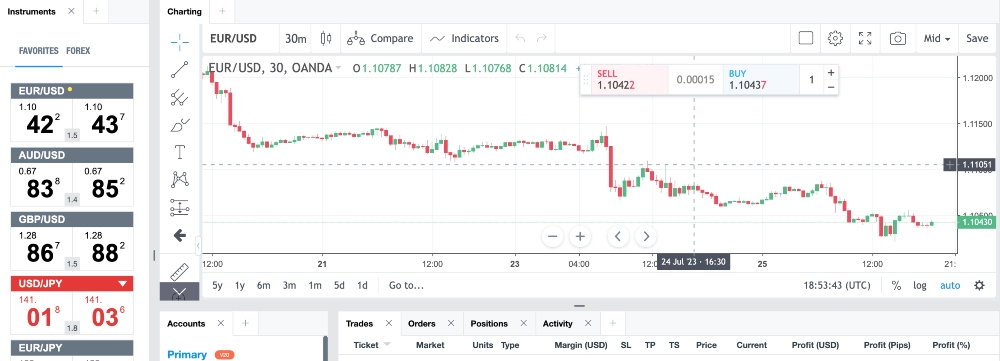

OANDA: Best Demo Account For US Traders

Virtual Funds: $100,000. Time Limit: None.

Why We Recommend OANDA

OANDA is a trustworthy US broker with regulatory oversight from the NFA/CFTC and a competitive demo account.

As well as access to MetaTrader 4 and TradingView, the broker offers a proprietary web and mobile application. We also rate the advanced tools such as MultiCharts and CQG FX.

We explain why OANDA makes our list of best brokers with demo trading accounts below.

Pros/Cons of OANDA

Pros

There are no time restrictions on the demo account

Similar to XM, OANDA’s demo account does not expire. This means you can practice trading for as long as you need, and use it alongside a live profile.

This is one of the key features we look for in a paper trading account and separates OANDA from many brokers with demo accounts in the US.

The simulator account provides access to all assets and tools

We rate that the single demo account provides access to all trading platforms. You can explore MetaTrader 4, as well as the proprietary web, desktop, and mobile app – you don’t need to register for a separate account depending on your platform choice.

We also like that the broker provides user guides for all platforms, with key questions covering system requirements, how to customize your preferences, graph features, and more. This makes it easier for beginners to learn how the platforms work.

Excellent resources for high-volume traders

OANDA is a welcoming broker for high-volume traders, and this sets it apart from many of the competitors that came up in our reviews.

The ‘Elite’ account, which is targeted at high-volume clients, offers several excellent benefits such as fee rebates, personalized account management, reimbursement for subscription to TradingView, and priority in customer service queues.

These features, together with the streamlined, restriction-free demo account, make this one of the best places for high-volume traders in the US to practice their strategies before putting them into action on real markets.

Cons

There is limited education to support beginners while demo trading

OANDA does have some resources for traders to sharpen their skills, but these are restricted to basic materials, such as weekly market updates and insights. The broker’s ‘Academy’ compares poorly to some of the best brokers with demo accounts.

We don’t consider this a major drawback for many experienced traders, but it may deter some beginners.

Limited funding options when you upgrade to a live account

With no e-wallets available, clients will need to use traditional bank transfers or card payments to fund their live accounts.

This doesn’t affect your experience with the demo account, but it may prove limiting if you decide to start live forex trading with OANDA.

Why Is OANDA Better Than The Competition?

OANDA’S demo account offering is very strong, with access to all trading platforms from one registration.

We also rate that there is no expiry time and $100,000 available to practice trading on almost 70 forex pairs, more than many competitors.

Who Should Choose OANDA?

OANDA is suitable for US traders looking for fast access to a demo trading account with a large virtual bankroll and no time restrictions.

The broker is especially good for high-volume traders who can benefit from various perks if they upgrade to a live account, including fee rebates, priority support and a personal account manager.

Who Should Avoid OANDA?

We don’t recommend OANDA if you are based in the US and want to trade stocks or CFDs – these are not available in the demo account or real-money profile.

The broker also isn’t the best pick if you plan to fund a live account, should you open one, with popular e-wallets like PayPal, as there are not supported.

What To Look For In A Demo Account

There are several categories our experts test and compare brokers with demo accounts in to find the best providers:

Sign-Up Time

The best brokers with demo accounts offer a fast and seamless sign-up process. We consider anything below 10 minutes fast, though we get started with many of the brokers we evaluate in less than 5 minutes.

The top brokers with demo trading accounts only require your name, email address and password. You can then usually activate your account and choose any settings, including the base currency, trading platform, leverage, and amount of virtual funds.

Virtual Funds

The amount of virtual money available will impact the extent to which you can test forex strategies.

Most of the brokers with demo accounts we try offer between $10,000 and $100,000. We consider anything below $10,000 fairly limiting.

In our experience, the best brokers with demo trading accounts will also top up your balance. Some firms, such as Plus500, will even automatically replenish your practice account when it reaches a certain level, such as $200.

Trial Duration

The length of time the demo account is available is a key consideration.

Most brokers automatically close paper trading accounts after 30 to 90 days. However, we favor demo trading accounts with no expiry, as they allow you to continuously trial strategies alongside real-money accounts.

Access To Platforms

The best brokers with demo accounts provide access to all of their platforms.

MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader are the most popular third-party platforms, however an increasing number of brands offer proprietary software.

Ensuring you have access to any in-house platform in demo mode is particularly important, as it will allow you to try the features in a risk-free environment.