easyMarkets

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, TRY, SEK, CHF, PLN, CZK

-

🛠 PlatformsMT4, MT5, TradingView

-

⇔ Spread

GBPUSD: 1.3 var (MT5) EURUSD: 0.9 (MT4) GBPEUR: 1.5 (MT4) -

# Assets81+

-

🪙 Minimum Deposit€100

-

🫴 Bonus Offer-

My Opinion On easyMarkets

I enjoy the forex trading experience at easyMarkets. The low minimum deposit, fast sign-up process and reliable MetaTrader platforms make it straightforward to get started. I also rate the numerous risk management features, especially Deal Cancelation, which allows me to undo losing trades within 6 hours.

Looking at the negatives, the investment offering is limited compared to major brokers. My testing also shows that spreads in the Standard account trail alternatives. Finally, I would like to see telephone support made available.

Summary

- Instruments: 250+ available as CFDs, options, forwards, and easyTrade including 60+ forex pairs, stocks, indices, metals, commodities, crypto

- Live Accounts: Standard, Premium, VIP

- Platform & Apps: easyMarkets, MT4, MT5

- Deposit Options: Credit/debit card, wire transfer, UnionPay, Skrill, Neteller, Perfect Money, WebMoney, Sticpay, crypto

- Demo Account: Yes

Pros & Cons

- Trusted forex broker with 20+ years in the industry plus CySEC and ASIC authorization

- Easy-to-use risk management features, including easyTrade and Deal Cancellation

- Convenient deposits with multiple methods and 10+ base currencies including Bitcoin

- Well-designed web platform with advanced charting from TradingView

- A $25 minimum deposit lowers entry requirements for new traders

- Fixed spreads on forex pairs offer price certainty

- High leverage up to 1:2000 for global traders

- Premium and VIP accounts require a high minimum deposit of $2,000 and $10,000

- The demo account doesn't offer access to MT4 or MT5

- Slim product portfolio with only around 50 shares

- No telephone customer support

- No forex copy trading solution

Is easyMarkets Regulated?

I feel comfortable that easyMarkets is reliable – the forex broker operates via several global entities, all with regulatory oversight. I am also pleased with the safety measures in place, as customer funds are segregated from company money in custodian banks and negative balance protection is provided.

My research shows that of its four branches, easyMarkets provides top-tier oversight to EU and Australian traders through regulation from the CySEC and ASIC, respectively. However, the watchdogs overseeing the offshore branches are not the most credible, with less stringent membership requirements and limited access to compensation schemes in the case of business disputes.

easyMarkets is regulated through the following entities:

- Easy Forex Trading Ltd – regulated by the Cyprus Securities & Exchange Commission (CySEC), registration number 079/07

- Easy Markets Pty Ltd – regulated by the Australian Securities and Investments Commission (ASIC), AFS license number 246566

- EF Worldwide Ltd – regulated by the Financial Services Authority (FSA) of Seychelles, license number SD056

- EF Worldwide Ltd – regulated by the British Virgin Islands Financial Services Commission (BVIFSC), registration number SIBA/L/20/1135

Forex Accounts

easyMarkets offers three live accounts: Standard, Premium and VIP. I found they are available on either the MT4 or easyMarkets platform, with an additional floating spread account on MT5.

Importantly, my analysis shows that each of the account types provides different trading terms depending on the platform you use. For example, price quotes on the EUR/USD through the easyMarkets platform on Premium and VIP accounts are 1.5 pips and 0.8 pips respectively, while on the same accounts on MT4, I was quoted 1.2 pips and 0.7 pips. This means there are effectively seven accounts, with MT4 and MT5 accounts offering the best terms.

In my opinion, the Standard accounts offer the most attractive conditions for beginners thanks to their low minimum deposit of $25, though my testing shows the fixed spreads are less competitive, especially on the bespoke platform.

The Premium and VIP accounts will appeal to experienced traders, with tighter fixed spreads in return for a larger minimum investment of $2,000 and $10,000, respectively.

The other important consideration in my view is the safety features. The easyMarkets platform provides the best safety features, with guaranteed stop loss orders, no slippage, plus Deal Cancellation and Freeze Rate functions, which aren’t available at most forex brokers I test.

The MetaTrader accounts are geared towards experienced traders with higher leverage, Trading Central indicators, and lower average fees.

I am reassured to see an Islamic account is also available for Muslim traders, with no swap fees.

How To Open A Live Account

I found the registration process at easyMarkets straightforward, though I recommend having verification documents to hand to prevent delays. To get started:

- Add your name, email, and phone number on the registration screen and create a password

- Choose your country of residency from the dropdown menu on the following page and click ‘I confirm’

- The easyMarkets client area will load on the following screen

- Fill in your personal details and provide information on your financial situation and trading experience

- Upload the requested documents

- Verify your ID over the telephone

Trading Fees

My analysis shows that easyMarkets offers competitive fees with a choice of fixed and floating spreads. There are no commissions on any of the broker’s accounts or platforms.

Fixed spreads are available on the broker’s in-house platform and MT4, with the latter offering slightly lower spreads, starting from 1.0 pip on majors like the USD/JPY, compared to the 1.5 pips for the same pair on the easyMarkets platform. Importantly, these are lower than other fixed-spread forex brokers I have evaluated.

The fixed spread model will ultimately appeal to new traders and those looking for price certainty – spreads won’t widen during volatile periods. My only criticism is that traders will need a Premium or VIP account for the lowest spreads and this requires a $2,000 or $10,000 deposit, which may be too high for some retail investors.

The MT5 solution is a better option if you want floating spreads. While not the tightest forex spreads I have seen, they are in line with many competitors, starting from 0.5 pips on the EUR/USD, 0.9 pips on the GBP/USD and 1.0 pip on the USD/JPY.

Non-Trading Fees

While using easyMarkets, I found a biannual $25 inactivity fee applies after 12 months of account dormancy. However, I don’t score the broker down for this – it’s a common charge in the industry and will only impact casual traders.

The forex broker also charges swap fees for positions held overnight. Again, these rates are standard.

Payment Methods

Deposits and withdrawals are a key benefit of trading forex with easyMarkets in my view. Not only do I rate the slick and user-friendly cashier portal, but the broker supports a wide range of fast and fee-free payment methods.

My testing shows that the fastest methods are cards, Skrill and Neteller which are near-instant, though other methods should process within one working day.

easyMarkets also stands out against competitors with its large list of base currencies, including EUR, GBP, USD, CNY, JPY, SGD and HKD. This means traders from major jurisdictions can manage their accounts in a convenient currency.

How To Make A Deposit

I find the process of adding funds to my live trading account simple:

- Login to the easyMarkets client portal

- Select the ‘Deposit Funds’ icon found top right of the platform interface

- Choose a payment method from the list, such as debit card

- Input the amount to deposit and follow the on-screen instructions

Forex Assets

With 60+ currency pairs including majors, minors, and exotics, I am pleased with the breadth of forex trading opportunities.

easyMarkets also offers more trading vehicles than the vast majority of brokers I review. You can trade forex through CFDs, options and forwards. CFDs offer high leverage and long/short opportunities, while options and futures are good for hedging and offer set expiries and contract terms.

You can also trade forex through easyTrade – a unique instrument that operates similarly to binary options, though with some important differences. There are unlimited payouts and you can close trades before the expiry.

Ultimately, it’s hard to find a broker that offers the same variety of forex trading instruments. My only minor complaint is that not all 60+ currency pairs are available with each trading vehicle, with fewer volatile currencies available through easyTrade, for example.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

I am less impressed with the selection of non-forex investments. While there remains a good range of trading vehicles, the selection of stocks in particular is limiting, with only around 50 popular equities. This falls short of competitors like CMC Markets, with 9,000+ shares.

You can trade:

- 50+ US, EU, JA, and HK stocks including Nike, JP Morgan, Adidas, Toyota, and Bank of China

- 15 index funds such as S&P 500, FTSE 100, CAC 40 and Japan 225

- 15+ commodities including gold, silver, natural gas, WTI Crude oil, and wheat

- 20 cryptos including Bitcoin, Ripple and Ethereum

Execution

easyMarkets is a market maker with its own dealing desk. This means the broker creates market liquidity and adds a small markup fee to the buy and sell price of assets.

I usually prefer trading with no-dealing-desk brokers as I feel brokers who act as counterparties to their clients’ trades can be more exposed to conflicts of interest. With that said, easyMarkets still offers reliable execution and competitive fixed-spread pricing.

Leverage

easyMarkets offers leveraged trading, which can be used for placing day trade orders, forward deals, pending orders, and options.

European forex traders can access leverage up to 1:30 on major currency pairs and 1:20 on minors. Global investors and those with professional trader status can access leverage up to 1:2000.

Importantly, I don’t recommend high leverage for beginners – the risk of large losses seriously increases. If you do opt for highly leverage trading, I would make the most of the forex broker’s risk management tools, which I explain how to use in more detail below.

Platforms & Apps

I see the three trading platforms offered by easyMarkets as a significant advantage, with the industry-leading MetaTrader 4 (MT4), MetaTrader 5 (MT5), as well as a proprietary platform.

The MetaTrader platforms are my favorite solutions thanks to their automated trading capabilities, though I also rate the easyMarkets platform for its sleek design and TradingView charting package.

The proprietary platform is available directly through web browsers, or as a mobile app whereas the MetaTrader platforms can also be downloaded to desktops.

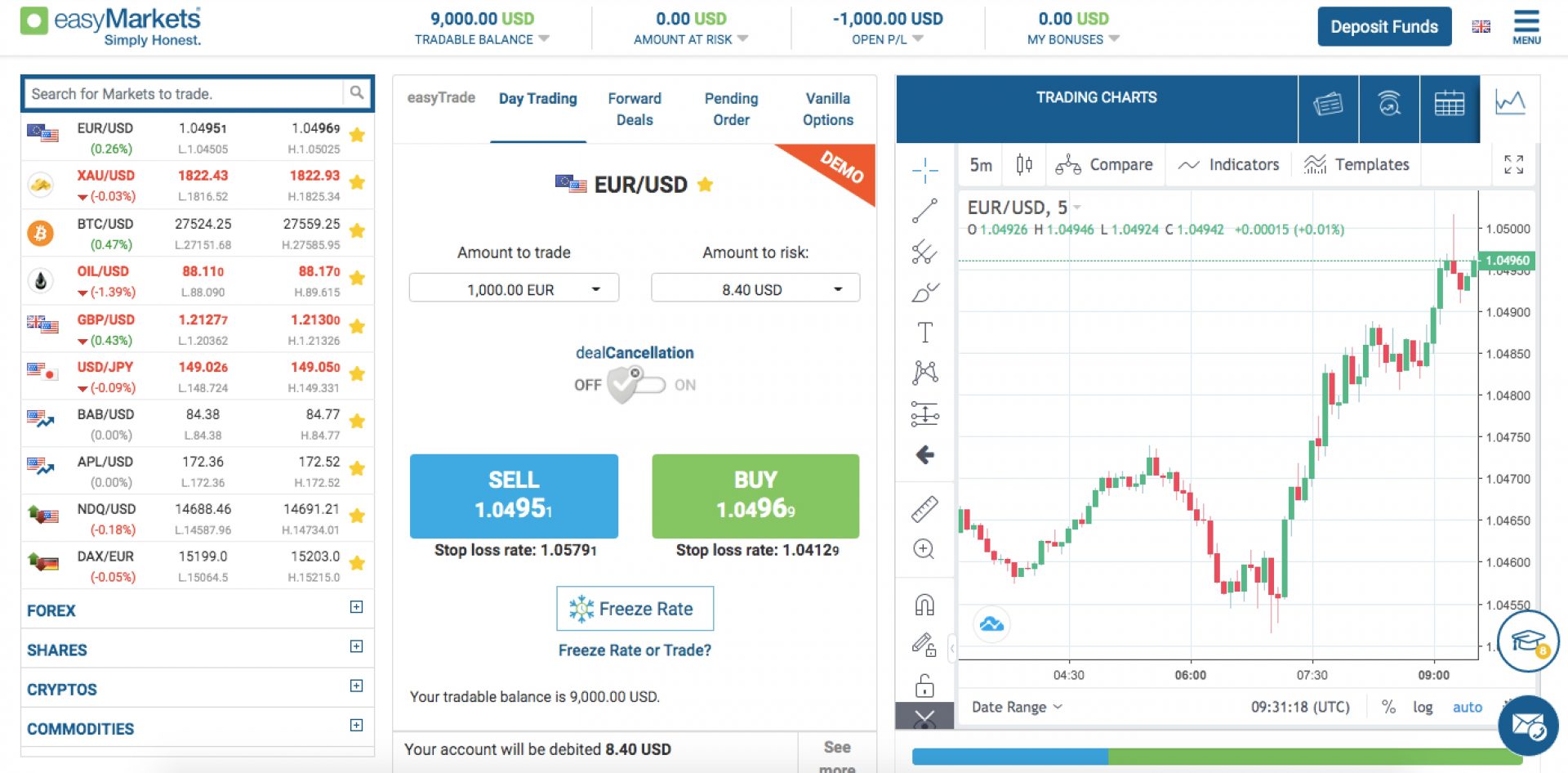

easyMarkets Platform

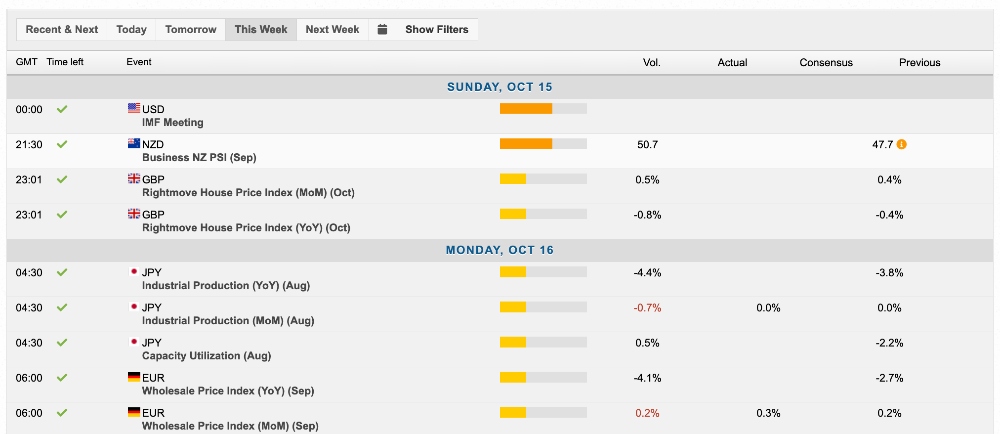

I have been impressed with the broker’s proprietary platform. I find the interface easy to use and it’s equipped with many of the key features I need to trade forex, including market sentiment data, trading signals and an economic calendar. The fact I can create watchlists and easily view my open orders is a bonus too.

However, the stand-out benefit for me is the built-in TradingView charting which offers 7 chart types, 11 timeframes, 60+ technical indicators, and 18 trend analysis tools. This software package is an upgrade from MetaTrader in terms of usability and sophistication in my view.

The broker also offers a mobile app of its platform. The application is available for free download to iOS and Android devices and offers most of the same features, including all order types.

How To Make A Forex Trade On easyMarkets

- Use the ‘+’ icon next to forex in the left menu to find a currency pair

- Choose an order type from the top of the trading ticket

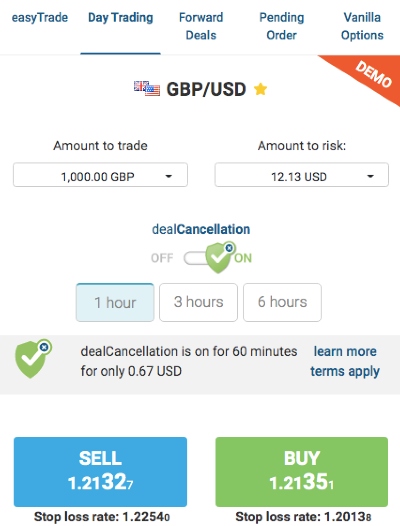

- Click on the Deal Cancellation slider if you want to protect your trade (pricing is displayed by expiry time)

- Select ‘Sell’ or ‘Buy’ to open the position

MetaTrader 4 And MetaTrader 5

The most popular forex trading platforms in the world, MT4 and MT5 have gained their following with good reason, offering one-click trading, integrated technical indicators, plus expert advisors (EAs) and scripts for automated trading. The platforms are also loaded with 20+ years of historical data, ideal for backtesting strategies.

Looking at the negatives, I don’t find the interface visually appealing, which impacts the trading experience for me. The design is outdated compared to the easyMarkets platform and the interface feels cluttered with lots of widgets, although I can minimize or remove some of these.

MT4 and MT5 also have mobile app compatibility, with iOS and Android downloads.

Forex Tools

easyMarkets beats most competitors I have tested when it comes to risk management tools. Many of these features could prove useful when trading forex, especially for beginners providing important guardrails.

My only minor complaints are that there is no copy trading, VPS hosting or access to useful tools like Autochartist. In my view, this limits the broker’s appeal to more experienced traders.

Below are the tools I find useful while trading forex at easyMarkets.

- easyTrade – This is available on forex options and allows me to set maximum risk levels per currency pair, close trades before the expiry time or set automatic closeouts at a pre-defined target price. I especially rate that there is no cap on the potential upside, meaning there are no limits on the profits you can make while using this feature.

- Deal Cancellation – This gives me the option to cancel a trade up to the expiration time to prevent significant losses or protect profits. A small fee applies, though this is set by asset and market volatility at the time of order execution. On the new order ticket, simply click the Deal Cancellation slider to ‘On’. Open trades with the feature activated will have the shield icon displayed next to them.

- Freeze Rate – This is another unique tool that holds an asset’s price for a few seconds while I determine whether to open the position. I have found that this can be particularly beneficial during volatile market conditions, especially before central bank announcements.

Forex Education

I have been impressed with the educational resources, including videos, e-books, and articles. Topics include how to manage risk, technical and fundamental analysis, and when to enter and exit trades.

The introductory modules for brand-new forex traders are particularly strong and I enjoy taking the quiz at the end of each module to ensure my learning is on track.

Altogether, I feel the content stands up very well against most rivals, and during my testing, I was pleased to see materials that will suit different experience levels.

Forex Research

I also rate the market analysis offered by easyMarkets, which includes daily market news with expert commentary and live currency rates.

I find the economic calendar particularly useful, as it shows potential events that could affect the markets over the coming week.

Demo Account

The broker claims to offer a free demo account to test MT4, MT5, and the proprietary, so during my review I was disappointed to only get a practice account on the easyMarkets platform.

On a lighter note, my account came loaded with $10,000 in virtual funds. I also like that there are no time restrictions, which is ideal for beginners getting to grips with the forex market and learning how to use the in-house platform.

How To Open A Demo Account

I found registration quick, with no lengthy account details required. It took me just a couple of minutes to sign up.

- Click ‘Try Demo Account’ from the broker’s homepage

- Add your name, email, and phone number on the registration screen and create a password

- Select ‘Sign Up’

- Choose your country of residency from the dropdown menu on the following page and click ‘I confirm’

- The easyMarkets platform will load on the following screen

Bonus Offers

easyMarkets offers occasional bonuses and financial incentives to new and existing customers, though eligibility varies between countries due to regulatory restrictions. For example, I was offered a refer-a-friend scheme and a first deposit bonus when I registered for a live account.

The deposit bonus is available for new customers depositing at least $100 with tier-based rewards from 30% to 50%. On the downside, I reviewed the T&Cs and found profits can only be withdrawn when you trade a certain number of lots.

The referral program is easy to participate in, though rewards are based on your referral’s 30-day turnover, the minimum requirement being $50,000 for the smallest bonus of $25. As a result, this isn’t particularly attractive.

Trading Restrictions

I did not come across any restrictions whilst using the easyMarkets trading platforms. This means strategies implementing hedging, scalping, and news trading are permitted, so long as they are in good faith.

Customer Service

easyMarkets offers multiple customer support options, with email, live chat, and WhatsApp available 24/5 in 8 languages.

I think this coverage stands up well to most competitors, and while I am a bit disappointed that there is no telephone support, I have been pleased with the sub-two-minute responses during my tests of the online chat.

- Email – support@easymarkets.com

- Chat – Facebook Messenger, Viber, live chat and WhatsApp links via the ‘Contact Us’ webpage

- Office Address – EF Worldwide Limited, CT House, Office No.8F, Providence, Mahe, Seychelles

Company Details

easyMarkets, a trading name of EF Worldwide Ltd, was established in 2001. The company was re-branded in 2016 from its original trading name easy-forex.

The brokerage offers services worldwide with regulatory oversight from some of the most respected watchdogs, including the CySEC and ASIC.

Other reassuring signs for me that this broker can be trusted is that it is the official trading partner of Real Madrid CF and has been recognized with several awards, including the Most Trusted Forex Broker in the Middle East at the Fin Expo Egypt 2022, and Most Reputable Multi-Asset Broker at the Forex Expo Dubai 2022.

Trading Hours

easyMarkets publishes transparent market trading hours as well as a daily holiday schedule.

Major and minor currency pairs are available to trade from 10 PM Sunday to 9 PM Friday (GMT). Some exotic pairs have amended times, so check the broker’s comprehensive schedule.

Who Is easyMarkets Best For?

Based on my assessment, easyMarkets is a good option for new forex traders. The fixed spreads offer price certainty, while the integrated risk management tools in the proprietary platform are useful for investors getting to grips with forex markets. These, alongside a comprehensive learning academy and unlimited demo account, make easyMarkets great for beginners.

Equally, easyMarkets is one of the best forex brokers if you want fixed spreads, especially if you can afford the starting deposit for the Premium or VIP solution.

FAQ

Is easyMarkets Legit Or A Scam?

easyMarkets is a legitimate forex broker based on my tests, The firm has been operating since 2001, is regulated by trusted financial bodies, holds high-profile partnerships, and has picked up multiple awards.

Can I Trust easyMarkets?

My review shows that easyMarkets is a trustworthy forex broker. The company is well regulated and I did not find evidence of unfair operating practices or weak security measures during my evaluation.

Is easyMarkets A Regulated Forex Broker?

Yes, easyMarkets is regulated globally. The brand operates four entities, overseen by the CySEC, ASIC, FSA, and BVIFSC.

Does easyMarkets Offer Low Forex Trading Fees?

My testing shows that easyMarkets offers low fees compared to other fixed spread brokers, particularly in the Premium and VIP accounts.

However, the floating spread account doesn’t offer the lowest fees, especially compared to brokers with raw-spread accounts.

Is easyMarkets A Good Forex Broker For Beginners?

My evaluation shows that easyMarkets is a good forex broker for beginners. New investors will appreciate the commission-free trading model with fixed spreads. The educational materials, unlimited demo account and low $25 minimum deposit are also excellent perks for newer traders.

Does easyMarkets Have A Forex App?

Yes, easyMarkets offers a mobile trading app. It can be downloaded from the Apple App Store and Google Play. Importantly, it offers easy account management, online trading and the broker’s suite of risk management tools.

How Long Do Withdrawals Take At easyMarkets?

Withdrawals from an easyMarkets account are relatively quick, though timings vary by payment method in my experience. The forex broker processes requests within two business days and you can expect to see funds within several working days.

Can You Make Money Trading Forex With easyMarkets?

While it is possible to make money trading forex at easyMarkets thanks to its commission-free trading model, fixed spreads and reliable trading tools, you could also lose money.

Online trading is risky, so only invest what you can afford to lose. Also, consider using the broker’s multiple risk management functions.

Article Sources

Easy Forex Trading Ltd – CySEC License

Easy Markets Pty Ltd – ASIC License