ForexChief

-

💵 CurrenciesUSD, EUR, GBP, JPY, CHF

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: 0.9 EURUSD: 0.4 GBPEUR: 0.9 -

# Assets40

-

🪙 Minimum Deposit$10

-

🫴 Bonus Offer$100 No Deposit Bonus

Our Opinion On ForexChief

ForexChief is a promising forex broker. Standout features for us are the powerful MetaTrader 4 and MetaTrader 5 platforms and flexible STP/ECN accounts. The cashback rebates are also a great perk for active forex traders.

However, we are underwhelmed by ForexChief’s regulatory credentials, which fall short of our expectations. The withdrawal fees charged on some payment methods can also be avoided at alternatives.

Summary

- Instruments: 150+ including forex pairs, stocks, indices, commodities, crypto

- Live Accounts: CENT, Classic+, DirectFX, xPRIME

- Platforms & Apps: MetaTrader 4 (MT4), MetaTrader 5 (MT5), App

- Deposit Options: Bank cards, wire transfers and e-wallets

- Demo Account: Yes

Pros & Cons

- Two excellent platforms, MT4 and MT5, with multi-device access

- High-quality educational content including forex trading guides

- Flexible STP & ECN accounts with raw spreads from 0.0 pips

- Strong range of funding methods and supported currencies

- High leverage up to 1:1000 for experienced traders

- Rebate scheme for high-volume forex traders

- Low minimum deposit

- Weak regulatory status lowers safety score

- Withdrawal fees on bank cards and e-wallets

- Slim product portfolio with around 150 assets

- Market research trails alternatives

- No telephone customer support

- Limited functionality on the app

Is ForexChief Regulated?

The broker’s weak regulatory status is our main criticism. ForexChief Ltd is regulated by the Vanuatu Financial Services Commission (VFSC), license number 14777.

This offshore regulator does not provide the same level of protection as reputable bodies like the UK Financial Conduct Authority (FCA) or the Cyprus Securities & Exchange Commission (CySEC). For example, VFSC does not enforce negative balance protection and independent support for disputes.

To its credit, though, ForexChief segregates client money from operating funds and guarantees balances if lost following a technical fault.

Forex Accounts

I am impressed by ForexChief’s range of account types, which provide flexible conditions to suit different trading styles and needs. Three accounts also have low minimum deposits, allowing forex traders with less capital to get started easily.

CENT

The CENT account is a low-stakes retail account designed for beginners with no minimum deposit. It uses a market-making model, whereby the broker takes the opposing side of trades.

Here are the key features:

- Minimum Deposit: $0

- Minimum Order Size: 0.01 lots

- Maximum Order Size: 1,000 lots

- Maximum Leverage: 1:500

- Base Currency: USD, EUR

- Assets: 35+ Forex & Metals

- Spreads: From 0.9 pips

- Commission: $0

Unfortunately, we found that an Islamic-friendly solution is not available with this account. PAMM accounts and bonuses are also not supported.

Classic+

I think the Classic+ account will serve most retail traders. It shrugs off the market-making model for an STP system, while also offering an accessible minimum deposit and a good selection of forex assets.

Here are the key features:

- Minimum Deposit: $10

- Minimum Order Size: 0.01 lots

- Maximum Order Size: 100 lots

- Maximum Leverage: 1:1000

- Base Currency: USD, EUR, GBP

- Assets: 50+ Forex, Metals, Commodities & Indices

- Spreads: From 0.6 pips

- Commission: $0

This account also comes in a swap-free solution and provides access to PAMM trading and bonuses.

DirectFX

We have also made good use of the DirectFX account thanks to its ECN execution, coupling raw spreads with fixed commissions. This is a good option for day traders and scalpers.

Here are the key features:

- Minimum Deposit: $50

- Minimum Order Size: 0.01 lots

- Maximum Order Size: 100 lots

- Maximum Leverage: 1:1000

- Base Currency: USD, EUR, GBP

- Assets: 150+ Forex, Metals, Commodities, Indices, Stocks & Crypto

- Spreads: From 0.3 pips

- Commission: $15 per million for Forex, Metals, Commodities & Indices, 0.1% for Stocks & Crypto

Again, swap-free and PAMM accounts are available, as well as access to the broker’s bonuses.

xPRIME

ForexChief has designed the xPRIME ECN account for high-volume traders, offering tighter spreads and more currencies. However, the DirectFX account has lower commissions and is also ECN, hence we experienced the same spreads on both accounts.

- Minimum Deposit: $2,000

- Minimum Order Size: 0.01 lots

- Maximum Order Size: 100 lots

- Maximum Leverage: 1:1000

- Base Currency: USD, EUR, GBP, CHF, JPY

- Assets: 150+ Forex, Metals, Commodities, Indices, Stocks & Crypto

- Spreads: From 0.0 pips

- Commission: $25 per million for Forex, Metals, Commodities & Indices, 0.1% for Stocks & Crypto

A PAMM variation is not permitted in this account, though swap-free profiles and bonuses are available.

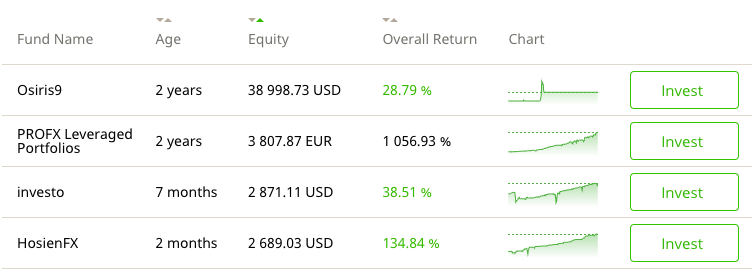

Investment & PAMM

Traders can also open specialist Investment and PAMM accounts that support long-term, passive investing. Those confident in their trading skills can also become investment managers, with the potential to bring in 50% of your fund’s profits.

Which Account Is Best For Me?

Our team recommend that newer traders consider the Classic+ account as we found it provides access to popular currencies with a low starting investment, while the no-commission structure is easy to pick up.

We would think twice about the CENT account as the Classic+ solution still caters to beginners but avoids the market-making model.

Those seeking more predictable pricing or using short-term strategies will be better served by the ECN, low-commission DirectFX account.

The xPRIME account is best for high-volume forex traders looking for the tightest spreads, though it offers limited benefits over the DirectFX solution.

How To Open A ForexChief Account

I found it easy to open an account, with the process taking just a few minutes.

- Fill out the sign-up form for a Personal Area account

- Verify your account using the email link and use the login details provided

- Go to the ‘My Accounts’ tab and click ‘Open Account’

- Configure your desired account and click ‘Open Account’

- Download and install your chosen trading platform

- Complete the identity verification in the ForexChief app

- Deposit funds and start trading

Trading Fees

We saw major differences between ForexChief’s accounts. Both the CENT and Classic+ accounts stick to floating spreads. DirectFX and xPRIME accounts charge a combination of tighter spreads and both fixed and relative commissions.

During testing, we got an average of 1.1 pips on the EUR/GBP and 1.0 pips on the USD/JPY through the CENT account, which is reasonable for an entry-level account. Moreover, we got the same typical spreads while using the Classic+ account, which follows an STP model.

With the DirectFX ECN account, we get average spreads of 0.9 pips for the EUR/GBP and 0.6 pips for the USD/JPY. These aren’t the tightest spreads we see at ECN forex brokers. There is also a 0.1% levy on stocks and cryptos and a $15 per million charge for all other assets.

While the xPRIME account claims to offer the best investment conditions, we experienced the same spreads as with DirectFX but with a flat rate of $25 per million.

Overall, our time with ForexChief has shown us that it trails the cheapest forex brokers, but does offer competitive pricing in some accounts, notably the CENT and Classic+ solutions.

Non-Trading Fees

I am pleased that non-trading fees are limited to overnight swap fees and some transaction charges, omitting inactivity fees and software subscriptions.

On the negative side, forex traders may see levies of up to 2% on some withdrawals. And while not the highest withdrawal rates we have seen, these charges can be avoided at the best forex brokers.

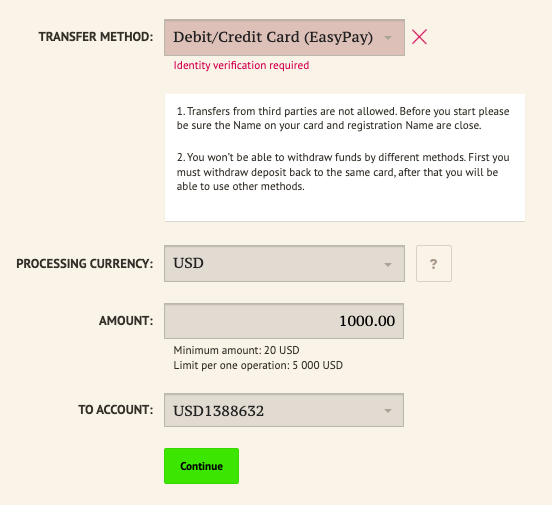

Payment Methods

I am impressed by the choice of payment options supported and the range of base currencies which makes account management convenient for global traders while avoiding conversion fees.

There are three bank transfer solutions:

- SEPA: EUR

- Local Bank Transfer: Any Currency

- SWIFT: USD, CHF, GBP, EUR, JPY AUD, CAD

There are five electronic payment solutions:

- Skrill: USD, EUR

- FasaPay: USD, IDR

- Neteller: USD, EUR, GBP

- Perfect Money: USD, EUR

- Advanced Cash: USD, EUR, GBP, UAH, BR

Credit and debit cards can also be used for deposits and withdrawals in USD, EUR and GBP.

Importantly, we experienced competitive processing times, seeing wire, SEPA and SWIFT transfers complete within one, two and three business days, respectively. Our payment card and e-wallet transfers are all processed instantly.

Withdrawals take longer, with seven working days for bank transfers, two days for SEPA transfers and five for SWIFT transfers. Payment card withdrawals take seven days, whilst e-wallets are processed the next day. These timelines are similar to competitors.

How To Make A Deposit

Funding my ForexChief account is a quick, three-step process:

- In your Personal Area, click ‘Deposit Funds’ and select a method

- Input your desired amount and fill in the details

- Submit the request and funds should appear when processed

Forex Assets

ForexChief offers 30+ CFDs on forex pairs, including all majors plus both minors and exotics, available 24/5.

Whilst beginners should find enough opportunities here, we would like to see more currency pairs available. Many top brokers we have reviewed, including AvaTrade and Plus500, offer upwards of 50 currency pairs.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

ForexChief falls short compared to alternatives like eToro when it comes to non-forex instruments. Whilst it supports commodities, indices, metals, stocks and cryptos, each asset class is very limited, with just over 100 instruments in total.

In addition, I think the omission of shares from outside the USA is a shame and may discourage some global stock investors.

You can trade:

- Crypto: 5 cryptocurrencies, comprising Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC) and Ripple (XRP)

- Stocks: 100 US equities, including Amazon, Apple and CVS

- Commodities: Brent Crude Oil, US Natural Gas & WTI Crude Oil

- Indices: 10 indices, including the FTSE 100, S&P 500 and DAX 40

- Metals: Silver and gold

Execution

ForexChief is a high-speed A-book broker, connecting clients to liquidity providers like ECN platforms, banks, institutional brokers and market makers via an aggregation scheme.

Our experience of this model has been of tight spreads and low latencies. With this broker, we have seen very little slippage outside peak trading periods.

Leverage

ForexChief clients are offered very high leverage rates of up to 1:1000 (1:500 on the CENT account), depending on asset type and account equity.

Cryptos and stocks are fixed at maximum limits of 1:5 and 1:2, whilst other instruments are scaled depending on account capital. For example, account balances of less than $3,000 see maximum forex leverage of 1:000, which goes down to 1:40 for account balances over $100,000.

We rarely see leverage rates higher than 1:1000 given the cap of 1:30 in heavily regulated jurisdictions like the EU, UK and Australia. Forex traders should be warned that high leverage can cause significant losses as much as they can profits.

xPRIME users have a 50% stop-out level, whilst the rest are called at 30%.

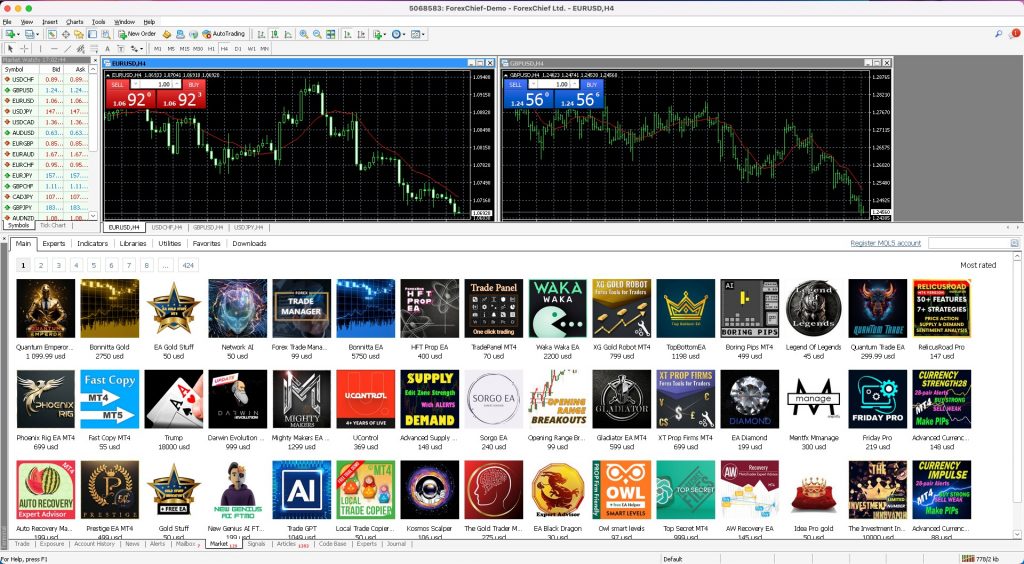

Platforms & Apps

I am pleased to have access to MetaTrader 4 and MetaTrader 5 at ForexChief. Both of these powerful and world-renowned platforms offer an excellent suite of tools to support a wide range of forex trading strategies.

MetaTrader 4 features 30 technical indicators, 31 graphical objects, nine timeframes, four pending order types and the MQL4 programming language.

MT5 comes with more built-in features, including 38 technical indicators, 44 graphical objects, 21 timeframes, six pending order types and the upgraded MQL5 language.

I have found MT5 to be the best thanks to its sleeker design, greater functionality and improved efficiency and speed. However, many forex traders are familiar with MT4, so some will prefer to stick with what they know.

Both platforms are available on desktop PCs, mobile devices and through your web browser.

ForexChief also has its own mobile app, though it is limited to account management, only allowing users to open accounts, view bonuses and manage their positions. With that said, I did appreciate that it has a direct link to both MT4 and MT5.

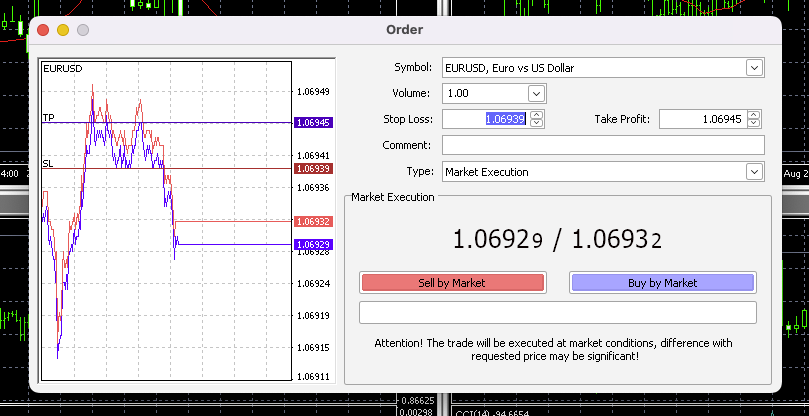

How To Make A Forex Trade

MT5 keeps the process of opening positions nice and simple:

- Log into the MT5 trading platform

- Choose your desired currency pair from the list on the left and open the respective chart

- Click the ‘New Order’ button at the top

- Configure your trade, including the volume, stop loss and take profit

- Click ‘Buy’ or ‘Sell’ as required to place your trade

Forex Tools

Our ForexChief trading experience is supplemented by a few free tools, including social trading, calculators and trackers.

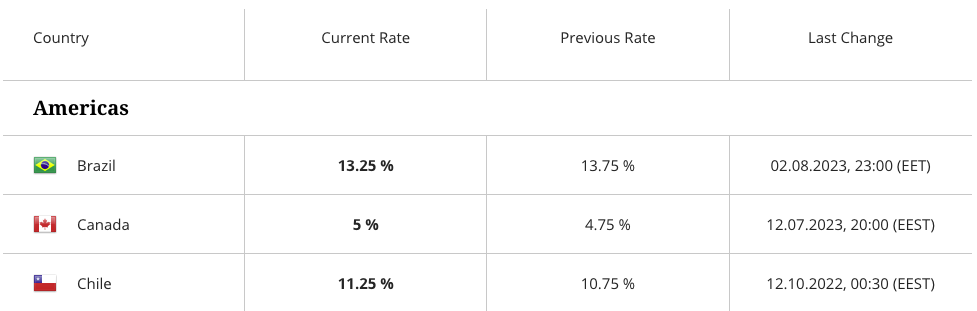

The Trader’s Calculator works much like those offered elsewhere, helping to remove errors from profit and loss predictions. However, I do think the global interest rate tracker is a nice touch. The tool allows users to follow the performance of global economies and better understand interest rate impacts on forex markets.

To improve its rating further, I would like to see ForexChief offer tools like a VPS to support active algo traders.

Forex Research

The firm initially pleasantly surprised me with its suite of research tools, with plenty of foreign exchange market reviews, economic articles, forecasts and informative pages.

However, I was disappointed to find that the content has not been updated since 2019. This makes it difficult for me to rank this broker’s depth and quality of forex resources.

Forex Education

ForexChief’s educational resources score better. The website has a helpful Library section with articles and videos on how to trade forex. These pages are impressive both in terms of quality and extent, providing a much better range of content than the basic education offered elsewhere.

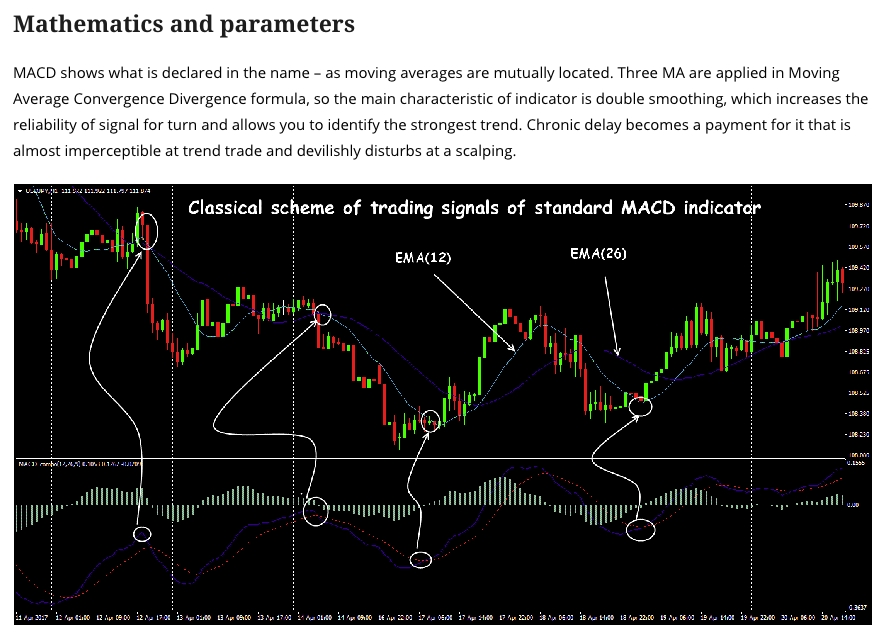

I would happily recommend ForexChief’s educational content to beginners. In particular, I like its detailed explanations of 24 major technical indicators, including Bollinger Bands, the Relative Strength Index (RSI) and MACDs.

Demo Account

We are pleased to see that ForexChief supports demo variants of its DirectFX and Classic+ accounts, though the CENT and xPRIME accounts are exempt.

Demo accounts can be opened in USD, EUR or GBP with a customizable balance and leverage of up to 1:1000.

We recommend that all forex investors make use of demo accounts, whether to learn trading, to become accustomed to the firm and its conditions, or to develop new strategies.

How To Open A Demo Account

Opening a demo account with ForexChief is straightforward, simply follow these steps:

- Log into the Personal Area on the ForexChief website

- Open the ‘My Accounts’ drop-down menu and click on ‘Open A Demo Account’

- Configure your account

- Hit the ‘Open Account’ button

- The details of your account will pop up and be sent to you via email

- Download and install your trading platform

- Log into your demo account and start practising

Bonus Offers

ForexChief offers new and existing customers several bonus deals and promotions, including deposit, no deposit and welcome bonuses, alongside demo trading contests.

Alongside these promotions are turnover rebates and trading credits, providing incentives to trade more volume through the firm. Those with high annual turnover can gain $10 per million in rebates.

This an extensive range of bonuses, allowing most traders to earn a little free cash for their efforts, as well as engage in trading competitions.

Trading Restrictions

During our evaluation, our team were not restricted in terms of strategies and investing styles; ForexChief supports scalping, hedging and automated trading.

Customer Service

The 24/7 customer support offered by ForexChief is a mixed bag. Whilst contact avenues are limited, the support we do receive is generally helpful and fast. I do think it’s a shame that no phone line is provided for instant support, though.

You can make use of the website’s live chat window, alongside the company’s email address, at info@forexchief.com, and social media using the @forexchief handle.

Company Details

ForexChief was founded in 2014 with its headquarters in Singapore.

The firm aims to provide high-speed, low-spread trading through advanced liquidity solutions. As such, it prides itself on its NDD execution systems and competitive ECN accounts.

The forex brokerage is regulated offshore by the Vanuatu Financial Service Commission.

Trading Hours

ForexChief clients can trade 24/5, though only on forex and cryptocurrencies.

We found that other assets are limited to the opening times of their respective exchanges, with no extended hours support. Whilst this latter point is the case with most firms, I am disappointed by the restricted crypto hours, given their decentralized nature and inherently 24/7 market.

Who Is ForexChief Best For?

ForexChief will suit a variety of investors, supporting newcomers with accessible minimum deposits, free demo accounts and high-quality educational content, whilst active forex traders can take advantage of high leverage, ECN accounts and advanced trading software.

ForexChief is also good for traders familiar with the MetaQuotes software, as both MetaTrader 4 and MetaTrader 5 are available.

FAQ

Is ForexChief Legit Or A Scam?

ForexChief is a legitimate forex broker established in 2014 and registered in Vanuatu. However, the firm is regulated by the VFSC which is not a reputable financial body and therefore you won’t have access to the same financial safeguards as other leading agencies.

Can I Trust ForexChief?

Overall, our team had a smooth experience trading with ForexChief. With that said, its offshore regulation does reduce its trust score to an extent.

Is ForexChief A Regulated Forex Broker?

ForexChief is regulated by the Vanuatu Financial Services Commission (VFSC). Forex traders should be aware that this is an offshore regulatory authority with limited fund protection measures compared to top-tier agencies like the CySEC.

Is ForexChief A Good Or Bad Forex Broker?

In our opinion, ForexChief is a decent forex broker offering some promising features, including the powerful MT4 and MT5 platforms, alongside a mix of STP and ECN accounts with high leverage.

On the downside, the firm falls short when it comes to product range, regulation strength, and costs.

Is ForexChief Good For Beginners?

ForexChief supports beginners through low starting deposits, bonus deals and educational resources. The free demo account is also an excellent resource for those new to forex trading.

Does ForexChief Offer Low Forex Trading Fees?

ForexChief isn’t the cheapest forex broker, but it does offer competitive spreads on some accounts, particularly the CENT and Classic+ solutions. The absence of inactivity fees is also a plus.

Does ForexChief Have A Forex App?

ForexChief clients can download the firm’s proprietary mobile app, though it can only be used for account management and to access bonuses or request transactions.

However, both MT4 and MT5 have dedicated mobile apps that support technical analysis and order placement. They are available on Apple and Android mobile and tablet devices.

How Long Do Withdrawals Take At ForexChief?

We saw a variety of withdrawal speeds at ForexChief, with e-wallets the fastest at one working day, whilst bank transfers and payment card withdrawals took up to seven days.

Can You Make Money Trading Forex With ForexChief?

ForexChief provides clients with the tools required to profit from the forex markets, including effective platforms, reliable order execution and access to dozens of popular currency pairs.

However, profits are never guaranteed and the high leverage rates at this forex broker can cut both ways.