FP Markets

-

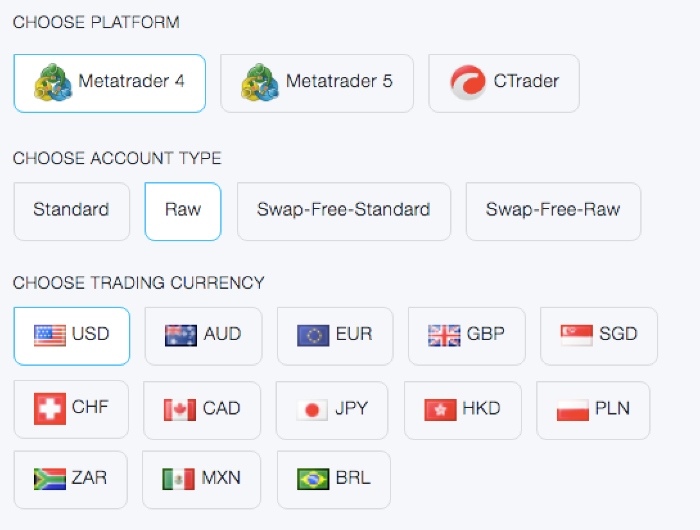

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, TRY, CHF, PLN, CZK, THB, VND

-

🛠 PlatformsMT4, MT5, AutoChartist, TradingCentral

-

⇔ Spread

GBPUSD: 1.9 EURUSD: 1.1 GBPEUR: 1.7 -

# Assets60+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

Our Opinion On FP Markets

FP Markets is a multi-regulated forex broker. What stands out for us are the excellent trading conditions for active traders, from fast execution speeds to deep liquidity and low spreads. Algo traders and scalpers are particularly well catered for with access to MT4, MT5, and cTrader, alongside VPS hosting.

On the negative front, the copy trading app doesn’t rival the features of industry leaders based on our tests. The demo account also expires after 30 days and the sign-up process is lengthy.

Overall though, FP Markets scores highly in our estimations, especially for serious forex traders looking for competitive pricing and access to the MetaTrader platforms.

Summary

- Instruments: 10,000+ including 70+ currency pairs, stocks, indices, commodities, bonds, ETFs, and crypto

- Live Accounts: Standard, Raw

- Platforms & Apps: MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, App

- Deposit Options: Bank cards, wire transfers and e-wallets

- Demo Account: Yes

Pros & Cons

- Low pricing, particularly on the Raw ECN account with spreads from 0.0

- Excellent suite of trading platforms including MT4, MT5 and cTrader

- Wide range of payment methods with 12+ base currencies

- Trustworthy broker regulated by the ASIC and CySEC

- Premium VPS hosting for algo traders and scalpers

- Very fast execution speeds averaging 40ms

- Access to Autochartist and Trading Central

- Beginner-friendly forex trading academy

- No fees for deposits and withdrawals

- Good reputation with 40+ awards

- 24/7 customer support

- Slow withdrawals with credit/debit cards taking up to 10 days

- Demo account automatically expires after 30 days

- Copy trading app trails industry leaders like eToro

- Slower sign-up process than some alternatives

- High monthly fees to access Signal Start

- No rebates for high-volume forex traders

Is FP Markets Regulated?

The forex broker boasts strong regulatory credentials with oversight from several authorities, including the Australian Securities & Investments Commission (ASIC) and the Cyprus Securities & Exchange Commission (CySEC). These are both well-regarded regulators who enforce strict standards to maintain a fair environment for retail investors.

Our team also investigated FP Markets’ history and is reassured not to find complaints of scams.

Below are details of the broker’s regulatory licenses.

- First Prudential Markets Pty Ltd – a regulated provider of Derivatives and Forex trading services, authorized by the Australian Securities and Investments Commission (ASIC), AFS license number 286354

- First Prudential Markets Ltd – regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 371/18

- FP Markets (Pty) Ltd – regulated by the Financial Sector Conduct Authority in South Africa (FSCA), FSP number 50926

- First Prudential Markets Limited – regulated by the Financial Services Authority (FSA) in the Seychelles, registration number SD130

- FP Markets Ltd – a registered Investment Dealer, authorized and regulated by the Financial Services Commission (FSC) in Mauritius, license number GB21026264

Forex Accounts

FP Markets offers a choice of accounts which serve different trading styles. This includes a Standard account with commission-free pricing and a Raw account with ultra-tight spreads and low commissions.

Where we see FP Markets’ model as excelling, though, is that unlike many forex brokers we review, the accounts offer the same trading platforms, tradeable assets and other features. This means that traders will not be disadvantaged by choosing either account.

The minimum deposit is also competitive at $100 with a 0.01 minimum order size, reducing the entry barriers for aspiring traders.

Additionally, we are pleased to see the broker offers an Islamic account for Muslim investors looking for swap-free trading.

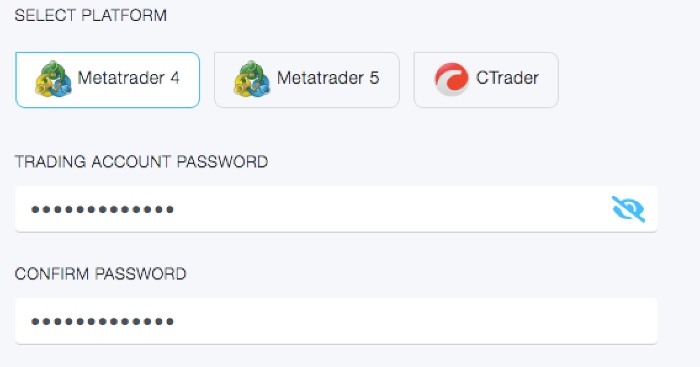

How To Open An Account

Unfortunately, I found the process of opening an account with FP markets fairly lengthy compared to other forex brokers I test. To get started:

- Enter your personal details in the application form (email, name, account type, country of residency, gender, language, nationality, and phone number), then select ‘Save and Next’

- Add your date of birth, residential address, financial information, and employment status, then select ‘Save and Next’

- Choose your account configuration settings – platform, account type, base currency, and leverage. Input a password then select ‘Save and Next’

- Provide details of your previous trading experience

- Review the T&Cs and click ‘Accept and Open Account’

- Fund your account and start trading forex

Trading Fees

FP Markets offers lower trading fees than the majority of forex brokers we evaluate.

Spreads on the Standard account are around the industry norm, starting from 1 pip on majors like the EUR/USD and USD/JPY and averaging 1.1 pips and 1.4 pips, respectively.

However, pricing on the Raw account is excellent. Spreads start from 0.0 pips on popular currency pairs like the EUR/USD and USD/JPY and came in at 0.1 pips and 0.3 pips, during testing. The $3 commission per lot is also lower than many alternatives.

Non-Trading Fees

FP Markets’ non-trading fees won’t catch traders off guard – the brand is transparent in detailing overnight fees and potential costs associated with features like VPS hosting.

We are especially happy to find no fees for deposits or withdrawals, and with zero charges for inactive accounts, the broker is competitive in this department.

Payment Methods

We see FP Markets’ payment methods as a strong point, with a wide selection of convenient solutions including bank cards, wire transfers, e-wallets, and cryptocurrencies like BTC, BCH, DASH and ETH.

We also enjoy the broker’s accessibility for international traders, with over 12 base currencies accepted, including USD, EUR, GBP, AUD, and HKD. This makes FP Markets a great option for global traders looking to manage accounts in their native currency.

Payment speeds are reasonable, with the majority of payment methods granting instant deposits – although we found that Coinspaid took around 24 hours so we don’t recommend this if you want to start trading forex quickly.

How To Make A Deposit

I enjoy the simplicity of the cashier portal:

- Login to the members area

- Select ‘Funding’ from the side menu and then click ‘Deposit’

- Choose a live trading account from the dropdown menu at the top of the page

- Select the deposit category type from the left side (credit/debit cards, wire transfer, alternative payment methods, or crypto payments)

- Click on the ‘Deposit’ icon on the right side of the payment type

- Select an amount to deposit or choose ‘other amount’

- Follow the onscreen instructions to add payment details and click ‘Deposit’ to confirm the transaction

Forex Assets

The forex offering caters to various trading strategies with over 70 currency pairs. From majors to exotics, we are impressed by the range, which is firmly on the upper end of the forex brokers we review.

We also like that the full suite of forex pairs, including the popular assets listed below, are available on both Standard and Raw accounts.

Forex can be traded through contracts for difference (CFDs), meaning leverage is available to increase returns (and losses).

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

Beyond forex, FP Markets provides opportunities for portfolio diversification through a huge range of 10,000+ assets. In particular, the library of shares is almost unmatched and covers diverse geographical regions, sectors and industries.

You can speculate on:

- Metals – Four precious metals including Gold and Silver

- Crypto – Five cryptos including Bitcoin and Ethereum

- ETFs – Dozens of ETFs including iShares Core S&P 500 ETF (IVV.arcx)

- Shares – 10,000+ stocks such as Tesco, Apple, Telefonica, PayPal and Alibaba

- Bonds – Two government bonds; US 10-year T-Note and UK Long Gilt Futures

- Indices – 19 major index funds including US 500, NASDAQ 100, UK 100, and ASX 200

- Commodities – Four energies and five soft commodities such as corn, wheat, Brent crude oil, and natural gas

Execution

FP Markets provides ECN execution, which connects traders directly to a network of liquidity providers, including banks, financial institutions, and other traders.

This type of execution model typically results in fast order executions and tight spreads, which is the case at FP Markets whose execution speeds average 40ms and come from an NY4 server facility.

Since the broker’s direct-market-access model allows traders to place orders directly with liquidity providers, you also have greater transparency and control over trades, enabling you to interact directly with the market’s order book.

Leverage

FP Markets offers leverage up to 1:30 on forex in Australia and the EU, while global traders and professional investors can use leverage up to 1:500.

This is fairly standard at online brokers, but we still only recommend using high leverage if you are an experienced trader and can manage risk effectively. Trading with high leverage can lead to large losses in volatile markets.

The broker operates with a 100% margin call level and a 50% stop-out.

Platforms & Apps

The choice of high-quality trading software is a key benefit of trading forex with FP Markets. MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader are available. And importantly, I find the integration with all three platforms seamless.

I enjoy using MT4 thanks to its user-friendly interface, wide range of technical indicators, advanced charting tools, and the ability to implement automated trading strategies through Expert Advisors (EAs). It is stable and reliable, making it a go-to choice for forex traders of all levels.

MT5 is the successor to MT4 and offers even more advanced features. It provides additional timeframes, a broader range of technical indicators, an economic calendar, and an enhanced interface. It also offers faster processing.

cTrader is another good option. It has a more modern design than the MetaQuotes software in my opinion and still delivers for forex traders, especially in terms of charting. The advanced order types, level II pricing and custom features also mean it caters to both short-term traders and longer-term investors.

How To Make A Forex Trade

Executing a forex trade on any of FP Markets’ platforms is a simple process, with all terminals requiring similar easy steps to complete a trade:

- Open the trading platform

- Select your preferred currency pair

- Determine the trade size and order type

- Set any stop-loss and take-profit levels for risk management

- Confirm your trade and monitor its progress

Forex Tools

The wide range of forex tools is another strong point for this broker. There are various tools that enhance my experience at FP Markets.

The economic calendar provides real-time updates on key events, helping me stay on top of market-moving developments. The forex calculators also come in handy for risk management and position sizing, streamlining my decision-making process.

I am even happier with the inclusion of Autochartist and Trading Central, which can help identify potential trading opportunities based on patterns and key levels, adding a dynamic dimension to my forex strategies.

Lastly, the real-time news feeds and customizable alerts keep me well-informed about market developments when I trade with this broker.

All in all, I think FP Markets’ suite of forex tools is excellent for traders of all experience levels.

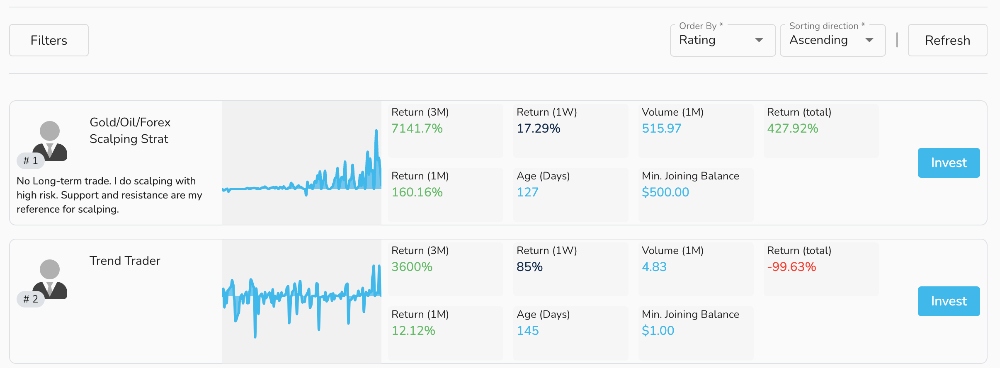

Social Trading

FP Markets is one of the few brokers to offer several copy trading solutions.

Signal Start offers forex signals where you can filter by percentage gains, drawdowns and returns. However, fees are on the high side with a $25 monthly subscription fee followed by a further $30 to $100 per month depending on the signal provider.

Myfxbook is also available. This is an advanced copy trading platform where you can mirror and automate forex strategies. The real benefit of this for us is that it integrates directly into your MetaTrader 4 platform, making it straightforward to use if you are familiar with MetaQuotes software.

Alternatively, the broker offers its own copy trading app. This user face is clean and we like that you can start or stop copy trading in one click, but it lacks the quality and features of market leaders like eToro. As a result, it isn’t our first choice for forex copy trading.

VPS Hosting

For more experienced traders, the broker offers forex VPS hosting for MT4, MT5, and cTrader. We find that the VPS provides stable market connectivity to execute algo trading and EAs.

To get started, we simply had to send the registration form to the customer support team at supportteam@fpmarkets.com.

On the downside, free VPS hosting requires a $1000 initial deposit and minimum trading volumes:

- cTrader – 20 forex lots (Standard account) or 40 lots (Raw account)

- MT4/MT5 – 10 forex lots (Standard account) or 20 lots (Raw account)

Forex Research

FP Markets provides an array of forex research that I feel provides depth to the analysis process.

The broker’s expert insights and market summaries offer valuable perspectives on current conditions and potential trading opportunities.

I find the daily market updates are well-presented enough to help me stay informed about the latest developments. The technical and fundamental analysis reports also offer actionable insights.

Forex Education

FP Markets offers a good selection of forex education resources. Their forex trading academy provides a structured learning path for traders of all levels, offering webinars, video tutorials, and written guides that cover various aspects of online currency trading.

We rate the accessibility of these resources, as they cater to both beginners and experienced traders looking to deepen their understanding.

The inclusion of educational content on trading strategies, technical and fundamental analysis, risk management, and trading psychology provides a well-rounded learning experience and we feel this is another strong point for FP Markets.

Demo Account

FP Markets does offer a demo account, but we are slightly disappointed that it is only available for 30 days.

With access to a variety of forex assets, platforms, and leverage, this can be a great tool for honing trading skills, so it is a shame that traders will not be able to continue using it in the long term.

This is in contrast to rivals like XM, which allows traders to use a paper-trading account in parallel with their live account, with no time limit.

How To Open A Demo Account

Opening a demo account is easy, taking a few steps that I completed in minutes:

- Click on ‘Quick Start’ from the top menu of the homepage

- Choose ‘Try A Demo’ under the ‘Your Account’ dropdown

- Enter your personal details on page one (name, email, country of residency, nationality, language, telephone)

- Select a platform, account type, and base currency by clicking the relevant icons

- Enter a trading account password and click ‘Save and Next’

- Login credentials will be sent to your registered email address

- Launch your chosen terminal using the links provided at the bottom of the page

- Start trading forex with virtual funds

Bonus Offers

Due to regulatory restrictions, FP Markets does not offer any bonus schemes in Australia, the EU or the UK. However, since our experts don’t recommend selecting forex brokers based on welcome bonuses, this isn’t an issue for us.

Customers registered under the global entity may be entitled to access to a $30 welcome bonus when signing up for an MT4 Standard profile. A minimum $200 deposit must be made to a new live trading account and 3+ standard FX lots must be traded to be eligible to withdraw profits.

Trading Restrictions

FP Markets has no trading restrictions based on our tests, meaning that investors with scalping, hedging, algo trading and other systems are free to use them.

Customer Service

FP Markets provides multiple contact methods including live chat, phone and email, ensuring easy access to customer support.

With 24/7 availability and responsive live chat and email responses, we find their multilingual customer service to be reliably helpful, with prompt responses to all the enquiries we sent during our review. In fact, we got through to agents in less than one minute on several occasions.

- Telephone – +442825447780

- Email – supportteam@fpmarkets.com

- Live Chat – Icon bottom right of the broker’s website

Company Details

FP Markets has been around since 2005 and is a global financial technology company dealing in forex and CFDs.

The brokerage is based in Sydney, Australia and also has an office in Limassol, Cyprus alongside employees in the UK, Asia and India, amongst other countries.

The company has been given more than 40 awards since its establishment, including multiple #1 Value Global Forex Broker awards, which is a promising sign of its credibility.

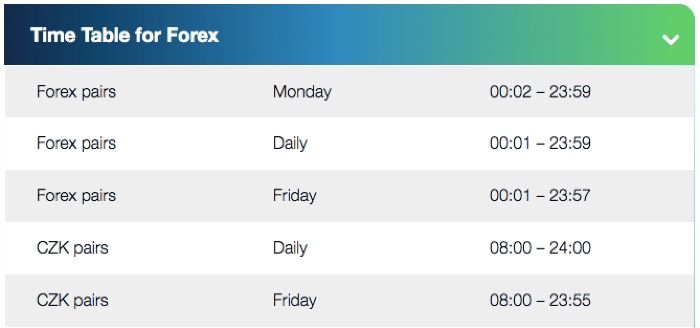

Trading Hours

FP Markets’ trading hours vary, with forex markets open 24 hours from Sunday evening until Friday evening with minor gaps for market maintenance.

Trading hours for indices can vary based on the specific index and the exchange it is listed on. Major indices like the S&P 500, FTSE 100, and DAX 40 follow the trading hours of their respective stock exchanges.

Trading hours for commodities can also vary depending on the specific commodity and the exchange it is traded on.

Cryptocurrency markets operate 24/7, allowing for continuous trading throughout the week.

Who Is FP Markets Best For?

FP Markets is well-suited to all types of forex traders, but especially scalpers, day traders, and algorithmic traders who value ECN and DMA execution with fast order speeds, deep liquidity and low latency. High-quality VPS hosting and powerful trading software are also strong points.

In addition, the social trading tools, including Myfxbook Autotrade, the copy trading app and Signal Start, make FP Markets a good pick for aspiring traders and casual investors.

FAQ

Is FP Markets Legit Or A Scam?

FP Markets is a legitimate and reputable broker. Their commitment to transparency and fair practices has contributed to a positive reputation within the trading community. They are also regulated by respected authorities, which adds a layer of security for traders.

Can I Trust FP Markets?

Yes, based on our evaluation, we believe FP Markets is a trustworthy forex broker. Their regulatory compliance, no-dealing-desk model and dedication to providing transparent trading conditions indicate a commitment to fostering a reliable trading environment.

Is FP Markets A Regulated Forex Broker?

FP Markets is regulated by reputable financial authorities, including ASIC (Australian Securities and Investments Commission) and CySEC (Cyprus Securities and Exchange Commission). This regulatory oversight helps ensure adherence to industry standards and provides traders with peace of mind.

Is FP Markets A Good Or Bad Forex Broker?

FP Markets is one of the better forex brokers we review. Execution is fast and reliable, fees are low and transparent, and the selection of top-rated trading software is impressive, with MT4, MT5 and cTrader.

Looking at the negatives, the copy trading app doesn’t compare to rivals like eToro. We also prefer unlimited demo accounts, and the paper trading solution at FP Markets expires after 30 days. However, these are both minor criticisms.

Is FP Markets Good For Beginners?

FP Markets could be suitable for beginners, but it is best for seasoned traders in our view. The broker offers educational resources, social trading and a demo account which are helpful for new traders, however the execution model and trading tools will serve serious investors in particular.

Does FP Markets Offer Low Forex Trading Fees?

Yes, FP Markets offers low trading fees. The Standard account offers spread-only pricing starting from 1 pip on majors, which is around the industry average. However, the ECN account offers tighter spreads of 0.1 pips on the EUR/USD during our tests, with a $3 commission per lot which is lower than many forex brokers. There are also no inactivity fees or deposit/withdrawal charges.

Does FP Markets Have A Forex App?

Yes, FP Markets offers forex trading apps. As well as the copy trading application, MT4, MT5 and cTrader are all compatible with iOS and Android devices. These applications allow forex traders to access their accounts, monitor the markets, execute trades, and manage positions from their smartphones or tablets.

How Long Do Withdrawals Take At FP Markets?

Withdrawal processing times at FP Markets can vary depending on the withdrawal method and other factors. The majority offer a one working day processing time which is competitive, though the up to 10 working day transaction time for credit/debit cards is slower than many alternatives.

Can You Make Money Trading Forex With FP Markets?

You could make money trading forex with FP Markets, as with any legitimate forex broker. However, trading forex involves risk and requires skill – your capital is at risk and an effective strategy and money management system is needed.