Fusion Markets

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD

-

🛠 PlatformsMT4, MT5, cTrader, DupliTrade

-

⇔ Spread

GBPUSD: 0.0 EURUSD: 0.0 GBPEUR: 0.0 -

# Assets90+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Our Opinion On Fusion Markets

We rate the 90+ forex pairs available at Fusion Markets with very low fees. Oversight from a tier-one regulator, the Australian Securities & Investments Commission (ASIC), is also a reassuring sign that the broker is trustworthy. Our testing did find that Fusion Markets trails some alternatives when it comes to education, but it remains a good forex broker for new and experienced traders.

Summary

- Instruments: 250+ including 90+ forex pairs, stocks, indices, commodities, cryptocurrencies

- Live Accounts: Classic, ZERO

- Platforms & Apps: MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, Fusion+, DupliTrade, Myfxbook AutoTrade

- Deposit Options: Bank cards, wire transfers, e-wallets

- Demo Account: Yes

Pros & Cons

- Very low trading fees with spreads from 0.0 pips and a $4.50 commission

- Excellent suite of trading software including MT4, MT5 & cTrader integration

- Beginner-friendly Fusion+ copy trading platform with intuitive dashboard

- Respected and regulated broker with oversight from the ASIC

- Wide range of payment methods with no transfer fees

- 24/7 customer support with fast response times

- No minimum deposit requirement

- Hedging and scalping permitted

- No inactivity fees

- Limited regulatory oversight for traders outside of Australia

- Slower payment timelines than some alternatives

- Below average educational resources

- Trading on US stocks only

- Outdated blogs

Is Fusion Markets Regulated?

We are satisfied with Fusion Markets’ regulatory credentials, though Australian traders will receive the best safeguards.

Fusion Markets is regulated by the Australian Securities and Investments Commission (ASIC), the Vanuatu Financial Services Commission (VFSC), and the Financial Services Authority of Seychelles (FSA).

The ASIC is a tier-one regulator that mandates multiple measures designed to protect retail traders, including the segregation of client funds, negative balance protection, and leverage limited to 1:30.

On the negative side, the FSA and VFSC are less reputable. This means traders may receive limited regulatory protection in the event the broker goes bankrupt or adopts unfair trading practices.

Traders registered through these entities also won’t receive negative balance protection, though Fusion Markets does still segregate client funds from its operating capital.

Forex Accounts

Fusion Markets offers two standard account types; Classic and ZERO.

With a $0 minimum deposit, they are accessible for newer traders and in line with popular alternatives like XTB. Seasoned traders will also appreciate that there are no restrictions on trading strategies, with scalping and hedging permitted.

The Classic Account keeps costs simple with commission-free trading and is the best all-round option for beginners. All trading fees are included in bid-ask spreads, which start at 0.9 pips.

The ZERO Account features lower spreads, starting from 0.0 pips, with a commission of $4.50 per round turn per lot. We recommend this for high-volume or experienced traders looking for the tightest spreads.

Fusion Markets also offers Pro, Islamic and MAM/PAMM accounts, available upon request.

Pro accounts come with dedicated relationship managers, volume and referral-based rebates, priority support, early access to new products and services, plus higher leverage.

Islamic-friendly accounts are swap-free, meaning fees are not charged on positions held overnight. This will appeal to Muslim traders looking to comply with Sharia Law.

The MAM/PAM accounts allow traders to place trading decisions in the hands of a money manager. We found that eligible traders can apply to be a manager or have their funds managed by contacting the broker’s account managers.

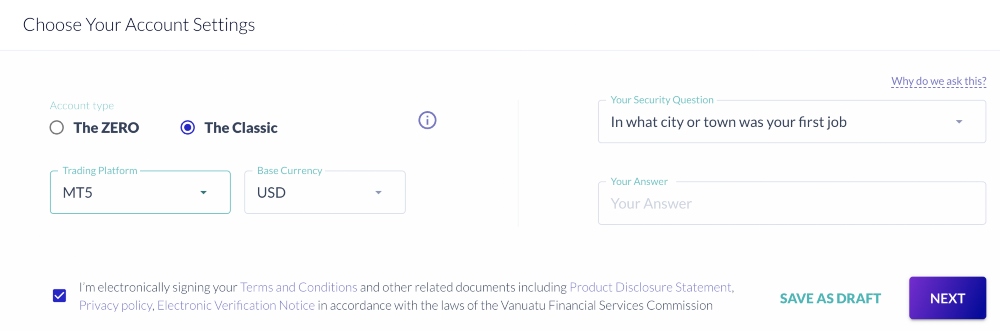

How To Open A Fusion Markets Account

Fusion Markets offers a straightforward account opening process. It only took me around 5 minutes to sign up and get started.

- Enter your email address and a password. Alternatively, you can sign up with your Google or Apple credentials

- Provide basic contact details including your name and address

- Select your account settings, including the account type, platform and base currency

- Verify your identity by providing a photo ID and proof of address

- Wait for the Fusion Markets team to approve the application

- Deposit funds and begin trading

Trading Fees

We have evaluated hundreds of forex brokers and Fusion Markets stands out for its low trading fees.

The Zero Account offers tight spreads from 0.0 pips with a $4.50 round turn per lot commission. This is lower than other forex brokers like Pepperstone, which charges a $7 commission on its raw spread account. This also makes the firm a great option for active traders.

While using Fusion Markets, we got tight spreads on popular forex assets:

- EUR/USD – 0.03 pips

- GBP/USD – 0.12 pips

- AUD/CAD – 0.5 pips

The Classic Account charges no commission, with costs wrapped into the spreads starting from 0.9 pips. Again, this compares well to alternatives and will serve traders looking for a competitive and transparent single trading fee.

Non-Trading Fees

We appreciate that there are no hidden fees.

For example, there are no penalties for leaving your account inactive – something we come across frequently. There are also no deposit, withdrawal or account fees.

As expected, overnight swap fees do apply, varying by asset and volume. These are in line with competitors.

Our team also like that clients who trade more than 20 lots of forex or metals in a 30-day period get access to a complimentary virtual private server (VPS). The VPS typically costs $15 per month, so this is a good perk for active forex traders.

Payment Methods

Fusion Markets offers more deposit and withdrawal methods than most forex brokers we test, making it accessible to global traders.

These include Visa, Mastercard, wire transfer, PayPal, Skrill, Neteller, Fasapay, and Perfect Money. The broker also supports crypto deposits, which aren’t available at many alternatives.

The downside is that deposits can take up to 5 business days depending on the country are based in and the method used, which trails brokers that offer instant account funding. We recommend Visa and Mastercard for faster deposits, as these offer near-immediate processing times.

For withdrawals, we found that requests received by 11:00 am AEDT (00:00 GMT) are processed on the same day, otherwise, they will be processed on the next business day. Once approved, they can take between 1 to 5 business days to complete. Again, these timelines are slower than some forex brokers.

On a more positive note, I appreciate that Fusion Markets doesn’t charge any funding fees, though external fees may be charged by the service provider. International transfers may also be subject to foreign exchange fees and/or intermediary bank processing fees.

How To Make A Deposit

You can fund your account in a few straightforward steps. It only takes me a couple of minutes to navigate the cashier portal.

- Log into the Fusion Markets client portal

- Click on ‘Payments’

- Choose the ‘Deposit’ tab (accounts must be verified before this step)

- Select the account you would like to deposit to

- Choose which deposit option you would like to use

- Fill in the details of your deposit, including size, account details, or wallet code

- Submit the deposit request

Forex Assets

Fusion Markets offers an impressive selection of over 90 forex CFDs, which are available to trade 24/5.

We are comfortable that this range should cover the needs of most retail traders looking to speculate on major, minor and exotic currencies. It is also significantly more than the 30 to 60 pairs we typically see at most forex brokers.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

Fusion Markets trails top brokers when it comes to non-forex assets. We do note the modest range of US stocks, indices, commodities and cryptocurrencies, but the selection is not as wide as market leaders like Plus500 and AvaTrade.

The narrow range of US stocks, in particular, means Fusion Markets won’t suit traders interested in equities from other regions.

You can trade:

- Stocks – 100+ shares are available, including Amazon, Tesla, Alphabet, Meta, Microsoft, Airbnb, Costco, Ford and JP Morgan

- Indices – Popular global indices are available, including the Nasdaq 100, S&P 500, FTSE 100, CAC 40, DAX 40, Nikkei 225 and ASX 200

- Commodities – Hard and soft commodities are available, including gold, silver, copper, oil, natural gas, sugar, cocoa and coffee

- Cryptocurrencies – Several leading cryptos are available, including Bitcoin, Bitcoin Cash, Ethereum, Cardano, Binance Coin and Dogecoin

Execution

Fusion Markets is an electronic communication network (ECN) broker.

As a result, clients get ultra-fast execution speeds averaging 40ms – we consider anything below 100ms good. The deep liquidity also allows the brokerage to provide very low trading fees.

Leverage

Fusion Markets offers leveraged trading, however, the maximum leverage available depends on the entity you open an account with.

The ASIC branch is more heavily regulated, with a maximum limit of 1:30 to protect retail traders. The VFSC and FSA-regulated entities don’t impose strict rules, with leverage available up to 1:500.

Importantly, we urge traders to approach leverage with caution and always use risk management tools to protect against large losses, especially when trading with high leverage. This is particularly true for beginners.

For VFSC and FSA clients, the margin call is at 90% and positions will be closed at 20% of your free margin (stop out). For ASIC clients, the margin stop out is at 50%.

Platforms & Apps

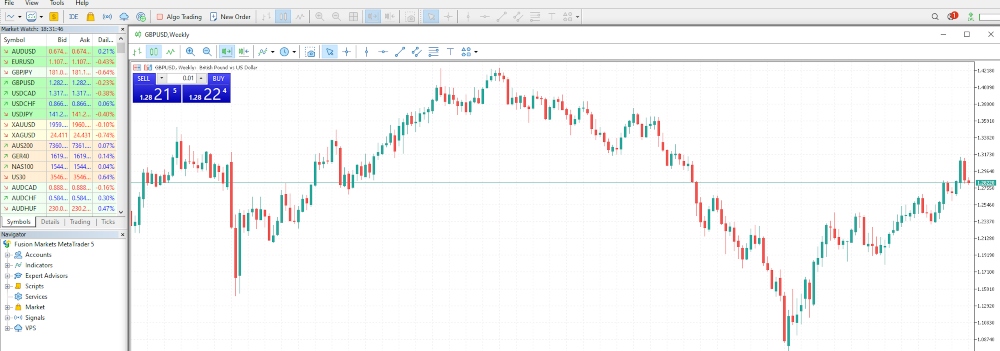

MetaTrader

The range of powerful platforms is a key advantage of trading with Fusion Markets. I like that both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are available.

I can’t fault the technical analysis capabilities of either platform, with a full library of advanced indicators and drawing tools available, plus multiple time frames, access to automated trading through Expert Advisors (EAs), and an excellent range of resources in the proprietary marketplace.

I would recommend MT5 for high-volume traders owing to the faster processing and wider range of order types and technical analysis tools. Still, MT4 is a reliable solution specifically designed for forex trading.

My only major criticism is that while both solutions offer decent levels of customizability, the interfaces are a little outdated and clunky compared to the in-house platforms offered by forex brokers like AvaTrade.

Some of my favorite features of MT4 and MT5 include:

- 30 and 38 built-in technical indicators, respectively

- 31 and 44 graphical objects, respectively

- 9 and 21 time frames, respectively

- 4 and 6 order types, respectively

- Automated trading through EAs

Both platforms are accessible as desktop applications, browser-based web traders, and mobile applications.

You can download the MetaTrader platforms directly from the Fusion Markets website. The mobile apps are available on the iOS App Store and Android Google Play Store.

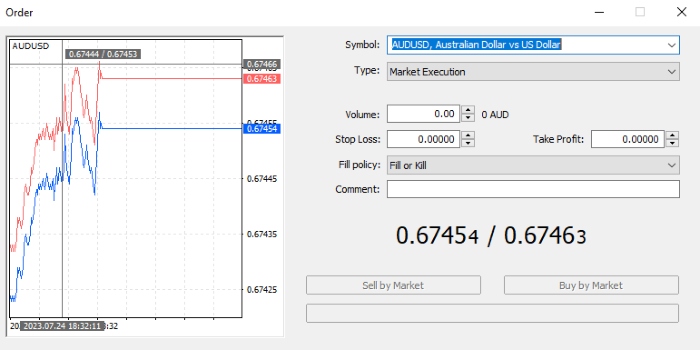

How To Make A Forex Trade

Placing a trade on MetaTrader is really simple:

- Log into the MetaTrader platform of your choice

- Choose the asset you would like to trade, such as EUR/USD

- Click the ‘New Order’ button

- Fill in the details of your trade including volume, stop loss, and take profit

- Click the ‘Buy by market’ or ‘Sell by market’ buttons to confirm the trade

Tip: you can activate one-click trading to make trades directly from charts.

cTrader

Although the MetaTrader platforms are the most well-known, cTrader’s desktop, web and mobile platform is also available.

For me, cTrader offers a cleaner, more intuitive user experience than MT4 and MT5. It has a more modern look and feel while still possessing a superb range of trading tools. For instance, there are 26 timeframes, over 70 indicators, and 3 market depth settings.

Similar to the MetaTrader software, you can also trade directly from charts in one click and execute automated trading strategies through cAlgo.

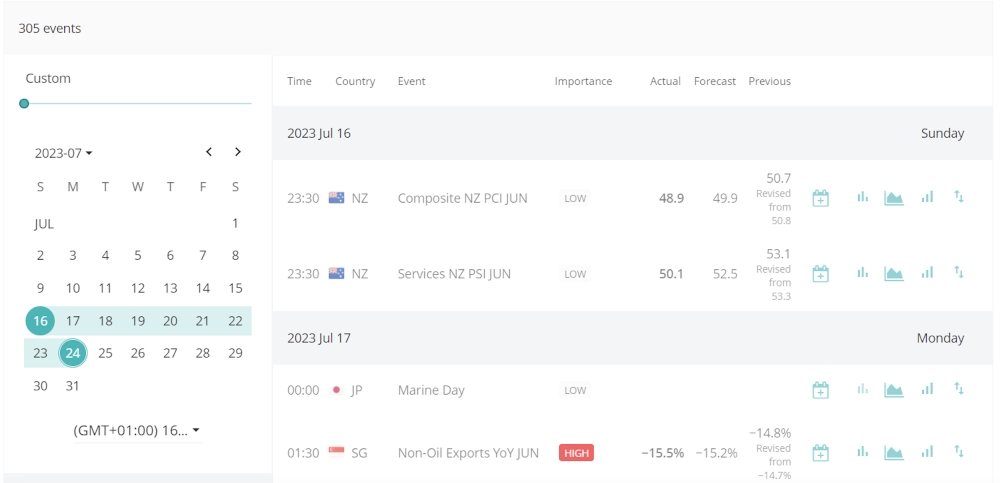

Forex Tools

Fusion Markets offers a fairly decent selection of free tools to support the online trading experience. These include trading calculators, an economic calendar, technical analysis insights, plus a VPS.

With that said, I think the forex broker lacks some of the more visually engaging analysis tools that I see at competitors, such as market sentiment services and forex heat maps. Otherwise, I think most traders will be satisfied, especially beginners.

Copy Trading

The extra services that really stand out are the broker’s copy and auto trading solutions. These are available through Fusion+, Myfxbook AutoTrade and DupliTrade.

Fusion+

I was intrigued by the broker’s bespoke copy trading platform: Fusion+. Traders can copy the trades of money managers, allowing them to invest without having to perform analysis and choose assets themselves.

The service is free of charge as long as 2.5 lots of forex or metals are traded per month. If you trade less than this, then the fee is $10 per month.

Money managers (Fusion+ Masters) can charge up to a 30% performance fee to clients.

Overall, the volume requirements and maintenance fee mean Fusion+ doesn’t rival alternatives like eToro. However, the 30% cut money managers can take will make it attractive to experienced traders.

Myfxbook AutoTrade

Myfxbook AutoTrade is a popular social trading platform. Seasoned traders can send forex signals to other users, allowing them to set up automated trades with no hidden fees. I particularly like that you keep control over your funds and account, with no lock-in requirements.

This will ultimately appeal to forex traders looking for a hands-off approach and a reliable third-party social trading system.

DupliTrade

Alternatively, DupliTrade allows clients to copy the actions of other forex traders into their MetaTrader 4 accounts.

The key benefit of this tool is the strict entry criteria – only traders with a proven track record are selected. DupliTrade is also one of the few services to provide 24/5 customer support.

Forex Research

Fusion Markets scores fairly well when it comes to market research and expert insights.

I rate the technical analysis and insights into popular assets, including key support and resistance levels, trade setups and alternative scenarios. I also find the AI-powered Market Buzz tool a good way to read up on emerging topics.

On the negative side, the broker’s blog section is not updated regularly, so it isn’t great if you want updates on the latest market events or fresh educational materials.

Forex Education

I am disappointed by the educational materials at Fusion Markets. Aside from the outdated blogs and basic FAQs, there is very little for aspiring traders.

This is made worse when you consider that many leading forex brokers, including XM and Pepperstone, offer dedicated education hubs, packed with webinars, e-books, trading courses and more.

Demo Account

It is good to see that traders can open Classic and ZERO demo accounts directly from the client portal.

You can choose the maximum leverage as well as the virtual sum of funds, though you can add more later as required.

We often recommend that traders practice strategies in a demo account before risking funds. Not only can you test and refine trade setups, but you can get a feel for the platform and features.

How To Open A Demo Account

I didn’t have any issues signing up for a free demo account at Fusion Markets. To get started:

- Register with Fusion Markets

- Sign in to the client portal

- Go to the ‘Accounts’ tab and click ‘Demo’

- Click on the ‘New’ button

- Choose the account settings

- Press ‘Create Account’

- You will be emailed the login details for your demo account

Bonus Offers

As is standard at regulated brokers, there are no welcome bonuses.

I don’t view this as a disadvantage – many reputable regulators ban trading promotions that encourage over-trading with unfair terms and conditions. I also think there are more important elements to consider when choosing a forex broker, including trading fees, platform features and account safety.

Trading Restrictions

Fusion Markets does not impose any restrictions on trading strategies. This means hedging, scalping and automated trading are all permitted.

Customer Service

Fusion Markets scores well in terms of customer support. The broker is available around the clock – a noticeable advantage over the many forex brokers we use with no weekend support.

The team have also been responsive when we needed them. We contacted them via email three times during weekdays and found that in all cases we received a response within 1 hour.

There are several other contact methods available too, including telephone, live chat, an account manager, or an online message form.

Contact details:

- Email Address: help@fusionmarkets.com

- Contact Phone Number: +61 3 8376 2706

- HQ Address: Level 10/627 Chapel Street, South Yarra VIC 3141, Australia

- Vanuatu Office Address: Govant Building, BP 1276 Port Vila, Vanuatu

- Seychelles Office Address: CT House, Office 9A, Providence, Mahe, Seychelles

Company Details

Established in 2017, Fusion Markets was founded by CEO Phil Horner in Australia.

The broker opened its services to retail clients in 2019 and is run by established industry members, with over 50 years of combined experience.

The brokerage aims to provide the lowest fees possible to traders, offering some of the best pricing in Australia.

The company is regulated by the ASIC, VFSC and FSA and it is reassuring to see that the brand has received industry awards in recent years.

Trading Hours

Trading hours vary by asset. Most can only be traded when their underlying market is open. We have pulled out some examples below:

- Forex: Sunday 10:02 pm – Friday 9:59 pm (GMT)

- Nasdaq 100: Sunday 10:00 pm – Friday 8:59 pm (GMT)

- DAX 40: Monday 12:15 am – Friday 9:00 pm (GMT)

- Cryptocurrencies: 24/7

Market breaks and holidays are routinely published on the Fusion Markets website.

Who Is Fusion Markets Best For?

We recommend Fusion Markets for experienced traders looking for low forex fees, powerful trading software, fast execution, and access to useful tools like a VPS.

The broker will also serve beginners due to its $0 minimum deposit, free demo account and multiple copy trading tools. With that said, we would like to see Fusion Markets improve its education offering to bring it on par with leading alternatives.

FAQ

Is Fusion Markets Legit Or A Scam?

Fusion Markets is a legitimate broker with its main branch regulated by the Australian Securities and Investments Commission (ASIC) – a tier-one regulator.

Our experts did not find reports of scams during our research and the broker has picked up multiple awards.

Can I Trust Fusion Markets?

We consider Fusion Markets a trustworthy broker owing to its strong regulatory oversight, positive user reviews and various client safeguards. These include negative balance protection for Australian clients, segregated accounts and no misleading financial incentives.

Is Fusion Markets A Regulated Forex Broker?

Yes, Fusion Markets is regulated in three jurisdictions. The main Australian branch is regulated by a top-tier agency, the Australian Securities and Investments Commission (ASIC).

The broker’s offshore entities operate with regulation from the Vanuatu Financial Services Commission (VFSC) and the Financial Services Authority (FSA) of Seychelles. On the downside, these are not highly-regarded financial regulators.

Is Fusion Markets A Good Or Bad Forex Broker?

Fusion Markets is a good forex broker with over 90 currency pairs and very low fees with zero-pip spreads and a $4.50 commission. The brokerage also offers an excellent range of additional tools alongside MT4 and MT5, including a VPS and copy trading platforms.

The only major downsides for us are the lack of educational resources and slower payment timelines than some competitors.

Is Fusion Markets Good For Beginners?

Fusion Markets offers no minimum deposit, a demo account plus a choice of copy trading tools, which will all appeal to beginners. We also like that it only takes 5 minutes to sign up for an account.

However, educational resources are lacking, with only a basic and outdated blog section. In contrast, many top brokers provide fully-equipped training hubs, so improvement is needed here.

Does Fusion Markets Offer Low Forex Trading Fees?

Fusion Markets offers very low fees for forex trading. Spreads on the ZERO account come in as low as 0.0 pips with a $4.50 commission per round turn. There are also no deposit fees or inactivity penalties.

This makes Fusion Markets one of the cheapest forex brokers we have reviewed.

Does Fusion Markets Have A Forex App?

MetaTrader 4, MetaTrader 5 and cTrader all have mobile applications available on iOS and Android devices.

While testing the apps, I was able to utilize many of the same features available in the desktop solutions, including technical analysis tools and charting features.

How Long Do Withdrawals Take At Fusion Markets?

Withdrawals at Fusion Markets aren’t the fastest, but they are in line with many brokers.

You can expect withdrawals to take up to 1 business day to be processed and they will clear in your account within 5 business days, depending on the funding method used.

Can You Make Money Trading Forex With Fusion Markets?

With low fees, excellent trading tools and zero strategy restrictions, traders can develop and test various setups at Fusion Markets.

However, this does not guarantee profits. Many traders lose money, regardless of the forex broker they use. With this in mind, always take a sensible approach to risk and wallet management.