FXCM

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, ZAR, CHF

-

🛠 PlatformsMT4, eSignal, TradingView

-

⇔ Spread

GBPUSD: 0.5 pips var* EURUSD: 0.2 pips var* GBPEUR: 0.5 pips var* -

# Assets40

-

🪙 Minimum Deposit$50

-

🫴 Bonus Offer-

Our Opinion On FXCM

We consider FXCM an excellent broker – it is overseen by tier-one regulators, has a strong industry presence, and offers tight spreads on forex pairs. The suite of advanced platforms and code-free automated trading tools is particularly strong. FXCM does trail industry leaders when it comes to market access, but it remains a strong contender for both beginners and experienced traders.

Summary

- Instruments: 400+ including 40+ forex pairs, stocks, indices, commodities, cryptocurrencies

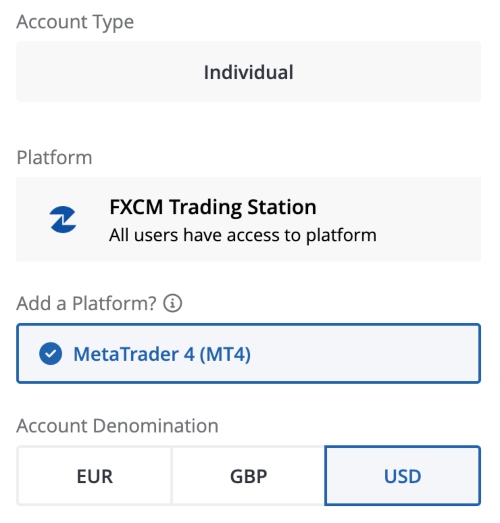

- Live Accounts: Standard, Active Trader, Professional, Corporate

- Platforms & Apps: MetaTrader 4 (MT4), TradingView, Trading Station, Capitalise.ai

- Deposit Options: Bank cards, wire transfers, e-wallets

- Demo Account: Yes

Pros & Cons

- Best-in-class algorithmic trading software with code-free automation via Capitalise.ai

- Trustworthy forex broker licensed by tier-one regulators including the FCA & ASIC

- USD and JPY forex baskets for broader market exposure

- Fast and fee-free payment methods including PayPal

- Simple sign-up process that takes less than 10 minutes

- Tight forex spreads following a 54% reduction in costs

- Active Trader program with fee rebates

- Accessible minimum deposit of $50

- Free demo account with no expiry

- Narrow range of instruments compared to alternatives

- No MetaTrader 5 (MT5) integration

- Inactivity fee after 12 months

Is FXCM Regulated?

FXCM has strong regulatory credentials with oversight from several respected financial watchdogs.

This includes the UK Financial Conduct Authority (FCA) and the Australian Securities & Investments Commission (ASIC) – tier-one regulators, the Cyprus Securities & Exchange Commission (CySEC) – a tier-two regulator, and the South African Financial Sector Conduct Authority (FSCA).

This level of regulatory scrutiny brings stringent requirements and compliance checks, ensuring that UK and Australian traders in particular will be well covered. Traders who register with the FSCA branch will be able to access higher leverage, though the regulatory oversight is not quite as strong.

Importantly, FXCM implements several safeguards that we view as essential, including negative balance protection so your balance doesn’t fall below zero, and segregated client accounts so you can still access your funds should the broker faces financial difficulties.

Moreover, our experts found no evidence of major scams or security breaches associated with the broker. This solidifies our trust in their commitment to maintaining a secure trading environment.

Forex Accounts

FXCM offers two primary account types: Standard and Active Trader.

We recommend the Standard account for beginners and casual traders. It offers the full suite of assets with micro-lot trading, leverage in line with regulatory requirements, plus the broker’s four trading platforms.

The Active Trader solution is better for active traders. As well as priority support, market depth is stronger with multiple levels of liquidity at each price, offering useful information for high-frequency traders.

Professional and corporate accounts are also available upon request.

How To Open An Account

FXCM has a fast sign-up process. It took me less than 10 minutes to register for an account.

- Fill out the account application form with your up-to-date personal information

- Choose your trading account settings, including platform and currency

- Answer a set of questions about your trading experience

- Verify your identity by uploading scans of ID documents and proof of address

- Review and accept the terms and conditions

- Fund your account with a supported payment method

- Start trading

Trading Fees

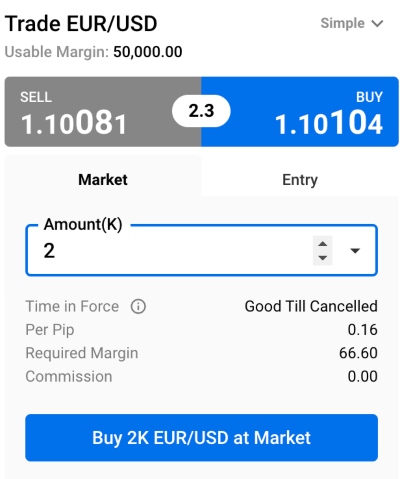

We have evaluated more than 400 forex brokers and FXCM scores well when it comes to trading fees. There is no commission, just a tight, variable spread.

While using the broker, we got low spreads from 0.6 pips on the AUD/USD and 0.9 pips on EUR/CHF. This compares well to leading forex brokers, including Pepperstone and AvaTrade.

This also comes after the broker reduced its spreads by up to 54% on selected forex, stocks and other CFDs in 2022. The result is that FXCM is now a great option for traders seeking tight spreads in a commission-free trading account.

Non-Trading Fees

While not a deal breaker, there is an inactivity fee charged to dormant accounts after 12 months of inactivity. The fee is up to 50 units of the currency your account is denominated in or the balance of your account, depending on which is less.

To prevent this from happening, you either have to place a new trade, maintain an existing trade or close your account.

Overnight costs are also applied for positions held after 10 pm GMT, but this is industry standard.

The upside is that FXCM does not charge for deposits or withdrawals.

Payment Methods

A wide range of deposit methods are available at FXCM. This includes debit and credit cards, bank wire transfer, PayPal, Google and Apple Pay, Open Banking, Skrill, Neteller and Rapid Transfer. This represents a good selection of payment options and the absence of a crypto deposit option is the only minor complaint I have.

Bank wire deposits take between one and two business days when you are transferring domestically, whereas e-wallets like PayPal are processed instantly, so I would opt for this if you want to fund your account promptly.

The minimum deposit for a live account is 50 of the account’s base currency, which is relatively low and attainable for both beginner and more experienced traders.

How To Make A Deposit

The account funding process at FXCM only takes a couple of minutes and a few simple steps:

- Log in to the MyFXCM client area

- Navigate to the deposit section in the left-hand menu

- Choose your preferred deposit method (bank wire, card, or electronic payment)

- Provide the required details for the chosen method

- Enter the deposit amount within any specified limits

- Confirm the deposit and follow any additional instructions

- Wait for the funds to be processed and reflected in your account balance

Forex Assets

FXCM trails many brokers when it comes to the breadth of forex pairs, with around 40 assets available. This is significantly less than the 80+ at Forex.com or 300+ at CMC Markets.

With that said, most retail traders will only regularly trade a small selection of currency pairs. For that reason, I don’t mark brokers like FXCM too harshly for the more limited offering – as long as your preferred pairs are on the list, you should be fine.

Moreover, I rate the forex baskets on offer, covering the US Dollar and Japanese Yen. FXCM is one of only a handful of brokers that offer such products.

These currency indices provide a more objective view of a currency’s performance by tracking it against a set of relevant currencies, such as those of key trading partners. These are good options if you want to reduce your risk exposure to a single currency.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

There are also stocks, indices, commodities and cryptos at FXCM.

The largest asset class is shares, with 100+ stock CFDs, including giants like Alibaba, Amazon and Meta. This is a reasonable selection of stocks, but it does not stand up to the thousands of equities available from alternatives like eToro. As such, I don’t recommend FXCM for dedicated stock traders.

On a lighter note, many traders will appreciate the 20+ crypto CFDs, traded in USD, EUR, GBP and AUD pairs. The list includes big hitters like Bitcoin but also some smaller tokens like Tezos, and although it is not the widest selection of cryptocurrencies, it does provide decent scope.

FXCM also offers 14 indices, covering major global markets and exchanges including US, European, British, Japanese and more as well as the VIX volatility index.

The broker’s commodity list includes gold and silver as well as energies and a few soft commodities, while the Euro-Bund Futures Index is also available to trade.

All in all, I think the asset classes offer broad coverage that most traders will get a lot out of, but FXCM’s instrument list lacks depth, especially in its range of stocks.

Execution

FXCM is a hybrid market maker/no-dealing desk broker. This allows for lightning-fast execution and very tight spreads.

The broker advertises average execution speeds of 0.018 seconds, which makes them very competitive. When I placed my own trades, I found that the execution speed was as fast as the broker advertised. And since I count anything under 0.1 seconds as good, this is a big strength of this broker.

Leverage

FXCM offers leveraged trading on CFDs and forex, allowing traders to take advantage of small market movements.

The amount of leverage available will depend on the FXCM entity that you sign up with. The offshore branch offers flexible leverage up to 1:1000 for accounts with less than $5000 deposited funds. This drops to 1:400 for accounts funded from $5000 – $50,000, and to 1:200 on CFDs and 1:100 on forex thereafter.

These amounts are the absolute maximum leverage on offer, but they may vary according to the asset traded, with more volatile assets generally providing lower amounts of leverage.

Importantly, we urge less experienced traders to trade on margin with caution, as 1:1000 is very high and could lead to large losses.

Traders that sign up with the FCA-, ASIC- or CySEC-regulated branches can trade with leverage up to 1:30 in line with regulatory requirements. This is to help protect retail traders from accumulating substantial losses. Leverage by asset is as follows:

- Major Currency Pairs – 1:30

- Non-Major Currency Pairs, Gold and Major Indices – 1:20

- Commodities (Excluding Gold) and Non-Major Equity Indices – 1:10

- Individual Equities – 1:5

Platforms & Apps

The wide selection of powerful trading platforms is one of the biggest selling points of FXCM for me. These include the brand’s proprietary Trading Station as well as the popular MetaTrader 4, TradingView, and Capitalise.ai.

Trade Station

When testing the in-house platform, I was struck by its ease of use and intuitive design. Both analysis and trades can take place directly from the chart with a few clicks, and the handy sidebar makes it very easy to cycle through tradeable assets.

A news feed below the chart adds fundamental analysis to the mix, making this a great all-in-one platform that beginners should find easy to pick up. The addition of preloaded technical indicators and automated trading strategies means that more experienced traders will also find a lot of value in this platform.

For these reasons, I rate Trading Station highly among the dozens of proprietary platforms I have tested.

I also thought the addition of MT4 and the other third-party options was a great move by FXCM which will please forex traders who are used to these platforms or want to take advantage of their special features, including MetaTrader’s Expert Advisors (EAs).

Capitalise.ai

In particular, I would recommend Capitalise.ai for users interested in algorithmic trading but that don’t have coding skills. You can enter instructions in text form and the tool will sort the coding for you.

You can create custom strategies via a user-friendly interface, incorporating various technical indicators, price patterns, and market conditions.

Here is how to use it:

- Open the tool through your FXCM trading account

- Define your trading strategy with specific rules and conditions

- Back-test your strategy with historical data to evaluate performance

- Optimize and refine the strategy based on the back-testing results

- Deploy the strategy in your live trading account

Forex Tools

FXCM offers a ‘forex simulator’ that provides traders with a realistic and risk-free environment to practice their trading strategies. The simulator is designed to replicate live market conditions and allows traders to execute trades, monitor price movements, and analyze their performance without risking actual capital.

The simulator also offers features like customizable trade sizes, various order types, and real-time charting tools to enhance the trading experience.

I see this as a very useful tool that traders can use both for educational and analytical purposes, making it ideal for both beginner traders and experienced pros to hash out new strategies and test them in diverse market conditions. Moreover, I found the user interface to be streamlined and simple.

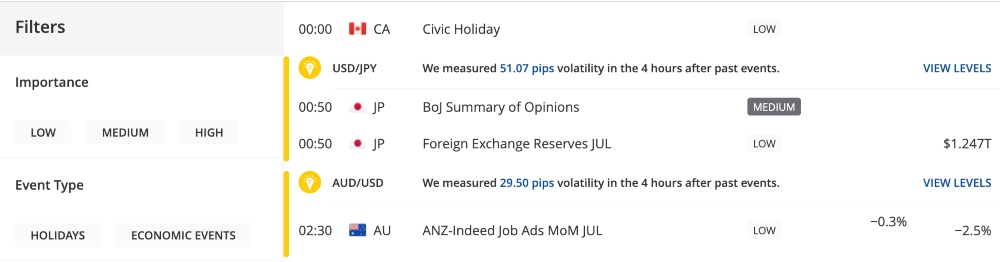

An easy-to-use economic calendar is also available. Helpfully, you can filter it by the impact and importance of events.

Forex Research

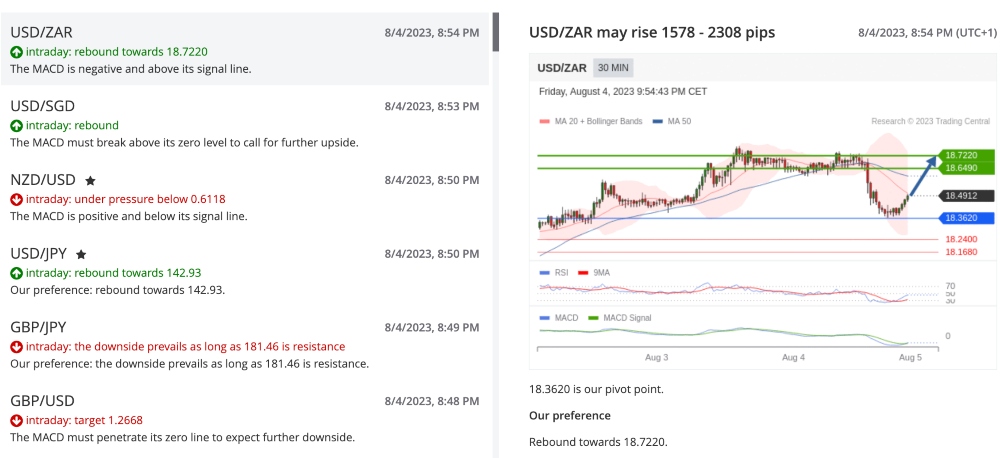

FXCM offers analyst insights and market summaries to provide traders with valuable research.

The analyst insights often include expert commentary, technical analysis, and fundamental insights on various financial instruments such as currencies, commodities, and indices.

The market summaries provide concise overviews of recent market movements, key price levels, and notable news that may impact the markets.

These insights and summaries can be accessed through the FXCM website, trading platforms, or through specialized research tools provided by FXCM.

They serve as valuable resources for traders looking to make informed trading decisions and, in my opinion, stack up well against the analysis provided by similar brokers.

Forex Education

FXCM offers a range of comprehensive forex education resources. These include online courses, webinars, video tutorials, trading guides, eBooks, and a forex glossary. They cover various topics such as technical analysis, fundamental analysis, risk management, trading strategies, and more.

Overall, I find their educational tools to be very useful, and I appreciate the chance to access them with a few clicks on the broker’s website. It is great to see the course topics divided into sections according to traders’ skill levels, making them easy for the appropriate levels to access, and I am happy with the range of recorded materials available.

Demo Account

FXCM offers a free demo account for traders to practice trading in a risk-free environment.

You can access the same trading platforms and tools available on live accounts, allowing you to familiarize yourself with the platform’s features, practice executing trades, and test your strategies without risking real money. Instead, you will trade with 50,000 virtual units of the relevant currency.

I was especially happy to see that it is offered without any time limit or other restrictions, meaning that you can continue to use it as a strategy testing tool long after you register with FXCM. I generally prefer forex brokers with an unlimited demo account.

How To Open A Demo Account

- Visit the FXCM website

- Click “Try Demo”

- Provide your name and email

- Receive your demo account login credentials via email

- Log in to the trading platform or demo account portal

- Start practising with virtual funds

Bonus Offers

FXCM’s offshore entity offers up to $200 as a welcome bonus when you open a live account. The actual amount you receive depends on how much you deposit in your first week of trading.

There is also a rebate program that allows cash rebates depending on the volume you trade, which is a perk for active traders.

Generally, we do not view these types of schemes as dealbreakers, as the terms and conditions needed to benefit from them are often difficult to meet and we feel the true value of a broker is in its pricing, reliability and the services it offers clients.

Note that the regulated branches will not offer promotional schemes due to regulatory restrictions.

Trading Restrictions

There are no trading restrictions with FXCM, which is great news for serious traders who like to employ scalping, hedging and other strategies.

I do note, however, that I had to enable hedging before I could make use of this strategy, though I did this easily by accessing my account settings.

Customer Service

I find the FXCM customer support team responsive and helpful. They can be reached through various channels, including phone, email, and live chat support.

We tested the live chat function several times over a week and found that each time responses were timely and the customer service representatives were knowledgeable, professional, and provided helpful assistance.

My only minor complaint is that customer support isn’t available on the weekend. Whilst this won’t be a deal breaker for most traders, it may frustrate clients that trade cryptos over the weekend.

Company Details

FXCM (Forex Capital Markets) is a well-established and globally recognized forex and CFD broker.

Founded in 1999, FXCM has grown to become one of the leading providers of online trading services in the industry.

With headquarters in New York, FXCM operates globally, serving traders from various countries. The company has over 10 international offices and more than 25 industry awards.

Trading Hours

FXCM offers 24-hour forex trading from Sunday at 5:00 PM Eastern Time (ET) until Friday at 5:00 PM ET.

The trading hours for CFDs on stocks, indices and commodities may vary depending on the specific market. For example, indices like the S&P 500 or the FTSE 100 will have trading hours that correspond to the opening hours of the underlying stock exchanges.

Who Is FXCM Best For?

FXCM is well-suited to a diverse range of forex traders thanks to its competitive spreads, flexible accounts and customizable platforms.

Newer traders can access a wealth of educational resources, an unlimited demo account and reliable customer support, while algorithmic traders can take advantage of FXCM’s automated trading software.

We do miss a raw-spread ECN account, but the pricing and restriction-free trading, as well as good support for algorithmic strategies, still make this a suitable stop for serious forex traders.

FAQ

Is FXCM Legit Or A Scam?

FXCM is a legitimate forex broker with a long-standing presence in the industry since 1999 and dozens of industry accolades. Our experts are comfortable that the brokerage is not operating a scam.

Can I Trust FXCM?

FXCM is trustworthy. It is regulated by multiple tier-one financial authorities, including the FCA and ASIC, which adds credibility and oversight to its operations.

Is FXCM A Regulated Forex Broker?

Yes, FXCM is regulated by several financial authorities, including the FCA in the UK, ASIC in Australia, the CySEC in Europe, and the FSCA in South Africa.

These regulations provide certain protections for traders, including negative balance protection and segregated accounts, and ensure compliance with industry standards.

Is FXCM A Good Or Bad Forex Broker?

FXCM is a good forex broker. It offers competitive trading fees, a wide range of financial instruments, multiple trading platforms, fast execution speeds, and high-quality educational resources. It is also a multi-regulated and reliable broker.

Is FXCM Good For Beginners?

Yes, FXCM is suitable for beginners. It provides high-quality educational resources, unrestricted demo accounts, and user-friendly platforms to help beginners learn and improve their trading skills. Capitalise.ai also supports traders in developing algorithmic strategies with no coding skills.

Does FXCM Offer Low Forex Trading Fees?

FXCM offers competitive trading fees, including low spreads of 0.6 pips on popular currency pairs like AUD/USD. The brokerage also cut its trading fees by up to 54% in 2022, bringing it in line with other low-cost forex brokers.

Does FXCM Have A Forex App?

Traders can access FXCM on the go using either the mobile-optimized version of the proprietary Trading Station platform or the reliable MT4 application. Both apps are available from the Apple App Store and Google Play. Importantly, we did not encounter any technical issues upon testing.

How Long Do Withdrawals Take At FXCM?

Withdrawal times at FXCM are industry-standard. Domestic wire transfers take one to two working days while international wire transfers can take three to five business days. Whilst not as fast as some forex brokers we have tested, these are similar to most competitors.

Can You Make Money Trading Forex With FXCM?

FXCM provides competitive conditions. However, success in forex trading depends on various factors such as market conditions, trading strategies, risk management, and individual trading skills. Profitability ultimately depends on the trader’s abilities and the wider market environment.