IronFX

-

💵 CurrenciesUSD, EUR, GBP, AUD, JPY, PLN, CZK

-

🛠 PlatformsMT4, AutoChartist, TradingCentral

-

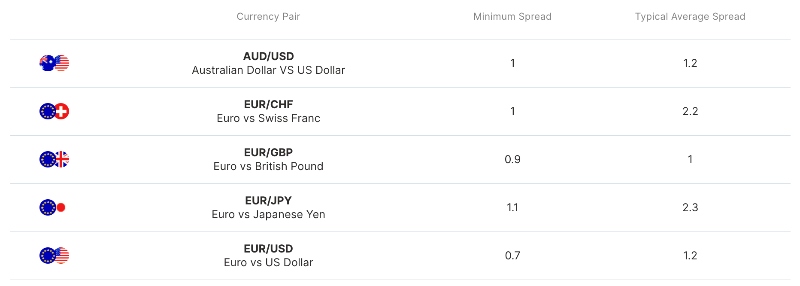

⇔ Spread

GBPUSD: From 0.8 EURUSD: From 0.7 GBPEUR: From 0.9 -

# Assets80+

-

🪙 Minimum Deposit$100

-

🫴 Bonus OfferTraders can choose between: 100% unlimited Sharing Bonus – minimum $200 deposit. 40% Power Bonus up to $4,000 – minimum $500 deposit. 20% Iron Bonus up to $2,000 – minimum $100 deposit.

Our Opinion On IronFX

IronFX is a multi-regulated forex broker that offers 70+ currency pairs and supports a range of trading styles. We think it is an excellent choice for beginners with a fast sign-up process, a fixed spread account and a user-friendly copy trading platform. Our team also likes IronFX for automated forex trading, with access to MetaTrader 4, ECN pricing and a VPS.

It does disappoint in some areas, though: withdrawal times are slower than other forex brokers. Our tests also revealed a $55 withdrawal fee on bank transfers and high inactivity penalties.

Summary

- Instruments: 500+ including 75 forex pairs, stocks, indices, commodities, futures

- Live Accounts: Live Floating, Live Fixed, ECN/STP

- Platforms & Apps: MetaTrader 4 (MT4), WebTrader, App

- Deposit Options: Bank cards, wire transfers, e-wallets

- Demo Account: Yes

Pros & Cons

- Established forex broker with 1.5+ million traders

- Heavily regulated and licensed by the FCA & CySEC

- Flexible pricing structure with fixed and floating spreads

- Access to the MetaTrader 4 platform and mobile app

- Hundreds of instruments spanning 6 asset classes

- Hands-off trading through TradeCopier and PMAM

- Spreads from 0.0 pips on the STP/ECN accounts

- High-quality education through the Academy

- Very high leverage up to 1:1000

- There is a $55 charge on bank wire withdrawals below $300

- A 3% inactivity fee applies to dormant accounts

- Slow withdrawal times up to 10 days

- No cryptocurrency trading

- US clients not accepted

- PayPal not available

Is IronFX Regulated?

Our experts do not have concerns regarding the legitimacy of IronFX whose history is free from scams, scandals and security breaches. The forex broker is also regulated by trusted regulators:

- Notesco UK Limited – regulated by the UK’s FCA with license number 585561

- Notesco Financial Services Ltd – regulated by Europe’s CySEC with license number 125/10

- Notesco (SA) Pty Ltd – regulated by South Africa’s FSCA with license number 45276

Regulatory oversight from several reputable bodies is a reassuring sign that clients will receive safeguards like negative balance protection, so you can’t lose more than your account balance and segregated funds, which safeguards your funds from the company’s operating capital.

With that said the offshore entity, Tradeco Limited, is registered with the Seychelles FSA. This is not a well-regarded regulator so traders who sign up with this entity will receive little limited legal protection.

Forex Accounts

IronFX offers seven account options, with various conditions to suit different trading styles. These are split into Live Fixed/Live Floating, which are the best for new and casual traders and STP/ECN, which are geared towards experienced investors and algo traders. An Islamic-friendly trading solution is also available.

We are comfortable that the $100 minimum deposit is accessible for most traders. The availability of a 24/5 account manager is also a nice bonus and will support new clients.

We have pulled out the key features of each account below.

Live Fixed/Live Floating

- Standard – spreads from 1.6 pips, fixed to 2. Commission-free and you can trade the full range of instruments. Multiple base currencies including USD, EUR, GBP, AUD, JPY, BTC, PLN and CZK.

- Premium – spreads from 1.4 pips, fixed to 1.8. Commission-free and you can trade the full range of instruments. Multiple base currencies including USD, EUR, GBP, AUD, JPY, BTC, PLN and CZK.

- VIP – Spreads from 1.2 pips, fixed to 1.6. Commission-free, all asset classes are available but the only base currency supported is USD.

- Live Zero – Spreads fixed to 0. Commission payable but the only base currencies are USD and EUR.

STP/ECN

- No commission – Spreads from 0.9 pips and as the name suggests, there is no commission. Multiple base currencies including USD, EUR, JPY, GBP and BTC.

- Zero spread – spreads from 0 pips plus a commission and flexible leverage up to 500. Multiple base currencies including USD, EUR, JPY, GBP and BTC.

- Absolute Zero – spreads from 0 pips, no commission, plus flexible leverage up to 200. USD, EUR and JPY base currencies.

How To Open An Account

Opening a live trading account with IronFX can be done in a few minutes and I found the process smooth:

- Enter your personal details in the sign-up form including name, email and country

- Select the account type, leverage, bonus and base currency

- Click ‘Register Now’ to submit your application

- Sign in to the client portal with the credentials sent to your email

Trading Fees

You can choose between multiple pricing models, with rates getting better as you move up the tiered accounts with the VIP solution offering the lowest fees.

Forex spreads were competitive when we evaluated IronFX. Spreads on the EUR/USD started from 0.5 pips on the live floating account, 1.6 pips on the live fixed account, and 0.2 on the STP/ECN solution.

These aren’t the tightest spreads we have seen but they compare well to most competitors. The fixed spread account is also unusual and provides newer traders with a degree of price certainty.

Non-Trading Fees

We are disappointed to see that IronFX charges a sizable 3% inactivity fee, as well as a 3% fee on funds when withdrawals are requested when the account isn’t active. This means the broker isn’t the best option for casual investors.

Payment Methods

Our team is impressed with the range of funding methods supported, with e-wallets, local transfer solutions, plus traditional payment options. These include wire transfers, Skrill, Neteller, FasaPay, China Union, Perfect Money, plus debit and credit cards. The only notable absence is PayPal.

The forex broker also doesn’t charge deposit fees and processing speeds are quick, typically taking up to 24 hours. With that said, we found wire transfers can take up to 5 days.

We are less impressed with withdrawal timelines. You have to wait up to 10 days, which is double the time of many leading forex brokers. As a result, traders who prioritize fast withdrawals will be better served elsewhere.

Our team is also disappointed to see that withdrawals for sums of less than $300 carry a hefty $55 charge, which is likely to penalize beginners most heavily.

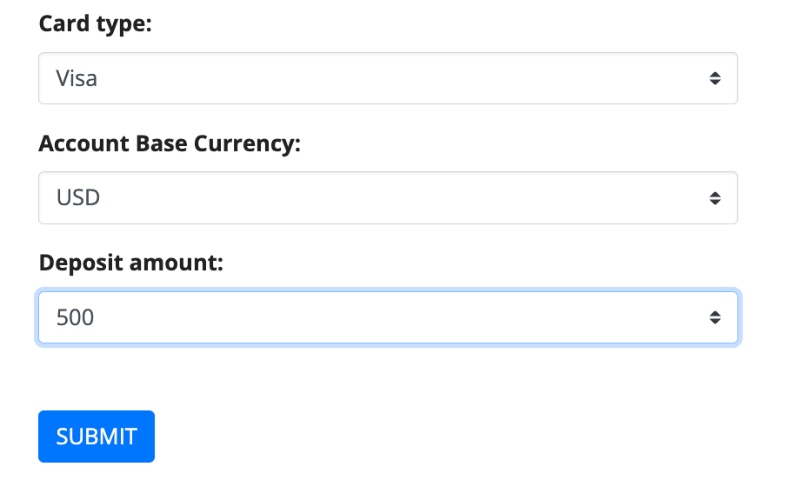

How To Make A Deposit

Making a deposit at IronFX is quick and easy:

- Log in to the client portal and click on the ‘Deposit Funds’ tab

- Chose a funding method such as a debit card

- Enter the amount of $100+

- Provide any requested details and click to confirm the deposit

Forex Assets

You can trade 75 major, minor and exotic currency pairs, including the most popular and liquid assets such as EUR/USD, GBP/USD and JPY/USD. We are happy with this range of forex pairs, which is on the high end of the brokers we review.

You can trade forex as CFDs, meaning you can bet on rising and falling prices while increasing your market exposure in return for a modest investment.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

IronFX offers a good range of commodities, futures and indices, but we are disappointed with the absence of crypto trading. The selection of stocks is also limited compared to alternatives, with around 140 US equities available.

You can trade:

- Metals – spot silver, gold, platinum and palladium

- Indices – 19 spot indices including the UK 100, Germany 40 and Nasdaq 100

- Commodities – 19 agricultural and energy commodities including sugar, natural gas, wheat and cocoa

- Shares – 140+ shares including household names like Airbnb, American Express, Netflix and Tesla

- Futures – energy, commodity, base metal and currency futures

Leverage

IronFX’s leverage is flexible and varies according to the instrument traded and limits set out by respective regulatory bodies, with up to 1:1000 available from the offshore entity, 1:500 from the FSCA-regulated entity, and 1:30 from the branches regulated by CySEC and the FCA.

Traders should be aware that leverage elevates risk. As a result, we only recommend that experienced investors trade with high leverage.

For ECN/STP accounts, stop-out levels are set at 50%. For real account holders, stop-out levels are set at 20%.

Platforms & Apps

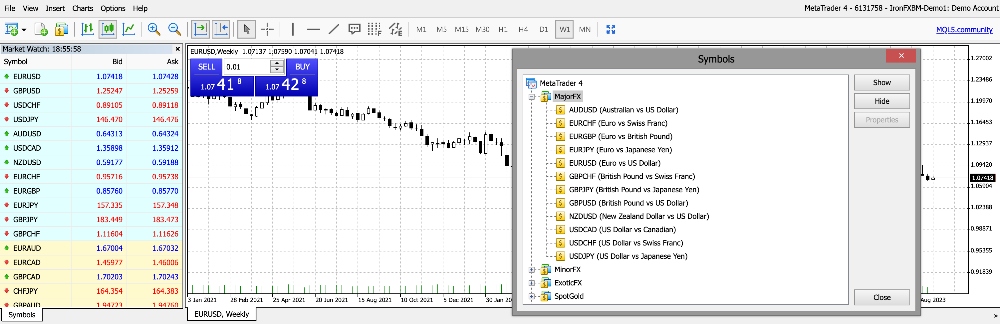

IronFX offers the industry-favourite MetaTrader 4 (MT4) platform, available on desktop, web and mobile.

I consider MT4 one of the best forex trading platforms thanks to its intuitive interface, options for customization and advanced tools.

There are 30 built-in indicators with 2000 free indicators available for download and over 700 paid options. The 9 timeframes and unlimited charts also mean it can serve various trading styles, from scalping through to swing trading.

I would recommend this platform to all forex traders due to its dependability, flexibility and ease of use.

IronFX also offers a proprietary mobile trading app which can be downloaded directly from the broker’s website. The application is compatible with both Android and iOS devices and offers good functionality. I also like that it doesn’t compromise on market access – you can trade all 500+ instruments and manage your account on the go.

How To Make A Forex Trade

I find it easy to place trades on MT4’s intuitive interface:

- Log in to your account and open MT4’s Market Watch window

- Right-click on the forex pair you want to trade and click ‘New Order’

- Enter the trade volume and any risk management parameters

- Hit the ‘Sell’ or ‘Buy’ button to confirm the order

Forex Tools

There is a good suite of extra tools which can bolster the trading experience. The highlights for me are copy trading, Trading Central and VPS.

Copy Trading

Copy trading is available through IronFX’s proprietary TradeCopier solution. Our team really liked using this tool – there are lots of options for traders to follow and an active community to learn from and contribute to.

You can also register as a Strategy Provider or Strategy Follower through Trade Copier, meaning experienced traders can benefit from the system by earning commissions from their followers.

Trading Central

Trading Central is an analysis and insights platform that I think is a great addition. It offers high-quality and easy-to-digest fundamental and technical data to inform investment decisions.

There is historical data, technical views, customizable filters and a very modern-feeling interface which makes it enjoyable to use and easy to learn.

VPS

The VPS is another good feature that will serve high-frequency traders. It offers a fast, secure and stable connection to the financial markets with no downtime. The VPS works particularly well with MetaTrader 4’s Expert Advisor (EA) trading robots.

Forex Research

I appreciate that IronFX places emphasis on forex research and analysis. There are market trend reports as well as regular financial news and updates from across the industry in the Financial News blog.

We rate the blog’s regular updates, containing useful insights in a handy bitesize format. The language is accessible, visual summaries are easy to digest and many also include video content.

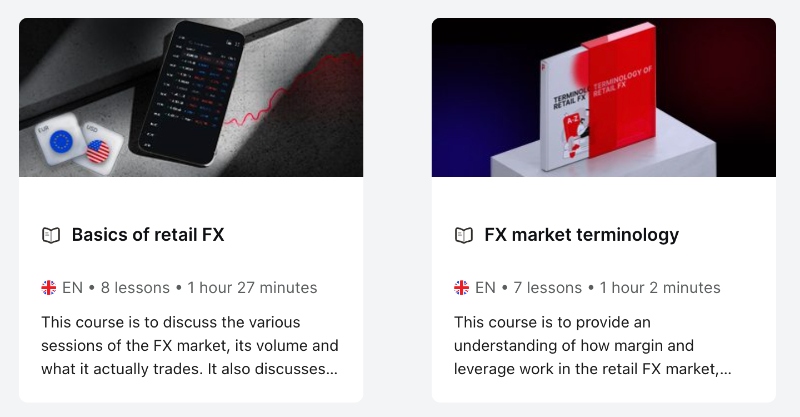

Forex Education

IronFX offers a comprehensive suite of resources and educational materials, from podcasts, webinars and seminars to a TV channel.

This is a great selection of education, and I feel this is a strong point for the broker, especially given the additional Academy where you can enhance your trading skills through bespoke courses, ebooks and more.

All in all, we feel these resources are amongst the best we have seen, catering to a range of learning styles and experience levels.

Demo Account

IronFX offers access to multiple demo accounts and we are pleased to see these matching the broker’s live trading accounts.

I recommend starting here if you are new to the MetaTrader 4 platform. You can test the different tools and practice forex strategies with zero risk.

How To Open A Demo Account

Opening a demo account is a quick and simple process that took me less than two minutes.

- Visit the IronFX website

- Select ‘Open a Demo Account’

- Enter your contact details including name, email address and phone number

- Choose the demo settings including account type, leverage and currency

- Select ‘Trade For Free’

Bonus Offers

IronFX offers several trading promotions through its offshore branch. This includes a 100% sharing bonus and deposit boosters, plus regular trading tournaments with cash prizes.

These can be a good way to practice trading forex but terms and conditions mean withdrawing bonus funds is difficult. Also, we don’t recommend choosing a forex broker based on their bonuses as they are often prohibited in heavily regulated jurisdictions.

Trading Restrictions

IronFX permits a wide range of trading styles including scalping, hedging and algo trading. We didn’t come across any strategy restrictions while using the forex broker.

Customer Service

Our team is pleased with the responsiveness of the 24/5 customer support team, who were helpful during our tests and responded to live chat queries within 10 minutes.

Account holders also benefit from a dedicated account manager, which is not a benefit we usually see.

You can contact the forex broker using these details:

- Email – support@IronFX.eu (Cyprus/EU), support@IronFX.com (Bermuda, South Africa), support@ironfx.co.uk (UK)

- Phone – +357 25027212 (Cyprus/EU), +27 11 0176600 (South Africa), +44 (0) 207 416 6670 (UK)

- Live chat – on the broker’s website

Company Details

Founded in 2010 by a team of experienced financial professionals, IronFX has built up a solid reputation as a reliable forex broker.

Today, it connects retail traders from across the world, offering 500+ instruments across six asset classes. Over 1.5 million traders have opened an account from more than 180 countries.

The brokerage has had a series of sponsorship deals, including with the Korean Team at the AIDA Depth World Championship. IronFX has also won dozens of industry awards.

Trading Hours

Trading hours are 24/5 for forex, Monday to Friday from 00:00 – 24:00. For a detailed breakdown of trading hours for all assets, visit the trading portal.

Importantly, spreads will vary depending on market conditions, with peak hours offering the tightest floating spreads.

Who Is IronFX Best For?

IronFX is a good forex broker for algo traders with access to EAs, a VPS and tight spreads on the ECN account. The broker is also suitable for hands-off traders with a copy trading service and PAMM solution.

In addition, IronFX will serve beginners with its fixed spread account, high-quality educational materials and straightforward sign-up process.

FAQ

Is IronFX Legit Or A Scam?

IronFX is a legitimate forex broker. Over the course of 10+ years, the company has earned a good reputation with multiple awards and over 1.5 million clients.

Can I Trust IronFX?

Yes, our team does have any concerns regarding IronFX being a reliable, trustworthy forex broker. It has a good standing in the industry and strong regulatory credentials.

Is IronFX A Regulated Forex Broker?

Yes, the broker is regulated in multiple jurisdictions, including the EEA through the CySEC, the UK via the FCA and South Africa through the FSCA.

With that said, the offshore entity is effectively unregulated so clients registered here won’t get the same level of legal protection.

Is IronFX A Good Or Bad Forex Broker?

IronFX is a good forex broker based on our evaluation. It offers more than 70 currency pairs, the gold standard of forex trading platforms MetaTrader 4, plus 7 account types to suit different trading styles.

Our only minor complaints are the inactivity fees, lack of PayPal support, plus the absence of crypto trading.

Is IronFX Good For Beginners?

IronFX is a good option for beginners. We think the MetaTrader 4 platform is a great platform for those who are new to forex trading. Its copy trading service, TradeCopier, is another draw for new traders as is the competitive fee structure with fixed spreads.

Does IronFX Have A Forex App?

Yes, IronFX offers a proprietary mobile trading app that can be downloaded directly from the broker’s website and is compatible with iOS and Android devices. The app offers good functionality and is easy to use. Alternatively, you can download the MT4 app.

How Long Do Withdrawals Take At IronFX?

Withdrawal times are a weak point for this broker, taking up to 10 days with some payment methods. As a result, IronFX isn’t the best option if you want fast access to your trading profits.

Can You Make Money Trading Forex With IronFX?

The competitive pricing model, advanced tools, top-tier trading platform and reliable execution mean it is possible to make money trading forex with IronFX.

However, only skilled traders with an effective strategy will turn a profit. Only risk what you can afford to lose.