Just2Trade

-

💵 CurrenciesUSD, EUR, RUB

-

🛠 PlatformsMT4, MT5, TradingCentral

-

⇔ Spread

GBPUSD: 0.0 EURUSD: 0.0 GBPEUR: 0.0 -

# Assets50+

-

🪙 Minimum Deposit$100

-

🫴 Bonus OfferUp to $2,000 for professional accounts

Our Opinion On Just2Trade

Based on our tests, Just2Trade is an excellent broker for active forex traders. Our evaluation has shown high-quality order executions with speeds of 50ms, alongside tight spreads from 0.0 pips. The brokerage also offers one of the largest investment offerings we have seen, with 35,000+ instruments, including dozens of currency pairs.

Looking at the negatives, Just2Trade scores poorly when it comes to education, reducing its suitability for beginners. We are also disappointed by the deposit and withdrawal fees, which can be avoided at other forex brokers we use.

Summary

- Instruments: 35,000+ including 60+ forex pairs, stocks, futures, bonds

- Live Accounts: Forex & CFD Standard, Forex ECN, MT5 Global

- Platforms & Apps: MetaTrader 4 (MT4), MetaTrader 5 (MT5), CQG, Sterling Trader Pro

- Deposit Options: Bank cards, wire transfers, e-wallets

- Demo Account: Yes

Pros & Cons

- Very low fees on the MT5 Global account with spreads from 0.0 and a $2 commission

- Award-winning and trusted forex broker regulated by the CySEC

- 24/7 customer support with fast responses during testing

- Best-in-class investment offering with 35,000+ assets

- Excellent MetaTrader integration with MT4 and MT5

- Low minimum investment of $100

- Forex scalping permitted

- Negative balance protection is not available on all accounts

- Deposit and withdrawal fees charged on some accounts

- Below-average education and market research

- Copy trading app trails industry leaders

- No Islamic-friendly trading account

Is Just2Trade Regulated?

Our team is comfortable with Just2Trade’s regulatory status. The broker holds a license with the Cyprus Securities and Exchange Commission (CySEC), license number 281/15. This is a top-tier financial agency and offers good customer protection.

The broker is also a member of the Investor Compensation Fund, which protects clients with compensation of up to €20,000 in the case of an unresolved dispute with the brokerage.

Additionally, our research uncovered zero reports of scams or unfair operating practices, which is reassuring.

Our only complaint is that while this broker offers negative balance protection on their Standard account, it is not available on the other trading accounts. This means clients can lose more than their account balance if the markets move against them.

Forex Accounts

Just2Trade offers three trading accounts to currency traders: Forex & CFD Standard, Forex ECN, and MT5 Global.

The Standard account is our pick for beginners. The minimum deposit is accessible at $100 and users get commission-free trading with variable spreads.

The Forex ECN account is a good option for active forex traders looking for the tightest spreads and access to popular currency pairs. The minimum investment is also reasonable at $200.

Our research shows that the MT5 Global account is best for experienced traders. Account holders get tight spreads with a very low commission rate, plus access to the powerful MetaTrader 5 platform.

Below is a comparison of the different accounts.

| Forex & CFD Standard | Forex ECN | MT5 Global | |

|---|---|---|---|

| Minimum Deposit | $100 | $200 | $100 |

| Minimum Trade | 0.01 lots | 0.01 lots | 0.01 lots |

| Forex Pairs | 47 | 45 | 50 |

| Spreads | From 0.5 pips | From 0.0 pips | From 0.0 pips |

| Commission | $0 | $3 | $2 |

Just2Trade also offers a professional account for high-volume traders with a minimum deposit of $5000. The key benefits here are access to more than 50 execution routes, as well as powerful trading software like Sterling Trader Pro.

On the downside, our research has revealed that swap-free accounts are not available. For Islamic traders, we recommend AvaTrade instead.

How To Open A Live Account

I rated the straightforward sign-up procedure at Just2Trade, even if it did take longer than other forex brokers I have used. To get started:

- Enter your name, email address and phone number in the application form

- Fill in the required personal information such as your address and tax information

- Fill in your economic profile including your funding options, income and other financial details

- Choose your account settings including base currency and trading platform

- Provide the required documents (proof of identity and address)

- Once verified you can log in to your account

Trading Fees

Our testing shows that Just2Trade offers lower fees than most forex brokers, especially in its premium accounts.

The Forex Standard account offers commission-free trading with spreads from 0.5 pips. This is noticeably tighter than the variable spread accounts at the majority of brokerages.

The Forex ECN account offers ultra-tight spreads from 0.0 pips, although a low commission of up to $3 applies. Again, this fares well with many firms that charge a commission of $3.50+ on their ECN solutions.

Meanwhile, the MT5 Global account offers 0.0 pip spreads with an even lower commission of up to $2. This is firmly toward the low end of the forex brokers we review.

Non-Trading Fees

We appreciate that there are no deposit fees on the Standard and MT5 Global accounts, although third-party fees may apply to bank transfers.

However, we are disappointed to find that there are fees for depositing in ECN accounts, the amount of which varies depending on the method you use. There are also withdrawal fees with this account, reducing its appeal.

Just2Trade does not charge inactivity fees – a levy we see at many forex brokers we review. This is good news for casual traders.

Other fees to be aware of are the swap fees that are charged on positions held overnight. Traders should also keep in mind that triple rate swap fees are charged on a Wednesday.

Payment Methods

I like the variety of payment methods supported by Just2Trade, making the broker easy to use. Accepted funding methods depend on the account type you pick but they include bank wire transfer, credit/debit card, Neteller, Skrill, PayPal, Klarna, FasaPay and other digital wallets.

Processing times vary depending on the method you choose. For instant funding, I recommend card payments, which I find easy to set up, while bank wire transfers can take up to 5 days.

Our testing of Just2Trade also shows a good range of supported base currencies, including EUR and USD, making this broker accessible to global traders – removing potential conversion fees.

My only criticism is the fees for depositing funds to the ECN account, which don’t stand up against competitors like Pepperstone which doesn’t charge.

How To Make A Deposit

I find navigating the client portal simple. To make a deposit:

- Sign in to the members’ area

- Click the ‘Fund’ icon in the central menu

- Choose the payment method you want to use

- Enter the payment details and the amount you want to transfer

- Confirm the deposit

Withdrawals

Our review shows Just2Trade scores less favorably when it comes to withdrawals. Not all deposit options are available – bank transfers, card payments and some e-wallets such as PayPal are supported.

Additionally, the broker charges withdrawal fees which vary depending on the method you choose. Many leading forex brokers we evaluate do not charge at all, so this is a negative, especially for traders who make frequent withdrawals.

On a more positive note, our tests show that withdrawal times are in line with competitors, varying between payment methods with e-wallets being instant and bank wires taking up to 5 days.

Forex Assets

We are impressed with the range of forex assets available. With the MT5 Global account, you have access to 50 forex instruments, the Standard account offers 47 pairs and the ECN 45 pairs. With this variety of currency pairs, including majors, minors and exotics, traders won’t be short of opportunities.

Importantly, forex can be traded via contracts for difference (CFDs). This type of derivative allows traders to go long or short on currencies. CFDs can also be traded with leverage, which increases potential returns (and losses).

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

The huge range of 35,000+ instruments is a key benefit of opening an account. Our tests show that only a select few brokers, such as Saxo Bank, can rival Just2Trade when it comes to the number of trading products.

With that said, traders should be aware that the available instruments vary depending on the account you have. For example, the Standard account offers a reduced list of metals and CFDs in addition to forex. The MT5 Global account offers the widest variety of assets.

Supported assets include:

- Stocks: Trade 30,000 shares from 14 global markets including Apple, Coca-Cola and Barclays

- Precious metals: Trade 7 metals including gold, copper, silver, platinum and palladium

- Futures: Trade 5000 futures including on CME, ICE and CBOE

- Energies: Speculate on the price of 3 energy CFDs including oil and natural gas

- Indices: Trade 7 index CFDs including UK100, AUS200 and US500

- Bonds: Trade a range of European, US and ICE bonds

Execution

Just2Trade uses electronic communications networks (ECNs). This means the broker effectively acts as a middleman to give traders access to the forex market.

The key benefits of this system are the tight spreads and fast execution speeds, which come in as low as 50 ms based on our evaluation. This makes the firm a good option for active forex traders and scalpers in our opinion.

Leverage

Leverage up to 1:50 is available, although while testing Just2Trade, we found that you can apply for higher leverage up to 1:500.

This is much higher than the 1:30 limit for retail investors imposed by many regulators. As a result, we recommend caution. High leverage is best used by experienced traders with a solid grip on risk management.

It is worth noting that Just2Trade has a margin call of 100% and a stop-out level that is triggered when your account falls below 50% of the required margin.

Platforms & Apps

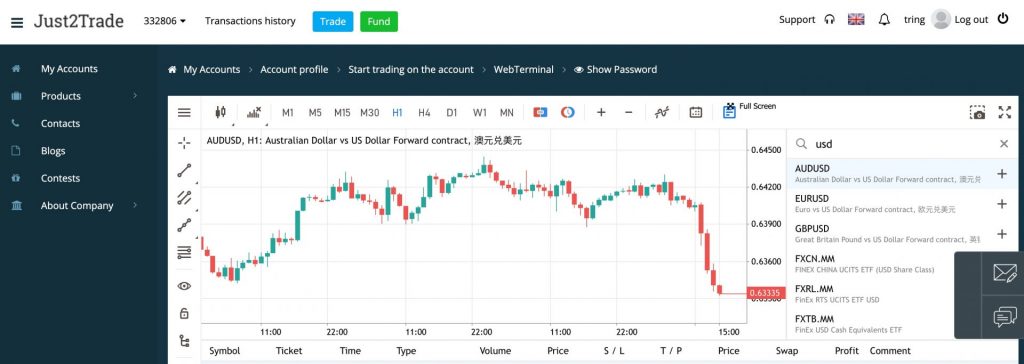

MT4 & MT5

Just2Trade uses the reliable and popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. They can be downloaded as desktop programs or mobile app on iOS and Android devices.

Our testing shows that both MT4 and MT5 support forex trading and provide an excellent suite of technical indicators, charts and analysis tools. Importantly, we find both platforms easy to use with a sophisticated design and a customizable workspace.

MT4 is our pick for beginners while MT5 is good for experienced traders thanks to its faster processing and greater breadth of indicators, order types and trading tools.

Below is our comparison of the two MetaTrader platforms.

| MetaTrader 4 | MetaTrader 5 | |

|---|---|---|

| Timeframes | 9 | 21 |

| Graphical Objects | 31 | 44 |

| Technical Indicators | 30 | 38 |

| Order Types | 4 | 6 |

| Automated Trading | Expert Advisors (EAs) | Expert Advisors (EAs) |

| Strategy Tester | Single-Threaded | Multi-Threaded |

How To Make A Forex Trade

I find making a forex trade on the MetaTrader platforms straightforward:

- Sign in to your MT4 or MT5 account

- Click on the ‘New Order’ icon from the menu at the top of the screen

- Use the search button to find the forex asset you want to trade

- Input the trade volume in lots

- Enter any stop loss or take profit levels

- Press ‘Buy’ or ‘Sell’ and you’ve made a trade

CQG

There is also the CQG platform with four different solutions that can be used to trade futures and options.

The platform offers clear market data and graphs, though we particularly rate the Excel output option and economic calendar, which are useful for planning trades.

Forex Tools

We aren’t impressed with the additional trading features available. Based on our evaluation, there aren’t many forex tools to improve the trading experience. Below are the two main exceptions.

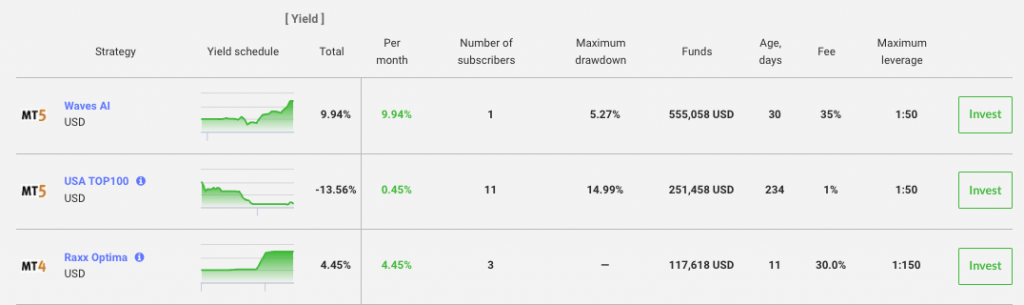

J2T Copy

This copy trading tool allows traders to choose an investment manager to manage their funds and make investments on their behalf.

It is useful if you don’t have the time or knowledge to make your own trades, though there is no guarantee you will make money. J2T Copy is also available with a low minimum investment of $100, making it accessible to beginners.

Yet it doesn’t offer the same user-friendly interface, or have as good a reputation as alternatives like eToro.

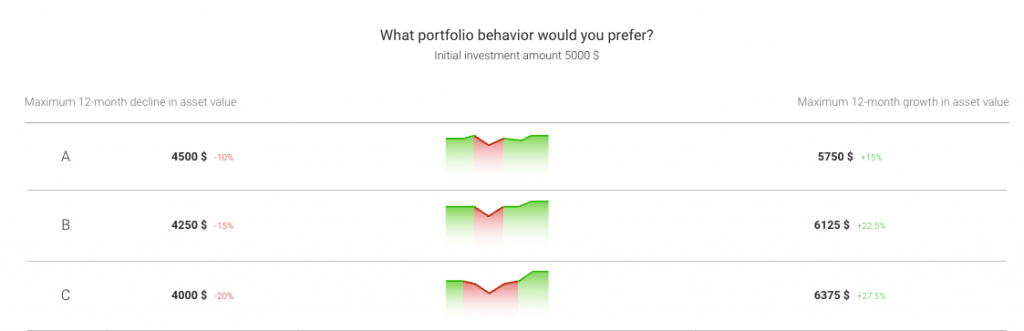

Robo-advisor

Just2Trade also offers an automated investment advisor. You can set goals such as general savings, retirement or college savings, which makes the tool user-friendly and gives you clear aims. You then choose an investment portfolio and let the robo-advisor provide advice and services.

On the downside, the minimum investment is fairly high at $500. Also, similar to the copy trading service, there is no guarantee you will make a profit.

Forex Research

From on our assessment, Just2Trade provides an average offering of market research. There is real-time data to help with trading decisions, including an economic calendar, market news and information on initial public offerings (IPOs).

Yet while we enjoy using these features, our team finds that the depth and quality of market research don’t rival alternatives like IG Group.

Forex Education

We rank the broker down when it comes to educational resources. There is a blog, an index of financial terms and a collection of research notes (both a subscription and a historical library).

The research notes are quite useful for forex trading, but there are no videos, webinars or guides to support beginners. Ultimately, the educational resources are nowhere near as extensive as competitors like Pepperstone. With this in mind, Just2Trade isn’t the best forex broker for new traders in our view.

Demo Account

We are pleased to see that Just2Trade offers a free demo account. These simulation accounts are a great way for beginners to learn more about forex trading without financial risk. They also offer traders the chance to find out if the broker suits their strategy before committing funds.

The demo account is available to simulate all three types of forex accounts using $100,000 in virtual funds.

How To Open A Demo Account

I found it easy to open a demo account at Just2Trade, although the platform is a little confusing to navigate. To get started:

- Click on the ‘Demo’ icon in the top right-hand side of the broker’s website

- Sign up with your name and email

- Create a password and enter your phone number

- When you are logged into the account click the ‘Trade’ icon in the central menu

- Click the ‘Open Demo account’ button and enter your details to access MetaTrader

Bonus Offers

Our evaluation of Just2Trade shows there are limited trading promotions for retail traders. This is common in the online trading industry, and while it may be a disappointment to some investors, we do not rank Just2Trade down for this. Our team don’t recommend traders choose a broker based on sign-up bonuses.

With that said, there is a ‘Contests’ tab in the broker’s platform which can be monitored for the opportunity to win prizes.

There is also a campaign to become a professional trader which offers a bonus of up to $2000.

Customer Service

We have been fairly impressed with the customer service provided. Support is available 24/7 which stands up well against competitors we have tested. Contact methods include live chat, telephone and email.

Importantly, during our tests, the live chat was quick and easy to use with responses in less than a minute and email responses within 24 hours.

Contact details:

- Live chat: Located in the bottom right-hand side of the broker’s website

- Email: 24_support@just2trade.online

- Phone number: +357 25030442

Company Details

Just2Trade (under Lime Trading Ltd) is a well-established forex broker based in Limassol, Cyprus.

The company now has more than 155,000 clients in over 130 countries. This is a good indication that the brand is a large, legitimate brokerage.

Also reassuring for us is the number of awards the broker has picked up, including the 10 Top FX Brokers Worldwide 2023 at the Forextop Awards and the Best Customer Service 2022 at the World Finance Awards.

Trading Hours

The opening hours at Just2Trade vary depending on the instrument you are trading. For forex, trading starts at 10:05 pm UTC on Sunday and ends at 8:55 pm UTC on Friday with a break between sessions from 9:00 pm until 9:05 pm UTC on weekdays.

We appreciate that information on upcoming holidays and market closures can be viewed on the broker’s website via the news page.

Who Is Just2Trade Best For?

In our assessment, Just2Trade is best for active forex traders looking for ultra-tight spreads with ECN pricing and fast execution speeds.

It is also a good option if you are familiar with the MetaTrader suite – both MT4 and MT5 are available with excellent integration based on our tests.

FAQ

Is Just2Trade Legit Or A Scam?

We are comfortable that Just2Trade is a legitimate forex broker. The company holds a license with a respected regulator: the CySEC. The firm also has a global client base with more than 155,000 traders.

Can I Trust Just2Trade?

Just2Trade is a trustworthy forex broker in our view. It has strong regulatory credentials, other positive user reviews, and has received a number of industry awards.

Is Just2Trade A Regulated Forex Broker?

Yes, Just2Trade is regulated by a respected governing body. The forex broker holds a license with the Cyprus Securities & Exchange Commission (CySEC).

Is Just2Trade A Good Or Bad Forex Broker?

The results from our assessment show that Just2Trade is a good forex broker. Dozens of currency pairs are available with below-average fees, high-quality order executions and access to two leading platforms – MT4 and MT5.

Our only minor complaints are the subpar education, research and copy trading application.

Is Just2Trade Good For Beginners?

Just2Trade is a reasonable forex broker for beginners, but not the best we have tested. The $100 minimum deposit is accessible, there is a free demo account and a copy trading app, however there is little in terms of education or beginner-friendly trading tools.

Does Just2Trade Offer Low Forex Trading Fees?

Just2Trade offers lower fees than most forex brokers based on our evaluation. The MT5 Global account is particularly competitive, with spreads from 0.0 and a commission up to $2, which is significantly lower than most alternatives.

Does Just2Trade Have A Forex App?

Just2Trade offers the MT4 and MT5 apps. These apps can be downloaded to iOS or Android devices. They have mobile-optimized charts, multiple order types and facilitate one-click trading.

How Long Do Withdrawals Take At Just2Trade?

Withdrawal times vary depending on the payment method. Our experience shows that once verified, the funds will be returned to your account instantly in the case of e-wallets and within 5 days if you choose bank wire. Just2Trade processes withdrawals within 24 hours of the request being made.