LiteFinance

-

💵 CurrenciesUSD, EUR

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: 0.8 EURUSD: 0.2 GBPEUR: 0.5 -

# Assets55

-

🪙 Minimum Deposit$50

-

🫴 Bonus OfferRebate on payment fees

Our Opinion On LiteFinance

LiteFinance is a trustworthy forex broker regulated by the CySEC. Our team rates the high-quality trading platforms with both MetaTrader 4 and MetaTrader 5 available. We also like the forex copy trading tool for hands-off investors and appreciate the low minimum deposit.

Looking at the downsides, our tests show that forex spreads in the Classic account are wider than many alternatives. Additionally, LiteFinance has a slim product portfolio.

Summary

- Instruments: 190+ including 55 forex pairs, stocks, indices, commodities, crypto

- Live Accounts: ECN, Classic

- Platforms & Apps: MetaTrader 4 (MT4), MetaTrader 5 (MT5), LiteFinance App

- Deposit Options: Bank cards, wire transfers, and e-wallets including Neteller and Skrill

- Demo Account: Yes

Pros & Cons

- Reputable forex broker with 1+ million traders and CySEC regulation

- Forex copy trading service with investment terms of up to 1 year

- Access to the MetaTrader 4 and MetaTrader 5 platforms

- Wide range of deposit and withdrawal options

- $50 minimum deposit with no transfer fees

- 55 major, minor and exotic currency pairs

- VPS available for stable connectivity

- Around-the-clock customer support

- Daily forex market analysis

- Islamic-friendly account

- Above-average spreads on the Classic account starting from 1.8 pips

- Weak regulatory oversight through the offshore entity

Is LiteFinance Regulated?

We are satisfied with the regulatory status of LiteFinance. LiteForex (Europe) Limited is authorized by the Cyprus Securities and Exchange Commission (CySEC), licence number 093/08. This is a respected financial regulator that helps protect retail traders from scams and unfair trading practices.

On the negative side, global traders will be registered with LiteFinance Global LLC, which is regulated offshore by the St Vincent and the Grenadines Financial Services Authority (SVGFSA). This is not well regarded in terms of investor protection and traders won’t get the same peace of mind as clients registered under the Cyprus entity.

Forex Accounts

LiteFinance offers two accounts; ECN and Classic. From our evaluation, the ECN account is better suited to experienced investors and active traders looking for tighter spreads and fast execution. The Classic account is best for beginners and casual traders looking for commission-free trading.

Importantly, both accounts offer competitive features, including market execution, access to MT4 and MT5, swap-free trading for Muslim investors, plus negative balance protection. The ECN account also offers interest of up to 2.5% on uninvested funds. Our only criticism is the fees which trail the cheapest forex brokers.

We pull out the key features of each account below.

| ECN Account | Classic Account | |

|---|---|---|

| Minimum Deposit | $50 | $50 |

| Base Currency | USD / EUR | USD / EUR |

| Floating Spread | From 0.0 | From 1.8 |

| Commission | From $10 | $0 |

| Leverage | 1:1000 | 1:1000 |

| Minimum Lot | 0.01 Lots | 0.01 Lots |

| Interest Rate | 2.5% | 0% |

How To Open An Account

I appreciated the slick sign-up process. It only took me a couple of minutes to register.

- In the application form, select your country of residence, enter your email and your password, and click ‘Register’

- Enter the verification code sent to your registered email address

- Specify which account you want to open, your preferred leverage, and your base currency, then click ‘Open Trading Account’

- Your account will now appear in your profile and you can deposit to start trading

Trading Fees

We did a thorough review of the trading fees at LiteFinance to find out how they compare to other forex brokers.

We found that commission-free trading was available in the Classic account, but with high minimum spreads from 1.8 pips on popular currency pairs like the EUR/USD. This doesn’t compete with market leaders like Pepperstone.

For the ECN account, we found raw spreads from 0.0 pips with a commission of $10 per lot on major forex pairs, $20 on forex crosses and $30 on forex minors. Again, these fees are higher than many alternatives, including AvaTrade.

Non-Trading Fees

A benefit we like about trading with LiteFinance is that they compensate any processing fees from payment providers, meaning that all deposits and withdrawals are free.

After one year of inactivity, though, there will be a fee of $10 per month, which is the only additional charge. An inactivity fee is common at forex brokers so this isn’t a major drawback for us.

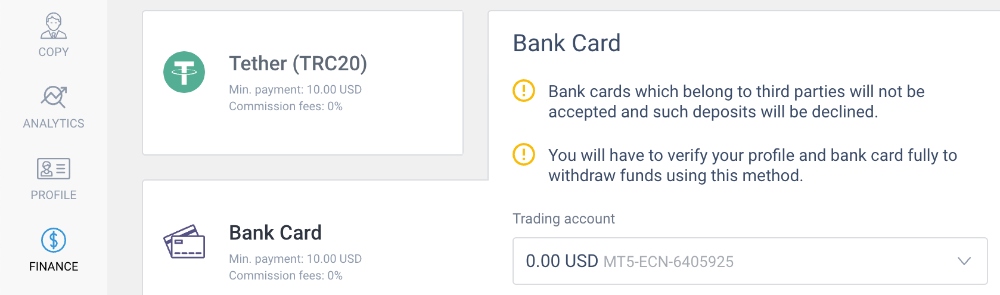

Payment Methods

LiteFinance offers a strong range of deposit options, including credit/debit cards, bank wire transfers, Bitcoin, and electronic wallets like Neteller and Skrill.

When we evaluated the account funding process, we found that average processing times are one working day, though some e-wallets are often faster.

We also found that minimum deposits vary depending on the method, with bank transfers requiring a $100 payment while most other deposit solutions support transfers from $10.

How To Make A Deposit

Of the forex brokers we have reviewed, LiteFinance has one of the easiest client portals to navigate. To fund your account:

- Log into the personal area

- Select ‘Finance’ on the left-hand side, this will bring you to a range of deposit options

- Select ‘Deposit’ and scroll until you find your desired method

- Enter your relevant details for the chosen payment method

- For confirmation, go to ‘History of Transfers’ which will show you a receipt

There is also the option of auto withdrawal which we tested. This allows you to instantly withdraw up to $5000 in funds per day using a variety of withdrawal methods such as bank wire, crypto, and e-wallets.

Forex Assets

LiteFinance offers a good range of currency pairs with 55 forex assets and a particularly impressive suite of exotics. They also offer the same selection in both the ECN and the Classic accounts, so beginners and experienced traders have access to the same opportunities.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | GBP/AUD | Yes |

| GBP/USD | Yes | USD/CAD | Yes |

| AUD/USD | Yes | USD/CHF | Yes |

| GBP/JPY | Yes | GBP/NZD | Yes |

| USD/JPY | Yes | EUR/GBP | Yes |

Non-Forex Assets

LiteFinance offers an average selection of additional instruments. You can trade 15+ major indices, 12+ metals, energies and soft commodities, 60+ cryptocurrencies, plus CFD shares from several stock exchanges, including the NASDAQ, NYSE, Euronext, and London Stock Exchange.

Overall, the selection of additional instruments is smaller than big names like Plus500, especially in terms of stocks, but it will meet the needs of most casual traders.

Leverage

LiteFinance offers leverage up to 1:1000 through its global entity. With that said, the majority of forex assets have leverage nearer the 1:200 or 1:100 level. We also found that you can scale the leverage down to 1:1 when you open an account.

The EU-regulated branch offers leverage up to 1:30 in line with regulatory requirements.

Importantly, we don’t recommend beginners trade forex with high leverage – it increases your risk of accumulating large losses quickly. Make use of tools like stop-loss orders to limit your losses.

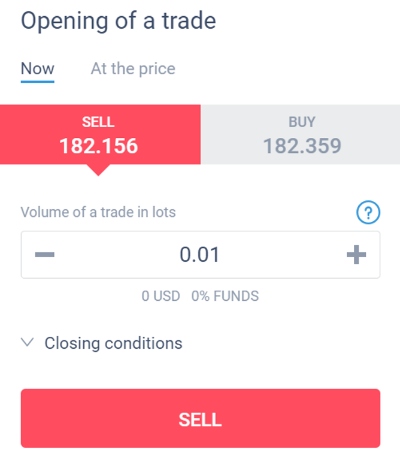

Platforms & Apps

The forex broker offers the MetaTrader 4 and MetaTrader 5 platforms, both of which can be downloaded for Windows and Mac PCs. There is also a fully functional LiteFinance App for both Android and iOS.

For me, MetaTrader 5 (MT5) stands out as the best platform for serious forex traders. It offers a wider selection of timeframes with 21 options, compared to the 9 offered on MT4. Traders using MT5 also benefit from six pending order types, including Buy Stop Limit and Sell Stop Limit, while MT4 supports only four types.

In addition, the platform’s Depth of Market (DOM) feature enables real-time access to market liquidity, which is absent in MT4. MT5 also offers more built-in indicators and analytical objects, and provides compatibility for various markets.

Overall, though, both are incredibly reliable platforms and user-friendly. In my opinion, the MetaTrader platforms are among the best for beginners and experienced traders.

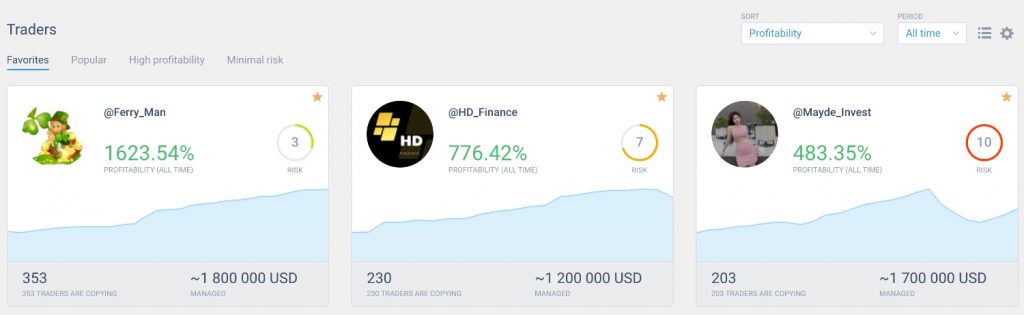

Forex Tools

The forex tools available at LiteFinance are decent. What really stands out for us is the forex copy trading. You can essentially follow the trades of more experienced investors. A copy trading leaderboard is available to help you find the highest-performing traders and you can choose the investment term up to a maximum of one year.

On the downside, it trails best-in-class brokers like eToro, which offers more master traders and a more user-friendly platform.

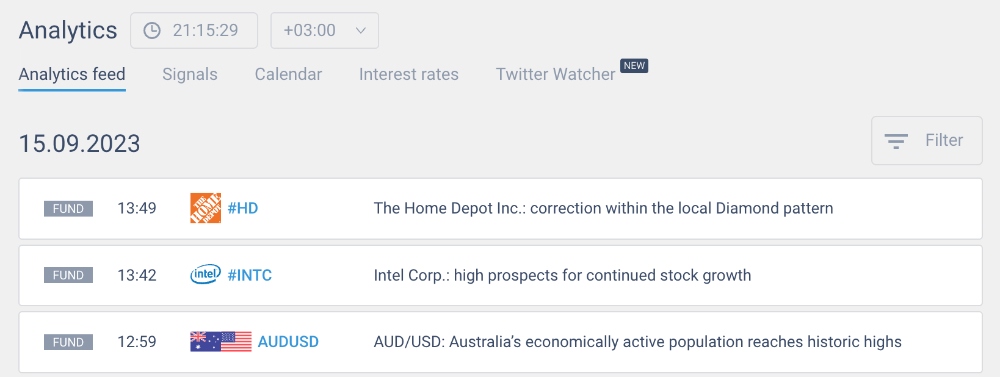

Forex Research

LiteFinance scores reasonably well in terms of its forex research, though not as well as alternatives like CMC Markets.

You can track currency rates using the broker’s online quote charts, showing open and close prices, plus market sentiment on all forex pairs. We also find their daily forex news and analysis useful for keeping track of market conditions.

Forex Education

Compared to other forex brokers we review, the educational resources offered by LiteFinance are competitive, accessible and cover a lot of ground.

Traders can access a wide selection of expert-led forex webinars, discussing a range of topics including the basics, strategies, money management and more. We are also pleased to see that this section is updated regularly.

There is also a forex glossary so that beginners can learn key terms, plus forex books, strategy documents, and an extensive FAQ portal.

Demo Account

LiteFinance offers a free demo account through its web portal which I find very easy to navigate. I particularly like that there is no formal registration required, making it straightforward to get started, learn how the platforms work and test forex strategies.

How To Open A Demo Account

- Open the official website and select ‘Registration’ in the upper right corner

- Enter your information including your email address or phone number and create a password

- Activate the demo trading mode in the right-hand side corner of the dashboard

- Begin trading using virtual funds

Bonus Offers

LiteFinance offers a Trade Smart promotion where traders can get up to 50% of their deposit in bonus credit.

However, we found that the withdrawal conditions are hard to meet. We needed to meet a trading volume of at least 2% of our initial deposit within 30 days, but the floating loss could not exceed 20% of the account’s balance. The maximum loss also cannot exceed 79% of the total investment, and the margin cannot exceed 30% of equity.

On a lighter note, we were intrigued by the Best of the Best demo competition, which could appeal to new investors looking to test their skills.

The tournament gives users the chance to trade forex with virtual funds and win real prize money up to $4000. The prize money goes to the five participants whose trading is the most profitable. We haven’t found many forex brokers that offer competitions like this, so we think this is a nice addition.

Trading Restrictions

I am happy to find that there are no trading restrictions at LiteFinance. Most trading strategies are supported, from algo trading with Expert Advisors (EAs) to scalping and hedging.

Customer Service

Customer support is in line with the 24/5 nature of the forex market, available from midnight on Monday until 11:59 pm on Friday (GMT+2).

Support is offered via live chat which I found very useful during testing – agents gave fast and accurate responses during operating hours.

They also have the following avenues for customer support:

- Email: clients@litefinance.com

- Skype: liteforex.support

- Telegram: LiteFinanceSupport

We found that Telegram and Skype are also fast in terms of responses, while our email queries were answered within one working day.

Company Details

LiteFinance is a forex and CFD broker founded in 2005. Originally known as LiteForex and rebranding to LiteFinance in 2021, the company has undergone continuous expansion since its inception. This includes in 2022 when the brokerage opened up eight new offices including in Singapore, Uganda, Morocco and Egypt.

The company has received many international awards and has matched competitors in several areas with awards for ‘Best ECN Broker’ and ‘Best Retail Forex Broker’. These are good signs for us that LiteFinance is a reliable, high-quality forex broker.

Trading Hours

Trading hours vary depending on the instrument you are trading with forex available from 00:00 on Monday to 23:59 on Friday. European stocks are available from 10:05 on Monday to 18:30 on Friday, while US stocks can be traded from 16:35 on Monday to 23:00 on Friday. Cryptos are available 24/7.

The above trading times are in GMT+2.

Who Is LiteFinance Best For?

LiteFinance will appeal to global investors looking to trade forex with high leverage up to 1:500. It will also serve traders looking for raw spreads with its ECN account and those familiar with the MT4 and MT5 platforms.

Finally, the social trading service will serve beginners and hands-off investors who want to trust their funds to more experienced traders.

FAQ

Is LiteFinance Legit Or A Scam?

LiteFinance is a legitimate forex broker. They have been operating since 2005, have garnered a good reputation in the industry and have received multiple awards.

Can I Trust LiteFinance?

We trust LiteFinance. They are overseen by a reputable regulator and have a global presence with over a million accounts opened. Our experts also don’t have any concerns about scams following their review.

Is LiteFinance A Regulated Forex Broker?

Yes, LiteForex Europe Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) while LiteFinance Global LLC is regulated by the St Vincent and the Grenadines Financial Services Authority (SVGFSA).

On the negative side, the SVGFSA is not a well-regarded regulator so traders who sign up with the offshore entity won’t get the same level of legal protection as EU traders who open an account with the CySEC-regulated branch.

Is LiteFinance A Good Or Bad Forex Broker?

Overall, LiteFinance is a decent forex broker for the majority of traders. It offers access to two of the best trading platforms – MT4 and MT5, the minimum deposit is low at $50, and there are various useful extras, from copy trading to daily forex analysis.

Our only major complaints are the relatively wide spreads on the Classic account and high commissions on the ECN solution, plus the weak regulatory oversight through its offshore entity.

Is LiteFinance Good For Beginners?

LiteFinance is good for beginners with a $50 minimum deposit, forex copy trading, and spread-only pricing on the Classic account. The demo account is also quick and easy to get started with and the firm offers good educational materials.

Does LiteFinance Offer Low Forex Trading Fees?

LiteFinance does not offer the lowest forex trading fees. Based on our evaluation, spreads on the Classic account start from 1.8 pips on major currency pairs, which is higher than many alternatives. The commission on the ECN account, which starts at $10 on major currency pairs, is also higher than the cheapest forex brokers.

Does LiteFinance Have A Forex App?

Yes, LiteFinance offers a forex app that allows traders to access their accounts and trade on the go. The mobile app is available for both Android and iOS devices, offering a user-friendly interface and useful trading features. You can execute trades, make deposits and withdrawals, and access real-time market data and analysis.

How Long Do Withdrawals Take At LiteFinance?

Withdrawal processing times vary depending on the payment method. In our experience, withdrawals made through electronic payment methods are processed faster, usually within 1 to 3 business days. However, bank wire transfers can take up to 5 business days or more.

Can You Make Money Trading Forex With LiteFinance?

LiteFinance offers excellent trading software, market execution and high leverage. However, making money requires a sound understanding of the financial markets, strong risk management skills, and an effective trading strategy.