OANDA US

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD

-

🛠 PlatformsMT4, TradingView, AutoChartist

-

⇔ Spread

GBPUSD: 3.4 EURUSD: 1.6 GBPEUR: 1.7 -

# Assets65+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Our Opinion On OANDA US

OANDA is a US-regulated forex broker with an excellent reputation. We highly rate the web platform which comes with sophisticated charting tools and a user-friendly interface. Our team also appreciate the wide range of 68 currency pairs – more than most forex brokers we test. In addition, the forex broker stands out for its Elite Trader Scheme, which offers up to a 34% discount on trading fees.

On the negative side, we would like to see OANDA offer weekend customer support. We also find the range of investments narrow, with forex and crypto only.

OANDA Corporation is regulated by the CFTC/NFA. OANDA is a member Firm of the NFA (Member ID: 0325821). CFDs are not available to residents in the United States.

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

Pros & Cons

- Top-rated forex broker with 20+ years in the trading industry

- Authorized by tier-one regulators including the NFA and CFTC

- Catalog of forex trading tools including a VPS, MultiCharts and MotiveWave

- MetaTrader 4 premium upgrade with 28 extra tools and indicators

- Real-time rates on major forex pairs and 25 years of historical exchange rate data

- Discounts for high-volume traders through the Elite Trader Scheme

- Beginner-friendly web platform with modern design

- No minimum deposit reduces entry barrier

- 1:50 leverage on major forex pairs

- Negative balance protection is not available to US traders

- Withdrawal charges for cards and wire transfers

- No customer support on the weekend

- Education trails some alternatives

- No Islamic-friendly account

Summary

- Instruments: 68 forex pairs, 8 cryptos

- Live Accounts: Standard, Elite Trader

- Platform & Apps: OANDA Trade, MT4, TradingView, App

- Deposit Options: Credit/debit card, bank transfer, ACH transfer

- Demo Account: Yes

Is OANDA US Regulated?

Our experts are pleased with the top-tier regulatory oversight covering OANDA Corporation. The firm is registered with the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), license number 0325821.

As well as adding a layer of credibility and trust, the strong regulatory credentials means several safeguards are in place, including customer funds held segregated from company money in custodian banks.

Our team are also reassured that no scams or security concerns came up during our research.

Forex Accounts

OANDA US offers two accounts: Standard and Elite Trader. The Standard account is the best option for the majority of retail traders, with no minimum deposit, access to all instruments and trading platforms, plus straightforward spread-only pricing.

One of our favorite features is the multi-currency sub-accounts. You can register for a live account with a US Dollar base, and link sub-profiles with a choice of 19 alternative currencies. This can help save on currency conversion fees and segregate your trades.

Alternatively, the Elite Trader program will serve high-volume investors who get discounts on trading fees, access to VIP events and a dedicated account manager. The upgraded package on the TradingView platform is a particularly good perk for technical analysis.

On the negative side, we are disappointed to find there is no Islamic-friendly swap-free account.

How To Open A Live Account

I found OANDA’s registration process quite lengthy, though most of the steps are needed to satisfy regulatory requirements. To get started:

- Open the sign-up form

- Select the US from the dropdown menu and click ‘Confirm and continue’

- Complete your details on the following page (name, date of birth, and mobile number)

- Confirm your citizenship and add your SSN/TIN

- Input your address and confirm the length of residence

- Complete your current employment status and trading experience

- Upload your identity and proof of residency documents to confirm your application

Trading Fees

OANDA’s pricing model is competitive. The brand offers two fee structures, but most retail traders will be limited to the spread-only solution since the Elite Trader program requires a monthly trading volume of $10 million.

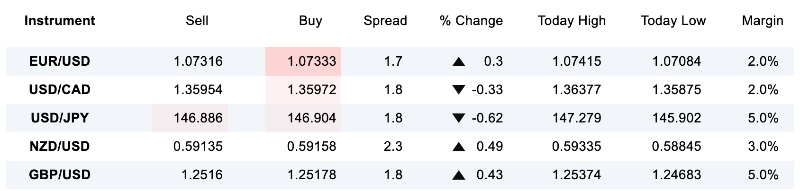

Spread Only

We are satisfied with the pricing on the spread-only account, which we think is around the average offered by leading forex brokers with similar accounts.

During testing, we got live FX spreads of 1.4 pips on the EUR/USD and USD/JPY, with no commission payable. Less popular pairs are also reasonable, with the ZAR/JPY and CAD/CHF coming in at 2.1 pips and 2.4 pips, respectively.

OANDA Corporation also offers low fees on spot crypto trading. Through a partnership with Paxos, competitive commission rates of 0.25% are available on popular digital currencies like Bitcoin.

Elite Trader

The Elite Trader scheme offers excellent savings of up to 34% on trading fees. This makes OANDA Corporation a great option for high-volume forex traders.

There are five tiers that are staggered based on your monthly trading volume:

| Tier 1 | Tier 2 | Tier 3 | Tier 4 | Tier 5 | |

|---|---|---|---|---|---|

| Monthly Trading Volume | $10M – $49M | $50M – $249M | $250M – $499M | $500M – $1B | $1B+ |

| Rebate Per Million | $5 | $7 | $10 | $15 | $17 |

| Average Savings | 10% | 14% | 20% | 30% | 34% |

Non-Trading Fees

OANDA is a mixed bag when it comes to non-trading fees. A $10 monthly inactivity fee applies after 12 months of account dormancy, though three months of charges will be returned if you resume trading.

We rate that Autochartist, CQG, and TradingView are available to OANDA customers for free. However, we are less impressed with the charges required to use MultiCharts, MotiveWave, or a VPS. While many brokers offer clients free VPS hosting, a $30 monthly subscription is charged at OANDA US.

Payment Methods

OANDA stands out for its $0 minimum investment and fee-free deposits, which makes it accessible to new traders.

However, the forex broker offers a fairly narrow range of deposit options, with credit/debit cards, wire transfers, or ACH transfers. There is no support for e-wallets like PayPal.

Similar to other brokers, credit/debit cards offer the fastest account funding times, while ACH and wire transfers can take up to five working days to clear.

There is a $20 charge for the first bank transfer each calendar month, ($15 fee plus banking charges). Cards are slightly better, with no fee for the first withdrawal per month.

How To Make A Deposit

I find it quick and easy to add funds to my OANDA account:

- Log in to the OANDA US client portal

- Select ‘Manage Funds’ and then ‘Deposit’

- Choose the trading account to add money to from the dropdown menu

- Click on a payment method to use

- Follow the instructions displayed on the screen to confirm the deposit

Forex Assets

A highlight of trading with OANDA for me is the excellent suite of forex assets. There are 68 currency pairs including majors, minors, and exotics. I am pleased with the selection of USD pairs in particular, which will appeal to new and experienced forex traders in the US.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

OANDA falls short when it comes to additional trading opportunities – just eight cryptocurrencies are available. This means the broker isn’t a good option if you also want to trade popular asset classes like stocks and commodities.

You can speculate on Bitcoin, Bitcoin Cash, Ethereum, Litecoin, PAX Gold, Chainlink, Uniswap, and AAVE. You can spot trade all the cryptos on the firm’s mobile app in partnership with Paxos.

Execution

OANDA Corporation is a market maker. This type of broker creates market liquidity by taking the other side of its clients’ trades and typically adds a small markup to the buy and sell price of assets.

While the lack of an STP/ECN model might deter some active day traders looking for the tightest spreads, OANDA’s execution model works well with a focus on platform reliability and speed. The average order execution speed is 12ms – anything below 100ms is fast in our view.

Leverage

US clients can access leverage in line with the rules set out by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC).

You can trade major forex pairs with a maximum leverage of 1:50 and up to 1:20 for minor and exotics. This includes 1:50 on the EUR/USD and USD/CAD. These levels align with other US-regulated brokers.

Platforms & Apps

The selection of high-quality trading platforms and apps is a key bonus of signing up with OANDA US. You can choose from a proprietary platform and popular third-party solutions MetaTrader 4 (MT4) and TradingView. The broker’s app is also excellent for on-the-go trading.

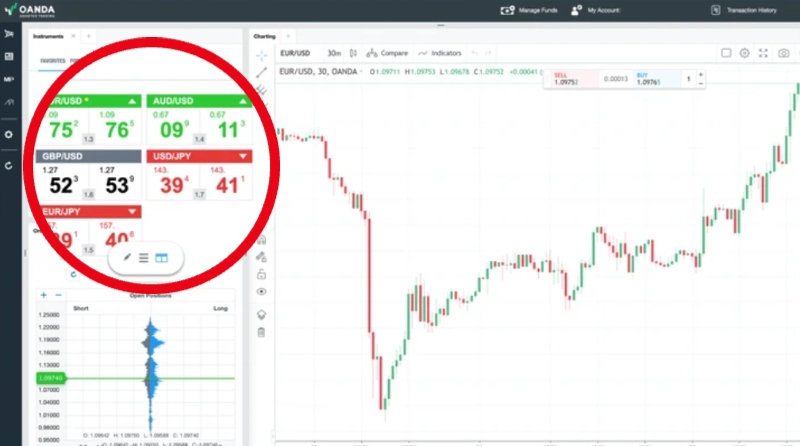

OANDA Web

I like the clear navigation and customizable interface in OANDA’s in-house platform. The layout doesn’t feel too crowded, making it suitable for beginners.

At the same time, the platform caters well to more experienced traders with its range of analysis tools and features. Highlights for me are the position ratios and news aggregator that comes with a useful search function.

Importantly, the web-based solution is stable – I didn’t experience any connection glitches during testing.

How To Open A Forex Trade

I find it quick and easy to open new positions on the brand’s platform thanks to its intuitive layout:

- Choose a forex asset to trade from the left window of the platform interface

- Click the ‘Buy’ or ‘Sell’ price in the new order screen

- Input the number of units to trade or use the arrow toggle

- Confirm risk management parameters and add the price triggers

- Review the order details and click ‘Submit’ to place the order

OANDA App

The OANDA mobile app offers seamless integration between desktop and mobile devices. And while many forex apps we test offer limited functionality compared to their desktop counterparts, the OANDA application still offers powerful trading tools.

Highlights for me are the customizable trading alerts and the ability to adjust your workspace and default parameters. I can manage my trades and risk settings, view my account profitability and make deposits through Android- and iOS-compatible mobile apps.

MetaTrader 4

I am also happy with OANDA’s inclusion of MetaTrader 4.

Though I don’t think this terminal is as slick as the in-house platform, it is a long-running industry leader for good reason and I rate the charting, indicators and overall customization capabilities of this platform.

One of my favorite functions is the Expert Advisors (EAs) for automated forex trading. These can help find opportunities based on pre-defined parameters and open and close positions automatically. They also work well with a VPS.

OANDA also stands out by offering a MetaTrader 4 premium upgrade with 28 additional powerful forex indicators. This is a great perk for serious forex traders.

TradingView

TradingView is another good option. It boasts an impressive suite of analysis tools, including 100+ in-built indicators, 12+ graph styles and 50+ drawing tools. You can also synchronize as many as 8 charts in one layout.

However, the best feature of TradingView for me is access to the social trading community with 50+ million members. This makes it a great place for sourcing trading ideas, as well as additional indicators and trading tools.

Forex Tools

OANDA offers an excellent catalog of extra forex tools, which will appeal to experienced traders in particular.

There is VPS hosting and advanced charting software. The only notable absence is a copy trading service, which is offered by some alternatives, such as eToro.

I have pulled out several of the best tools:

- VPS – provides 24/7 forex VPS hosting via Liquidity Connect and BeeksFX. This is a great option that works well with MT4’s expert advisors.

- MotiveWave – an advanced strategy backtesting and charting system that will serve seasoned traders. I can access depth of market data, 250+ built-in indicators, and strategy optimization and reporting functions such as replay mode.

- CQG FX – provides access to charting, analytics, and order execution tools. This is best for skilled investors, though I do rate the easy-to-use bot-builder.

Forex Education

While OANDA offers some basic educational content, overall I feel the broker is lacking in this area. The content is less detailed and user-friendly than the resources offered by forex brokers like IG Group.

Moreover, I get frustrated by the lack of filters as this makes it challenging to navigate to the right topic, and I think this could be off-putting to rookie traders looking for quick and easy access to learning materials.

Demo Account

We are glad to see that OANDA offers a demo account available to prospective clients, and especially happy to find live market pricing with no time limits on the account.

This allows users to practice forex trading and learn the functions of the platforms before risking real funds.

How To Open A Demo Account

I didn’t run into any issues opening a demo account – it only took me a couple of minutes. On the registration page:

- Select the US from the list of countries

- Add your email address and create a password

- Input your name and mobile number and select ‘Confirm and continue’

- Review and accept the T&Cs and choose ‘Open demo account’

- Confirm registration by verifying the link sent to your registered email address

Bonus Offers

Due to regulatory restrictions, I was not offered any welcome bonuses when I signed up for an OANDA US account.

This isn’t an issue for me – most US-regulated brokers are restricted from offering trading promotions. Also, OANDA Corporation offers a selection of useful perks through the Elite Trader program.

Trading Restrictions

I did not come across any forex trading restrictions whilst using OANDA, with hedging, scalping and news trading strategies permitted.

Customer Service

I think OANDA’s customer support is reliable. I can contact the brand via live chat, telephone number, and email, and I received swift and helpful responses to my test queries.

However, while I find the live chat most useful, I do think the initial chatbot navigation is frustrating before you get transferred to an agent. I would also like to see technical support available over the weekend to match rivals like NinjaTrader.

To get in contact with OANDA in the US:

- Live chat on the website

- Email frontdesk@oanda.com

- Call the telephone number 212-252-2129

Company Details

Founded in 1996 in Delaware, the OANDA Group has a long history in the financial services industry and was the first company to publish stock exchange information on the internet.

The brand is renowned for its foreign exchange data via its API and Historical Currency Converter. The company was acquired in 2018 by CVC Capital Partners.

OANDA has multiple global offices, including in New York and Toronto in North America.

Trading Hours

The forex market is available to trade Sunday to Friday from 17:03 to 16:58 (New York time) while crypto including Bitcoin (BTC) trading is available 24/7.

We found that maintenance closures and upcoming holiday trading times are regularly published on the ‘Trading’ section of the broker’s website.

Who Is OANDA US Best For?

OANDA is an excellent option for high-volume forex traders. The Elite Trader Scheme is one of the best loyalty programs we have seen, with cash rebates, priority support and a range of perks.

The user-friendly web platform and mobile app, $0 minimum deposit and unlimited demo account also mean OANDA US is a good forex broker for beginners.

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

FAQ

Is OANDA US Legit Or A Scam?

OANDA is a legitimate forex broker. The US entity is licensed with the CTFC and NFA with safeguards in place including segregated client funds.

Can I Trust OANDA US?

OANDA is a trustworthy forex broker, with more than 20 years in the business and oversight from top regulators. We did not come across any reported scams and the brand has picked up a string of industry awards.

Is OANDA US A Regulated Forex Broker?

Yes, OANDA Corporation is registered as a Futures Commission Merchant and Retail Foreign Exchange Dealer with the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA).

Does OANDA US Offer Low Forex Trading Fees?

While not the lowest we have seen, OANDA’s trading fees are competitive. We were offered average spreads from 1.4 pips on the Standard account, with no commission charges.

The Elite Trader program is also a great way to lower your costs if you trade forex in high volumes. You can save up to 34% with cash rebates.

Is OANDA US A Good Forex Broker For Beginners?

OANDA is a great forex broker for beginners with no minimum deposit and unlimited demo account access. The OANDA Trade platform is also well-designed with a clean interface and easy-to-learn features.

Does OANDA US Have A Forex App?

Yes, OANDA’s proprietary platform has iOS and Android mobile compatibility with all the desktop solution’s features available.

Alternatively, MetaTrader 4 and TradingView apps can be downloaded to mobile devices.

How Long Do Withdrawals Take At OANDA US?

Withdrawal times from an OANDA account vary depending on the payment method, with the fastest, card payments, taking up to three days to process.

While not the quickest withdrawal times we see at forex brokers, they are in line with most competitors.

Can You Make Money Trading Forex With OANDA US?

Skilled forex investors may be able to make a profit at OANDA thanks to its powerful trading tools, competitive pricing, and variety of currency pairs.

However, many traders will lose money so an effective risk management strategy and sensible approach to money management are a must.