Skilling

-

💵 CurrenciesUSD, EUR, GBP, SEK, NOK

-

🛠 PlatformsMT4, cTrader, TradingView, AutoChartist

-

⇔ Spread

GBPUSD: 0.1 EURUSD: 0.1 GBPEUR: 0.1 -

# Assets70+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

Our Opinion On Skilling

Skilling is a trustworthy forex broker with no strategy restrictions, four excellent platforms, tight spreads from 0.1 pips and copy trading. We also rate the fast execution speeds and regulatory oversight from the CySEC. The broker does have a few weak points – notably the lack of market research and education – but overall we consider it a great option for aspiring forex traders.

Summary

- Instruments – 1000+ including 70+ forex pairs, stocks, indices, commodities, and cryptocurrencies

- Live Accounts – Standard, Premium, MT4, MT4 Premium

- Platform & Apps – Skilling Trader, MetaTrader 4, cTrader

- Deposit Options – Bank cards, wire transfers, and e-wallets including PayPal

- Demo Account – Yes

Pros & Cons

- 24/5 customer support via email, live chat and telephone with fast response times

- Regulated by CySEC with additional insurance up to €1 million for EEA customers

- Demo account available for all trading platforms with $10,000 in virtual funds

- Excellent range of 70+ currency pairs with majors, minors and exotics

- Easy-to-use proprietary platform with Trade Assistant for beginners

- User-friendly copy trading with 800+ strategies available

- Low forex trading fees with spreads from 0.1 pips

- Commission-free stock trading

- Fast execution speeds of 5ms

- Narrower range of instruments on MetaTrader 4 accounts

- Weak research and education compared to alternatives

- Limited regulatory oversight for non-EEA traders

- Withdrawal fees apply for bank wire transfers

- Not available in the US

Is Skilling Regulated?

Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 357/18. This is a strong enough body to ensure that the broker is a secure and reliable destination for forex traders.

EEA clients will be registered under this reputable financial watchdog, with guarantees of negative balance protection and segregated client funds. Our experts are also reassured by the additional client money insurance up to €1 million, above the standard Investor Compensation Fund (ICF) threshold.

Global clients (outside of the EEA) will be registered under the alternative subsidiary, authorized by the Seychelles Financial Services Authority (FSA), license number SD042. Although our experts don’t consider this as reputable as CySEC, traders can still access the same safeguarding initiatives except for the compensation and additional insurance scheme.

Our team is also pleased to find no reports of scams or security breaches, which adds credibility to the forex broker.

Forex Accounts

Skilling offers two live account types, with Standard or Premium solutions on both the broker’s proprietary software and MetaTrader 4.

As is typical among online brokers, the main difference between the accounts is the pricing with the commission-free Standard account charging wider spreads. We appreciate that pricing is competitive on each account type, though we recommend the Premium solution for active forex traders who can afford the $5000 minimum deposit.

Importantly, the minimum deposit on the Standard account is accessible for beginners at $100 – we consider anything below $500 low. With that said, some popular alternatives like XTB and XM offer even lower starting deposits at $0 and $5, respectively.

One criticism we do have after testing Skilling is that the MetaTrader accounts offer narrower market access. There are 20 fewer forex pairs and 680 fewer shares vs the proprietary platform. As such, we don’t recommend Skilling if you want to trade stock CFDs on MetaTrader 4.

Our team have pulled out the key differences between the Standard and Premium accounts below.

Standard

Best for beginners

- Commission-free

- Spreads from 0.7 pips

- $100 minimum deposit

Premium

Best for active and experienced traders

- Spreads from 0.1 pips

- $5000 minimum deposit

- $35 commission per million volume traded

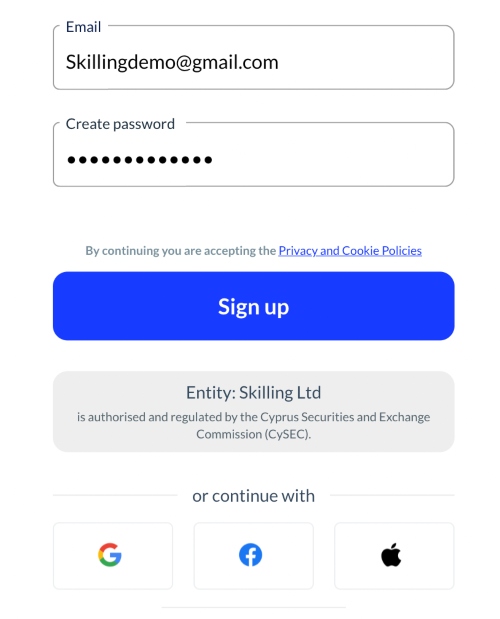

How To Open An Account

I thought the registration process at Skilling was fairly straightforward, but it does take longer than the alternatives we have evaluated. It can take up to half an hour to declare your previous investment experience and provide all the requested details.

To get started:

- Add your email address to the online registration form and create a password

- Select ‘Sign Up’

- Choose your country of residence from the dropdown menu and click ‘Complete Registration’

- Add your name on the following screen

- Complete your date of birth on the following screen

- Add your telephone number on the next screen

- Complete your country of tax residency, country of birth, and nationality and choose ‘Continue’

- Add your address on the following screen

- Complete your financial background details including employment status and source of trading funds

- Add trading experience details including education and investment knowledge

- Review the client agreement and upload identity documentation (you can skip this part and upload at a later date)

Trading Fees

Skilling trading fees vary by account type, but are competitive vs alternatives.

We recommend the Standard/MT4 Standard for beginners, with no commission fees and floating spreads from 0.7 pips. When we used Skilling, we received tight spreads below one pip on the EUR/USD and GBP/USD.

Our team finds that the Premium/MT4 Premium account is better for experienced traders, particularly day traders. Spreads are much tighter vs the Standard profiles from 0.1 pips, though a $35 commission fee applies per million in volume traded. In our test, we got a 0.3 pip spread on EUR/USD and 0.5 pips on EUR/GBP, which is reasonable albeit slightly higher than some ECN forex brokers.

Non-Trading Fees

As is standard, Skilling charges swap fees if you hold positions overnight. Our team also finds a 0.7% currency conversion fee will apply to instruments denominated in an alternative currency to your account base, which is fairly expensive.

On a lighter note, we are pleased to see Skilling does not have an inactivity fee, which is an advantage over the many providers that impose an average $10–$15 monthly charge on dormant accounts.

The broker’s cCopy terminal is free to use, though strategy providers will set their own charges, which will include a performance fee, management fee, and cost per volume traded. We did not find a minimum investment amount required to get started however, which is a bonus.

Overall, Skilling isn’t the cheapest forex broker around, but fees are in line with many competitors and there are no hidden charges.

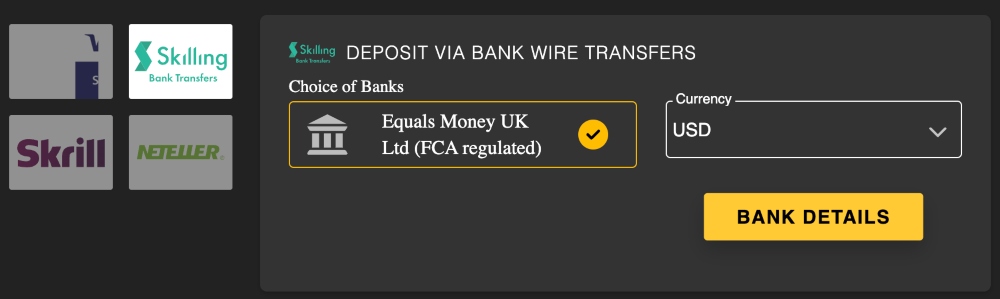

Payment Methods

Skilling is accessible to global traders thanks to its wide range of accepted payment methods with instant processing times and fee-free account funding. With that said, we recommend avoiding Skrill and Neteller as these incur fees of up to 2.9%.

The choice of account currencies, which include USD, EUR, GBP, SEK and NOK, will also to appeal to traders from the respective countries, making it easier to fund and manage online forex trading.

Accepted deposit solutions include:

- Skrill

- Neteller

- Klarna

- Trustly

- PayPal

- Bank wire transfer

- Apple Pay/Google Pay

- Visa/MasterCard credit and debit cards

Withdrawal times at Skilling are fast. The broker processes all withdrawal requests Monday to Friday up to 3 PM (UTC), with expected fund clearance within one day – a real advantage of this broker, given that many competitors require three or more working days to process withdrawals.

Again, we note that Skrill and Neteller withdrawals are liable for up to a 2.9% charge. We are also disappointed to see that bank wire transfers have a €25 charge for SWIFT transactions and €15 for SEPA.

Our experts reviewed the terms and conditions and found that a 2.5% fee applies for subsequent withdrawal requests after the first withdrawal per day. We don’t consider this a major drawback, but it is worth being aware of in case you plan to make multiple withdrawals in quick succession.

How To Make A Deposit

You will need to complete the account verification requirements before making a payment to your live trading account. Once this was done, I was able to make a deposit quickly and easily in a few steps:

- Login to the Skilling.com client dashboard

- Click on ‘Deposit’ from the menu on the left

- Select a payment method on the screen and choose ‘Continue’

- Complete the relevant payment details on the screen and click ‘Continue’

- Email validation will be sent confirming the payment

Forex Assets

You can trade 70+ forex CFDs including majors, minors, and crosses with Skilling. This is a decent selection and places the brand high in the top half of the brokers we have reviewed in this respect, in line with FxPro (70+) and higher than AvaTrade (60+).

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

The non-forex asset list is competitive, with indices, commodities, stocks, and cryptocurrency (global entity only) available to create a diverse portfolio. These can all be traded via contracts for difference (CFDs).

There are no bonds, futures, or options trading opportunities, which is a shame, though we do think the 1000+ tradeable assets offer more variety than most competitors.

The suite of stocks and indices is particularly strong, providing exposure to major economies and sectors in the US, UK, Europe, Australia, and Asia.

Supported instruments include:

- 16 global indices including S&P 500, FTSE 100, and Dow Jones 30

- 50+ digital currencies including Bitcoin, Ethereum and Litecoin

- 6 soft and hard commodities such as gold, silver, natural gas, and Brent crude oil

- 700+ company stocks such as Google, Apple, Amazon, Facebook, and Tesla

Execution

Skilling offers straight-through processing (STP) or electronic communication network (ECN) order execution, depending on the account type you register for.

This offers several benefits to forex traders, including deeper liquidity and tighter spreads, while avoiding the potential conflict of interest posed when you trade with market maker brokers like AvaTrade.

Execution speeds are also extremely quick, with orders completed in as little as 5ms. We consider anything below 100ms fast, so this broker will serve active traders well, particularly those deploying ultra-short-term strategies like forex scalping.

Leverage

Skilling uses a dynamic leverage model for forex trading. We found the higher the volume being traded, the reduced leverage ratios available. Although this may be disappointing for some traders, it can help protect against significant losses.

The maximum leverage available via the offshore branch on some major forex pairs is very high at 1:1000 with a margin requirement of 0.10%.

Commodities, indices, and shares also follow the same dynamic leverage model so bear this in mind if you are planning on trading significant volumes. The maximum leverage for these asset classes is not as substantial as forex trading, with a maximum 1:200 level for commodities, and 1:10 for company stocks.

Traders who sign up with Skilling’s EEA-regulated branch will be limited to a maximum of 1:30 leverage on major forex pairs in accordance with local regulations. This is the same at most EU-regulated brokers and is designed to prevent retail traders from accumulating substantial losses when trading on margin.

All account types have a 50% stop-out level.

Platforms & Apps

Skilling offers a choice of three trading platforms, and we appreciate the flexibility this offers. It is also an advantage over the many brokers that support just one or two platforms with no beginner-friendly, in-house software available.

You can trade on cTrader, MetaTrader 4, or the brand’s proprietary Skilling Trader.

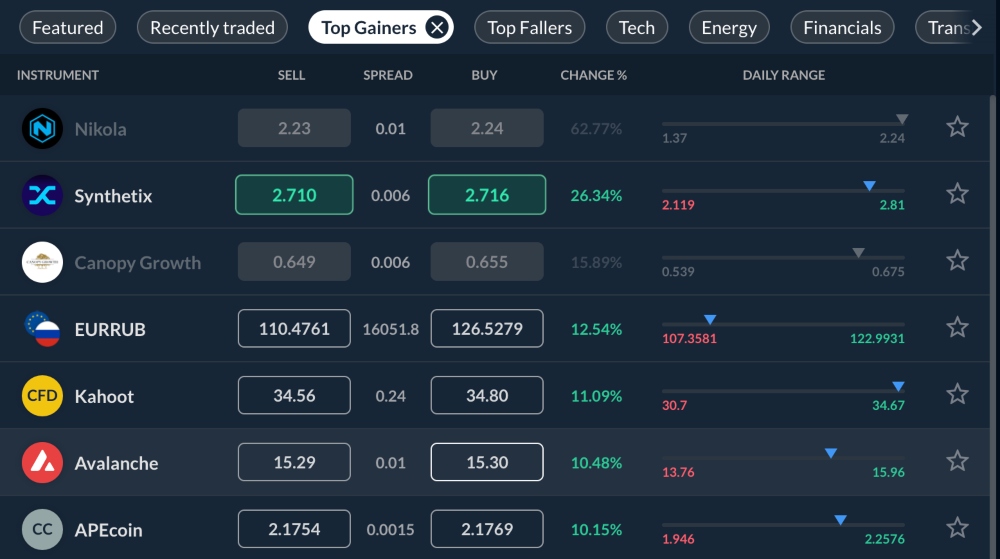

Skilling Trader

This is the broker’s default platform, offering access to all instruments in a user-friendly terminal. You can download the platform or use it as a web trader or mobile app.

We really like the feel of the proprietary platform, with all the advanced functions offered by the third-party options, but in a simple and intuitive format. A key bonus for us is the ability to integrate the platform with your Skilling account, creating a seamless view in a single dashboard.

When compared to MT4, you also have access to more technical indicators (90+) including volume oscillator, stochastic RSI, and MACD and chart types (11). You can view charts across 10 timeframes, and access 12 drawing tools and 19 analysis tools such as Gann square and Fib retracement.

Our favorite feature is the ‘Explore Markets’ function, in which you can filter instruments by several different factors such as top gainers, recently traded, and most volatile. This can help identify potential opportunities.

All in all, we consider this platform to be an excellent vehicle for speculating on popular financial markets that stands up well to its established rivals.

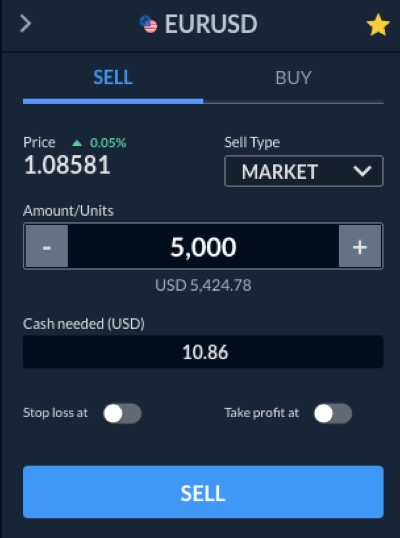

How To Place A Forex Trade On Skilling Trader

You can take a position on popular forex pairs in a few straightforward steps:

- Use the market watch window on the left side to choose an asset. Alternatively, consider using the ‘Explore Markets’ function for trade ideas

- Select ‘Buy’ or ‘Sell’ next to the instrument name to open the ‘New Order’ screen

- Choose the order type from the dropdown menu (market or order)

- Use the ‘+’ and ‘-‘ toggles to amend the volume

- Use the ‘Stop Loss At’ or ‘Take Profit At’ sliders to add risk parameters and set the cut-off price

- Select ‘Buy’ or ‘Sell’ to complete the transaction

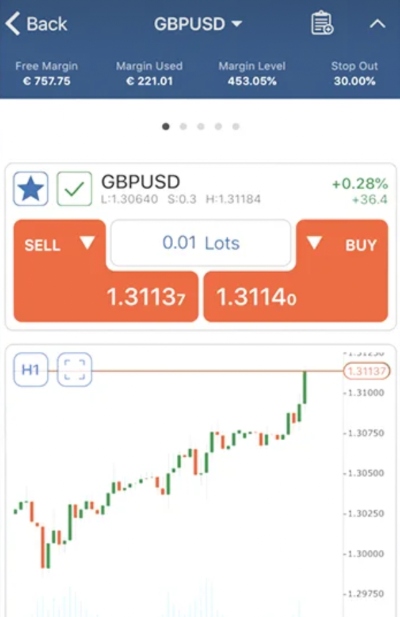

cTrader

Developed by Spotware, cTrader is an advanced, third-party trading solution. It can be used by Skilling customers via desktop download, as a web trader or through a mobile app. You can also integrate the terminal with the broker’s proprietary platform.

cTrader proves access to advanced charting tools, multiple order types, level 2 pricing and more. Upon testing, we feel the terminal is more complex than the broker’s proprietary software, and this might put off some newer traders.

However, those who persist and who have coding knowledge will be able to use the powerful Automate Editor, designed for algorithmic trading strategies with C# and .net framework.

MetaTrader 4

You also have the option to trade on MetaTrader 4 (MT4), a market-leading third-party platform with advanced functionality. We find the browser, desktop, and mobile-based platforms very versatile and fully customizable with different interface views and access to Expert Advisor (EA) trading robots.

You can create custom indicators, scripts, and strategies without any prior coding experience, which we think is one of the key advantages of the platform and a big reason for its popularity among algorithmic traders.

Other useful features include three chart types, nine timeframe views, 30+ in-built technical indicators, and single-thread strategy backtesting.

However, a major downside we found with choosing MT4 is the reduced access to the list of instruments – you are only permitted to trade 200+ products vs the full lineup of 1000+ on the broker’s own software. If you do plan to trade on MT4, this is an important consideration.

Forex Tools

Skilling offers an average selection of extra tools. The brand provides copy trading and managed accounts for a hands-off approach to trading forex. The insights into top gainers, top fallers and specific sectors are also useful.

However, it is disappointing that there is no Virtual Private Server (VPS) hosting for 24/7 platform connectivity. Skilling also doesn’t offer an economic calendar with details of release dates and financial events that may cause price fluctuations. This is disappointing since many competitors such as eToro offer these calendars.

The range of tools cements our view of Skilling as an especially good broker for newer traders. But we think the lack of a VPS and the curtailed list of assets on MT4 does take the shine off this brand for many dedicated forex traders whose strategies involve 24-hour algorithmic trading.

Copy Trading

Users can choose from a catalog of 800+ strategy providers to follow and duplicate positions in real-time.

Our team like the easy trade setup experience, especially for beginners, with customers permitted to retain full account control including the ability to start, pause or stop copy trading at any time.

The server uses an equity-to-equity model, with automatic rebalancing based on your invested capital amount. We appreciate that this means there are no complex input requirements from a retail investor perspective. You can also set an equity stop loss, which like in traditional trading will cancel trades automatically when a predefined threshold is met.

How To Start Copy Trading

It only takes a few minutes to find a suitable strategy provider and start mirroring their positions:

- Sign in to the cTrader platform

- Choose the ‘Copy’ icon from the menu on the left

- Use the filters to browse the strategy list and find the most appropriate fund manager

- Select the ‘Start Copying’ icon on the right side of the strategy provider name to get started

- Input the value you want to invest in and select ‘Start Copying’. This will start the strategy duplication process

- Select from the strategy names listed on the left menu to stop or pause copying, or remove funds

PAMM/MAM

Another alternative to boost your forex trading prospects is via the Skilling PAMM/MAM accounts. You can invest your personal capital with an experienced money manager and let them do the leg work for you.

We see this as another excellent option for more casual traders who do not have the time or confidence to formulate their own strategies. You will receive a percentage split of the profits, which varies by provider.

How To Start PAMM Trading

It is very simple to get started with PAMM trading:

- Create a live Skilling account and verify your profile by uploading identity documents and proof of residency

- Review trading statistics and the past performance of money managers

- Request to join a pool by emailing support@skilling.com with the name of the money manager

- Allocate your funds to your chosen money manager account and monitor positions

Forex Education And Research

Skilling’s educational content is decent, though we feel it is some way behind competitors like eToro and Forex.com.

The broker’s online learning academy is not as comprehensive as leading brands, with basic details of forex and CFD trading provided. It would be good to see some more information published for experienced retail investors, including more advanced strategy guides and online webinars.

Information is also not categorized by experience level, which leaves us forced to scroll through articles to find relevant material.

On a more positive note, we rate the broker’s ‘Markets Insight’ blog section, which provides commentary and analysis from the firm’s team of experts. The information is updated with the latest figures, including data from the day we use the services. Topics include price prediction forecasts for popular products with expected volatility and weekly themes by asset class.

Demo Account

We are pleased that Skilling offers a demo account loaded with $10,000 in virtual funds. You can use the demo account to test all of the broker’s trading platforms, including their iOS and Android mobile apps.

We like the flexibility of the paper trading profile, which allows users to practice trading with leverage and build confidence by creating a diverse portfolio with no risk.

The other key bonus for me is that the simulator account doesn’t expire. This means you can test and refine strategies in a risk-free setting alongside your real-money account. This is an advantage over forex brokers like AvaTrade where the demo account expires after just 21 days.

How To Open A Demo Account

I have reviewed hundreds of forex brokers and appreciate the quick and easy sign-up process at Skilling. I activated the simulator account and was trading in just a few minutes.

- Register for a Skilling account by selecting the ‘Sign Up’ logo on the broker’s website

- Add your email address and create a password, then click ‘Sign Up’

- From the client dashboard, select ‘Accounts’ from the menu at the top and then click ‘Demo Trading’

- Click the ‘Add Account’ icon

- In the registration form pop-up, add an account nickname, choose a platform from the dropdown menu, select ‘demo’ from the account options, choose a base currency, then click ‘Create Account’

- Launch the trading platform and begin trading

Bonus Offers

Traders that sign up with the non-EU entity can take part in several promotions.

When we registered for a Skilling account, we were offered a $30 welcome bonus. Profits generated using the bonus are withdrawable, though new customers must deposit at least $100. We could also take part in a refer-a-friend scheme, weekly zero-commission products, and an $888 ‘lucky money’ prize draw.

On the negative side, we never recommend selecting a brokerage based on trading bonuses. These can encourage over-trading and excessive risk-taking. Other comparison factors are more important, including fees, safety and trading tools.

Also due to regulatory restrictions, these bonuses are not available to residents of the following jurisdictions; European Union, United States, Canada, United Kingdom, Australia, Israel, or Japan.

However, it is the cashback rebate program that stands out for us, with monthly rewards of up to $10,000 based on trading activity. This is a great perk for high-volume traders, even if the rebates are quite tight, with the highest return of $15 per $1 million requiring a trading volume of over $200 million. This program is available to all customers, with no additional sign-up requirements.

Trading Restrictions

Our experts did not come across any trading restrictions while using Skilling – traders should be able to implement their scalping, hedging and other strategies freely.

Micro lot trading is also supported, with a minimum lot size of 0.01.

Customer Service

We have reviewed a long list of forex brokers and Skilling ranks highly for its customer support. We tested the live chat service several times and received responses in less than a minute, which is quicker than most competitors.

Our team also like that you can use alternative chat systems such as WhatsApp and Facebook Messenger to reach agents quickly.

Other contact methods include email and telephone, though it is worth noting that accessibility varies by method, with telephone available Monday to Friday from 08:00 to 17:00 (CET) and live chat between 04:00 and 22:00 (CET).

To speak to Skilling.com:

- Email – support@skilling.com

- Telephone – +35722276710 or +44(20)80806555

- Live Chat – icons bottom right of the broker’s website

- HQ Address – 62 Athalassas Avenue, 2nd Floor, Strovolos, CY-2012, Nicosia

Company Details

Skilling is a Scandinavian fintech company, established in 2016 by a team of technology experts. Today, the broker-dealer group’s 70+ employees are headed by CEO Michael Kamerman.

The brokerage has headquarters in Nicosia, Cyprus, with additional offices in Malta, Spain, and the UK.

Skilling received licensing from the Cyprus Securities and Exchange Commission (CySEC) in 2018, which allowed trading services to be offered across all EEA territories.

In 2020, the brand was issued business licensing from the Seychelles Financial Services Authority (FSA), which enabled operations to be launched outside of the EU.

The broker has also picked up various awards, including being recognized as the ‘Best Forex Trading Platform’ at the 2022 Global Forex Awards.

Trading Hours

As is standard, the broker’s trading hours vary by asset class. We are pleased to see a full schedule by instrument published on the website, including details of daily break sessions.

Trading hours (GMT):

- Forex – Sunday 22:05 to Friday 22:00

- Commodities – Most instruments are available from Sunday 23:00 to Friday 22:00

- Indices – Varies by instrument, with the S&P 500 available from Sunday 23:00 to Friday 21:15

- Shares – Varies by stock exchange including NYSE company shares available to trade between Monday 14:30 and Friday 21:00 and the Frankfurt stock exchange Monday 08:00 to Friday 16:30

Who Is Skilling Best For?

Skilling is a great forex and CFD broker, especially for beginners owing to the user-friendly web platform and resources like copy trading. The low starting deposit, zero inactivity fee and unlimited demo account are also appealing to newer and casual traders.

Experienced and active traders will be well served by the fast execution speeds of 0.5ms and tight spreads from 0.1 pips. However, the lack of VPS and limited MetaTrader 4 offering may deter traders looking to deploy automated strategies.

FAQ

Is Skilling Legit Or A Scam?

Skilling is a legitimate global broker. Our experts did not find any major reports of scams or security breaches. The company is also regulated by a tier-two financial agency, the Cyprus Securities & Exchange Commission (CySEC), which is reassuring.

Can I Trust Skilling?

Yes, Skilling is a trustworthy brokerage. The business has been providing forex and CFD trading since 2016 with a customer base spanning popular trading jurisdictions. The firm has also won multiple industry awards and offers account safety measures like negative balance protection and segregated client accounts.

Can You Make Money Trading Forex With Skilling?

Skillful retail forex traders can make money with Skilling – this is a well-regarded broker with powerful trading software, competitive fees and reliable execution.

However, there is no guarantee you will turn a profit and many traders lose money. With this in mind, make sure you employ suitable risk management tools and only deposit what you can afford to lose.

Does Skilling Offer Low Forex Trading Fees?

Forex trading fees at Skilling are competitive. The broker offers different pricing models, depending on the account type you choose. You can trade commission-free with floating spreads from 0.7 pips, or access raw spreads from 0 pips, with a $35 commission charge per million in traded volume. Both pricing structures compare well to alternative forex brokers.

Is Skilling A Regulated Forex Broker?

Skilling is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) in which EEA customers will be registered. This is a well-respected regulator.

On the negative side, global traders will be registered under the Seychelles Financial Services Authority (SFSA) entity. This does not offer the same level of regulatory oversight or legal protections to clients.

Is Skilling A Good Or Bad Forex Broker For Beginners?

Following our Skilling broker review, our experts rate this brand as an excellent choice for beginners. The brokerage offers a demo account with no expiry on all trading platforms. The minimum deposit is also accessible at $100 and we particularly rate the copy trading solution which allows you to mirror 800+ strategies from experienced traders.

Does Skilling Have A Forex App?

All forex trading platforms offered by Skilling have mobile app compatibility. This includes the proprietary software with all the powerful and competitive trading conditions mirrored in the iOS and Android solutions. You can trade forex and alternative instruments at the click of a button, with all graphs and charts optimized for smaller screens.

How Long Do Withdrawals Take At Skilling?

Withdrawal times from a Skilling trading account vary by payment method but generally are quicker than average. We found that Skilling processes withdrawal requests Monday to Friday until 3 PM (UTC) and fund clearance for all payment methods can be within one working day.