ThinkMarkets

-

💵 CurrenciesUSD, EUR, GBP, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, AutoChartist, TradingCentral

-

⇔ Spread

GBPUSD: 0.3 EURUSD: 0.0 GBPEUR: 0.0 -

# Assets45+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Our Opinion On ThinkMarkets

ThinkMarkets is a multi-award-winning forex broker. We like the fast sign-up process with no minimum deposit and low fees on the Standard and ThinkZero accounts. Our team also enjoy using the broker’s ThinkTrader platform, which offers a slick interface, dynamic charts and sophisticated analysis tools.

Weak points for us are the average selection of payment methods and limited social trading tools, but these are very minor complaints. Overall, ThinkMarkets impresses as an excellent forex broker for traders of all skill levels and trading styles.

Summary

- Instruments: 4,000+, including 46 forex pairs, stocks, indices, commodities, ETFs, crypto

- Live Accounts: Standard, ThinkZero, Professional

- Platforms & Apps: ThinkTrader, MetaTrader 4 (MT4), MetaTrader 5 (MT5)

- Deposit Options: Bank cards, wire transfers, e-wallets

- Demo Account: Yes

Pros & Cons

- Supports industry-leading MT4, MT5 platforms and bespoke ThinkTrader

- Spreads from 0.0 pips with a $3.50 commission on the ThinkZero account

- High-quality market research including daily forex updates

- Trusted forex broker regulated by multiple financial bodies

- Accessible Standard account with no minimum deposit

- 24/7 customer support with <5 minute response times

- Up to 40 daily trading ideas from the Signal Centre

- Free VPS available to reduce latency and slippage

- Average range of payment methods

- Limited social investing features

- Traders from the US not accepted

Is ThinkMarkets Regulated?

Very few forex brokers match the regulatory credentials of Think Markets. The broker holds multiple licenses with financial regulators, including top-tier bodies like the UK Financial Conduct Authority (FCA), the Australian Securities & Investments Commission (ASIC), and the Cyprus Securities & Exchange Commission (CySEC).

We also found no reports of scams and are reassured to see that the firm uses reputable firms for its insurance (Lloyd’s of London) and banking partners (Barclays).

Add in high levels of account security with two-factor authentication (2FA) and one-time passwords (OTP), and we are comfortable that ThinkMarkets is a trustworthy forex broker.

Forex Accounts

Our team is happy with the two accounts, which cater to forex investors with different trading styles and experience levels.

We think the zero-commission Standard account is best for beginners with spread-only pricing, access to dozens of currency pairs and the broker’s full suite of trading tools. This account also has a minimum deposit of $0, which is an advantage over rivals like Eightcap at $100.

The key features of the Standard account are:

- Minimum Deposit – $0

- Spreads – from 0.4 pips

- Maximum Leverage – 1:30

- Maximum Position Size – 50 lots

- Account Manager – No

We recommend the ThinkZero for experienced traders seeking tighter spreads and extra perks. In return for a larger deposit of $500, you can trade with spreads from 0.0 pips and greater position sizes. The ThinkZero account also comes with an account manager.

The key features of the ThinkZero account are:

- Minimum Deposit – $500

- Spreads – from 0.0 pips

- Maximum Leverage – 1:30

- Maximum Position Size – 100 lots

- Account Manager – Yes

How To Open An Account

I found it very simple to sign up for an account with ThinkMarkets in a few minutes:

- Click on the green Create Account icon on the broker’s website

- Click Create A Live Account

- Enter your country of residence and email address and create a password

- Enter your personal information and choose an account type

- Submit photo ID and proof of residence documents for verification

- Once verified, log in and start trading

Trading Fees

Trading fees on both accounts compare favorably to competitors.

The Standard account charges no commission, while the ThinkZero account’s low commission of $3.50 per lot is competitive to access raw spreads. In fact, tight spreads are available on both account types with the Standard STP account starting from 0.4 pips and ThinkZero starting at 0.0.

During tests, we got 1.3 pips on the GBP/USD, which is lower than the 2.0 pips at eToro but slightly higher than the 0.9 pips we got at CMC Markets.

Non-Trading Fees

Our team is pleased with the free deposits and withdrawals from ThinkMarkets, which make moving funds simple and fee-free.

There are also no inactivity fees, which is another bonus and compares well to forex brokers like Forex.com, which has a $15 monthly fee.

Payment Methods

While ThinkMarkets supports several payment methods, we are disappointed by the lack of popular e-wallets like PayPal. Supported funding methods include wire transfer, credit/debit card, Neteller and Skrill.

For instant funding, we would recommend card payments, while bank wire transfers are much slower, taking up to four days.

The forex broker also supports a wide range of base currencies, including USD, EUR and GBP. This makes it easy and affordable for international traders to use the brokerage.

How To Make A Deposit

I find it very easy to fund my account following the five quick steps outlined below:

- Log in to the client portal

- Click the flag icon in the top-right-hand side of the page

- Click the blue Deposit icon in the drop-down menu

- Choose a payment method and the amount to deposit

- Confirm the deposit

Withdrawals can also be made free of charge using the same payment methods as deposits. However, we found that withdrawal times vary between payment methods, with e-wallets being instant and wire transfers taking up to five days to reach us.

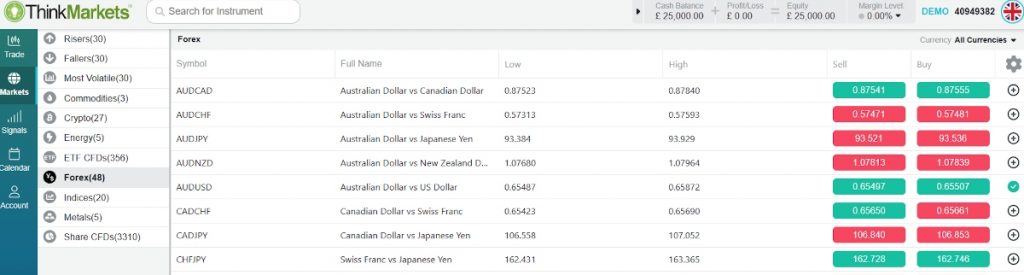

Forex Assets

Our team is satisfied with the range of forex assets offered by ThinkMarkets, with 46 major, minor and exotic instruments. Although some rivals such as AvaTrade offer 60 or 70+, we are sure there is enough here to meet most traders’ goals.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

ThinkMarkets also impresses for its wide selection of 4,000+ non-forex assets, including indices, energies, metals, shares, ETFs, futures, crypto and spread betting. The selection of equities is particularly strong, providing access to major stock exchanges, including in the US. Equally, the depth of metals beats most alternatives.

You can trade:

- Indices – 13 indices, including the FTSE 100 and Dow Jones Index

- Shares – 3500+ equity CFDs and ETFs, including Amazon, Facebook and Apple

- Energies – Three energy products, including crude oil and natural gas

- Metals – Nine metals, including gold, silver and platinum

- Futures – Ten futures, including wheat, the FTSE 100 and soybeans

- Cryptos – 20+ major tokens, including Bitcoin (BTC) and Ethereum (ETH)

- Spread Betting (UK only) – 40+ spread bet contracts, covering forex, metals and indices

Execution

ThinkMarkets offers over-the-counter (OTC) products and straight-through processing (STP) order execution. This allows for fast execution speeds and our team is happy with this model, which works efficiently for almost all of our trades.

We are also pleased that the broker does not act as a market maker – we prefer the more objective non-dealing-desk model since it leaves less room for conflicts of interest.

Leverage

Maximum leverage limits are capped at the 1:30 sanctioned by most top-tier regulators. This amount is available for major forex pairs with reduced limits available for more volatile instruments.

With that said, the firm’s offshore branch offers higher leverage up to 1:500. Professional traders can also access the same rates. Importantly, higher leverage can lead to significant losses, so we only recommend it for experienced traders.

ThinkMarkets has a stop-out level that is automatically triggered when your account falls below 50% of the required margin.

Platforms & Apps

ThinkTrader

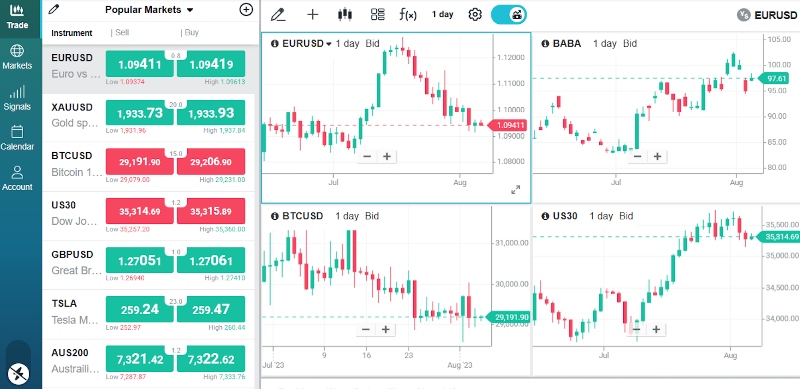

I rate the proprietary platform, ThinkTrader, which I find straightforward to use.

As well as a simple layout that I think will serve beginners, it still performs in terms of tools and features. There are 20 chart types, 125+ technical indicators, 50+ drawing tools, an economic calendar, plus support for one-click trading.

I especially rate the four-screen display which makes it easier to monitor four currency pairs simultaneously.

MetaTrader 4 & MetaTrader 5

I am also pleased with support for the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

I find these platforms easy to use and I appreciate the range and efficacy of the analytical tools they offer. MT4 and MT5 both support customizable charts, sophisticated technical indicators, multiple order types, and Expert Advisors for algo trading.

I think both platforms are excellent for traders of all stripes, though in my view experienced traders can get more out of the newer MT5. It is faster with more pending order types, indicators and an integrated news feed.

I have highlighted the main features of each platform below.

MetaTrader 4

- Nine timeframes

- 31 graphical objects

- Expert Advisors (EAs)

- In-depth pricing history

- Single-thread strategy testing

- 30 technical indicators including RSI and Moving Average

- 4 pending order types (buy limit, buy stop, sell limit and sell stop)

MetaTrader 5

- 21 timeframes

- Expert Advisors (EAs)

- Six pending order types

- Built-in economic calendar

- Multi-thread strategy testing

- 38 technical indicators including MACD and Stochastic Oscillator

- 44 graphical objects such as Elliott Wave and Fibonacci Retracement

How To Make A Forex Trade

Making a trade on the MT5 platform is a straightforward process that is easy to get the hang of:

- Sign in to your MetaTrader account

- Click the New Order icon from the menu at the top of the screen

- Select the forex asset you want to trade

- Input the trade volume

- Enter any stop loss or take profit levels you want

- Press Buy or Sell to complete the trade

I find opening and closing positions just as simple on ThinkTrader:

- Click the Trade icon on the left-hand menu

- Find the instrument you want to trade

- Click the Buy icon on the right-hand side

- Enter the amount and conditions of the trade

- Click the blue Confirm BUY icon

Forex Tools

Although I like the free VPS hosting, overall I am slightly disappointed with the lack of forex trading tools, with only a few additional features.

These are the three forex tools that I had access to while using ThinkMarkets:

VPS Hosting

The broker offers a free VPS to its forex traders, and I am happy with the opportunity this provides for serious investors to carry out automated trading.

The VPS uses an external server to manage trading connectivity, meaning your account is running without the downtime caused by computer problems.

I especially like that any clients who trade a minimum of 15 lots per month can access this tool for free.

Signal Centre

I also enjoy using the Signal Centre, which delivers daily trading ideas directly to your platform interface.

With up to 40 trading signals sent daily before the market opens, I find this useful for planning strategies and tracking forex trading opportunities.

Although the $500 deposit required for this service makes it less accessible to those on a lower budget, I think this is within reach for most forex traders.

Traders’ Gym

The Traders’ Gym allows clients to back-test investment strategies on historical data spanning more than 4,000 instruments.

I especially like that you can create up to 50 simulations with different timeframes and markets using this service, which can help confirm the validity of forex trades and strategies before committing financially.

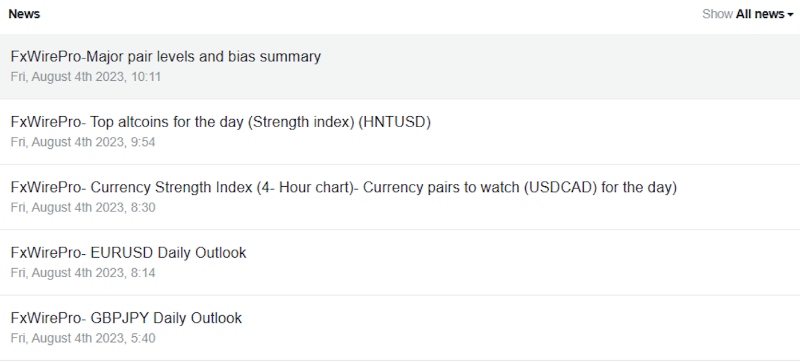

Forex Research

Our team rates ThinkMarkets for its inclusion of real-time market data including news, technical analysis, an economic calendar and reports to help clients make forex trading decisions.

We particularly like the special reports, which include interesting articles laying out market concepts and data from fresh perspectives. I feel this feature contends well with major competitors.

Forex Education

I highly recommend the educational resources, which include webinars and tutorials for all experience levels, articles, a glossary and a knowledge base.

The extensive variety of educational materials offered by this firm is similar to the levels we have seen at top brokers like eToro, so we see ThinkMarkets as a great choice for newer traders.

Demo Account

Simulated accounts are a great way for beginners to learn the ropes of forex trading before taking on financial risk.

The broker’s free demo account offers an important opportunity to test strategies and develop trading systems before committing real funds, and we are pleased to see no time restrictions for active users.

How To Open A Demo Account

I found it simple to open a ThinkMarkets demo account with a few mouse clicks:

- Click the Trading Accounts icon in the top left corner of the broker’s website

- Click the Demo Account icon on the drop-down menu

- Enter your personal details

- Choose the account type

- Verify your email address to start paper trading

Bonus Offers

We are not surprised to find no bonuses when trading with ThinkMarkets since regulations ban the use of financial incentive schemes in many of the broker’s registered regions. As a result, this isn’t a problem for us, and more a reassuring sign that this is a legitimate forex broker.

Customer Service

I am impressed with the 24/7 customer service, placing ThinkMarkets among our best-rated forex brokers in this area.

Contact methods include live chat, telephone and email, providing quick access and long-form communication options.

During our tests, the live chat was fast and easy to use with helpful answers in less than five minutes and we received email responses within 24 hours.

Contact details:

- Live Chat – icon on the right-hand side of the official site

- Email – support@thinkmarkets.com

- Phone Number – +442035142374

Company Details

ThinkMarkets is a multi-award-winning forex broker founded in 2010 that now has 450,000+ clients and offices in 11 cities including London, Chicago and Tokyo.

For me, the brand’s multiple awards from respected brands including the 2022 World Finance Best Trading Platform are a good sign of ThinkMartkets’ credentials.

Trading Hours

Opening hours vary by instrument, with forex trading open from Monday 00:03 until Friday 23:55 GMT+3, while metals are available from 01:03 Monday to 23:59 Friday GMT+3.

Full information on opening hours can be found on the contract specification page, and upcoming events that change trading hours can be found on the news page of the broker’s official website.

Who Is ThinkMarkets Best For?

ThinkMarkets has lots to offer forex traders at all levels of experience. The low starting deposit, easy-to-use ThinkTrader platform and excellent educational resources will suit beginners, while the strong range of currency pairs and forex research tools provide value for seasoned traders.

With a VPS and access to the MetaTrader software, ThinkMarkets is also a particularly good option for active algo traders.

FAQ

Is ThinkMarkets Legit Or A Scam?

Our team is confident that ThinkMarkets is a legitimate forex broker, with oversight from multiple internationally respected regulators.

The brand’s excellent security measures also make us feel secure when trading with ThinkMarkets.

Can I Trust ThinkMarkets?

We are comfortable that ThinkMarkets is a trustworthy forex broker. There are no reports of the company taking part in scams and it operates with strong regulatory oversight and security protocols.

Is ThinkMarkets A Regulated Forex Broker?

ThinkMarkets is regulated by top-tier governing bodies including the UK’s FCA, Australia’s ASIC and the EU’s CySEC. The forex broker is also registered with other regulators, including the FSCA, CIMA, FSA and FSC.

Is ThinkMarkets A Good Or Bad Forex Broker?

We think ThinkMarkets is a good forex broker for beginners and experienced traders alike, with up to 46 forex pairs, a $0 minimum deposit, high-quality tools, STP & ECN accounts and tight spreads.

We like the design of the in-house platform and excellent educational resources, though we would like to see more social trading tools.

Is ThinkMarkets Good For Beginners?

We think ThinkMarkets is a good forex broker for beginners thanks to its $0 minimum deposit, intuitive ThinkTrader platform and smooth sign-up process. The unlimited demo account is also helpful for learning the ropes and the collection of educational resources is varied and extensive.

Does ThinkMarkets Offer Low Forex Trading Fees?

ThinkMarkets’ trading fees are competitive in the industry, with tight spreads from 0.4 pips and zero commission on the Standard account and raw spreads from 0.0 pips and commission fees of $3.50 on the ThinkZero account.

There are also no deposit and withdrawal fees or inactivity charges, reducing non-trading costs.

Does ThinkMarkets Have A Forex App?

ThinkMarkets offers its own proprietary mobile app, alongside the MT4 and MT5 mobile platforms.

I personally find the ThinkTrader app more user-friendly than the MetaTrader options, but this will be down to preference.

How Long Do Withdrawals Take At ThinkMarkets?

Withdrawal times vary by payment method, with payments usually reaching your e-wallet account instantly once a withdrawal is verified. Bank wires are slower, taking up to four days.

Can You Make Money Trading Forex With ThinkMarkets?

ThinkMarkets is a competitive forex broker with high-quality trading software, STP/ECN execution and access to 40+ currency pairs. However, there is no guarantee of making money when trading forex online, regardless of the broker you select.