Brokers With Volatility Index

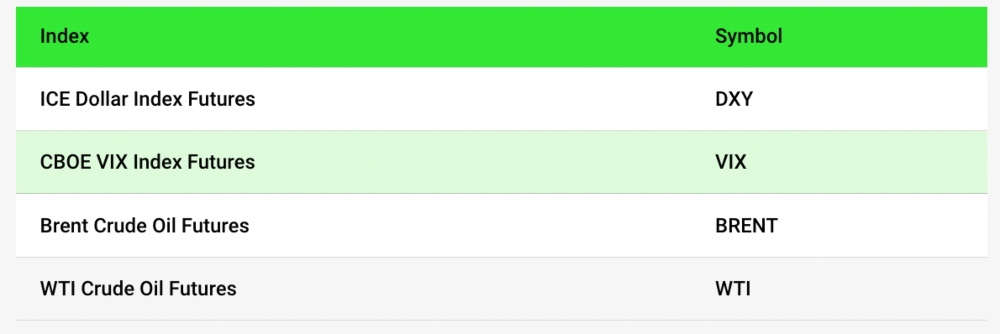

The Volatility Index, or VIX, is a useful indicator of market sentiment, with higher volatility indicating market jitters and thus lending the VIX its reputation as a ‘fear gauge’. Brokers with volatility index trading allow clients not only to use the VIX as an analysis tool, but also to profit by correctly predicting trends in market sentiment using derivatives such as CFDs and futures.

The VIX generally refers to the Chicago Board Options Exchange (CBOE)’s index, also known as the Volatility Index 75, which gauges US markets through the S&P 500. The best brokers with Volatility Index 75 offer low fees, excellent platforms, and competitive trading conditions. Above all, traders should seek out volatility index brokers which are trustworthy and overseen by a reputable regulatory body for a secure trading experience.

Our experts have tested the top brokers with volatility index trading to compile the best five on the market today.

List of Best Volatility Index Brokers 2026

- Pepperstone: Best Overall VIX Broker

- eToro: Best VIX Broker For Social Trading

- Skilling: Best VIX Broker For Beginners

- IC Markets: Best VIX Broker For High Leverage

- Deriv.com: Best Synthetic Volatility Index Broker

Pepperstone: Best Overall VIX Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.2 -

# Assets60+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend Pepperstone

We recommend Pepperstone because it is a great all-round broker. Pepperstone offers an excellent range of 1200+ tradeable assets including the VIX, market-leading platforms including MetaTrader 4, MetaTrader 5 and cTrader, plus regulatory oversight from tier-one financial bodies including the UK’s Financial Conduct Authority. Add in competitive fees and high-quality education, and Pepperstone is a top choice for traders of all stripes who want to profit from the VIX.

VIX traders at Pepperstone can speculate on the index’s movements via CFDs on VIX futures.

Below we explain in detail what makes Pepperstone our favorite overall broker with the Volatility Index.

Pros/Cons of Pepperstone

Pros

Razor account caters to experienced traders with ~30ms execution speeds

The low-spread, lightning-fast Razor account offered by Pepperstone is an excellent option for active VIX traders who need to make precise trades. Our team especially rates that most orders are executed in less than 30ms – we consider anything below 100ms fast.

The opportunity to also trade the VIX using a Virtual Private Server (VPS) is another advantage for serious traders, especially those deploying automated strategies.

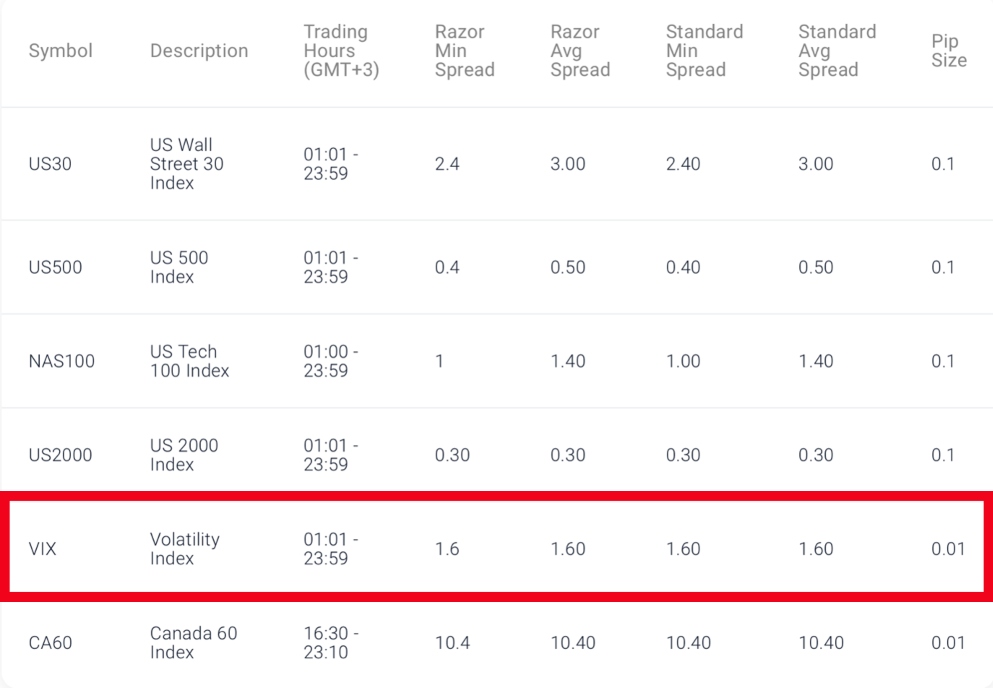

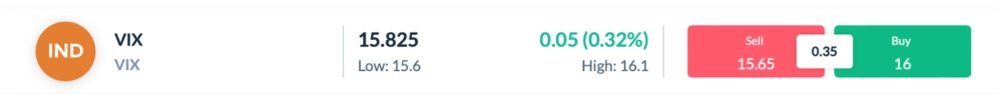

Transparent pricing with average spreads on the VIX of 1.6 pips

Out of the VIX brokers we assessed, Pepperstone had one of the most transparent pricing schedules and no hidden charges. With zero deposit charges, withdrawal fees or inactivity penalties, traders only need to consider the spread, commission and overnight funding fees.

On top of that, our team appreciate the competitive prices when trading other assets, with spreads dipping as low as zero on the raw Razor accounts, which charge a competitive $3 / $3.50 per lot on cTrader and MetaTrader, respectively. This makes Pepperstone suitable for traders looking to build a diverse portfolio with low fees.

Supports an excellent range of trading platforms including MetaTrader

MetaTrader 4, MetaTrader 5, cTrader, TradingView, Autochartist… we rate Pepperstone’s range of platforms and tools, which offers more choice than every alternative we tested. This ensures that traders will have a comfortable selection of high-quality software to use when trading the VIX.

The presence of MT4 and MT5 is especially handy, since many VIX trading strategies can be set up with trading robots through the Expert Advisors (EAs) available on the MetaTrader platforms.

One of the most reliable brands around with top-tier regulatory oversight

With regulation from UK’s FCA, Australia’s ASIC, Cyprus’s CySEC and more, Pepperstone is one of the most heavily regulated VIX brokers that we evaluated. In contrast, Skilling (which we review in detail below) only has authorization from the CySEC.

We almost always use regulated brokers and generally recommend that our readers do the same. Oversight from tier-one regulators in particular, such as the FCA and ASIC, ensures certain safety measures should be in place, including negative balance protection and segregated client accounts.

As a result, we are not surprised that some 400,000 clients also trust this broker.

Great choice for beginners with high-quality education and a $0 minimum deposit

With excellent educational content available in a variety of formats, Pepperstone offers more than most brokers with the volatility index for newer traders. We particularly rate the beginner-friendly breakdown of the VIX, which explains how it works, including how it is calculated, plus tips on how to trade the Volatility Index 75.

Pepperstone also has a $0 minimum deposit, which reduces the entry barrier for new traders. This is significantly lower than other brokers with volatility index trading that did not make our top list, such as Saxo, which has a minimum funding requirement of $500.

Cons

Limited demo account with 30 day expiry

It is a shame that Pepperstone deactivates traders’ demo accounts after 30 days. These accounts can be useful for planning trades and sharpening trading strategies, especially if you plan to use technical analysis methods that are popular when trading the VIX.

Alternative brokers with volatility index trading, including eToro, offer demo accounts indefinitely. This will appeal to traders like us who want to be able to continuously test and refine VIX trading strategies before putting down real money.

Mediocre range of funding methods

Within our tests, Pepperstone had an average range of payment options. While the broker supports the usual debit/credit cards, wire transfers and PayPal, there are limited alternative e-wallets or crypto deposits, which are accepted by some rival VIX brokers. eToro, for example, accepts Bitcoin deposits and withdrawals.

We don’t consider this a major drawback, but it is worth bearing in mind if you prefer to fund your trading activities in digital currencies.

Why Is Pepperstone Better Than The Competition?

Pepperstone offers a complete package to anyone looking for a broker with volatility index trading. It has more high-quality trading platforms than any other VIX broker we reviewed, beginner-friendly educational content, transparent account conditions, and a good range of other assets to complement your VIX trading.

It is difficult to find fault with this broker, and none of its weaker points are in crucial areas in our opinion.

Overall, Pepperstone’s advantages make this broker the full package for VIX traders and we are happy to recommend it as our top overall broker with volatility index trading.

Who Should Choose Pepperstone?

Thanks to its choice of account types including the very competitive Razor option, Pepperstone caters very well to both beginners and more experienced traders interested in the volatility index.

The educational content and low deposit will suit beginners well, while more experienced traders can make frequent, high-volume trades with support for automated strategies alongside fast execution speeds.

If you are looking to trade the VIX and other assets, Pepperstone is a reliable broker.

Who Should Avoid Pepperstone?

There is little to fault about Pepperstone, but we do think some skillful traders with a large risk appetite could be put off by the limited leverage. This is not a mark against the broker, since they offer the maximum 1:30 allowed by respective regulators (and 1:20 for VIX), but traders seeking higher leverage might turn to an offshore broker.

eToro: Best VIX Broker For Social Trading

Why We Recommend eToro

We recommend eToro because it is an established brand with good regulatory oversight, an extremely wide range of tradeable assets including the VIX, a user-friendly platform, and the best social trading platform on the market.

VIX traders at eToro can speculate on the index’s movements via CFDs on VIX futures.

Read on to find out why we recommend eToro above other brokers with volatility index trading.

Pros/Cons of eToro

Pros

Excellent educational content and social trading features

Traders can read up on the VIX and other crucial topics using eToro’s premium suite of educational materials, which outshine most other brokers’ offerings.

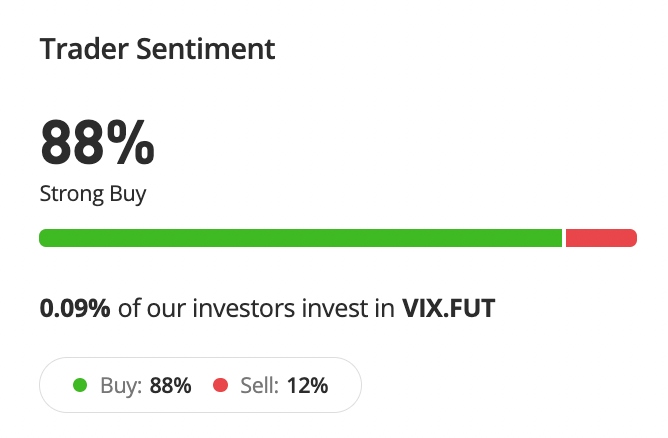

Yet it is eToro’s social trading service that really outperformed all of the other VIX brokers we tested. There is a huge online community home to thousands of active traders. In particular, the ‘like’ and ‘comment’ functionality on the newsfeed really stands out for us, as it allows us to swap trading ideas, predictions, and insights into the volatility index.

Choice of VIX futures or ETFs

Most of the brokers we evaluated with volatility indices only offer trading through futures contracts, including Pepperstone. However, eToro traders have more options as they can speculate on VIX futures through CFDs, but they can also do so through several ETFs, providing more flexibility.

One benefit of eToro’s ETFs is they offer an opportunity to lower your portfolio risk in US stocks, as the ProShares Ultra VIX Short-Term Futures ETF, for example, is typically negatively correlated with the S&P 500.

Intuitive and feature-rich proprietary platform

Of all the VIX brokers we tested, eToro’s browser-based platform was one of the easiest to use, on par with Skilling. Our team appreciates the slick interface that still has a surprising amount of power under the bonnet with integrated TradingView charts, an automated news feed and investor sentiment gauges. We particularly rate the premium technical analysis features from ProCharts which let you analyze multiple assets over different timeframes, including the volatility index.

Beginners will have an easier time learning to trade the VIX here than with more sophisticated terminals like MetaTrader offered by alternatives like IC Markets, though there are enough features to keep experienced traders happy.

Demo account that can be activated at any time with a $100K bankroll

eToro’s simulator account is a great way for beginners to learn how the platform works or for more experienced traders to practice their VIX trading strategies.

And, unlike many other volatility index brokers which only offer this feature temporarily, such as IC Markets, eToro allows traders to switch between their real-money and virtual accounts at any time.

Our experts also rate how straightforward eToro have designed the joining process for a paper trading account. We only had to follow these four easy steps to start demo trading on the volatility index:

- Select ‘Start Investing’ on the broker’s homepage

- Enter your name, email address and password (or sign up with your Google of Facebook account)

- Verify your account using the activation code sent to the registered email

- Sign in to the client area and open the web terminal

Well-regulated by respected authorities with an excellent reputation

eToro is one of the most secure and multi-regulated brokers with volatility index trading. We reviewed multiple leading firms and eToro was one of the few to be regulated in Europe, the UK, Australia and the US.

This makes eToro one of the safest brokers to trade the VIX with.

Wide market access with 3000+ instruments in addition to the VIX

eToro has a huge range of assets available that eclipses the offerings of most other brokers, with thousands of stocks from 20 different international exchanges, and a large range of commodities, indices, ETFs, cryptocurrencies and currencies.

Since traders are unlikely to limit themselves to the VIX, this flexibility is a great advantage for eToro traders looking to build a diverse portfolio.

Cons

Expensive pricing for VIX futures

The spread for eToro’s VIX future CFDs is sometimes wider than other brokers. When our experts tested eToro, the spread was around 1.3% of the price of futures, meaning the asset needs to cover a fair amount of ground before you make a profit.

No third-party platform or trading robot support

eToro’s platform is good for beginners, but seasoned traders may miss the opportunity to use third-party terminals – particularly the MetaTrader 4 and MetaTrader 5 solutions. The absence of features such as Expert Advisors can be quite limiting for experienced VIX traders, especially those interested in automated strategies.

Some traders will seek a VIX broker with MetaTrader and VPS support as a result, such as Pepperstone or IC Markets.

Withdrawal fees of $5 plus currency conversion charges

Of all the brokers with volatility indices that we tested, eToro was the only one to charge a flat withdrawal fee. eToro clients need to pay $5 per withdrawal, and since they need to fund their accounts in dollars, some traders may also be subject to currency conversion charges. Together with sometimes wide spreads, these fees can make eToro one of the more expensive brokers to trade the volatility index with.

Neither Pepperstone, IC Markets, Skilling nor Deriv charges a withdrawal fee, and all offer a wider range of account currencies, catering to global traders.

Why Is eToro Better Than The Competition?

The social trading service that connects you with other VIX traders is the key bonus for us, with no alternative able to compete in this area. This alone means some traders, especially beginners, may be willing to pay more in terms of withdrawal fees.

eToro also provides an excellent all-in-one web-based platform that allows users to trade an extremely broad range of assets, including the VIX and many related stocks, indices and ETFs.

eToro is also a highly professional operation, with oversight by excellent regulators including the top-tier FCA, and it is available to US traders.

Altogether, this makes eToro a very attractive option for trading the VIX, especially for social investors.

Who Should Choose eToro?

With its intuitive platform, eToro is aimed toward a more casual trader who still demands decent analysis tools and an excellent range of assets to trade. We feel the broker serves this market very well.

Many more hands-off traders, in particular, will be drawn to eToro thanks to its successful social investing features, which can take the legwork out of trading the volatility index when you’re starting out.

Additionally, the ability to dip into a demo virtual account at any time means traders will have the opportunity to learn the platform and practice VIX strategies risk-free.

Who Should Avoid eToro?

While casual social traders will be served well by eToro’s platform, more experienced traders may prefer a broker that offers a more sophisticated terminal, particularly if they are used to a third-party platform like MT4. IC Markets is a better option in this regard.

eToro also isn’t a good option if you aren’t willing to pay the withdrawal fee and slightly higher trading fees in return for access to a best-in-class social trading platform.

Skilling: Best VIX Broker For Beginners

Why We Recommend Skilling

We recommend Skilling for volatility index trading because it is another good all-round broker that offers similar benefits to Pepperstone, but with the added advantage of a very easy-to-use in-house platform for beginner traders.

VIX traders at Skilling can speculate on the index’s movements via CFDs on VIX futures.

Read on to find out why we recommend Skilling for trading the volatility index.

Pros/Cons of Skilling

Pros

Excellent proprietary trading platform for less-experienced traders

We found the interface on Skilling’s in-house platform the most intuitive out of all the volatility index brokers that we used. We could access the VIX and other assets, check price history via customizable charts, and execute trades at the click of a mouse. VIX trades take place on the same screen as a live chart, with open position and order history also easy to bring up in the window.

We found that Skilling’s platform is on a similar par to eToro’s in terms of ease of use, but it has more of a ‘trading terminal’ feel, with similarities to classic software like the MetaTrader platforms.

It is ultimately a good option for VIX traders who want to learn the ropes before progressing to more sophisticated platforms.

High-quality copy trading tools and educational resources

Beginners are well served by Skilling’s suite of educational materials. This includes the handy ‘trade assistant’ feature that supports new users. The only downside is that while the broker will walk beginners through the steps to place a trade on the S&P 500, it doesn’t cover the specifics of trading the VIX.

There is also a well-equipped help centre, market updates and other features including weekly news round-ups. This range of materials compares favorably to most other brokers, especially Deriv, though Pepperstone still outperforms Skilling in this area.

Nonetheless, paired with Skilling’s copy trading service, this is a great package for beginners that will help them get to grips with trading the volatility index while also dipping into other markets.

Good portfolio diversification opportunities beyond the VIX with 900+ instruments

Besides the VIX, Skilling has a strong range of assets including stocks, forex, commodities and indices. The 900+ CFDs are not quite as extensive as Pepperstone (1200+) or IC Markets (2250+), but this is still comfortably ahead of most other brokers.

Importantly, it means traders can build a diverse portfolio alongside the VIX, spanning multiple asset classes and using various strategies and trading setups.

Good pricing on the VIX with raw spreads from 0.19 available

Skilling offers some of the lowest fees on the volatility index based on our tests. We were offered a spread of 0.35 on the VIX, though the average spread is even lower at 0.19. Both figures are competitive and come in tighter than Pepperstone, for example.

Our team also rate the straightforward pricing structure at Skilling. The standard account has commission-free trading with spreads from 0.7 and the raw spread account has a $35 commission per million in notional volume and spreads from zero.

Cons

Less established brand than alternative VIX brokers on this list

Skilling presents an impressive offering to VIX traders, but it hasn’t been around long enough to build up the kind of reputation enjoyed by IC Markets and Pepperstone, for example.

Skilling was established in 2016, with IC Markets launching in 2007 and Pepperstone in 2010. As a result, it doesn’t have the same global customer base and market presence. Whilst this isn’t a dealbreaker, it may deter some users who prefer to trade the volatility index with a better-known brand.

High minimum deposit of $500 to access raw spread accounts

Although the minimum deposit for the standard account is reasonable at 100 EUR, USD, GBP or 1000 NOK or SEK, the raw spread account has a higher barrier for entry of 500 EUR or its equivalent.

This is a shame since it may put this account type out of the reach of some newer VIX traders, who are the users best served by Skilling’s offering.

Why Is Skilling Better Than The Competition?

Skilling is another excellent all-rounder with competitive pricing on the volatility index and a good selection of beginner-friendly platforms and tools.

Traders will be able to comfortably analyze and execute trades on the VIX and related indices using MT4 or cTrader. However, we would opt for Skilling’s own platform if you are a newer trader, owing to the user-friendly terminal. This is the standout benefit of trading the volatility index at Skilling and separates the brand from other brokers in this list.

Who Should Choose Skilling?

Skilling is a great option for beginner traders, who will benefit the most from its intuitive and easy-to-learn platform, as well as copy trading and other newbie-friendly features.

The low minimum initial deposit for the standard account is another benefit for beginners.

Who Should Avoid Skilling?

Skilling is not the best pick for seasoned traders. Despite the raw spread accounts with competitive fees, advanced traders will find more sophisticated tools at alternatives like Pepperstone, which offers a VPS and fee rebates for high-volume traders, including on indices.

Skilling’s limited regulatory oversight in some jurisdictions may also deter traders from certain countries. In particular, Skilling is not regulated in Australia, so Aussie residents will be better off with eToro, for instance, which is authorized by the ASIC.

IC Markets: Best VIX Broker For High-Leverage

Why We Recommend IC Markets

We recommend IC Markets for experienced traders that want to speculate on the VIX with high leverage up to 1:200 through the offshore entity, in return for fewer regulatory protections.

IC Markets is a rare example of a brokerage with an offshore entity that is reliable and offers many of the premium services and safeguards you would expect from top-tier regulated brokers.

It is worth noting that IC Markets still offers regulated trading on the volatility index through its CySEC and ASIC-regulated branches, but with lower leverage and greater regulatory oversight.

VIX traders at IC Markets can speculate on the index’s movements via CFDs on VIX futures.

Read on to see why IC Markets is our top pick for highly leveraged VIX trading.

Pros/Cons of IC Markets

Pros

Higher leverage than most brokers up to 1:200 on VIX

Out of the brokers we examined, IC Markets offers among the highest leverage on the VIX through its offshore entity. This will appeal to traders with a large risk appetite looking to seriously magnify their purchasing power beyond what their capital would otherwise allow.

Essentially, global traders that sign up with the branch overseen by the more relaxed Seychelles Financial Services Agency (FSA), can access higher leverage afforded retail clients by regulators in Australian, UK and European jurisdictions. At brokers regulated by these brands, such as eToro and Skilling, the volatility index is available with 1:10 leverage.

The downside of highly leveraged trading is the risk of amplified losses, so a robust approach to risk management is needed.

Strong product range beyond VIX including forex, commodities and cryptos

As well as VIX futures, IC Markets offers a wide range of other assets including a handful of other futures, 60+ forex pairs, 2100+ stocks, gold and other commodities, indices including the S&P 500 and FTSE 100, bonds, and cryptocurrencies.

Not many brokers with volatility index trading offer more breadth or depth. Skilling, for example, only offers around 900 instruments while Deriv offers around 150.

This means traders will have plenty of alternatives during periods when the VIX is not moving, and they will also have access to the S&P 500 and other relevant US assets that have a relationship with the Volatility Index 75.

Excellent range of trading platforms including MetaTrader software

With MetaTrader 4, MetaTrader 5, and cTrader available, IC Markets provides its clients with some of the most powerful and trusted platform options. Importantly, there is also the chance to make use of a VPS service, meaning that experienced VIX traders can put the MetaTrader Expert Advisors or other trading robots to use.

However what stands out for us is that IC Markets also supports ZuluTrade, MyFxBook AutoTrade, and a proprietary copy trader called IC Social. Few other brokers with volatility index trading offer such a stacked range of tools. In fact, only Pepperstone rivals IC Markets when it comes to third-party trading software.

Flexible funding methods with 10 base currencies and fee-free deposits

We tested many leading brokers with volatility index trading and IC Markets outshines alternatives in terms of its global accessibility by providing a very flexible range of funding methods. The broker accepts funding from diverse sources, including regional banks, broker-to-broker and various e-wallets as well as the standard card and wire transfer.

You can also deposit in any one of 10 different currencies, including USD, EUR, GBP, JPY, CHF, and AUD. This is a strong point for this broker, since many firms only accept one or two currencies and a few funding methods, including eToro.

The result is that IC Markets is accessible to global traders interested in the VIX who can avoid inconvenient payment options and currency conversion fees.

Cons

Weak regulatory oversight at the global branch

Although IC Markets’ offshore entity does bring the advantage of high leverage, traders should be aware that they will not be covered to the same extent as a heavily regulated alternative.

This doesn’t make IC Markets an unreliable broker – the company does have EU and Australian-regulated branches, for instance. However, many traders will still prefer to opt for a regulated alternative that provides the strongest possible cover when trading the VIX. Pepperstone and eToro are the safest VIX brokers on this list in terms of regulatory oversight.

No negative balance protection

The offshore branch of IC Markets does not provide negative balance protection as standard.

This is an important measure when trading the volatility index with leverage, as it prevents you from becoming indebted to the broker should trades turn against you.

All the other brokers with volatility index trading on this list do offer negative balance protection.

No bonus offers or other incentives

IC Markets’ offshore branch is not constrained by regulations restricting sign-up, deposit or other trading bonuses, so it will be shame for some that they don’t provide these to prospective traders.

With that said, we never recommend selecting a broker based on bonus deals alone. This is a very small part of the equation and some offshore brokers attach challenging volume requirements to bonuses so withdrawing associated profits is difficult anyway.

Why Is IC Markets Better Than The Competition?

IC Markets is one of the most reliable offshore brokers on the market, meaning that clients can trade VIX futures with high leverage while still being assured of an excellent trading experience.

Other brands cannot provide the same level of leverage on the VIX while also boasting such a strong track record and reputation.

Who Should Choose IC Markets?

IC Markets’ offshore entity is a great choice for traders who want to access higher leverage on the volatility index beyond the levels provided by EU, Australian and UK-regulated brokers.

Because of the strong trading software with VPS and robot support, IC Markets will also be a good choice for experienced traders to execute fast-paced day trading strategies which often suit the VIX and work well with leverage.

Who Should Avoid IC Markets?

IC Markets’ global branch is a poor choice if you want investor protections and regulatory measures like negative balance protection and access to compensation schemes.

If you are not planning to trade with high leverage, a top-tier regulated broker like Pepperstone is a better choice. Alternatively, you can sign up with the EU or Australian-regulated branches of IC Markets.

Deriv.com: Best Synthetic Volatility Index Broker

Why We Recommend Deriv.com

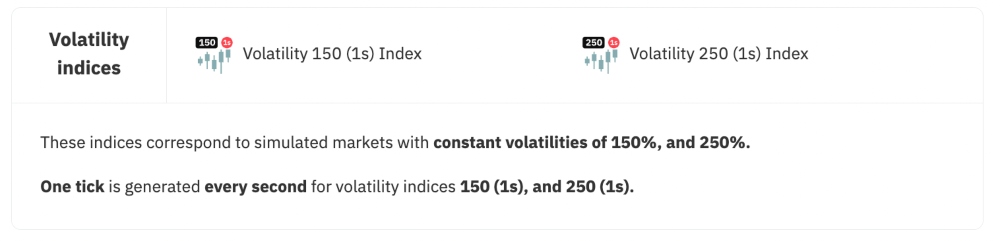

Our final recommendation for volatility index trading offers users a different experience. Deriv.com offers synthetic index trading on several volatility indices, meaning that the price movements are generated algorithmically and are not linked to real-world events.

Here, volatility refers to the degree of volatility driving the price movements of the index, with higher volatility meaning more frequent and more drastic price movements.

Deriv.com offers indices with 150% and 250% volatility and ticks generated every second, plus a Boom 300 and Crash 300 index simulating periods of rapid price increase or decrease respectively. This provides a good selection for traders, simulating market conditions that will suit a range of trading styles.

Another perk for us is that Deriv’s volatility indices can be traded over the weekend, suiting many casual retail traders.

Our team explain the benefits and drawbacks of trading volatility indices with Deriv in more detail below.

Pros/Cons of Deriv.com

Pros

Synthetic indices are an interesting alternative to the traditional VIX

The proprietary synthetic volatility indices offered by Deriv.com are different to the products on offer from almost any other broker we reviewed and tested.

Even if you regularly trade on real-world markets, an account with Deriv.com can provide an interesting break where the bets are on ‘pure’ numbers and not influenced by surprise real-world events.

Volatility index trading is available around the clock

Since synthetic indices are not traded on physical markets, they truly never sleep. While other brokers’ VIX assets are only available during market hours, including at IC Markets and Skilling, Deriv.com traders can access volatility index trading 24/7. This is a serious plus if you want to trade over the weekend.

Good for technical analysis on volatility indices

Because of the nature of synthetic indices, they are a good choice for traders who are interested in technical analysis approaches.

There are no fundamentals or news events to factor in here; the price movements are computer generated to simulate real-world market movements, making Deriv.com an excellent place to sharpen up your technical analysis skills.

Reliable broker with 2.5+ million clients

Deriv.com is overseen by several financial bodies including the Malta Financial Services Authority (FSA), giving the broker EU regulation. This, and the broker’s good track record and reputation, assure traders they are dealing with a legitimate company and can trade volatility indices in a secure environment.

With that said, it is worth noting that Deriv does not operate with the same degree of regulatory oversight as other volatility index brokers we evaluated. Both Pepperstone and eToro are better options if you want a firm authorized by tier-one regulators.

Cons

…It’s not real

We are fans of Deriv.com’s synthetic indices, and we think they provide a good alternative for volatility index traders, but in the end, they are simply not the real thing. Ultimately, many traders will prefer brokers that let them trade the real VIX.

A limited selection of volatilities

Deriv.com’s list of synthetic volatility indices once covered much broader ground, with seven volatilities available from 10% through 250%.

Although most traders will prefer the faster-paced indices available now, we think it is a shame that the old flexibility is no longer available, which limits trading setups.

A limited selection of alternative assets outside of volatility indices

Deriv.com ranked poorly in our list of brokers with volatility indices when considering the access to additional assets.

Users can trade forex, stocks, commodities and cryptocurrencies through Deriv.com, but compared to the other top volatility index brokers the asset list lacks depth with less than 100 tradeable assets. This is in comparison to the thousands of instruments offered by other top VIX brokers, such as Pepperstone and IC Markets.

Why Is Deriv.com Better Than The Competition?

Deriv.com isn’t the best volatility index broker, but it does offer something different to all competing brokers – an alternative take on volatility indices that are available 24/7.

As the industry-leader in synthetic indices, Deriv.com stands out from the competition for traders willing to give these bespoke products a try.

Who Should Choose Deriv.com?

Traders who like making short-term, technical analysis-driven trades should try Deriv.com’s synthetic indices.

After reviewing a range of brokers with volatility indices, our team found that Deriv.com is also the best option for around-the-clock trading, especially for users interested in trading on the weekend.

Who Should Avoid Deriv.com?

Traders interested in the Chicago Board Options Exchange (CBOE)’s volatility index 75 should not sign up with Deriv.com, as they do not offer this.

Also, users who favor trading in a heavily regulated environment should consider alternative brokers in our list. Deriv.com does not match Pepperstone, for example, when it comes to regulatory oversight.

What To Look For In A Volatility Index Broker

There are several key things you should consider when choosing a broker with volatility index trading:

- Regulation and reputation

- Competitive and transparent pricing

- High-quality and reliable trading software

- Diversification opportunities on related products

- Accessible account conditions

Choose A Trustworthy VIX Broker Overseen By A Good Regulator

It is important to ensure that you sign up with a reliable and regulated VIX broker to make sure your money is as safe as possible.

The best regulators ensure that brokers comply with strict rules. This includes negative balance protection, meaning that you cannot lose more than your account balance on leveraged VIX trades, plus segregated accounts, ensuring that client and company funds are kept separate.

Besides this, many top-tier regulators in countries like the UK also ensure that clients’ funds are protected in case the broker’s business fails. In the UK’s case, the Financial Services Compensation Scheme (FSCS) provides protection of up to £85,000.

The UK’s FCA, US regulators FINRA and SEC, and Australia’s ASIC are all considered exemplary organizations. Many trustworthy brokers are also regulated by tier-two bodies like Cyprus’s CySEC.

Weaker regulatory bodies include many offshore financial agencies. Unlike top-tier regulators, these bodies do not hold much power over the brokers they oversee, and you should be wary of signing up with an offshore firm. You risk losing all of your money should the broker go under or behave inappropriately.

Importantly, we recommend checking a broker’s credentials on the respective regulator’s database, such as the FCA register. This will also help you weed out firms that falsely use the registration details of licensed firms, like ExpoToro/TraToro did with eToro’s authorization details.

Choose A VIX Broker With Low Fees

A broker’s fees are one of the most important considerations for volatility index traders because they have a direct impact on your ability to turn a profit.

The choice of fees is not always a simple one, since it will depend partly on your trading style. Brokers usually earn their money through spreads, through commissions and through non-trading fees.

The non-trading fees are usually the easiest to factor in, and a good, reliable volatility index broker will be up-front and transparent about these. They include deposit and withdrawal fees, account maintenance or inactivity fees, or charges for specific services, such as extra analysis tools. The best brokers with volatility index trading can keep these fees close to zero or near to zero.

It is more difficult to compare the price of direct trading fees, since VIX brokers often have a variable spread that can widen during periods of volatility. Generally, though, raw spread accounts with a low commission will be the cheapest in the long run for active traders, particularly high-volume day traders who need to profit from relatively small price movements.

The wider spreads from commission-free accounts can make that challenging, but they can suit traders who have longer-term setups.

Our tip is also to consider a broker’s ‘average spreads’ on the VIX over a set period, rather than just the minimum spread which can be deceiving. Fortunately, the top brokers with volatility index trading, including Pepperstone and Skilling, publish both the minimum and average spread figures.

Finally, we always recommend considering what you get for your money. Some VIX brokers may have slightly higher trading fees, but offer faster execution speeds, trading signals and access to more advanced market research, which can indirectly help profit margins.

Ultimately, it is about balancing fees with the quality of the service and tools you get.

Choose A VIX Broker With Excellent Trading Software

The trading platform is what you will use to read VIX charts, analyze market conditions and execute trades, so it is one of the most important factors when you choose a broker.

You should find a broker with a platform that you’re comfortable trading with and which has all the tools and features you need. MT4, MT5 and cTrader are considered excellent choices for trading the volatility index and most other assets. Of all the brokers with volatility index trading that we tested, MT4 was the most widely available option.

An important feature that some users should consider when choosing a platform to trade the VIX is automated trading support. This usually isn’t something we recommend newer traders to start worrying about until they have learned the basics, but it is good to have the option to progress to this because Volatility Index 75 trading can lend itself to short-term, automated strategies.

MT4 and MT5, in particular, are extremely well regarded for their Expert Advisors (EAs), trading robots that will implement your strategy without manual intervention, and these can be very useful when trading the volatility index and its associated instruments like the S&P 500 and NASDAQ 100.

Choose A VIX Broker That Offers Diversification Opportunities

The volatility index can be traded as an asset in itself using CFDs and other derivative products, but it was originally created as a gauge of market conditions. If you only trade the VIX, you could be missing out on other trading opportunities related to it.

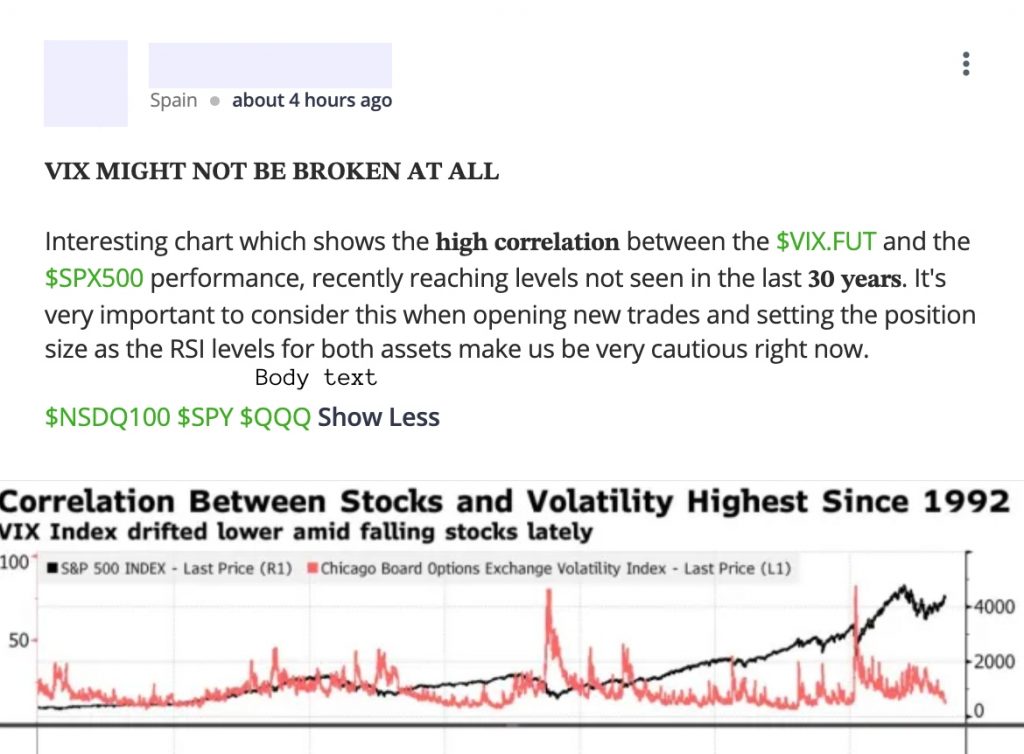

An important instrument with regard to the VIX is another index, the S&P 500. This tracks the performance of the top 500 companies in the US, and the VIX was designed to indicate the level of volatility experienced on this index by looking at the changing dynamics of options trading.

You may therefore want access to other S&P 500 products when trading VIX, since the chart movements of the two are intertwined and good knowledge of one may provide trading opportunities on the other.

You may also look at related assets such as the NASDAQ 100, which contains many of the largest companies on the S&P 500.

Even some commodities have been shown to have a correlation to the VIX, as heightened volatility and fear in the markets can lead to more demand for ‘safe havens’ like gold, and vice versa.

So, it can make sense to have a good range of products available so that you can branch out and capitalize on more opportunities beyond just the VIX.

Choose A VIX Broker With Accessible Account Conditions

We have evaluated dozens of brokers with volatility index trading and entry requirements can vary significantly. Important elements to consider are the minimum deposit requirement, accepted deposit and withdrawal methods, and supported base currencies.

The minimum deposit will be the first hurdle for beginners looking to speculate on the volatility index with an online broker. We consider anything below $200 low and anything above $500 high. We also see an increasing number of VIX brokers offering minimum funding requirements of less than $100 and even $0 in some cases.

Yet whilst this will understandably appeal to newer traders, our experience has taught us that sometimes it is worth paying more upfront to get access to a better suite of advanced tools like Autochartist, plus more competitive trading conditions with lower fees.

Another worthwhile consideration when choosing between VIX brokers is support for fee-free and near-instant deposit solutions like PayPal. This can make it easier to load your account and start trading quickly. Bank transfers often provide the slowest processing times in our experience, sometimes taking up to five working days and incurring third-party fees.

Fortunately, all the volatility index brokers in our top list accept fast deposits via bank cards, popular e-wallets, wire transfer, and in some cases – crypto.

A final, and often overlooked factor, is the base currencies offered by a brokerage. The base currency of your account will be the currency your deposit is paid in, the balance your account is displayed in, and the currency you manage your VIX trading activity in.

We have evaluated a long list of brokers with volatility index trading and most popular brands offer accounts in USD, EUR, GBP, with lesser but still fairly decent support for AUD and CAD. This will cater to a large global customer base, but traders based outside of these regions may need to shop around to find a broker with more choice. IC Markets is a good place to start here, with 10 currencies accepted, including NZD, SGD, HKD and CAD.