Admirals

-

💵 CurrenciesUSD, EUR, GBP, SEK, CHF, CZK

-

🛠 PlatformsMT4, MT5, TradingCentral

-

⇔ Spread

GBPUSD: 1 EURUSD: 0.6 GBPEUR: 1 -

# Assets50

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

My Opinion On Admirals

I signed up with Admirals, traded forex on its platforms and evaluated the full suite of services, and what stands out is the market-leading tools, including MetaTrader Supreme Edition and Stereo Trader. I also compared the trading fees to alternatives and found that Admirals is noticeably cheaper, especially if you want to trade major forex pairs.

However, my first-hand experience at the broker also reveals some negatives. For example, the $250 minimum deposit is on the high side of forex brokers I review, which may deter some beginners. Also, I found that you only get one free withdrawal each month, after which you have to pay a 1% fee.

Fortunately, these are minor complaints for me. Overall, the benefits of trading forex at Admirals far outweigh the weak points based on my tests.

Summary

- Instruments: 8000+ including 80+ forex pairs, stocks, indices, commodities, bonds, ETFs

- Live Accounts: Trade.MT5, Invest.MT5, Bets.MT5, Zero.MT5, Trade.MT4, Zero.MT4

- Platform & Apps: MT4, MT5, Admirals App

- Deposit Options: Bank wire transfer, credit/debit card, PayPal, Skrill, Neteller, iDEAL, PoLi, Klarna

- Demo Account: Yes

Pros & Cons

- I give Admirals a high trust score thanks to its tier-one regulatory oversight and 40+ industry awards

- Admirals offers one of the best MetaTrader suites I have seen with multiple bolt-ons

- There is a huge investment offering with 8000+ instruments and 80+ currency pairs

- The Analytics Portal is really useful with deep insights into popular currency pairs

- Customer support is excellent with response times of <3 minutes during my tests

- The educational resources are top-rate with access to demo trading

- My testing shows that forex trading fees are very low

- I found the demo account expires after 30 days unless you open a live account

- The $250 minimum deposit for Trade accounts is higher than many competitors

- The copy trading app is easy to use but not as good as eToro’s

- Only one withdrawal is free each month, then you have to pay 1%

- You can expect average execution speeds of 100ms to 250ms

Is Admirals Regulated?

For me, one of the most important considerations is whether a forex broker is trustworthy, as this will help keep you safe from scams. That is why I always check if a brokerage is authorized by respected regulators.

Thankfully, I examined Admirals regulatory credentials and it is licensed by six financial bodies, several of which I consider tier-one. These include the UK Financial Conduct Authority (FCA) and the Australian Securities & Investments Commission (ASIC). The Cyprus Securities & Exchange Commission (CySEC) is also respected.

This sends a clear sign of a professional operation that adheres to stringent customer safeguards. Moreover, I did not find reports of scams or security breaches while researching the broker’s history.

For peace of mind, below is a full breakdown of the broker’s regulatory credentials.

- Admiral Markets UK Limited – Regulated by the UK Financial Conduct Authority (FCA), license 595450

- Admiral Markets Cyprus Ltd – Regulated by the Cyprus Securities and Exchange Commission (CySEC), license 201/13

- Admirals AU Pty Ltd – Regulated by the Australian Securities & Investments Commission (ASIC), license 410681

- Admiral Markets AS Jordan Ltd – Regulated by the Jordan Securities Commission (JSC), license 57026

- Admirals SA (Pty) Ltd – Regulated by the South African Financial Sector Conduct Authority (FSCA), license FSP51311

- Admirals KE Ltd – Regulated by the Kenyan Capital Markets Authority (CMA), license 178

Forex Accounts

The wide range of accounts available at Admirals – Trade.MT5, Invest.MT5, Bets.MT5, Zero.MT5, Trade.MT4, Zero.MT4 – is a mixed bag in my view.

On the one hand, I think it’s good to have a choice of accounts to suit different trading styles and requirements. However, I also find that adding multiple accounts to differentiate between the different platforms is a needlessly complicated step, which makes getting started trickier.

And, while it is always good to have the choice between commission-free trading and raw spreads, I find it frustrating that some account types have narrower investment offerings, with the Trade.MT4 account limited to just 37 forex pairs.

Another observation is that an Islamic account option is only available on Trade.MT5, so you can’t get swap-free trading conditions on the MetaTrader 4 platform.

In my opinion, the key things to decide are which platform you want to trade on (MT4 or MT5) and which pricing model you want (commission-free variable spreads or raw spreads with a low commission). This will help you find the right solution.

I have also compared the different trading accounts below to make it easier.

| Trade.MT5 | Invest.MT5 | Bets.MT5 | Zero.MT5 | Trade.MT4 | Zero.MT4 | |

|---|---|---|---|---|---|---|

| Trading Platform | MT5 | MT5 | MT5 | MT5 | MT4 | MT4 |

| Spreads | From 0.5 | From 0.0 | From 0.5 | From 0.0 | From 0.5 | From 0.0 |

| Commission (Forex) | $0 | NA | $0 | $1.8 to $3.0 per lot | $0 | $1.8 to $3.0 per lot |

| Minimum Deposit | $250 | $1 | £100 | $250 | $250 | $250 |

| Base Currencies | EUR, USD, GBP, CHF | EUR, USD, GBP, CHF | GBP | EUR, USD, GBP, CHF | EUR, USD, GBP, CHF | EUR, USD, GBP, CHF |

| Instruments | Forex, Commodities, Indices, Futures, Stocks, ETFs, Bonds | Stocks, ETFs | Forex, Commodities, Indices, Futures | Forex, Commodities, Indices | Forex, Commodities, Indices, Stocks, Bonds | Forex, commodities, Indices |

How To Open A Live Account

Admirals doesn’t have the fastest sign-up process I have seen. It took me around around 15 minutes to fill in the required details and get started.

- In the application form, select your country of residence, add your email and phone number, and create a password, then select ‘Sign Up’

- Activate your account by selecting ‘Confirm Email’ in the link sent to your registered email

- From the client dashboard select ‘Open Live Account’ on the right-hand side (green button)

- Select ‘Individual’ client type and accept the terms and conditions

- Choose your country of residence from the menu and click ‘Next’

- Add your personal details on the following page (name, citizenship, date of birth, place of birth and gender)

- Add your address on the next page and select ‘Next’

- Provide your identification number (e.g. unique taxpayer reference number for UK residents)

- Input your financial status including income and assets

- Confirm US/non-US citizenship, education level, and employment status

- Review and agree to the terms and conditions

- Upload your identity and residency documents

Trading Fees

Of the more than 100 forex brokers I have reviewed, few come close to the tight spreads and low overall fees offered by Admirals.

During my tests, the average spread on the GBP/USD pair was 0.6 pips, which considering that this is a commission-free account, is about as good as you will find from any broker.

Commission fees are also very low on the Zero account, ranging from $1.80 to $3 per lot, and with spreads from 0 pips, this is another very affordable contender in its class.

Ultimately, pricing is one of the areas where Admirals really shines based on my evaluation.

Non-Trading Fees

The $10 inactivity fee for dormant accounts is a frustrating if common fee; however, as it is only activated after 24 months of zero trading I don’t deem this a serious issue.

There are no deposit charges, though a 1% fee applies to withdrawals. This will be quite steep for traders who make large withdrawals, but I recommend trying to avoid this by making use of the one free withdrawal each month.

The other charge I noticed was a 0.3% currency conversion fee applicable for any transactions I make in different currencies to my base currency.

Swap rates apply on positions held overnight, but again, this is standard practice. These can also be avoided by signing up for an Islamic forex account, though I did note that an administration fee applies after 3 days.

Payment Methods

Finding a forex broker with a good selection of accessible, secure and low-cost deposit methods is important for me, as it makes the account funding process convenient.

Fortunately, I have been impressed with Admirals’ range of payment methods, which includes a good selection of e-wallets and traditional methods, all with free deposits and usually a one-working-day or faster processing time, with withdrawals often processed on the same day.

The majority of forex trading accounts have a $250 minimum deposit, though UK traders can use the spread betting profile with an initial £100 investment.

Though I generally consider anything under $500 competitive, $250 is still noticeably higher than several competitors I have reviewed, such as XTB and Pepperstone, both of which have no minimum deposit. These are better options if you want low entry barriers.

Some of the most popular deposit methods include PayPal, Skrill, Neteller, iDEAL, POLi, Bank wire transfer, plus Visa and Mastercard.

How To Make A Deposit

The deposit process is another area where I enjoyed using Admirals, thanks to its smooth interface and intuitive steps:

- Log in to the Admirals Trader’s room

- Click the ‘Deposit’ icon on the relevant account

- Payment options will be displayed in the centre of the following page

- Choose your preferred method by clicking on the icon

- Complete the relevant prompts below including the deposit amount and select ‘Deposit’

- Once funds have cleared, your account balance will be updated next to your live account details

Forex Assets

I prefer brokers that provide excellent coverage of the foreign exchange market as it provides more trading opportunities. With this in mind, I investigated the number of currency pairs available in Admirals’ trading platforms and then compared this to alternatives, to see how competitive the offering is.

I found that Admirals offers over 80 forex CFDs, including majors, minors, and exotics. This is definitely on the high side of forex brokers I test and is more than competitors like XM and AvaTrade, both of which offer around 50 forex assets.

Importantly, Admirals also offers many of the most popular currency pairs, which I show in the table below.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | GBP/AUD | Yes |

| GBP/USD | Yes | USD/CAD | Yes |

| AUD/USD | Yes | USD/CHF | Yes |

| GBP/JPY | Yes | GBP/NZD | Yes |

| USD/JPY | Yes | EUR/GBP | Yes |

Non-Forex Assets

Another important consideration for me is the availability of additional instruments to diversify my holdings and strategies beyond forex. So, I always look at both the breadth and depth of product portfolios.

Fortunately, with over 8000 assets tradeable including commodities, bonds, stocks, and ETFs, Admirals excels in this area. This is more than the vast majority of brokers, giving you one of the most diverse product lists around.

Admirals is also one of the few brokers I have seen to offer direct stock investing, as well as fractional shares. Direct share dealing will appeal to longer-term investors, while fractional shares lower the financial barrier for beginners.

While using Admirals, I found that you can trade:

- 30+ commodities: precious metals, energies, and agriculture including Gold, Crude Oil, and Natural Gas

- 30+ Indices: popular index funds such as the DAX40, NASDAQ100, FTSE100 and S&P500

- 3500+ Stocks: US, EU, and UK shares including Facebook, Tesla, BMW, BP, and HSBC

- 100+ ETFs: US and EU exchange-traded funds such as SPDR S&P 500 Trust, iShares MSCI Emerging Markets, and iShares Core DAX

- Bonds: 10-year Germany Bund Futures CFD and 10-year US Treasury Note Futures

Execution

Admirals uses straight-through processing (STP). What I appreciate about this model is that there is no dealing desk intervention, as orders are routed directly to the broker’s liquidity providers, removing potential conflicts of interest.

Leverage

When I am reviewing forex brokers the level of leverage available is important as it allows me to multiply my buying power, and in return, my potential profits. However, very high leverage also comes with its own risks, mainly that I could lose a large amount of money.

My first-hand research shows that Admirals offers leverage up to 1:500 on major forex pairs if you sign up with its offshore entity. This is very high so I would only recommend using this if you are an experienced trader with a good grip on risk management.

Alternatively, EU, UK and Australian traders can access forex leverage up to 1:30. This is what you will find at other tightly regulated brokers.

Importantly, while trying Admirals I found that your account may be subject to a margin call and positions can be closed automatically in line with its 50% stop-out level (ratio of account equity to reserved margin).

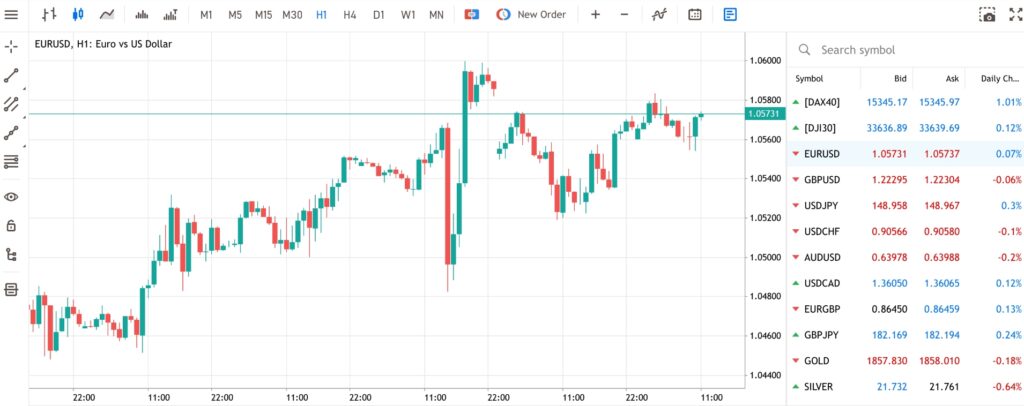

Platforms & Apps

Having thoroughly tested Admirals, its trading platforms and tools are the key selling point for me. Rarely have I seen a forex broker that offers access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) with the same number of value-add bolt-ons.

This ultimately makes for a comprehensive trading experience in my view. I have everything I need to analyze and speculate on the foreign exchange market in a clean, user-friendly interface.

Like many traders, I am a long-time user of the MetaTrader platforms, and I feel they offer the perfect blend of intuitive and user-friendly interfaces with advanced customization and analytical tools for experienced traders.

Importantly, MT4 and MT5 work smoothly via major web browsers, desktop clients, or mobile apps, and I find it easy to switch between computer and mobile to stay up to date with the current market events.

I found that the broker also offers Parallels macOS for users to run MT4 and MT5 seamlessly and operate several virtual spaces at once.

Based on my time testing the platforms, MT5 would be my pick for most traders. It is newer, with faster processing, more order types and indicators, plus a built-in newsfeed. With that said, if you are familiar with MetaTrader 4 then I can understand sticking with what you know.

I have pulled out the key features of each platform below.

MT4

- Four pending order types and trailing stop

- Three chart types with nine timeframe views

- One-click trading and trade directly from charts

- Concealed IP addresses and 128-bit encryption security

- Algorithmic trading functionality using Expert Advisors (EAs)

- 24 analytical tools plus access to a catalog of custom tools

- 30+ integrated technical indicators such as Bollinger Bands and Average True Range

MT5

- Six pending order types and trailing stop

- Three chart types with 21 timeframe views

- Multi-thread strategy backtesting capabilities

- 44 analytical tools plus access to a catalogue of custom tools

- Integrated economic calendar and Depth of Market data (DoM)

- Access to Expert Advisor (EA) automated trading capabilities with MQL5 programming language

- 38+ integrated technical indicators such as Alligator and Momentum

How To Open A Forex Trade

I have placed trades on both MT4 and MT5 and the process is very similar:

- Open the ‘Market Watch’ window on the left-hand side of the platform

- Right-click on the forex pair to trade from the watchlist menu or the chart

- Click ‘New Order’

- Add your trade parameters such as order type, volume, and risk management stops and limits

- Confirm the order by selecting ‘Buy’ or ‘Sell’

Forex Tools

I feel Admirals has put together an excellent suite of extra tools that puts it in the same bracket as industry leaders like Pepperstone, with a VPS, copy trading and analysis tools to suit all kinds of traders.

However, as I alluded to above, it’s the add-ons for the MetaTrader suite which really make the forex broker stand out. They elevate the trading environment in my view.

MetaTrader Supreme Edition

My favorite free addition is the MetaTrader Supreme Edition. This is a collection of advanced tools that can be integrated into the terminals. It includes an indicator package, strategy simulator, global opinion widgets, and access to the mini terminal.

StereoTrader

This unique tool offered by Admirals provides more optimized order technicalities in the MT4/MT5 platforms, with tighter precision and premium features designed to offer more control of investments.

I see this as a great tool for experienced traders looking to improve efficiency.

Trading Central

Trading Central is an excellent technical analysis and research tool that can be accessed through MetaTrader Supreme.

While using Admirals, two versions were available to me, covering forex ideas and technical insights. Importantly, I found both useful but would recommend the former for beginners due to the educational commentary and real-time price tracking. This can really help inform the decision-making process.

Copy Trading

Admiral Markets offers an intuitive copy trading solution that I think is good for beginners looking to trade through the expertise of established forex investors. The tool can be accessed via the left menu of the client dashboard.

During my testing, I was impressed with the risk tolerance questionnaire, which provides a filtered view of signal providers and can help you find one that suits their needs.

However looking at the negatives, I don’t think the usability of the platform matches that of eToro. For me, eToro’s performance metrics are cleaner and easier to follow, especially the returns and risk ratings.

VPS

After opening an Admirals account and investigating the tools available, I found a free VPS service is available if you have €5000 in account equity.

I would recommend this for serious investors and algo traders who value 24-hour low-latency connectivity.

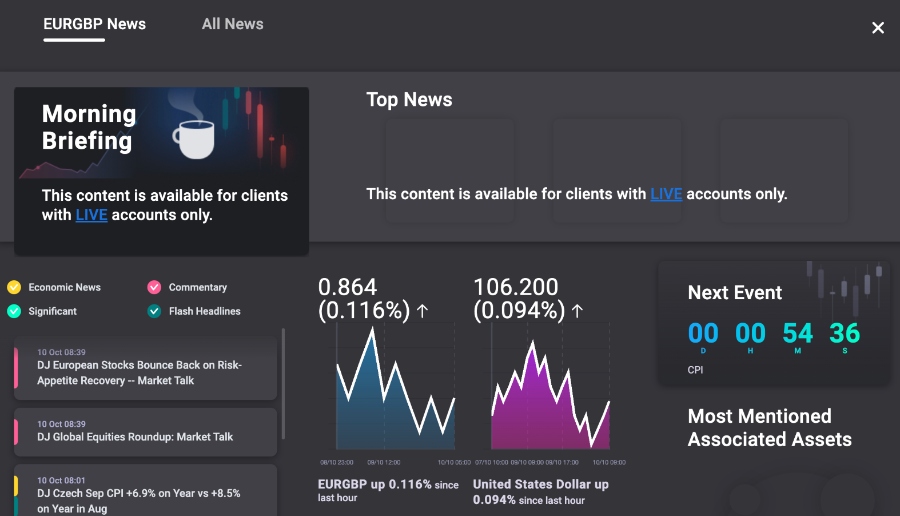

Forex Research

I have been very impressed with the research and analytics available to me in my Admirals’ client area. When I open the Analytics Portal, I can view global sentiment indicators, technical and fundamental analysis, and market news from industry sources including Dow Jones and Trading Central.

The real highlight for me is that I can view analytics specific to popular currency pairs, including the EUR/USD and GBP/USD. This gives me a real deep dive into key forex assets, from morning news headlines to sentiment indicators. To make this even more useful, I would like to see the broker offer deep insights into other, less popular currency pairs.

The forex calendar is also helpful, with upcoming financial announcements and global events in one useful view.

Aside from this, I appreciate the additional research tools, including a weekly trading podcast, calculators, and market heat map. I have compared Admirals to many competitors and few offer the same number or quality of research tools.

Forex Education

When I evaluate forex brokers, I also assess the educational resources available. These can prove particularly useful if you are a beginner, but even experienced traders always have more to learn.

Importantly, Admirals’ educational materials stand out thanks to the range of content for beginners, though I was also impressed to see learning materials aimed at intermediate and advanced investors.

As well as the standard articles, e-books, and a glossary of key terms, I especially enjoyed the ‘Zero to Hero’ 20 days of lessons, providing a deep dive into forex trading. This is where I would start if you are new to forex trading.

Alternatively, the ‘Forex 101’ pathway of nine lessons is another resource I enjoyed, mainly because it has the added benefit of written notes and interactive quizzes. This course also finishes in demo mode, where you can put all your learning into practice. I feel this interactive approach is a perfect way to develop and test forex strategies if you are new to online trading.

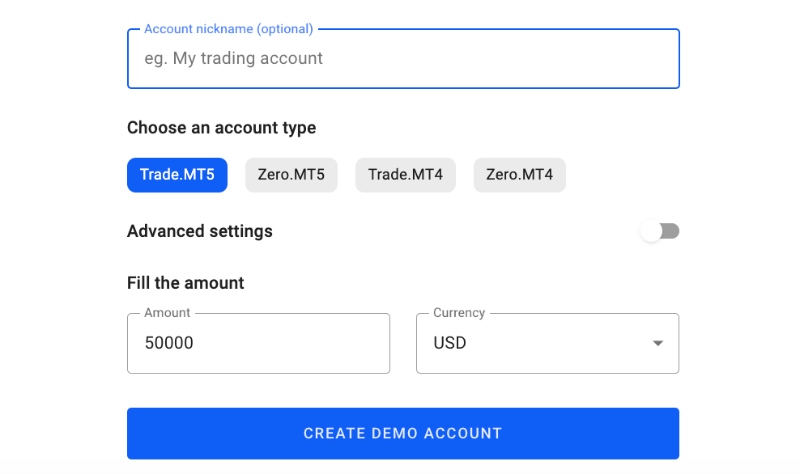

Demo Account

Having access to an accessible and feature-rich demo account is important to me. That’s why I always sign up for a paper trading account where possible, and Admirals is no exception.

When I signed up for the free demo account, I found that it offers access to MT4 and MT5 with live pricing, historical market data and a real-time news stream – an offering that I see as top-rate.

Though I was disappointed to discover a 30-day time limit, I was reassured that this is lifted for live account holders, and I really enjoy how Admiral integrates its demo account in its educational content, making this one of the best training tools I have come across at any forex broker.

How To Open A Demo Account

It took me less than five minutes to active demo mode and sign up for an Admirals account using the instructions further above. Once you are in the client portal:

- Select ‘Manage Your Accounts’ and then click the ‘Demo’ tab

- Select ‘Open Demo Account’

- Choose between Trading, Investing, or Spread Betting (UK only)

- Select an account type to mirror

- Input a virtual balance amount and choose a currency from the dropdown

- Select ‘Create Demo Account’

Bonus Offers

I always thoroughly investigate any trading promotions available to new and existing traders. While I never recommend picking a broker based on their bonus deals, I know some aspiring traders appreciate trying new strategies with free trading credit.

My testing shows that Admirals does offer sign-up bonuses for new customers, but it depends on your location. Examples of previous financial incentives available to global traders have included a $100 no-deposit bonus and a 100% deposit bonus for payments over $2,500.

Trading Restrictions

I signed up with Admirals, used the trading platforms and didn’t come across any strategy restrictions. As a result, you can use forex scalping, algo trading, news trading, and hedging.

Alternative Brokers for US

Customer Service

Having an easy-to-reach and reliable customer support team is essential for me. I find it very frustrating when I can’t get help quickly if I run into platform or technical issues. That is why I did a thorough test of the Admirals’ support team and then compared the response times and quality of responses with competitors I have used.

Importantly, my testing shows that Admirals offers some of the best customer support in the industry, thanks in part to country-specific contact details (email and telephone).

There is also a multilingual live chat service, which provided me with a fast response time of less than 3 minutes on each of the occasions I tested it.

I also find the initial chatbot easy to use, with suitable answers typically provided instantly. In contrast, I often find the chatbots at other brokers slow and unable to provide me with the help I need.

Company Details

Admiral Markets was established in 2001 and has headquarters in Tallinn, Estonia. It has since rebranded to Admirals, and serves hundreds of thousands of traders across the world.

The forex broker is licensed to provide trading services through six entities, with regulation from the likes of the CySEC, ASIC, and the FCA.

My research into the broker’s history also revealed that it has won over 40 industry awards, which reassures me that it is a legitimate and trusted trading firm.

Trading Hours

I have found that the forex market is open 24 hours a day, 5 days a week at Admirals. The broker’s trading hours are Sunday 10 PM to Friday 10 PM (GMT).

I also rate the forex calendar available on the broker’s website, which includes additional information not typically offered by alternative brands, including impacted currencies, forecasted price impacts, and comparable previous events.

Who Is Admiral Best For?

I have reviewed more than 100 forex brokers and in my view, Admirals is a serious contender in almost all respects. The MetaTrader add-ons and very low fees help separate the firm from most competitors, and make Admirals an excellent option for serious forex investors looking for reliable trading tools.

The free demo account and top-tier educational materials also make Admirals good for beginners based on my assessment, though a lower minimum deposit would make it even better.

FAQ

Is Admirals Legit Or A Scam?

I have found nothing during my research of Admirals or my time using the broker to suggest they are a scam. The strong regulatory oversight and dozens of awards are also good signs that they are a legitimate forex broker.

Can I Trust Admirals?

I give Admirals a high trust score thanks to its authorization from tier-one regulators, excellent reputation, multiple awards and large global client base.

Does Admirals Offer Low Forex Trading Fees?

Admirals offers very low fees based on my testing. This is especially true on major forex pairs, which are available with sub 1-pip spreads. Equally, the Zero account offers below-average commissions that start from $1.80 per lot in forex.

Is Admirals A Regulated Forex Broker?

Yes, Admirals is a regulated forex broker. I verified the firm’s credentials on the databases of all advertised regulators, including the CySEC, FCA, ASIC, FSCA, CMA, and JSC.

Is Admirals A Good Forex Broker For Beginners?

My analysis shows that Admirals is an excellent forex broker for beginners. The educational content is some of the best I have seen in the market, and there is a demo account, copy trading, plus a responsive customer support team on hand to answer queries.

Does Admirals Have A Forex App?

Yes, Admirals has a proprietary mobile app. You can use it to fund and manage your account, analyze the foreign exchange market, and place trades. It has a simple interface with a clear menu and navigation panels, making it easy to learn and use.

How Long Do Withdrawals Take At Admirals?

Admirals aim to process all requests the same day if received before 5 PM, though transaction times will vary depending on the method being used. Based on my research, you can normally expect to wait up to five working days to receive funds.

Can You Make Money Trading Forex With Admirals?

With low fees, best-in-class trading software and reliable execution, you can make money trading forex with Admirals.

But I would caveat that it is by no means guaranteed. Online trading is risky so only invest what you can afford to lose. My tip is to also make use of the risk management tools available in Admirals’ platforms, including stop losses.

Article Sources

Admiral Markets UK Ltd – FCA Licence

Admiral Markets Cyprus Ltd – CySEC License

Admirals AU Pty Ltd – ASIC License

Admiral Markets AS Jordan Ltd – JSC License