Anzo Capital

-

💵 CurrenciesUSD, EUR

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: 0.3 pips EURUSD: 0.0 pips GBPEUR: 0.3 pips -

# Assets45

-

🪙 Minimum Deposit$100

-

🫴 Bonus OfferWelcome Bonus Up To $500

My Opinion On Anzo Capital

Anzo Capital is a forex broker that ticks a lot of my boxes – it offers a choice of STP or ECN execution models, promising fair pricing and fast execution, and supports two leading platforms in MetaTrader 4 and MetaTrader 5.

On the cover, this should be a broker to suit FX investors of all stripes and strategies, but there’s a lot more that makes a great broker, so I’ve done a deep dive and spent weeks testing Anzo’s services to discover whether it lives up to its promise and what sets it apart from the competition.

My verdict: Anzo Capital is good if you want to trade forex with high leverage on the MetaTrader suite. Want to find out how I reached that conclusion? Read my full review below.

Summary

- Instruments: 100+ including 45 currency pairs, stocks, indices, metals, energies

- Live Accounts: ECN, STP, Cent

- Platform & Apps: MetaTrader 4, MetaTrader 5

- Deposit Options: Credit/debit card, bank wire transfer, Skrill, Neteller, DusuPay, Sticpay

- Demo Account: Yes

Pros & Cons

- I compared forex trading fees to alternatives and found very low commissions of $4 on the ECN account

- There are fee-free deposits and withdrawals with a seamless payment process

- I find the MetaTrader suite top-tier for technical analysis and algo trading

- The $25 minimum deposit lowers the entry barrier for beginners

- There are forex trading guides for all skill levels

- My research found no trustworthy regulation or negative balance protection

- The lack of market research or advanced tools impacts the trading experience

- I can't build a diverse portfolio due to the slim product portfolio beyond forex

- There are no rebates for high-volume forex traders

- I found that the demo account expires after 30 days

Is Anzo Capital Regulated?

By checking the respective regulators’ registers, I have verified that Anzo Capital runs two branches, registered with the Financial Services Commission of Belize (license number 000331/469) and the St Vincent & The Grenadines Financial Services Authority (license number 308 LLC 2020).

Unfortunately, I don’t recognize these as reputable financial watchdogs that oversee the foreign exchange market. They have less stringent member requirements for registered firms and do not enforce safeguards which I consider important.

For example, my review of the brand’s client agreement did not turn up any sign of negative balance protection, depriving customers of an important measure that prevents them from becoming indebted to the broker. Instead, the agreement states that ‘debts must be liquidated by the trading client within 10 days’. This is a major shortcoming and ranks the brand down in my opinion.

On the plus side, the broker states that it does segregate client funds from business money – though this is really the bare minimum and is a policy that any honest broker will implement.

If you want a tightly regulated forex broker, I recommend the alternatives below.

Alternative Brokers for US

Forex Accounts

Anzo Capital’s three account types – STP, ECN, or Cent – follow a familiar model for traders that I like; sometimes simple really is best.

The STP and Cent accounts provide commission-free trading with floating spreads, while the ECN account will suit serious traders who demand raw spreads and are willing to pay a low commission.

I like the Cent account for beginners and rate it as a good entry point to start trading forex on the live market. I find the minimum deposit requirement competitive at $20 and it is pleasing to see that there are no commission fees. That being said, trading on MetaTrader 5 is not permitted which is popular with forex traders.

If you want to trade forex with high leverage and floating spreads, STP would be my pick. You can trade forex with 1:1000 leverage, double that of the ECN and Cent accounts.

One disappointment while trading with Anzo Capital is the lack of an Islamic account with swap-free conditions. Otherwise, the broker has done well with its offering.

Below is my comparison of the different accounts.

| STP | ECN | Cent | |

|---|---|---|---|

| Minimum Deposit | $100 | $500 | $20 |

| Base Currency | USD, EUR | USD, EUR | USD |

| Spreads | Floating | Floating | Floating |

| Commission | $0 | $4 | $0 |

| Platform | MT4, MT5 | MT4, MT5 | MT4 |

| Leverage | 1:1000 | 1:500 | 1:500 |

| Account Manager | No | Yes | No |

How To Open An Anzo Capital Account

I enjoyed the sign-up process for Anzo Capital – while following the industry standard forms and ID verification processes, I found it quicker than many brokers since it did not demand information on sensitive information such as my employment status and earnings:

- Add your name, email address, and phone number to the application form

- Create a password, choose an account type, and select your nationality

- Agree to the T&Cs and click ‘Submit’

- Confirm your application by verifying the link sent to your email address

- Complete your personal details in the client profile and click ‘Submit’

- Upload your identity documents to complete the application

Trading Fees

The transparent fees at Anzo Capital are an advantage of the firm that I rate highly. All accounts offer floating spreads, with the tightest available on ECN accounts.

My analysis shows that trading fees are around the average, though I was pleasantly surprised at some of the spreads I was offered during testing. I find them reasonable on the commission-free STP accounts, but they are much more competitive on ECN accounts, making the low $4 round-turn commission worthwhile.

As a comparison, while trading with Anzo Capital the 0.3-pip spread I received on the GBP/USD pair was very close to rivals like Pepperstone; however, the $4 round-turn is considerably lower than Pepperstone’s $7.

To provide a clearer picture of the costs forex traders can expect, I recorded spreads on popular pairs:

| STP | ECN | |

|---|---|---|

| GBP/USD | 1.7 | 0.3 |

| EUR/JPY | 1.7 | 0.2 |

| AUD/CAD | 2.4 | 0.3 |

Non-Trading Fees

All in all, I see Anzo Capital’s non-trading fees as decent. A bonus for me is that not just deposits but also withdrawals are free, as long as you make the withdrawal from an active trading account. However, accounts with no trading activity at all or which have been dormant for a month or more will incur a 6% fee.

A $15 inactivity fee applies to dormant accounts after 90 days, which I feel is quite a short grace period, though the policy in itself is very common among the many forex brokers I have reviewed.

Besides these fees, swap rates apply on positions held overnight, including three days’ worth of interest on Wednesdays to cover weekend orders. Again, these are commonplace so I don’t mark the broker down here.

Payment Methods

The ease and convenience with which I can fund trading accounts is often neglected by forex brokers in my experience, which can be frustrating.

I prefer using forex brokers that offer flexible options, and Anzo Capital delivers with a good selection of e-wallet solutions, credit/debit cards, and wire transfers, with both Skrill and Neteller being good examples of the former.

A small downside is the small range of account base currencies, which I feel may put off international traders. Although with USD and EUR supported, a great many investors will be catered for.

Importantly, the broker does not charge any commission fees and I rate that Anzo Capital will also reimburse any third-party bank charges for wire transfer payments over $3000.

I have highlighted the minimum and maximum payment thresholds that I unearthed during my research below.

- Sticpay (USD) – $100 minimum, no maximum

- Skrill (USD/EUR) – $20 minimum, no maximum

- Neteller (USD/EUR) – $20 minimum, no maximum

- DusuPay (GHS/XAF) – $20 minimum, $500 maximum

- Bank wire transfer (USD/EUR) – $100 minimum, no maximum

- Online Banking (IDR/VND/MYR) – $100 minimum, $10,000 maximum

- Visa & MasterCard Credit/Debit Card (USD/EUR) – $20 minimum, $3000 maximum

I am happy with the instant card and e-wallet deposits and same-day processing from the broker’s side for withdrawal requests received within working hours.

There is a $20 minimum withdrawal for all methods which is reasonable, except for wire transfers at $100.

How To Make A Deposit

I find funding my Anzo Capital live account quick and seamless:

- Log in to the client portal

- Select ‘Deposit Funds’ from the homepage

- Choose a payment method from the available list (variable by jurisdiction)

- Follow the on-screen instructions and click ‘Confirm’ to continue

- You will be redirected back to the client portal once the payment has been submitted

Forex Assets

While I feel Anzo Capital offers a decent selection of 45 currency pairs, this isn’t the most competitive range in the market, and I score it below alternative brands such as BlackBull Markets, for example, which offers 60+, or the specialist Forex.com with 80+.

Importantly though, there are plenty of majors and minors, providing trading opportunities on popular currency pairs. It is the suite of more volatile exotics which is less compelling.

Below are the key forex assets I can see in Anzo Capital’s trading platform.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

Looking at the downsides, I was not able to create the most diverse portfolio while trading with Anzo Capital.

The non-FX instrument list comprising commodities, indices and stocks is not extensive compared to many rival brands that I have tested. I have been particularly disappointed on the commodity front, with just two precious metals and energies a piece. As a comparison, IG Group offers upwards of 35 hard and soft commodities.

Below are the non-forex instruments available to me in Anzo’s desktop platform and mobile app:

- Precious Metals: Gold and Silver

- Energies: WTI and Brent Crude Oil (spot or CFDs)

- Stocks: 29 global stock CFDs including Tesla, Microsoft and Coca Cola

- Indices: 11 index funds such as FTSE 100, S&P 500 and DAX 30 (CFDs or cash)

What I’d Like To See

I think Anzo Capital could strengthen its appeal to serious traders by offering a wider selection of stocks and commodities.

Execution

While I enjoy Anzo Capital’s hybrid STP and ECN execution, I was disappointed not to be offered any details of average order execution speeds, even with a query to the broker’s customer service team.

The main difference between STP and ECN execution is order routing, with ECN orders routed to the interbank market, and STP orders routed to a pool of liquidity providers.

In Anzo Capital’s model, the STP accounts offer commission-free trading and the ECN accounts provide raw spreads with a commission.

Leverage

I like that Anzo Capital allows me to trade with high leverage up to 1:1000 for forex instruments, though this uses a dynamic model based on account equity with less leverage available to higher amounts:

- <$5000 – up to 1:1000

- $5001 to $50,000 – up to 1:500

- $50,001 to $100,000 – up to 1:300

- $100,001 to $250,000 – up to 1:200

- >$250,001 – up to 1:100

Importantly, I recommend that beginners are careful when trading on leverage. This is especially true when such high leverage rates are provided alongside the absence of negative balance protection, which means traders risk losing significantly more than their balance.

I have found that all account types have an 80% margin call and 50% stop-out level.

Platforms & Apps

I am very glad to be able to trade forex on Anzo Capital using either the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms. These are accessible via desktop download, web trader, or mobile app.

I particularly enjoy keeping up to date with market trends and trades from a smartphone, and the MetaTrader application provides a secure and stable smaller screen interface to do just this on iOS and Android (APK) devices.

I find MetaTrader’s automated trading functionality using Expert Advisors (EAs) particularly strong, and I use the function to observe and trade FX using my own algorithms or by importing parameters set by peer traders.

Although I don’t think the MetaTrader platforms provide the sleekest of visual aids compared to newer platforms like TradingView, I do think new traders will have no problem learning the ropes on either MT4 or MT5.

And if I were to recommend one of the two platforms based on my own experience trading on both, MT5 would be my pick. It offers more advanced functionality, from additional order types and an integrated newsfeed to faster processing and extra indicators.

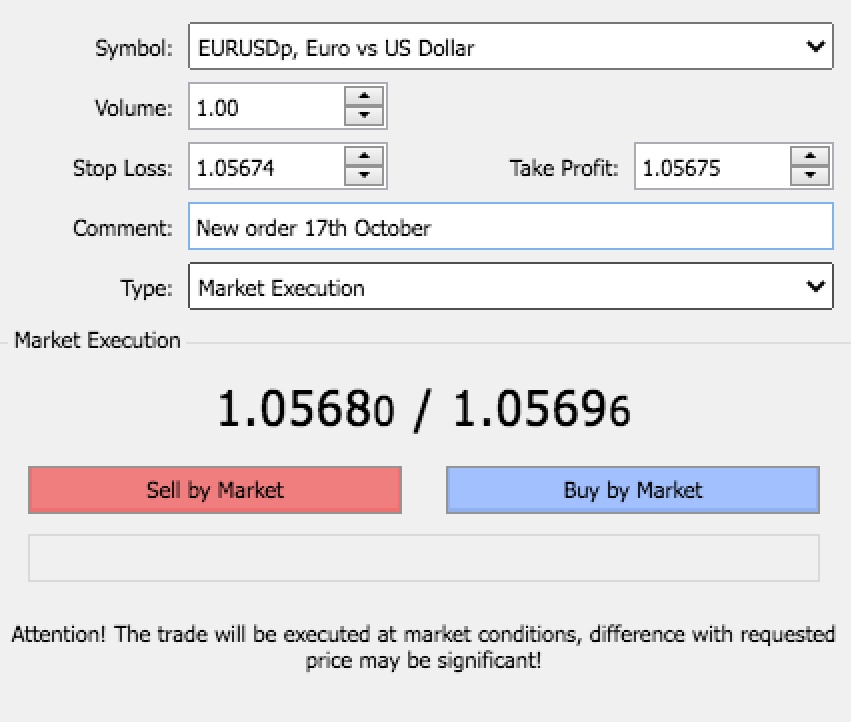

How To Open A Forex Trade

I have placed many trades on Anzo’s platforms and find it easy to place new orders in a few clicks:

- Choose a currency pair from the instrument menu on the left

- Right-click on the asset and click ‘New Order’

- In the ticket window, input your trade parameters (volume, stop loss/take profit, comment, and order type)

- Select ‘Buy’ or ‘Sell’ to confirm the direction of the position

Forex Tools

For me, forex tools are a hugely important part of trading, so I was very disappointed that Anzo Capital offers no third-party trend analysis services such as Trading Central or Autochartist. For serious algo traders, the absence of VPS hosting is also a considerable drawback.

This makes it longer and more complicated to plan my forex trades while using Anzo Capital as I need to leave the broker’s platform to use third-party tools.

Aside from an economic calendar and some useful forex calculators, the broker does not rank well in this respect at all.

I am, however, able to register for MQL5 signals, which provide a selection of free and paid signals to follow and copy positions in real-time.

Forex Research

I feel let down by Anzo Capital’s research offering, which has none of the expert analysis, insights, or commentary typically provided by top forex brokers in the market. This means I need to leave Anzo Capital to source the market insights I need.

As a comparison, CMC Markets provides daily insights through its investment magazine, Opto.

What I’d Like To See

I think the broker could improve its rating by providing a strong suite of market research tools to support trading decisions.

Forex Education

I enjoy using the educational resources offered by Anzo Capital, including video tutorials, podcasts, and free forex guides.

The guides are the standout for me, and I was impressed to find materials handily organized into three experience levels. This is where I would start as a beginner.

Looking at the negatives, I don’t rate the podcasts or video tutorials, due to the limited posts and basic information, with just four podcast publications that are outdated.

Demo Account

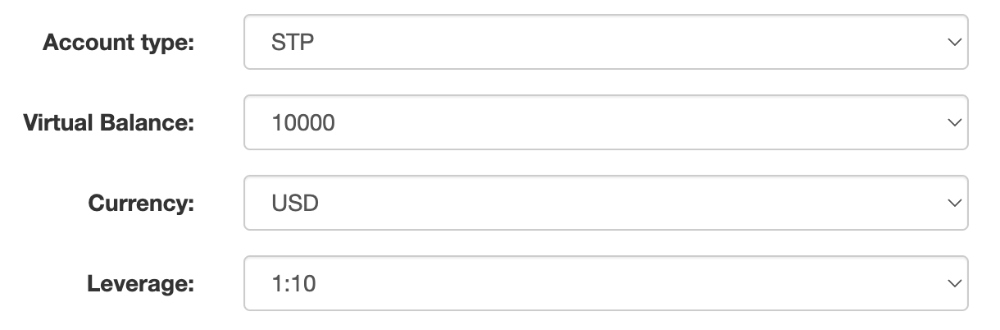

Anzo Capital’s demo account allows traders to try their services before committing to a live account, and I enjoyed testing this paper-trading account’s real-time pricing and live market conditions.

With a $100,000 virtual balance and leverage up to 1:1000, this is a great way to try out both the broker’s platforms in my view.

It was a shame to find that the demo account is only active for 30 days, especially since I would have liked to keep it open alongside a live profile to test new strategies.

How To Open A Demo Account

I found the account registration process straightforward, with just a few steps to get started:

- Click ‘Accounts’ from the menu along the top of the broker’s website

- Choose ‘Open Demo Account’

- Enter your name, email address, and phone number

- Create a password and choose a platform from the dropdown menu

- Agree to the T&Cs and click ‘Submit’

- Decide on the account settings (type, valance, currency and leverage)

- Login credentials and platform links are sent to your registered email address

Bonus Offers

I found a variety of bonus rewards and financial incentives available when I signed up for an Anzo Capital trading account. A quick search also provided me with details of historical promotions, including a welcome deposit deal.

The bonus I was interested in provided a 20% reward based on my initial deposit, with a $500 transfer, for example, unlocking a $100 bonus.

To convert credits into a cash balance, I do think that the trading volume requirements are extensive. For this bonus, I had to trade 50 FX lots within 120 days, which may not be suitable for novice traders.

Disappointingly, I did not find any rebates or discounts for high-volume traders, though I was able to use the refer-a-friend scheme once I had registered for a live account. This provides rewards for referred and referred clients so long as a $500 deposit is made.

Trading Restrictions

I did not come across any trading restrictions when investing on the Anzo Capital platform, so traders who enjoy scalping, hedging and other strategies will not be at a disadvantage trading with this broker.

Customer Service

Anzo Capital customer support is quite limited, with just a live chat service alongside an email request form and address (support@anzocapital.com). I think it is a shame there is no telephone number. That being said, customer service agents are available Monday to Friday from 7:30 AM to 2 AM (GMT +8).

I tested the live chat service on multiple occasions as part of my review. Overall the process is straightforward, with no automated bot integration which often removes the less personalized approach towards help.

I asked an account-specific question followed by a regulation status query and received a response almost instantly to both. The latter reply did feel like a mere copy-and-paste exercise, though it did answer my question.

Company Details

Founded in 2015, Anzo Capital is an online forex and CFD broker serving customers on a global scale.

The firm has a registered headquarters address in Belize, with authorization from the Financial Services Commission of Belize and St Vincent & The Grenadines Financial Services Authority.

My research uncovered that the broker has some industry awards under its belt, including the Best Trade Execution Platform APAC from Global Brands Magazine.

Trading Hours

The forex market is open for trading 24/5. Anzo Capital reflects these timings, operating on a GMT +3 server time, or GMT +2 after DST.

I like having access to an economic calendar, with details of upcoming political and monetary events. This is useful to determine circumstances that may cause volatility in the FX market.

Disappointingly, I was unable to find specific details of public holiday dates by country.

Who Is Anzo Capital Best For?

I consider Anzo Capital best for traders who have a decent base of experience and are looking for a no-frills broker with access to the MetaTrader suite. The commissions on the ECN accounts are competitive, though the tradeoff is the lack of tools and other extras.

I also like the broker’s range of educational content, alongside the free demo account, which will suit aspiring investors who can also benefit from the low minimum deposit on the Cent account.

However, for me, the major weakness is the firm’s offshore licensing. This, alongside the lack of negative balance protection, means this is not the safest forex broker on the market.

Alternative Brokers for US

FAQ

Is Anzo Capital Legit Or A Scam?

I am comfortable that Anzo Capital is a legitimate brokerage. The broker has been in business since 2015 and is recognized with industry awards, even though the regulatory status is not the most reputable.

Can I Trust Anzo Capital?

While Anzo Capital is a decent broker with a fine track record, I do find its lack of top-tier regulation concerning, especially with no negative balance protection.

Is Anzo Capital A Regulated Forex Broker?

Anzo Capital is registered offshore with the Financial Services Commission of Belize and the St Vincent & The Grenadines Financial Services Authority. However, these bodies do not robustly oversee the foreign exchange market, so do not expect a strong degree of trader protection.

Does Anzo Capital Offer Low Forex Trading Fees?

My analysis shows that Anzo Capital offers average fees. I sourced the lowest forex trading fees while using the ECN account, with floating spreads and a low $4 commission.

Is Anzo Capital A Good Forex Broker For Beginners?

I rate Anzo Capital as an adequate choice for beginners, thanks to the demo account and useful forex trading guides. However, novice traders should be aware of the risks since the broker does not provide negative balance protection.

Does Anzo Capital Have A Forex App?

Anzo Capital does not have its own mobile trading app, though MT4 and MT5 do have mobile app compatibility. I have used both and find them to be reliable solutions for trading currencies on the go.

How Long Do Withdrawals Take At Anzo Capital?

Withdrawals from an Anzo Capital trading account are competitive, with same-day processing for requests received within working hours. This is much faster than the majority of brokers I have assessed.

Can You Make Money Trading Forex With Anzo Capital?

It is possible to profit when trading forex with Anzo Capital. However, many retail investors lose money, so I recommend exploring the educational content and practising on the demo account when starting out.