Best ASIC-Regulated Forex Brokers

Australian traders should choose a forex broker regulated by the Australian Securities and Investments Commission (ASIC), ensuring compliance with industry safety standards. In this guide, we evaluate and rank the best ASIC-regulated forex brokers.

List of Best ASIC Forex Brokers

Following our tests, we recommend these 5 forex brokers authorized by the ASIC:

- Vantage: Highly trusted. Great platforms. Fast account opening.

- AvaTrade: Beginner-friendly platforms. Great education. Reliable support.

- IC Markets: Low fees. Strong investment offering. Convenient deposits.

- Fusion Markets: Superior pricing. Excellent platform offering. Copy trading tools.

- XM: Great track record. Good research. Strong education.

| Vantage | AvaTrade | IC Markets | Fusion Markets | XM | |

|---|---|---|---|---|---|

| ASIC-Regulated | Yes | Yes | Yes | Yes | Yes |

| License Number | 428901 | 406684 | 335692 | 385620 | 443670 |

| Minimum Deposit | $50 | $100 | $200 | $0 | $5 |

1. Vantage

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN

-

🛠 PlatformsMT4, MT5, TradingView, DupliTrade

-

⇔ Spread

GBPUSD: 0.5 EURUSD: 0.0 GBPEUR: 0.5 -

# Assets40+

-

🪙 Minimum Deposit$50

-

🫴 Bonus Offer50% Welcome Deposit Bonus

Why We Recommend Vantage

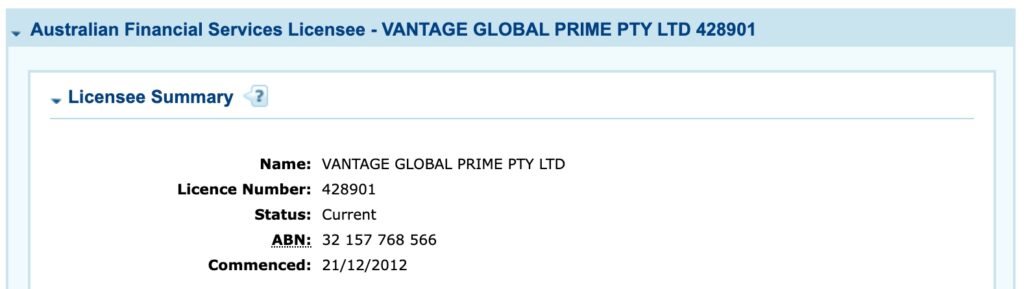

Vantage Global Prime Pty Ltd operates under ASIC regulation and calls Sydney its headquarters, segregating client funds through the National Australia Bank (NAB).

We recommend Vantage because it caters to the full spectrum of forex traders with top-rate platforms, excellent pricing, and fast account opening.

Pros/Cons Of Vantage

Pros

User-friendly platforms to suit different needs

The Vantage App, with its intuitive interface, trading from charts, daily market commentary, and news coverage, offers the full package for mobile traders.

Equally, ProTrader impresses for charting with its 100+ indicators and TradingView integration, while MetaTrader 4 and MetaTrader 5 offer powerful algo trading and backtesting capabilities.

Low trading fees with spreads from 0.0 and no inactivity fee

Evaluating Vantage’s Raw ECN account revealed below-average spreads (0.3 pips on AUD/USD, 0.0 pips on EUR/USD) and a competitive $6 round-turn commission.

The Standard STP account, while less competitive in spreads, is commission-free – ideal for beginners seeking straightforward pricing.

Convenient account funding with AUD deposits

Vantage’s support for fast and secure payment methods, including AUD deposits via bank cards and electronic wallets like AstroPay and FasaPay, makes managing funds hassle-free.

The smooth sign-up process, taking less than 5 minutes, adds to the convenience of signing up.

Cons

A $10,000 deposit is needed for the best forex trading conditions

The most favorable spreads and commissions, starting from 0.0 pips with a $3 round-turn commission, are only accessible to Pro ECN account holders.

Vantage Academy is good but trails best-in-class brokers

While Vantage Academy serves as a good starting point for new traders, with forex courses, webinars, and ebooks tailored for beginners, it falls short of the industry’s best brokers. Improving its offerings with more interactive elements and quizzes would improve the learning experience.

Why Is Vantage Better Than The Competition?

Vantage stands out for its choice of high-quality platforms, convenient account opening and low fees. Additionally, it earns our trust as an ASIC-regulated forex broker with a stellar reputation, almost 15 years of industry experience, and a large client base of 900,000.

Who Should Choose Vantage?

Vantage has something for most forex traders. Beginners can opt for the commission-free STP account, while intermediate and advanced traders can find favorable trading conditions in the Raw ECN and Pro ECN accounts.

Who Should Avoid Vantage?

Hands-off investors interested in copy trading should avoid Vantage. While the broker offers DupliTrade, ZuluTrade, and Myfxbook Autotrade in other regions, these services are not available in Australia. Fusion Markets is a better option.

2. AvaTrade

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD

-

🛠 PlatformsMT4, MT5, AlgoTrader, TradingCentral, DupliTrade

-

⇔ Spread

GBPUSD: 1.5 EURUSD: 0.9 GBPEUR: 1.5 -

# Assets50+

-

🪙 Minimum Deposit$100

-

🫴 Bonus OfferWelcome bonus 20% up to 10.000$

Why We Recommend AvaTrade

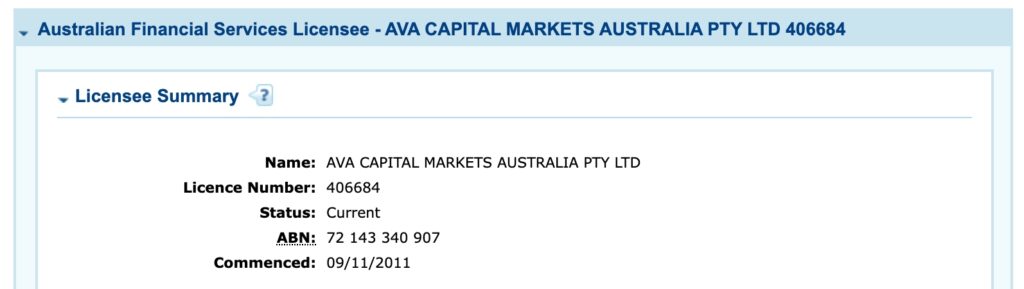

Ava Capital Markets Australia Pty Ltd is regulated by the ASIC, has an office in Sydney and has proven its credentials with countless industry awards since it launched in 2006.

AvaTrade also shined during our hands-on testing for its beginner-friendly platforms, excellent education and useful research.

Pros/Cons Of AvaTrade

Pros

User-friendly WebTrader with reliable third-party software

As well as the MetaTrader suite, the AvaTrade platform is cleanly designed and packed with useful features, including an in-built news feed, market sentiment data and insights from analysts.

It also delivers a great charting package with 50+ integrated indicators (more than MetaTrader), 3 types of charts (candlestick, bar and line) and 10 timeframes (1 minute to 1 month).

Excellent educational materials for beginners

The Academy is home to a long row of courses with dozens of lectures and well-presented information on how to analyze currencies, technical analysis, pitfalls to avoid and risk management. The 50+ interactive quizzes also provide an enjoyable way to test your knowledge.

Local customer support with fast response times

AvaTrade provides an Australian contact number as well as assistance via live chat, WhatsApp, inquiry form and email.

We tested the support via live chat on multiple occasions and received fast responses (typically within two minutes), and helpful replies to our queries about forex trading conditions.

Cons

Spreads trail the lowest-cost forex brokers

During testing, we got spreads of 1.1 pips on the AUD/USD and 2.7 pips on the AUD/CAD. As a comparison, IC Markets offers the AUD/USD at 0.8 pips and the AUD/CAD at 1.7 pips in its commission-free account.

A high inactivity fee of $50

The $50 inactivity fee applies after three months while there is a $100 administration charge after 12 months of no trading. This is higher than most forex brokers and will deter casual casual investors.

Why Is AvaTrade Better Than The Competition?

AvaTrade excels for its beginner-friendly trading conditions. The web platform is well-designed and easy to navigate, customer support is reliable, and the education is superb.

Who Should Choose AvaTrade?

Beginners should choose AvaTrade. You will struggle to find a forex broker that better supports aspiring investors, from its platforms, education and customer service to its free demo account and copy trading services.

Who Should Avoid AvaTrade?

Experienced forex traders looking for ECN pricing with ultra-tight spreads should avoid AvaTrade. Vantage is a better option with its Raw ECN and Pro ECN accounts.

The above-average inactivity fee also means AvaTrade is a bad option for casual investors. IC Markets is a good alternative with no inactivity fee.

3. IC Markets

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, cTrader, DupliTrade

-

⇔ Spread

GBPUSD: 0.5 EURUSD: 0.1 GBPEUR: 0.5 -

# Assets55+

-

🪙 Minimum Deposit$200

-

🫴 Bonus Offer-

Why We Recommend IC Markets

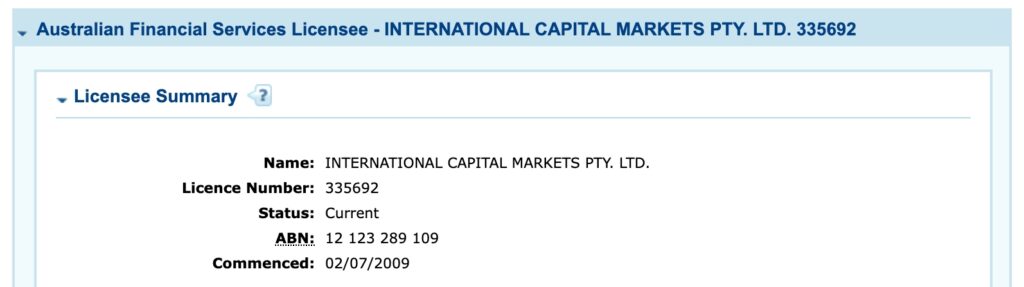

International Capital Markets Pty Ltd is regulated by the ASIC. IC Markets is also a member of the Australian Financial Complaints Authority (AFCA), an external adjudicator that helps resolve disputes between traders and members.

We recommend IC Markets because it offers excellent pricing for active traders with an above-average selection of currency pairs and convenient account funding.

Pros/Cons Of IC Markets

Pros

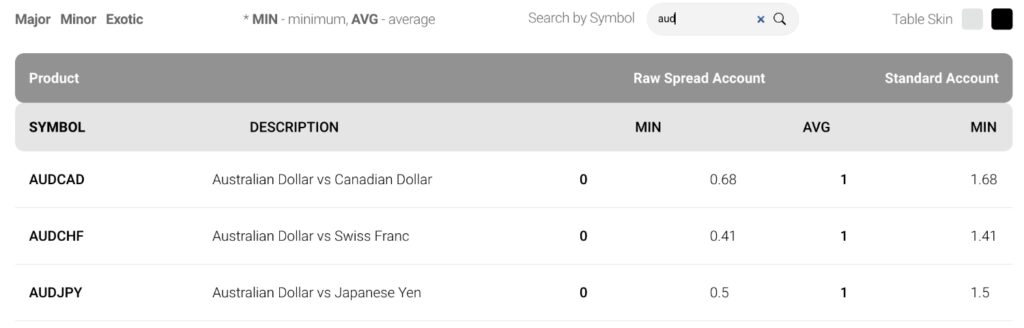

Industry-low fees with spreads from 0.0 in the Raw Spread account

Spreads on major currency pairs came in below average during testing at 0.02 on the EUR/USD and 0.6 pips on the AUD/USD. The $6 commission per lot round-turn on cTrader is also competitive, making the account a strong option for day traders.

Excellent investment offering with 60+ currency pairs

IC Markets offers 61 forex pairs, more than rivals like AvaTrade (53) and Vantage (49), opening up more opportunities on volatile currencies.

The broker’s more than 2000 CFDs spanning other asset classes are also above-average, with a strong selection of stock CFDs, including shares listed on the Australian Stock Exchange.

Fee-free deposits with AUD accepted as a base currency

IC Markets offers a wide selection of payment methods, including POLi and Bpay, ensuring convenient account funding for Australian traders.

Cons

IC Social is not available to Australian traders

IC Markets’ intuitive copy trading app, enabled by Pelican Exchange, is not available in Australia. Fortunately, traders can still access the popular third-party solution, ZuluTrade.

The $200 minimum deposit is higher than alternatives

IC Markets’ minimum deposit is higher than every other ASIC-regulated forex broker on our shortlist. Budget traders may want a lower-deposit broker like Fusion Markets.

Why Is IC Markets Better Than The Competition?

IC Markets offers lower forex fees than most alternatives, especially through its Raw Spread accounts.

It also offers very convenient funding with AUD-denominated accounts and an extensive choice of deposit options, including POLi and Bpay.

Who Should Choose IC Markets?

Day traders should choose IC Markets. The fees are hard to beat while the powerful cTrader and MetaTrader platforms deliver an excellent environment for fast-paced strategies like forex scalping.

Who Should Avoid IC Markets?

Hands-off copy traders shouldn’t choose IC Markets. With no access to the IC Social app in Australia, brokers like Fusion Markets offer stronger social trading tools.

4. Fusion Markets

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD

-

🛠 PlatformsMT4, MT5, cTrader, DupliTrade

-

⇔ Spread

GBPUSD: 0.0 EURUSD: 0.0 GBPEUR: 0.0 -

# Assets90+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend Fusion Markets

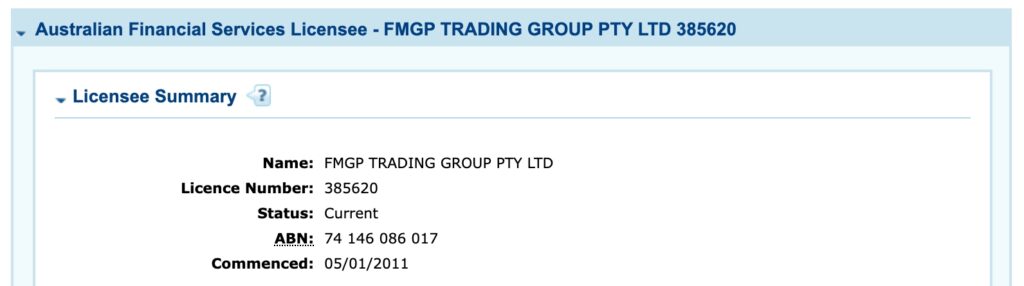

FMGP Trading Group Pty Ltd was founded in 2016 by a group of forex industry veterans. The firm is regulated by the ASIC, while client funds are segregated in the National Australia Bank.

We recommend Fusion Markets because it offers superior pricing and powerful trading software that provides an excellent user experience.

Pros/Cons Of Fusion Markets

Pros

Very low fees in the Zero account with spreads from 0.0 pips and a $4.50 commission

Fusion Markets is one of the lowest-cost forex brokers accepting Australian traders. The AUD/USD had an average spread of 0.02 during testing, while non-trading fees came in near zero with no minimum deposit or transfer fees.

Excellent MetaTrader package alongside cTrader

MetaTrader 4 was designed for forex trading with a strong charting package, including 30 indicators, 31 graphical objects and 9 timeframes. MetaTrader 5 is the latest iteration delivering superior features, with additional indicators, graphical objects, timeframes, order types and more.

cTrader offers the best user experience with a more intuitive workspace and sophisticated features for advanced traders, including more than 70 indicators and 3 market depth settings.

DupliTrade copy trading platform with vetted strategy providers

DupliTrade stands out from other copy trading platforms, including the Fusion+ Copy Trading service, with its smaller pool of carefully selected signal providers that have a demonstrable track record.

The intuitive design also makes it very easy to find providers, copy trades and manage your activity in several clicks.

Cons

Weak educational tools for beginners

Aside from some basic and infrequently updated blogs, Fusion Markets offers little to upskill new forex traders. AvaTrade performs much better here, with an excellent variety of training materials, from trading tutorials to podcasts and webinars.

Slim product portfolio with around 250 instruments

Although Fusion Markets offers an above-average selection of 90+ currency pairs, it trails industry leaders when it comes to other asset classes, especially its 100 stocks with no Australian shares.

Why Is Fusion Markets Better Than The Competition?

Our assessment found that Fusion Markets leads the pack when it comes to pricing. Additionally, Fusion Markets offers more currency pairs than every other ASIC forex broker in our shortlist.

Who Should Choose Fusion Markets?

Active forex traders should choose Fusion Markets as the low fees will protect profit margins.

Casual traders should also pick Fusion Markets. The DupliTrade copy trading platform is available and there is no inactivity fee.

Who Should Avoid Fusion Markets?

Beginners should avoid Fusion Markets. It doesn’t offer the comprehensive learning environment of rivals like AvaTrade with its diverse training materials and unlimited demo account.

5. XM

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, AUD, JPY, ZAR, CHF, SGD, PLN, HUF

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: 1.9 EURUSD: 1.6 GBPEUR: 1.8 -

# Assets55+

-

🪙 Minimum Deposit$5

-

🫴 Bonus Offer$50 No Deposit Bonus When You Register A Real Account, Deposit Bonus Up To $5000, Free VPN Service

Why We Recommend XM

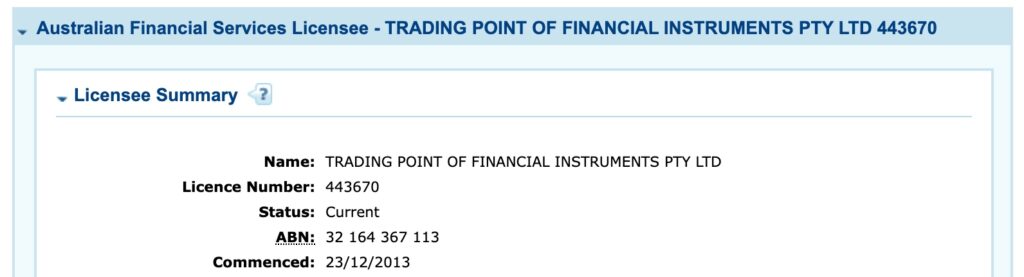

Trading Point of Financial Instruments Pty Ltd is regulated by the ASIC. We recommend XM because it is a hugely respected forex broker with fantastic educational tools and market research to support aspiring traders.

Pros/Cons Of XM

Pros

Trusted forex broker with 10+ million clients

XM has an excellent reputation, demonstrated by its dozens of industry awards and millions of clients spanning 190+ countries.

Beginner-friendly education through the Learning Centre

XM’s education materials compete with the best in the industry and cater to a range of learning styles with forex webinars, platform tutorials and even XM Live, where experts walk through trade setups.

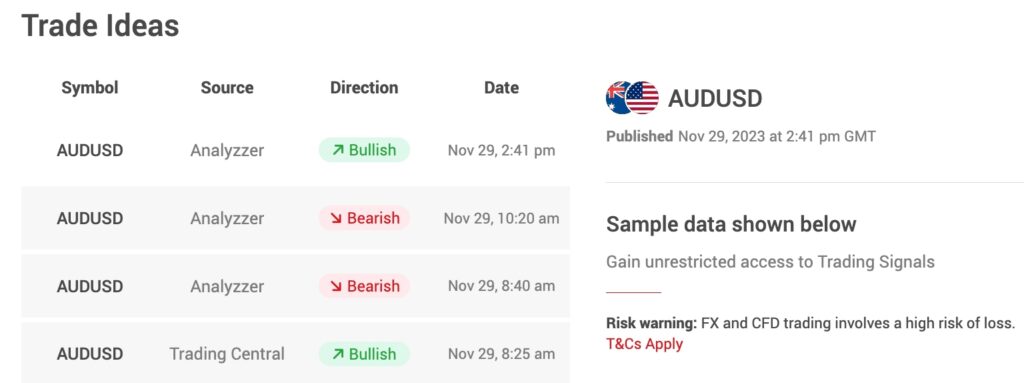

Top-rate market research with actionable trading ideas

XM delivers a wealth of market research tools to support budding traders, from extended forex news coverage and in-depth technical summaries to trading ideas and signals from Trading Central and Autochartist.

Cons

Average forex trading fees in the Standard account

XM trails the cheapest forex brokers in its commission-free account with spreads from 1.6 pips on the AUD/USD and EUR/USD. As a comparison, IC Markets offers spreads from 0.8 pips on the AUD/USD and EUR/USD.

No proprietary forex trading platform

XM only supports the MT4 and MT5 platforms, so investors unfamiliar with the MetaQuotes software or who don’t enjoy the dated design will be frustrated.

Why Is XM Better Than The Competition?

XM excels for its comprehensive market research and educational tools, the variety and quality of which you can’t find at many alternatives based on our comprehensive reviews.

Who Should Choose XM?

XM is a great option for beginners looking for a comprehensive trading environment with integrated education and research. The $5 minimum deposit is also on the low side, reducing the entry barrier for new traders.

Who Should Avoid XM?

Traders looking for the best pricing should avoid XM. It trails alternatives in our shortlist like Fusion Markets and IC Markets.

Traders looking for an alternative to MetaTrader should also avoid XM. Vantage and AvaTrade are better in this department, with excellent proprietary trading software.

Why Australian Traders Should Choose an ASIC-Regulated Forex Broker

Safety of Funds

ASIC-regulated forex brokers usually segregate client funds in trusted Australian banks, minimizing the risk of misuse. In the event your broker faces financial difficulties, this separation ensures that your funds remain unaffected.

Fair Trading Practices

ASIC-regulated forex brokers must offer transparent pricing, reducing the chance of unexpected costs. They must also adhere to rules that prevent misleading promotions, limit leverage to 1:30 on forex, and provide negative balance protection so you can’t lose more than your initial investment.

Confidence

Opting for an ASIC-regulated forex broker will give you peace of mind, as you can expect your broker to adhere to the industry’s strictest safety requirements. ASIC’s high standards are respected by regulatory bodies worldwide.

Review Methodology

To find the best ASIC forex brokers, we started by verifying firms had an Australian financial services (AFS) licence on ASIC Connect.

We then evaluated shortlisted forex brokers in several departments:

- Costs – balancing affordability with platform quality

- Product Portfolio – preferring brokers with a large selection of currency pairs

- Trading Accounts – comparing entry requirements and account suitability for different trading styles

- Tool Assessment – scrutinizing platforms, apps and tools for their design and functionality

FAQ

How Do I Check Whether A Forex Broker Is Regulated By The ASIC?

Open ASIC Connect on the regulator’s website and search for the broker’s credentials using their name or license number. Many ASIC-regulated forex brokers publish their license details in the footer of their websites.

Do Forex Brokers In Australia Have To Be Regulated By The ASIC?

Forex brokers operating in Australia should be regulated by the ASIC. Traders can sign up with brokers registered and regulated elsewhere, but they won’t provide the same recourse options and legal protections for Australian traders.

How Much Forex Leverage Is Allowed Under ASIC Rules?

ASIC-regulated brokers should not offer retail traders leverage beyond 1:30 on forex.