BlackBull Markets

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, SGD

-

🛠 PlatformsMT4, MT5, TradingView, AutoChartist

-

⇔ Spread

GBPUSD: Average 0.8 pips (variable by account) EURUSD: Average 0.2 pips (variable by account) GBPEUR: Average 0.8 pips (variable by account) -

# Assets64

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

My Opinion On BlackBull Markets

My tests show that BlackBull Markets is a good ECN broker. With execution speeds under 20ms, spreads from 0.0 pips and high leverage up to 1:500, the firm has a lot to offer serious forex traders. I also rate that you can access TradingView Pro if you trade one lot per month.

Assessing the drawbacks, a $20,000 minimum deposit is needed for the best trading conditions. I also find the market research tools underwhelming and the withdrawal fees disappointing.

Summary

- Instruments: 26,000+ including 60+ forex pairs, stocks, indices, commodities, futures, crypto

- Live Accounts: ECN Standard, ECN Prime, ECN Institutional

- Platform & Apps: MT4, MT5, TradingView, BlackBull Trade, BlackBull Shares, BlackBull CopyTrader

- Deposit Options: Credit/debit cards, wire transfer, crypto, Use Pay, Skrill, Neteller, POLi, PaymentAsia, SEPA, HexoPay, Help2Pay, FXPay, FasaPay, China UnionPay, Boleta, Beeteller, AstroPay

- Demo Account: Yes

Pros & Cons

- True ECN forex broker with very fast execution speeds of <20 ms

- Excellent tools including VPS hosting, FIX API and Autochartist

- Around-the-clock customer service with strong phone support

- Convenient deposits with no fees and eight base currencies

- Multiple copy trading solutions including ZuluTrade

- Top-rated platforms including TradingView Pro

- Huge range of investments with 26,000 assets

- No minimum deposit on the Standard account

- $20,000 deposit is required to access the best trading conditions

- $5 withdrawal fee applies for all payment methods

- Weak educational materials for beginners

- High spreads on the Standard account

- Average market research tools

Is BlackBull Markets Regulated?

I am relatively satisfied with this forex broker’s regulatory credentials, although it is not authorized by tier-one regulators.

BlackBull Group Limited is registered in New Zealand, and regulated by the country’s respected Financial Markets Authority (FMA). International forex traders will be registered under the BBG Limited entity, regulated by the Financial Services Authority in Seychelles (FSA). This is less reputable, with fewer requirements for registered firms.

Fortunately, I am reassured that the broker offers account safeguards which I view as important – negative balance protection so that I can’t lose more than my balance, and segregated client accounts to keep my funds separate from the company’s capital.

Forex Accounts

BlackBull Markets offers three live accounts: ECN Standard, ECN Prime and ECN Institutional – with swap-free conditions for Islamic traders.

I like this selection of account types, each of which comes with the full range of platform options plus eight base currencies, catering to global traders.

My analysis shows that the ECN Standard account will suit beginners, with floating spreads from 0.8 pips, zero commissions and a minimum order size of 0.01 lots. It also has the lowest entry requirements with no minimum deposit.

The ECN Prime account offers attractive conditions for seasoned forex traders, with spreads from 0.1 pips and a $6 commission per lot. My only criticism is that you need to stump up a $2,000 deposit, which is on the high side of forex brokers I review.

The Institutional account provides the best trading conditions with spreads from 0 pips and a lower commission of $4 per lot, though I think the minimum deposit is unrealistic for many traders at $20,000.

One feature I particularly appreciated while signing up is BlackBull’s joining quiz, which offers new traders recommendations on which account to register for based on their trading experience, deposit capabilities, and expected trade sizes. This is fairly unique and a nice touch.

How To Open A Live Account

I found the live account registration process straightforward, with the broker aiming to approve applications within 24 hours. To open an account:

- From the client portal, select ‘Accounts’ from the side menu and then ‘Live’

- Select ‘Create An Account’

- Input your name, address, date of birth, country of residency, and phone number

- Choose your trading preferences; account type, base currency, leverage, and platform

- Answer the employment status questions and declare your financial position

- Review the T&Cs and tick the box to agree

- Upload identity documents and proof of address to complete the application

Trading Fees

My testing shows that BlackBull Markets offers competitive fees with the premium accounts but trails alternatives in the entry-level solution.

For example, while the broker advertises floating spreads from 0.8 pips in the Standard account, I got a 1.5 pip spread on the EUR/USD and 3.3 pips on the GBP/USD while using BlackBull Markets, which is higher than other forex brokers I have evaluated, such as AvaTrade.

Trading fees on the Prime and Institutional accounts are more competitive, especially the latter, with its spreads from 0.0 pips and below-average commission of $4 per lot.

Overall, I rate the transparent pricing structure but BlackBull Markets isn’t the cheapest forex broker, especially for beginners.

Non-Trading Fees

One advantage of trading forex with BlackBull Markets that I appreciate is that no inactivity fees apply, regardless of the length of time your account is dormant.

However, I do get frustrated by the $5 charge for all withdrawals. Most leading forex brokers I evaluate do not charge for withdrawals, so this is worth keeping in mind if you plan to make regular withdrawals.

Payment Methods

I see BlackBull Markets’ extensive list of payment methods as a notable benefit. As well as bank cards and wire transfers, there is a host of electronic solutions like Skrill, FasaPay, Boleta and AstroPay, plus cryptocurrencies and local solutions.

With no fees at the deposit stage and a straightforward funding process, loading your BlackBull Markets account is convenient.

How To Make A Deposit

I can fund my account in minutes using these steps:

- Login to the BlackBull Markets client area

- Select ‘My Wallet’ from the menu along the left and click ‘Add Funds’ under the relevant account

- Review the available payment methods and select your desired option

- Input the amount to deposit, noting the minimum investment by account

- Complete the required payment details and choose ‘Confirm’

Forex Assets

BlackBull Markets offers good exposure to the foreign exchange market, with over 60 currency pairs covering majors, minors, and crosses.

This is a competitive offering, providing plenty of opportunity to speculate on global currencies, especially given the high leverage up to 1:500.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

One area that BlackBull Markets really stands out from the competition is its wide product portfolio. The brokerage offers one of the largest product lists I have seen, with over 26,000 tradeable assets. The breadth of stocks and futures is particularly strong, ensuring I can build a diverse portfolio.

You can trade:

- Stocks – Thousands of share CFDs including Tesla, JP Morgan Chase, TripAdvisor, BlackRock, Apple, and Amazon

- Indices – Stock market indices such as NAS 100, Germany 30, UK 100, and France 40

- Commodities – Energy, agriculture, and precious metal CFDs including gold, wheat, WTI oil, natural gas, and silver

- Futures – Index funds and government bonds such as the US 10-year T-Note, UK Long Gilt, Japan 225, and S&P 500

- Crypto – 10 popular cryptocurrencies against the US Dollar including Bitcoin, Ethereum, and Ripple

Execution

BlackBull Markets is a true ECN (Electronic Communication Network) forex broker with no dealing desk intervention.

The brokerage provides bridging with three Equinix Servers based in New York, London, and Tokyo. This ensures a stable market connection with excellent liquidity and very fast execution speeds of <20ms based on our research.

Ultimately, this model provides competitive trading conditions, especially for active forex traders and high-volume investors.

Leverage

The broker offers relatively high leverage up to 1:500 for major forex pairs, however, this may vary depending on your location.

Importantly, while trading with high leverage can increase profit prospects, it can also amplify losses. I recommend beginners avoid high leverage given the risks. And if not, effective wallet and risk management is key.

I found that a margin call will be issued if your account falls below 75% and a stop-out will be activated if your account falls below 50%.

Platforms & Apps

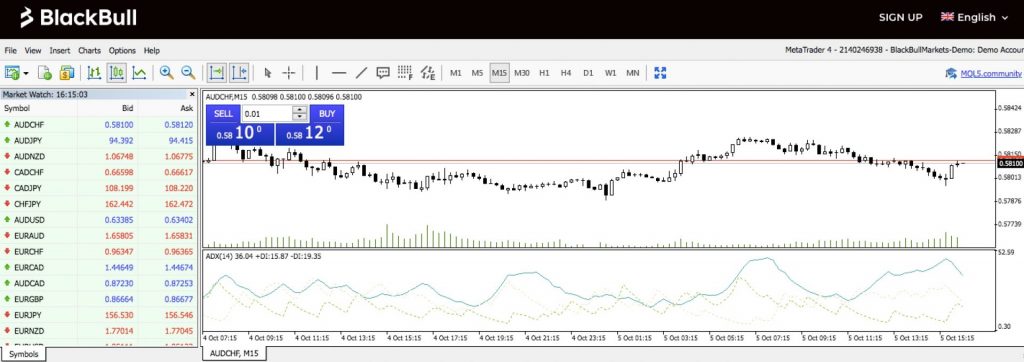

I have been very impressed with BlackBull’s selection of trading platforms, which includes the industry-leading MetaTrader platforms as well as the excellent TradingView software and a bespoke solution.

TradingView

If you want a modern design with powerful charting, I would opt for TradingView. I find this an excellent option for technical analysis with over 100 indicators and 15 charting styles.

If you trade one lot per month you also get free access to TradingView Pro, which comes with extra indicators and alerts.

Below are the features I find most useful:

- 90 drawing tools

- Custom alerts with 12 conditions

- Candlestick pattern recognition tool

- Over 100 integrated technical indicators

- Web, desktop, and mobile/tablet versions

- Historic price data unfolding with four replay speeds

- 15 chart types including Renko, Kagi, and Point & Figure

- Strategy simulation with Pine Script programming language

BlackBull Trade

During testing, I found BlackBull Trade equally intuitive, with a sleek design and plenty of customizable charting views. It doesn’t offer the same breadth of analysis features as the other platforms, though there is ample for aspiring traders.

MT4 & MT5

MetaTrader 4 and MetaTrader 5 are good picks if you are already familiar with the software from MetaQuotes, or you want strong algo trading features. You can build, test and run expert advisors or download automated trading bots from the marketplace.

With a host of training guides online, you will also get the most support and training materials if you choose the MetaTrader platforms, not to mention if you move to another forex broker there is a good chance they will offer MT4 and/or MT5.

If you want advanced tools, more order types, faster processing and the latest design, I would choose MT5, which is the newest platform from MetaQuotes.

How To Place A Forex Trade

I don’t experience any issues navigating the MetaTrader platform and opening new positions by following these steps:

- Find a currency pair using the menu on the left

- Right-click on the asset and click ‘New Order’

- In the ticket window, input your trade parameters (volume, stop loss/take profit, comment and order type)

- Select ‘Buy’ or ‘Sell’ to confirm the direction of the trade

Forex Tools

BlackBull Markets has an impressive range of forex trading tools including a copy trading service, FIX API, and VPS hosting. I think these offer considerable value and not many forex brokers I evaluate offer all of these services, especially of comparable quality.

Below are the features I find most useful.

Copy Trading

The two third-party copy trading solutions offered by BlackBull, ZuluTrade and Myfxbook, are among my favorites, even before I had used BlackBull Markets.

These platforms offer a hands-off approach to investing that is ideal for beginners looking for ideas and expertise from more experienced traders.

I am a big fan of both platforms, but rate ZuluTrade slightly better than Myfxbook, simply given the larger pool of professional traders and unique risk management tools. In particular, I’m thinking about ZuluGuard, which automatically stops copying if the strategy provider deviates from their normal approach.

BlackBull CopyTrader

BlackBull CopyTrader is a low-latency copy trading service that enables users to follow and copy the strategies of any listed signal providers using an MT4 or MT5 broker. This means you get access to a huge number of seasoned traders, though I find weeding out the best ones more challenging.

Still, I find the interface easy to use, and it provides detailed performance statistics of experienced traders, including investors’ equity, server, and total profits.

I also like the flexibility of the risk management parameters, with the choice to set trading actions and maximum risk thresholds.

I find selecting an account to copy is a simple process:

- Log in to the BlackBull Markets client area

- Select ‘CopyTrader’ from the side menu and review the statistics of available providers

- Click ‘Copy’ under their profile

- Input your investment amount and relevant risk management parameters

- Click ‘Create’ to start copying

Autochartist

Another bonus in my opinion is that BlackBull supports the Autochartist plugin for MT4 and MT5. I can use this powerful pattern recognition technology to identify market opportunities.

I also think it has been well designed to suit both beginners and experienced investors, with visual aids of support and resistance levels, Fibonacci retracements and extensions, plus assets with excessive volatility.

VPS

BlackBull Markets has partnered with BeeksFX for VPS hosting, which is another perk of this forex broker that raises its rating in my view. This will appeal to Prime and Institutional account holders who use algorithmic trading strategies and expert advisors.

While there is a $30 monthly fee for Standard accounts, investors who deposit $2,000 and trade 20 forex lots per month can access it for free.

FIX API

This is another feature geared towards advanced traders, who can use it to connect directly to the broker’s bridge provider through FIX coding.

Importantly, I found that FIX API is compatible with any FIX program, offering full customization and low latency.

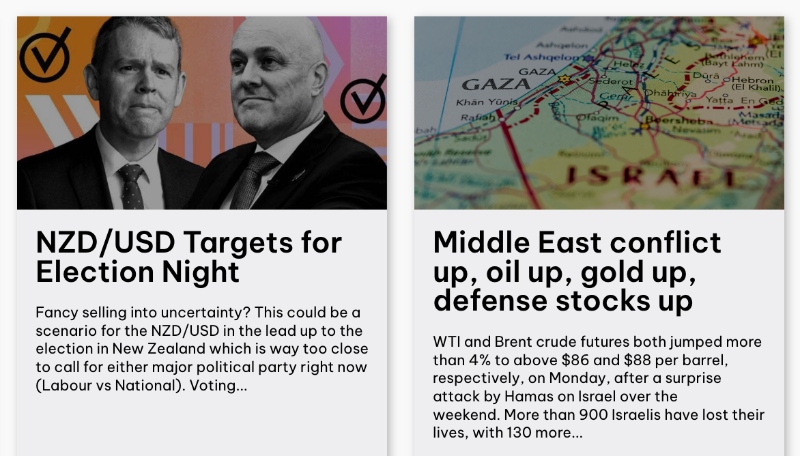

Forex Research

The Market Reviews are my favored research method, with regular articles on the latest financial news and expert commentary.

After reading many of the articles, they offer good coverage of geopolitical events, particularly in the Asia-Pacific region, though they don’t rival the insights from other forex brokers I have tested.

There is also an economic calendar. I find this most useful for identifying upcoming events that could affect foreign exchange markets and specific currency pairs.

Forex Education

I think BlackBull’s educational resources are mediocre. I like that the forex trading tutorials are organized into beginner, intermediate, and pro levels, though I find the online lessons quite simplistic, with very limited information per article. I would like to see more integrated videos and images to support the content.

I also tried the broker’s webinars, though these were mostly outdated. So, if education is important to you then I recommend you look at one of these forex brokers:

Alternative Brokers for US

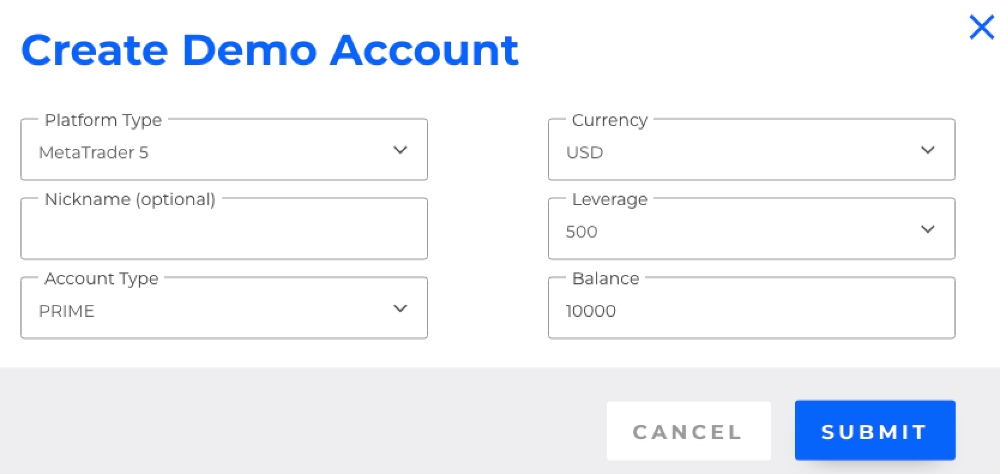

Demo Account

While using BlackBull Markets, I was able to open a demo account for MT4, MT5, TradingView, and BlackBull Trade. I consider it extremely convenient to have the chance to test drive the forex broker on all platforms – this often isn’t the case in my experience.

I was disappointed, though, that you can only practice trading risk-free for 30 days. This limits the usefulness of the demo account, especially given that many top forex brokers offer unlimited demo trading.

How To Register For A Demo Account

It took me less than two minutes to sign up for a paper trading account at BlackBull Markets. To get started:

- Click ‘Education’ from the top menu on the broker’s website and then choose ‘Demo Trade’

- Add your email address and click ‘Get Started’

- Add your name, phone number, and country of residency on the following page

- Create a password, agree to the T&Cs, and click ‘Register’

- Select ‘Accounts’, then ‘Demo’ from the side menu

- Choose ‘Create Demo Account’

Bonus Offers

I found limited bonus rewards and promotions for new and existing BlackBull Markets customers. This is unusual, as promotions are often available at offshore forex brokers.

That said, a refer-a-friend scheme was live, offering up to $250 for both the referred client and the referee. As with all promotions, eligibility requirements apply, including an initial deposit of $500 and at least five FX lots to be traded by the referred client.

Trading Restrictions

In my time testing BlackBull Markets, I did not find any restrictions on trading setups, so investors are free to use hedging, scalping, and other strategies on the broker’s platforms. I see this as another advantage for serious forex traders.

Customer Service

I think BlackBull Market’s customer support is excellent, with 24/7 telephone availability a standout.

Other contact methods include live chat and email, though I particularly rate the online help, with FAQs split by platform, trading, and account. On multiple occasions, I have quickly been able to get answers to queries which saved me from having to contact an agent.

Contact details:

- Email – support@blackbull.com

- Live chat – icon at the bottom right of the broker’s website

- Telephone – +6495585142 (NZ), +35722279444 (Cyprus), +442070978222 (UK), +33184672111 (France), +523385262705 (Mexico), +541139860543 (Argentina)

- HQ Address – BlackBull Markets, level 20, 188 Quay Street, Auckland 1010 or JUC Building, Office F7B, Providence Zone 18, Mahe, Seychelles

Company Details

BlackBull Markets is a forex and CFD brokerage established in 2014. Today, the company provides online trading services in over 180 countries, with a HQ presence in Auckland, New Zealand, as well as local offices elsewhere.

BlackBull Markets has won several industry awards including the Best Global FX Broker at the 2022 ForexExpo Dubai and has been part of the Deloitte Fast 50 Index for three years in a row.

Trading Hours

BlackBull Markets offers 24/5 trading, Monday to Friday, with forex available throughout.

Foreign exchange trading hours are based on when the trading floor is open in four main markets:

- New York – 8 AM to 5 PM (EST)

- Tokyo – 7 PM to 4 AM (EST)

- London – 3 AM to 11 AM (EST)

- Sydney – 3 PM to 12 AM (EST)

BlackBull also offers a useful timetable and updates to trading hours on its support page.

Who Is BlackBull Markets Best For?

My analysis shows that BlackBull Markets is best for experienced forex traders looking for true ECN execution with tight spreads, low commissions and fast execution speeds. The VPS also makes the brokerage good for algo traders.

In addition, hands-off traders will be well served by BlackBull Markets, with three copy trading services to choose from, including an in-house app.

FAQ

Is BlackBull Markets Legit Or A Scam?

I did not find any indication that BlackBull Markets is a scam. The broker has been providing financial services since 2014 and adheres to safeguarding measures like negative balance protection and segregated client accounts.

Can I Trust BlackBull Markets?

I am comfortable that BlackBull Markets is a trustworthy forex broker. With that said, it isn’t overseen by tier-one regulators, reducing its trust score to a degree.

Is BlackBull Markets A Regulated Forex Broker?

Yes, BlackBull Markets is regulated by New Zealand’s Financial Markets Authority (FMA). Its offshore entity is also regulated by the Financial Services Authority in Seychelles (FSA).

Does BlackBull Markets Offer Low Forex Trading Fees?

BlackBull Markets offers low forex trading fees on its ECN Prime and ECN Institutional accounts, with the latter providing spreads from 0 pips with a $4 commission.

However, the Standard account is less competitive, with variable spreads from 0.6 pips but average spreads much higher on major forex pairs during my tests. The $5 withdrawal fee is also disappointing.

Is BlackBull Markets A Good Forex Broker For Beginners?

BlackBull Markets is an average forex broker for beginners based on my assessment. There is a free demo account, low minimum deposit and copy trading, but the education falls short of the competitors I have evaluated. Pricing is also average on the entry-level account.

Does BlackBull Markets Have A Forex App?

BlackBull Markets offers a proprietary mobile app, available for free download to iOS and Android devices. Alternatively, I found that can you use MT4 and MT5 on mobile and tablet devices.

How Long Do Withdrawals Take At BlackBull Markets?

Withdrawals from BlackBull Markets vary by payment method, but are similar to most forex brokers I have evaluated. The firm processes withdrawals within 1 working day, though wire transfers can take up to 10 working days. I found that e-wallets are the fastest, offering near-immediate withdrawals.

Can You Make Money Trading Forex With BlackBull Markets?

Skillful traders can make a profit when trading forex with BlackBull Markets. However, they will need an effective strategy and good risk management. Many traders will lose money.