FXCC

-

💵 CurrenciesUSD, EUR, GBP

-

🛠 PlatformsMT4

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 0.2 GBPEUR: 0.5 -

# Assets70+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer100% First Deposit Bonus Up To $2000

Our Opinion On FXCC

FXCC is an award-winning forex broker. During testing, we have been impressed with the ECN pricing that offers spreads from 0.0 pips, while the 70+ currency pairs provide better market coverage than most alternatives. The free VPS is also a bonus for active traders.

On the negative side, there is a slim selection of trading platforms with access to MetaTrader 4 (MT4) only. Our team is also disappointed by the withdrawal fees and weak regulatory oversight through the offshore branch.

Summary

- Instruments: 100+ including 70+ forex pairs, indices, commodities, crypto

- Live Accounts: ECN XL

- Platforms & Apps: MetaTrader 4 (MT4)

- Deposit Options: Bank cards, wire transfers, e-wallets, crypto

- Demo Account: Yes

Pros & Cons

- ECN pricing with tight spreads from 0.0 pips on forex

- Multilingual and highly responsive customer support

- Access to the MetaTrader 4 (MT4) platform and app

- A free VPS and EA support for automated trading

- Good educational resources for new traders

- Scalping and hedging strategies permitted

- Zero deposit and commission fees

- Regulated by the CySEC

- $0 minimum deposit

- High withdrawal fees up to $45 for bank transfers

- Slim product portfolio beyond forex with no stocks

- $5 inactivity charge after 120 days

- No copy trading platform

Is FXCC Regulated?

FX Central Clearing Ltd, operating as FXCC, is regulated by the Cyprus Securities & Exchange Commission (CySEC). This is a respected European regulator and a reassuring sign that the forex broker is legitimate.

FXCC adheres to important rules set by this regulator including the segregation of client and business funds and the use of reputable international banks for the safekeeping of client money.

Traders outside of the European Economic Area (EEA) can register with the Caribbean-based Central Clearing Ltd. Unfortunately, this entity is not overseen by a trusted regulator. While traders still enjoy protective measures such as fund segregation, they are not restricted to a maximum leverage of 1:30 and may have limited legal recourse should the broker run into financial difficulties.

Forex Accounts

FXCC only offers one live account: ECN XL.

The account stands out as a competitive option for traders of all experience levels. Beginners will appreciate the straightforward pricing model with zero-commission trading, while experienced traders will rate the tight spreads with no restrictions on trading strategies.

Another bonus for us is the $0 minimum deposit and 0.01 minimum lot size, which makes FXCC more accessible than forex brokers such as Plus500 and AvaTrade, both requiring a minimum deposit of $100.

Islamic traders will also be pleased that a swap-free account is available upon request.

We have pulled out the key features of the ECN XL account:

- Commission – $0

- Spreads – floating from 0 pips

- Base Currencies – USD, EUR and GBP

How To Open An Account

FXCC has a very simple registration process that I completed in minutes following the steps below:

- Enter your name, email and desired password in the sign-up form

- Click ‘Open Account’

- To unlock full account functionality, complete your profile by providing detailed personal information

- Submit documentation showing proof of address, identity and payment details

- Wait for verification for full access to the broker’s tools and features

Trading Fees

I like FXCC’s floating spread pricing model, which rivals the cheapest zero-commission brokers that I have reviewed. Tight spreads increase the viability of short-term trading strategies, while the no-commission model makes trading with FXCC simple for beginners.

During tests, the EUR/USD came in at 0.1 pips, which is tighter than rivals like XM with its 0.6 pips on the same pair. Spreads on other key currency pairs are also competitive, coming in at 0.5 pips on the EUR/GBP and 0.7 pips on the GBP/USD.

Non-Trading Fees

On the downside, FXCC’s high fees for most withdrawal methods are a disadvantage. The $30 – $45 charges are way above brokers such as eToro, which only charges $5, and many brokers we evaluate that offer free withdrawals.

We are also disappointed with FXCC’s monthly inactivity fee of $5, imposed when your account is not funded or you execute no trades over a period of 120 days. While this type of fee is not unusual, FXCC imposes it after a relatively short period of time, especially compared with OANDA, which only charges its $10 inactivity penalty after 12 months.

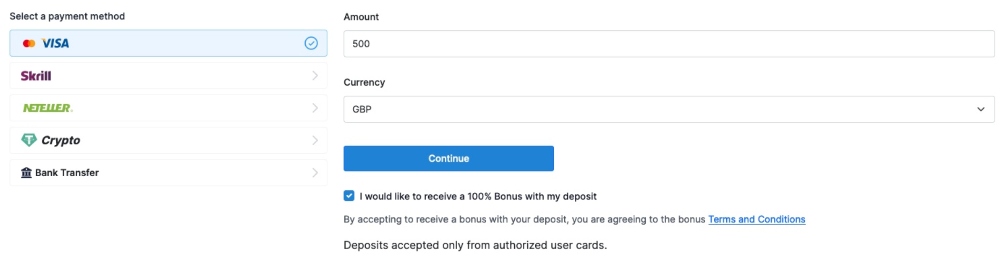

Payment Methods

I am happy with the selection of fee-free funding methods accepted by FXCC, which supports Visa/Mastercard, bank wire transfers, cryptocurrency and four e-wallets – Skrill, Neteller, EeziePay and AWEpay. This makes it easy for global traders to get started with the forex broker.

My major complaint is the withdrawal fees, with bank wire transfers incurring a fee between $30 and $45 and other methods incurring a percentage charge – 2% for Neteller, 2.7% for Skrill, 2% for crypto and 3.4% for both EeziePay and AWEpay. To avoid these charges, I recommend using Visa or Mastercard bank cards, as I found these do not incur a fee.

The speed of transfers varies according to the payment method used. Bank wire transfers are on the slow end, taking between five and seven business days for both deposit and withdrawal requests, while crypto transactions are usually fast, taking 15 minutes or so.

EeziePay and AWEpay process both deposits and withdrawals instantly, however you should be wary of currency conversion fees. The other e-wallets Neteller and Skrill process deposits within an hour of the request and are instant for withdrawals, which is competitive.

How To Make A Deposit

I find it very easy to transfer funds into my FXCC account by following these easy steps:

- On the FXCC traders hub, click the ‘Deposit’ tab

- Select the payment method, such as bank transfer

- Enter the amount you wish to deposit and the currency

- Fill in the relevant payment method details

- If you select bank transfer, FXCC will display the bank account details where you should send the funds.

Forex Assets

Our team highly rates FXCC’s forex offering, which includes 72 major, minor and exotic currency pairs and is on par with competitors like OANDA, which offers 68 pairs, and Forex.com with its 82 pairs.

This will be enough to satisfy most traders and provide opportunities to deploy a range of forex trading strategies.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

FXCC’s non-forex asset list is less competitive, with the lack of shares a notable exclusion and very few other markets. Many competing forex brokers such as CMC Markets and Plus500 offer trading in thousands of global instruments including stocks from a range of international exchanges, so FXCC is behind the competition here.

You can trade:

- Energies: US Crude Oil and UK Crude Oil

- Indices: 12 indices such as the S&P 500, FTSE 100 and DAX 40

- Metals: Gold, silver, palladium and platinum against USD. You can also trade gold against EUR

- Cryptocurrency: Eight digital currencies such as Bitcoin, Ethereum and Litecoin against the USD

Execution

Our team rates FXCC’s execution model, which combines straight-through processing (STP) and electronic communication network (ECN) to ensure fast and high-quality execution with low pricing.

FXCC uses a no-dealing desk model and does not act as a market maker, reducing the risk of price slippage or a conflict of interest by the broker.

Leverage

FXCC’s leverage for clients registered within the CySEC-authorized EEA branch is limited to a maximum of 1:30 due to regulatory restrictions.

However, professional traders and clients of the broker’s offshore entity can access higher leverage up to 1:500. While this will appeal to some traders, we recommend using risk management tools such as stop-loss orders to protect against large losses, especially for beginners.

FXCC’s stop-out kicks in when your margin level drops to 50% or lower. At this point, the forex broker will begin to close your positions until the margin level of your account is above the threshold again. You can avoid a stop-out by depositing funds into your account.

Platforms & Apps

FXCC offers the world-leading platform MetaTrader 4 (MT4), which I find an excellent terminal for forex trading owing to its intuitive interface, wide range of technical analysis and charting tools and powerful Expert Advisor (EA) bots.

MT4 ultimately gives me the flexibility I need to analyze the foreign exchange market, with 9 time frames ranging from 1 minute to 1 month, 30 integrated indicators, plus 2000 free custom indicators and 700 paid options. It is one of the best forex platforms for technical traders.

Seasoned traders may be disappointed that the latest iteration from MetaQuotes isn’t available – MetaTrader 5 (MT5), as this offers faster processing and more advanced analysis features, but I don’t consider this a major drawback – MT4 will serve most active traders.

MetaTrader 4 is available for download to desktop devices or through major web browsers. You can also find download links to the MT4 app for both iOS and Android devices via the FXCC website.

How To Make A Forex Trade

MetaTrader 4’s simple interface makes placing forex trades straightforward:

- On the MT4 menu bar, click the ‘New Order’ button

- Choose the forex pair you want to trade from the ‘Symbols’ list

- Select the trade type from either market execution or pending order

- Specify the trade details with the type of pending order (if desired) trade volume and strike prices for stop loss and take profit orders

- Confirm the order

Forex Tools

Although FXCC does not offer an extensive suite of forex tools, I am satisfied with the inclusion of a free Virtual Private Server (VPS). This works extremely well with MT4’s expert advisors for automated trading, and I frequently make use of it when trading on FXCC.

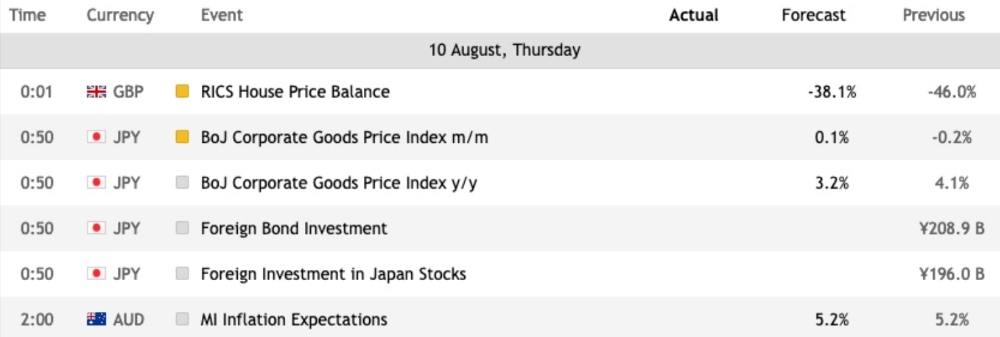

An economic calendar is also available to keep track of upcoming noteworthy events like the publishing of reports on country inflation rates, imports and exports.

Still, I feel that FXCC could become a more attractive forex broker by expanding the range of tools it supports. One excellent addition would be copy trading, allowing rookie traders to mirror and learn from more experienced peers, who can earn commissions from copiers.

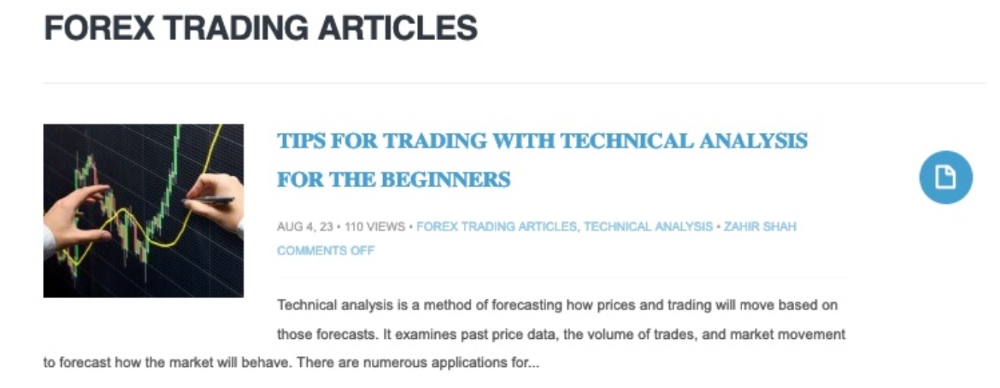

Forex Research

I am satisfied with FXCC’s forex research offering, which includes a blog with regular articles and posts highlighting promising opportunities as well as general tips on trading.

I particularly enjoy the daily market analysis provided by in-house experts and the morning roll call, though I do feel FXCC can improve its research by introducing regular live streams with experts and real-time trading sessions.

Forex Education

Having tested hundreds of forex brokers, I feel that the FXCC’s education section is fairly average, with a decent range of materials available but nothing that stands out.

The online broker covers a range of important topics including guides on foundational information for the forex market that all beginners should read. Clients can also download a range of ebook PDFs for free that go into further detail on strategizing and online trading.

These are useful resources, but FXCC still lags some behind industry leaders like eToro with its comprehensive forex education academy.

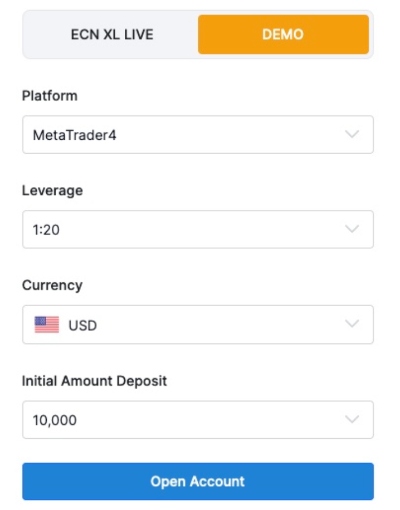

Demo Account

One of the best ways to build experience with FXCC is through the free demo account which gives you the option of a base currency in USD, EUR and GBP, leverage up to 1:500, and provides virtual funds so you can test strategies.

I do feel slightly let down that the FXCC demo mode is limited to 30 days, but I found that you can simply open another demo account after the first one expires.

How To Open A Demo Account

The simple process to register with FXCC for a demo account can be completed in a few easy steps that should only take a minute:

- On the FXCC website, click the ‘Register’ button on the menu bar

- Enter your name, email and desired password

- Click ‘Open Account’

- Select ‘Demo’ and specify the account details. This includes the leverage, currency and the initial balance

- Click the ‘Open Account’ button and make a note of the login details that FXCC provides

Bonus Offers

FXCC’s offshore entity offers a 100% welcome bonus up to $2000 whereby new clients can double their initial deposit size. However, due to European regulations, this bonus is not available for clients from the EEA.

Importantly, we never recommend choosing a forex broker based on their bonuses as they can encourage bad trading habits.

Trading Restrictions

Our team is happy to see that FXCC does not impose any trading restrictions, meaning strategies such as hedging and scalping are viable.

This makes the broker a worthwhile option for serious forex traders who will also enjoy the VPS service and MT4 support.

Customer Service

I rate FXCC’s customer service as top-notch in terms of responsiveness and speed. The multilingual support team responded very quickly to my queries over live chat, never taking more than 30 minutes to get back to me. I also find the FAQs section on the website a useful way to solve basic queries.

The only downside of FXCC’s customer support desk is that it is not available during weekends although the crypto markets remain open.

The available methods for contacting the customer service team include:

- Live chat

- Contact form on the website

- Call +44 203 150 0832

- Email info@fxcc.com

- Contact the team on social media such as Facebook, Twitter, LinkedIn, Instagram

Company Details

FXCC was launched in 2010 by a group of forex experts aiming to create a competitive and supportive trading experience for clients through transparency and high trade quality.

Since its foundation, FXCC has won many awards, bolstering its reputation as a reliable broker for forex traders.

The registration details of the broker’s two branches are:

- Central Clearing Ltd: Registered in Nevis with company number C55272

- FX Central Clearing Ltd: Registered with the Cyprus Securities and Exchange Commission with license number 121/10

Trading Hours

FXCC’s trading hours vary according to the asset and the market. For forex, the opening hours are 00:05 until 23:55, Monday to Friday GMT+3. To find the hours for other markets and specific assets, check the ‘Symbols’ tab on the MT4 platform.

I find FXCC’s in-house forex market hours tool a handy way to check holidays and other events that could impact trading hours.

Who Is FXCC Best For?

FXCC is a good forex broker for all experience levels. New currency traders will enjoy the $0 minimum deposit, education and trading resources, plus the zero commission policy. Experienced traders will appreciate the tight spreads, access to MT4 and a VPS, plus zero strategy restrictions.

FAQ

Is FXCC Legit Or A Scam?

FXCC is a legitimate forex broker. The European branch is licensed by the CySEC, a reputable regulator, and the brokerage has earned a good reputation with over 10 years in the business.

Can I Trust FXCC?

FXCC is a trustworthy forex broker. The broker uses a price aggregator to ensure that counterparty orders use the best bid and ask prices currently available. The multiple industry awards are also a reassuring sign for us.

Is FXCC A Regulated Forex Broker?

The European branch of FXCC is regulated by the Cyprus Securities & Exchange (CySEC), under FX Central Clearing Ltd.

On the downside, the offshore branch is unregulated, reducing the broker’s safety rating for global traders.

Is FXCC A Good Or Bad Forex Broker?

FXCC is a good forex broker. The deposit is low, the MetaTrader 4 platform is one of the best for forex trading, and the tight spreads through the ECN model are competitive.

FXCC could offer more in terms of trading tools and reduce or eliminate its withdrawal fees, but these are minor complaints.

Is FXCC Good For Beginners?

FXCC is an excellent low-cost choice for beginners due to its decent range of educational resources and free demo account – a great way to build up experience before trading with real capital. The $0 minimum deposit also makes the forex broker accessible for new traders.

Does FXCC Offer Low Forex Trading Fees?

FXCC offers very competitive forex trading fees. There are no commissions and tight spreads sourced directly from liquidity providers. While testing FXCC, the EUR/USD was available at 0.1 pips and the EUR/GBP at 0.5 pips.

Does FXCC Have A Forex App?

FXCC does not have a dedicated mobile app, but clients can trade using MT4’s app, which is available from the Apple App Store and Google Play.

How Long Do Withdrawals Take At FXCC?

Withdrawal times for FXCC depend on the method you choose. The e-wallets Neteller, Skrill, EeziePay and AWEpay are the fastest as they process withdrawals immediately. Crypto withdrawals are also quick as you can expect funds to be transferred within just 15 minutes. However, bank cards and wire transfers take up to five working days.

Can You Make Money Trading Forex With FXCC?

Yes, it is possible to have a profitable strategy when trading with FXCC, which offers the reliable MetaTrader 4 platform and plenty of analysis to support forex trading.

However, no forex broker or strategy can guarantee positive returns so you should never invest more than what you would be comfortable losing.