SuperForex

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, RUB, PLN, AED, BRL, THB, VND

-

🛠 PlatformsMT4

-

⇔ Spread

GBPUSD: 2.5 (standard account) EURUSD: 2.0 (standard account) GBPEUR: 2.5 (standard account) -

# Assets100+

-

🪙 Minimum Deposit$1

-

🫴 Bonus Offer$88 No Deposit Bonus

My Opinion On SuperForex

SuperForex is an online broker that offers trading on 80+ currency pairs through the MetaTrader 4 platform. But how does it compare with alternatives? To find out, I tested every facet of SuperForex, evaluating its account types, reviewing its trading terms, and trying the platforms and tools.

My verdict? While SuperForex has several strengths, including low entry requirements, decent market research and attractive promotions, I feel the broker is let down by high trading fees, a complicated account system and poor regulatory oversight.

Summary

- Instruments: 150+ including 80+ forex pairs, stocks, indices, metals, energies, crypto

- Live Accounts: STP Standard, STP Swap-Free, STP No-Spread, STP Micro-Cent, STP Crypto, Profi STP, ECN Standard, ECN Standard-Mini, ECN Swap-Free, ECN Swap-Free Mini, ECN Crypto

- Platform & Apps: MetaTrader 4

- Deposit Options: Bank wire transfer, credit/debit card, crypto, SticPay, Payeer, Perfect Money

- Demo Account: Yes

Pros & Cons

- I find the MT4 platform reliable for trading currencies with strong technical analysis features

- The execution speeds from 40ms are faster than average, helping to reduce slippage

- I think the forex education is great for new traders, especially the training lectures

- The 35+ base currencies are among the most I've seen, catering to global traders

- With a $1 minimum deposit, SuperForex is accessible to beginners

- My assessment of the fees shows that SuperForex is an expensive broker with a $9 commission on ECN accounts

- The copy trading tool does not compete with industry leaders offering limited performance statistics

- I find the number of account types and bonuses excessive, making getting started complicated

- SuperForex has weak regulatory credentials, with no oversight from tier-one regulators

- I think the broker's proprietary app is of limited use since it doesn't have trading functionality

Is SuperForex Regulated?

Regulatory oversight is an important factor for me when I review brokers – well-regulated firms are more likely to keep your funds secure and protect you from scams.

Unfortunately, I have to score SuperForex poorly in this department. The brand is registered offshore under the name FINATEQS CORP by the Belize Financial Services Commission (FSC). This is not a reputable watchdog.

However, I was pleased to find that SuperForex has membership with the Investor Compensation Fund (ICF), which offers up to €20,000 financial reimbursement in the case of business failure.

Additionally, I was reassured that the broker segregates client funds and offers an Auto-Reset Balance program, which essentially provides negative balance protection, preventing you from incurring losses beyond your account balance.

Nevertheless, these basic measures hardly make up for the lack of strict oversight you’d get from regulators like the UK Financial Conduct Authority (FCA) or the Australian Securities & Investments Commission (ASIC). So, if choosing a tightly regulated broker is important to you, I recommend one of the alternatives below.

Alternative Brokers for US

Forex Accounts

SuperForex offers 10+ live account options, all with STP or ECN execution. I appreciate brokers giving a mix of account types to suit different strategies, but for me the sheer number of choices here is confusing.

There are differences in maximum leverage, base currencies, pricing, bonuses, and more which made it a headache when I signed up. I prefer brokers such as IC Markets that offer a simpler structure of Standard or Raw spread profiles.

The good news is that all accounts except the Profi STP profile have a minimum deposit requirement of $100 or less, making the broker accessible. The swap-free account also helps with this, providing halal trading for Islamic investors.

Importantly, the STP accounts are better if you want fixed spreads and price certainty while the ECN accounts are good if you want variable, low spreads.

I would also think about the size and volume of trades you plan to make. The micro and mini solutions are good for beginners, the standard account is good for experienced traders, while the profi profile is best for pro investors looking for maximum buying power with 1:3000 leverage. As the name suggests, the crypto accounts are best if you want to speculate on digital currencies.

I have compared the SuperForex accounts below, highlighting the key differences.

| Account | Minimum Deposit | Maximum Leverage | Spreads | Forex Copy Trading | Base Currencies |

|---|---|---|---|---|---|

| Standard | $5 | 1:1000 | Fixed | Yes | 34 |

| Swap-free | $5 | 1:1000 | Fixed | Yes | 27 |

| No Spread | $50 | 1:1000 | None | No | 2 |

| Micro Cent | $1 | 1:1000 | Fixed | Yes | 3 |

| Profi STP | $500 | 1:3000 | From 0.01 pips | No | 3 |

| Crypto | $50 | 1:10 | Fixed | No | 1 |

| Account | Minimum Deposit | Maximum Leverage | Spreads | Forex Copy Trading | Base Currencies |

|---|---|---|---|---|---|

| ECN Standard | $100 | 1:1000 | Floating | No | 25 |

| ECN Standard-Mini | $5 | 1:1000 | Floating | No | 17 |

| ECN Swap-Free | $100 | 1:1000 | Floating | No | 17 |

| ECN Swap-Free Mini | $5 | 1:1000 | Floating | No | 15 |

| ECN Crypto | $50 | 1:10 | Floating | No | 4 (crypto) |

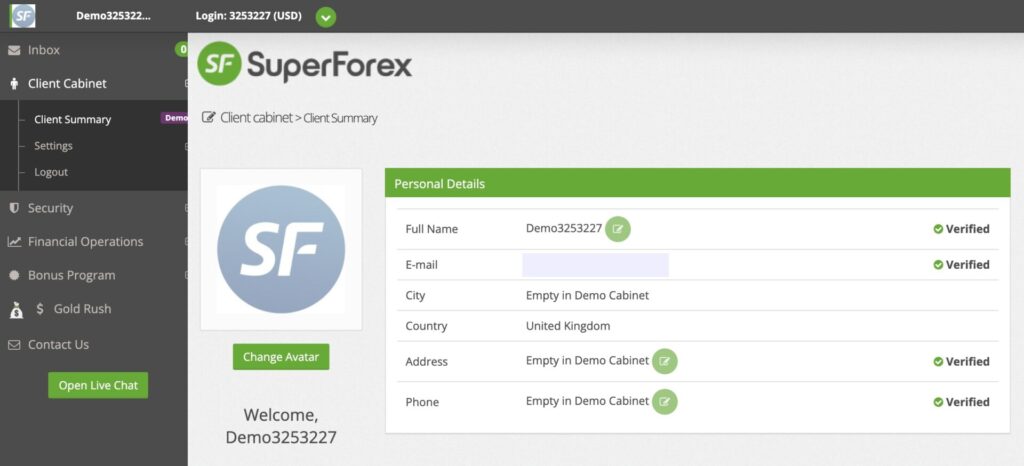

How To Open An Account

Despite the complicated account system, I found SuperForex’s registration process quick and straightforward, especially since you can sign up with a few clicks via a Google or Facebook account. Alternatively:

- Review the Public Offer Agreement and agree to the terms by ticking the box

- In the account registration form choose individual or corporate account

- Add your personal details – name, date of birth, address, telephone and email – and create a password

- Choose your account type, leverage, and base currency

- Tick the box if you want to choose a swap-free profile

- Select ‘Open Account’

Trading Fees

After recording and comparing the trading fees at SuperForex with alternatives, I can say that pricing is a weak point for this broker.

Spreads and commissions vary depending on the account type, with higher spreads on the STP accounts, as these follow a fixed pricing model.

For example, when I used the STP Standard account I was offered a 2.5-pip spread on GBP/USD and EUR/GBP with a 2.2-pip spread. This is expensive compared to the fixed spreads available at other brokers, such as easyMarkets, which offers spreads from 1.3-pips and 1.5-pips, respectively.

What also surprised me was to be offered a 2-pip spread on the same pairs on some of SuperForex’s ECN accounts, but with a $9 round-turn commission. Not only is the spread still very wide when I routinely find these pairs available with less than 1 pip spreads – but the commission is also much higher than most competitors, with Pepperstone, for instance, charging $7 round-turn.

Non-Trading Fees

Swap rates apply to positions held overnight, except to customers trading forex on a swap-free profile.

Besides this, SuperForex has done well by shielding customers from non-trading fees, with no deposit or withdrawal fees charged and some accounts available with 35 base currencies, meaning many international traders will be protected from conversion charges.

Payment Methods

SuperForex offers a range of electronic payment, credit/debit card, and wire transfer solutions. These include SticPay, Payeer, Perfect Money, bank wire transfer, VISA & MasterCard, plus cryptos. I count this as a good selection of funding options, though I would like to see PayPal or another mainstream e-wallet.

I was also interested to see that I was not required to verify my account to add funds, which is often not the case for firms with stringent regulations.

My main grievance is the $300 minimum deposit requirement for wire transfers, which is far higher than other methods – credit/debit cards, for instance, only need a $1 initial deposit.

How To Make A Deposit

I have no issues making a payment to my live trading account. I am able to add funds to my profile without having to complete any verification stipulations which saves time. To get started:

- Log in to the client portal and click ‘Financial Operations’ from the menu on the left

- Choose ‘Deposit Money’ to review the payment methods

- Click the ‘Deposit’ icon next to the payment type logos

- Add the amount to the deposit and select ‘Deposit Money’

- Follow the on-screen instructions to complete the payment (you may be redirected to external websites depending on the payment type)

Forex Assets

I expect good forex brokers to offer all the major pairs as well as a good selection of minors and exotics so that traders have flexible options to build a portfolio and won’t miss out on trading opportunities.

While I don’t think it’s a requirement to have a huge range of options, SuperForex has lived up to its name with 80+ pairs – a selection that’s comfortably on the high side and outstrips some rivals like IC Markets (60+).

This is a nice advantage to have, though it is worth noting that access varies between account types.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

SuperForex does provide non-forex instruments, which is important to allow traders to build a diverse portfolio and provide hedging opportunities, but with only around 100 non-forex assets I feel the offering lacks depth.

On the upside, there is good multi-asset market coverage, which I unpack below:

- Indices: 19 stock index funds including NASDAQ 100, DAX 30, and FTSE 100

- Stocks: 75+ company shares such as Unilever, Procter & Gamble, and JP Morgan Chase & Co

- ETFs: 23 exchange-traded funds such as ProShares UltraPro QQQ and Microsectors FANG+ Index

- Commodities: 5 metals, 3 energies, and 6 soft commodities including gold, Brent crude oil, wheat, and sugar

- Crypto: 9 cryptocurrency and USD pairs including BTC/USD and ETH/USD

Execution

SuperForex offers both STP and ECN execution. In my experience, these execution models offer the fairest pricing, thanks to the removal of dealing desk intervention.

In addition to this, SuperForex offers highly competitive trading speeds, with a minimum order execution speed of 40ms, which is considerably faster than the 100ms standard we set for ‘fast’ brokers.

Leverage

SuperForex offers very high leverage up to 1:3000, though I find maximum ratios do vary between account types. The majority of STP and ECN accounts offer up to 1:1000, which is still far above the 1:30 maximum stipulated by most brokers with top-tier regulatory oversight.

Importantly, such a high amount of leverage is not right for everyone, so I appreciated that at account registration, I was able to choose a leverage ratio that was aligned with my strategy and risk tolerance.

I would caution less experienced traders against using such significant leverage, as losses will be amplified.

Tip: if you do choose to trade with margin, set a stop loss.

Platforms & Apps

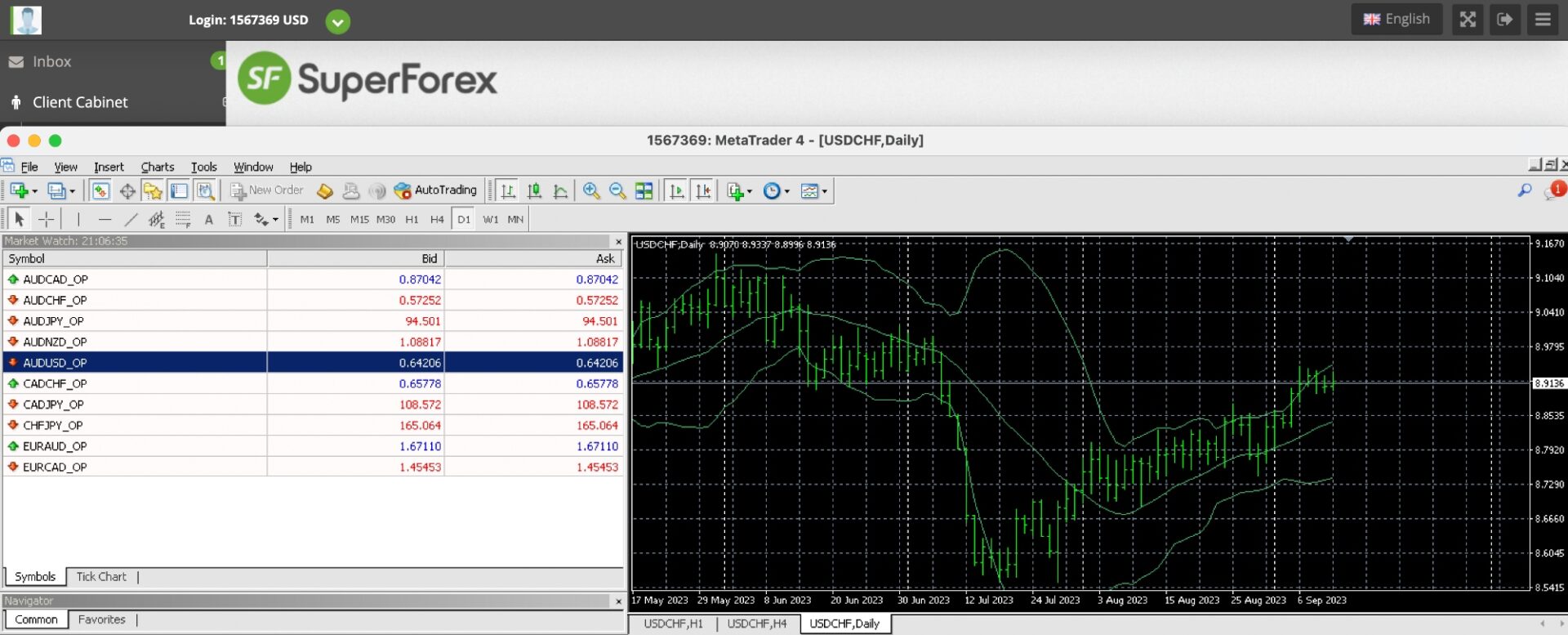

SuperForex only supports one trading platform, MetaTrader 4 (MT4). Although this extremely popular, tried-and-true terminal is easy to pick up and offers advanced functionality for experienced forex traders, I do feel the best brokers offer more choice and would have appreciated a more up-to-date option, such as MetaTrader 5.

After signing into the platform and placing many trades, several strengths and weaknesses became apparent. I have broken down the results of my tests below.

Design & Navigation

I enjoy MT4’s seamless transitions between device types. I can access my account and open positions on the desktop download, WebTrader, and mobile app.

Yet while the MT4 platform is easy to navigate, I think brands such as eToro offer more modern and sleek platforms that are especially attractive to newer traders.

Charts

In my opinion, MT4’s charting capabilities are decent but not as extensive as alternatives. The platform offers enough technical analysis tools for most retail traders, but veteran investors may prefer an alternative like TradingView, which outguns MT4 in the charting department.

Forex traders can make use of 3 chart types (bar, line, and candlestick) with 9 timeframe views (1 minute to 1 month). It is also good to see some of the most popular technical indicators integrated into the platform, including RSI and Bollinger Bonds.

Order Types

I am content with MT4’s order types, which include standard market orders and four pending order types, as well as stop-loss and take-profit options. This will serve most traders and strategies.

Mobile App

SuperForex has a mobile app, though this is only compatible with Android devices. It provides full access to all account management features, including deposits and withdrawals, bonus requests, and account registration.

However, for me, I didn’t find the app particularly useful, given it does not have a trading function. With this in mind, I would recommend the MT4 mobile app. You can execute positions while on the go.

How To Make A Forex Trade

I find MT4’s order ticket simple to complete, with new orders initiated in just a few clicks:

- Choose an instrument to trade from the ‘Market Watch’ dashboard on the left

- Right-click on the currency pair and select ‘New Order’

- Input your trade parameters to the order ticket, including order type, trade volume, and stop-loss or take-profit prices

- Confirm the order by choosing ‘Buy’ or ‘Sell’

Forex Tools

I am happy with SuperForex’s selection of tools, as I consider these important ways to boost your trading prospects. The tools can help traders identify opportunities and assist with entry and exit points.

However, with no VPS service, I do think SuperForex is missing a tool that some serious algo traders will consider a must-have.

Pattern Graphix

SuperForex offers Pattern Graphix MT4 software for no fee. The pattern recognition tool offers trade suggestions and trend acknowledgment which is especially useful for those new to forex trading.

When testing the plug-in, I found the pop-out alerts helpful and appreciated the custom notifications that kept me up to date on trend continuation patterns, reversal indicators, and more.

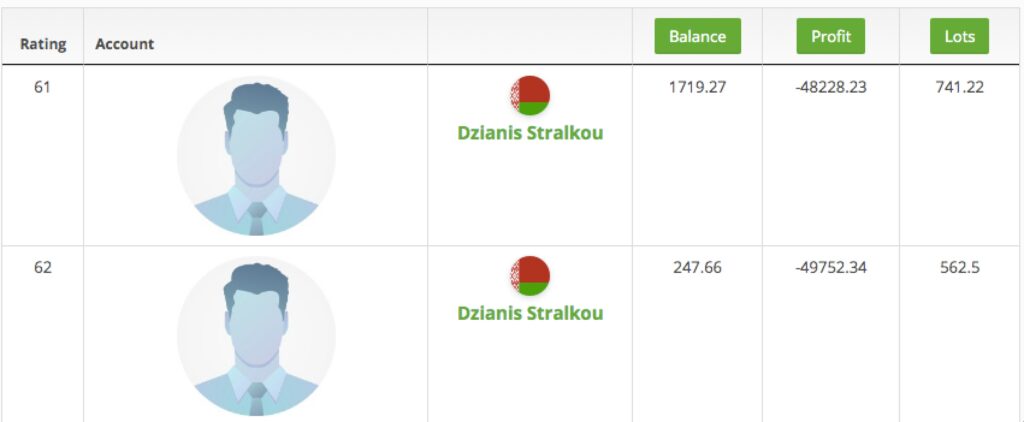

Forex Copy

SuperForex also offers a copy trading service, Forex Copy, which allows traders to connect and mirror the positions of experienced traders in real time. One of the main appeals l I find is the low minimum deposit requirement of just $10 to get started.

However, when I compare the tool to leading social trading brokers, there are several shortcomings. Firstly, there are less than 70 registered ‘master traders’, which I don’t feel is a large enough pool to choose from.

Secondly, and perhaps the biggest disappointment for me is the lack of performance statistics. The only information available when comparing master traders was total account balance, profit, and total lots traded. For me, there is nowhere near enough data on signal providers to make an educated decision about who to mirror with my funds.

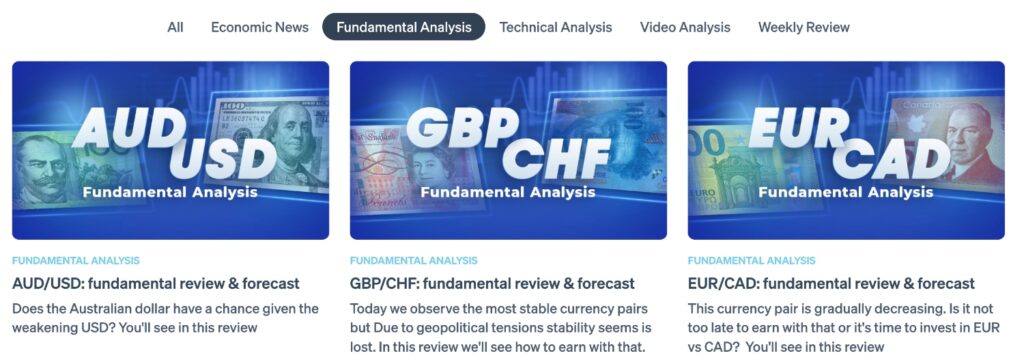

Forex Research

After spending time using SuperForex, I can recommend the brand for forex research. The broker publishes up-to-date economic news and analysis from company experts. I enjoy that the analysis is supported by video discussions, which for me demonstrates credibility.

Discussion points are shown with live tutorials on the MT4 terminal. I also like the technical and fundamental analysis bulletins, which provide in-depth reviews of trends.

Looking at the negatives, I found the supporting economic news to be outdated, and this is an area for improvement.

Forex Education

I found some useful educational content on the SuperForex platform, with videos and forex training courses available, though I don’t feel these provide a particularly deep learning experience.

On the other hand, I found the training lectures much more detailed, and suitable for forex traders looking to take their skills to the next level. Some of the topics include using automated trading strategies, technical analysis, and how news can impact market fluctuations.

Interestingly, the broker also has education office hubs. These are used to host in-person seminars, led by financial experts. Although just 10 locations currently offer this service, I am intrigued by this offering and think it could make this broker attractive for new traders who live near one of these locations.

Demo Account

SuperForex provides a free demo account to practice trading forex risk-free. I consider this a minimum stipulation of major brokers, as it offers new clients the chance to test a platform before signing up.

I used the demo account and was pleased to see real-time pricing and market conditions. All demo profiles are loaded with $50,000 in virtual funds and up to 1:1000 leverage which is plenty to explore the platform.

My main complaint is the lack of flexibility with account types. Given the number of live accounts available, the demo account configurations are quite limited, only providing ECN Standard, ECN Mini, or No Spread.

Bonus Offers

SuperForex provides numerous promotions – so many, in fact, that I found it confusing trying to take in all the different restrictions and eligibility requirements.

As with the range of account types, I think the broker would do better to simplify, though at least there is a bonus comparison chart on the SuperForex website providing details of key features.

I explored the 50% deposit bonus in detail during my review, and I found this reward to have surprisingly fair terms, with no minimum trading volumes, restrictions on how much profit can be withdrawn, or time limits to trade with the financial incentive. Instead, the bonus is integrated into the margin. There are also no restrictions on the number of times you can opt into this reward.

I also came across some additional perks that aren’t typically seen with alternative brands while trading with SuperForex, including a deposit protection scheme which can be used to protect your funds against losses with a credit reimbursement. There are no limits on the value that can be claimed back however, the program is not available to traders with a >70% closed deal loss pattern in the last 90 days of trading.

Other incentives include access to a loyalty scheme with lowered spreads and exclusive trading signals, and a competitive 5% interest rate scheme on your account equity with monthly payments.

Overall, SuperForex offers more bonuses and deals than almost every other forex broker I have reviewed. However, I never recommend picking a brokerage based on its promotions – trading conditions and account safety are more important in my view.

Trading Restrictions

My review of SuperForex did not come across any trading restrictions. This means you can trade with automated strategies, including via Expert Advisors (EAs).

Alternative systems including scalping and hedging are also permitted, however, I did find that hedging is not accepted on accounts that have made use of the $50 no-deposit bonus.

Customer Service

For me, reliable customer support is key when choosing a forex broker, so I always devote time to testing the contact methods and customer service availability.

I was not impressed that SuperForex’s assistants are only available during office hours, Monday to Friday from 07:00 to 17:00 (GMT+0). Most top brokers provide support, at least through live chat, 24/5 to cover forex market hours, while some are open 24/7.

In fact, I was very disappointed when I tested SuperForex’s live chat function at 16:30 to receive no response.

I do however, appreciate there are some alternative contact options, though these unfortunately are limited to the same hours. You can use telephone (+442045771579), email (support@superforex.com), or other chat functions including Skype and WhatsApp.

Company Details

SuperForex has been providing online trading services since 2013 and is available in 150+ countries.

It is pleasing to see the broker has been recognized with several industry awards including the Best ECN Broker in Africa 2021 by the Global Business Magazine and The Best Withdrawal Options 2022 by the World Financial Awards.

These are reassuring signs for me that this is a legitimate forex broker.

Trading Hours

The forex market is open for trading 24/5. However, I was a bit disappointed with the lack of transparency offered by SuperForex when it comes to trading hours. I rate brokers that offer a calendar with upcoming market closures and public holiday dates, which the firm is lacking.

Who Is SuperForex Best For?

Based on my time using SuperForex, I would recommend the broker for several types of traders:

- Those seeking very high leverage – the 1:3000 rate available is among the highest I have seen, though the trade-off is an above-average minimum deposit of $1000.

- Those seeking fixed spreads – this offers price certainty, though they aren’t the cheapest fixed spreads I have found.

- Those seeking copy trading – this will appeal to hands-off investors, though again, it doesn’t rival the social trading solutions of many alternatives I have evaluated.

FAQ

Is SuperForex Legit Or A Scam?

I feel confident that SuperForex is a legitimate brokerage. I opened an account, explored the client dashboard, and activated a bonus reward. The MT4 platform also operated smoothly, with no glitches.

Can I Trust SuperForex?

Though I didn’t find any faults while using SuperForex, the broker cannot attain the highest trust score given its weak regulatory credentials.

Is SuperForex A Regulated Forex Broker?

SuperForex is regulated offshore by the Financial Services Commission of Belize (FSC).

Is SuperForex A Good Or Bad Forex Broker?

Overall I think SuperForex is a reasonable forex broker, with plenty of research and analysis tools, the reliable MT4 platform, and a wide range of accounts to suit different trading styles. That being said, the regulatory credentials and expensive trading fees do pull the brand down in my rankings.

Is SuperForex Good For Beginners?

Having tested SuperForex, I see the brand as a mediocre choice for beginners. It offers a decent amount of educational content, a demo account, fixed spreads, and a low minimum deposit requirement, but the trading fees are not the best and the trading platform is not optimized for new traders.

Does SuperForex Offer Low Forex Trading Fees?

My analysis shows that SuperForex does not offer low trading fees. Trades on the ECN Standard account, for instance, will incur a $9 commission fee, alongside spreads that are wider than many competitors.

Does SuperForex Have A Forex App?

SuperForex does have a proprietary mobile app, though it does not offer trading functionality. As a result, I find it of limited use. Instead, traders can download the MT4 app which facilitates forex trading.

How Long Do Withdrawals Take At SuperForex?

SuperForex’s finance team processes transactions within three working hours, which is faster than the up to 2-days average processing speeds I see at other forex brokers.

Completion times will vary by payment method, however e-wallet solutions typically process money instantly.

Can You Make Money Trading Forex With SuperForex?

Yes, it is possible for skilled traders to make a profit trading currencies with SuperForex. However, there is a high risk of losses, especially given the huge amount of leverage available. The above-average trading fees also make it harder to turn a profit.