CloseOption

-

💵 CurrenciesUSD

-

🛠 PlatformsProprietary

-

⇔ Spread

GBPUSD: No fee - payouts approx. 80% (Copper) EURUSD: No fee - payouts approx. 80% (Copper) GBPEUR: No fee - payouts approx. 80% (Copper) -

# Assets20+

-

🪙 Minimum Deposit$5

-

🫴 Bonus Offer$10 Welcome Gift

Our Opinion On CloseOption

Traders looking for straightforward binary options on popular forex pairs and cryptos will be well served by CloseOption. We rate the relatively high payouts up to 95% for active traders and the low minimum deposit of $5. The flexible contract lengths spanning 30 seconds to one month also provide both short and medium-term trading opportunities. On the negative side, CloseOption doesn’t offer binaries on stocks or commodities. Our team also note the limited regulatory oversight which reduces the firm’s safety score.

Summary

- Instruments: Binary options contracts on 30+ forex pairs, plus a small range of cryptocurrencies

- Live Accounts: Real, Demo, Contest

- Platforms & Apps: TradeRoom WebTrader

- Deposit Options: Bank cards, wire transfers, e-wallets and cryptocurrencies

- Demo Account: Yes

Pros & Cons

- User-friendly web platform with customizable charts and one-click trading

- Suitable for longer-term binary options traders with one-month contracts

- Good range of fee-free and fast payment methods including cryptos

- Joining bonuses and weekly tournaments with $3000 in cash prizes

- 24/7 customer support with fast live chat response times

- High payouts up to 95% on forex assets

- Low starting deposit of just $5

- Easy-access demo account

- Narrow range of underlying assets with no stocks or commodities

- Platform lacks advanced charting and analysis tools

- $50 – $100 charge for bank wire withdrawals

- High deposit needed for the best payouts

- No authorization from a trusted regulator

- Monthly inactivity fee of 0.5% plus $10

- No copy trading

Is CloseOption Regulated?

Our team’s primary criticism is CloseOption’s weak regulatory status.

The broker is registered in Georgia and permitted to operate by the National Bank of Georgia, under license number B 2-08/3647. As such, the firm only has to follow local trading laws in Georgia, which makes the broker’s regulatory status relatively poor.

Central banks do not generally have the same stringent rules and enforcement powers as trusted regulators like the Cyprus Securities & Exchange Commission (CySEC) or the UK Financial Conduct Authority (FCA).

With that said, binary options trading is not authorized by established financial agencies so CloseOption operates on a similar regulatory footing to other binary brokers. It is just worth being aware that you won’t get the same legal protections afforded to clients of heavily regulated forex brokers like Plus500.

Accounts

We like the clear account structure with three options: Real, Demo and Contest. A key bonus for us is that the real account has five tiers, with conditions improving the more you deposit and trade. This means higher payouts and priority service for active traders.

Real Account

The Real account is the standard live trading account available to all clients, with full access to binary options trading on 30+ forex pairs.

The minimum deposit is very reasonable at $5 and noticeably lower than alternatives like RaceOption ($250) and Pocket Option ($50). This reduces the entry barrier for newer traders and those on a budget.

CloseOption also caters to traders with a larger bankroll, supporting trade sizes up to $1,000. The other benefit for active traders is the opportunity to boost payouts on popular assets, including currency pairs, by increasing your deposit size:

- Copper: Deposit $0 – 1,000. Payouts: EUR/USD – 80%, other assets: 17 – 82%

- Bronze: Deposit $1,000 – 2,000. Payouts: EUR/USD – 82%, other assets: 17 – 85%

- Silver: Deposit $2,000 – 10,000. Payouts: EUR/USD – 84%, other assets: 17 – 87%

- Gold: Deposit $10,000 – 50,000. Payouts: EUR/USD – 85%, other assets: 17 – 90%

- Diamond: Deposit $50,000 – 1,000,000. Payouts: EUR/USD – 93%, other assets: 17 – 95%

Alongside higher returns, you can also access a weekly cash gift (Gold and Diamond), a dedicated manager (Diamond), and favorable conditions for trading contests.

Demo Account

A free demo account is available to traders. We appreciate that the simulator account sufficiently mimics the live profile, allowing us to test and refine strategies before trading with real money.

Another bonus for us is the recharging capabilities. Whilst the demo account comes with $100,000, we could recharge our account with $100,000 three more times by contacting the broker’s support team. This effectively means no expiry time on the demo account.

For new traders, we recommend starting with the paper trading account. It is a great way to learn how binary options work and test CloseOption before making a deposit.

Contest Account

Contest accounts can be opened by traders by signing up for one of CloseOption’s competitions. These are run weekly and provide a competitive environment to test your skills against other binary options traders.

This is an enticing feature that isn’t available at most binary options brokers. And with a $3000 prize pot split between 20 participants each week, it will appeal to traders looking to win money.

On the negative side, our experts found that there is typically an entrance fee of $10. Whilst not a large amount, it does mean you can’t participate without some financial risk.

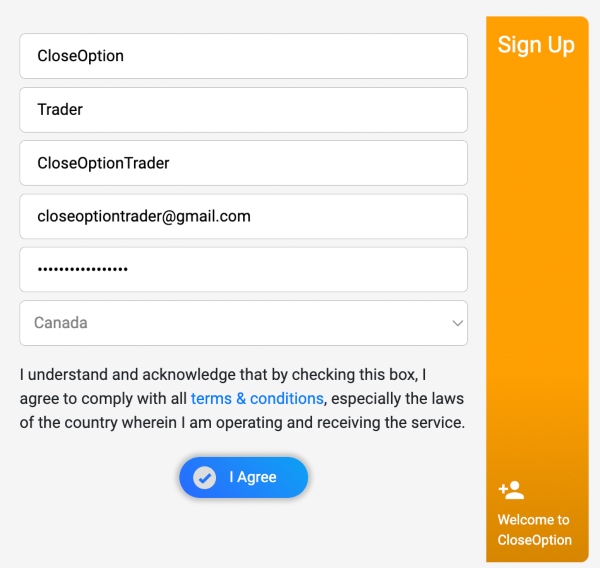

How To Open An Account

I have tested more than a dozen binary options brokers and CloseOption offers one of the most straightforward joining processes. It only took me a few minutes to register.

- Fill out the application form (or register with your Google account)

- Click the ‘Sign Up’ button

- You will receive an email to activate your account

- Verify your identity by providing a legal ID and proof of address

- Once your application has been reviewed and approved, you can fund your account

Trading Fees

The bulk of CloseOption’s revenue is generated from losing binary options contracts. When a trade doesn’t go in the client’s direction, the initial investment is given to the broker.

This means there are no spreads or commissions – unlike traditional forex brokers.

Non-Trading Fees

An advantage of trading with CloseOption is the zero deposit fees. This makes it cheap to fund your account without the broker taking a cut.

On the negative side, CloseOption charges an inactivity fee of 0.5% of the balance for accounts that have been inactive for three months. Traders also have to pay a $10 reactivation fee to resume trading.

This is a noticeable drawback for casual traders, especially when popular alternatives, including Spectre.ai, do not have an inactivity penalty.

CloseOption Payouts

Payouts at CloseOption are fairly competitive, especially if you qualify for a Diamond profile, which climbs to 95%. This puts it on par with the majority of binary options brokers that we have tested.

However, entry-level traders can only get up to 80% on the EUR/USD and 82% on the USD/JPY. This is lower than the likes of Pocket Option which offers 92% and 88%, respectively. This significantly reduces the broker’s appeal for traders on a budget.

Payouts on digital currencies are much lower at 40%. This fares well against alternatives and reflects crypto’s highly volatile market conditions.

Timeframes

A big bonus of trading binary options with CloseOption for us is the range of expiry times. You can open contracts from just 30 seconds for short-term trading opportunities, or hold trades for up to one month, catering to longer-term trading setups.

This provides more flexibility than many alternatives. Binaries at GC Option, for example, span from 1 minute to 48 hours while Dukascopy only offers contracts from 3 minutes to 1 day.

Payment Methods

We have evaluated multiple binary options brokers and CloseOption offers an adequate selection of accessible funding solutions. These include bank cards, wire transfers, PayPal, Web Money, Perfect Money, and wire transfers.

Crypto enthusiasts will also appreciate that you can deposit and withdraw in Bitcoin, Dash, Ether, Ripple, and Monero, amongst other popular digital tokens.

The broker does not charge fees for deposits or withdrawals in Bitcoin, Perfect Money or Web Money. However, wire transfers incur a fee ranging from 1% to 8.4%, which covers the exchange fees for converting the transfer to Chinese Yuan. The good news is that this fee is covered by the broker and will be credited back to the trader’s account after registration.

Based on our tests, most payment methods offer near-instant account funding at about 10 seconds. The only exception is crypto transfers which can take up to 30 minutes to reflect in your live account.

One key criticism we have is that wire transfer withdrawals come with a charge of between $50 and $100. This is disappointing and much higher than competitors like Deriv and Quotex, which do not charge for withdrawals.

On a lighter note, withdrawal speeds are around the industry average, typically taking around three business days to process.

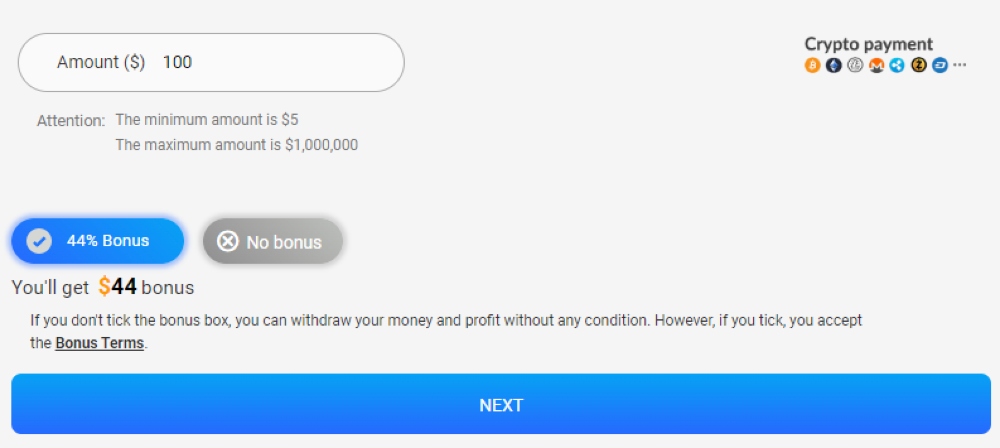

How To Make A Deposit

I find the account funding process at CloseOption quick and easy. It takes less than two minutes to navigate to the cashier portal and make a transfer.

- Log into the CloseOption client dashboard

- Go to the ‘Deposit’ tab

- Choose which deposit method you would like to use

- Click ‘Next’ and input the amount you would like to deposit. You will also have the choice to choose a deposit bonus

- Some methods, such as Perfect Money, may ask for your account number

- Enter any bank details for a wire transfer or wallet details for crypto transfers

- Confirm the deposit

Forex Assets

CloseOption offers binary options on an average selection of over 30 forex pairs spanning majors, minors and a few exotics.

The majority of traders should be satisfied with the range of majors and minors, however those looking for more exotics will need to look elsewhere. Pocket Option is a good pick here, with over 50 forex assets.

Importantly, forex binary options are a product with only two possible outcomes. Will the price of GBP/EUR, for example, increase or decrease over a set timeframe, such as 1 hour?

If the trader is correct, the contract finishes ‘in the money’ and the trader wins the payout (and gets their initial deposit back). If they are incorrect, the contract finishes ‘out of the money’ and the trader loses their stake.

Non-Forex Assets

CloseOption has a sub-standard offering of non-forex assets. Only a few cryptos paired with the US Dollar are available, including BTC/USD, LTC/USD, ETH/USD, and BCH/USD.

This means the broker isn’t suitable if you want to trade binaries on stocks, indices, metals or energies. IQCent is a better alternative if you want to trade binary options on these underlying assets with more than 100 instruments.

Execution

CloseOption has a straightforward execution model. Traders are betting directly against the broker which essentially offers odds, in the form of payouts, on potential market fluctuations.

It is worth noting there is a delay of between 1,000 and 2,000 ms from when you click the ‘Call/Put’ buttons. This 1 to 2-second delay can bring some uncertainty in highly volatile markets but is fairly standard in binary options trading.

Leverage

CloseOption does not facilitate leveraged trading. This is standard practice at binary options brokers – contracts must be funded in full.

However, there is good variety in supported trade sizes, ranging from $1 to $5000.

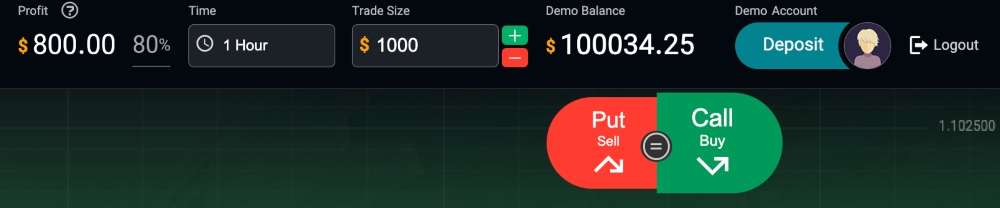

Platforms & Apps

We are fans of CloseOption’s bespoke binary options trading platform. The Trade Room has a sleek, intuitive design, with all tools easy to navigate from the main screen.

Your account balance and profit are shown at the top of the screen. You can also choose the expiry time of your chosen contract in this toolbar, ranging from 30 seconds to one month. It is good to see one-click buttons for Call/Put commands in the top toolbar, making the process of opening trades seamless.

We particularly like how customisable the charts are, with a good range of alternative charting displays, including line graphs or candlesticks, plus a selection of drawing tools. There is also a modest selection of chart timeframes: 5s, 10s, 30s and 1 min, though longer-term views would be a welcome addition.

One challenge we do face while using the CloseOption platform is the limited technical analysis tools. You don’t get the same selection of indicators and drawing tools available at binary options brokers like GC Option or WorldForex that offer the well-regarded MetaTrader 4 platform. Here, dozens of in-built indicators are offered plus thousands of downloadable tools from the MetaTrader marketplace.

We are also disappointed that the platform is only available on web browsers, so traders with a slower internet connection may struggle with performance. With that said, we appreciate that the platform can be used on desktop, laptop or mobile devices, making this platform accessible to all traders.

How To Open A Trade

The process to place a forex binary options trade is quick and can be done directly via the platform interface:

- Sign in to your CloseOption trading account

- From the dashboard, click the Trade Room button

- Choose which asset you would like to trade, such as EUR/USD

- Set your preferences for your trade, such as stake size and expiry time

- Click the ‘Put’/’Call’ button to place the trade in your chosen direction

Forex Tools

After testing various binary options brokers, CloseOption falls short when it comes to useful trading tools.

There are no signals or copy trading solutions, available at popular alternatives like IQCent and RaceOption.

They do provide a personal account manager to Diamond-level traders, but this will only serve the most active traders, leaving little for new and moderately active traders.

Forex Research

CloseOption scores slightly better when it comes to market research.

The broker publishes technical analysis reports on different underlying assets, including currencies. The analysis notes the key support and resistance levels of the respective underlying asset throughout the week. Detailed written analysis and forecasts are given underneath explaining the results.

Yet while these reports are useful to a degree, they do not provide the same quality and level of insights as the market research provided by traditional brokers like Admiral Markets. Here, you can find useful tools like forex heatmaps which paint a picture of currencies with the most movement and opportunities.

Forex Education

CloseOption provides some basic educational tools to help binary options traders get started. This includes a tutorial section that is accessible from the client dashboard. These guides cover the basics of using the trading platform, navigating the client portal, and general account information.

The broker’s ‘Knowledgebase’ also covers a range of topics, including technical analysis reports, forex news, crypto news, strategy articles, blockchain-specific updates, and more.

However, upon review these materials don’t match the in-depth, premium resources from leading forex brokers like FxPro and Plus500, which offer dedicated training courses and academies for beginners.

Ultimately, binary options brokers like CloseOption do not offer the same quality of education as larger forex and CFD brokers.

Bonus Offers

Due to the limited regulatory oversight, CloseOption is not restricted from offering financial incentives. When we tested the platform, three promotions were available:

- 44% deposit bonus – when you make new and recurring deposits

- $10 no deposit bonus – deposited into your account before you transfer any funds

- $3000 weekly trading contest – split between the top 20 traders but requires an admission fee of around $10

But while these bonuses will appeal to prospective traders, we don’t recommend selecting a brand based on their promotions. Having reviewed dozens of firms and their trading offers, there are often misleading terms and restrictive withdrawal conditions.

Trading Restrictions

We appreciate that CloseOption does not have many trading restrictions. All strategies and trading styles, for example, are permitted. With that said, there are two stipulations worth highlighting:

- You can only buy/sell 25 options per expiry

- The minimum investment per trade is $1 and the maximum investment is $5000

Customer Service

After assessing multiple binary options brokers, CloseOption scores fairly high for its customer support.

The team is available 24/7 via a chatbot, online form, email address, phone number, and call-back request. We recommend the live chat for the fastest assistance – we got a response within a couple of minutes upon testing.

Contact details:

- Email Address: info@closeoption.com

- UK Contact Number: +44 203 290 2097

- Address: Vake-saburtalo district, Al Kazvegi Avenue, N41 Apt.N19, Tbilisi, Georgia

Company Details

CloseOption is a binary options broker based in Tbilisi, Georgia. The firm was first registered in 2013 in Georgia and was issued a license by the National Bank of Georgia in 2017.

The firm claims to have over 2.5 million members and seeks to provide a high-quality binary options trading service to build a strong rapport with clients.

On the downside, our experts could not verify the background of the owners and management team, raising transparency concerns.

Trading Hours

You can trade with CloseOption between 9:00 pm (UTC) on Sundays to 9:00 pm (UTC) on Fridays. The broker does not offer trading during the weekends because of the high volatility of markets.

We think this is a real drawback as weekend trading is available at many popular alternatives, including IQCent. Crypto traders, in particular, will be disappointed by the lack of weekend trading.

Who Is CloseOption Best For?

CloseOption is a good choice for beginners looking to trade binaries on popular forex and crypto assets with competitive payouts. The low starting deposit, demo account and basic guides will appeal to budding investors while experienced traders can benefit from the tiered account system.

On the negative side, users looking to trade binary options on stocks, indices and commodities should not open an account. Instead, traders should consider alternatives like Pocket Option.

FAQ

Is CloseOption Legit Or A Scam?

CloseOption is a legitimate binary options firm registered in Georgia with company number D86708031. The broker also holds a local license with the National Bank of Georgia, with registration number B 2-08/3647. We are comfortable that the broker is operating lawfully and is not a scam.

Can I Trust CloseOption?

CloseOption has built a decent reputation in binary options circles with over 2.5 million customers worldwide. With that said, the weak regulatory oversight lowers the firm’s trust score. The broker could also be more transparent about the security measures it employs. For example, we could not activate two-factor authentication upon login.

Is CloseOption A Regulated Binary Options Broker?

CloseOption is authorized in Georgia by the National Bank. However, this is not considered a reputable financial authority for retail traders, so clients will not receive the same level of protection as offered by tier-one regulators like the UK Financial Conduct Authority (FCA) or the Australian Securities & Investments Commission (ASIC).

With that said, due to the unregulated nature of binary options – weak regulatory oversight is common place.

Is CloseOption A Good Or Bad Binary Options Broker?

CloseOption is a decent binary options broker and a strong contender against other alternatives. Our team rate the broker’s favorable payouts up to 95% on forex assets, no deposit fees, 24/7 customer support, and intuitive trading platform. The broker also offers longer contract timeframes than most binary options brands up to one month.

On the negative side, the firm operates with limited regulatory oversight. It also falls short of competitors in terms of additional tools with no copy trading and basic market research.

Is CloseOption Good For Beginners?

CloseOption is a good choice for beginners. There are plenty of beginner-friendly educational resources, as well as platform and trading tutorials within the client portal. We like that the starting deposit is low at just $5 while the minimum stake is only $1. There is also a free demo account with no expiry.

Does CloseOption Offer Low Forex Trading Fees?

CloseOption offers zero spreads or commissions. Instead, the broker makes its money through losing binary options trades.

It is worth noting that our team also found an inactivity charge applies after three months and that wire transfer withdrawals come with a steep fee of $50 to $100.

Does CloseOption Have A Forex App?

CloseOption does not have a dedicated mobile trading app. However, the platform can be accessed from any web browser, making trading easily accessible on the go from a web browser.

The only drawback is that it was sometimes slow to load upon testing, though our internet connection could be playing a role here.

How Long Do Withdrawals Take At CloseOption?

While testing CloseOption, we found that withdrawals typically take 3 business days to process from the request being submitted. This is around the industry standard. Make sure you have verified your account with identity documents to prevent any delays.

Can You Make Money Trading Forex Binary Options With CloseOption?

CloseOption offers competitive payouts up to 95% on successful contracts, plus low non-trading fees. This means there are opportunities to make money trading forex binary options with the broker.

With that said, profits are never guaranteed – you will lose your entire stake if your trade finishes ‘out of the money’. As such, consider developing your strategy and risk management approach in the broker’s free demo account first.