Eightcap

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, NZD, SGD

-

🛠 PlatformsMT4, MT5, TradingView

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.0 -

# Assets50+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

Our Opinion on Eightcap

Eightcap is an award-winning, regulated forex broker that offers 800+ instruments through the reliable MetaTrader platforms. Stand-out features for us are the choice of account types to suit both beginners and experienced traders, low forex trading fees, and advanced tools like the AI-powered economic calendar. Eightcap does fall short when it comes to market research and the limited-time demo account, but it remains an excellent forex broker overall.

Summary

- Instruments: 800+ including 53 forex pairs, stocks, indices, commodities, cryptocurrencies

- Live Accounts: Standard, Raw, TradingView

- Platforms & Apps: MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView

- Deposit Options: Bank cards, wire transfers, e-wallets

- Demo Account: Yes

Pros & Cons

- Tight spreads on forex pairs from 0.0 pips with a $3.50 commission

- Trustworthy forex broker with oversight from tier-one regulators

- No strategy restrictions with scalping and hedging permitted

- Advanced trading tools including a forex VPS and AI calendar

- Fast account opening that takes less than 5 minutes

- Automated trading software from Capitalise.ai

- Over 100 crypto products including indices

- MetaTrader 4 and MetaTrader 5 integration

- Low minimum deposit of $100

- High leverage up to 1:500

- Demo account automatically expires after 30 days

- Narrow range of commodities

- Average educational materials

- No copy trading

Is Eightcap Regulated?

Our team is pleased with Eightcap’s regulatory status, which includes licenses from multiple top-tier financial bodies providing good levels of client protection, as well as a high-leverage offshore branch.

The oversight by Australian, British and Cypriot regulators provides strong safeguards to traders, including negative balance protection and segregated client funds.

Eightcap subsidiaries and their respective regulatory oversight:

- Eightcap Pty Ltd – Regulated by the Australian Securities and Investments Commission (ASIC), license number AFSL 391441

- Eightcap Group Ltd – Regulated by the UK Financial Conduct Authority (FCA), license number FRN 921296

- Eightcap EU Ltd – Regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 246/14

- Eightcap Global Limited – Regulated by the Securities Commission of the Bahamas (SCB), license number 246/14

Our experts were also reassured to find no reports of scams or unfair practices during our research of Eightcap.

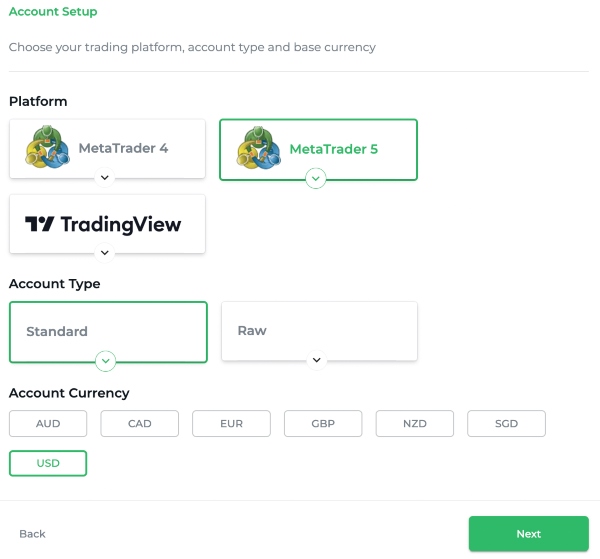

Forex Accounts

Eightcap offers two account types with different fee structures to suit various forex strategies and experience levels.

We like that both have a reasonably low minimum deposit of $100, which is competitive vs alternatives like IC Markets ($200) and makes it a good choice for beginners.

We think the Standard account will suit newer traders best thanks to its commission-free model, while the Raw account is a good option for active and experienced traders looking for ultra-tight spreads and competitive commissions.

Our team highlight the key differences between the accounts below.

Standard Account

Best for beginners

- Commission – $0 (shares have a commission)

- Spreads – from 1.0 pip

- Minimum trade size – 0.01 lot

- Maximum trade size – 100 lots

- Base account currencies – AUD, USD, GBP, EUR, SGD, CAD, NZD

Raw Account

Best for active traders

- Commission – 2.25 – 3.5 (depending on the base currency)

- Spreads – from 0.0 pip

- Minimum trade size – 0.01 lot

- Maximum trade size – 100 lots

- Base account currencies – AUD, USD, GBP, EUR, SGD, CAD, NZD

The broker also offers a TradingView Account with the same conditions as the Standard profile. This popular third-party software is home to a variety of analytical tools and powerful charts as well as thousands of active users sharing ideas.

Disappointingly this broker does not offer swap-free accounts, which is a disadvantage compared to brokers like AvaTrade.

How To Open An Eightcap Account

I have opened accounts at dozens of brokers and Eightcap has one of the most straightforward joining processes. It took me less than five minutes to register for a live account.

To get started:

- Enter basic contact details such as your name, email, password and country of residence

- Click on the verification link sent to your email

- Provide details of your address, tax information and date of birth

- Pick the platform, account type, base currency and leverage you want

- Submit the required identification documents (proof of address and ID)

- Once verified, you can login to your live account

The verification process can take up to 24 hours during times of high traffic.

Trading Fees

Eightcap offers lower trading fees than most brokers we have evaluated.

The Standard account offers commission-free trading with spreads from 1.0 pip, coming in below the industry average. We got spreads of 1.0 on the EUR/USD and 1.1 on GBP/USD upon testing.

The Raw account offers spreads from 0.0, with a $7 round-lot commission. Seasoned traders will appreciate that they can keep costs down while trading forex in high volumes.

Other fees to be aware of are swap fees which apply to open positions held overnight. Traders should also note the triple swap rates charged on positions held overnight on a Wednesday which are used to cover the weekend, when markets are closed.

Non-Trading Fees

I appreciate that there are no deposit or withdrawal fees – charges that add up and eat away at your profits.

Additionally, Eightcap does not charge an inactivity fee to casual traders, which is another positive compared to competitors like eToro.

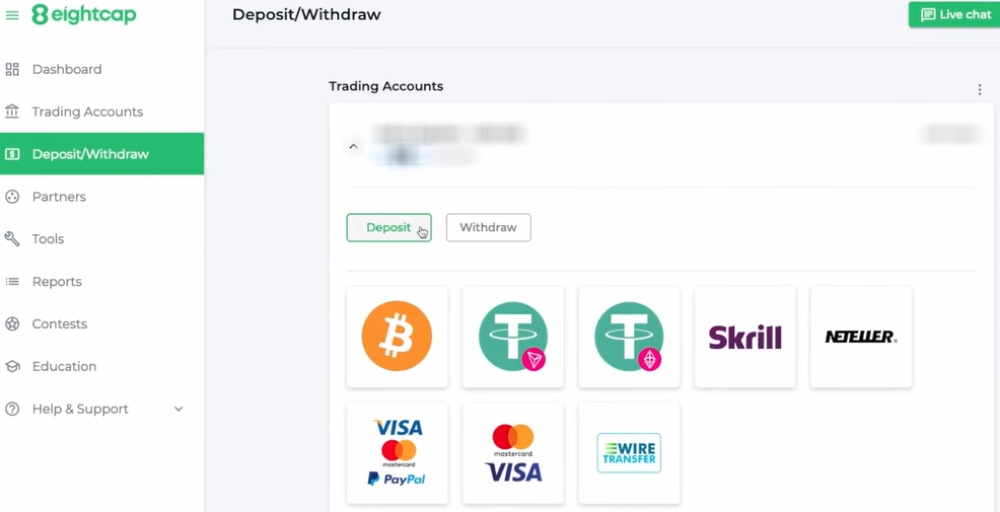

Payment Methods

Eightcap supports more funding methods than most forex brokers. This includes bank wire transfer, credit/debit card, Neteller, Skrill, PayPal, Orbital and HAYVN Pay.

We also rate that crypto deposits are accepted, with Bitcoin and Tether supported. The downside is that Eightcap only accepts these for USD accounts, but it is still good to have an option that not many brokers offer.

Eightcap supports a wide selection of account currencies, including USD, EUR, GBP and AUD. This facilitates straightforward, conversion-free access to funds when using the broker globally. It also means traders in most of the broker’s supported countries can find a fast and affordable payment solution that suits them.

Deposit processing times vary depending on the method you choose. For instant funding, we would recommend card payments while bank wire transfers can take between one and five business days. The broker aims to process withdrawals within 24 hours, which is in line with most of the industry.

I appreciate that the brokerage charges no deposit or withdrawal fees, but some payment methods such as wire transfer may have third-party charges. We would like to see Eightcap follow the lead of some other forex brokers and cover these fees, but this is a minor complaint in an overall very strong offering.

How To Make A Deposit

I find funding my Eightcap account to be a fast and intuitive process that can be completed in minutes through a few simple steps:

- Log in to the Eightcap client portal

- Click on the ‘Deposit/Withdraw’ icon from the menu on the left-hand side of the page

- Select ‘Deposit’ and choose your payment method from the icons displayed

- Enter the amount you would like to deposit

- Confirmation of your deposit will appear once it is processed

Forex Assets

The suite of 53 forex assets offered by Eightcap is decent but is far from the widest range out there. CMC Markets clocks in at 330+ pairs, while competitors like Forex.com offer 80+ pairs.

We do not see this as a major disadvantage, since there is enough variety to cover the most popular majors, minors and exotics, and realistically, most clients will only trade a few pairs that they know well.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Like most online brokers, Eightcap offers forex trading via contracts for difference (CFDs), allowing traders to go long or short on a currency pair and magnify their buying power with leverage.

Non-Forex Assets

Eightcap offers a reasonable selection of non-forex assets, from stocks and indices to commodities and cryptocurrencies.

The hundreds of global share CFDs are particularly strong, with access to blue chip companies from major economies like the US. I also rate the integration with TradingView which allows me to quickly check share price history through the Eightcap website.

On the negative side, the range of precious metals and energies is very limited compared to other brokers we have reviewed. Also, the broker isn’t a good option if you want products like ETFs or bonds – since Eightcap does not offer these. AvaTrade is a better pick here.

Supported assets include:

- Stocks – 600+ share CFDs including Netflix, Meta, Amazon and Apple

- Indices – 17 index CFDs including NDX 100, DAX 30 and FTSE 100

- Commodities – Metals including gold, silver, nickel, platinum and palladium, plus crude oil

- Cryptocurrencies – 86 cryptocurrencies including Bitcoin, Ethereum and Litecoin

Execution

Eightcap is a no-dealing desk (NDD) broker.

One of the key benefits of this system is removing the conflict of interest associated with dealing desk brokers, since the firm does not act as counterparty to your trade (and profit from your losing positions).

The downside of this system is that it can lead to some higher costs, but fortunately, Eightcap keeps trading fees low.

Leverage

Leverage varies depending on the asset you trade and the local regulations covering the Eightcap entity that you register with.

The FCA-, ASIC- and CySEC-regulated entities offer maximum leverage of 1:30 as stipulated by regulatory requirements.

The broker’s offshore entity offers high leverage up to 1:500 on forex majors, gold and oil. This is by no means the highest leverage available, with some offshore brokers offering 1:1000 or more. However, we think it is more than sufficient for most retail traders, who will be able to take a $10,000 position on major forex pairs with a mere $20 stake.

We also urge caution when trading with high leverage as losses are multiplied to an equal extent, so be sure to implement risk management strategies.

Platforms & Apps

While using Eightcap, the selection of popular third-party platforms makes for a reliable trading experience.

I am a little disappointed that there is no proprietary app, as this is a feature of many competitors such as CMC Markets. However, all of the platforms at Eightcap are intuitive, powerful and time-tested options so this is no big complaint.

We like both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer a variety of technical indicators, automated trading via Expert Advisors (EAs), flexible charts and forex signals.

I would recommend MT4 for beginners while experienced traders will appreciate MT5 for the faster processing, additional analysis tools, and wider range of order types.

The platforms can be downloaded as a desktop program or mobile app on iOS and Android devices. A WebTrader is also available through this broker and can be accessed through major browsers without the need to download software.

Eightcap also offers the TradingView platform which offers social investing alongside a huge range of intuitive charts and drawing tools. This will suit traders that want more visually-appealing charts and a social trading network.

We have pulled out the key features of each platform below.

| MetaTrader 4 | MetaTrader 5 | TradingView |

| 9 timeframes | 21 timeframes | 8 charts per tab with synchronized time intervals and symbols |

| 31 graphical objects | 44 graphical objects | 90+ smart drawing tools |

| 30 technical indicators | 38 technical indicators | 100,000 indicators and the option to build your own |

| 4 pending order types | 6 pending order types | 15+ charts including Kagi, Renko and Point & Figure |

| Expert Advisors (EAs) | Expert Advisors (EAs) | Customizable alerts |

| In-depth pricing history | In-depth pricing history | Access to social trading community |

| Single-thread strategy testing | Multi-thread strategy testing |

How To Make A Forex Trade

Making a trade on the Eightcap MetaTrader platforms is a simple process. One-click trading can be enabled on both platforms or traders can execute manually in a few steps:

- Sign in to your MT4 or MT5 profile via the Eightcap client portal

- Click on the ‘New Order’ icon from the menu at the top of the screen

- Use the search button to find the forex asset you want to trade

- Input the trade volume

- Enter any take profit levels or stop loss you want

- Press ‘Buy’ or ‘Sell’ to execute the trade

Forex Tools

We are impressed with the variety of useful forex trading tools available, which include access to some powerful third-party solutions that can support experienced forex traders with their algorithmic strategies.

Capitalise.ai

Capitalise.ai is a leading provider of automated trading plans that scan the markets 24/7 for suitable opportunities that meet your goals.

The key advantage of the tool in my opinion is that it allows you to create automated strategies from scratch or a template with no coding involved.

I find the experience to be quick and straightforward, with all of the necessary steps signposted on an attractive interface.

One feature that I find especially useful is the back-testing option so you can test strategies against historical market data.

The tool is available as a standalone app or a plugin to your MT4 account, and monthly training sessions are available on the broker’s website.

FlashTrader

FlashTrader is another tool offered by Eightcap which can help speed up the process of opening positions.

The solution allows users to customize and automate parts of their trading setup that they would ordinarily enter manually. For example, a trader might decide to automatically add stops and targets to every trade or choose to set price targets that automatically take profit on half a position before moving instantly to target a higher profit level.

Setting up the tool is straightforward:

- Open or log in to your live MT5 account

- Download FlashTrader from the client portal

- Sync the account with the tool

- Use the tool for faster forex trading

Forex VPS

With the Virtual Private Server (VPS), you can trade 24/7 without downtime or interruption due to network or power issues. Serious traders will find this tool useful as it ensures high-speed connectivity and fast trades with low latency.

These features work extremely well in conjunction with Expert Advisors and similar trading robots. As a result, it is always welcome to find this feature offered by a broker, and I especially like that Eightcap’s VPS comes pre-installed on all MT4 accounts so you do not need to pay for access.

If you do not have a MT4 account you can still access the VPS by depositing a minimum of $1000 and meeting the monthly criteria of 5 traded lots.

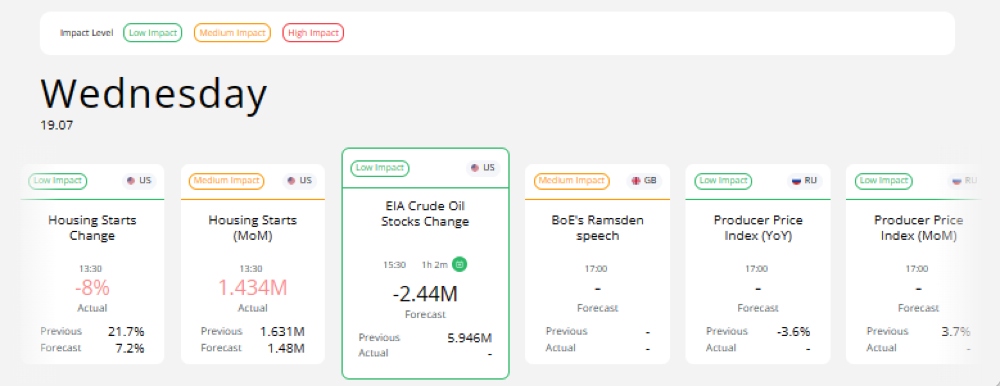

Forex Research

The AI economic calendar goes way beyond the basic calendars provided by alternatives, generating trading ideas by analyzing market events from 100 countries and 1000+ macroeconomic events.

I particularly like the ability to personalize your areas of interest so events are filtered to match the impact they have on your watchlist.

Additionally, the sentiment chart, up-to-date news and potential range features offered by this calendar make it a useful tool for forex traders.

Traders also get high-quality weekly live streams from the Trading Week Ahead, market forecasts from Trading Outlook and market analysis articles from Trading Ideas.

The market research ultimately compares well to competitors such as FxPro and XM.

Forex Education

The Eightcap Lab offers articles and courses on various topics such as trading strategies, trading tools and the fundamentals of trading, which is a good place for newer investors to pick up the basics.

There are also e-books, webinars and video/audio content, which we think is a good way to accommodate traders with different learning styles.

However, while the education at Eightcap is better than average, it falls behind some alternatives like eToro. The depth, quality and interactivity of the content ultimately trail some of the best brokers with forex education.

Demo Account

Eightcap offers a free demo account. However, I don’t like that demo account conditions vary depending on whether you also hold an active live account.

The demo account has a 30-day or 5000-order limit for non-active account holders. This does not stand up well against the unlimited accounts offered by competitors such as Vantage.

Eightcap makes up for this somewhat by allowing clients with live trading accounts to use demo accounts indefinitely. Traders with active accounts can hold up to six demo accounts simultaneously; this drops to one account for inactive clients.

How To Open A Demo Account

I found it easy to open a demo account with no difficulties in the sign-up process:

- Go to the ‘Accounts’ page on the broker’s website

- Click the ‘Try a Demo’ icon on the page

- Fill in details such as your name, contact details, platform and currency

- Verify your account with the link sent to your email address

- Log in and open your Eightcap demo account

Bonus Offers

A downside for some traders will be that there is nothing offered in the way of bonus deals. However, this is normal for reputable brokers – particularly regulated firms in countries where they are banned from offering trading promotions.

Our experts also never recommend selecting a forex broker based on their bonus deals. They can encourage over-trading and there are more important factors, including fees, tools and safety.

Customer Service

I have tested more than 100 forex brokers and I’ve been impressed with the 24/5 customer service at Eightcap.

I would recommend live chat for the fastest response. I typically get a reply in less than a minute and during busier hours, a queue counter lets you know roughly how long you can expect to wait. It is particularly good to be directed straight to a person rather than an automated answering service, which frustrates me while using other brokers.

Contact details:

- Live chat – bottom right-hand side of the broker’s website

- Email address – global@eightcap.com

- Phone number – +61385922375

Eightcap also maintains active social media accounts on Facebook, Instagram, Twitter, YouTube and LinkedIn.

Company Details

Eightcap is an online forex broker launched in 2009 in Melbourne, Australia. The company is now well-established with 80,000+ clients worldwide.

The broker has won multiple awards including the International Business Magazine 2022 Best CFD Broker Australia and AtoZ Markets 2023 Best Crypto Broker. For our team, this is a good sign that this broker is trustworthy and respected.

Eightcap is also partnered with Scuderia Ferrari and has an interest in investing in F1 through their ambassador Daniel Ricciardo.

Trading Hours

The trading hours offered by Eightcap vary depending on the instrument you are trading. For forex, the opening hours are 00:04- 23:58 (UTC+3).

Opening hours for each asset can be found in individual instruments’ sections on the broker’s website.

Information on upcoming holidays and market closures can also be viewed via the news page.

Who Is Eightcap Best For?

Eightcap will serve users that want to trade forex CFDs on the reliable MT4 and MT5 platforms with tight spreads.

Eightcap also stands out for its list of 100+ crypto derivatives, which will appeal to aspiring cryptocurrency investors.

On the negative side, we don’t recommend Eightcap for Muslim traders due to the absence of a swap-free account.

The number of forex pairs also falls behind some competitors, though we don’t think this will be a dealbreaker for most retail traders.

FAQ

Is Eightcap Legit Or A Scam?

Our team is confident that Eightcap is a legitimate forex broker. The company holds licenses with multiple top-tier regulators, including the ASIC and FCA.

We are also pleased to find negative balance protection and other account safeguards to lower the risks to online traders.

Can I Trust Eightcap?

We are comfortable that Eightcap is a trustworthy broker. The award-winning firm has an excellent track record and our experts did not uncover any reports of the company’s involvement in scams or unfair trading practices.

Is Eightcap A Regulated Forex Broker?

Yes, Eightcap is regulated by four governing bodies. The forex broker holds licenses with the Australian ASIC, the UK’s FCA – both top-tier organizations – as well as the EU’s CySEC and an offshore entity governed by the SCB in the Bahamas.

Is Eightcap A Good Or Bad Forex Broker?

Overall, Eightcap is a good forex broker. With 53 forex pairs, low fees, a wide range of trading tools and trusted regulators, this is a reliable firm. The platforms are also user-friendly and there is a choice of account types so traders can find an account to suit their goals.

Our only key criticisms are the limited-time demo account for prospective traders, average educational materials, and narrow choice of commodities.

Is Eightcap Good For Beginners?

Yes, Eightcap is a good option for beginners. There is a low minimum deposit of just $100 and you will find tight spreads on the commission-free account, plus a free demo account.

I would like to see more copy trading tools available as this feature, offered by rivals, would allow beginners to learn directly from expert traders. However, the broker still ranks highly for newer traders.

Does Eightcap Offer Low Forex Trading Fees?

Eightcap trading fees are below the industry average. While using the broker, I was offered a spread of 1.0 on EUR/USD with the Standard account, which is competitive, while the Raw account starts with spreads from 0.0 alongside a $3.50 commission.

There are also no deposit fees or inactivity charges, which keep non-trading costs down.

Does Eightcap Have A Forex App?

Eightcap does not offer its own trading app, which puts it at a disadvantage compared to some competitors like Plus500. An Eightcap app could provide traders with a more tailored and user-friendly experience.

With that said, I do rate the third-party options in MT4 and MT5, which facilitate on-the-go trading. So I don’t consider the lack of an in-house app a major disadvantage.

How Long Do Withdrawals Take At Eightcap?

Withdrawal times vary depending on the chosen payment method. Once verified the funds will be returned to your account instantly in the case of e-wallets and within five days if you chose a bank wire transfer. Eightcap aims to process withdrawals within 24 hours of the request being made.

Can You Make Money Trading Forex With Eightcap?

Eightcap is a competitive forex broker with a good variety of assets, versatile trading tools and low fees. However, there is no guarantee of making money when trading forex online regardless of the broker you chose.

With this in mind, make sure you develop and test your forex trading strategy with suitable risk management parameters.