FXOpen

-

💵 CurrenciesUSD, EUR, GBP, AUD, JPY, CHF, HKD, RUB

-

🛠 PlatformsMT4, MT5, TradingView

-

⇔ Spread

GBPUSD: 0.2 EURUSD: 0.2 GBPEUR: 0.2 -

# Assets50+

-

🪙 Minimum Deposit$1

-

🫴 Bonus Offer-

Our Opinion On FXOpen

FXOpen is a multi-regulated broker with competitive trading conditions for forex traders. The pricing on its ECN account is particularly strong with discounts for high-volume traders. We also rate the choice of industry-leading platforms, including MetaTrader 4, MetaTrader 5 and TradingView.

On the negative side, the account structure is complicated. FXOpen also trails the top brokers when it comes to non-trading costs with withdrawal fees and inactivity penalties.

Summary

- Instruments: 600+ including 50+ forex pairs, stocks, indices, commodities, ETFs, cryptos

- Live Accounts: Micro, STP, ECN, Crypto

- Platforms & Apps: MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, TickTrader

- Deposit Options: Bank cards, wire transfers, e-wallets

- Demo Account: Yes

Pros & Cons

- No strategy restrictions with scalping, hedging and Expert Advisors (EAs) permitted

- Excellent pricing with spreads from 0.0 pips with a $1.50 commission per lot

- Top-tier trading platforms including MetaTrader, TradingView and TickTrader

- Oversight from tier-one regulators with 3.9 million accounts opened

- Smooth sign-up process that only takes a few minutes

- Copy trading service through a PAMM solution

- Low minimum deposit of $1

- Phone dealing facilities

- $10 monthly inactivity fee with a $50 reactivation charge

- Withdrawal fee charged on some e-wallets and bank transfers

- Weak regulatory oversight through the offshore branch

- Market access varies between trading accounts

- Below-average educational materials

- Slim portfolio of stock CFDs

Is FXOpen Regulated?

Our experts have no concerns regarding the legitimacy of FXOpen. The company has a good reputation and we found its record to be free from scams and security breaches.

FXOpen is regulated by some of the top financial bodies globally, with the UK branch overseen by the Financial Conduct Authority (FCA), the Australian entity authorized by the Australian Securities & Exchange Commission (ASIC), and the EU arm regulated by the Cyprus Securities and Exchange Commission (CySEC).

These bodies provide stringent oversight to ensure fair business practices are followed, with benefits including negative balance protection, limits on leverage, and segregation of client funds from company capital.

On the downside, the brokerage also operates an offshore branch, FXOpen Markets Limited, which is unregulated and provides fewer safeguards, with high leverage up to 1:500. Traders with this entity will not receive the same degree of legal protection.

Forex Accounts

FXOpen’s accounts cater to a range of trading styles and budgets: Micro, STP, ECN and Crypto. An Islamic account, professional account, and PAMM solution are also available upon request.

However, we are sorry to see that the accounts have different limits on the markets available and other features, which makes getting started complicated. Also, only the ECN account provides access to trading platforms that aren’t MT4.

We unpack the key features of each account below.

Micro Account

Best for beginners

- Floating spreads

- Commission-free

- $1 minimum deposit

- 28 currency pairs plus gold and silver

- MT4 only

STP Account

Best for scalping and high-frequency trading with zero commissions

- Tight spreads

- Commission-free

- $10 minimum deposit

- 50 currency pairs, gold and silver

- MT4 only

ECN Account

Best for scalping and high-frequency trading with raw spreads

- Raw spreads

- $1.50/lot commission

- $300 minimum deposit

- 50 currency pairs, 25+ cryptocurrencies, shares, indices and commodities

- MT4, MT5 and TickTrader

Crypto Account

Best for crypto traders

- Tight spreads

- Commissions from 0.5%

- $10 minimum deposit

- 43 crypto pairs

- MT4 only

Note the minimum deposit and other features may vary depending on which entity you register with.

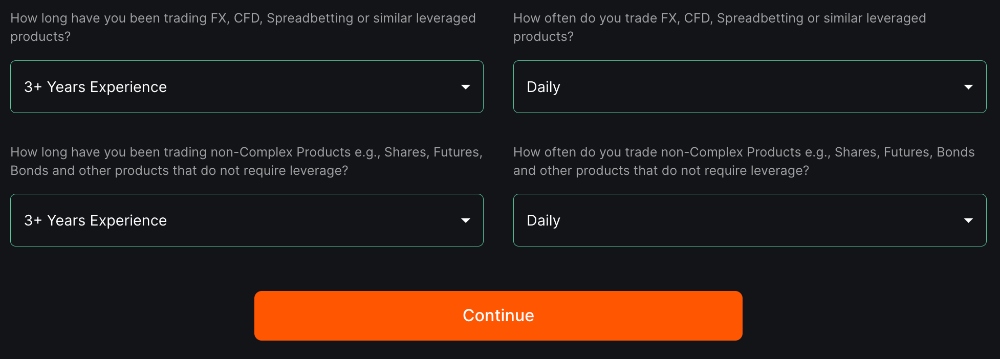

How To Open An Account

It took me less than 5 minutes to register for an FXOpen account which is faster than many rivals. To sign up:

- Provide an email, password and phone number in the registration form

- Log in to the client portal, My FXOpen, with your account credentials

- Select the type of account you wish to open and the parameters

- Provide the requested details including your trading experience

- Verify your profile by submitting identity documents

- Fund your account to start trading

Trading Fees

FXOpen offers lower-than-average trading fees.

The ECN account, in particular, stood out during our tests for its tight spreads and low commissions. We could trade the EUR/USD from 0.2 pips with a commission of $3.50 per lot, though this reduces based on your trading volume, coming in as low as $1.50, which will appeal to serious forex traders.

Spreads on other popular markets are competitive too, with gold available at 0.13 and oil at 0.05 when we used FXOpen.

Spreads on the Micro and STP accounts are less competitive, but with no commission, they will appeal to newer traders looking for straightforward pricing.

Non-Trading Fees

FXOpen falls short when it comes to non-trading fees.

UK and EU clients can enjoy fee-free deposits and withdrawals on all payment methods except wire transfers, which will incur a charge.

Clients of the Australian and offshore branches will be charged both deposit and withdrawal fees, though you can avoid these by using certain payment methods such as an FXOpen prepaid card.

A $10 inactivity fee is also charged to accounts that have been dormant for more than six months, which is fairly common. However, the $50 charge to reactivate a dormant account is excessive and not something we see at the best forex brokers.

Payment Methods

FXOpen offers several payment methods for deposits and withdrawals, with different funding solutions available in each jurisdiction.

We think the choices available in the UK and EU – which only accept bank transfers and card payments – are limited compared to many forex brokers we review, who also accept e-wallets and crypto payments.

Australian clients fare slightly better with the addition of Skrill. However, clients of the offshore branch have much more choice with crypto payments and a selection of digital payment methods also available.

While deposits are usually processed within one hour, our bank transfer withdrawals usually take 1–3 days to be credited and card withdrawals can take up to 5 days. These timelines are around the industry norm.

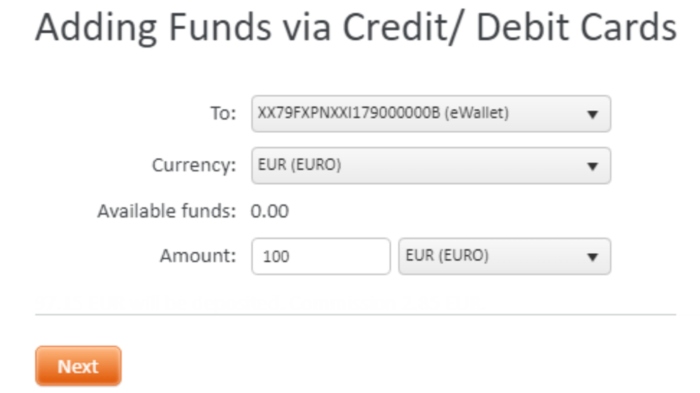

How To Make A Deposit

I find it quick and easy to fund my FXOpen account in a few simple steps:

- Sign in to My FXOpen

- Select ‘Add Funds’ and choose your payment method

- Complete the form and submit the payment details as prompted

- Click ‘Add Funds’, then ‘Next’

- Complete the payment

Forex Assets

We are satisfied with the selection of forex instruments available, with 50+ major, minor and exotic pairs.

While some rivals offer 70+ or even 80+, we feel the full range of major pairs and decent range of minor and emerging currencies gives most traders enough variety to deploy various strategies.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

FXOpen has an above-average selection of non-forex assets that will satisfy most traders, even if the range is far below the thousands of instruments at some leading competitors, including CMC Markets and AvaTrade. The breadth of stocks and commodities is particularly narrow.

- Shares – Trade some of the biggest names including Apple, Netflix, Tesla and Nike

- ETFs – Take positions on a basket of securities in a single position

- Indices – Trade global indices such as UK 100, Japan 225 and US SPX 500

- Commodities – Speculate on a handful of energies and metals including gold, silver and natural gas

- Cryptocurrencies – Take positions on dozens of cryptos including Bitcoin, Ripple, Ethereum and Litecoin

Execution

FXOpen’s no-dealing-desk model on its STP and ECN accounts is one of our favorite things about the broker, as it offers very fast execution – averaging below 100ms during testing – and fair pricing sourced directly from liquidity providers.

On the negative side, the Micro account’s market maker model is less attractive. We feel it can put traders at a disadvantage as they must trade against the broker, raising a potential conflict of interest.

Leverage

FXOpen’s leverage levels are capped by asset according to each branch’s local regulations.

For retail clients in the broker’s UK, EU and Australian branches, that means 1:30 for major forex pains, 1:20 for minor, gold and indices and 1:10 for energy and silver.

Clients of the broker’s offshore branch can access 1:500 leverage, as can professional clients in any branch.

If you trade with the offshore branch, we recommend employing risk management tools such as stop loss orders, as high leverage can lead to significant losses in volatile markets.

Platforms & Apps

I am very pleased with the four trading platforms supported by FXOpen, which has assembled three of the best third-party solutions on the market as well as a decent bespoke platform.

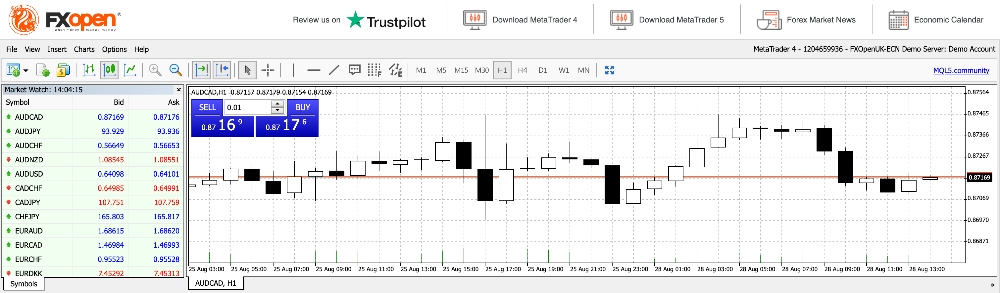

MetaTrader 4

I think the industry-leading MT4 platform is ideal for beginners, with a range of customizable features and analysis tools.

While I find the look and feel of MT4 somewhat outdated, it is hard to beat when it comes to charting and technical analysis. There are 9 timeframes, over 30 indicators and graphical objects, plus thousands more available from the MetaTrader Market.

I also appreciate the one-click trading directly from charts, which makes it very quick and easy to open a forex trade.

MetaTrader 5

Best suited to experienced traders, MT5 is another reliable platform.

The latest iteration from MetaQuotes offers faster processing and more advanced features, including 21 timeframes, 38 built-in indicators, and an integrated economic calendar.

Unlike MetaTrader 4, which is geared towards forex trading, MetaTrader 5 has been designed so you can speculate on multiple markets, including stocks, indices, commodities and crypto.

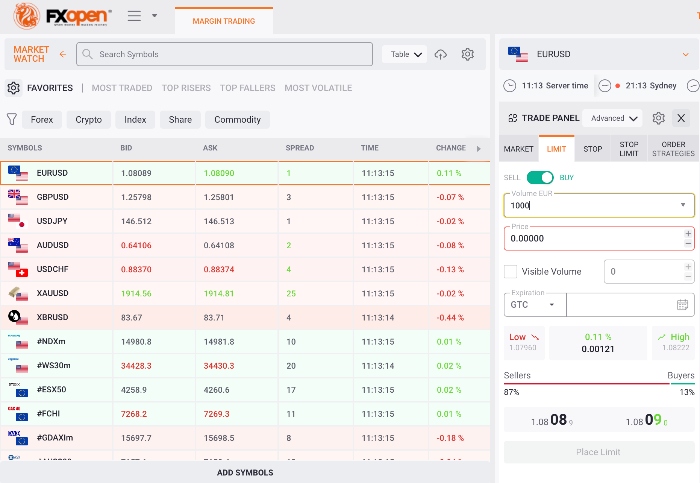

TradingView

For a slicker interface with modern visuals, I would recommend TradingView.

This is one of my favorite charting platforms with a huge array of graph types, drawing tools and technical indicators. I also find the forex heatmaps and economic calendar useful for keeping abreast of market updates.

But above all, I like it for the streamlined interface and the social trading functions.

TickTrader

I enjoy trading with FXOpen’s proprietary TickTrader thanks to its impressive analysis tools, intuitive navigation and customizability. In fact, there are over 12,000 integrated functions.

Other highlights for me are the one-click/double-click trading mode, custom alerts and slippage control for stop orders and market orders.

My only minor complaints are that there are no back-testing capabilities or trading signals.

Forex Tools

Although there are fewer forex tools available compared to rivals like Pepperstone, FXOpen’s suite of additional features did enhance my trading experience, especially with the inclusion of the VPS and copy trading.

The VPS is free to all users who maintain a balance of $5000 in their trading accounts. This is one of the most useful tools for high-volume algorithmic traders, and I regularly use a VPS to execute automated forex strategies.

FXOpen also offers copy trading via a PAMM account, which can be a good way for beginners and time-challenged traders to benefit from the decisions made by experienced pros.

Besides these, useful features include an economic calendar and the ‘Market Pulse’ forum where traders can go to check news and discuss trending topics.

Forex Education

I am quite let down by the educational resources available from FXOpen, which only provides a couple of pages explaining the basic concepts of CFD trading.

Compared to industry leaders like eToro, this is a poor selection of resources and this limits the broker’s appeal to rookie traders.

There is a section on trading news and analysis that can provide some good insights, but this too pales in comparison to the deep analysis tools offered by some rivals such as XM.

Demo Account

I like that FXOpen offers a demo account credited with $1,000,000 in virtual funds, and it is great to see no restrictions on how long active demo accounts remain open.

This is important for me because an unlimited demo account means I can always test strategies before using them in my real-money account.

How To Open A Demo Account

Opening an FXOpen demo account is a straightforward process that only took me a minute:

- Visit the broker’s website

- Select ‘Try Demo’ on the front page

- Fill in the form with an email, password and telephone number and click ‘Next’

- Your login details will be displayed on the next screen where you can also login

Bonus Offers

In accordance with local rules at its regulated branches, FXOpen does not offer any welcome bonuses. This is standard practice at EU, UK and Australian-regulated forex brokers.

With that said, users who sign up with the offshore branch may be able to claim a welcome offer and take part in a forex trading contest where you can win up to $50,000 by competing against other traders.

Trading Restrictions

We are happy to see no trading restrictions with FXOpen, which permits scalping and hedging as well as algorithmic trading through Expert Advisors (EAs).

Customer Service

FXOpen’s customer support is satisfactory, providing service 24/5. We reached a knowledgeable assistant via live chat within minutes each time we tested this function.

However, we feel the opening hours are limited compared to some competitors that stay open 24/7, which may be important for clients speculating on crypto over the weekend.

You can contact FXOpen via:

- Live chat: Icon in the bottom-right of the website

- Email: support@fxopen.com

- Phone: + 44 (0) 203 519 1224

Company Details

FXOpen was set up in 2005 by a group of experienced traders. It originally started out as an educational center offering courses on financial markets, but today it operates as a global brokerage with offices in the UK, Australia, New Zealand and Russia.

The company is popular with online traders. The firm has over 1 million registered traders and more than 750,000 open orders.

Trading Hours

Trading hours vary by instrument, with forex, indices and commodities traded between 22:00 Sunday–22:00 Friday.

For local trading hours, check the published market opening hours.

Who Is FXOpen Best For?

FXOpen is a reputable ECN and STP broker catering to forex traders of all experience levels.

The low minimum deposit and unlimited demo account will serve beginners, while the VPS service and support for EAs will appeal to serious forex traders.

FAQ

Is FXOpen Legit Or A Scam?

FXOpen is a legitimate broker with 15+ years experience, more than 1 million registered traders and multiple industry awards. Our experts are comfortable that the brokerage is not a scam.

Can I Trust FXOpen?

FXOpen is a trustworthy forex broker with a good reputation. The company operates with strong regulatory oversight in the EU, UK and Australia.

Is FXOpen A Regulated Forex Broker?

Yes, FXOpen is regulated in multiple markets. In the UK, it is regulated by the Financial Conduct Authority (FCA), in the EU by the Cyprus Securities & Exchange Commission (CySEC), and in Australia by the Australian Securities & Investments Commission (ASIC).

On the negative side, the offshore entity, FXOpen Markets Limited, is unregulated so traders here will not get the same level of legal protection.

Is FXOpen A Good Or Bad Forex Broker?

FXOpen is a good forex broker. We like the no-dealing-desk execution model, reassuring regulatory credentials and excellent pricing on the ECN account. The low starting deposit and free demo account also make it easy to get started with the brokerage.

On the negative side, FXOpen trails the best forex brokers when it comes to education and research. The withdrawal fee and reactivation charge are also drawbacks compared to many alternatives.

Is FXOpen Good For Beginners?

Yes, we are impressed with how accessible FXOpen’s services and platforms are. MT4 is a great trading platform for beginners, the minimum deposit is just $1, there is an easy-to-open demo account, plus a copy trading service so you can learn from pro traders.

Does FXOpen Offer Low Forex Trading Fees?

FXOpen has a competitive fee structure. Trading fees vary between accounts and execution types, but the ECN solution provides particularly competitive pricing with spreads from 0.0 pips and a commission from $1.50 for high-volume traders.

On the downside, we are less impressed with the non-trading charges, including a $10 monthly inactivity fee, a $50 reactivation charge, plus withdrawal fees on some payment methods.

Does FXOpen Have A Forex App?

MetaTrader 4, MetaTrader 5, TradingView and TickTrader can all be used on mobile tablet devices. Applications can be downloaded from Apple and Android app stores, or opened via mobile-optimized web terminals.

How Long Do Withdrawals Take At FXOpen?

Withdrawal times vary according to the withdrawal method used but all requests should be processed within 5 days. While not as fast as some forex brokers, these speeds are in line with most of the industry.

Can You Make Money Trading Forex With FXOpen?

FXOpen offers a competitive environment where some forex traders will make money. Execution speeds are fast, the platforms are powerful, and fees are low.

With that said, most retail traders lose money so only risk what you can afford. We also recommend using risk management tools like stop-loss orders to minimize losses.