Kwakol Markets

-

💵 CurrenciesUSD

-

🛠 PlatformsMT4, MT5, AutoChartist

-

⇔ Spread

GBPUSD: From 0.8 pips (Standard Account) EURUSD: From 0.8 pips (Standard Account) GBPEUR: From 0.8 pips (Standard Account) -

# Assets90+

-

🪙 Minimum Deposit$1

-

🫴 Bonus Offer-

Our Opinion On Kwakol Markets

Kwakol Markets is a forex broker that offers trading on 90+ currency pairs. Positives for us are the competitive pricing on the STP and ECN accounts and regulatory oversight from the top-tier ASIC. Our testing did reveal some drawbacks, including the clunky client terminal and below-average customer support, but it remains an attractive option for traders familiar with the MetaTrader and cTrader platforms.

Summary

- Instruments: 1000+ including 90+ forex pairs, stocks, synthetic indices, commodities, and crypto

- Live Accounts: Standard, Pro, Gold, Platinum, Diamond, Premium, VIP, No-Swap

- Platform & Apps: MT4, MT5, cTrader

- Deposit Options: Credit/debit cards, wire transfers, PayPal, crypto

- Demo Account: Yes

Pros & Cons

- Wide range of instruments with 1000+ products including 90+ major, minor and exotic currency pairs

- Oversight from the ASIC with segregated client funds and negative balance protection

- Educational content including weekly trading quizzes and e-books

- Access to industry-leading trading platforms MT4, MT5 and cTrader

- Copy trading service with access to experienced traders

- Fast sign-up process that takes less than 5 minutes

- Machine learning news analysis from Acuity

- Free trading calculators to plan trades

- Very high minimum deposit for the best accounts

- Weak regulatory credentials in some jurisdictions

- Unresponsive customer support during testing

- Difficult to navigate the client portal

- USD is the only account currency

Is Kwakol Markets Regulated?

Kwakol is registered as an authorized finance company with the Australian Securities and Investments Commission (ASIC), ACN number 656 656 665, and a foreign exchange dealer by FINTRAC in Canada. We checked these licences to confirm their legitimacy and found all to be up to date.

However, in other areas Kwakol Markets’ regulatory status is a little murky. The broker claims to have an MSB and NFA license in the USA, but our checks of the official register found that the brokerage is not currently a member. While this may be simply down to the site requiring an update, having false or deceptive claims on a firm’s website damages its credibility.

We are pleased, though, to see all client funds are held separately from company money in top-tier banks and retail investors are granted negative balance protection, meaning losses cannot exceed invested amounts.

Forex Accounts

Kwakol Markets offers eight live accounts, including a swap-free solution for Islamic traders.

This is more than most forex brokers we test and while it may appeal to traders with different styles and budgets, we think it is excessive and some traders will find it complicated to choose between them.

Accounts primarily differ by minimum deposits, leverage, and average market execution times. However, the pricing conditions are relatively similar between the top-tier accounts, disregarding the large step-ups in terms of initial funding.

Aside from the Standard account, the minimum deposit ranges from $10,000 to $1,000,000, which is much higher than most alternatives, and will be out of reach for many aspiring traders.

On the plus side, the account types include zero-commission options for casual traders that still have tight spreads from 0.8 pips, as well as ECN solutions that will suit higher-volume traders looking for ultra-tight spreads.

We explain the differences between the trading accounts below.

| Standard | No-Swap | Pro | Gold | Premium | Platinum | Diamond | VIP | |

|---|---|---|---|---|---|---|---|---|

| Minimum Deposit | $250 | $1 | $10,000 | $25,000 | $25,000 | $100,000 | $250,000 | $1,000,000 |

| Spreads | From 0.8 | From 1.6 | From 0.01 | From 0.01 | From 0.0 | From 0.0 | From 0.0 | From 0.0 |

| Commission | Zero | Zero | Variable | Variable | Variable | Variable | Variable | Variable |

| Leverage | 1:200 | 1:1000 | 1:300 | 1:400 | 1:500 | 1:450 | 1:450 | 1:1000 |

| Execution Speed | 0.1 seconds | 0.3 seconds | 0.1 seconds | 0.3 seconds | 0.3 seconds | 0.3 seconds | 0.3 seconds | 0.1 seconds |

How To Open A Live Account

The sign-up form is very straightforward. It only took us two minutes to fill in.

- Choose an account type from the dropdown menu on the application form

- Add your email address and create a password

- On the following page add your name, date of birth, and telephone contact number

- Complete your address

- Agree to the T&Cs and click ‘Sign Up’ to confirm your registration

Trading Fees

Kwakol Markets’ trading fees vary depending on the account type, but overall, we find their pricing to be competitive.

The minimum spread on the Standard account is 0.8 pips, which compares well to other zero-commission accounts.

The Premium, Platinum, Diamond and VIP accounts offer the most competitive spreads from 0 pips. However, we feel the initial deposit requirements ranging from $25,000 to $1 million are a huge commitment that will be out of reach for most traders.

Compared to rivals like IC Markets with its minimum deposit of $200, and the $0 minimum at well-known brokers like Pepperstone, Kwakol Markets is uncompetitive in this area.

Additionally, the broker is not forthcoming about its commission charges. You need to contact the customer support team to verify the commission rates you will get. With that said, we were quoted $2 per standard lot on the Premium profile, which is very competitive.

Non-Trading Fees

The broker charges overnight fees for all account types except for the Islamic profile. This is standard practice.

In addition, a $10 monthly charge applies to dormant accounts after six months, which we find slightly frustrating but is commonplace in the industry.

Payment Methods

Our experts are impressed with the payment options available to retail investors, all with no brokerage fees.

The choice of e-wallets, cryptos, standard credit/debit cards, and bank wire transfers will suit the needs of most global traders.

There are minimum deposit limits by payment method, though we appreciate that these are all low. We would recommend PayPal for international traders, given the faster processing times.

- UPI – $10 minimum, up to 24-hour processing

- Sticpay – $10 minimum, up to 24-hour processing

- PayPal – $10 minimum, up to 60-minute processing

- Help2Pay – $10 minimum, up to 24 hour processing

- Bank Cards – $10 minimum, up to 24-hour processing

- Match2Pay – $10 minimum, up to 24-hour processing

- Bank Wire Transfer – $1 minimum, up to 48-hour processing

- Cryptocurrency (Bitcoin, Ethereum, Litecoin, and Tether) – $10 minimum, up to 60-minute processing

How To Make A Deposit

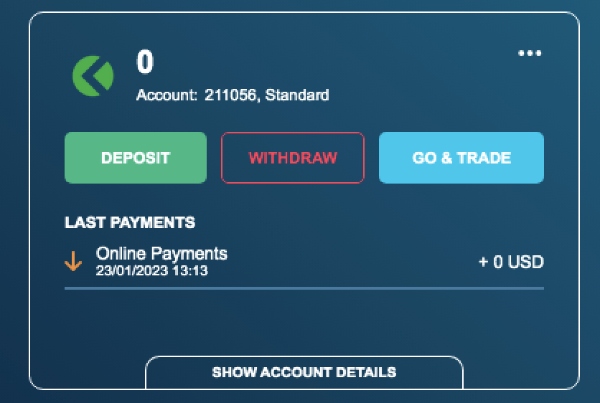

I find depositing to my live trading account quick and easy at Kwakol Markets. The process only requires a few steps and I usually complete it without hassle in a minute or two.

- Log in to the Kwakol Markets client area

- Click the ‘Deposit’ icon under the relevant trading account

- Choose the payment method to add money

- Follow the on-screen instructions to complete the transaction (this includes adding the amount to fund and uploading a proof of payment)

- Submit the payment

- You can review transaction details in the ‘transaction history’ tab of the client portal

Withdrawals

All payment methods have a minimum withdrawal amount of $10, which is on the low end of the many forex brokers we have evaluated.

We are also impressed that the broker processes the majority of payments within 24 hours except for bank wire transfers and PayPal, which may take longer.

Finally, our team is pleased to see no applicable brokerage fees when withdrawing money from a live account.

Forex Assets

Kwakol Markets offers a large suite of forex assets, with CFDs on 90+ major, minor, and exotics available. This is very competitive, with many major players offering in the region of 60 – 70 currency pairs.

Forex can be traded over-the-counter (OTC).

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

A decent selection of non-forex assets is available to Kwakol Markets traders. The full product portfolio spans 1000+ products, with several asset classes including commodities, stocks and cryptocurrency.

Unusually, Kwakol Markets also offers synthetic products. These instruments are not influenced by macroeconomic factors and are available 24/7, giving you more flexibility to trade when and how you want.

- Stocks – Hundreds of US, EU, and Asian share CFDs such as Amazon, McDonald’s, Bank of China, and Adidas

- Indices – 12+ index funds including the FTSE 100, and S&P 500

- Commodities – 15+ precious metal, agriculture, and energy commodities including crude oil, natural gas, and gold

- Cryptocurrency – Six popular digital currencies paired with major fiat currencies and alternative cryptos such as BTC/ETH, ETH/AUD, and BCH/GBP

- Synthetics – Eight synthetic products categorized into four groups; power indices, swift indices, moon indices, and dump indices, which are reflective of simulated market conditions

Execution

Kwakol Markets offers a true electronic communication network (ECN) and straight-through-processing (STP).

These execution models are a positive for us as they often provide fairer trading conditions than market maker brokers with tight spreads and reliable execution.

Execution types and average processing times vary by account. However, some of the lower-tier profiles offer the fastest execution speeds, with the Standard account from 0.1 seconds.

Leverage

The broker offers high leverage up to 1:1000, varying by regulated entity and account type.

While using Kwakol Markets, we could trade major forex pairs such as the USD/EUR and EUR/GBP with up to 1:100 leverage. This means we could trade with $10,000 in return for a $100 outlay.

However, we always recommend caution when trading on margin. You run the risk of incurring large losses if the markets move quickly against you.

Platforms & Apps

Kwakol Markets supports three excellent trading platforms: MetaTrader 4, MetaTrader 5, and cTrader.

All three trading solutions provide powerful functionality, making them the choice for millions of retail traders around the world.

Personally, I prefer using the MetaTrader software because I find the interface intuitive and I rate the expert advisor (EA) trading bots. With that said, I also like the advanced charting capabilities on cTrader – the extensive range of integrated indicators and timeframes will appeal to serious forex traders.

On the negative side, I feel that the client terminal has room for improvement, with broken links and some bugs that make it difficult to navigate between screens after logging in.

I have pulled out the highlights of each platform below.

cTrader

- 70+ in-built technical indicators

- Eight chart types with 54 timeframe views

- Custom indicator builder using the cTrader C# API

- Advanced order types including trailing stop, market range and OCO

- cTrader Automate algorithms with strategy backtesting and optimization

MetaTrader 4

- Single-thread strategy tester

- 30+ in-built technical indicators

- Three chart types with nine timeframe views

- Access to Expert Advisors (EAs) for algorithmic trading

- Four pending order types including Buy Stop and Sell Limit

MetaTrader 5

- Multi-thread strategy tester

- 38+ in-built technical indicators

- Three chart types with 21 timeframe views

- Six pending order types including Buy Stop Limit and Sell Stop Limit

- Access to Expert Advisors (EAs) for algorithmic trading with MQL5 programming language

How To Open A Forex Trade With cTrader

I find it easy to open and close positions on all of Kwakol’s interfaces and platforms, as the order screens are easy to follow, with self-explanatory input requirements. I explain the steps to place a forex trade on cTrader below.

- From the cTrader terminal, right-click on the currency symbol and select ‘Create New Order’

- Ensure the instrument is displayed in the top left box or choose a new product from the dropdown

- Add the trade direction by choosing ‘Buy’ or ‘Sell’

- Input the order volume in lots using the toggle symbols or by manually entering the figure

- Use the ‘Market Range’ function to source a suitable price range for the order to be filled

- Tick the ‘Stop Loss’ or ‘Take Profit’ boxes to add a risk parameter and input the price

- Add a comment if you wish

- Click ‘Place Order’ to confirm the position

Forex Tools

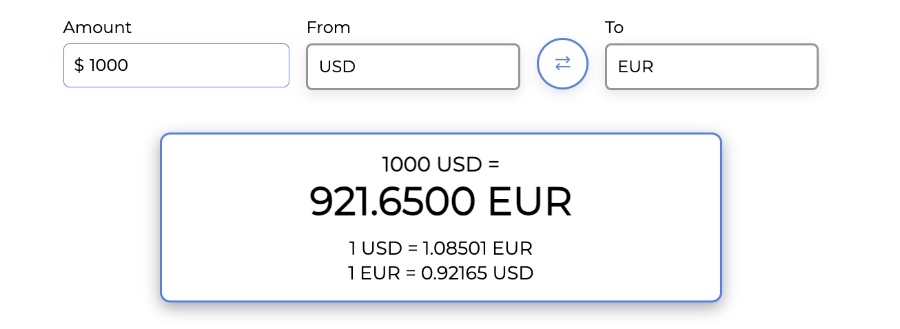

We are satisfied with the suite of trading tools available from Kwakol, with a selection of forex calculators including a currency converter and a pivot point calculator as well as some powerful social trading and charting tools.

They don’t match the breadth and quality of tools available at alternatives like CMC Markets or Forex.com, but they will prove useful for aspiring forex traders.

Copy Trading

Kwakol Markets offers a copy trading service via PAMM accounts. The solution permits retail investors to duplicate positions of more experienced traders and, hopefully, earn profits from their extensive knowledge.

We like the inclusion of the PAMM service, but we think the lack of performance statistics and detailed information on the strategy providers is a drawback.

The only data available to us when we use Kwakol Markets’ PAMM service is the average return on investment, number of subscribers, and average winning trades. Compared to the copy trading platforms offered by competitors like eToro, this is a weak showing.

Autochartist

Our experts are happy to see that Kwakol Markets has Autochartist integration. The program provides a useful way for investors of all skill levels to add pattern identification functions to their charts using technical indicators.

The tool is available to download as a plug-in function that can be incorporated into the MT4 and MT5 interface. We had no issues installing it, and it makes a very helpful addition to our trading arsenal.

Acuity

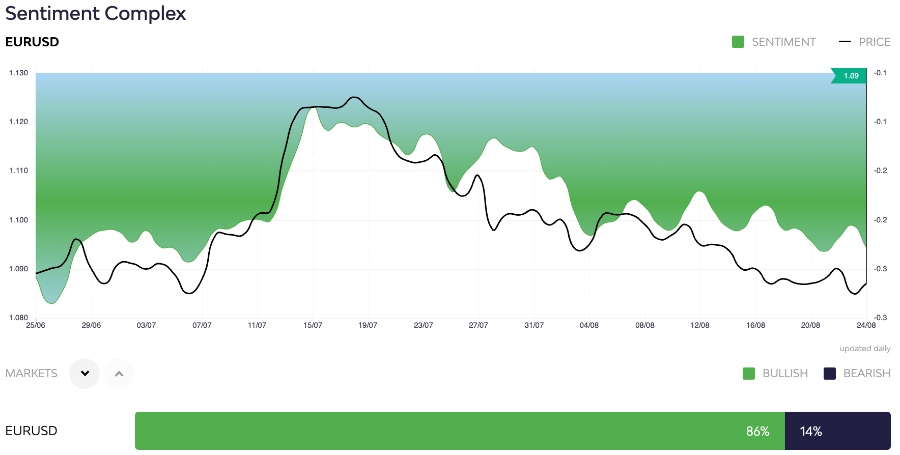

One of our favorite features offered by Kwakol Markets is the analysis from Acuity.

This provides a visual overview of market sentiment data and can be overlaid onto an existing MetaTrader account. Real-time news and insights are provided so you can see exactly what is influencing the forex market.

Forex Research

There is limited additional research or market insights offered by Kwakol Markets, which we see as a big drawback compared to the up-to-date information and analysis provided by many competitors.

Instead, the broker offers customers access to a Telegram social channel, where peer traders can share their ideas and perceptions of market movements.

Forex Education

We are satisfied with the educational content available at Kwakol Markets, though we do think it falls behind the comprehensive learning materials offered by forex brokers like Plus500 and IC Markets.

The mixture of academy courses, e-books, and news articles covers a decent range of topics, and we like the addition of weekly trading quizzes, which can be used to test your knowledge.

However, we think more experienced traders will feel let down as the broker lacks advanced information, with no details on sophisticated strategy formation, for example.

Demo Account

Kwakol Markets offers a free demo account loaded with virtual funds and simulated live trading conditions.

We are big fans of this feature as it allows users to test the broker’s platforms with no risk of losing their capital.

Our only criticism is that traders may struggle to access the demo profile on Kwakol Markets, as the client portal is not the most user-friendly with some dead links.

How To Open A Demo Account

- Sign in to the Kwakol Markets client portal

- Choose ‘Go & Trade’ under the list of account types

- Select ‘Try Demo’

- Add a promo code on the first page (if applicable) and select ‘Next Step’

- Input your email address and password

- Agree to the T&Cs and select ‘Sign Up’

Bonus Offers

Our experts were not offered any bonus rewards when we registered for a live trading account.

However, this isn’t a serious drawback in our opinion as many regulators ban financial incentives because they can encourage overtrading and excessive risk-taking.

Trading Restrictions

We are pleased to report no trading restrictions from Kwakol Markets, meaning you can trade using a variety of strategies and styles such as hedging, scalping and netting.

This is good news for experienced forex traders who can employ these strategies to great effect.

Customer Service

We find Kwakol Markets’ customer service disappointing, as we were unable to reach a customer service agent during our review. This is unusual and we see it as a poor sign – of the hundreds of forex brokers we have reviewed, only a few have failed to respond to our queries over the course of our testing period.

This means there is no guarantee of fast support, but it also sets Kwakol apart from the top forex brokers who pride themselves on swift and helpful customer service.

The brokerage offers customer support via telephone, email, or live chat. There is also a registered office address for postal inquiries.

- Email – support@kwakolmarkets.net

- Telephone – 02080891165 or +447862144547

- Address – Mall 169, Adetokunbo, Ademola Crescent, Wuse ll, Abuja

Company Details

Kwakol Markets is a global broker based in Nigeria. The brokerage has additional licensing in Australia and Canada, offering financial services and online trading for customers.

The brand has picked up a few awards including the Best Emerging Broker 2022 at the UF Awards.

Trading Hours

Kwakol Markets’ trading hours follow standard industry opening times. This includes forex trading available 24 hours, Monday to Friday.

Cryptocurrency offers the most flexibility when it comes to trading hours, with opportunities open over the weekend.

Who Is Kwakol Markets Best For?

With its premium account types and very high minimum deposits, Kwakol Markets is best for forex traders looking for low spreads and ECN execution.

The forex broker will also serve traders familiar with the MetaTrader 4, MetaTrader 5 and cTrader platforms.

FAQ

Is Kwakol Markets Legit Or A Scam?

Kwakol Markets is regulated by the ASIC. This is a top-tier financial body and a good indication that the forex broker is not a scam.

On the negative side, we found it difficult to speak to a customer service agent and feel some areas of information are lacking.

Can I Trust Kwakol Markets?

The broker’s regulatory credentials are a promising sign that the company is trustworthy.

With that said, it isn’t in the same league as some forex brokers due to the weak support and reported challenges in withdrawing money.

Does Kwakol Markets Offer Low Forex Trading Fees?

Pricing conditions vary by account type, with the most competitive spreads available on the higher-tier profiles. The Standard profile is the most suitable for beginners with the lowest minimum deposit requirement and floating spreads from 0.8 pips.

Is Kwakol Markets A Regulated Forex Broker?

Kwakol Markets Pty Limited is authorized by the Australian Securities and Investments Commission (ASIC) and holds a Foreign Exchange dealer license issued by FINTRAC Money Services Canada.

Is Kwakol Markets A Good Forex Broker For Beginners?

Kwakol Markets is a decent forex broker for novice traders. The brand offers some basic educational content and access to a demo account. The Standard account will be the most suitable and the $250 initial funding requirement is accessible.

Does Kwakol Markets Have A Forex App?

Kwakol Markets does not have a proprietary mobile app. That being said, MT4, MT5, and cTrader all have mobile compatibility and facilitate forex trading from mobile and tablet devices.

How Long Do Withdrawals Take At Kwakol Markets?

All payment methods except for PayPal and bank wire transfers support fund clearance within 24 hours. These are fast withdrawal times and compare well to rival forex brokers.

Can You Make Money Trading Forex With Kwakol Markets?

It is possible to make a profit when trading forex with Kwakol Markets. The broker offers competitive pricing and powerful trading tools, including MT4, MT5, cTrader and Autochartist.

However, trading forex is risky so only deposit what you can afford to lose. Many traders lose money.