LQDFX

-

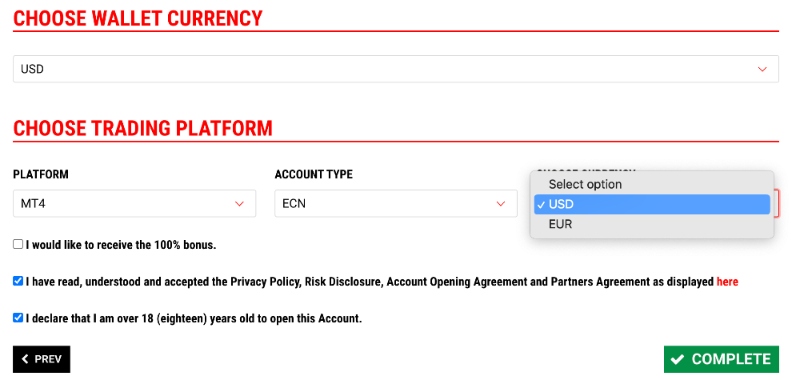

💵 CurrenciesUSD, EUR

-

🛠 PlatformsMT4

-

⇔ Spread

GBPUSD: 0.1 - 1.8 pips (depending on account) EURUSD: 0.1 - 1.2 pips (depending on account) GBPEUR: 0.5 - 1.7 pips (depending on account) -

# Assets71

-

🪙 Minimum Deposit$20

-

🫴 Bonus Offer100% deposit bonus up to $20,000

Our Opinion On LQDFX

LQDFX is a forex broker with competitive trading conditions. Stand-out features for us are the range of STP accounts with fast execution speeds and spreads from 0.0 pips. We also rated the MetaTrader 4 platform during testing, especially for its sophisticated charting and automated trading capabilities.

On the downside, LQDFX is not regulated by a trusted financial authority. We also think the narrow selection of payment methods is limiting and the market analysis trails the best forex brokers.

Summary

- Instruments: 100+ including 71 forex pairs, stocks, indices, commodities, crypto

- Live Accounts: Micro, Gold, ECN, VIP, Islamic

- Platforms & Apps: MetaTrader 4 (MT4)

- Deposit Options: Bank cards, PayRedeem, crypto

- Demo Account: Yes

Pros & Cons

- Tight spreads from 0.0 pips with low commissions from $2.50

- Excellent forex coverage with 70+ currency pairs

- 24/5 support with fast response times during testing

- Accessible $20 minimum deposit for beginners

- High-quality education to support new traders

- Access to the MetaTrader 4 platform and app

- Free deposits and free crypto withdrawals

- Very high leverage up to 1:1000

- Unlimited demo account

- PAMM solution

- Offshore regulatory status lowers safety score

- Narrow product portfolio beyond forex

- Outdated market news and analysis

- No MetaTrader 5 (MT5)

- Limited deposit options

Is LQDFX Regulated?

LQDFX is an unregulated forex broker based in Saint Lucia. We see this as a particular weakness.

Although unregulated brokers are common, they are often subject to less oversight, which creates additional risks for traders. Clients tend not to benefit from safeguards like access to compensation schemes, limits on leverage, and restrictions on trading promotions.

That being said, we are somewhat reassured to see that LQDFX uses segregated accounts, which means that client funds are kept separate from those belonging to the firm.

The company also offers negative balance protection, which is an important safeguard imposed by top-tier regulators that ensures clients can’t become indebted to their broker if the market moves against them.

Forex Accounts

LQDFX offers an excellent choice of trading accounts that will serve different trading styles and budgets. This includes a Micro account that is well-suited to beginners and a VIP account that will meet the needs of high-volume traders.

We are also happy to find that the Micro and Islamic accounts have a low minimum deposit of just $20. This is on the low end of the brokers we review, and makes LQDFX accessible to newer traders.

In addition, all live account types come with an account manager and you can access all the same instruments with each one.

We compare the accounts available below.

| Micro | Gold | ECN | VIP | Islamic | |

|---|---|---|---|---|---|

| Minimum Deposit | $20 | $500 | $500 | $25,000 | $20 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.1 Lots | 0.01 Lots |

| Maximum Trade | 5 Lots | 40 Lots | 40 Lots | None | 40 Lots |

| Average Spread | 1.0 | 0.7 | 0.1 | 0.1 | 0.7 |

| Forex Commission | $0 | $0 | $3.50 | $2.50 | $0 |

| Maximum Leverage | 1:1000 | 1:300 | 1:300 | 1:100 | 1:300 |

How To Open A LQDFX Account

I found the process for opening an LQDFX account to be quick and easy, and was able to start trading in minutes:

- Click Open Account and then Individual

- Enter your personal details including your name, email and telephone

- Input details about your financial situation, employment background and trading experience

- Choose your wallet currency (USD/EUR), platform and account type

- Upload documents as part of the KYC verification process

Trading Fees

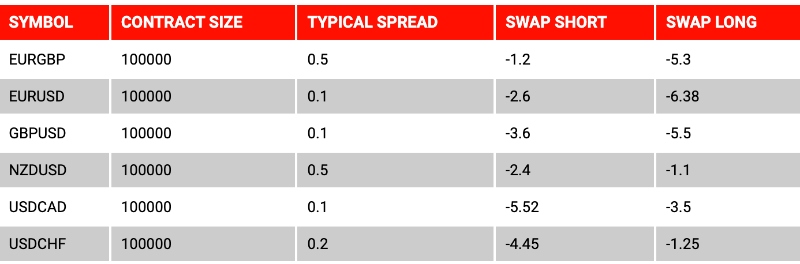

Trading fees at LQDFX were competitive during testing, particularly on the ECN and VIP accounts.

Our team sees typical EUR/USD spreads of just 0.1 pips on the ECN accounts, while the average spread for the Micro account is around 1.2 pips. These are tighter than most forex brokers we review.

Most LQDFX accounts offer commission-free trading, although ECN and VIP accounts include charges on forex positions. ECN rates are $3.50 per lot, whilst VIP account holders are charged $2.50 per lot. Again, these rates compare well to other firms, especially the VIP solution which will appeal to serious forex traders who can afford the $25,000 minimum deposit.

Non-Trading Fees

LQDFX charges standard swap fees on all account types (except Islamic profiles) on CFD positions held overnight.

While this is common practice, the inactivity penalty is a drawback for us. There is a reactivation fee of 20% of the account balance if left unused for 12 consecutive months.

Payment Methods

I think LQDFX falls short when it comes to deposit and withdrawal options. You are limited to PayRedeem, bank cards, plus several cryptocurrencies. The lack of support for wire transfers or popular e-wallets like PayPal, in particular, will be inconvenient for some traders.

I also find the $10 flat fee for card withdrawals disappointing – many top forex brokers offer fee-free withdrawals.

On the plus side, I appreciate that there are no deposit fees and almost instant processing times. Withdrawal timelines are also reasonable, taking up to 2 days with PayRedeem and cryptos. However, bank cards can take up to 10 days, so I recommend using an alternative method if you want your profits quickly.

Forex Assets

LQDFX offers an excellent range of 71 forex pairs, which is more than most forex brokers we test. With a wide selection of majors, minors and exotics, there are trading opportunities for beginners through to seasoned currency traders.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | GBP/AUD | Yes |

| GBP/USD | Yes | USD/CAD | Yes |

| AUD/USD | Yes | USD/CHF | Yes |

| GBP/JPY | Yes | GBP/NZD | Yes |

| USD/JPY | Yes | EUR/GBP | Yes |

Non-Forex Assets

I have been less impressed by the choice of non-forex CFDs. The depth of stocks and commodities is below the offerings of many rivals. Traders looking for more diversification opportunities should consider competitors like CMC Markets or eToro, which offer 12,000+ and 3,000+ instruments, respectively.

At LQDFX, you can speculate on:

- Four metals, including gold & silver

- 11 indices, including the S&P 500 & FTSE 100

- 13 cryptos, including Bitcoin, Litecoin & Ethereum

- Four energies, including natural gas & Brent Crude oil

- 37 stocks, including blue chips like Amazon, Apple & Tesla

Execution

Barring the Electronic Communication Network (ECN) solution, all accounts at LQDFX implement Straight-Through Processing (STP).

Both STP and ECN models have no dealing desk (NDD) intervention, something we like to see as there is no conflict of interest between the trader and the broker.

During our trial of the firm’s services, we also saw no requotes, which resulted in faster execution times and better profit margins.

Leverage

Due to the forex broker’s offshore status, it can offer very high leverage up to 1:1000. This is available with the Micro account, while the Gold, ECN and Islamic accounts are capped at 1:300, and the VIP at 1:100. We found that broker issues margin calls at 50% of our capital.

We recommend that beginners, in particular, approach highly leveraged trading with caution. 1:1000 is significantly beyond the 1:30 limit imposed by EU regulators for example – a measure designed to help protect retail investors from significant losses.

Platforms & Apps

The broker offers the industry-leading MetaTrader 4 (MT4) platform. This is one of the key advantages of trading forex with LQDFX in my opinion.

I like the software’s wide range of built-in indicators and analytical tools, making it a great platform for technical analysis. With 9 timeframes, 30 integrated indicators, 23 analytical objects and 3 execution modes, it offers enough functionality for most aspiring traders.

It is also an excellent solution for algo traders. Its Expert Advisors (EAs) can be built, tested and deployed with a range of useful guides available online. I particularly rate that you can buy proven EAs from the MetaTrader marketplace, with thousands of options available.

I often like to check my positions when away from my desktop, and MT4’s mobile app works well for this purpose. It can be downloaded for free onto iOS and Android devices.

How To Make A Forex Trade On MT4

MetaTrader 4 is one of the easiest platforms that I have used to place forex trades. The process is as simple as these 4 steps:

- Right-click on your chosen forex asset on the list of assets on the left

- Click New Order

- Complete the information in the pop-up window including volume and, if relevant, your stop loss and take profit

- Click Sell by Market or Buy by Market to complete the order

For even simpler trades, one-click trading can be enabled in the Options tab.

Forex Tools

I am pleased that LQDFX provides free trading signals, including stop-loss and take-profit suggestions, across all markets.

I also rate the helpful suite of fairly standard tools easily accessible, including an economic calendar and several trading calculators.

However, the best solution in my view is the VPS service for uninterrupted, low-latency automated trading. This is free if you have an account balance of $2000, otherwise a $50 monthly fee applies.

Forex Research

The market news and analysis section on the broker’s website is lacking, with much of the material outdated.

Given the fast-moving nature of the forex market, regular news and articles with expert analysis can prove useful. It is also an area that many alternatives do well in, including XTB.

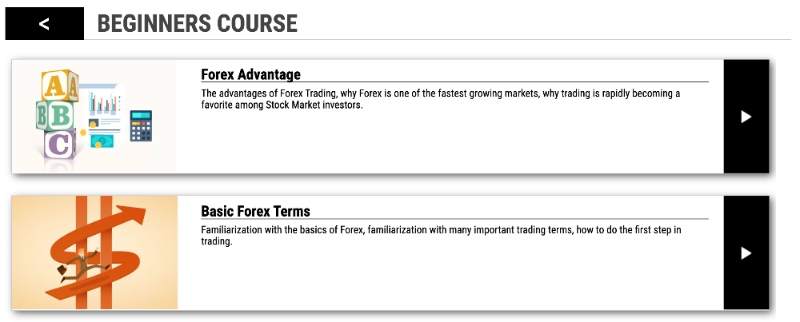

Forex Education

Our team are satisfied with the forex education provided by LQDFX, though we see more extensive materials at brokers like eToro.

Nevertheless, we like LQDFX’s set of learning resources, particularly its video tutorial courses. These are especially useful for beginners, covering various topics including strategies and how to use the MetaTrader 4 platform.

There is also a free forex e-book, which includes quiz questions to test your understanding.

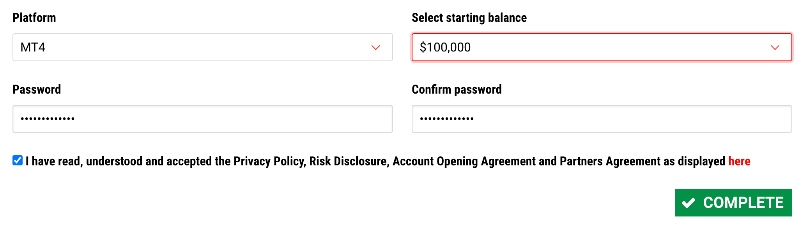

Demo Account

LQDFX clients can open free demo accounts in either USD or EUR with a virtual balance up to $100,000.

This is a service that I find can make a significant difference to my trading success, so I am very pleased to find it here without time limits.

How To Sign Up For A Demo Account

LQDFX demo accounts can be opened in just a few minutes, with most of the time spent downloading. To open an account:

- Click Open Demo Account on the LQDFX homepage’s top banner

- Input your personal information and choose your wallet currency and balance

- Click Complete

- Download the MT4 platform and login

Bonus Offers

LQDFX’s main promotional campaign is a 100% Bonus Program, which is available on all deposits over $250.

Those making use of this bonus can earn up to $20,000, though we did find some fairly steep wagering requirements that must be met before funds can be withdrawn. As a result, it is best thought of as funds you can use to practice online trading.

Trading Restrictions

I appreciate that LQDFX does not restrict its traders from using forex scalping or hedging strategies. However, you are not permitted to carry out arbitrage systems.

Customer Service

Multilingual 24/5 customer support is available should you have any queries or problems. I am satisfied with this coverage and with the quick responses (within two minutes) I received to multiple queries I sent via live chat. Some traders may prefer to see 24/7 support, but this isn’t a dealbreaker in my view.

To get in contact:

- Live Chat: bar on the right-hand side of the website

- Phone Number: +359 2490 4462

- Email: support@lqdfx.com

Company Details

LQDFX is owned by LQD Ltd and was established in 2015. Its registered address is in Saint Lucia, although it does have a physical office address in Bulgaria.

LQDFX is not a regulated firm, although our research revealed that it has won some respected industry awards and received good feedback from other users.

Whilst clients from the US, Canada and the UK are not accepted, residents in many other countries are permitted to open an account.

Trading Hours

The forex market typically runs from Monday 00:02 to Friday 23:57 GMT+3, with a short daily break between 23:58 and 00:02 GMT+3.

The LQDFX server time zone is GMT+3.

Who Is LQDFX Best For?

LQDFX is a good option for beginners thanks to its $20 minimum deposit, Micro account, unlimited demo mode and strong educational materials.

Active short-term traders will also rate the low pricing on the premium accounts, fast execution speeds, high leverage, and access to the powerful MetaTrader 4 platform.

On the downside, LQDFX is not a good option if you want a heavily regulated forex broker – it operates with limited regulatory scrutiny compared to many alternatives.

FAQ

Is LQDFX Legit Or A Scam?

LQDFX is a legitimate forex broker based in Saint Lucia. But while the company does have a decent track record so far, the lack of regulatory oversight does make it less safe than more established forex brokers.

Can I Trust LQDFX?

While we found many positives during our review of LQDFX, it is an unregulated broker, which comes with additional risks. Such firms are subject to limited scrutiny and investors are less likely to benefit from measures like access to compensation funds, restrictions on leveraged trading and bans on misleading trading promotions.

Is LQDFX A Regulated Forex Broker?

No – LQDFX is an unregulated broker. It has a registered address in Saint Lucia and an office presence in Bulgaria, but is not authorized by any top-tier regulators.

Is LQDFX A Good Or Bad Forex Broker?

LQDFX offers good trading conditions for a range of forex traders. There is a choice of accounts, competitive fees, responsive customer support, and the most popular third-party trading platform – MetaTrader 4.

On the negative side, it has weak regulatory credentials and its market research and analysis trails many alternatives.

Is LQDFX Good For Beginners?

LQDFX has been designed with beginners in mind. There is a free demo account, a low minimum deposit, a Micro account plus decent learning resources.

Does LQDFX Offer Low Forex Trading Fees?

I saw competitive forex spreads on LQDFX’s no-commission STP accounts at around 1 pips on major currency pairs. Its ECN variants also provide raw spreads with a low commission from $2.50 on the VIP account.

Does LQDFX Have A Forex App?

This broker does not have its own mobile app. However, clients can use the MT4 app on iOS and Android devices.

How Long Do Withdrawals Take At LQDFX?

We saw typical withdrawal times of one or two business days at LQDFX, although payment cards can take much longer, up to ten business days. These are similar timelines to most popular forex brokers.

Can You Make Money Trading Forex With LQDFX?

LQDFX offers attractive conditions for currency traders looking to make money. Fees are competitive, the MT4 platform is excellent, and execution speeds are fast with no requotes.

However, our experts stress that sound and rigorous risk management systems should always be in place when speculating on forex markets. Your capital is at risk.