Moneta Markets

-

💵 CurrenciesUSD, EUR, GBP, CAD, NZD, JPY, HKD, SGD, BRL

-

🛠 PlatformsMT4, MT5, TradingView, TradingCentral

-

⇔ Spread

GBPUSD: Floating EURUSD: Floating GBPEUR: Floating -

# Assets45+

-

🪙 Minimum Deposit$50

-

🫴 Bonus Offer50% Cashback Bonus, Free VPS

Our Opinion On Moneta Markets

Moneta Markets is a regulated forex broker with a low minimum deposit and a fast sign-up process. We particularly rate the ECN pricing with spreads from 0.0 pips and high leverage up to 1:1000 on over 45 currency pairs.

On the negative side, the educational materials and demo account trail some forex brokers. Regulatory safeguards also vary depending on which entity you open an account with.

Overall though, after testing Moneta Markets, our team is assured the broker has something to offer forex traders of all experience levels and trading styles.

Pros & Cons

- Strong product portfolio with 1000+ instruments including 45+ major, minor, and exotic currency pairs

- Powerful forex trading tools including VPS connectivity and ZuluTrade copy trading

- Access to industry-leading trading platforms MetaTrader 4 and MetaTrader 5

- Transparent fee structure split by account type

- No inactivity charges or account opening fees

- Authorized by a tier-one regulator - the ASIC

- Fast order execution speeds from 15ms

- Swap free accounts for Islamic traders

- Low minimum deposit of $50

- 50% cashback bonus

- Limited educational materials with course access requiring a $500 deposit

- Weak regulatory oversight through the offshore branch

- The demo account expires after 30 days

Summary

- Instruments: 1000+ including 45+ forex pairs, stocks, indices, commodities, bonds, ETFs, crypto

- Live Accounts: Direct STP, Prime ECN, Ultra ECN

- Platform & Apps: MT4, MT5, ProTrader, AppTrader

- Deposit Options: Wire transfer, credit card, SticPay, FasaPay, JCB, crypto

- Demo Account: Yes

Is Moneta Markets Regulated?

Moneta Markets is regulated by several financial bodies:

- Moneta Markets South Africa (Pty) Ltd is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa

- AGC Capital Securities Pty Ltd is regulated by the Australian Securities & Investments Commission (ASIC)

- Moneta Markets Ltd is regulated by the Financial Services Authority (FSA) of Seychelles and registered under Saint Lucia Registry of International Business Companies

Whilst we don’t consider the Seychelles and Saint Lucia to offer particularly strong regulatory oversight, we are reassured by authorization from the ASIC and FSCA, especially the former.

Our team also finds that several client safety measures are in place, with segregated client funds and negative balance protection available. The broker has also taken out Professional Indemnity Insurance. In addition, our experts did not uncover any major scams or security breaches in their investigations.

Overall, we are comfortable that Moneta Markets is a reliable forex broker, with the caveat that traders who sign up with the Seychelles entity may receive fewer legal protections.

Forex Accounts

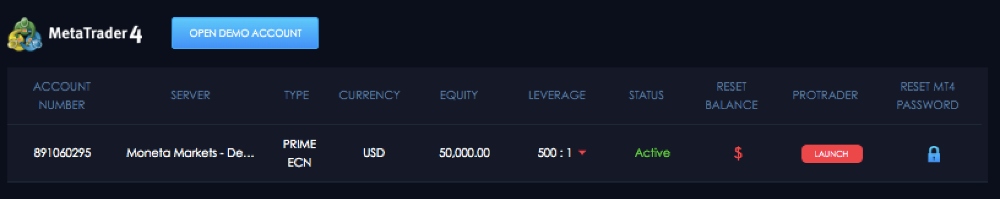

Moneta Markets offers three live accounts – Direct STP, Prime ECN and Ultra ECN. A swap-free account is also available to Islamic traders.

Our team recommend the Direct STP accounts for beginners, as it has the lowest deposit of $50 and no commissions. The ECN account will serve active day traders with zero-pip pricing, a small commission and a $200 deposit. The Ultra ECN solution is best for high-volume traders looking for even lower commissions in return for a higher starting deposit of $50,000.

These solutions ultimately provide traders with flexible yet uncomplicated ways to approach online trading. We also like that, unlike with some forex brokers, traders are not penalized for their choice of account by being offered a limited product portfolio.

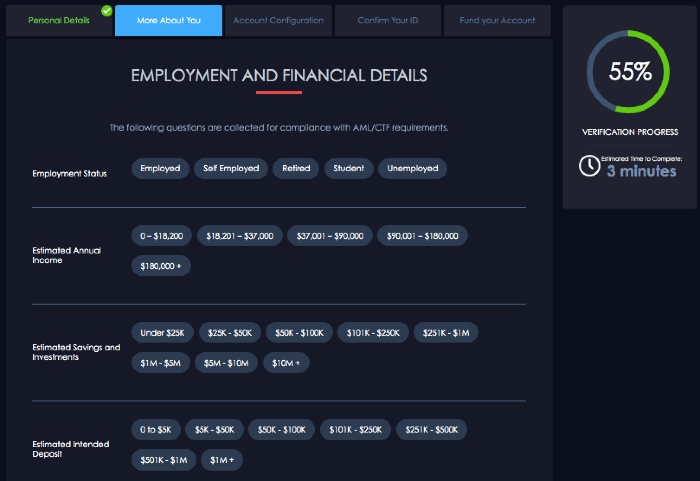

How To Open A Live Account

Moneta Markets’ account registration process was as simple as we expect from good forex brokers, with all the steps clearly marked on a series of straightforward forms. The process should take less than half an hour for traders who have the necessary documents to hand:

- Complete your personal details on the first registration page (title, name, nationality, email, telephone contact number, date of birth, place of birth, ID document type and ID document number)

- Add your address details in the following screen

- Input employment and financial details including your estimated annual income, source of trading funds and expected trading volume

- Select a trading platform, account type and base currency. Review the T&Cs and choose ‘Next’

- Upload proof of residency and identity to finalize your application

Trading Fees

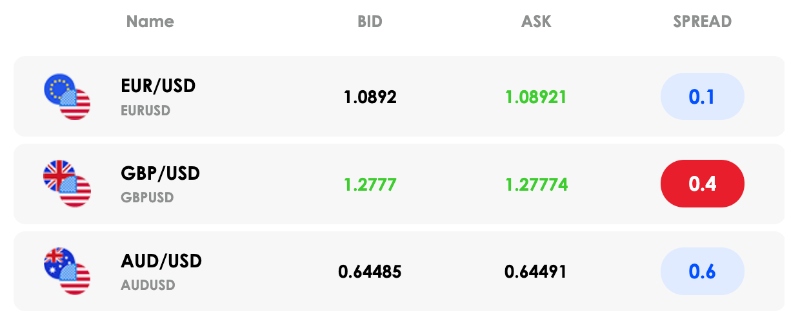

Our experts rate Moneta Markets trading fees as competitive, with the Ultra ECN pricing among the best on the market.

- Direct STP – Spreads from 1.2 pips, no commission fee

- Prime ECN – Spreads from 0 pips, $3 commission per lot per side

- Ultra ECN – Spreads from 0 pips, $1 commission per lot per side

While using Moneta Markets, we were offered an average spread of 0.26 pips on the Prime ECN account vs 1.36 pips on the Direct STP profile for the EUR/USD. This is reasonable and puts the brand on par with other popular forex brokers.

The brokerage also scores well for its fees on other asset classes. Upon testing, US share CFDs were commission-free while EU and UK share CFDs have a competitive 0.1% commission.

Non-Trading Fees

I appreciate that there are no inactivity fees. This is an advantage over alternatives, such as CMC Markets and Plus500, which both charge $10 per month after a period of inactivity.

Deposits are free of charge, while withdrawals incur a $20 fee for bank wire transfers, though the forex broker will waive this fee once per month. It is good to see fee-free deposits, but most forex brokers also offer free withdrawals with no fees or restrictions on any payment method, including wire transfers.

It is also worth being aware of the minimum requirements for free access to VPS hosting, which includes a $500 initial deposit and a minimum trading volume of 5 FX lots per month.

Payment Methods

Moneta Markets offers a good range of funding methods, with a few digital payments plus traditional cards, wire transfers and cryptocurrencies. These will accommodate global traders.

The wide selection of base currencies is strong, reducing conversion fees for account holders. Supported currencies include USD, EUR, GBP, NZD, SGD, JPY, CAD, HKD, and BRL.

All payment methods also offer instant funding with the exception of bank wire transfers which can take up to five days.

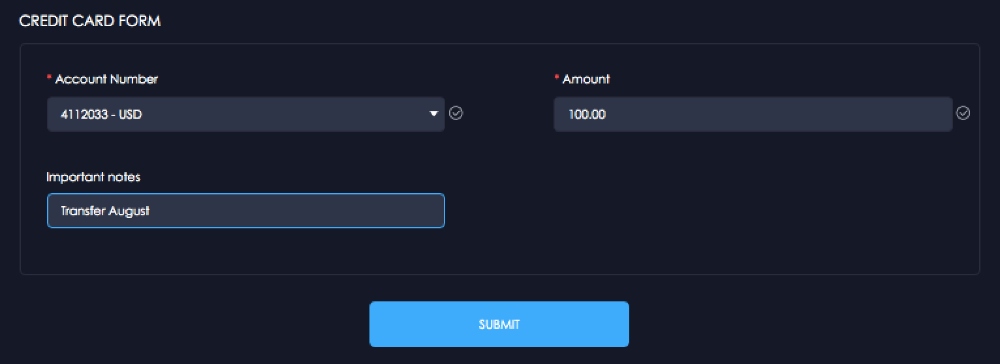

How To Make A Deposit

I find making a deposit straightforward thanks to Moneta’s slick interface. The process can be completed easily in a couple of minutes:

- Log in to the client portal

- Choose ‘Funds’ from the side menu and then ‘Deposit Funds’

- Select a payment method from the list of choices

- Input the amount to deposit

- Follow the on-screen instructions to complete the payment and click ‘Submit’

Forex Assets

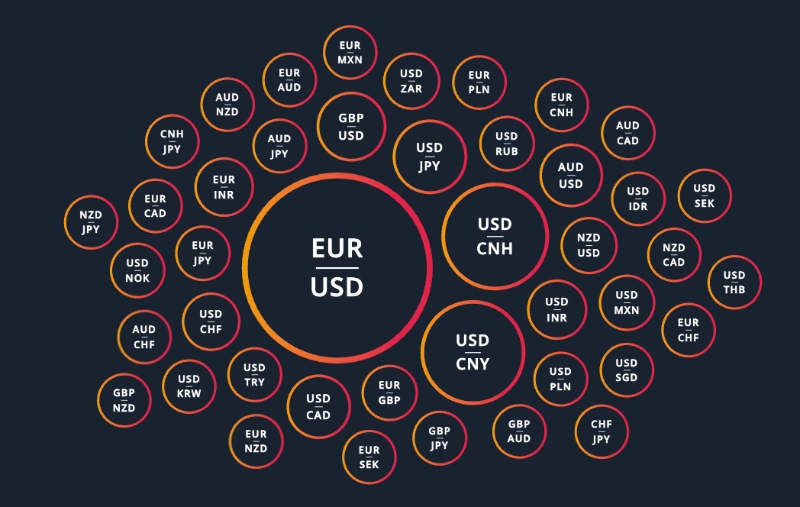

You can trade 45+ currency pairs including majors, minors and crosses. Though we see this as an adequate list of instruments, it leaves Moneta Markets behind some competitors, including Forex.com (80+) and FxPro (70+).

Yet while it is often beneficial to have wider market coverage since this brings added opportunities, realistically many traders will stick to a handful of currencies that they know well. So, with a good selection of the most popular currencies, the brokerage provides enough for most aspiring forex traders.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

We are happy with the wide range of alternative instruments, which can be traded alongside forex to create a diverse portfolio. The suite of equities spanning US, UK, EU, Australian and Hong Kong stock markets is particularly strong.

You can trade:

- Commodities – 15+ precious metal, agriculture and energy commodities including crude oil, natural gas, sugar, gold and silver

- Bonds – 5+ government bonds including Euro Bund Futures, UK Long Gilt Futures and US 10-Year T-Note Futures

- ETFs – 50+ exchange-traded funds such as iShares Global Clean Energy ETF, Technology Select Sector SPDR Fund and Vanguard Total International Bond ETF

- Stocks – 700+ US, UK, EU, AU and HK shares such as Telefonica, Meta, Apple and Google

- Indices – 20+ index funds including NASDAQ 100, Nikkei 225, FTSE 100 and Dow Jones 30

- Cryptos – 40+ popular cryptocurrencies including Bitcoin, Ethereum and Litecoin (swap-free)

Execution

The firm’s execution model provides excellent pricing and ultra-fast execution speeds. We consider anything below 100ms very fast, and with speeds from 15ms, Moneta Markets is beyond most forex brokers that we review.

Moneta Markets integrates both STP and ECN execution via its account types. The brokerage uses OneZero’s next-generation price engine, which offers fast order execution from global data centers.

Some of the partnered liquidity providers the brand works with are also top-tier, including J.P. Morgan, Credit Suisse and UBS.

Leverage

Moneta Markets offers very high leverage of up to 1:1000 on forex. This means for every $1 invested, you can borrow $1000 to boost your position sizes.

High leverage can be beneficial to experienced traders with strong risk management strategies, as it allows them to turn the opportunities they are confident about into significant profits. However, it also raises risks considerably, so we urge newer traders to stick to the lower levels mandated by most top-tier regulators, for example 1:30.

The company operates an 80% margin call and a 50% stop-out level, which is around the industry standard. You can expect email alerts when your positions are at risk.

Platforms & Apps

Trading platforms are a strong point for Moneta Markets, which offers some of the best third-party platforms plus a proprietary terminal. Clients have access to ProTrader, MetaTrader 4 (MT4), MetaTrader 5 (MT5), and AppTrader.

ProTrader

I think ProTrader is the most visually appealing, with a sleeker interface than MT4/MT5, thanks to its integration of the excellent TradingView charting system. It can also be opened directly through web browsers, making it good if you want to start trading forex quickly on an easy to use solution.

I find the platform offers a good library of analysis tools to help analyze the markets and plan trades. This includes 20+ chart layout options, with 12 custom chart types, a much larger list than offered on the MetaTrader platforms.

Our useful features include access to 50+ technical analysis and drawing tools and in-built news streams.

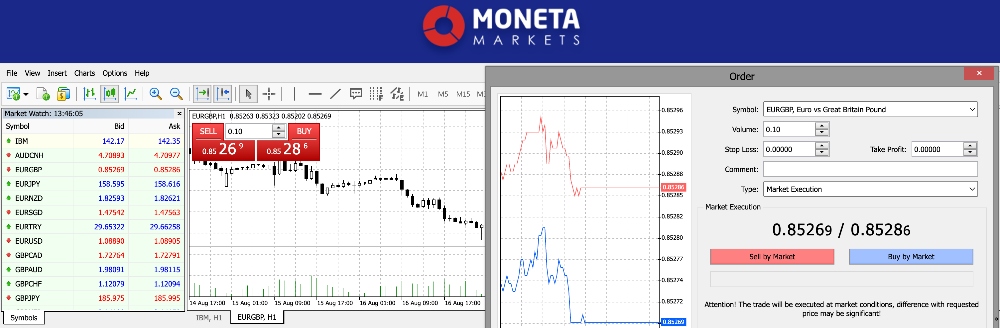

MT4 & MT5

The MetaTrader terminals are renowned for their powerful features and custom charting, with integrated technical indicators and additional plugins available.

Although not as modern as the broker’s proprietary platform, many traders will prefer to use these tried-and-tested favorites.

Among the best features offered by MetaTrader are its Expert Advisors (EAs) for automated forex trading. You can let your trades be fulfilled, with little intervention required.

How To Open A Forex Trade

I find it simple to place a forex trade in seconds with a few mouse clicks:

- Open the MetaTrader web trader or download the platform to a desktop device

- Log in with your registered credentials

- Double-click on the forex asset you wish to speculate on in the ‘Market Watch’ widget

- Add trade details to the ‘New Order’ screen including order volume, order type, stop loss/take profit price, and a comment

- Select ‘Buy’ or ‘Sell’ to open the position

AppTrader

This mobile trading app integrates with MT4 and MT5 accounts. I have tested dozens of forex trading apps and this stands out for its user-friendly interface and slick design.

It is also home to several features which make it an effective all-in-one trading solution. Highlights for me are the trading signals, AI Market Buzz, and position size calculator. The economic calendar is also useful for keeping up to date with upcoming events while on the go.

Forex Tools

Moneta Markets offers an excellent suite of additional tools, which provide good value for both beginners and experienced forex traders.

There is enough to support a range of trading activities, with copy trading, an economic calendar, VPS hosting, technical views, and featured ideas. We also like that traders can access Alpha Generation indicators, which can be installed directly into the MetaTrader terminals for entry and exit point configuration.

ZuluTrade

Moneta Markets offers integration with the third-party copy trading software ZuluTrade. This is a market-leading solution that provides a great service to traders of all experience levels.

Customers can link their brokerage account with the platform and create a diverse portfolio using the expertise of signal providers.

ZuluTrade provides a good range of data to help you choose who to copy trade, and we recommend spending time reviewing the performance statistics of the top social traders as well as making use of risk management features such as ZuluGuard.

We particularly like that there are no separate minimum deposit requirements to access the copy trading function.

CopyTrader

Another useful tool that boosts our experience with Moneta Markets is the CopyTrader app.

There are over 6000 traders you can follow. However, the highlight for me is that you can find a suitable master trader by choosing your preferred trading style and entering your risk tolerance. You can then start copy trading in one click.

The app is available on the Apple App Store and Google Play.

VPS

We are pleased to see that Moneta Markets provides a forex VPS via Hokocloud, offering 24/7 market connectivity. This is a great solution for active forex traders deploying algorithmic trading strategies.

To access the service for free, you need to deposit $500 and trade a minimum of 5 FX lots per month. It is quite normal for forex brokers to have these kinds of requirements for VPS services, so we don’t consider the entry criteria a major drawback.

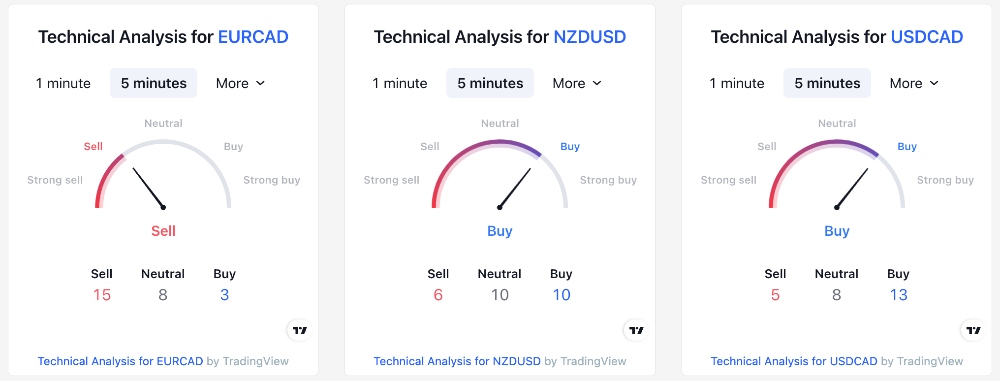

Forex Sentiment

A useful feature, particularly for beginners, is the brand’s market sentiment data by currency pair. You can filter by timeframe and view peer outlooks by instrument.

I find that this can be a good way to get a feel for current market conditions, and combined with the other tools on offer, can help give you confidence in choosing which positions to take.

Forex Research

The forex broker offers news and analysis via WebTV. However, the focus is on industry news from the NYSE trading floor and I would like to see more comprehensive analysis and market commentary to match rivals.

It is also a shame to see that the brand’s ‘Daily Finance News Updates’ sometimes contain out-of-date information.

All in all, the forex research trails industry leaders like CMC Markets.

Forex Education

Moneta Markets offers limited free educational content to its clients. We see this as a big drawback as it leaves the forex broker behind competitors such as eToro and IC Markets, especially for beginners who may need support to make trading decisions.

There is a ‘Market Masters Course’ offering trading tutorials to learn the basics of forex trading and technical and fundamental research. However, this requires a $500 deposit, which limits its availability to new forex traders and those with less capital.

Demo Account

Moneta Markets offers a free demo account.

Yet while we are always pleased to see a demo account, our team is disappointed that the demo profile expires after 30 days and is only available for the MetaTrader platforms. This is limiting for beginners and means you can’t fully test the proprietary platform before depositing funds.

How To Open A Demo Account

The sign-up process for a demo account is similarly streamlined to the live account registration. To get started:

- Click ‘Demo’ from the top right of the broker’s website

- Add your personal details to the online application form (name, country of residency, phone and email) and click ‘Next’

- Configure your demo account by selecting a trading platform, account type, base currency, leverage level and virtual account balance and choose ‘Next’

- Login information will be shown on the next screen

- Launch the trading terminals from the left menu, log in with your registered credentials and start investing

Bonus Offers

A 50% Cashback Bonus is available at the time of writing.

Following a $500 deposit, you can get bonus credits that can be turned into cash when you trade forex, gold and oil. A helpful daily cashback calculation is also available in the broker’s client portal.

You can opt in to any deposit promos and deals when you sign up for a live account.

Trading Restrictions

Moneta Markets does not impose any trading restrictions. This means you can use scalping, swing, and hedging strategies.

You can trade currency pairs with a minimum volume of 0.01 lots and maximum 100 lots per click.

Customer Service

I am happy with Moneta Markets’ multilingual customer support, which is available 24/7.

When I tested the customer service I was impressed with the live chat function, with a response from an agent coming in less than one minute in each of my three tests of the system.

Besides live chat, contact methods include:

- Email – support@monetamarkets.com

- UK Telephone Contact Number – +44(113)3204819

- International Telephone Contact Number – +61283301233

Company Details

Moneta Markets launched in 2009. The brand has a respectable 70,000 live accounts, operating from a headquarters in Johannesburg, South Africa.

The broker executes an average of 1.5 million trades per month with a trading volume in the region of $100 billion.

The brand has also been recognized with several awards including the Most Advanced CFD Trading Platform at the CV Magazine awards and the CFD Platform of the Year at the FinTech awards.

Trading Hours

The broker’s opening hours vary by asset class, though follow standard market times. This includes 00:01-23:58 for forex and 09:30-16:00 (NY Time) for US stocks.

Moneta Markets’ server follows a GMT+2, or GMT+3 time zone.

Who Is Moneta Markets Best For?

The choice of account types with different pricing models, execution and trading tools allows for a versatile client base.

The $50 minimum deposit, demo account and copy trading tools will appeal to new currency traders, while the excellent pricing on the Ultra ECN account and free VPS makes this a great option for high-volume traders.

FAQ

Is Moneta Markets Legit Or A Scam?

Moneta Markets is a legitimate broker, operating since 2009. Tens of thousands of traders have opened an account with the award-winning firm. Also, our team did not uncover reports of scams during their research.

Can I Trust Moneta Markets?

Moneta Markets is a trustworthy forex broker. The regulated broker segregates client funds from its own capital, offers negative balance protection for retail traders, and has professional indemnity insurance. The brand also has a good reputation.

Is Moneta Markets A Regulated Forex Broker?

Moneta Markets is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa, the Australian Securities & Investments Commission (ASIC), and the Financial Services Authority (FSA) in the Seychelles. The company is also registered with the Saint Lucia Registry of International Business Companies.

Does Moneta Markets Offer Low Forex Trading Fees?

Moneta Markets’ trading fees are competitive, though they vary between accounts.

You can trade commission-free on the Direct STP account with floating spreads averaging 1.2 pips. The Prime ECN account offers raw spreads from 0 pips, with a $3 commission per lot, per side. Alternatively, high-volume traders with the Ultra ECN account can get very low pricing with spreads from 0 pips and a $1 commission per lot, per side.

Is Moneta Markets A Good Forex Broker For Beginners?

Moneta Markets is a fairly good forex broker for beginners. There is a low starting deposit, a free demo account and copy trading tools.

On the negative side, it trails the best forex brokers for beginners when it comes to educational materials.

Does Moneta Markets Have A Forex App?

Yes, AppTrader is a custom application that links with MT4 and MT5 accounts. It features multiple trading tools, from live signals and technical analysis to economic calendars and position size calculators. It is also available in multiple languages.

Alternatively, the MetaTrader apps can be downloaded from the respective app store.

How Long Do Withdrawals Take At Moneta Markets?

Withdrawals at Moneta Markets typically take between one and three working days. While not the fastest timelines, this is similar to most reputable forex brokers so we don’t have any issues here.

Can You Make Money Trading Forex With Moneta Markets?

Skilled forex traders may be able to make money at Moneta Markets, thank to its competitive pricing, fast execution speeds, and high-quality trading tools.

However, the risks of online trading are high, regardless of the forex broker you use. With this in mind, only risk what you can afford to lose and have a money management strategy.