Best Forex Brokers In The UAE

The best forex brokers in the United Arab Emirates (UAE) provide a competitive trading environment and are regulated by a trusted regulator, such as the Securities and Commodities Authority (SCA), Dubai Financial Services Authority (DFSA) or Financial Services Regulatory Authority (FSRA).

In this guide, we evaluate the top forex brokers for UAE residents, taking into account:

Whether the broker is regulated in the UAE

The trading platforms and tools

The investment offering

The account conditions

List Of Best Forex Brokers In The UAE 2026

Based on our hands-on tests, we recommend these 5 forex brokers for traders in the UAE:

- AvaTrade: Outstanding reputation. Top-notch platforms. Local support

- Pepperstone: Low fees for active traders. Huge range of currency pairs. Fast execution.

- IG Group: Massive investment offering. User-friendly platform. Excellent education.

- XTB: Highly trusted. Great web platform. No minimum deposit.

- XM: Flexible accounts. Fast account opening. Great market research.

| AvaTrade | Pepperstone | IG | XTB | XM | |

|---|---|---|---|---|---|

| Accepts UAE Traders | Yes | Yes | Yes | Yes | Yes |

| Regulated in the UAE | Yes | Yes | Yes | Yes | Yes |

| Local Support | Yes | Yes | Yes | Yes | No |

| Minimum Deposit | $100 | $0 | $0 | $0 | $5 |

1. AvaTrade

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD

-

🛠 PlatformsMT4, MT5, AlgoTrader, TradingCentral, DupliTrade

-

⇔ Spread

GBPUSD: 1.5 EURUSD: 0.9 GBPEUR: 1.5 -

# Assets50+

-

🪙 Minimum Deposit$100

-

🫴 Bonus OfferWelcome bonus 20% up to 10.000$

Why We Recommend AvaTrade

AvaTrade stands out as our go-to choice for forex traders in the UAE. With a fantastic reputation, cutting-edge platforms, and round-the-clock local support, it’s our undisputed winner.

Pros/Cons of AvaTrade

Pros

A trusted, multi-regulated broker with 400,000+ clients

Ava Trade Middle East Limited is regulated by the Abu Dubai Global Markets Financial Services Regulatory Authority (FSRA), processes more than 2 million trades a month, and has picked up multiple awards, underscoring its reliability.

Excellent platforms including WebTrader, AvaTradeGo, MT4 and MT5

The proprietary WebTrader delivers a terrific user experience, with a super clean design that makes it easy to get started. Integrated news and analyst insights also help identify trading opportunities. Additionally, the AvaTraderGo app ensures a smooth transition to mobile devices.

For advanced traders, the MetaTrader suite delivers a reliable third-party solution, boasting powerful charting packages with dozens of indicators and drawing tools, multiple charting styles and various timeframes.

Local support available in the UAE including telephone, email and live chat

We tested AvaTrade’s live chat support over several days and got average response times of less than 2 minutes. Agents were also knowledgeable, providing helpful responses to our queries about forex trading conditions in the UAE.

Cons

Forex spreads trail the cheapest brokers

During testing, AvaTrade came in with a spread of 1.0 pip on the EUR/USD, slightly higher than IG’s typical spread of 0.8 pips for comparison.

Casual traders should also note the $50 inactivity fee after three months, which can be avoided at alternatives like Pepperstone.

AED is not available as an account currency

While supporting five base currencies (USD, EUR, GBP, AUD, CAD), AvaTrade lacks an AED account. As well as making managing your account less convenient, we also learned that you may need to pay a conversion fee when depositing in Dirham.

Why Is AvaTrade Better Than The Competition?

AvaTrade’s excellent reputation and strong regulatory credentials, including authorization from the FSRA, separate it from other forex brokers in the UAE.

The web platform also provides an excellent trading environment for new investors, and the support team consistently prove their ability to assist new traders.

Who Should Choose AvaTrade?

AvaTrade is the ideal choice for beginners, offering in-house platform designed with new traders in mind. Accessible through web browsers, the platform is complemented by a local support team available 24/5.

For traders seeking an Islamic-friendly account, AvaTrade is also a standout option. No swap fees on overnight trades, coupled with a quick account setup within a couple of days, make it a compelling choice.

Who Should Avoid AvaTrade?

AvaTrade is not the top choice for those seeking the lowest fees. Our analysis indicates that both its trading and non-trading fees are comparatively higher than some alternatives in our shortlist.

2. Pepperstone

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.2 -

# Assets60+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend Pepperstone

We recommend Pepperstone because it maintains its position as a low-cost forex broker for active traders. It also offers a huge suite of currency pairs, plus forex indices, which can’t be found at the majority of brokers.

Pepperstone Financial Services (DIFC) Limited is regulated by the Dubai Financial Services Authority (DFSA).

Pros/Cons of Pepperstone

Pros

Ultra-tight forex spreads for active traders starting from 0.0 pips

During tests of the Razor account, we got an average spread of 0.1 pips on the EUR/USD, alongside a competitive commission of $3.50 on MetaTrader or $3 on cTrader and TradingView.

High-volume traders can also secure commission discounts of 15%+ when they meet monthly volume thresholds.

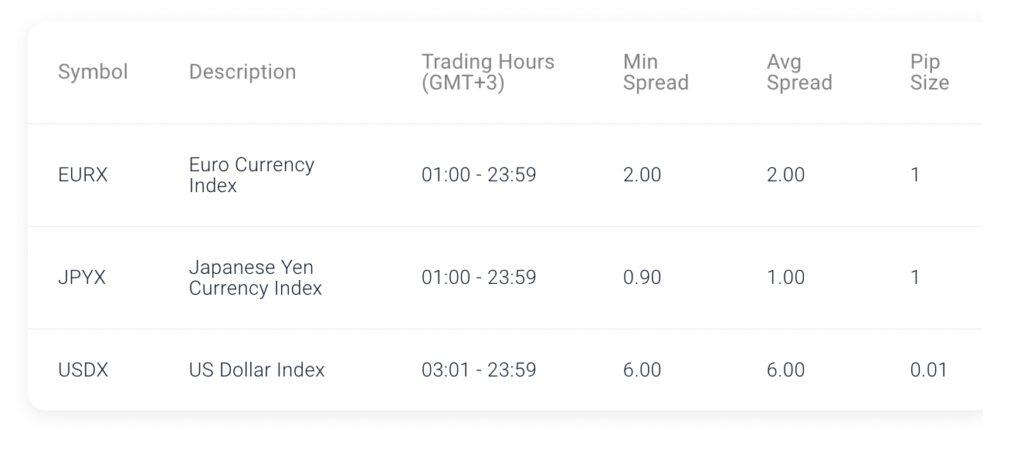

90+ currency pairs alongside forex indices

Pepperstone offers more currency pairs, and in turn, more trading opportunities, than the majority of brokers we have tested, including majors, minors, exotics and non-deliverable forwards (NDFs).

It also offers three currency indices (USDX, EURX, JPYX), offering traders an alternative way to speculate on the value of a currency relative to a basket of comparable currencies.

Fast and reliable order execution with tier-one liquidity providers

With execution speeds averaging around 30 milliseconds, active day traders, in particular, can secure the best prices in fast-moving forex markets.

Cons

The demo account expires after 30 days

We prefer forex brokers like AvaTrade with unlimited demo accounts, especially for beginners, as they offer a risk-free environment for traders to test and refine strategies before risking real money.

The Islamic account has a $100 charge per lot on trades held for 5 days

We also discovered that while the swap-free account is available as standard in certain countries, including Indonesia, Turkey, Oman, Morocco, and Egypt, traders in the UAE will need to contact the support team to open an Islamic account.

Why Is Pepperstone Better Than The Competition?

Pepperstone excels with its extensive range of forex pairs and fairly unique currency indices. It also stands out for its low fees, with excellent pricing for active traders.

In addition, traders in the UAE are assigned an account manager when they sign up – a nice addition that’s helpful for resolving any onboarding issues.

Who Should Choose Pepperstone?

Traders in the UAE looking for trading opportunities on a huge selection of currencies and an alternative way to speculate on major currencies like the USD and EUR should choose Pepperstone.

Additionally, active traders should consider Pepperstone – its rebate scheme for high-volume traders can help keep costs down.

Who Should Avoid Pepperstone?

For those seeking an unlimited demo account, Pepperstone is not the ideal choice; AvaTrade offers a more suitable option.

Similarly, Pepperstone doesn’t provide the most competitive swap-free account due to its $100 admin fee. In this department, AvaTrade again is a better alternative.

3. IG

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, ZAR, SEK, DKK, CHF, HKD, SGD

-

🛠 PlatformsMT4, AutoChartist, TradingCentral

-

⇔ Spread

GBPUSD: 0.9 EURUSD: 0.8 GBPEUR: 0.9 -

# Assets80+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend IG

We recommend IG because its investment offering is almost unrivalled, its educational tools are best-in-class, and the web platform delivers a superb user experience.

IG Limited is regulated by the Dubai Financial Services Authority (DFSA).

Pros/Cons of IG

Pros

17,000+ markets with 80+ currency pairs

As well as offering more currency pairs than nearly every forex broker we have tested, IG is fairly unique in that it offers weekend trading on the EUR/USD, USD/JPY and GBP/USD – providing opportunities to hedge weekday positions.

Multiple platforms: Online, App, ProRealTime, MetaTrader 4, L2 Dealer

The IG Online platform, in particular, continues to provide an excellent user experience thanks to its intuitive design, allowing traders to instantly grasp spreads and margin requirements.

The platform also offers first-rate monitoring tools, including watchlists, price alerts, and Autochartist.

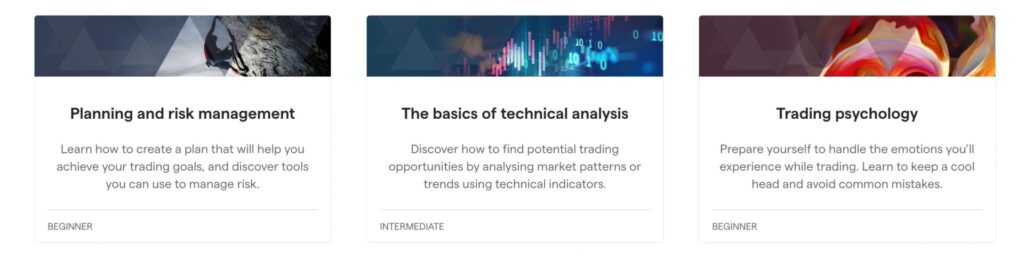

Top-notch education through the IG Academy

With more than 15 engaging and well-designed courses, IG provides tailored content for beginners, intermediate traders, and advanced traders.

These courses are helpfully divided into bite-sized lessons, featuring practical exercises, intuitive graphics, and quizzes to assess your learning progress.

Cons

IG does not offer an AED account

Despite the exceptionally low $0 minimum deposit, we found that traders in the UAE must manage their account in a currency like the USD, with a 0.5% conversion fee applying when you deposit in AED.

No Islamic trading account

Positions held overnight will incur swap fees, with triple rates applying on Wednesdays. This may raise concerns for Islamic traders looking to adhere to Islamic Finance principles.

Why Is IG Better Than The Competition?

The IG Academy stands out as one of the premier educational resources, particularly for beginner traders.

Additionally, the forex broker excels in its platform offerings, providing a selection of in-house software and proprietary solutions to cater to different preferences.

Who Should Choose IG?

IG is an excellent choice for beginners, offering a comprehensive learning environment through its educational materials.

Experienced traders seeking diverse opportunities will also find IG appealing, with its extensive offering of 17,000+ instruments and advanced platforms like ProRealTime and MetaTrader 4.

Who Should Avoid IG?

For those seeking a swap-free account, IG is not the ideal choice, as it’s not available. AvaTrade is a better alternative.

4. XTB

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP

-

🛠 PlatformsProprietary

-

⇔ Spread

GBPUSD: 0.1 EURUSD: 0.2 GBPEUR: 0.1 -

# Assets45+

-

🪙 Minimum Deposit$0

-

🫴 Bonus OfferNo

Why We Recommend XTB

We recommend XTB because it is one of the most trusted forex brokers accepting traders in the UAE. The xStation platform stands out for providing an excellent trading experience, and the straightforward onboarding process, coupled with no minimum deposit, adds to its appeal.

XTB MENA Ltd is regulated by the Dubai Financial Services Authority (DFSA).

Pros/Cons of XTB

Pros

Hugely respected and listed on the Warsaw Stock Exchange

XTB also holds licenses from tier-one regulators such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities & Exchange Commission (CySEC) in Europe. The fact that it boasts over 780,000 clients further emphasizes its reliability.

xStation offers a comprehensive trading experience

The xStation platform provides an exceptional user experience with its feature-rich design and accessible layout on desktop, web browser, and mobile app.

Its robust charting package, boasting over 45 technical indicators and various time frames, is ideal for technical analysis.

Accessible to beginners with a $0 minimum deposit

Signing up with XTB is straightforward for new traders, thanks to the single trading account option and Islamic-friendly solution.

To get started, you’ll need to provide personal details, information about your trading experience, and undergo ID verification.

Cons

No third-party platforms like MetaTrader

For those familiar with popular third-party solutions like MetaTrader 4 or cTrader, xStation might not meet their expectations, potentially leaving advanced traders seeking alternatives.

Average customer support during testing

Despite providing local support in both English and Arabic, XTB falls short in terms of wait times. During testing, we had to wait approximately 10 minutes to get through to someone on live chat.

In contrast, our top-rated broker, AvaTrade, delivered an average response time of around two minutes.

Why Is XTB Better Than The Competition?

XTB stands out as one of the most trusted forex brokers for residents in the UAE. Being listed on a stock exchange, authorized in multiple jurisdictions including the Middle East, and with multiple awards to its name, it continues to build an outstanding reputation.

Moreover, XTB makes the trading journey accessible, with no minimum deposit and a swift account opening process, typically taking around 10 minutes.

Who Should Choose XTB?

For traders in search of a user-friendly web platform, XTB is an excellent choice. xStation boasts a modern design and a range of useful tools, including free audio market commentary, a feature that can cost at alternatives.

Who Should Avoid XTB?

For traders looking to speculate on forex using popular third-party software like MetaTrader, it’s worth considering an alternative. AvaTrade emerges as a superior option, supporting both MT4 and MT5.

5. XM

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, AUD, JPY, ZAR, CHF, SGD, PLN, HUF

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: 1.9 EURUSD: 1.6 GBPEUR: 1.8 -

# Assets55+

-

🪙 Minimum Deposit$5

-

🫴 Bonus Offer$50 No Deposit Bonus When You Register A Real Account, Deposit Bonus Up To $5000, Free VPN Service

Why We Recommend XM

We recommend XM because it offers a choice of accounts to suit different trading styles, a seamless sign-up process, and exceptional market research tools to inform trading decisions. 24/5 customer support is also available in Arabic.

Trading Point MENA Limited, operating as XM, is regulated by the Dubai Financial Services Authority (DFSA).

Pros/Cons of XM

Pros

Multiple account options for traders in the UAE: Standard, Micro, Ultra Low

The Standard account will meet the needs of a large variety of traders with traditional, spread-only pricing from 0.6 pips.

The Micro account is a good option for beginners looking to trade in small volumes with contract sizes equaling 1000 units.

The Zero account will appeal to active forex traders looking for spreads from 0.0 and a competitive commission of $3.50 per lot.

Straightforward sign-up with accounts often verified the same day

I can’t fault the registration process – it’s all handled from one simple form and took me less than 5 minutes.

Similar to the standard procedure for most forex brokers accepting UAE residents, you need to provide basic personal and contact details. Additionally, identity verification is needed.

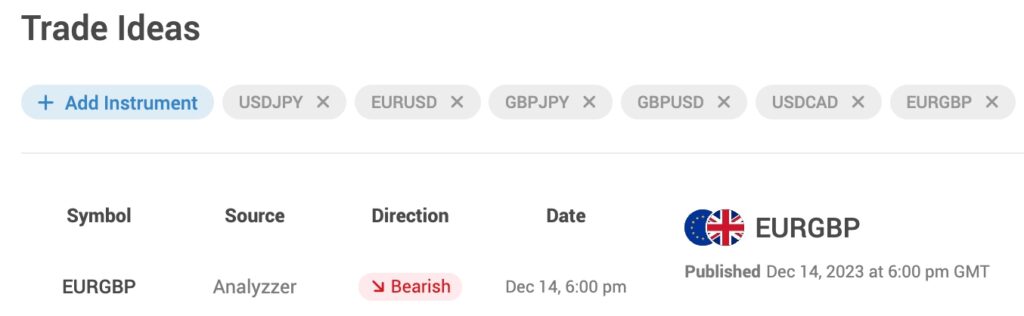

Research Hub with daily market updates and expert commentary

During testing, we found the technical summaries, especially those accompanied by video commentary, to be particularly useful.

However, for traders new to technical analysis who seek straightforward recommendations, XM’s Trade Ideas may be a better option, though it’s important to note that there is no guarantee of success.

Cons

Average product portfolio with 1000+ markets

While XM’s offering of 50+ currency pairs and 1000+ stocks, indices, and commodities caters to many aspiring traders, it falls seriously short when compared to the 17,000+ markets and 80+ currency pairs available at IG.

This broader selection at IG makes it a more suitable choice for advanced traders.

No copy trading service

XM lacks a copy trading service, reducing its appeal to aspiring investors who find copy trading platforms a helpful way to learn from seasoned forex traders.

Why Is XM Better Than The Competition?

XM’s choice of three accounts, plus an Islamic solution, caters to the full spectrum of traders in the UAE, from beginners through to advanced traders.

The standout feature lies in its market research tools, which surpass competitors. The platform provides comprehensive daily coverage of the forex market, accompanied by actionable insights.

Who Should Choose XM?

XM is an ideal choice for beginners. The Micro account, with its low minimum trade size and accessible starting deposit of $5, caters to those who are new to forex trading.

Additionally, the platform’s market research features and trading ideas provide valuable support for new investors, helping them discover market opportunities.

Who Should Avoid XM?

Hands-off traders may find XM less suitable as it lacks a forex copy trading platform. If learning from experienced traders and copying their strategies is a priority, we recommend AvaTrade.

What To Look For In A Forex Broker In The UAE

To find the best forex brokers that accept traders from the United Arab Emirates, there are several factors that our experts consider, and you should too:

UAE Regulation

Trading with a UAE-regulated forex broker ensures compliance with local laws and regulations, designed to protect traders.

Regulators like the Securities and Commodities Authority (SCA) and Dubai Financial Services Authority (DFSA) take action against rule-violating brokers and provide a complaints system for issue resolution.

Our experts verified the regulatory credentials of every forex broker recommended in this guide.

Platforms And Tools

Access to a user-friendly and reliable platform is critical for an enjoyable trading experience with the necessary tools for market analysis and trade execution.

As part of our exhaustive review process, we assess both in-house and third-party platforms based on design, ease of use, and trading tools. Only UAE forex brokers with high-quality platforms are included in our top list.

Tip: Utilize demo accounts offered by all our recommended brokers to familiarize yourself with features before trading with real money.

Investment Offering

Choosing a forex broker with access to a broad range of currency pairs is key because it provides diverse opportunities for profit and risk management. This flexibility allows you to capitalize on economic conditions and geopolitical events in the UAE and beyond.

In our evaluations, we confirm the availability of markets by logging into brokers’ platforms. We’ve found the top firms typically offer hundreds of instruments, including forex, stocks, indices, and commodities, featuring at least 40 currency pairs.

Account Conditions

For traders in the UAE, selecting a forex broker with flexible accounts, including Islamic trading solutions, is important. These adhere to interest-free principles and cater to the specific needs of Muslim traders.

That said, we balance account competitiveness and entry requirements with platform quality, tools, and market access.

We also favor forex brokers that provide reliable customer support via telephone, email and live chat, with the best ones offering UAE-based helplines that can assist new traders.

FAQ

Is Forex Trading Legal In UAE?

Yes, forex trading is legal in the UAE. Brokers are typically regulated by the Securities and Commodities Authority (SCA), the Dubai Financial Services Authority (DFSA), or the Abu Dhabi Financial Services Regulatory Authority (FSRA), though this isn’t a legal requirement.

Which Is The Best Forex Broker In The UAE?

Based on our assessment, AvaTrade is the best forex broker in the UAE. The broker is regulated, offers excellent trading platforms, and provides local support for forex traders in the UAE.

Runners up in our shortlist are Pepperstone, IG Group, XTB, and XM.

Article Sources

Securities and Commodities Authority (SCA)