IG Group

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, ZAR, SEK, DKK, CHF, HKD, SGD

-

🛠 PlatformsMT4, AutoChartist, TradingCentral

-

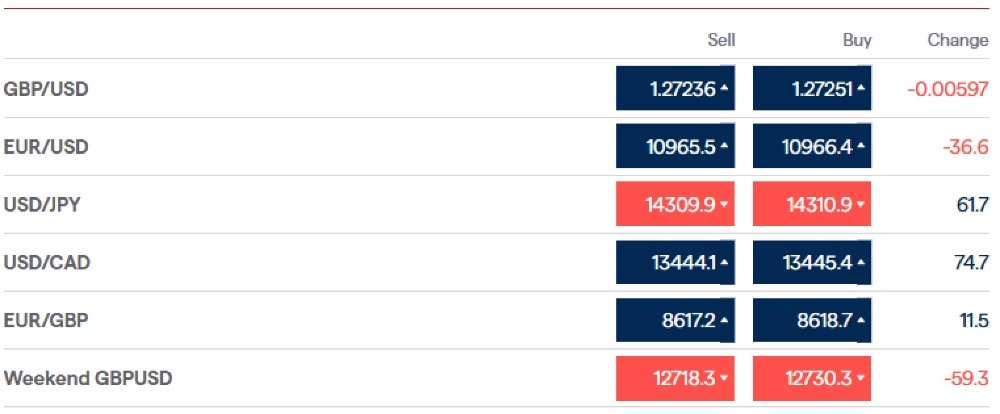

⇔ Spread

GBPUSD: 0.9 EURUSD: 0.8 GBPEUR: 0.9 -

# Assets80+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Our Opinion On IG

IG is a multi-award-winning forex broker with 300,000+ clients. Key highlights for us are the easy-to-use web platform, 80+ currency pairs and fast account opening. IG does fall short when it comes to payment methods and copy trading, but we still consider it an excellent forex broker for both beginners and seasoned traders.

Summary

- Instruments: 17,000+ including 81 forex pairs, stocks, indices, commodities, ETFs, crypto

- Live Accounts: CFD

- Platforms & Apps: Online Platform, MetaTrader 4 (MT4), L2 Dealer, ProRealTime

- Deposit Options: Bank cards, wire transfers, PayPal

- Demo Account: Yes

Pros & Cons

- Easy-to-use web platform with one-click trading, advanced technical analysis and integrates Reuters news

- Excellent forex coverage with tight spreads from 0.1 pips on popular currency pairs

- Fast and reliable customer support available around the clock

- Trustworthy company listed on the London Stock Exchange

- Long-term investing opportunities through share dealing

- Best-in-class educational materials through IG Academy

- A large suite of investments with 17,000+ instruments

- It takes less than 5 minutes to open an account

- Fewer payment methods than many alternatives

- $12 monthly inactivity fee after two years

- No copy trading platform

Is IG Regulated?

IG is one of the most strictly governed forex brokers that we have reviewed, holding licenses with several respected regulators.

These include the UK Financial Conduct Authority (FCA), Australian Securities & Investments Commission (ASIC), US National Futures Association (NFA), US Commodity Futures Trading Commission (CFTC), Monetary Authority of Singapore (MAS), and Dubai Financial Services Authority (DFSA).

This level of regulatory oversight provides assurances that traders’ funds are in safe hands and that they will not face unfair practices while trading.

Our team is particularly pleased to see that the IG Group segregates client funds with independent banks, which provides capital protection in the case of the broker going bankrupt.

In addition, negative balance protection is provided, which means traders cannot lose more money than is in their accounts, negating the risk that a bad trade will leave them in debt to the forex brokerage.

Our experts alo did not find reports of scams or malpractice during their research.

Forex Accounts

IG offers competitive account conditions, which provide users with excellent vehicles to access currency markets.

The CFD Account is the most widespread way for retail traders to speculate on forex movements, and we like IG’s zero-commission, low-spread take. CFD traders do not buy or sell assets outright but instead aim to profit by opening long or short contracts to make bets that a currency will rise or fall in value, respectively.

Or team rate the competitively low minimum deposit of $0 compared to similar brokers such as IC Markets ($200).

Another bonus for us is the inclusion of investment profiles for directly buying and selling shares, plus professional accounts and access to ISAs and SIPPs.

On the negative side, the broker does not offer an Islamic account, which is provided by many competitors, including XTB. There is also no ECN account, which often provides the best value for high-volume forex traders.

We have pulled out the key account features below.

CFD Account

- Spreads from 0.1 pips

- Minimum deposit of $0

- Maximum leverage of 1:30

- Commission fees charged

- Five trading platforms supported

How To Open An Account

I found it easy to sign up for an account via IG’s streamlined interface. The process involves a few simple steps that only took me a few minutes:

- Enter your name, email address and create a password in the sign-up application

- Complete a form with contact details such as your telephone number and address

- Enter your financial details and fill in the questionnaire about your trading experience

- Log in to your account using the credentials shared and start trading

Trading Fees

We are impressed by the trading fees, which stand up to competitors and are among the best on offer for low/no-commission accounts.

The broker offers low commissions on their CFD account which are only charged when trading shares (there are no commission fees on forex trading).

Commission varies depending on the market you trade with – UK and Euro markets charge 0.1% while the US market has a commission of $0.02 per share.

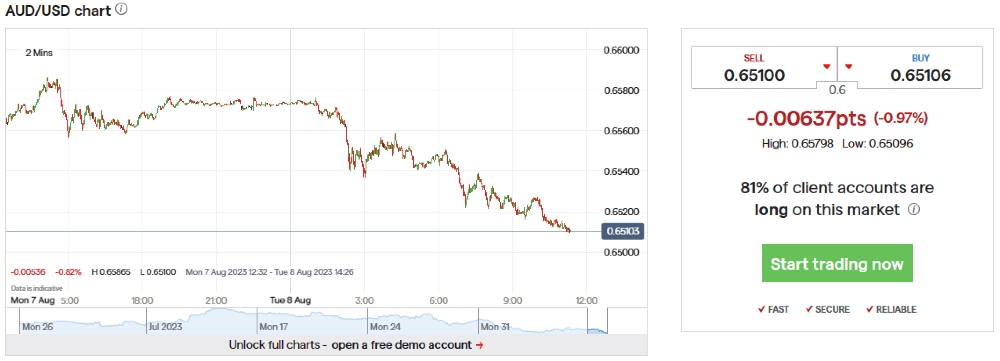

The broker also offers fairly tight spreads from 0.1 pips. However, since the lowest spreads can differ greatly from the average, we also noted the typical spreads while testing IG, and found them to be competitive.

For example, the 0.8 pip-spreads on EUR/USD and 0.9 on EUR/GBP stand up to competitors such as AvaTrade, though it is possible to find tighter spreads, particularly from ECN accounts.

Non-Trading Fees

I like that there are no deposit or withdrawal fees, which is an advantage over forex brokers that charge traders for transactions.

However, third-party fees may apply for moving funds, and traders should also be aware of a $15 fee for same-day transfers under $100.

This broker does charge an inactivity fee. However, this only kicks in after two years, which is longer than the industry norm of three to six months. The $12 monthly charge is also lower than many alternatives.

Other fees to be aware of include overnight swap fees charged on positions held overnight. Triple-rate swap fees are charged on a Wednesday.

Additionally, traders may need to pay extra to access some third-party services or trade international stocks. Accessing ProRealTime charts incurs a $30 fee, and trading US-incorporated stocks without completing the correct form will incur a $50 fee.

Payment Methods

IG trails the best forex brokers when it comes to supported payment methods.

With just wire transfer, credit/debit card and PayPal available, it is a shame that IG is less viable for traders who prefer to fund their accounts with e-wallets such as Neteller or Skrill, or cryptocurrencies like Bitcoin.

Processing times vary depending on the method you choose, from near-instant funding with card or PayPal payments, which we found easy to set up, and bank wire transfers taking up to five working days.

With no deposit or withdrawal fees, the forex broker stands up well against competitors such as eToro ($5 withdrawal charge), though it does lag behind a few alternatives that offer to refund third-party fees.

Our team also rate the large variety of currencies supported by IG, providing traders with easy international transactions free of currency conversion charges. Supported currencies include USD, GBP, AUD, CAD, EUR, DKK, HKD, SGD, CHF, SEK, JPY and ZAR – a list that is far beyond most of the forex brokers we have reviewed.

The 0.5% conversion fee for transactions in alternative currencies is also relatively low and provides more flexibility for traders.

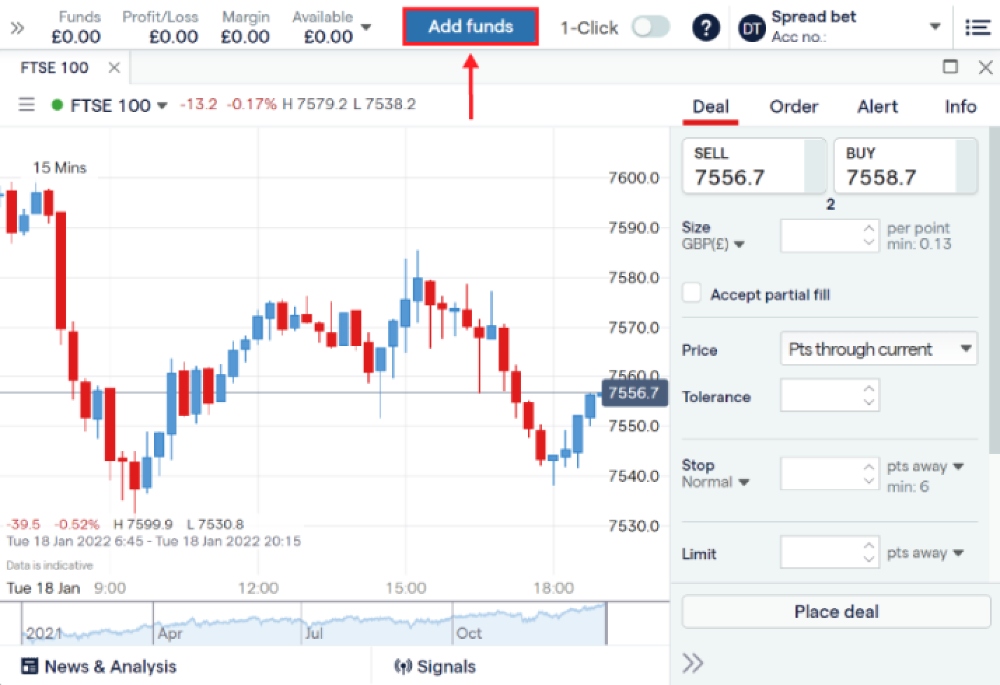

How To Make A Deposit

I find funding my IG account easy thanks to an intuitive deposit process that can be completed in a minute:

- Log in to the client portal ‘My IG’

- Click the ‘Dashboard’ icon at the top of the page

- Click the ‘Add Funds’ icon next to the account you want to fund

- Choose the method you want to use and the amount you want to transfer

- Confirm the deposit

You can also deposit funds on the web trading platform by clicking the ‘Add Funds’ icon on the top right-hand side.

Withdrawals can be made with the same payment methods as deposits – bank transfer, card payments and PayPal.

Withdrawal times vary between payment methods, but I appreciate the instant withdrawals via e-wallets, while bank wire withdrawals can take up to five days.

Forex Assets

The 81 currency pairs including majors, minors and exotics are more than most forex brokers, ensuring that a wide range of traders are catered to. This variety stands up well against competitors such as Pepperstone, which offers 60+ pairs.

It is not always necessary to have a huge range of forex pairs, as many clients only trade a handful of currencies that they are comfortable with. We, therefore, recommend that traders focus on other factors like pricing, platforms and regulation while selecting a forex broker.

Nevertheless, IG’s excellent selection is an advantage that provides plenty of scope to meet most forex traders’ goals.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

IG offers an extensive selection of over 17,000 additional non-forex assets – more than nearly every other broker we have tested.

The firm offers shares, indices, options, ETFs, futures, commodities, bonds and crypto. You can also take part in spot trading, sector trading, IPOs, thematic and basket trading, interest rates trading and volatility trading.

This is a versatile range of instruments, and we are sure traders will find everything they need to build a diverse portfolio.

Our team is especially impressed by the wide range of indices and ETFs offered, which is among the market leaders when it comes to these asset classes.

Supported assets include:

- Indices – 80 indices including US 500, FTSE 100 and Germany 40

- Shares – 1300+ shares including Amazon, Apple and Tesla

- Commodities – 35 commodities including metals such as gold, zinc, nickel or cobalt, energies and agricultural markets

- ETFs – 5,400 ETFs such as Vanguard FTSE 100 UCTIS, iShares Core S&P 500 and HAN-GINS Cloud Technology UCITS

- Options – daily, weekly, monthly and quarterly options

- Futures – 15 futures including index, commodity and bond futures

- Bonds – 14+ bonds such as Japanese government bonds, Long-term BTP and Bund

- Crypto – 10+ popular cryptocurrencies including Bitcoin plus a crypto index for broader exposure

Execution

IG is a market maker, which means that they set the prices and act as counterparties to traders.

As with most brokers using this model, low to no commission fees are charged and trades are executed fairly quickly, but the trade-off is that the spreads are often wider than raw spread ECN accounts.

However, unlike some market maker brokers, IG does source its pricing from liquidity providers. This is a reassuring policy and we are impressed by both the competitive pricing offered with this model, and by the precautions that the brokerage takes to prevent slippage.

Leverage

The leverage offered varies depending on the asset you choose to trade. The maximum leverage available is 1:30 for major forex pairs. On indices and commodities, the maximum leverage is 1:20.

This leverage meets the EU/UK/Australian cap of 1:30, and we feel it provides a good balance, allowing traders to open positions with boosted trading power without the high risk associated with higher levels of leverage. With that said, we still recommend traders employ risk management strategies to minimize any losses.

Traders should note that IG has a stop-out level that is automatically triggered when your account is below 50% of the required margin.

Note, retail traders in some countries may be able to access higher leverage, while professional traders can access leverage up to 1:250.

Platforms & Apps

I place a big importance on the trading platforms supported by forex brokers since they can have a large impact on your trading experience.

Fortunately, I am impressed by IG’s third-party options including the popular and reliable MetaTrader 4 (MT4) as well as a proprietary platform.

MT4 is available as a desktop program or mobile app on iOS and Android devices, and stands out for its intuitive design, great variety of technical indicators, Expert Advisor (EA) trading robots and forex signals.

I think MT4 is well suited to both beginners and experienced forex traders. I find it a very easy and enjoyable way to trade with IG and I especially like the clear and easy-to-navigate customizable charts.

I am also pleased with the broker’s proprietary platform, which I find to be both powerful and easy to use. The platform is available in desktop, web and mobile versions (download on iOS and Apple devices).

I especially rate the number of charts and analysis tools and would recommend this platform to traders with any experience level as the simple layout suits beginners while the analysis tools add to the experience for seasoned traders.

For high-volume traders, the broker also supports the ProRealTime platform which can be accessed for a fee of $30 and provides access to a massive range of analytical tools and charts.

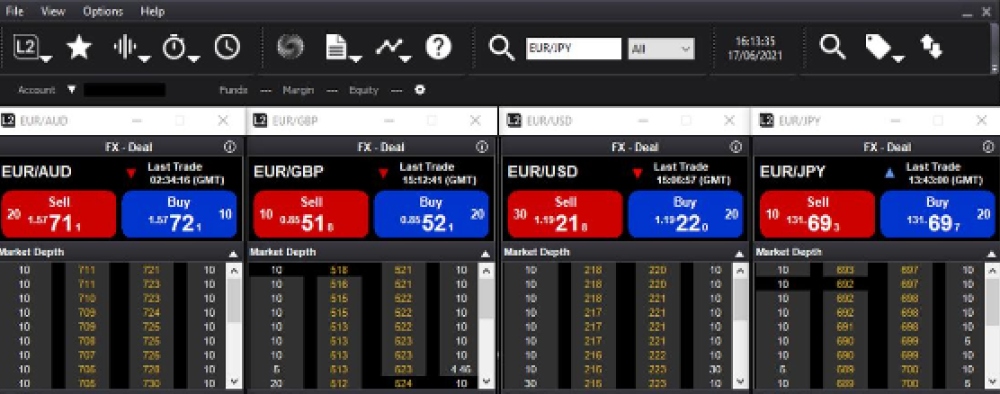

The L2 Dealer platform is also offered by the broker for direct market access (DMA) which allows traders to create watchlists and execute algorithmic orders.

I have highlighted some of the most useful features from each platform below:

MetaTrader 4

- 9 timeframes

- 31 graphical objects

- 30 technical indicators including RSI and Moving Average

- Expert Advisors (EAs) for automated trading

- Single-thread strategy testing

- In-depth pricing history

Proprietary Platform

- Customizable alerts

- 4 timeframes on a single chart

- 28 technical indicators including MACD, RSI and Bollinger Bands

- News and analysis tools available

- One-click trading available

- Personalized platform layout

- 19 drawing tools

ProRealTime

- 100+ technical indicators including CCI, Chaikin oscillator, Moving Average and OrderBook volume

- Backtesting using 30 years of historical data

- Trend lines drawn every 5 minutes

- Customizable algorithms

- Trading 24 hours a day

L2 Dealer

- Option to enter auctions

- Compare market sentiment

- View the full order book before making a trade

- Level 1 and 2 pricing options

- Customizable alerts

How To Make A Forex Trade

The best forex brokers make the process of trading quick, and I find placing a trade on IG’s MetaTrader platform to be streamlined:

- Sign in to your MetaTrader account

- Press the ‘New Order’ button in the menu at the top

- Use the search button to find the forex asset you want to trade

- Input the trade volume you want

- Enter any stop loss or take profit levels

- Press ‘Buy’ or ‘Sell’ and you’ve made a trade

Trading on the IG proprietary platform is also straightforward thanks to the eye-catching interface and intuitive process:

- Log in to the client portal

- Scroll down and click on the asset menu

- Find the asset you want to trade from the list on the left-hand side of the screen

- Click on the ‘Buy’ icon

- Enter the amount you want to buy and change any settings you want to apply

- Click the ‘Place Deal’ icon

Forex Tools

I am disappointed by the small variety of forex trading tools available. There is no copy trading, which can be a good way for new traders to learn from more experienced investors.

API trading is the main forex tool supplied by the broker. But since IG’s API trading capability is geared more toward experienced traders, I see the lack of tools for beginners as a significant disadvantage compared to competitors like eToro which offer a wealth of solutions to support new traders.

API Trading

The application programming interface (API) allows you to connect two different applications (such as your trading account and your automated trading platform).

This is a useful system for experienced traders as it allows faster order execution and allows you to take more control over trades. APIs also allow information such as historical data and live market data to be delivered directly to you so you don’t need to search manually.

Forex Research

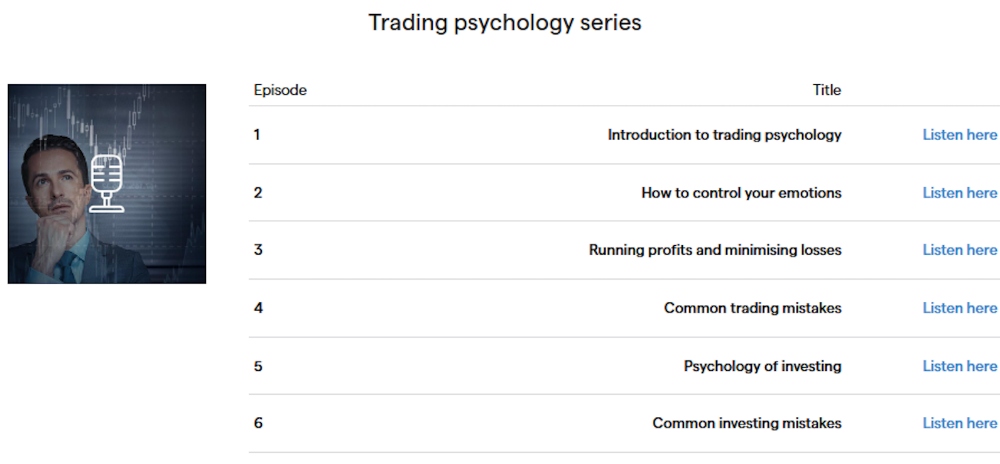

There is a wealth of real-time market data available to help you make forex trading decisions. This includes market news, technical analysis, a list of financial events, special reports, trade ideas, subscriptions to research and insights and a trading podcast.

I really enjoyed using these features when testing the broker, especially listening to the podcast which is really interesting and had some great insights that helped me make trading decisions.

Ultimately, I found the variety of market research tools compares favorably to competitors, and in this respect, places IG firmly in the top end of the hundreds of forex brokers we have reviewed.

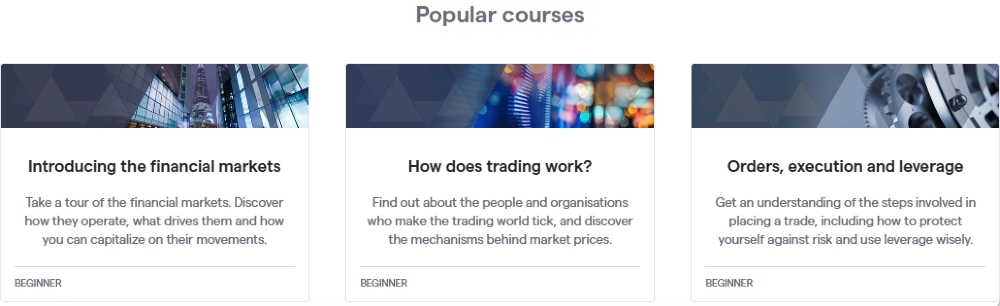

Forex Education

The educational resources offered are another strong point, with live webinars, seminars, and tutorials from beginner levels to advanced available on the IG Academy. I find the webinars especially useful, easy to follow and engaging.

The broker also provides articles about using trading platforms, strategies, risk management and other important topics as well as a glossary of financial terms.

Overall, the materials compete with the top educational brokers such as eToro, so we are comfortable recommending IG to beginners looking to learn more about forex trading.

Demo Account

The brokerage offers a free demo account. It comes with $10,000 in simulated funds to practice trading with.

These accounts are a great way for beginners to learn more about forex trading without financial risk. They also offer traders the chance to find out if the broker suits their strategy and trading style before committing real funds.

Importantly, the demo account does not have a time limit and does not incur charges for extra features such as chart packages. This means that traders will be able to try important features before they pay for them or test new strategies at any time during their trading journey, making IG’s demo account a powerful tool.

How To Open A Demo Account

I found it very easy to open a demo account by following a few simple steps:

- Click on the white ‘Create Demo Account’ icon on the broker’s website

- Enter details including your name, email address and phone number

- Click ‘go to IG portal’

Bonus Offers

While regulated brokers like IG are not generally permitted to offer incentives such as deposit and trading bonuses, there is a refer-a-friend scheme.

The promotion offers $50 for each friend to open an account with IG with a maximum of five successful referrals. The new members need to open a qualifying account using the link you send them, then fund and place one trade within the first three months of opening the account.

Customer Service

I am satisfied with the customer service. Contact methods include live chat, telephone numbers and email addresses.

Support is available from 8 am until 6 pm Monday to Friday, which stands up against many competitors, and I found the agents working during these times to be knowledgeable and professional.

When I tested the customer service the live chat was quick with answers in less than two minutes and I received an email response within 12 hours.

The broker also provides an FAQs page which is a good place to start if you have a basic query. Additionally, traders can reach agents through social media channels.

My only minor complaint is that some forex brokers offer 24/5 or even 24/7 support, which is reassuring to have.

Contact Details

- Live chat – bottom right-hand side of the broker’s website

- Email – helpdesk.uk@ig.com

- Phone number – 08001953100

Company Details

IG is a long-standing forex broker founded in 1974 in London. The company now has over 310,000 clients worldwide and offices in 16 countries.

The broker has won many accolades in multiple different areas, with high-profile forex awards. For me, this kind of success is a reassuring sign that this broker is legitimate and trustworthy.

Trading Hours

The trading hours offered vary depending on the instrument you are trading. Full information on trading hours and market events which change opening hours can be found on the broker’s website.

With that said, we do like the added bonus of the out-of-hours and weekend trading hours, which means some products can be traded 24/7.

Who Is IG Best For?

Our team thinks IG has lots to offer forex traders at all experience levels. The $0 minimum deposit, free demo account and excellent range of educational resources are ideal for beginners. Experienced traders will also be well served by the huge range of instruments, advanced platforms, and API trading.

Ultimately, IG Index is a hugely respected and reliable broker with competitive trading conditions for both short- and long-term traders.

FAQ

Is IG Legit Or A Scam?

IG is a legitimate forex broker. The company holds a license with the FCA in the UK, the ASIC in Australia, and the NFA and CFTC in the US, among others, with safeguards in place including negative balance protection and segregated client accounts.

These measures make us feel secure when trading with the broker, and the range of awards under IG’s belt shows that it is well-regarded in the industry.

Can I Trust IG?

We are comfortable that IG is a trustworthy broker. Other reviews from clients and ratings are generally positive and there are no reports of the company taking part in any scams.

The brokerage also has over 310,000 registered accounts and more than 45 years of experience – both reassuring signs for us.

Is IG A Regulated Forex Broker?

Yes, the IG Group holds licenses with the FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, BMA, FSCA, FMA, JFSA, and FINMA.

This level of oversight provides traders with peace of mind when using the company, with very few brokers holding such strong regulatory credentials.

Is IG A Good Or Bad Forex Broker?

IG is a very good forex broker. The firm offers 81 forex pairs with a low minimum deposit, powerful trading software, and below-average spreads on popular currencies pairs. There are also great educational resources.

On the negative side, the range of funding methods is narrow and there is no copy trading software, but these are minor complaints.

Is IG Good For Beginners?

IG is a great option for beginners. Opening an account requires no minimum deposit and the broker offers best-in-class education through the IG Academy. The demo account is also helpful for beginners with no expiry and platform guides.

Does IG Offer Low Forex Trading Fees?

IG’s trading fees are competitive in the industry. Tight spreads from 0.1 pips are available, and when we used the broker, we were offered below-average spreads of 0.8 pips on EUR/USD and 0.9 on EUR/GBP. This compares well to rivals like Pepperstone.

Does IG Have A Forex App?

IG offers its own proprietary mobile app alongside the MT4 app. These applications can be downloaded for iOS or Android devices.

You can use these apps to execute trades, view news and charts and create a custom watchlist. I personally found the IG app more user-friendly than the MetaTrader option but this will be down to personal preference.

How Long Do Withdrawals Take At IG?

Withdrawal times vary depending on the payment method you choose. Once verified the funds will be returned to your account instantly in the case of e-wallets and within 5 days for bank wire transfers.

These timelines are similar to most reputable forex brokers.

Can You Make Money Trading Forex With IG?

IG Index is a competitive forex broker with a good variety of assets, reliable tools and low fees, so it is possible to earn money with this broker.

However, there is no guarantee of making money when trading forex online regardless of the broker you chose to use. We always recommend that traders approach investing with a sensible risk management strategy to avoid heavy losses.