Best Wise Forex brokers

Forex brokers that accept Wise deposits allow investors to fund trading accounts with a secure online payment system. Wise, formerly TransferWise, is particularly popular with traders looking to move money abroad with low to zero conversion fees.

Our team have researched, compared and ranked the best forex brokers who support Wise deposits, taking into account:

The funding process, fees and transfer times

The minimum deposit and account conditions

The forex platforms and trading tools

The regulation and reputation of the forex broker

List of Best Forex Brokers Accepting Wise 2026

These are the top TransferWise forex brokers based on our tests:

- XM: Best Overall Wise Forex Broker

- IC Markets: Best For Forex Day Traders

- Fusion Markets: Best For Low Forex Trading Fees

| XM | IC Markets | Fusion Markets | |

|---|---|---|---|

| Minimum Deposit | $5 | $200 | $0 |

| Minimum Withdrawal | $5 | $0 | $0 |

| Transfer Fees | $0 | $0 | $0 |

| Processing Times | Deposits – Instant Withdrawals – Up to 5 Days | Deposits – Instant Withdrawals – Up to 14 Days | Deposits – Instant Withdrawals – Up to 5 Days |

XM: Best Overall Wise Forex Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, AUD, JPY, ZAR, CHF, SGD, PLN, HUF

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: 1.9 EURUSD: 1.6 GBPEUR: 1.8 -

# Assets55+

-

🪙 Minimum Deposit$5

-

🫴 Bonus Offer$50 No Deposit Bonus When You Register A Real Account, Deposit Bonus Up To $5000, Free VPN Service

Why We Recommend XM

We recommend XM because it is a trusted forex broker authorized by tier-one regulators. It also offers very low spreads from 0.0 pips on 55+ currency pairs and access to the industry-leading MetaTrader 4 and MetaTrader 5 platforms.

You can fund your XM account using TransferWise in a few simple steps with no fees and a low minimum deposit of $5.

We explain why XM tops our rankings of the best forex brokers that accept Wise deposits below.

Pros/Cons of XM

Pros

XM is a multi-regulated forex broker with 10+ million clients

XM is a top-rated forex broker with millions of traders spanning over 190 countries. The firm has picked up more than 30 awards, adding to its credibility.

Also, with oversight from the Australian Securities & Investments Commission (ASIC), the UK Financial Conduct Authority (FCA), and the Cyprus Securities & Exchange Commission (CySEC), our experts are comfortable that XM is a legitimate, secure forex broker.

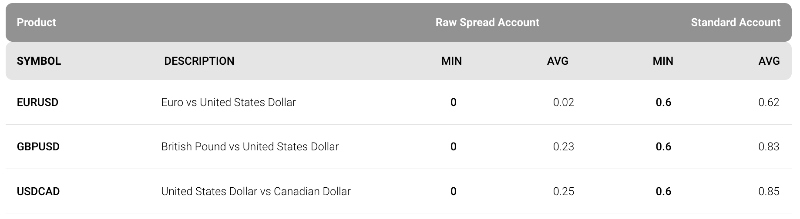

Very tight spreads from 0.0 pips on 55+ currency pairs

XM offers some of the lowest trading fees we have seen, with a choice of pricing models; spread-only pricing in the Standard account, or tight spreads with a low commission in the Zero account.

When we evaluated XM’s Standard account, our team got spreads of 0.6 pips on majors like the EUR/USD and GBP/USD, which is lower than most competitors. The raw spreads from 0.0 with a $3.50 commission in the Zero account also rival the cheapest forex brokers.

Forex trading on the reliable MetaTrader 4 and MetaTrader 5 platforms

XM impresses for its high-quality trading software, with both MetaTrader 4 and MetaTrader 5 available on desktop, web and mobile.

These are some of the best-known and powerful forex trading platforms available in the market today. We rate the dozens of indicators and drawing tools, dynamic charting, and multiple order types. The support for automated trading via Expert Advisors (EAs) is also a stand-out feature for us.

Based on our experience, we recommend beginners opt for MT4 while MT5 will serve serious forex traders looking for more analysis tools and faster processing.

Cons

No forex copy trading service

While not a dealbreaker in our opinion, XM does not offer a forex copy trading platform. This means new traders can’t copy the trades and strategies of more experienced forex investors.

This is an increasingly popular tool offered by leading brokers, so we hope XM introduces this service in the future.

Why Is XM Better Than The Competition?

XM is the most trustworthy forex broker that accepts Wise deposits. It is well-established, has a great reputation, millions of clients and operates with oversight from top-tier regulators.

It also offers very competitive trading conditions for forex investors, with a choice of low-cost trading accounts and best-in-class trading platforms.

Who Should Choose XM?

Forex traders looking for traditional, spread-only pricing should choose XM. Equally, experienced forex traders looking for raw spreads and reliable trading software should consider XM.

XM will also meet the needs of traders looking to get started quickly – the minimum deposit is low at $5 and you can fund your account with Wise in a few minutes through the user-friendly client dashboard.

Who Should Avoid XM?

Investors interested in forex copy trading should avoid XM, as the broker does not offer this. IC Markets is a better option.

IC Markets: Best For Forex Day Traders

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, cTrader, DupliTrade

-

⇔ Spread

GBPUSD: 0.5 EURUSD: 0.1 GBPEUR: 0.5 -

# Assets55+

-

🪙 Minimum Deposit$200

-

🫴 Bonus Offer-

Why We Recommend IC Markets

We recommend IC Markets because it offers superior trading conditions for active day traders and scalpers. With deep liquidity, fast execution speeds and tight spreads, IC Markets offers a competitive package.

You can load your IC Markets account with a $200 minimum deposit and there are no transfer fees and near-instant processing with Wise.

We unpack the key reasons to trade forex with IC Markets below.

Pros/Cons of IC Markets

Pros

Ultra-fast execution speeds of <40ms with tight forex spreads

IC Markets offers low latency, superior liquidity and very fast execution speeds that average less than 40ms. Anything below 100ms is fast in our opinion, so IC Markets impresses here.

The Raw spread account also offers competitive fees, with spreads from 0.0 pips alongside a $3.50 commission. We also found that you can reduce the commission to $3.00 on the cTrader platform while the Raw Trader Plus program offers cash rebates.

These conditions allow serious investors to secure their forex trades with low fees, especially in volatile markets.

No restrictions on strategies with scalping and algo trading permitted

IC Markets caters to active forex traders with no restrictions on trading strategies. During our evaluation, we found that scalping is allowed, while automated trading is supported through the MetaTrader 4 and cTrader platforms.

Up to 2000 orders can also be opened in the cTrader account, making it a particularly good option for high-volume traders.

Trade 60+ currency pairs with high leverage up to 1:500

IC Markets offers excellent coverage of the foreign exchange market with over 60 major, minor and exotics. You can go long or short through contracts for difference (CFDs), while the high leverage up to 1:500 means you can amplify your buying power and potential returns.

The flip side of high leverage is the risk of larger losses, so we recommend using risk management tools like stop-losses.

Cons

It can take up to 14 days to withdraw funds by TransferWise

While deposits with Wise are fast at IC Markets, withdrawal speeds are slower than other forex brokers we reviewed.

Although not a major criticism in our view, we found it can take up to 14 days before funds are back in your account.

Why Is IC Markets Better Than The Competition?

IC Markets offers some of the best trading conditions for serious investors and forex day traders.

Execution speeds are among the fastest we have seen, fees are low, and there are no restrictions on trading systems. The Raw Trader Plus scheme also offers discounts for trading in high volumes, as well as complimentary VPS hosting.

Who Should Choose IC Markets?

Active day traders should choose IC Markets. It offers the infrastructure, tools and pricing to serve scalpers, algo traders and high-volume forex investors.

Forex traders looking for high leverage should also choose IC Markets, with up to 1:500 available on currency pairs.

Who Should Avoid IC Markets?

Forex traders looking to withdraw funds quickly or regularly with Wise may want to avoid IC Markets. It takes twice as long as other Wise forex brokers we reviewed, including XM and Fusion Markets.

Fusion Markets: Best For Low Forex Fees

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD

-

🛠 PlatformsMT4, MT5, cTrader, DupliTrade

-

⇔ Spread

GBPUSD: 0.0 EURUSD: 0.0 GBPEUR: 0.0 -

# Assets90+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend Fusion Markets

We recommend Fusion Markets because it offers excellent trading conditions for forex investors with 90+ currency pairs, very low spreads from 0.0 pips, and access to market-leading software, including MetaTrader 4.

Forex traders can make fast and free deposits to Fusion Markets using Wise in the user-friendly client area.

Below we explain why Fusion Markets is one of the best forex brokers accepting Wise.

Pros/Cons of Fusion Markets

Pros

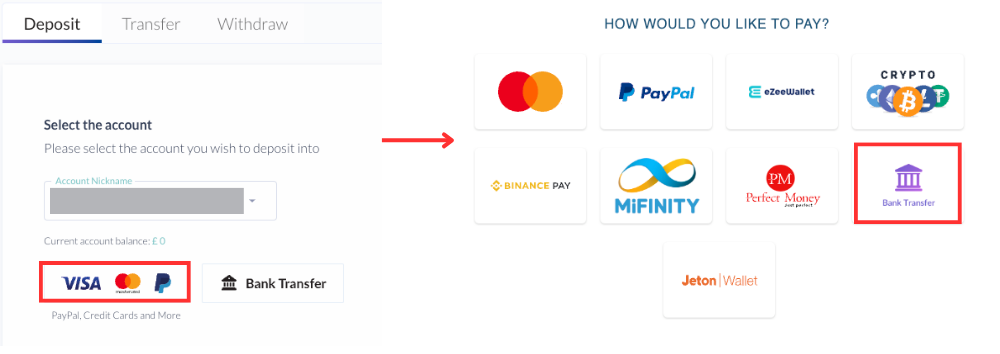

Fee-free Wise deposits with instant processing

There are no fees when you use Wise to fund your Fusion Markets account. We also found that funds are available almost immediately.

Once I log into my account, all I need to do is select ‘Deposit’ from the ‘Payments’ section and then choose the payment method logos on the left-hand side. In the next window, I select ‘Bank Transfer’ to reveal the bank details for my TransferWise payment.

Importantly, Fusion Markets will need the full transfer receipt to credit the funds to your forex trading account.

Very low fees with forex spreads from 0.0 pips and low to no commission

Trading fees at Fusion Markets are low based on our tests and will serve both beginners and active forex traders.

In the ZERO account, you can get tight spreads from 0.0 pips and a $2.25 commission per side. This is lower than the around $3.50 commission we typically see at forex brokers.

Alternatively, beginners may prefer the Standard account, with zero commissions and competitive spreads from 0.9 pips on majors like the EUR/USD. Again, these stand up well against alternatives.

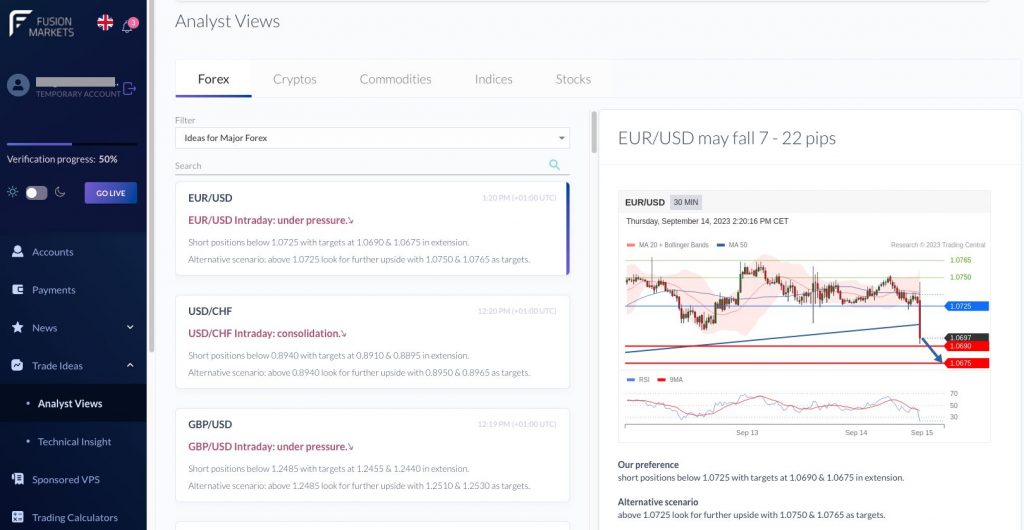

Best-in-class forex trading software, including MT4, MT5, cTrader and DupliTrade

Fusion Markets offers an impressive suite of trading software and extra tools. The broker’s standard platform package includes MetaTrader 4, MetaTrader 5 and cTrader. In addition, social traders can access the popular Myfxbook Autotrade and DupliTrade platforms.

I particularly rate the broker’s Fusion+ Copy Trading for its ease of use and the Analyst Views, which offers daily technical insights across forex and other markets.

Cons

Weaker regulatory oversight for non-Australian clients

Forex traders outside Australia will need to register with the offshore Vanuatu or Seychelles entities, which are authorized by the Vanuatu Financial Services Commission (VFSC) and the Financial Services Authority (FSA), respectively.

This means most global clients will not receive the same degree of legal safeguards as those who trade forex under the ASIC-regulated entity.

Average educational materials for beginners

Fusion Markets trails some forex brokers we evaluate when it comes to education. Aside from some blogs which aren’t kept up to date and some basic resources in the trading platforms, there is little to support newer traders.

While not a major drawback in our opinion, I would like to see Fusion Markets introduce more resources for forex traders, including strategy guides and platform tutorials so you can get the most out of the broker’s tools.

Why Is Fusion Markets Better Than The Competition?

Fusion Markets stands above the competition for its very low trading fees on currency pairs, industry-leading software in MT4, MT5, cTrader and copy trading tools, plus strong reputation and regulatory oversight from the ASIC.

We also appreciate the fast, low-cost and convenient process of making deposits to Fusion Markets accounts with TransferWise.

Who Should Choose Fusion Markets?

Fusion Markets is a good forex broker for a range of traders. The Zero account is great for active traders with low fees, fast execution speeds and a huge range of currency pairs.

The $0 minimum deposit and free demo account will appeal to those with less starting capital, while hands-off traders will find value in the Fusion+ Copy Trading service and third-party copy trading tools.

Who Should Avoid Fusion Markets?

Traders outside of Australia who want a forex broker regulated by a trusted financial body should avoid Fusion Markets. The VFSC and FSA are not well-regarded regulators.

Investors looking for high-quality education should also avoid Fusion Markets, as the broker scored poorly in this area during our tests.

How To Compare Wise Forex Brokers

To find the best brokers that accept Wise deposits, there are several key metrics we look at:

The Funding Process, Fees and Transfer Times

The best Wise forex brokers offer a fast and seamless payment process after logging in to the client dashboard. The deposit and withdrawal functions should be easy to navigate, and the process should be secure.

We also look at the broker’s processing times for deposits and withdrawals. In our experience, the top firms will process deposits straightaway while withdrawals can take up to 5 working days.

The Minimum Deposit and Account Conditions

Another important consideration is the accessibility and flexibility of forex trading accounts.

We prefer Wise forex brokers that have a minimum deposit of <$500, reducing the entry barrier for newer traders.

Our team also look at the trading conditions offered in accounts. This includes checking for strong coverage of the foreign exchange markets, competitive trading fees, access to leverage, and any restrictions on forex trading strategies.

The Forex Platforms and Trading Tools

The best forex brokers accepting Wise payments offer high-quality trading platforms where you can execute trades.

Among the most popular platforms are MetaTrader 4 and MetaTrader 5, though we also test in-house software to check whether they are well-designed and offer the charting capabilities and tools needed to analyze the currency markets.

Wise forex brokers that offer helpful tools like copy trading, automated bots, and expert market analysis will also rank higher.

The Regulation and Reputation of the Forex Broker

The reputation and regulatory oversight of forex brokers is of utmost importance. Trading forex with a well-regulated broker can help keep your funds safe while trading forex with an unregulated broker can increase the risk of scams.

Our experts verify that Wise forex brokers are regulated by the bodies they claim to be. We do this by running their licensing details through the relevant regulator’s database and checking for any violations.

Our Methodology

To select the best forex brokers that accept Wise deposits, our team first identified the firms that accept the payment method.

We then looked at the deposit and withdrawal process, considering the minimum payment, any fees and typical processing speeds with Wise. As part of this, we signed into brokers’ client areas and navigated the cashier portal.

Finally, we evaluated the wider trading environment for forex investors, assessing their fees, accounts, tools and safety record. Only firms we trust that offer good conditions for traders made our list of the best Wise forex brokers.

FAQ

Which Is The Best Forex Broker Accepting Wise Deposits?

XM is the best forex broker accepting Wise in 2026.

The forex broker is trusted and regulated with tight spreads from 0.0 pips alongside a $3.50 commission per side. Clients can also trade more than 50 currency pairs on powerful platforms, including MT4 and MT5. In addition, deposits and withdrawals via Wise are fast and free in the client area.

Can I Use TransferWise To Trade Forex?

Yes, some brokers accept money remitter services like Wise, including XM, IC Markets, and Fusion Markets.

To use the payment system, you will need to check the login reference is correct and provide the full transfer receipt so the forex broker can apply the funds.

Article Sources

XM – Deposit & Withdrawal Conditions