Amega

-

💵 CurrenciesUSD

-

🛠 PlatformsMT5

-

⇔ Spread

GBPUSD: From 0.8 pips EURUSD: From 0.8 pips GBPEUR: From 0.8 pips -

# Assets70+

-

🪙 Minimum Deposit$20

-

🫴 Bonus Offer-

Our Opinion On Amega

Amega offers the powerful MetaTrader 5 platform and the convenience of commission-free trading. Adding to the broker’s appeal is the no minimum deposit and straightforward sign-up process, which took us just a few minutes.

However, Amega struggles to compete with the best forex brokers. The product portfolio is limited, while its research and educational tools could be improved. The notable weak point lies in regulatory oversight, a crucial factor influencing our assessment of the broker’s trustworthiness.

Verdict: Amega is a no-frills forex broker with low entry requirements but it trails the top brokers.

Summary

- Instruments: 100+ including 25 currency pairs, stocks, indices, and commodities

- Live Accounts: Standard, Raw

- Platform & Apps: MetaTrader 5

- Deposit Options: Skrill, Neteller, Sticpay, Dusupay, Vertupay, Unlimint

- Demo Account: Yes

Pros & Cons

- The $0 minimum deposit makes Amega accessible to beginners

- No restrictions with algo trading, scalping and hedging permitted

- Multiple incentives including a cashback scheme for active traders

- Raw account with spreads from 0 pips and a fixed commission

- Unlimited demo account that mirrors live market conditions

- Access to MetaTrader 5 on desktop, web and mobile

- Weak regulatory oversight and short track record lower its trust rating

- Below-average investment offering including 25 currency pairs

- Subpar educational and market research tools

- No proprietary trading platform or mobile app

- Limited deposit options with no bank cards

- Withdrawal charges apply

Is Amega Regulated?

We recommend that retail traders look for brokers with strong regulatory oversight, as this is the best assurance of fund security and business transparency. Unfortunately, Amega falls short in this respect.

The firm is registered with the Mauritius Financial Services Commission (FSC), license number GB22200548. This is not a well-respected regulator, offering limited trader safeguards. And while we are pleased to find that forex traders are covered by negative balance protection and segregated client funds, these measures are really the bare minimum when it comes to safety.

If you want a tightly regulated forex broker, we recommend one of the alternatives below.

Alternative Brokers for US

Forex Accounts

The simplicity of Amega’s Standard or Raw accounts is a plus, making it straightforward to get started.

The two accounts vary according to their pricing models, with a standard, commission-free account that will appeal to newer traders and a raw account with tighter spreads and fixed commissions for experienced traders.

We are pleased to see an Islamic account is also available, providing swap-free trading for Muslim investors.

The other benefit is the fast account opening. It only took us a few minutes to sign up and verify our profile, with a much shorter questionnaire than we normally see at brokers.

Our only complaint is that the Raw account offers a narrower product portfolio, though it does come with a choice of bonuses.

Trading Fees

Amega offers average trading fees. Spreads start from 0.8 pips on major currency pairs in the Standard account, which compares well to commission-free brokers like Plus500.

The Raw account offers the tightest spreads from 0 pips, alongside a 0.0035% commission on forex trades. During our tests, we got a 0.1 pip-spread on the EUR/USD, which competes with low-cost forex brokers.

The other notable feature is the cashback incentive, which although only offering a $1 rebate on every lot traded, is a nice addition.

Non-Trading Fees

Amega falls short when it comes to non-trading fees, with free deposits but a charge for withdrawals as well as a relatively low inactivity fee of $5 per month after 180 days.

Swap fees also apply for positions held overnight, except on Islamic profiles, though this is industry practice.

Payment Methods

Although Amega offers free, instant deposits, we find the broker’s funding solutions disappointing due to the withdrawal charges and poor selection of payment options.

Popular deposit solutions including wire transfers and credit/debit cards are not available, which we consider a minimum requirement. Instead, you can fund your account using Skrill, Neteller, SticPay, Dusupay (Africa), Unlimint (Indonesia) and Vertupay (Vietnam, Thailand, Malaysia, Japan and Singapore).

Most disappointingly for us, the broker charges a percentage on withdrawals, leaving you out of pocket when you want to retrieve profits:

| Payment Method | Withdrawal Fee |

|---|---|

| SticPay | 2% |

| DusuPay | 2.5% + $0.30 |

| Skrill | 1% |

| Neteller | 1% |

On a lighter note, the deposit process is smooth, with an integrated transaction form in the client portal. You simply need to select your live account, choose a payment method and decide how much to transfer. Your trading account balance should update within a few minutes.

Forex Assets

Amega trails the best brokers with its forex offering. We prefer brokers with a range of major, minor, and exotic currency pairs, as this provides more trading opportunities. With Amega offering just 25+ currency pairs, the broker falls noticeably short of the top forex brokers like IC Markets with 60+.

On the bright side, we have found that Amega offers many of the most popular forex pairs:

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

Amega offers around 50 non-forex CFDs. This seriously limits trading opportunities for retail investors, especially in comparison to brokers like CMC Markets which offers over 12,000 instruments.

After logging into Amega’s trading platform, we found that you can speculate on:

- 4 precious metals including gold and silver

- 3 energies including natural gas and WTI crude oil

- 8 popular indices such as the S&P 500, FTSE 100 and DAX 40

- 7 agricultural commodities including sugar, cocoa, and cotton

- 25+ US company stocks including Tesla, Meta, General Electric, and McDonald’s

What We’d Like To See

Amega could better serve traders by offering a large product portfolio, especially in terms of forex, stocks and crypto.

Execution

Amega is classified as an STP forex broker. This means orders are executed following a straight-through-processing model, with no dealing desk intervention.

Execution speeds are around 100 ms, which is reasonable, though some way behind the fastest brokers like Pepperstone (most orders executed in <30 ms).

Leverage

As an offshore broker, Amega can offer very high leverage due to limited regulatory restrictions. While trading forex with Amega, we could use leverage up to 1:1000.

Yet while this can be used to seriously boost position sizes and profits, it comes with the risk of serious losses. As a result, we recommend that beginners use lower leverage.

Leverage on non-forex assets varies:

| Instrument | Leverage |

|---|---|

| Shares | 1:20 |

| Energies | 1:20 |

| Indices | 1:20 |

| Metals | 1:200 |

| Commodities | 1:10 |

We found that Amega has a 50% margin call and a 20% stop-out level.

Platforms & Apps

Amega offers just one trading platform; MetaTrader 5 (MT5). The lack of choice is a mark against the broker, as many leading firms offer the full MetaTrader suite (MT4 and MT5), plus additional third-party solutions and/or in-house software.

Looking at the positives, we consider MT5 an excellent platform for forex trading. The customizable dashboard and charts provide a flexible trading environment.

MT5 also delivers in terms of functionality, with 3 charting types, 21 timeframes, 38 integrated indicators and 44 drawing tools. The in-built newsfeed is also a nice touch, and not something available in MT4.

Importantly, while testing the platform, we experienced a smooth trading environment with no glitches or technical issues.

Our only major gripe is the design. When we compare it to CMC Markets’ Next Generation platform, MT5 feels clunky and outdated. And while this won’t bother traders already familiar with MetaTrader, it may frustrate beginners.

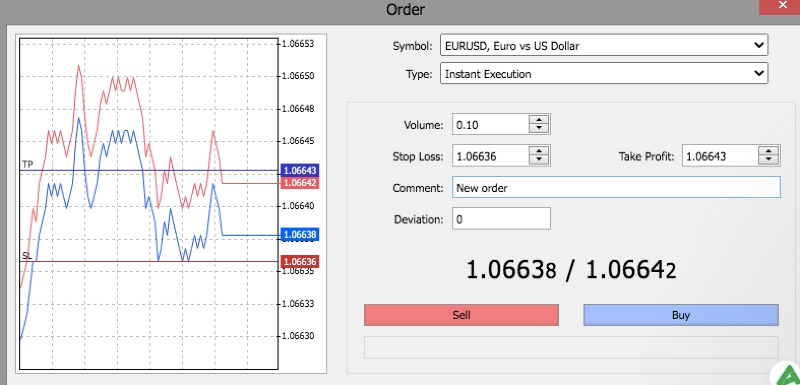

How To Make A Forex Trade

We faced no issues placing forex trades on the MT5 platform following these steps:

- Choose a currency pair from the ‘Market Watch’ window in the left menu

- Right-click on the forex pair and click ‘New Order’

- In the order ticket, add details including volume, order type, and stop-loss or take-profit if desired

- Approve the order by selecting ‘Buy’ or ‘Sell

Forex Tools

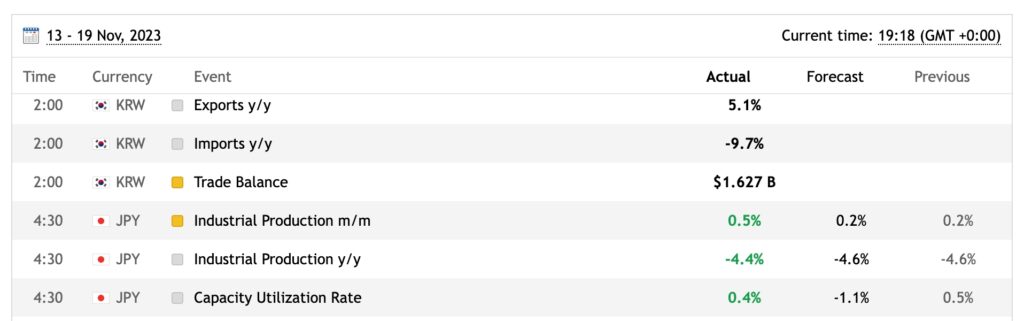

Amega’s selection of forex tools is disappointing. The firm has not pulled together a catalog of extra features for traders, meaning it does not compete well against the best forex brokers. The only thing of real value is the economic calendar.

The lack of copy trading is a shame for beginners and offered by alternatives like eToro. There are also no extras like Autochartist which can support analysis and trading ideas, and are offered by brokers such as Forex.com.

Forex Research

Amega has done poorly with its selection of forex research tools, and we feel quite limited when trading with this broker as a result.

The only research on offer is via an informal blog forum with company news and some basic analysis. This leaves us with cursory or outdated information, and while using Amega we frequently need to look elsewhere for ideas.

What We’d Like To See

Integration with popular tools like Trading Central would strengthen the broker’s score in this department and support aspiring traders.

Forex Education

Amega has attempted to provide some educational resources, though, in our opinion, it falls short on content.

We are also disappointed to see that all posts are outdated and very text-heavy, making it difficult to pick out useful information. We would rather see integrated videos and diagrams to make the content more user-friendly and engaging.

If high-quality educational tools are important to you, we recommend one of the forex brokers below.

Alternative Brokers for US

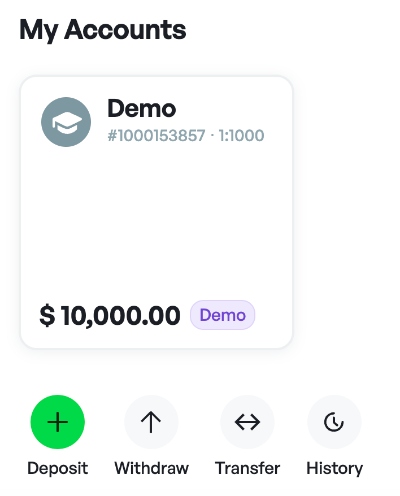

Demo Account

We always put a broker’s trading products to the test using a demo account before signing up. The demo environment provides an opportunity to familiarize yourself with trading tools, completely risk-free.

Pleasingly, Amega offers an unlimited paper trading account. It mirrors the same quotes, spreads, and swap fees of the live account, which for us is best practice.

We also like the option of flexible leverage up to 1:1000 and a virtual account balance up to $100,000.

How To Open A Demo Account

The demo account registration process took us less than three minutes, and we were pleased to be able to sign up in a few steps without providing personal information:

- Select ‘Sign Up’ from the broker’s homepage

- Add your name and email address and create a password. Click ‘Continue’

- From the client portal, choose ‘Accounts’ from the menu on the left and then ‘Open Demo Account’

- Choose ‘Demo’ from the dropdown menu and click ‘Continue’

- Review demo account details on the following page and click ‘Continue’ to confirm

Bonus Offers

Though we never recommend choosing a forex broker based on their financial incentives, they can be useful to practice trading when starting out, and Amega offers various promotions.

We found the simplest way to get a bonus is to sign up for a ‘bonus’ account type. You can access a deposit bonus of up to 150% to a maximum of $9000.

However, the most helpful ongoing incentive is the loyalty cashback program. Our assessment shows that this package is available to all traders, and there are no maximum limits on rewards. When we reviewed the terms and conditions, we found that $1 is available per lot traded. This can be withdrawn as cash or used as tradable credit.

Trading Restrictions

While using Amega Finance, we have been pleased to find there are no restrictions on trading strategies. This means expert advisors (EAs) are permitted, as well as hedging, scalping, news trading, and any other approaches.

Customer Service

We haven’t found Amega’s customer support impressive, mainly due to the limited availability. Agents are only available Monday to Friday from 7 AM to 2 PM (UTC).

However, we do rate the convenience of the online help center, which offers key information on accounts and platform queries. This is also integrated into the live chat, which is helpful when customer support agents are offline.

You can get in contact with Amega through:

- Telephone: +23052970273

- Email: support@amegafx.com

- Live Chat: Icon at the bottom right of the broker’s website

- FAQs: Click ‘company’ from the top menu and then ‘help center’

Company Details

Amega is an offshore forex and CFD broker. The firm was founded in 2018 and offers 100+ instruments on MetaTrader 5.

Unfortunately, the brokerage is not particularly transparent about its management team or operations. This is a red flag for us – the best forex brokers provide details on who runs their business and how it’s run.

Trading Hours

Amega offers forex trading 24 hours a day, Sunday 9 PM to Friday 9 PM (UTC). Within this, the forex market follows four major trading sessions:

- Sydney: 9 PM to 6 AM (UTC)

- Tokyo: 12 AM to 9 AM (UTC)

- London: 7 AM to 4 PM (UTC)

- New York: 1 PM to 10 PM (UTC)

Tip: Monitoring the crossover and end-of-sessions can help you identify market volatility and trading opportunities.

Who Is Amega Best For?

Amega is best for traders familiar with the MetaTrader 5 platform and seeking a no-frills forex broker. The $0 minimum deposit and straightforward sign-up process mean you can start trading quickly.

FAQ

Is Amega Legit Or A Scam?

Amega appears to be a legitimate broker. However, the brand’s regulatory status is not the most credible and there is limited company information available which does pose some concerns for us.

Can I Trust Amega?

While we had no problems during our weeks of testing Amega Finance, we have to mark the broker’s trust score down due to the lack of high-quality regulatory oversight, short track record and lack of transparency.

Is Amega A Regulated Forex Broker?

Amega is regulated by the Financial Services Commission of Mauritius (FSC). This is not a top-tier regulator.

Is Amega A Good Or Bad Forex Broker?

Amega has some good points, particularly the reliable MetaTrader 5 platform, straightforward account opening, and low entry requirements.

However, we did find that it lacks the research tools, educational content and, crucially, strong regulatory oversight that we expect from the top forex brokers.

Is Amega Good For Beginners?

Amega wouldn’t be our first pick for beginners. While the account registration process is simple, and there are no minimum deposit requirements, the limited education and additional tools will leave many new forex traders looking for more.

Does Amega Offer Low Forex Trading Fees?

Amega’s forex trading fees are competitive. The Raw account is the standout, with the tightest spreads from 0 pips and a low commission, though the Standard account is also competitive with spreads from 0.8 pips.

Does Amega Have A Forex App?

Amega does not have a proprietary mobile app, though those looking to trade on the go can make use of the MT5 app. This provides full access to all trading functions, including custom charting and technical analysis.

How Long Do Withdrawals Take At Amega?

Amega’s withdrawal timelines are competitive, with requests sometimes processed within 10 minutes. The time taken to receive funds though will vary between payment methods.

Can You Make Money Trading Forex With Amega?

It is possible to make a profit trading forex with Amega.com. The broker offers competitive fees and the reliable MetaTrader 5 platform with STP execution.

However, there are no guarantees and most retail traders lose money speculating on the foreign exchange market.