FBS

-

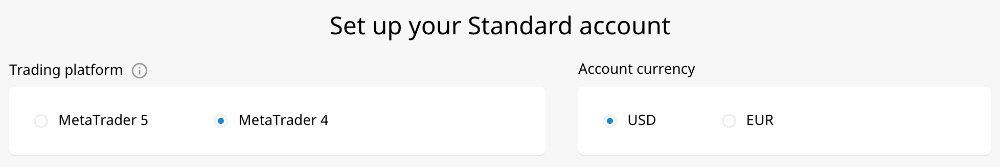

💵 CurrenciesUSD, EUR

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: From 0.6 EURUSD: From 0.5 GBPEUR: From 2.1 -

# Assets44

-

🪙 Minimum Deposit$1

-

🫴 Bonus Offer$100 welcome bonus (only available in certain regions)

Our Opinion On FBS

FBS is a multi-regulated forex and CFD broker with the MT4 and MT5 platforms. Our testing found competitive pricing on key currency pairs. We also rate the low minimum deposit and Cent account for beginners. Our only complaints are that the range of instruments and base currencies trails the best forex brokers.

Summary

- Instruments: 200+ including 40+ forex pairs, stocks, indices, commodities, cryptos

- Live Accounts: Standard, Cent, Crypto

- Platforms & Apps: FBS Trader, MetaTrader 4, MetaTrader 5

- Deposit Options: Bank cards, wire transfer, Neteller, Skrill, Rapid Transfer

- Demo Account: Yes

Pros & Cons

- Well-designed FBS Trader app with easy account management

- Fully digital account opening that only takes a few minutes

- Trusted forex broker regulated by the CySEC and ASIC

- Access to the MetaTrader 4 and MetaTrader 5 platforms

- Crypto account for serious cryptocurrency traders

- Competitive forex spreads from 1.0 pip

- Instant deposits with zero transfer fees

- Fast execution speeds of <0.4 seconds

- Around the clock customer support

- Very low minimum deposit of $1

- A data leak in 2021 exposed the personal information of millions of clients

- There is a limited number of instruments in the Cent account

- Only two base currencies are available; USD and EUR

- Limited perks and rebates for high-volume traders

- Market analysis materials are outdated

Is FBS Regulated?

FBS in the EU is the business name of Tradestone Limited, a company regulated by the Cyprus Securities & Exchange Commission (CySEC). This is a reputable authority that monitors online brokers and their activities.

Tradestone is a member of CySEC’s Investor Compensation Fund, which can pay compensation to clients should the brokerage not be able to meet its financial obligations. The maximum amount it can pay is €20,000.

The broker is also authorized by the Australian Securities & Investments Commission (ASIC), the South African Financial Conduct Authority (FSCA), and the International Financial Services Commission (IFSC) of Belize.

The ASIC is a tier-one regulator and the FSCA is fairly reputable, however the IFSC is not a well-regarded financial body. As such, traders that sign up with the offshore entity may receive fewer regulatory protections.

With that said, we are reassured to see that client funds are held in segregated accounts, meaning money belonging to the forex broker is not mixed with that belonging to its traders.

Forex Accounts

Two accounts are available at FBS, along with the Crypto Account.

The Cent Account is designed for beginners with its low $10 minimum deposit. However, the Standard Account’s minimum deposit is still only $100, which is accessible compared to many alternatives. The Crypto Account has an even lower minimum deposit of just $1. I recommend selecting the Standard Account if you can meet the minimum deposit requirement as this has a broader range of markets.

On the negative side, FBS falls short when it comes to base currencies, with just USD and EUR supported. This means that traders who do not hold these currencies may be liable for conversion fees when depositing funds into their accounts.

Islamic-friendly solutions are also available on the Standard and Cent accounts at FBS. These have no swap or interest rate charges, though our team finds that swap-free trading is not available for forex exotics, stocks, indices, energies, and cryptocurrencies.

We have highlighted the key differences between the accounts below.

Standard

Best for experienced traders

- €100 minimum deposit

- 0.01 lots minimum trade size

- Floating spreads from 1.0 pip

- MT4 and MT5 trading platforms

- Forex, metals, stocks, energies and indices

- Up to 1:30 leverage (up to 1:500 for professional traders)

Cent

Best for beginner traders

- €10 minimum deposit

- 0.01 cent lots minimum trade size

- Floating spreads from 1.0 pip

- MT4 and MT5 trading platforms

- Forex, metals and indices

- Up to 1:30 leverage (up to 1:500 for professional traders)

Crypto

Best for cryptocurrency traders

- $1 minimum deposit

- FBS Trader platform

- 0.01 lots minimum trade size

- Floating spreads from 1.0 pip

- 1:2 leverage (1:5 for professional traders)

- Commission of 0.05% for opening a position and the same for closing a position

How To Open An FBS Account

I found the process for opening an FBS account, whether forex or crypto, to be very simple and quick, taking just five minutes.

The first stage is to register a new personal area:

- Either use a social media account to autocomplete your details on the application form and skip to the next stage or enter them manually

- Provide your email address and full name, then click Register

- Create and verify a password for your account area (or keep using the temporary one provided by the broker at this stage)

- Verify your email address using the link sent by the broker

The final stage is to choose, customize and activate a trading account:

- Select your desired account type from the list of solutions provided

- Choose from the given leverage rates, MetaTrader platforms and account currencies

- Click the red Open Account button

- Save the account details provided on the next screen as these may be needed to login to your platform and begin trading currencies

Trading Fees

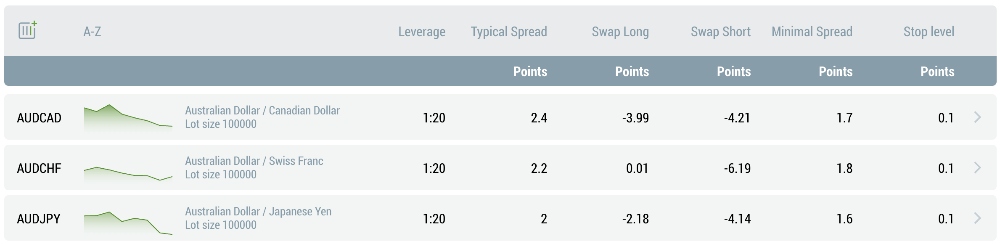

FBS offers competitive forex trading fees.

The typical spread for the EUR/USD on the FBS Standard and Cent accounts is 0.7 pips. This compares well to forex brokers such as OANDA, whose spread starts from 0.8 pips for the same currency pair.

The typical spread for GBP/USD is slightly higher but still reasonable at 1.2 pips. However, we did find some instruments, such as EUR/GBP, to be less competitive upon testing, averaging 2.7 pips on both accounts.

A reasonable commission charge of 0.7% is levied on US stock positions. Investors also incur a 0.05% charge for both opening and closing positions on the Crypto account.

CFD traders may also be liable for swap fees if they hold positions open overnight, unless the instrument is held through an FBS Islamic account.

Non-Trading Fees

The main non-trading cost to consider is the inactivity fee. Accounts that have been dormant for 180 days will be charged a quarterly maintenance fee of $30 or the balance of the account if there is less than $30 available.

Such a charge is fairly common across forex brokers, although we prefer that casual traders are not penalized for inactivity. Pepperstone, for example, does not charge an inactivity fee.

I appreciate that there are no deposit or withdrawal fees at FBS. Although free deposits at forex brokers are common, some firms charge for withdrawals. The slight caveat is that fees may be charged if you withdraw funds without having engaged in any trading activity.

You should also check whether your bank imposes any fees for wire transfers. Similarly, currency conversion charges should be considered if depositing in a currency that is neither USD nor EUR.

Payment Methods

FBS offers a good selection of funding solutions. Available deposit and withdrawal methods include:

- Skrill

- Neteller

- Wire Transfer

- Rapid Transfer

- Visa/Mastercard/Maestro bank cards

Deposits are all instant, apart from wire transfers, which take 3-4 business days to process. These timelines align with most of the industry.

FBS processes most withdrawals within 15-20 minutes (two days maximum), which is faster than many forex brokers. The exception is wire transfers, for which 48 hours is the norm. With that said, in our experience, it can take longer still for banks to process payments – Visa/Mastercard and wire transfer withdrawals can take up to 5-7 days in total.

We also found that additional documents may be required upon withdrawal requests as part of anti-money laundering obligations.

Our team appreciate that the minimum withdrawals are low, ranging from €1 for wire transfers to €10 for Skrill. This will appeal to newer traders and those on a budget.

How To Make A Deposit

When I went to deposit funds into my FBS forex trading account, I found the process smooth and quick:

- Enter your FBS personal account area

- Click the Finances tab at the top of the page

- Click the Deposit button

- Select your desired payment method and recipient account

- Fill out any necessary information regarding the payment method

- Enter the amount of money you wish to deposit and its currency

- Click the Deposit button

Forex Assets

FBS offers 43 forex pairs, including 15 exotics. Although this is a decent selection and includes all the majors we expect, other brokers like CMC Markets (330+) and Forex.com (80+) have many more.

Currency pairs can be traded as contracts for difference (CFDs), meaning you can leverage your balance to go long or short on key forex assets with greater purchasing power.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

FBS has a modest range of additional CFDs, with a particularly strong selection of cryptos.

On the negative side, the narrow portfolio of US stocks and commodities does not stack up to alternatives like IG or XM.

You can trade:

- 30 cryptos including BTC/USD and ETH/USD

- 99 stocks including blue chips like Apple and Amazon

- 11 indices including the S&P 500, Nasdaq 100 and FTSE 100

- Two metals consisting of Gold and Silver, both against the US Dollar

- Three energies including Natural Gas and Brent Crude Oil, both against the US Dollar

Execution

FBS is a no-dealing desk (NDD) broker, the main benefit of which is that it is not the counterparty in any trades. This avoids potential conflicts of interest. Both ECN and STP technologies are used to provide its services.

With execution speeds from just 0.3 seconds and 95% of orders executed within 0.4 seconds at FBS, traders can be satisfied that positions will be opened and closed efficiently at this broker.

Leverage

In line with EU regulations, leverage up to 1:30 is available to retail traders (1:500 for designated professional traders).

FBS traders outside the EU may be able to access much higher leverage up to 1:3000, although investors should be aware of the greater risk associated with excessive leverage.

Leverage varies depending on the market:

- Crypto – 1:2

- Indices – 1:20

- Energies – 1:10

- Forex majors – 1:30

- Forex minors and exotics – 1:20

- Stocks – 1:5 or zero, depending on the equity

Importantly, our team finds that European traders have negative balance protection, meaning that you can only lose what is in your account and cannot owe money to the forex broker.

Margin calls are activated at 80% or lower and a stop out at 50% of your account equity.

Platforms & Apps

FBS offers three trading platforms, its own FBS Trader, plus the hugely popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MT4 & MT5

The MetaTrader platforms will appeal to active forex traders. Stand-out features for me are the extensive range of in-built technical indicators and drawing tools, plus access to the MetaTrader Market, where you can buy and download thousands of indicators and trading bots.

I would also opt for MT4 or MT5 if you are interested in algorithmic trading. You can build, test and deploy automated trading strategies with guides available to help new users.

I have highlighted the key differences between MT4 and MT5 below.

| MetaTrader 4 | MetaTrader 5 | |

|---|---|---|

| Timeframes | 9 | 21 |

| Technical Indicators | 30 | 38 |

| Analytical Objects | 2 | 44 |

| Execution Modes | 3 | 6 |

| Device Compatibility | Windows, Mac, iOS and Android | Windows, Mac, iOS and Android |

| Algorithmic Trading | Yes – Expert Advisors (EAs) | Yes – Expert Advisors (EAs) |

How To Make A Forex Trade

You can place a trade on MetaTrader 4 in a few simple steps:

- Right-click on your chosen instrument in the list of assets on the left of the platform

- Click New Order

- Complete the information in the pop-up window including volume and, if relevant, your stop loss and take profit

- Click Sell by Market or Buy by Market to complete the order

One-click trading is also available, which can be enabled in the Options tab.

FBS Trader

FBS Trader is a proprietary charting and trading platform. I think beginners may find that this platform offers a more intuitive experience than the MetaTrader apps due to its user-friendly layout. The interface is clean and you can place and manage trades in a few clicks.

This forex trading app can be downloaded on both iOS and Android (APK). The download is usually simple if you have a smartphone with these operating systems.

Forex Tools

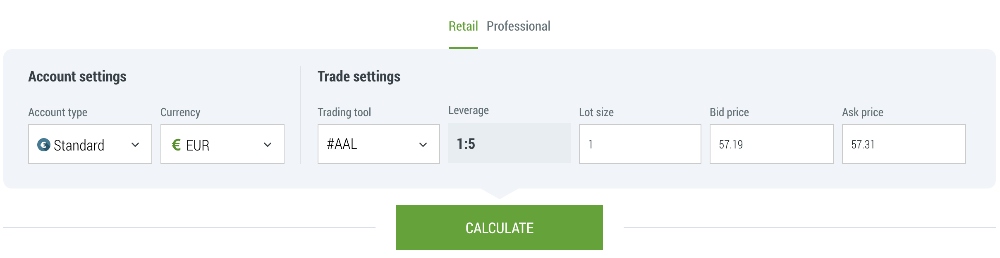

FBS has all the usual tools to assist traders, such as an economic calendar, calculators and currency converters.

Although we don’t think the forex broker has any particularly advanced features of its own, features like algorithmic trading and copy trading are provided on the MetaTrader platforms.

How To Use The FBS Trading Calculator

- Click Analytics & Education on the broker’s website and select Forex Calculators

- Select whether you are a retail or professional trader

- Select your account type and base currency

- Enter the trade settings, including lot size and bid/ask prices

- Click Calculate

Forex Research

On the face of it, FBS has more extensive market analysis than many forex brokers. Yet while the website contains a large number of useful insights into various markets, our team finds that some articles are outdated. Also, despite its name, the Daily Market Analysis section does not provide daily articles.

Fortunately, FBS also has Forex TV, which does a better job of providing engaging and up-to-date market analysis videos.

Forex Education

We think FBS has excellent educational materials and we like that it is tailored to traders of different abilities, not just beginners. For example, there are articles for four levels – Beginner, Elementary, Intermediate and Experienced.

Forex Intensive is the broker’s free five-week trading course designed for beginners and advanced traders. Specific courses are also available on topics like support and resistance levels, as are educational tutorial videos.

The FBS blog is a useful place to find out more information on current topics in the industry, such as how AI is impacting forex trading. The only drawback is that there are no webinars available at the time of our review.

Demo Account

Our team has tested hundreds of forex brokers and is pleased to see that FBS goes beyond the standard by offering a demo mode for each of its live accounts and trading platforms.

This means that those unsure which account type is best for them can test each of the Standard, Cent and Crypto accounts using virtual money in a simulated environment.

The demo account expires after 90 days, and while we prefer paper trading accounts that do not expire, this is a decent period to learn platform features.

Bonus Offers

No promotions are advertised to European clients by FBS, such as a deposit bonus of 100% or a no-deposit bonus. Strict regulations are in force around the use of such promotions for brokers regulated in the EU. This isn’t a drawback in our opinion – it’s standard practice and we don’t recommend picking a forex broker based on their bonuses.

With that said, promotions may be available to traders outside Europe. You can claim any welcome bonus and view terms and conditions when you sign up for an account.

Trading Restrictions

FBS has no trading restrictions, meaning any strategy can be used at this broker, including hedging and scalping. This is indicative of the forex broker’s wider approach of catering to many different types of traders.

Customer Service

FBS has 24/5 customer support available in six languages. This broker provides multiple contact methods, including a contact number and live chat, which are available throughout the forex trading period.

Having a responsive customer service team that can be contacted easily is important should you encounter any issues. The forex broker claims to have an average response time of less than one minute per request. We tested this several times and received a live chat response in less than a minute each time.

Contact methods:

- Email – info@fbs.eu

- Phone – +357 25 313540

- Live chat – help button at the bottom of the website

- Request a callback – icon at the top of the website

Company Details

This broker’s origin dates back to 2009, making FBS an established company in the industry. It has a client base of over 27 million and thousands of accounts are opened each day. Not only are these figures impressive but we also like brokers that are transparent about their customer base.

The strength of this forex broker is also reflected by the fact it has more than 60 international awards and recognitions.

The head office location of FBS’ EU entity is in Limassol, Cyprus – the same country where it is regulated. However, the brokerage is used and available for registration in 190 countries across the globe, including South Africa, Nigeria, India, Canada, Pakistan and Australia.

The broker’s website can be translated into multiple languages, including English, French and Spanish.

Trading Hours

The broker uses the standard MetaTrader server’s time zone: EET, which stands for Eastern European Time. Forex trading is from 00:00 Monday to 23:59 Friday (EET).

This provides investors with a wide timeframe to execute trades. However, the forex market is more liquid at certain times, particularly when two major forex trading sessions overlap.

Who Is FBS Best For?

With its low minimum deposit, free demo account and comprehensive education, FBS is a good choice for beginners.

The firm has also made an active effort to attract experienced traders by providing powerful platforms, fast execution speeds and support for algorithmic trading.

We are also reassured that FBS’s EU entity is regulated by the CySEC while the Australian branch is authorized by the trusted ASIC.

FAQ

Can I Trust FBS?

We consider FBS a trustworthy forex broker. The company is regulated by reputable financial bodies, has dozens of industry awards and millions of active traders.

Is FBS Legit Or A Scam?

FBS is a legitimate forex broker, established in 2009. Our experts did not uncover reports of scams during their research. The company also has a good reputation in the industry.

Is FBS A Regulated Forex Broker?

FBS is regulated by the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities & Investments Commission (ASIC), the South African Financial Sector Conduct Authority (FSCA), and the International Financial Services Commission (IFSC) of Belize.

Is FBS Good For Beginners?

FBS is a good forex broker for beginners with a $1 minimum deposit, a free demo account, competitive fees, and a wealth of learning resources.

Is FBS A Good Or Bad Forex Broker?

FBS is a good forex broker. 40+ currency pairs are available with competitive floating spreads, sophisticated trading software and fast order execution speeds. I also rate the smooth account opening through the mobile app.

On the negative side, only USD and EUR are available as account currencies and the depth of investment products trails some alternatives. High-volume traders may also be disappointed by the lack of rebates.

Does FBS Offer Low Forex Trading Fees?

FBS offers fairly low spreads on key forex instruments, including the EUR/USD at 0.7 pips. Spreads did come in wider on forex exotics during testing, but they remain competitive.

Does FBS Have A Forex App?

The broker’s proprietary trading app is FBS Trader, which can be downloaded from the App Store and Google Play, and allows users to trade forex on the go. The MT4 and MT5 mobile apps are also available.

How Long Do Withdrawals Take At FBS?

The broker processes most withdrawals on the same business day or within 48 hours, although the processing times of some banks can take 5-7 days. These timelines compare well with other top forex brokers.

Can You Make Money Trading Forex With FBS?

You can make money trading forex with FBS. However, without the relevant skills and experience, you may lose money instead. A sensible risk management strategy is key.