Best Forex Brokers With Instant Withdrawals

Forex brokers with instant or fast withdrawals allow investors to quickly access trading profits. Throughout this guide, we present our top picks for the best forex brokers with fast withdrawals. To compile our list, we took into account:

The withdrawal speed and payment terms

The account conditions and trading fees

The broker’s trust score and regulatory status

The quality of forex trading platforms and tools

List of Best Forex Brokers With Fast Withdrawals

Our tests show that these are the top 5 forex brokers with fast withdrawals:

- XTB: Best Overall Forex Broker For Fast Withdrawals

- IC Markets: Best For Forex Day Trading

- FBS: Best For Beginners

- OANDA: Best For Experienced Traders

- Eightcap: Best MetaTrader Forex Broker

| XTB | IC Markets | FBS | OANDA | Eightcap | |

|---|---|---|---|---|---|

| Same Day Withdrawals* | Yes | Yes | Yes | Yes | Yes |

| Withdrawal Fees | $20 under $100 (EU) 0 – 1.5% (Intl.) | $0 | 0 – €2 | $20 (first withdrawal) | 0% – 0.9% |

| Regulated | Yes | Yes | Yes | Yes | Yes |

*Withdrawal times can vary depending on your account status, payment method and the broker’s systems.

XTB: Best Overall Forex Broker For Fast Withdrawals

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP

-

🛠 PlatformsProprietary

-

⇔ Spread

GBPUSD: 0.1 EURUSD: 0.2 GBPEUR: 0.1 -

# Assets45+

-

🪙 Minimum Deposit$0

-

🫴 Bonus OfferNo

Why We Recommend XTB

We recommend XTB because it is a multi-regulated forex broker with an easy-to-use trading platform. Our tests also show that fees are low with spreads on currency pairs starting from 0.1 pips.

XTB offers fast and convenient withdrawals that can be requested through the client portal.

We explain why XTB is our top overall forex broker with same-day withdrawals below.

Pros/Cons of XTB

Pros

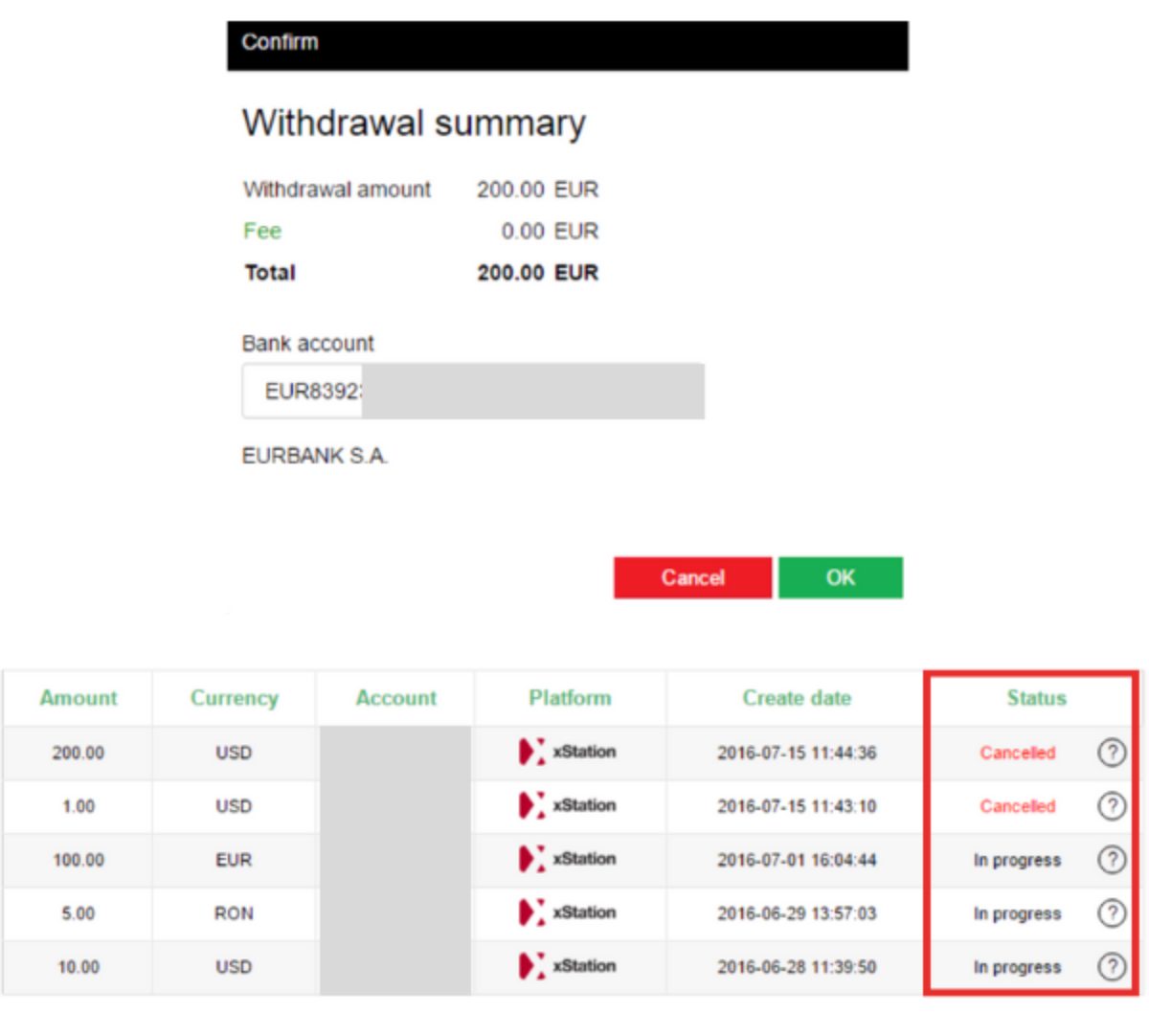

Fast withdrawals that you can track in real-time

XTB offers one of the quickest and smoothest withdrawal procedures that we have seen. We found that withdrawals are processed the same day if requested before 1 pm.

The live payment status page also provides real-time updates about delays or verification issues. You can view the date the request was made, the amount, and the current status. To view this, log in to the client area, click ‘My Profile’, and then ‘Payout History’.

The xStation platform is easy to use and great for beginners

xStation is one of the best trading platforms I have tested. It features a super slick design that makes for an enjoyable user experience.

It also houses an excellent library of tools, including 45 technical indicators and timeframes from 1 minute to 1 month, catering to short- and long-term trading strategies.

Low trading fees with zero commissions and forex spreads from 0.1 pips

Our testing shows that XTB is a low-cost forex broker. The EUR/USD has a target spread of 0.9 pips, while the EUR/GBP has a 1.0-pip spread. This stands up well to other forex brokers we compared XTB against.

We also rate that there is no minimum deposit to open an account, so traders on a budget can use the broker.

Cons

You have to pay a fee for withdrawals under $100

We were disappointed to find withdrawal fees if you want to take out small sums. We found that the fee varies depending on your base currency, but we were charged $20 for withdrawals under $100.

This 20% charge feels steep, especially when we compare it to IC Markets, which doesn’t charge anything for withdrawals.

Average customer support with slow response times during testing

We tested XTB’s customer support and felt it trails other forex brokers. We had to wait around 10 minutes to get help with a withdrawal query. Navigating the chatbot was also slow and frustrating.

Whilst not a dealbreaker in our opinion, faster and more reliable customer service would strengthen the broker’s rating, especially for beginners.

Why Is XTB Better Than The Competition?

Our analysis shows that XTB is a rare forex broker that offers very fast withdrawals via the majority of their accepted payment methods.

XTB is also one of the few brokers to offer the full package for forex traders – a top-rate platform accessible for beginners, competitive fees, and a heavily regulated trading environment.

Who Should Choose XTB?

Traders of all strategies and trading styles should consider XTB. The $0 minimum deposit is accessible, the sign-up process is straightforward and there are no restrictions on trading strategies.

With over 5,400 instruments (more than most competitors), including 45 currency pairs, investors can also build a diverse trading portfolio.

Who Should Avoid XTB?

We don’t recommend picking XTB if you want fast and reliable customer support – it lags behind other forex brokers based on our firsthand experience.

Traders looking to speculate on the foreign exchange market using the MetaTrader suite should also avoid XTB – neither MT4 nor MT5 are supported. FBS is a better option here.

IC Markets: Best For Forex Day Trading

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, cTrader, DupliTrade

-

⇔ Spread

GBPUSD: 0.5 EURUSD: 0.1 GBPEUR: 0.5 -

# Assets55+

-

🪙 Minimum Deposit$200

-

🫴 Bonus Offer-

Why We Recommend IC Markets

We recommend IC Markets because it offers an attractive environment for forex day traders, with excellent execution speeds, raw spreads and high leverage.

IC Markets also offers fast withdrawals, with payments processed the same day if requested by midday.

Our team explain why IC Markets is one of the best forex brokers with fast withdrawals below.

Pros/Cons of IC Markets

Pros

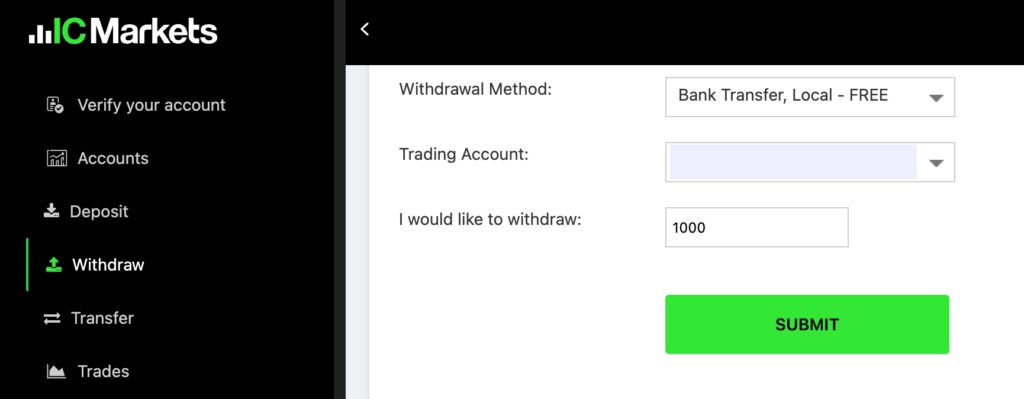

You can request withdrawals quickly, easily and with zero fees

IC Markets does not charge any fees for withdrawals, which sets it apart from many forex brokers we have reviewed, including popular brands like eToro.

We also found that the process to withdraw from the user-friendly client portal is fast and easy. After logging in, simply head to the ‘Withdraw’ section, choose a payment method and the account to withdraw from. Then enter the relevant payment details and withdrawal value, before hitting ‘Submit’.

Tip: the withdrawal status bar in the client terminal can be used to track the payment status.

Raw spread account with tight spreads from 0.0 and a $7 commission

IC Markets offers very low forex trading fees. Our tests show that spreads for the EUR/USD come in at 0.1 pips in the Raw Spread account, lower than average. The $7 commission is also competitive and can be reduced to $6 on cTrader.

Low forex fees will serve serious day traders looking to keep costs down when placing a high volume of trades.

Very fast execution speeds of 35ms on forex

Our analysis shows that IC Markets offers reliable and fast execution, with speeds of 35 milliseconds on currency pairs. This is thanks to the broker’s no-dealing desk model and server locations in London and New York.

We consider anything below 100 milliseconds fast, so this is impressive and will support active day traders looking to secure the best prices.

Cons

No two-factor authentication to improve account security

When we opened an IC Markets account, we could not add two-factor authentication. This is a weak point from a user security perspective.

We consider this an important safety measure and many forex brokers we use today provide this as standard.

Instant withdrawals are available with e-wallets only

We discovered that instant withdrawals are only available on certain e-wallets, including PayPal, Neteller, and Skrill.

This is fairly common so we haven’t ranked the broker down too much for this, but it is worth being aware of. Equally, we found that you must withdraw back to the original payment method.

Why Is IC Markets Better Than The Competition?

IC Markets offers some of the best trading conditions we have seen for serious traders. Our research shows that execution speeds are on the fast side, while the Raw Spread account offers better-than-average pricing.

The leverage up to 1:500 is also higher than most alternatives, boosting buying power and potential returns.

Who Should Choose IC Markets?

Day traders should choose IC Markets. Our tests show that you will struggle to find a forex broker that offers the same competitive trading conditions, from execution to fees.

IC Markets will also serve hands-off traders. The broker offers its own social trading app with an active community and signals that you can follow. IC Social is available on iOS and Android devices.

Who Should Avoid IC Markets?

Forex traders looking for the strongest account security should avoid IC Markets. We found that you can’t add multi-factor authentication using a mobile code or similar.

IC Markets also won’t serve traders looking for immediate withdrawals by wire transfers or bank cards – these can take several days. Only e-wallets offer instant processing.

FBS: Best For Beginners

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: From 0.6 EURUSD: From 0.5 GBPEUR: From 2.1 -

# Assets44

-

🪙 Minimum Deposit$1

-

🫴 Bonus Offer$100 welcome bonus (only available in certain regions)

Why We Recommend FBS

We recommend FBS because it is a trusted brand with excellent forex trading conditions for beginners, including a Cent account, a $1 minimum deposit and 24/7 customer support.

FBS also offers very fast withdrawals, with electronic transfers often providing immediate payments.

Below we uncover the reasons why FBS makes our rankings of fast withdrawal forex brokers.

Pros/Cons of FBS

Pros

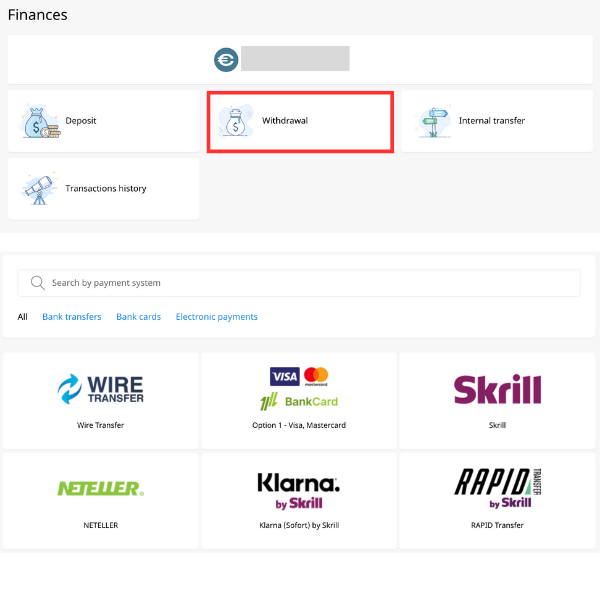

Immediate withdrawals with low minimum transfers from $1

Our research shows that FBS offers fast withdrawals, especially if you opt for an electronic solution like Skrill or Neteller. Here, withdrawals are processed immediately and normally paid out within 30 minutes.

FBS also impresses with its low minimum withdrawal, which varies by payment method but starts from $1.

We also rated the simplicity of FBS’ withdrawal process, which takes place on a user-friendly interface in just a few easy steps:

- Log in to the FBS client area

- Choose ‘Finances’ from the top menu and then select ‘Withdrawal’

- Select a payment method from the list

- Choose the trading account to withdraw funds from

- Input the relevant payment method details (such as your bank account number or card information)

- Input the value of funds to withdraw and choose ‘Confirm Withdrawal’

Flexible accounts including a Cent solution for beginners

FBS offers a choice of accounts to suit different trading styles: Cent, Standard and Crypto.

The Cent account would be our pick for beginners – it has a $10 minimum deposit and supports micro-lot trading. We are confident this account will serve new traders looking for low entry requirements.

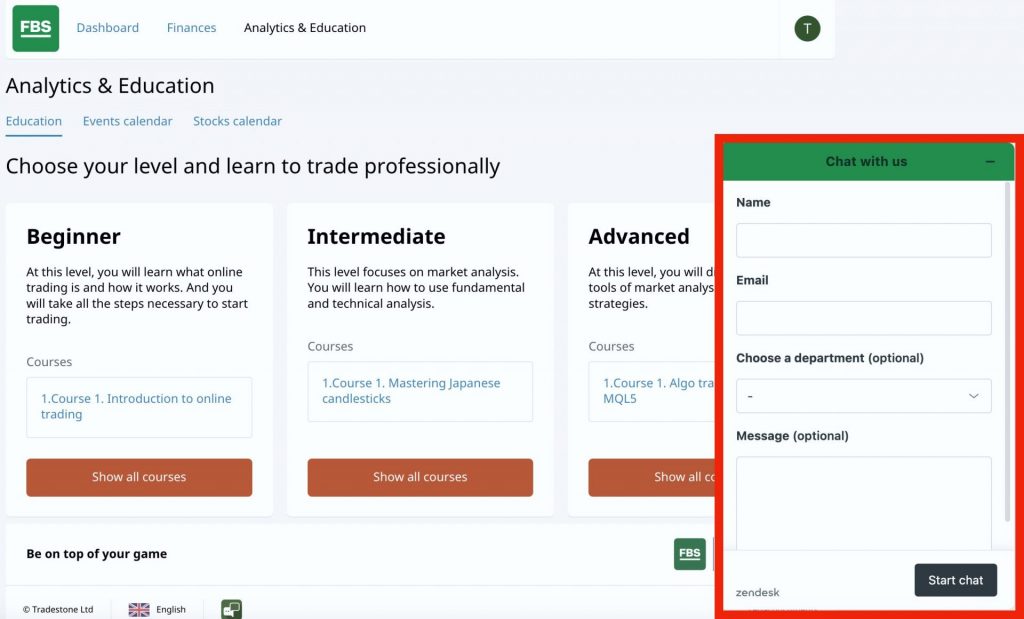

Responsive customer support is available 24/7

FBS provides reliable support if you need help with a withdrawal or have an account or platform question.

We tested the broker’s live chat service three times across one week, and were very impressed with the response times. Customer service agents were able to provide information on our withdrawal queries in less than 1 minute.

Cons

Withdrawal fees apply for some payment methods

Looking at the negatives, FBS charges transaction fees on several of its withdrawal methods.

We found a 2% charge for Neteller (from a minimum of $1 to a maximum of $30). There is also a €0.50 charge to withdraw from Apple Pay and Google Pay, though this is small so we don’t consider it a major drawback.

Withdrawals are instant for e-payments only

Our research found that instant withdrawals are available on Skrill, Neteller, and Perfect Money only.

While we see this at other brokers too, you should expect longer wait times for credit/debit cards and bank wire transfers, at 4 and 10 working days, respectively.

Why Is FBS Better Than The Competition?

FBS excels in its fast and reliable withdrawals with round-the-clock support for payment queries.

In addition, FBS is one of the few brokers we have evaluated to offer a trading account specifically aimed at beginners with very low entry requirements.

Who Should Choose FBS?

Investors looking to deposit and withdraw instantly using e-wallets like Skrill, Neteller and Perfect Money should choose FBS. These methods have the fastest processing speeds as well as low fees.

New currency traders should also choose FBS. The Cent account offers micro-lot trading with hands-on customer support and excellent educational materials, including Forex Intensive – a five-week course for beginner traders.

Who Should Avoid FBS?

FBS isn’t a good option if you want immediate withdrawals with bank cards and wire transfers, as these can take up to 10 business days.

FBS also isn’t the best forex broker for high-volume traders. Our investigation found limited perks or fee rebates for pro traders.

OANDA: Best For Pro Traders

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD

-

🛠 PlatformsMT4, MT5, TradingView, AutoChartist

-

⇔ Spread

GBPUSD: 1.4 EURUSD: 0.8 GBPEUR: 0.9 -

# Assets68

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend OANDA

We recommend OANDA because it offers excellent perks for pro traders, including fee rebates and dedicated relationship managers.

Traders have several options when it comes to withdrawals, including credit/debit cards, bank transfers, and ACH transfers.

Our team explains why we recommend OANDA below.

Pros/Cons of OANDA

Pros

Fee rebates up to $17 per million traded

OANDA’s Elite Trader program is one of the best we’ve seen for high-volume traders. The tiered rebate scheme offers between $5 and $17 per million traded, representing savings of up to 34%.

This makes OANDA an excellent option for serious traders looking to keep costs down.

Excellent trading tools including VPS hosting and TradingView

OANDA offers a choice of industry-leading trading platforms including MT4 and TradingView, as well as a bespoke mobile and web solution.

However, it’s the additional tools that we don’t see at many alternatives that stand out. This includes expert market analysis, VPS hosting from BeeksFX or Liquidity Connect, plus access to the Trade Tap blog for professional views and insights.

Our firsthand experience using forex brokers shows that few firms offer the same number of tools to support trading decisions.

Dedicated relationship manager with priority support for withdrawals

Traders who qualify for the Elite Trader program get a dedicated relationship manager. This attentive level of support will be particularly useful for traders who have specific queries or need prompt help with withdrawals.

In our view, this is a superb service that sets OANDA apart from the dozens of forex brokers that we have reviewed. Many of which offer slow and unreliable customer service.

Cons

High withdrawal fees for bank transfers

It is more expensive to withdraw funds from OANDA than other, low-cost forex brokers. We discovered that OANDA charges a $20 fee for the first bank transfer withdrawal each month, followed by a $15 charge for all requests thereafter.

Fortunately, we found that bank cards are more cost-effective, with no fee for the first request in the month followed by a $15 charge thereafter.

The withdrawal payment method hierarchy muddles the process

If you deposit money using multiple methods, you must follow a withdrawal hierarchy to get your funds. This includes credit/debit cards first, followed by PayPal, and then bank wire transfers.

This is not something we see at most forex brokers and makes for a cumbersome withdrawal process, which can also lead to delays.

Why Is OANDA Better Than The Competition?

Our analysis shows that OANDA is hard to beat for pro traders. The fee rebates of up to $17 per million traded are a fantastic perk if you plan to invest in high volumes.

We also consider OANDA one of the most trustworthy forex brokers. This is because it is regulated by some of the most stringent financial bodies, including the CFTC, NFA, FCA and ASIC. These regulators have tough membership requirements that are designed to protect retail investors.

Who Should Choose OANDA?

High-volume investors and professional traders should choose OANDA. The Elite Trader Scheme is top-tier and the broker supports advanced third-party tools, including TradingView, MT4, APIs, and VPS hosting.

US traders seeking a tightly regulated forex broker should also consider OANDA. It is authorized by the US Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA).

Who Should Avoid OANDA?

OANDA is a poor choice if you’re looking for low-cost withdrawals. Our review found above-average withdrawal fees, especially for bank transfers.

The choice of just three payment methods is also a limiting factor, with just bank cards, wire transfers and ACH transfers supported. If you want to deposit and withdraw using popular e-wallets, we recommend considering an alternative.

Eightcap: Best MetaTrader Forex Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, NZD, SGD

-

🛠 PlatformsMT4, MT5, TradingView

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.0 -

# Assets50+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

Why We Recommend Eightcap

We recommend Eightcap because it is a multi-regulated forex broker with competitive trading conditions and access to industry-leading platforms, including MT4, MT5, and TradingView.

Withdrawal processing times are fast, with the broker processing requests within 24 hours and crediting accounts instantly depending on the payment method.

Below we explain why Eightcap is a top pick for fast withdrawals.

Pros/Cons of Eightcap

Pros

Prompt withdrawals using a wide range of payment methods and zero fees

Alongside fast processing, Eightcap stands out for its large selection of convenient payment methods, including PayPal, FasaPay, POLi and crypto.

Eightcap also impressed us with its commission-free payments. There are no withdrawal fees, except for cryptocurrencies like Bitcoin. Ultimately, this makes for a convenient and smooth withdrawal process.

Excellent integration with MetaTrader 4 and MetaTrader 5

Eightcap offers an impressive selection of trading software for both beginners and experienced investors, including MT4, MT5 and TradingView.

The MetaTrader suite performed particularly well during our review. With dozens of technical indicators, dynamic charts and a range of order types, we are confident they can be used for a variety of trading styles.

Premium forex trading tools, including Capitalise.ai for algo trading

Our research shows that Eightcap offers access to some of the highest-quality trading tools to elevate the user experience.

Alongside MT4, MT5 and TradingView, you can access the powerful Capitalise.ai automation tool, an AI-powered economic calendar, a forex VPS and FlashTrader.

We have been particularly impressed with the Capitalise.ai platform. This is one of the few solutions we have seen that allows users to build automated strategies with no coding required. This is where we would start if you are new to algo trading.

Cons

Internal withdrawal checks can delay payouts by up to 2 days

We discovered that withdrawals at Eightcap can be delayed during busy periods. We found that this can add 2 business days to payment timelines.

This isn’t a significant drawback in our view, but it is worth keeping in mind if you always need instant withdrawals.

The demo account expires after 30 days

While testing Eightcap, we found that the demo account expires after 30 days. This is bad news for two reasons. Firstly, it doesn’t give new traders long to learn platform features and get familiar with the tools before trading forex with real money.

Secondly, users can’t operate both a live and demo account simultaneously after the trial period, which limits opportunities to develop forex strategies in a risk-free setting.

Why Is Eightcap Better Than The Competition?

Eightcap is better than most rivals thanks to its fast withdrawals and market-leading trading tools, including MetaTrader, TradingView and Capitalise.ai.

It is also one of the most heavily regulated forex brokers we have evaluated, with oversight from multiple leading bodies, including the FCA, ASIC, and CySEC.

Who Should Choose Eightcap?

Traders familiar with the MetaTrader platforms should choose Eightcap. We found that you can trade forex on the desktop, web and mobile iterations of the MT4 and MT5 platforms, with excellent integration and functionality.

Algo traders should also choose Eightcap. It offers a fairly unique tool in Capitalise.ai, which allows beginners to build algo strategies with no coding experience.

Who Should Avoid Eightcap?

Traders who want access to an unlimited demo account should avoid Eightcap – it will expire after 30 days, limiting the broker’s appeal to some beginners.

Investors who want instant withdrawals using traditional payment methods should also look elsewhere – only e-wallets and cryptos offer immediate payouts.

What To Look For In Fast Withdrawal Forex Brokers

We have tested and compared dozens of forex brokers with fast withdrawals, and our experience shows that there are several key factors to consider:

The Withdrawal Speed and Payment Terms

Choosing a forex broker with fast withdrawal times will ensure you can get your profits quickly. This money can then be used to invest elsewhere or for other purposes.

Our collective experience trading forex at a long row of brokers has shown us that withdrawal times can vary, but the fastest brokers will process requests instantly or on the same day.

With that said, we have found that withdrawal times can be affected by several factors:

- Account status – Most leading forex brokers require your account to be verified before you can request a withdrawal. Our tip is to provide verification documents when you open an account, which is sometimes a requirement anyway. This will help to prevent delays at the withdrawal stage.

- Payment method – Our research shows that cryptos and e-wallets, such as PayPal, Skrill and Neteller, offer the fastest processing. Bank cards and wire transfers, on the other hand, usually take longer, normally several working days.

- Brokers’ internal systems – Our years of using forex firms have shown us that the fastest brokers will process requests the same day, so long as you get the request in before the cut-off, normally around midday.

As well as comparing withdrawal times, it is also important to look at payment terms. This includes minimum and maximum transfer limits, which can prevent you from withdrawing more than a certain amount each day, for example.

The other important consideration is the presence of withdrawal fees. If you plan to make regular withdrawals, steep transaction fees will cut into profits. That is why we favor firms that offer commission-free withdrawals, though we balance the benefit of paying a small amount for access to better trading conditions and tools.

The Account Conditions and Trading Fees

Choosing a forex broker with an account that suits your trading style is important. It can impact how easy or hard it is to make a profit, while some accounts even restrict certain trading strategies.

Importantly, we like to see forex brokers providing a choice of flexible accounts to suit different trading strategies and skill levels, from beginners to professional traders. This often means a low starting deposit for new traders with commission-free trading and a raw spread account for experienced investors with premium tools.

Our team also record and analyze forex trading fees, which typically come in the form of spreads and/or commissions. Choosing an expensive broker will cut into your profit margins. That is we compare spreads on popular currency pairs to make sure brokers offer competitive pricing during key trading sessions.

The same logic extends to non-trading fees, which can include charges for account inactivity and costs for using specific tools. Again, we favor brokers with low to zero non-trading fees and most importantly, no hidden charges.

The Broker’s Trust Score and Regulatory Status

Choosing a trusted forex broker is of utmost importance. This will safeguard your capital from unfair operating practices and help protect you from scams.

Our research shows that the best forex brokers with fast withdrawals are authorized by respected financial authorities, such as the UK Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

While some offshore and unregulated brokers also advertise fast withdrawals, keep in mind that weak regulators do not provide the same amount of oversight and protection should you encounter withdrawal problems.

Importantly, all 5 of the forex brokers reviewed in this guide we deem trustworthy, thanks in part to their strong regulatory credentials.

The Quality of Forex Trading Platforms and Tools

Choosing a forex broker with easy-to-use and reliable trading software is critical. Our time testing platforms have shown that a well-designed, customizable interface can go a long way to ensuring you have an enjoyable trading experience.

It is also important the platform, app and other tools provide the features you need to effectively analyze the foreign exchange market and place trades. That is why, when we evaluate trading platforms, we look at the number of charting styles available, the breadth of indicators and drawing tools, plus the availability of useful extras like newsfeeds, market commentary and analyst insights.

Our tip is to also make use of a demo account if it’s available. This is one of the best ways to learn what is and isn’t available in a platform before you start trading forex with real money. Ultimately, if you don’t like the design or don’t have the tools needed for your trading strategy, you can try a different forex broker.

FAQ

Which Forex Broker Offers The Fastest Withdrawals?

Our reviews show that these 5 forex brokers come out on top for fast withdrawals: XTB, IC Markets, FBS, OANDA, and Eightcap.

Many of these forex brokers process withdrawals the same day if requests are submitted before the daily cut-off.

What Can Impact The Time It Will Take To Withdraw Profits From My Forex Account?

Three main factors can influence withdrawal speeds. Firstly, the payment method – e-wallets and cryptos offer near-instant speeds while bank cards and wire transfers can take several working days.

Your account status can also make a difference, as most forex platforms need to verify your identity before they can release funds.

Finally, the broker’s internal systems can impact withdrawal speeds, as some finance departments process requests on the same day while others take several working days.

Article Sources

IC Markets – Withdrawal Conditions