Axi

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD

-

🛠 PlatformsMT4, AutoChartist, DupliTrade

-

⇔ Spread

GBPUSD: from 0.6 pips (floating) EURUSD: from 0.2 pips (floating) GBPEUR: from 0.5 pips (floating) -

# Assets70+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Our Opinion On Axi

Axi, formerly AxiTrader, is a regulated forex broker with more than 60,000 traders. Standout features for us are the competitive trading conditions with a $0 minimum deposit, spreads from 0.0 pips and fast execution speeds. We also enjoy the integrated NexGen and Autochartist tools in the MetaTrader 4 platform that support technical analysis.

On the downside, the demo account expires after 30 days and the range of instruments is narrow. We also think the copy trading app trails some alternatives.

Summary

- Instruments: 220+ including 70+ forex pairs, stocks, indices, commodities, cryptos

- Live Accounts: Standard, Pro

- Platforms & Apps: MetaTrader 4 (MT4), App

- Deposit Options: Bank cards, wire transfers, and e-wallets

- Demo Account: Yes

Pros & Cons

- Advanced trading tools for experienced traders including MT4 NexGen plugin and Autochartist analytics

- Excellent educational resources to suit various learning styles including e-books, tutorials and webinars

- Competitive fees from 0.9 pips in the Standard account and 0.0 pips in the Pro account

- Accessible accounts with zero minimum deposit and 10 base currencies

- Strong regulatory oversight by top-tier bodies ASIC and FCA

- Copy trading service with no minimum investment requirement

- Free MT4 demo account with $50,000 in virtual funds

- Narrow range of non-forex assets with only 100 shares

- Copy trading app trails industry-leader eToro

- Demo account expires after 30 days

- No access to MetaTrader 5 (MT5)

- $10 monthly inactivity fee

Is Axi Regulated?

We can’t fault Axi’s regulatory status, with oversight from two top-tier financial agencies.

AxiCorp Financial Services Pty Ltd is regulated by the Australian Securities & Investments Commission (ASIC), ACN 127 606 348, and Axi Financial Services (UK) Ltd is regulated by the UK’s Financial Conduct Authority (FCA), license number 466201.

The ASIC and FCA are the gold standard when it comes to investor security, enforcing strict measures such as negative balance protection and access to compensation schemes. We also feel assured that brokers regulated by these bodies are required to keep client money in segregated accounts.

In Axi’s 15+ year history, our experts couldn’t find any evidence of security breaches or scams, which adds to its overall safety score.

Forex Accounts

AxiTrader offers two account types: Standard and Pro. The Standard account is best for new and casual traders whilst the Pro account serves investors with more experience.

Essentially, the zero-commission Standard account allows beginners to trade smaller volumes affordably, while higher-volume traders get much tighter spreads in exchange for a commission in the Pro account.

Our tests found that all other account features are identical, keeping things simple for prospective traders. It is particularly good to see that there is a $0 minimum deposit for both accounts.

We have pulled out the notable features of each account type below:

| Standard Account | Pro Account | |

|---|---|---|

| Products | 140+ FX Pairs, Metals, Indices, Shares CFDs | 140+ FX Pairs, Metals, Indices, Shares CFDs |

| Spreads | From 0.9 pips | From 0.0 pips |

| Pricing | 5-digit pricing | 5-digit pricing |

| Commission | None | $7 (USD) |

| Minimum Deposit | $0 | $0 |

| Minimum Trade Size | 0.01 lots | 0.01 lots |

| Base account currencies | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD |

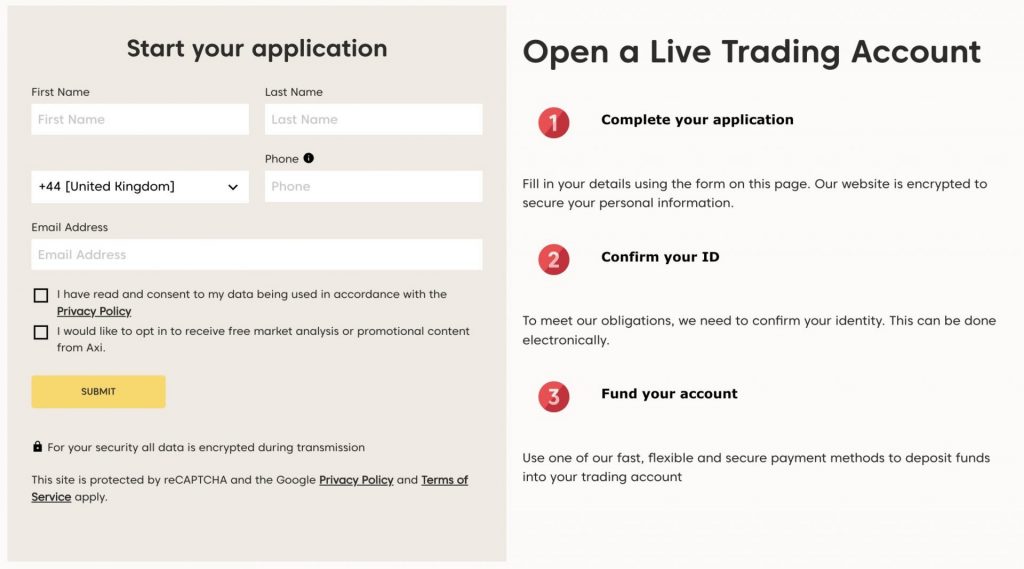

How To Open An Account

We are confident traders will find opening an account quick and straightforward. We were able to complete the process, including account approval, in less than an hour.

- Choose your account type (Standard or Pro)

- Provide personal details and select the trading platform

- Verify your identity with the required documents

- Complete and submit the application

- Receive confirmation and account approval emails

- Download and install the MT4 platform if needed

- Login to the client portal using the provided credentials

- Deposit funds into your account

- Start trading

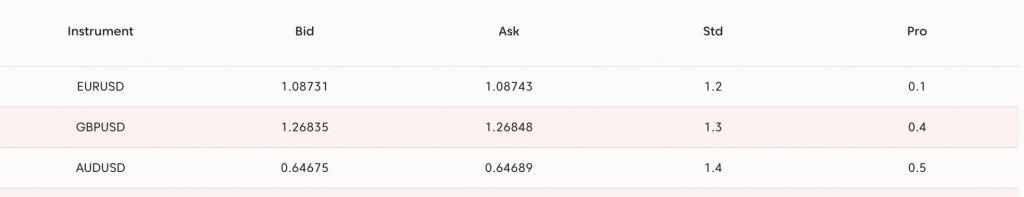

Trading Fees

Pricing is competitive. All trading fees in the Standard account are incorporated into the bid-offer spread, starting from 0.9 pips. These aren’t exceptional compared to the cheapest forex brokers, but they do stand up to most similar no-commission accounts.

Spreads start from 0.0 pips in the Pro account with a $7 commission per round trip. Based on our tests, these commissions are comparable to most competitors, including Pepperstone, and on the lower side overall of the 100+ forex brokers we have reviewed.

Non-Trading Fees

The non-trading fees are equally transparent and competitive.

The broker does not charge any fees for funding or withdrawing money from your trading account – except a 3% fee if you exceed a $50,000 monthly limit, which won’t be a problem for most traders.

Withdrawals are free if they are above $50, or if they are for the full balance of your account. If these requirements aren’t met there will be a fee of $25, which is reasonable since some forex brokers charge upwards of $30.

On the negative side, we aren’t thrilled to see a $10 monthly inactivity fee for accounts that remain dormant for more than 12 months.

Payment Methods

There is an excellent variety of payment methods available including credit card, debit card, bank transfer (local to international), international bank transfer, Przelewy24, Neteller, Skrill and many country-specific banking options.

We also enjoy the broker’s overall accessibility, with 10 base currencies covering a broad range of countries. This makes Axi a great option for global traders looking to manage accounts in their native currency while avoiding conversion fees.

Our testing found that the average deposit time is around 24 hours and the maximum is three working days. It is also good to see instant deposits from some popular methods such as Skrill and Neteller.

How To Make A Deposit

I had no complaints when depositing funds into my Axi account, only taking me a couple of minutes from start to finish:

- Log in to your Axi trading account

- Click the ‘Deposit’ button on the client dashboard

- Select your preferred deposit method

- Enter the amount you wish to transfer

- Follow the prompts to enter your payment details and confirm the transaction

- Depending on the method chosen, you may need to verify with a security code

- Once the deposit is successful, you will receive a confirmation message and the funds should be available in your account

Forex Assets

Axi offers 70+ forex CFDs, with a strong selection of majors, minors and exotics which rivals top competitors.

All the most popular currency pairs are available, while the leveraged nature of CFDs allows traders to increase their purchasing power and potential returns with a modest outlay.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | GBP/AUD | Yes |

| GBP/USD | Yes | USD/CAD | Yes |

| AUD/USD | Yes | USD/CHF | Yes |

| GBP/JPY | Yes | GBP/NZD | Yes |

| USD/JPY | Yes | EUR/GBP | Yes |

Non-Forex Assets

Sadly, Axi’s non-forex offering is not as impressive and trails alternatives like AvaTrade and eToro. The broker offers shares, indices and commodities, though the selection is narrow across all asset classes. As a result, Axi isn’t the best broker if you want to trade non-forex assets, especially less popular instruments.

You can trade:

- Shares: 100+ shares from US, UK and European markets

- Indices: 7 cash and futures indices including the US30, UK100 and DAX40

- Metals: 3 metals including gold and silver against USD (XAU/USD and XAG/USD)

- Commodities: 6 energies and softs including oil, natural gas, wheat and coffee

- Cryptocurrencies: 5 crypto CFDs available in permitted jurisdictions

Execution

Axi operates a no-dealing desk (NDD) execution model, which provides fair pricing and low latency.

Axi advertises ‘faster than ECN’ execution, with pricing sourced from up to 20 liquidity providers and co-located servers to ensure faster connection speeds. This will appeal to experienced traders looking for optimum conditions.

Leverage

Axi offers leverage up to 1:30 for major forex pairs in line with regulatory requirements, while more volatile instruments such as stocks are limited to 1:5.

The broker does have an offshore branch with higher leverage of up to 1:500, though we strongly urge caution and proper risk management measures given the danger of larger losses.

Platforms & Apps

Axi offers the MetaTrader 4 (MT4) platform, renowned for its powerful features and user-friendly interface.

I am always impressed with the wide range of integrated technical analysis tools and customizable charts available. The platform boasts 9 chart timeframes, over 60 technical indicators and graphical objects, and 4 pending order types.

One of the most notable features is MT4’s library of Expert Advisor (EA) trading robots. These are hugely popular due to the enhanced efficiency and precision they can add to trading strategies.

However, the best part in my opinion is that Axi provides access to some excellent integrated tools, including Autochartist and MT4 NexGen, which I cover later in this review.

Overall, MT4’s combination of powerful technical tools, extensive community and plugin support makes it stand out against others. And while I would like to see more platform options, I am confident that this industry-leading platform will satisfy most trading styles.

For those who prefer to trade on the go, the MT4 platform also comes with its own reliable mobile app which is available to download onto iOS or Android devices.

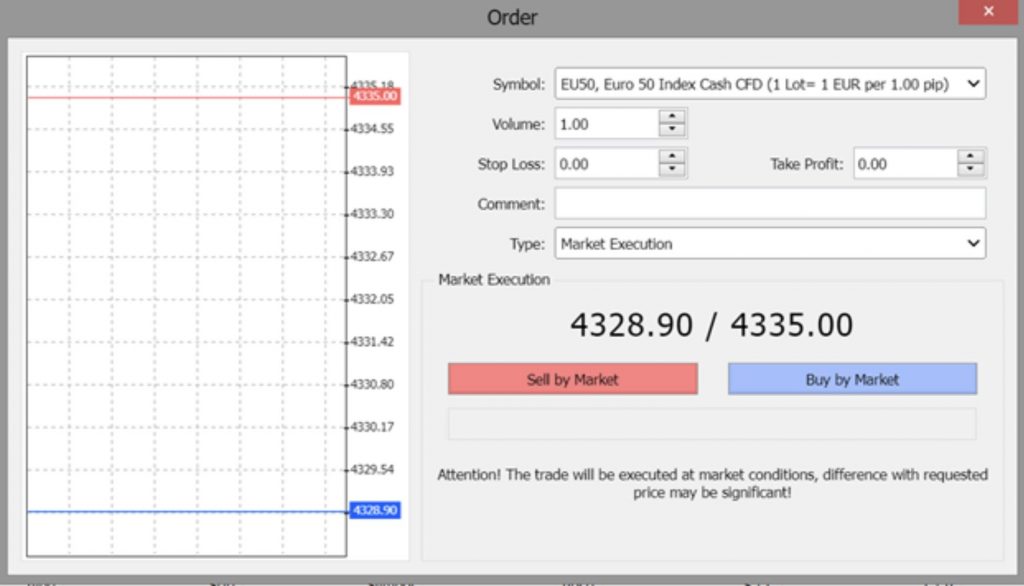

How To Make A Forex Trade

Opening forex trades with MT4’s intuitive user interface is always a seamless experience. It takes just a few clicks to complete a trade:

- Use MT4’s charts and indicators to analyze forex markets

- Right-click on a currency pair in ‘Market Watch’

- Select ‘New Order’

- Set the trade size, stop-loss, and take-profit levels for your trade

- Click ‘Buy’ or ‘Sell’ to execute the trade

- Manage your open trades in the ‘Terminal’ window

- To close a position, right-click on a trade, select ‘Close Order’ and confirm

Forex Tools

Axi ranks highly in this section thanks to the strong selection of forex trading tools. I have pulled out the three features I find the most useful:

Autochartist

This automated trading tool scans financial markets for technical patterns and chart formations. The service essentially alerts me in real-time when potential trading opportunities are identified, providing probability analysis and extra resources.

The tool works seamlessly within the MT4 platform and does not require any additional subscriptions or fees – a huge bonus for traders looking for hassle-free integration.

MT4 NexGen

Another key benefit of trading with Axi is this enhanced plugin. MT4 NexGen integrates extra features and functionalities into the MT4 platform through its Connect portal.

The portal comes with an excellent suite of tools including sentiment indicators, advanced orders and enhanced management features. I personally enjoy using the in-built news feed and economic calendar, which include useful data filters and timezone adjustments.

Overall, the powerful capabilities of this service will suit experienced traders, although new investors may also appreciate the integrated blog and education centre.

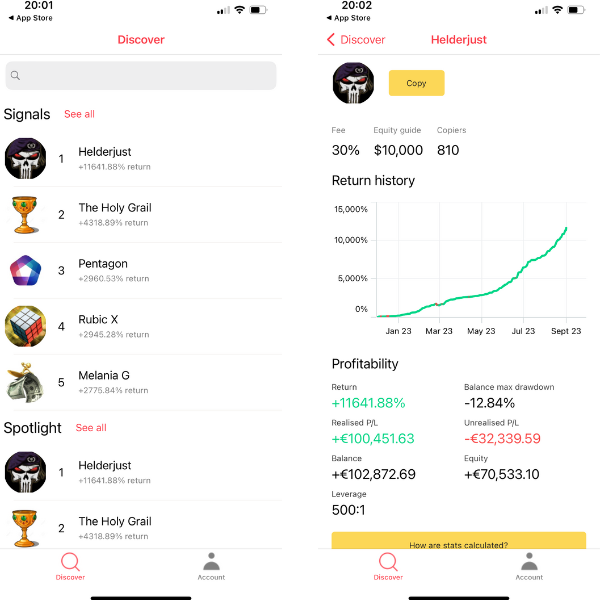

Copy Trading

Axi has also developed a dedicated mobile app for copy trading, aimed at novices or those who don’t have time to manage their own trades. The application essentially shows the top signal providers where you can view profitability statistics and copy trades directly from their profiles.

But whilst I think the app can add some value for traders, it doesn’t match up with market leaders such as eToro. For example, it would be nice to see some more community-focused features included for more social investing.

Forex Research

Axi does offer some of its own research materials including market analysis, news updates, and technical analysis reports.

However, while these resources offer a good level of market information, the quality is not exceptional when compared with the likes of IG or CMC Markets.

Forex Education

Axi scores better when it comes to forex education, which is one of my highlights of trading with this broker. Traders looking to hone their skills won’t be disappointed with the variety of resources available:

- MT4 video tutorials: A complete suite of step-by-step videos tailored to all experienced levels

- Axi Academy: A trading school for those looking to improve their skills

- Seminars and webinars: Expert-led insights into successful trading

- Axi Blog: A wide range of articles on trading-related topics

- Glossary: A list of useful trading terms and definitions

- Free eBooks: Longer reads for in-depth learning

Demo Account

We are pleased with Axi’s no-obligation demo account, which provides all users with $50,000 in virtual funds to practice trading with.

The risk-free environment is an excellent resource for traders to test the platform’s features and refine their trading skills. My only minor complaint is that it expires after 30 days while some firms offer unlimited paper trading profiles.

How To Open A Demo Account

Opening a demo account with Axi only took me a few minutes:

- Navigate to the ‘Demo Accounts’ section on Axi’s website

- Provide basic details like name and email

- Choose a trading platform and leverage

- Agree to the terms and conditions

- Receive a confirmation email

- Download the platform or open the WebTrader

- Log in using your credentials

- Start practising with virtual funds

Bonus Offers

Axi does not currently offer any bonus schemes. Incentives are heavily restricted by the broker’s regulators, so this isn’t a major complaint from our team.

Trading Restrictions

We are pleased to report no trading restrictions when trading with Axi, meaning traders can make use of scalping, hedging and other strategies freely.

Alternative Brokers for US

Customer Service

Axi’s customer service stands up well against competitors, with reliable 24/5 support in 14 different languages. Each time we tested the live chat feature we received prompt and helpful responses.

You can also contact the customer service team via email at service@axi.com. Our email queries received a response within 24 hours, which is also reasonable.

Alternatively, there are toll-free phone numbers for a range of countries including the UK, Hong Kong, Australia, China and more.

Company Details

AxiTrader was founded in 2007 and began as a two-person startup, expanding in the following years into an award-winning broker with more than 60,000 clients in more than 100 countries.

The firm has also won many awards including Best CFD Provider in 2021 and 2022, Most Trusted Broker and Best MT4 Provider.

The company was founded in Sydney, Australia and is now headquartered in London.

Trading Hours

Trading hours vary by instrument, with forex traded 24/5.

The market for precious metal products, including Gold, Silver, Palladium and Platinum, opens at 1:00 am Monday (Server time) and closes at midnight on Friday (Server time).

For indices, the trading hours depend on the index so we recommend searching for the relevant instruments within the MT4 platform.

The crypto market operates 24/7.

Who Is Axi Best For?

Axi is a top pick for experienced and active traders looking for advanced trading tools, fast execution speeds and raw spreads. Serious technical analysts who are comfortable with MetaTrader 4 (MT4) will find Axi’s integrated NexGen and Autochartist tools particularly appealing.

The broker’s educational resources also serve those seeking to enhance their forex knowledge. This, coupled with the free demo account, makes this a well-rounded broker for beginners.

FAQ

Is Axi Legit Or A Scam?

We are confident that Axi is a legitimate forex broker with a strong track record. Its regulatory status under respected authorities like the FCA and ASIC adds to its credibility, showing a commitment to industry standards and regulations.

Can I Trust Axi?

We consider Axi a trustworthy forex broker due to its strong regulatory oversight and reputation in the industry. After researching and testing the broker, we also found transparent trading conditions and a customer-focused approach.

Is Axi A Regulated Forex Broker?

Yes, Axi is regulated by authorities such as the UK FCA (Financial Conduct Authority) and ASIC (Australian Securities and Investments Commission).

Since these are among the most respected organizations in the industry, we view this as a key advantage for traders looking for a reliable broker.

Is Axi A Good Or Bad Forex Broker?

We consider Axi an excellent forex broker thanks to its advanced trading tools, competitive pricing, and wide range of currency pairs.

While in the end, the choice of broker comes down to personal preferences, Axi is a good option to include in your shortlist.

Is Axi Good For Beginners?

Axi is suitable for beginners due to its $0 minimum deposit, educational resources and user-friendly platforms like MetaTrader 4 (MT4). The availability of demo accounts also allows beginners to practice trading strategies without risking real funds.

Does Axi Offer Low Forex Trading Fees?

Yes – Axi offers low fees including floating spreads from 0.9 pips on the Standard account. The Pro account also offers competitive pricing, with tight spreads from 0 pips and commissions at $7 per round turn. This fee structure will appeal to traders looking to keep trading costs down, including high-volume traders.

Does Axi Have A Forex App?

You can trade at Axi on the go via the MT4 trading app. The mobile app provides a convenient way for traders to monitor markets, execute trades, and manage their accounts from their mobile devices.

How Long Do Withdrawals Take At Axi?

The duration of withdrawals at Axi can vary depending on factors such as the withdrawal method and processing times. With that said, we found many of the withdrawal processes to be instant, especially when using popular e-wallets like Skrill.

Can You Make Money Trading Forex With Axi?

Generating profits from forex trading is possible at Axi. However, success in the forex market requires a combination of effective strategies, risk management, market knowledge, and experience. Profits are not guaranteed and your capital is at risk.