Best Forex Brokers With Low Deposit

Low-deposit forex brokers make it easier for beginners and those with less capital to start trading. The minimum investment can range from zero to thousands of dollars, depending on the forex broker and type of account. In this guide, we share our pick of the best forex brokers with a low deposit, considering:

The minimum account size

The forex trading fees

The trading platforms and tools

The broker’s trust and safety score

List Of Best Forex Brokers With A Low Minimum Deposit

Based on our tests, these are the 5 best low-deposit forex brokers:

- XTB: Best Low Deposit Forex Broker

- XM: Best For Beginners

- Fusion Markets: Best Forex Trading Software

- IG Group: Best Market Research Tools

- OANDA US: Best For High-Volume Traders

| XTB | XM | Fusion Markets | IG Group | OANDA | |

|---|---|---|---|---|---|

| Minimum Deposit | $0 | $5 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Deposit Methods | Wire transfer, bank cards, e-wallets | Wire transfer, bank cards, Apple Pay, Google Wallet, e-wallets | Wire transfer, bank cards, PayPal, e-wallets, cryptos | Wire transfer, bank cards, PayPal | Wire transfer, ACH transfer, bank cards |

| Trading Platforms | xStation | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5, cTrader | MetaTrader 4, ProRealTime, L2 Dealer | OANDA Web, MetaTrader 4, TradingView |

| Regulators | CySEC, FCA, DFSA, IFSC, KNF | ASIC, CySEC, DFSA, FSC | ASIC, VFSC | ASIC, FCA, DFSA, BaFIN, CFTC, NFA, FSCA, MAS | CFTC, NFA |

XTB: Best Low Deposit Forex Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP

-

🛠 PlatformsProprietary

-

⇔ Spread

GBPUSD: 0.1 EURUSD: 0.2 GBPEUR: 0.1 -

# Assets45+

-

🪙 Minimum Deposit$0

-

🫴 Bonus OfferNo

Why We Recommend XTB

We recommend XTB because it offers an excellent environment for forex traders based on our assessment. It has a $0 minimum deposit with no transfer fees and a fast sign-up process.

Our experts also give XTB a high trust score due to its listing on the Warsaw Stock Exchange and authorization from respected regulators, including the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities & Exchange Commission (CySEC).

Below we explain why XTB is our top choice of low-deposit forex brokers.

Pros/Cons of XTB

Pros

No minimum deposit with near-instant account funding and zero fees

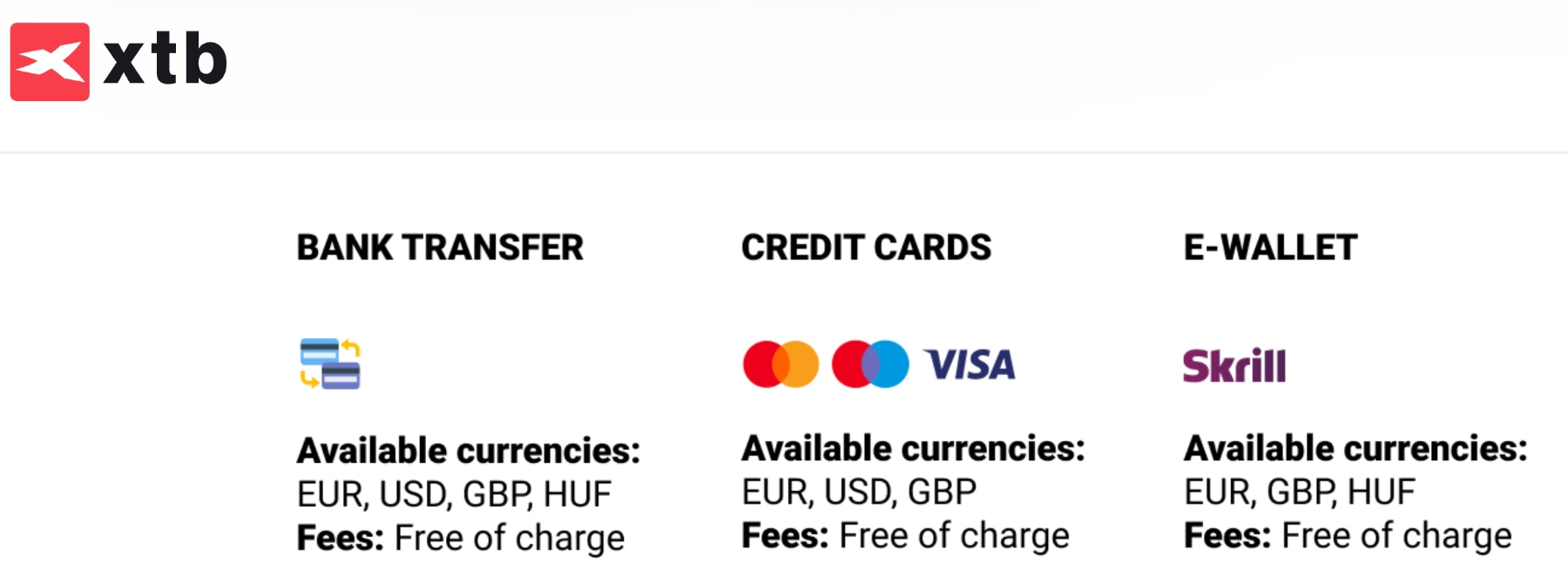

XTB is one of the few forex brokers we evaluated that allows traders to get started with zero minimum deposit. It also supports fee-free and instant funding options, including wire transfers, credit cards and e-wallets like Skrill.

This makes XTB a great option for new traders looking to speculate on the foreign exchange market with low entry requirements.

The xStation platform is easy-to-use with sophisticated trading tools

The xStation trading platform is one of the best we have tested. Our team enjoy the slick design which makes it straightforward to navigate currency pairs, customize the workspace and conduct technical analysis, with 45+ indicators and charting timeframes ranging from 1 minute to 1 month.

Our team finds that the xStation will serve both beginners and experienced forex traders. We also rate its accessibility, with a web solution, alongside a desktop client and mobile app.

Low spreads from 0.1 pips on 70+ currency pairs

Based on our testing, XTB offers below-average fees for forex trading. The Standard account offers spreads from 0.5 pips on major currency pairs like the EUR/USD, while the Pro account offers spreads from 0.1 pips.

Importantly, both accounts offer tighter spreads than most low-deposit forex brokers we reviewed. The zero commissions on forex assets and no hidden charges also help make XTB a low-cost forex broker.

Heavily regulated forex broker with 780,000+ traders

XTB is a legitimate, trustworthy and widely respected forex broker. Our research shows that the firm is authorized by six regulators, including reputable bodies like the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Europe.

XTB is also one of the few forex brokers to be publicly traded, adding to its credibility with transparent management structures and robust reporting requirements.

Cons

Average customer support with slow response times during testing

XTB trails the best low-deposit forex brokers when it comes to support support. In our tests, we sometimes had to wait 10 minutes to get through to an agent.

While not a dealbreaker in our opinion, this may deter beginners who want fast and responsive support, especially in fast-moving, volatile markets.

No access to the MetaTrader 4 or MetaTrader 5 platforms

Although we rate the in-house xStation platform, XTB is one of the few deposit forex brokers that we assessed not to support MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

Forex traders familiar with these popular software packages may prefer a low-deposit forex broker that offers MT4 or MT5 so they can avoid a learning curve.

Why Is XTB Better Than The Competition?

XTB has one of the lowest minimum investments we have seen – $0. With zero fees on the broker’s side, a slick deposit process and immediate account funding, it is straightforward to get started.

XTB also offers one of the best proprietary trading platforms we have used. xStation can’t be found at alternatives and will serve both new forex traders and seasoned investors in our view.

Who Should Choose XTB?

We recommend XTB for aspiring forex traders looking for low entry requirements with fast and fee-free account funding.

XTB is also a great option if you want a modern, web-accessible trading platform with rich analysis features for speculating on currency markets.

Who Should Avoid XTB?

Our testing shows that XTB isn’t a top pick if you want the best customer support. It trails alternatives we have evaluated, such as XM.

Investors who want to trade forex on the MetaTrader platforms should also avoid XTB, our review found that the broker does not integrate MT4 or MT5.

XM: Best For Beginners

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, AUD, JPY, ZAR, CHF, SGD, PLN, HUF

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: 1.9 EURUSD: 1.6 GBPEUR: 1.8 -

# Assets55+

-

🪙 Minimum Deposit$5

-

🫴 Bonus Offer$50 No Deposit Bonus When You Register A Real Account, Deposit Bonus Up To $5000, Free VPN Service

Why We Recommend XM

We recommend XM because it offers excellent trading conditions for beginners, including a low minimum deposit of $5. The multi-regulated broker has also won awards for its education and customer support.

Below we unpack the key reasons why XM is one of the best forex brokers with a low minimum deposit.

Pros/Cons of XM

Pros

Accessible accounts with a $5 minimum deposit and 0.01 minimum trade size

XM offers flexible trading accounts to meet different needs, with a low starting investment of $5.

In our assessment, the Micro and Standard accounts are good options for beginners with a low minimum trade size, floating spreads from 0.6 pips, and zero commission.

Best-in-class education, especially the ‘Beginner Room’

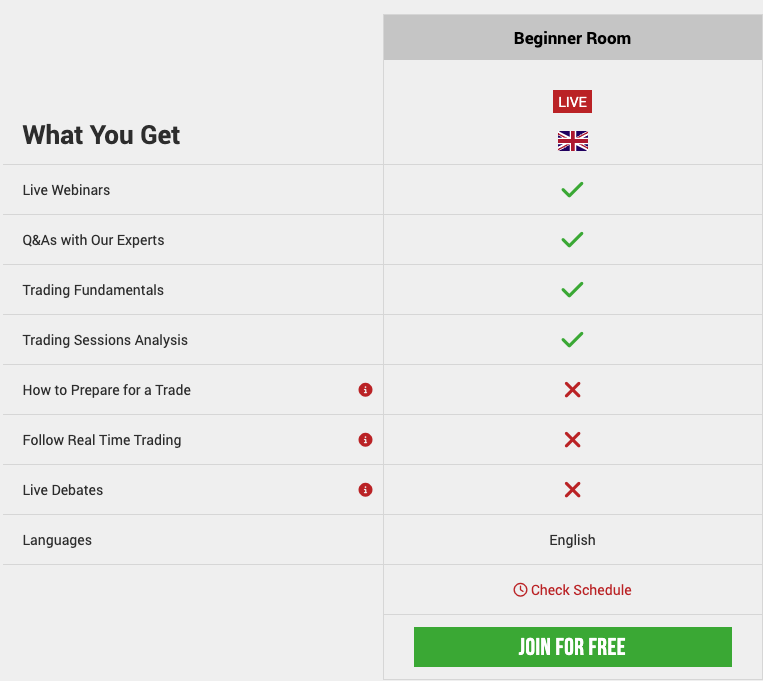

XM offers some of the best educational materials we have seen. New traders can join webinars on forex markets, live trading sessions, and access platform tutorials.

We recommend new investors start with the ‘Beginner Room’ to learn the basics.

Free demo account with $100,000 in virtual funds

XM offers an excellent demo account for new forex traders based on our tests. Investors get $100,000 to practice forex trading strategies risk-free. The paper trading account simulates real market conditions and offers access to the MetaTrader 4 and MetaTrader 5 platforms.

We particularly rate the fast joining process – it took us less than 5 minutes to open a demo account and start paper trading.

Cons

Limited forex copy trading tools

While XM global offers a social trading solution, it is not available in all jurisdictions. The number of strategy managers and usability of the app also trails industry leaders based on our evaluation.

$5 inactivity fee applies to dormant accounts

Whilst not a major complaint in our opinion, we found that XM charges a $5 monthly fee after 90 days of no trading activity. This won’t affect active traders, but it is worth bearing in mind for casual investors.

Why Is XM Better Than The Competition?

XM offers a choice of three trading accounts – all with a very low minimum deposit of $5. This is unlike many forex brokers we use that only have a low starting investment on entry-level accounts.

XM also has some of the best educational materials we have seen for aspiring currency traders, particularly the ‘Beginner Room’.

Who Should Choose XM?

Beginners should choose XM. You will struggle to find a lower deposit forex broker with the same quality of training materials, customer support and accessible account conditions.

Who Should Avoid XM?

Casual investors and hands-off traders should avoid XM. There is an inactivity fee after 90 days while the copy trading platform is only available in some countries and doesn’t rival alternatives we have tested.

Fusion Markets: Best Forex Trading Software

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD

-

🛠 PlatformsMT4, MT5, cTrader, DupliTrade

-

⇔ Spread

GBPUSD: 0.0 EURUSD: 0.0 GBPEUR: 0.0 -

# Assets90+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend Fusion Markets

We recommend Fusion Markets because it is a trusted forex broker with no minimum deposit and a superb suite of trading tools, including MetaTrader 4, MetaTrader 5 and cTrader.

Our team uncovers why Fusion Markets is a top-rated low deposit forex broker below.

Pros/Cons of Fusion Markets

Pros

Excellent suite of trading software, including MetaTrader and cTrader

Fusion Markets offers the best range of trading platforms and tools of the forex brokers we examined. As well as the respected MetaTrader 4 (MT4) and MetaTrader 5 (MT5), traders can access the hugely popular cTrader. For social traders, the broker also supports Myfxbook Autotrade and DupliTrade.

Ultimately, Fusion Markets offers high-quality trading platforms to support a variety of trading styles and strategies, from superior charting to algo trading and social investing.

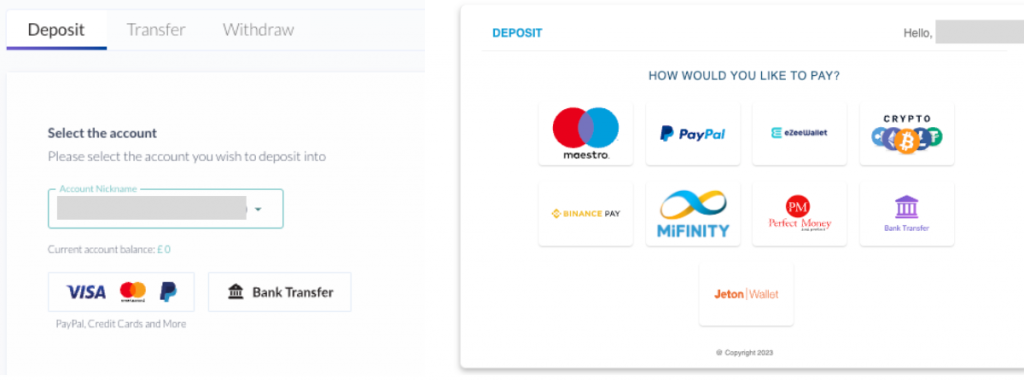

20+ accepted payment methods and 10 deposit currencies

Fusion Markets supports more deposit methods than almost every other forex broker we have tested. Over 20 funding solutions are available, from bank cards and wire transfers to PayPal and crypto.

There is also a wide range of 10 account currencies, including USD, EUR, GBP and AUD, making it convenient for global investors to manage their forex trades in a local currency.

Fusion Markets does not require a minimum deposit when you sign up, but when you are ready to fund your account, the process is easy:

- Sign in to the Fusion Markets client area

- Select ‘Payments’ from the left menu

- Choose the account number you want to add funds from the dropdown menu

- Select either the ‘Bank Transfer’ or ‘PayPal, Credit Cards and More’

- To make a card payment, choose the brand from the logos along the top

- Input your card details on the screen

- In the box on the right, choose your account currency and input an amount

- Click ‘Deposit’ to confirm the payment

90+ currency pairs with spreads from 0.0 pips

Fusion Markets offers an excellent range of 90+ major, minor and exotic currency pairs. This is more than most forex brokers based on our tests, and provides plenty of opportunities for serious traders.

Excellent market coverage is also paired with competitive fees, including spreads from 0.0 pips in the Zero account and spreads from 0.9 pips in the Classic account.

Cons

Some charges and delays for international payments

Our experts found that all wire transfers from a non-Australian account can cost up to $30 and take 5 working days.

This is more expensive and slower than other low-deposit forex brokers we evaluated and will impact global traders, in particular.

Limited educational materials for new forex traders

Fusion Markets scores poorly in our assessment when it comes to education and training. We found below-average resources for beginners, with limited platform tutorials or market insights.

Why Is Fusion Markets Better Than The Competition?

The choice and quality of trading platforms at Fusion Markets is hard to beat. The brokerage supports several of the industry’s leading trading software, including MT4, MT5, and cTrader.

The $0 minimum investment, 20+ payment methods and 10+ account currencies also make the deposit process very convenient.

Who Should Choose Fusion Markets?

Fusion Markets is a great choice for forex traders looking for powerful trading software, especially advanced charting and automated trading.

The forex broker is also a good option for serious forex traders with more than 90 currency pairs and a choice of accounts, including an ECN solution with spreads from 0.0 pips and a $4.50 commission.

Who Should Avoid Fusion Markets?

Our tests show that beginners will be better served by an alternative forex broker. Fusion Markets offers little in terms of education or market research.

We also don’t recommend Fusion Markets for global investors who want to fund their forex trades with wire transfer – you may need to pay high fees of up to $30 per transfer.

IG: Best Market Research Tools

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, ZAR, SEK, DKK, CHF, HKD, SGD

-

🛠 PlatformsMT4, AutoChartist, TradingCentral

-

⇔ Spread

GBPUSD: 0.9 EURUSD: 0.8 GBPEUR: 0.9 -

# Assets80+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend IG

We recommend IG because it offers convenient account funding with a $0 minimum deposit. Its market research tools are also among the best we have seen, while its 50+ years of experience and strong regulatory credentials are reassuring signs that the forex broker can be trusted.

Below we outline why IG is one of the best forex brokers with lowest minimum deposits.

Pros/Cons of IG

Pros

A huge suite of market research tools and resources

Based on our assessment, IG is a market leader when it comes to research. Highlights for us are the newsfeed from Reuters, specialist reports, expert analysis, and signals from Autochartist.

IG’s Academy is also an excellent resource for aspiring traders, with podcasts, webinars and comprehensive training guides.

Extended hours trading on popular forex pairs

IG is one of the few brokers with a low deposit that we reviewed to offer extended and weekend hours, including on popular currency pairs like the EUR/USD and USD/JPY.

We also appreciate that you can access over 80 pre- and post-market US shares, creating opportunities for traders looking to diversify outside of forex.

Zero-deposit trading accounts with an excellent range of payment methods

IG’s trading accounts are highly accessible, with no minimum deposit. When you are ready to start trading, the forex broker accepts deposits via wire transfers, credit cards and popular solutions like PayPal.

There is also an excellent range of 12+ supported account currencies with low conversion fees of 0.5% for traders depositing in an alternative currency.

Cons

Minimum deposit requirements vary depending on the payment method

Whilst there is no minimum deposit when depositing via bank wire, there is a minimum investment for cards and PayPal.

The amount depends on the currency you are using, for example, $50, £250 or €300, and applies per transaction.

Why Is IG Better Than The Competition?

IG stands out against other forex brokers for its out-of-hours trading opportunities on forex markets and high-quality research tools.

It also offers a smooth sign-up process that takes less than 5 minutes with no minimum deposit – making it more accessible than the majority of forex brokers we evaluated.

Who Should Choose IG?

Forex traders looking for top-tier market research tools should choose IG. You will struggle to find the same range and quality of insights.

Forex traders looking for opportunities outside of normal trading hours should also consider IG – you can trade popular currency pairs over the b.

Who Should Avoid IG?

Forex traders wanting to make low deposits via bank cards or PayPal should avoid IG, since the broker requires up to €300 per transaction with these solutions.

Our tests also show that while IG offers competitive spreads – 0.8 pips on the EUR/USD, they aren’t the lowest we see. You can get tighter spreads at ECN brokers, for example.

OANDA: Best For High-Volume Traders

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD

-

🛠 PlatformsMT4, TradingView, AutoChartist

-

⇔ Spread

GBPUSD: 3.4 EURUSD: 1.6 GBPEUR: 1.7 -

# Assets65+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend OANDA

We recommend OANDA because it has zero minimum deposit, 65+ currency pairs and an excellent reputation with multiple awards and authorization from tier-one regulators.

OANDA also offers attractive discounts for high-volume traders through its Elite Trader Scheme.

Below we unpack why OANDA is one of our top forex brokers with low minimum deposits.

Pros/Cons of OANDA

Pros

The Elite Trader program offers cash rebates up to 34% and exclusive perks

Our testing shows that OANDA offers one of the most attractive programs for high-volume forex traders. Investors can get cashback from $5 to $17 per million traded, representing up to a 34% reduction in trading fees.

We also found that elite traders get VIP benefits, including expedited request handling through a dedicated relationship manager, plus exclusive discounts on third-party platforms.

Powerful trading tools including VPS hosting and MotiveWave charting

OANDA offers advanced tools that will meet the needs of experienced forex traders. Traders get MultiCharts and MotiveWave charting analysis, which are available as plugins for the broker’s proprietary platform.

Additionally, you can access VPS hosting via two reputable partners, BeeksFX and Liquidity Connect, which will serve algo traders looking for 24/7 market connectivity.

Trustworthy forex broker regulated by the NFA and CFTC

We are comfortable that IG is a credible, trustworthy broker. It is tightly regulated by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC).

Our team are also reassured to see that the brokerage has been operating since 1996 and picked up a string of industry awards.

Cons

Narrow range of payment methods

Our analysis shows that OANDA supports a limited number of deposit options. You can fund your account with a debit card, bank wire or ACH transfer.

The available methods to withdraw are even fewer, with just debit cards and bank wire transfers available.

Negative balance protection not available to US traders

OANDA does not provide negative balance protection to US forex traders. While fairly common in our experience, it is worth noting that traders can lose more than their account balance in volatile markets.

Why Is OANDA Better Than The Competition?

OANDA’s Elite Trader scheme is among the best we have seen. High-volume traders can recoup up to 34% of trading fees.

The forex broker also stands out for its exclusive perks and advanced tools, including expedited request handling, plus MultiCharts and MotiveWave charting analysis.

Who Should Choose OANDA?

OANDA is an excellent option for high-volume forex traders looking to keep their costs down through cash rebates.

With oversight from the NFA and CFTC, OANDA is also a good broker for traders seeking a US-regulated and trusted forex broker.

Who Should Avoid OANDA?

Our assessment shows that OANDA isn’t a good option if you are based in the US and want negative balance protection. The brokerage does not provide this safeguard to retail investors.

Our evaluation also shows that the forex broker isn’t the best for convenient funding – with limited deposit options and slow processing times.

What To Look For In A Low Deposit Forex Broker

To put together a list of the best forex brokers with low minimum deposits, our experts looked at several factors:

The Minimum Account Size

Our analysis shows that the top low-deposit forex brokers accept traders with a minimum investment of $1 to $50. With that said, some firms even have no minimum deposit, allowing users to open an account and explore the client area and tools before investing.

Importantly, we balance a low minimum deposit with access to high-quality trading tools, opportunities in the foreign exchange market, and competitive fees.

The Forex Trading Fees

The best low-deposit forex brokers offer competitive trading fees. Our research shows that most brokerages primarily make money through spreads and/or commissions.

With this in mind, we assess the competitiveness of spreads and commissions on major, minor and exotic currency pairs. Importantly, we consider not just minimum spreads but average spreads across in market conditions.

Our experts also evaluate any non-trading fees, from inactivity penalties to deposit and withdrawal charges. Only low-deposit forex brokers with a competitive and transparent pricing schedule with no hidden charges make our rankings.

The Trading Platforms and Tools

The top forex brokers with a low minimum deposit offer well-designed, easy-to-use and feature-rich trading platforms. Using a platform that provides the interface and tools you need to analyze the foreign exchange market will enhance your trading experience.

Importantly, our team tests forex brokers’ trading platforms and apps where possible. The key things we evaluate are the design and usability, plus the breadth and quality of charting and analysis features.

In addition, we look for additional services to support the user experience, such as market research and education. These are particularly important for newer forex traders.

The Broker’s Trust and Safety Score

The best forex brokers with a low minimum deposit requirement are regulated by respected financial bodies. Trading forex with a regulated broker will help protect you from unfair trading practices and scams while keeping your capital secure.

Our experts always check whether a forex broker is regulated as part of the evaluation process. We verify their credentials on the respective regulators’ database to confirm they are legitimate and allowed to offer forex trading.

FAQ

Which Is The Best Forex Broker With A Low Deposit?

What Is The Minimum Deposit To Start Trading Forex?

The minimum deposit to start trading forex will depend on the broker. However, our analysis shows that many brokerages require between zero and thousands of dollars, with low-deposit forex brokers accepting minimum account sizes of $50 or less.