Scope Markets

-

💵 CurrenciesUSD, EUR, GBP

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.0 -

# Assets44

-

🪙 Minimum Deposit$50

-

🫴 Bonus Offer50% Deposit Bonus Up to $50,000. *Bonus promotions do not apply to all entities. Depending on the jurisdiction chosen to open an account with, different regulations apply.

Our Opinion On Scope Markets

Scope Markets is a no-frills broker that offers forex trading on 70+ currency pairs through its Scope Trader platform and MetaTrader suite. The $50 minimum deposit is low and the fast account setup makes getting started straightforward.

However, our tests highlight areas of concern: Scope Markets trails the top brokers in the trust department, while it has higher trading fees than the cheapest brokers, and lacks educational and research tools for beginners.

Summary

- Instruments: 1000+ CFDs including 70+ forex pairs, stocks, indices, commodities, futures

- Live Accounts: One Account

- Platform & Apps: Scope Trader, Scope Trader App, MetaTrader 4, MetaTrader 5

- Deposit Options: Wire transfer, credit/debit card, Neteller, Skrill

- Demo Account: Yes

Pros & Cons

- Commission-free trading model in the One Account will appeal to beginners

- Convenient account funding with a choice of deposit methods and no fees

- Reliable support with responsive live chat and email assistance during tests

- The $50 minimum deposit is accessible for new traders

- Above-average selection of 70+ currency pairs

- Not considered highly trusted given its weak regulatory credentials

- Limited fee transparency with spreads that trail the cheapest forex brokers

- Islamic account only provides access to 8 currency pairs

- Subpar market research with limited technical summaries

- Demo account expires after just 14 days

Is Scope Markets Regulated?

Scope Markets has an average trust score, lagging behind the best forex brokers in terms of regulatory oversight and trader safeguards.

The broker is regulated in three jurisdictions – one high-risk location and two mid-tier jurisdictions:

- RS Global Ltd is regulated by the Financial Services Commission of Belize (FSC) – an offshore regulator that provides limited investor protection.

- Scope Markets SA (PTY) Ltd is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa – a mid-tier regulator.

- SCFM Limited is regulated by the Capital Markets Authority (CMA) of Kenya – a mid-tier regulator.

If choosing a tightly regulated forex broker is important to you, and it should be to safeguard your funds, then we recommend one of these alternatives:

Alternative Brokers for US

Forex Accounts

Scope Markets offers the One Account in most regions. This provides commission-free trading on the broker’s 1000+ CFDs, making it an attractive starting point for beginners.

A swap-free account is also available to Muslim traders, though with access to just 8 currency pairs, it won’t cater to serious forex investors. AvaTrade is a better option for Islamic traders.

The lack of an ECN account with raw spreads, unless you live in Kenya, will also disappoint many advanced traders. Pepperstone is a good alternative here.

Looking at the positives, we like the registration process because it is quick and easy. It took us less than 5 minutes and requires personal details, information about your financial position, employment status, and trading knowledge. You also need to verify your identity and address by submitting copies of relevant documents, such as a passport and utility bill.

Trading Fees

Scope Markets gets a low score for its trading fees, primarily because of its limited transparency.

The broker offers commission-free trading with variable spreads from 0.9 pips that depend on market conditions. However, Scope Markets does not publish details on minimum and average spreads by currency pair, making it difficult to assess the costs you can expect.

The best forex brokers are more upfront. IC Markets for example, publishes comprehensive details on its forex spreads, which start from 0.8 pips on major currency pairs like the EUR/USD and USD/JPY in its Standard account.

Overnight financing rates will also apply to overnight positions, though these are waived for Islamic traders.

Non-Trading Fees

Scope Markets gets an average score for its non-trading fees.

You can expect a $10 inactivity fee after 6 months of inactivity – in line with much of the industry.

There is no charge for deposits and one free withdrawal per day. The $35 charge for additional withdrawals on the same day is steep, but this is unlikely to affect most traders.

Payment Methods

Scope Markets’ deposit and withdrawal options are good. You can fund your account with wire transfers, credit/debit cards and electronic wallets like Skrill and Neteller.

Deposit times vary between payment methods, with e-wallet solutions typically the fastest and usually processed immediately. Scope Markets also processes withdrawal requests the same day if received before 2 PM.

The actual process of making a deposit is smooth. Simply follow the on-screen instructions in the ‘My Wallet’ tab of the client portal.

Importantly, you cannot request a withdrawal until your account has been verified.

Forex Assets

Scope Markets offers an above-average selection of forex assets with 70+ currency pairs. This provides trading opportunities on a wide range of majors, minors and exotics with an accessible minimum trade size of 0.01 lots.

Importantly, all forex trading is done through CFDs.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

Although Scope Markets continues to widen its investment offering with 1000+ assets, it trails the top forex brokers like CMC Markets, which offers 12,000+ instruments.

The broker primarily offers derivatives in the form of CFDs, but spot investment products are also available in some regions.

You can trade the following assets:

- Indices: 13 stock indices including NAS100, S&P500, and FTSE100

- Shares: 1000+ stocks including Unilever, BMW, Amazon, Pepsi, and Tesla

- Commodities: 3 energies and 4 precious metals including gold, silver, natural gas, and crude oil

- Futures: 10 commodity or index futures including Dow Jones Index Mini Futures and Brent Oil Futures

- Cryptos: Popular digital currencies like Bitcoin and Ethereum (not available in all regions)

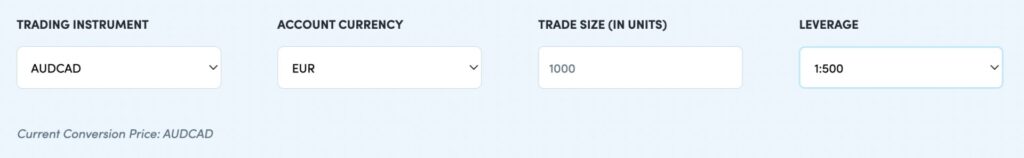

Leverage

Scope Markets offers very high leverage up to 1:2000 – much greater than the 1:30 cap in the EU, UK and Australia. This means you will have $2000 in purchasing power for every $1 outlay.

Yet while this may be attractive, is it important to recognize that both returns and losses will be magnified. As such, we don’t recommend that beginners trade with such high leverage.

It is also worth keeping in mind that the level of leverage available depends on trading volumes:

- Tier 1 (up to 25 lots): 1:2000

- Tier 2 (between 25 and 50 lots): 1:1000

- Tier 3 (between 50 and 100 lots): 1:500

- Tier 4 (between 100 and 200 lots): 1:100

Platforms & Apps

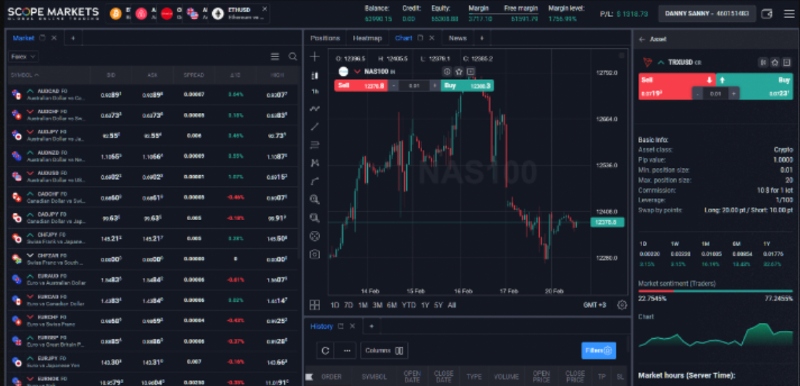

The selection of high-quality platforms is a strong point of trading forex at Scope Markets. You can use MetaTrader 4, MetaTrader 5, plus the broker’s own solutions – the Scope Trader web platform and Scope Trader App.

Scope Trader

Scope Trader sports a slicker design than the MetaTrader suite, with a modern look and feel that will appeal to new traders.

It also houses a selection of useful features, including a forex heatmap, news coverage, custom watchlists, and one-click trading. Additionally, the charting package is strong with 50+ indicators and drawing tools.

Where it falls short is in automated trading capabilities. Here, MetaTrader 4 and MetaTrader 5 are better options.

MetaTrader

MetaTrader 4 was designed for forex trading so it offers everything aspiring traders need. There are 30+ indicators, 20+ analytical tools, 3 types of charts, 9 timeframes, and 4 pending order types. Like Scope Trader, it also supports one-click trading.

Yet despite its position as the most popular forex platform, MetaTrader 5 promises a more complete trading experience for advanced traders. You get additional indicators, analytical tools, charting timeframes and order types, plus extras like an integrated news feed and faster processing. It is ultimately the newer, more advanced software, designed for multi-asset trading.

Placing a forex trade on either MetaTrader platform is easy. In the ‘Market Watch’ widget on the left of the interface, you can find a currency pair. You can then open the order widget to input details like the order type, trading volume and risk management tools like stop-loss and take-profit orders.

Forex Tools

Scope Markets does not compare with the best forex brokers when it comes to additional tools to elevate the trading experience. All you get is some basic calendars (profit, swap, margin, pip).

One notable criticism is that there is no forex copy trading, an increasingly popular service for aspiring traders that is offered by many alternatives, including Pepperstone.

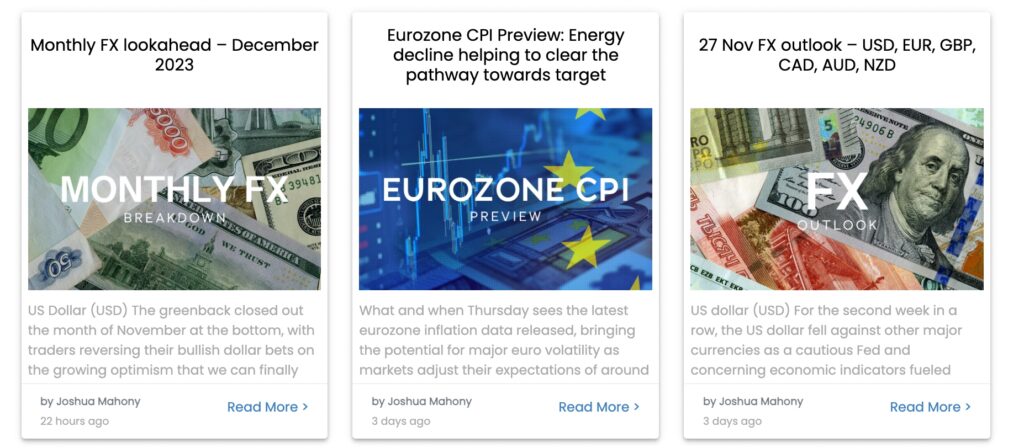

Forex Research

Scope Markets falls short of the top forex brokers in the research department. Although the broker continues to provide commentary in a blog-style forum, it doesn’t rival alternatives with mostly text-based summaries.

As a comparison, XM offers top-rate market research, including in-depth technical analysis, extensive forex market coverage and trading ideas from third-party solutions like Trading Central and Autochartist.

What We’d Like To See

Providing more technical summaries and fundamental analysis would support newer traders in finding opportunities.

Forex Education

Scope Markets’ lacklustre educational offering is another drawback that leaves it behind leaders in this area such as eToro. While exploring the video tutorials and e-books advertised, we were confronted with missing links and broken pages.

What We’d Like To See

Improving the educational offering with user-friendly guides on how the forex market works, identifying opportunities and managing risk would help beginners.

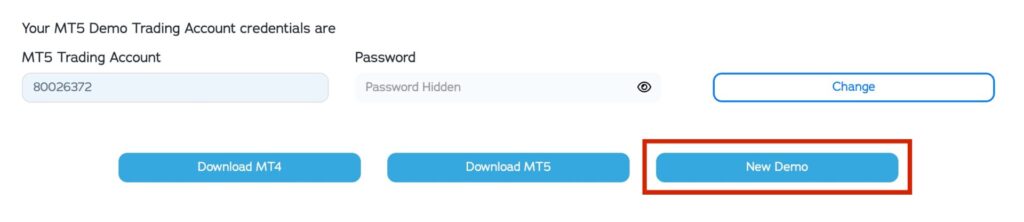

Demo Account

Scope Markets offers a demo account with $100,000 in virtual funds. However, with it expiring after just 14 days, it offers a much shorter window to try the platforms before investing funds. We have also been disappointed to find that only MT5 is available during tests.

Fortunately, opening a demo account is straightforward. Once you have registered for a profile you can activate demo mode within the client area.

Bonus Offers

Because Scope Markets operating with fewer restrictions than tightly regulated brokers, it can offer a 50% deposit bonus to new traders in some locations. This is available to users who deposit at least $100 with up to $50,000 in credit available.

Yet despite being attractive on the surface, withdrawing bonus funds is difficult. We dug into the terms and conditions and found a minimum trading volume of 0.125 round-turn per $0.50 bonus funds. As such, the trading credit is best thought of as funds for practicing trading strategies.

Trading Restrictions

Scope Markets does not place restrictions on popular trading strategies. This means scalping, hedging, news trading and algo trading are allowed on their platforms.

Customer Service

Scope Markets provides telephone, email, and live chat support, and overall we have been impressed with the speed and quality of assistance.

As part of our exhaustive reviews, we test the live chat and email support. On average, we get through to a customer service representative within 5 minutes on live chat while email replies take less than half an hour.

Company Details

Scope Markets is part of the Scope Markets Group, which operates through several entities registered in Belize, South Africa and Kenya.

The brokerage was established over 20 years ago but was acquired in 2022 by the Rostro Group to create a network of fintech brands.

Trading Hours

Forex can be traded at Scope Markets between 17:01 on Sunday and 16:58 on Friday EST.

Tip: the economic calendar is useful for understanding which events may influence the forex markets. Pay particular attention to the ‘impact rating’.

Who Is Scope Markets Best For?

Scope Markets is best for traders looking for a no-frills trading environment with high leverage and trading promotions in return for limited regulatory protections.

However, our ongoing testing shows that Scope Markets does not stand out in any area. As a result, most traders will be better off with one of our recommendations below.

Alternative Brokers for US

FAQ

Is Scope Markets Legit Or A Scam?

While Scope Markets appears to be a legitimate broker – we opened an account and tested the tools – it operates with limited regulatory oversight, providing less protection against scams.

Can I Trust Scope Markets?

Scope Markets has an average trust score. It is not regulated by tier-one financial bodies and lacks the reputation or client base of the most trusted forex brokers.

Is Scope Markets A Regulated Forex Broker?

Scope Markets is regulated by three financial bodies: The Financial Services Commission of Belize (offshore/high-risk), The Financial Sector Conduct Authority of South Africa (mid-tier), and the Capital Markets Authority of Kenya (mid-tier).

Is Scope Markets A Good Or Bad Forex Broker?

Scope Markets is an average forex broker that trails the best firms in almost every area, including accounts, fees, research tools and safety.

Is Scope Markets Good For Beginners?

Scope Markets is not great for beginners. Despite a low $50 minimum deposit, the demo account expires after 14 days and there are limited educational materials.

Does Scope Markets Have A Forex App?

Yes, Scope Markets offers its own app. It offers similar features to the web platform, including charting and analysis. Alternatively, MT4 and MT5 are available on iOS and Android devices.

Does Scope Markets Offer Low Forex Trading Fees?

Scope Markets offers average trading fees with zero commissions and floating spreads from 0.9 pips. Non-trading fees are also average with a $10 monthly inactivity fee and free deposits and withdrawals (one free withdrawal per day).

How Long Do Withdrawals Take At Scope Markets?

Scope Markets processes all withdrawal requests the same day if received before 2 pm. Exact processing times will vary by payment method, but e-wallets generally offer the fastest times.